Proof of Keys- Steemit Crypto Academy- S4W7- Homework Post for @awesononso

Hello to everyone out there, I would love to join Prof. @awesononso to welcome each and everyone to the seventh week of this season. The topic for this week is Proof of Keys and I'll try my best to give detailed answers to the test questions listed. If you reach the requirements, you could join me to do same my reading up the lesson on this link.

1.)

Keys have always been a means of security. You have an option to open the door with it or another option to lock the door with it. This means of security has been in use till date. It has now evolved from physical keys to softcopy keys. This keys serve serves as a means of encryption between two parties, the sender and a receiver of a message.

The symmetric encryption method was used in the past to protect and transmit information. In this form, a message was encrypted with one key and also decrypted with the same key. It was thriving at the time but users of this method experienced major setbacks. The fact that the key would have to be given hand to hand or sent in an unsafe manner to long distant parties. It wasn't really a safe approach because there would be a lot of duplicates of the key. Information could be stolen because a lot of people know the key and that brought about the introduction of the asymmetric encryption in the 1970s by Martin Hellman and his group from Stanford University.

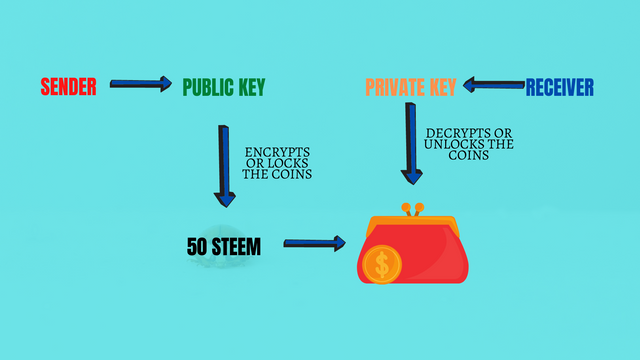

Public and Private Keys

The Asymmetric encryption is the use of two different keys to transmit and protect information. The public and private key. This method is seen to be the safest and is the type of encryption used to manage wallets of cryptocurrencies today.

The Public key: This is an open type of key. That means it can be made public to anyone without risking the security of the wallet. It is also called the wallet address and is normally given out to the sender. The sender uses this key to deposit or transmit digital assets to the wallet. It is just a one way key, because all it can do is to lock or encrypt the assets in place. Apart from that, it is known to be useless.

An example is a slot in a mailbox at the post office, where a sender can slide in the letter or item but he doesn't have the key (private key) to assess the mailbox. So once he puts his letter, he can't get it out.

The Private Key: This is the most important key to the receiver. It is the only key that can be used to assess the assets in the cryptocurrency wallet. It decrypts what ever was encrypted by the sender and gives the receiver the full right to do whatever he wants with the assets. Once lost, wallet becomes useless.

Now, we are through with the cryptography behind cryptocurrency wallets. There are two type of this wallets, the custodial and non-custodial wallet. I must make this clear that the two wallets make use of the public key and private key. Lets see how they relate:

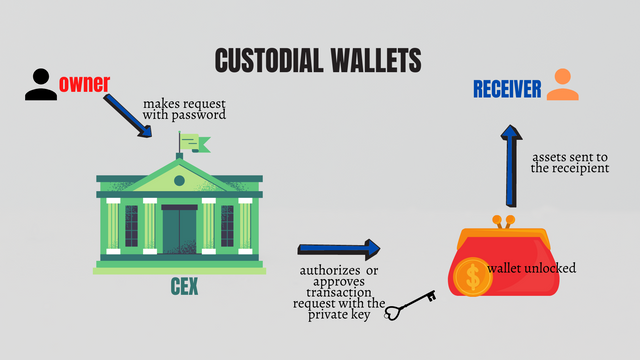

The Custodial Wallet

A custodial wallet is a type of wallet where the owner is not really in control of the Private Keys. This is normally seen on centralized exchanges like Binance, Coinbase and Huobi. Here the exchanges are in possession of the Private keys and easily have access to whatever is inside the wallet. When opening such wallets you are only entitled to creating the application password which just serves as a means of identification to the exchange to seek permission for the authorization (with the private key) to access the wallets.

