Steemit Crypto Academy - Season II Week II by @fendit| Make your cryptocurrencies work for you

Hello there. The professor explained how we can evaluate the cryptocurrencies in our account. Wants us to answer 3 questions as homework.

a) Which is your risk aversion, which of these products you find the most appealing and why

Today, many people are interested in cryptocurrencies. Some traders trade short-term. Some traders make long-term choices. Hodl does it, it keeps cryptocurrencies for a long time. Some are also evaluating crypto coins. There are products on the Binance stock exchange that we will use our crypto coins.

There are products suitable for every merchant. If you haven't discovered Binance products yet, I recommend you to explore Binance products.

My method of avoiding risk - aggressive risk tolerance. Because I can earn high profits with a small amount. High profit = high risk = high loss. I am aware of the risk, the harm, so I choose small amounts when taking risks.

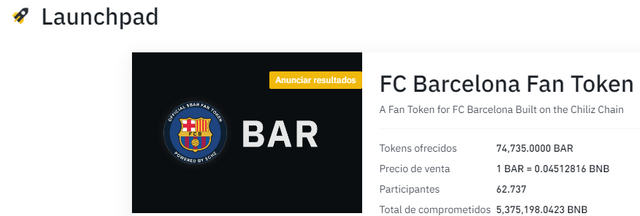

One of the most interesting Binance products, Launchpad. Launchpad products are aggressive and compliant with risk tolerance. Because there is a high risk. I was able to sell very cheap tokens at very high prices. Binance exchange showcases Launchpad products to fund token promotion and token projects.

How to Participate

To participate, you must have BNB in your account. The 7-day average of the BNBs in your account since the event starts. On the day the event expires / tokens will be distributed, you will be prompted to lock the BNBs you have in your account. Then the token distribution process begins. The BNBs and tokens you locked out will be sent to your Spot wallet after a while. The token you have is listed on the stock exchange, the price of the token will rise very high the day it will be listed on the exchange and I recommend you to sell it immediately.

b) Explain in your own words fixed and flexible savings, high risk products and launch pools

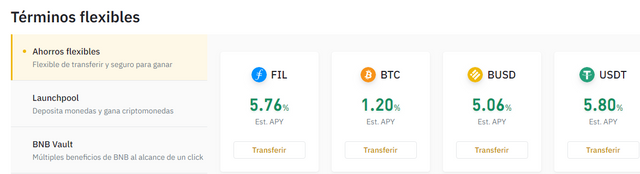

Flexible Savings

Binance exchange has a section with Margin transactions. Users must have those assets in Binance Margin's account in order to make transactions in this section. Binance Margin borrows from its users to own those assets and pays interest in return.

Users can value their owned and unused assets by lending them to Binance Margin. In return, he earns a certain rate of interest. The advantage of flexible savings is the freedom to reclaim your assets whenever you want.

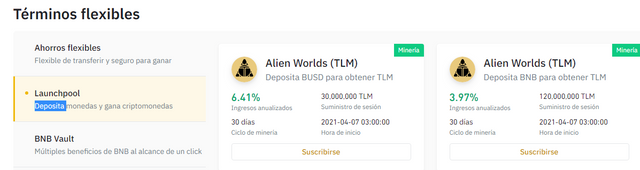

Launchpool

Binance exchange supports tokens that will be entering the market. The support of Binance, the newly launched token, is a great advantage for the token. To participate in this event, you must have BUSD / BNB or other tokens in your account. You lock BUSD / BNB or other tokens in your account. During the days you lock, you earn tokens that will enter the market as a reward.

Since Launchpool is evaluated in the category of flexible savings, you can unlock the BNB / BUSD you have locked at any time. But you cannot take advantage of that day's prize.

Actually, there is no complete locking here. You include the assets you have in the pool and you earn rewards. You cannot win a prize when you take it out of the pool.

Fixed Savings

The locked savings section is different from the other side. You must have tokens such as USDT, BUSD in your account to win rewards from this section. You lock these tokens for a certain period of time. There are 7 days, 14 days, 30 days and 90 days. For example, if you lock your tokens for 30 days, you will not be able to trade your tokens for 30 days. You cannot transfer. The more days you lock in, the higher the interest rate you will earn.