An example of this kind of wallet can be seen in modern day banks where a customer has to go through a third party to access his cash. In this case, the bank is in possession of the private key to his account, he only signs cheques to request for authorization to use funds in that bank account. Sometimes, he may even be restricted to a certain amount he can withdraw in a day. Well, on this kind of wallet, you still have the public key which can be used to deposit digital assets. In the bank setting, the public key is viewed as the account number.

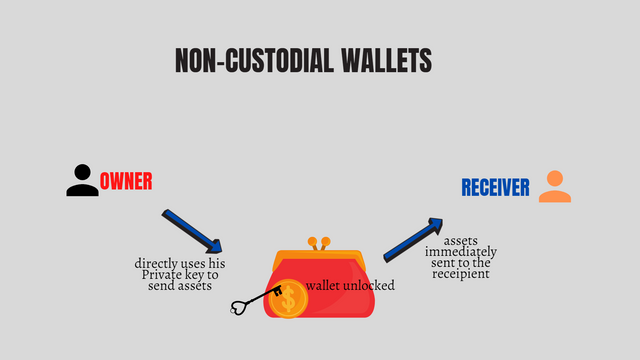

The Non-Custodial Wallet

The non-custodial wallets are normally decentralized wallets. In this type of wallet, the owner is in total possession of the Private keys. He has full right and is the highest authority on the wallet. He can choose what to do, however he likes and whenever he wants to. There is no restriction applied on this wallet.

This type of wallet was the idea Satoshi Nakamoto had when he first invented the Bitcoin. To eliminate all intermediaries and grant the owner full rights over all the assets in that wallet.

Now from what we've read above, we can see the relationship between the keys and the two types of wallets. They relationship is based on who is in possession of the private keys.

- In custodial wallet the private key is held by a third party

- while in the non-custodial, the private key is held by the owner of the wallet.

2.)

The proof of keys day is a special day set aside for a tradition in the cryptocurrency community of pulling out all digital assets from the custodial wallets or centralized exchanges to a decentralized wallet. It is simply a day to demand and take back control of your assets from the centralized exchanges. It was founded on the 10th aniversary of Bitcoin, which is the 3rd of January, 2019 by Trace Mayer.

I would say the Proof of keys day is a superb idea. This is because, there was a reason why the first cryptocurrency was created. Bitcoin was invented due to the distrust from the 2008 financial crisis were banks across the world failed its customers and these Centralized exchanges are almost alike with the banks. Satoshi Nakamoto created this payment system to eliminate all traces of third parties. To make a system where a client can make transactions directly with his peers without any restrictions.

This day was set aside to honour the genesis block and find out if we can trust the centralized exchanges we put our cash in. If the really have reserves of the exact amount of assets they display to us in our wallets. Also, to help new cryptocurrency holders learn how to manage their private keys. So why not? I see the proof of keys day as important.

What precaution do we take when Participating in it.

i.) First of all, we need to do proper research to find and acquire a trusted decentralised wallet. There may be some scams out there so make sure you know a friend that is already using it. Trust wallet and the tronlink are okay.

ii.) In the decentralised wallet, when you register an account, a mnemonic key will be handed over to you. You have to ensure that this key is joted down correctly on different pieces of paper and note books like this

Keep its safe and try to avoid storing your keys on gmail apps or internet cloud services.

iii.) Ensure you copy the right address for a particular token. Eg, if your token is TRX and your decentralised wallet supports it, go to the TRX wallet section and copy an address from there.

iv.) Ensure you paste this address in the right field on the centralised exchange and select the right network. All these is to make sure you don't lose your assets.

3.)

Well, it is safer to store your assets on the decentralised wallets but since we are talking about my preferences, I would prefer to keep my cash on the centralised exchange. I started my cryptocurrency journey using an exchange called Huobi and I must say, it's pretty cool. I'll state my reasons below.

On the decentralised wallet, the keys may not be so easy to remember and must be written down, so if you mishandle your keys or lose them. That marks the end of what so ever asset is in the wallet. Whereas, on the centralised exchange, in cases of a forgotten password, there is an option to retrieve it and this can go a long way. You never know until you are in those shoes.

The centralized exchange are known for their high liquidity and this aids in faster transactions between traders and this helps to reduce slippages. On the decentralized wallets, they are not so popular and orders are so slow to be filled. I can't see myself waiting for more than an hour to exchange my steem for usdt.

Well, some people may say centralised exchanges are not so safe but before I can access my Huobi wallet, I need to input my password every single time and also fill in an OTP sent to my mail box. This makes the exchange really safe.

Generally, I would say that a lot of people also store their assets on the CEX else, there won't be so popular with high liquidity.

4.)

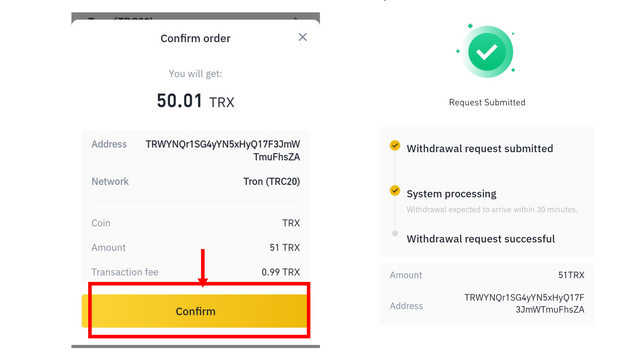

For the 50 TRX transfer

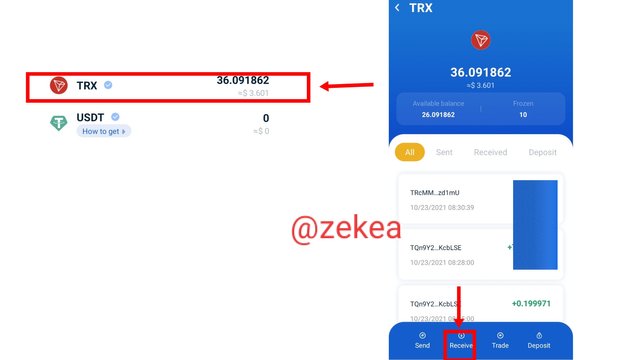

- Open up your Tronlink app.

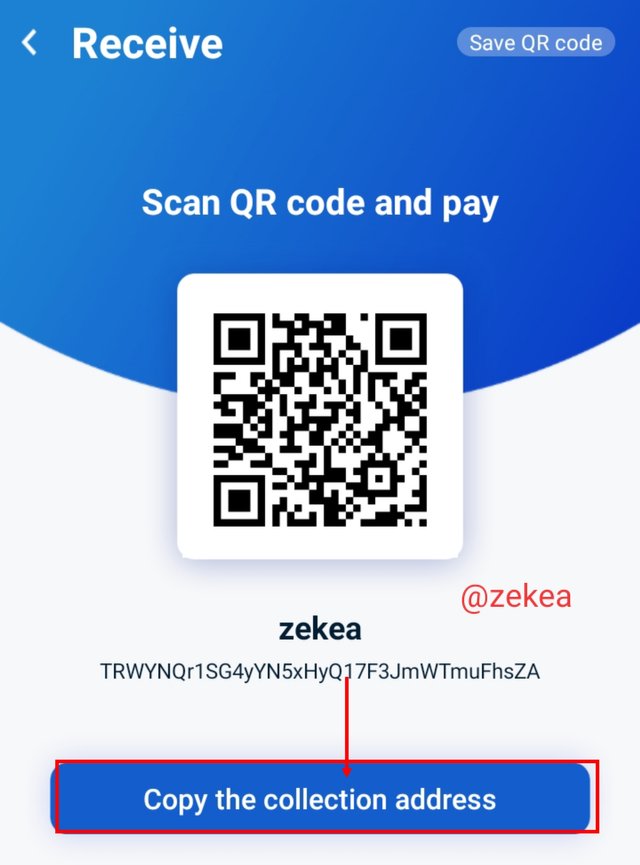

- Click on your TRX wallet highlighted above then from the next page, click on receive

- Now that we had gotten the TRX wallet address, we can now head down to the binance app

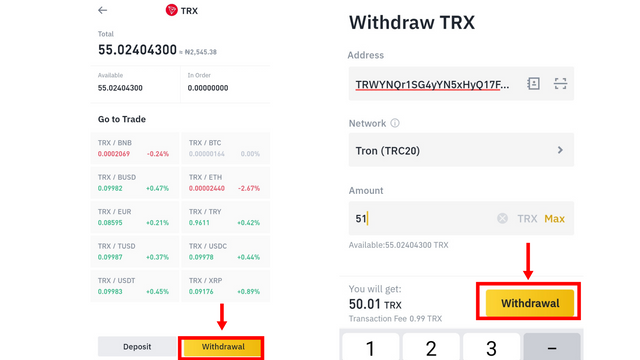

From the TRX wallet on the Binance application, click on withdraw.