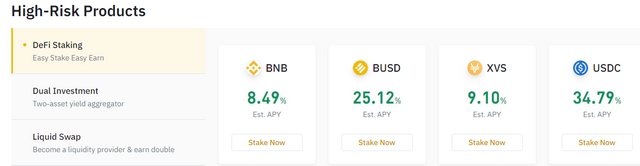

High-Risk Products

Defi Staking: It is the staking process performed on decentralized finance applications. Since the profit rate is very high in these products, the risk rate is also high. An error in the stacked network can cause you harm. You can stake Defi in two ways. As with flexible savings and fixed savings.

Dual Investment: Dual investment is a bit complicated actually. You deposit a cryptocurrency and in return you either earn from that cryptocurrency or USDT / BUSD.

If the cryptocurrency you deposit (BTC) is below the settlement price, you will earn the BTC you deposited + a very small amount of BTC. If the cryptocurrency you deposit (BTC) is above the settlement price, you will earn BUSD / USDT. In this case, your profit rate will be high.

Liquid Swap: You may have experienced this product elsewhere. Especially on decentralized exchanges. Users earn rewards by contributing to liquidity pools on decentralized exchanges. In the Liquid section, users earn rewards for contributing to the pool. In the exchange section, you can change your tokens.

I guess I don't need to mention Launchpad again, which I mentioned in the first question.

c) Show and give detail on how to set the investment you chose in Binance. If you don't use Binance as your exchange, let us know which alternatives you have in your own exchange and simulate the process of investing in Binance.

My favorite product is Launchpad. There is no active activity in the Launchpad section. That's why I'm going to talk about how Launchpool works. There are 16 events completed on Launchpool so far. There is 1 event ongoing. That's TLM.

After logging in to Binance, we immediately see the Launchpool page. If we click on Launchpool, we can switch to the active activity section. You can also use the Finance category to switch to the side where Launchpool events take place.

When we click there, we go to the page with the finest details about TLM.

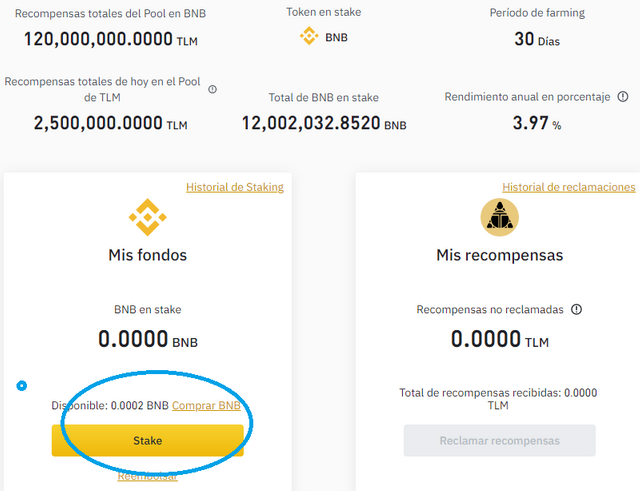

All the details about the event are available. There are information such as APY rate, how many days the farming will take, how much TLM will be distributed daily, how much BNB is staked, which crypto money is staked.

On the right is how many TLM we won as a reward. Since I did not participate in this event, I do not have TLM in my account.

Let's click on STAKE in the image.

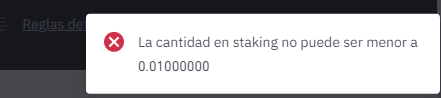

We write down the amount of BNB we will stake. We click on the place where it says STAKE again.

Since the minimum amount of BNB to stake is 0.01 BNB, I cannot continue the transaction. I can actually buy some BNB but the Binance Spot wallet is currently under maintenance.

After this process, we earn TLM as a daily reward. We can take back the BNBs we have transferred to the pool at any time, but this time we cannot benefit from the TLM awards that day.

CC: @fendit

Thank you for being part of my lecture and completing the task!

My comments:

I don't agree that much with this statement. There's no inherent risk when it comes to participating in a launchpool in Binance... it's somehow risky if you participate in other pool that's not that safe!

Your tasks were really good explained! Nice work on this!!

PD: Si te es mas facil, puedes hacer la tarea en español :)

Overall score:

6/10