From the next page fill the fields ensuring your insert the tronlink wallet address appropriately.

Click on withdraw

- Crosscheck the information displayed in the pop up menu, ensuring your filled the data in correctly, then click on confirm

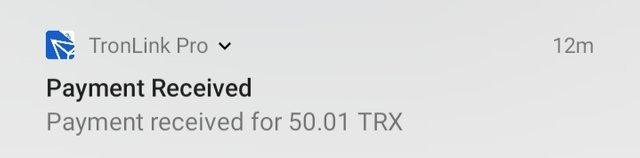

Now my TRX is securely locked up in my Tronlink wallet!!

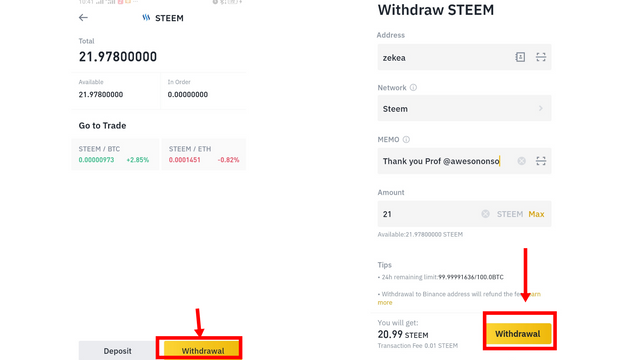

Now for the steem Transfer

From the binance application, Go to wallets, then click on Steem

Click on withdraw

From the next page fill the fields correctly, this time your wallet address is your steem username

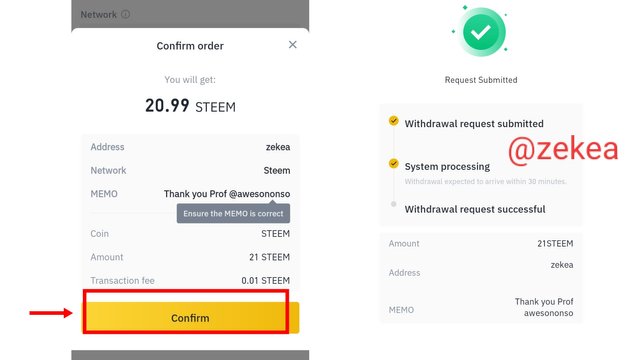

- Crosscheck the data displayed on the pop up screen then click on confirm

My STEEM is securely locked up in my Steemit wallet!!

4.)

The significance here is that, I am now the full owner of this amount of assets, I possess the private keys and can choose to do whatever I want without requesting for permission from a third party.

I must say, this was a good lesson because a lot of us had no idea that these centralised exchanges still had a private key. It has never been given to us, so we just assume we actually control the movement of our funds ourselves with just the password.

Well, we all need to partake in the Proof of Stake Day next January 3rd. Move out all our cash from the centralised exchanges to the decentralised wallets so we can get used to managing our private keys and also, take note if the centralised exchange you use displays the actual value in your wallet.

Special thanks to Prof. @awesononso

#club5050

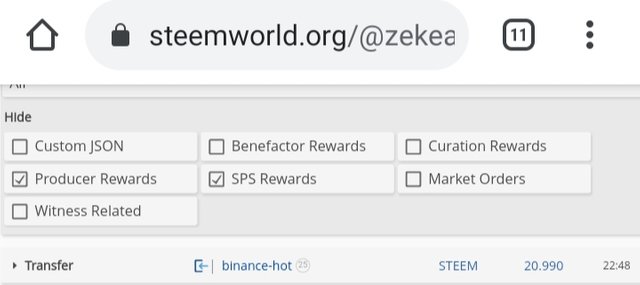

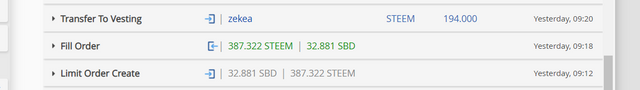

I changed my rewards of 32SBD to 387steem on the 21st of October and powered up half of it which is 194 steem.

#club5050 😀

Let's go!!!!

Hello @zekea,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

Thanks again as we anticipate your participation in the next class.

Woww!! Thanks Prof. @awesononso.

#club5050 😀