Trading Cryptocurrencies - Crypto Academy / S4W6 - Homework Post for Professor @reminiscence01

Hello All...

This week I will try to join professor @reminiscence01's class, this week's lesson on Trading Cryptocurrencies.

.jpg) Background from Canva

Background from Canva

1.) Explain the advantages and disadvantages of Spot Trading, Margin Trading, and Futures trading.

Spot Trading

Spot trading is a very common trade carried out by traders. This type of trading is very suitable for beginners because the risk is not too big and this type of trade is quite simple and easy to do. This trade is done by buying a cryptocurrency asset and holding it for a certain time so that when the price goes up they can sell the asset to take advantage of the trade. so when the trader has bought the asset the trader can analyze the market movement and can determine when is the right time to get out of the trade.

- Advantages of Spot Trading

The advantage of spot trading is that traders have full control over their asset holdings, they can trade according to the assets they own. so that traders can take advantage by buying assets when the price of the asset is down and selling it when the cryptocurrency asset fluctuates up again. When the price of an asset does not match the predictions of traders, they can hold their asset temporarily to make a profit, but this requires careful analysis and consideration.

- Disadvantages of Spot Trading

In Spot trading, it takes a lot of patience in trading. because when assets are down, traders cannot sell their assets because they will suffer losses. This also requires careful consideration and analysis when traders buy assets when prices are rising which is caused by this FOMO has a high risk because the asset could go down due to many other traders taking advantage of the increase in the cryptocurrency asset. so this type of trading really takes time and patience in trading.

Margin Trading

source

Margin trading is a type of trading that is very suitable for experienced traders who want to get big profits with small capital. Margin trading is a type of trading that utilizes third parties such as exchange platforms or other traders. so traders can take advantage of additional capital in their trades. As for traders, they can take advantage of the loan with a leverage of 2x, 5x, 10x, up to 100x. with this leverage, traders can maximize their profits. But keep in mind that every big profit has a big risk. if their trade fails then they must have additional capital to cover the loan.

- Advantages of Margin Trading.

By having small capital traders can start trading with additional capital from third parties, so they will get bigger profits if their trade is successful, so this type of trading is very suitable for experienced traders so that they can maximize their profits in this type of trading.

- Disadvantages of Margin Trading

Talking about big profits, of course, this type of trading has a big risk according to the leverage they set. so the greater the leverage they set when they fail, the more they will experience multiple losses. traders will also be exposed to liquidity when they fail. so traders have to pay the loan. so traders have to think about and have capital reserves to pay for losses from trading. because this trade is very risky, traders must be careful and must have careful planning before trading.

Futures Trading

source

Futures trading is a type of trading that predicts the price movement of an asset, so traders can predict which direction the set is moving, so traders can take advantage of both bullish and bearish trends when their predictions are correct. and vice versa they will get a loss if the predictions they make are wrong. This type of trading also has a high risk so this type of trading is not recommended for novice traders. traders can also maximize their profits such as margin trading with 2x, 5x, 10x, up to 100x leverage. it is with this leverage that they can multiply their profits.

- Advantages of Futures Trading

traders can maximize profits by multiplying their assets by the leverage they set. traders can also benefit during a bullish phase or a bearish phase. so by trading on this type of trade, traders can profit even though their capital is small. This is very profitable for traders who want to make profits in a short time.

- Disadvantages of Futures Trading

in this type of trading, the traders do not have full control of their assets, because the success of trading depends on the price movements of the cryptocurrency assets that they predict and set in advance. This type of trading also has a very high risk because if this trade fails then the traders will experience huge losses. so in trading on futures trading, traders must have experience and good analysis before entering a trade.

2.) Explain the different types of orders in trading, and how can a trader manage risk using an OCO order? (technical example needed).

Market Order

A market order is a type of order when a person makes a sale/purchase transaction at a price following the market price when the order was placed. So when someone places a sell order at the current market price, another trader is ready to buy the coin at the current price. Usually, the transaction process does not take long. for example I want to buy CHZ coins at a price of 0.3 USDT when the order is placed, and I want to buy with a capital of 6 USDT, so I will get 20 CHZ.

Limit Order

A limit order is a type of order when someone makes a buy/sell transaction but the transaction will not be executed immediately because someone places an order by setting a price limit. In this way, a trader wants to get more profit from their trade. for example, I want to buy a CHZ coin when the price is 0.3 USDT at the time the order is placed, then I set a price limit of 0.25 USDT. so when the price of CHZ fell 0.25 USDT then the order was just executed so I got 24 CHZ with 6 USDT of capital.

Stop-Limit Order

Stop limit is a type of order when someone makes a transaction by setting 2 types of orders, namely the limit price and the stop price. So a trader sets upper and lower limits in hopes of maximizing profits and preventing losses. This type of order is not executed immediately before touching the stop and limit. when the price of an asset hits one of them it will be executed immediately and the other orders will be cancelled. For example, I want to buy CHZ at a price of 0.3 USDT at the time of order. so I set the limit at 0.25 USDT and set a stop at 0.35 USDT.

OCO

OCO is a combination of other order types. The principle of OCO is that if one order has been executed, the other type of order will be cancelled, so with this type of order, the order is not executed immediately. because this order type sets 2 different order types and waits for the price to touch one of the predefined order types. eg I want to sell my 20 CHZ at the current price of 0.3 USDT. so I set the price with a target of 0.4 USDT. because the market is very volatile I also set another order at 0.25 USDT and 0.27 USDT. so that when my order has been executed at 0.4 USDT the other orders are automatically cancelled.

Stop Loss and Take Profit Orders

Stop Loss and Take Profit are types of orders that a person places in a buy/sell transaction so that the trade can exit automatically. There are types of trading in order to maximize profits and minimize losses. someone usually does technical analysis before trading when they want to enter the market then they will set a stop loss and take profit because they doubt the market is not going according to their predictions. then stop loss and take profit is very important to set. Usually, a trader sets a stop loss and take profit with a ratio of 1:1, 1:2 and others according to their trading style.

Managing Risk by Using OCO Orders.

In trading, managing risk is needed so that a trader can maximize their profits but the risk of their losses can be minimized. when the market is very volatile then we must have a good trading strategy, one of which is by setting the OCO order type. This is a combination order type between limit orders and stop-limit orders.

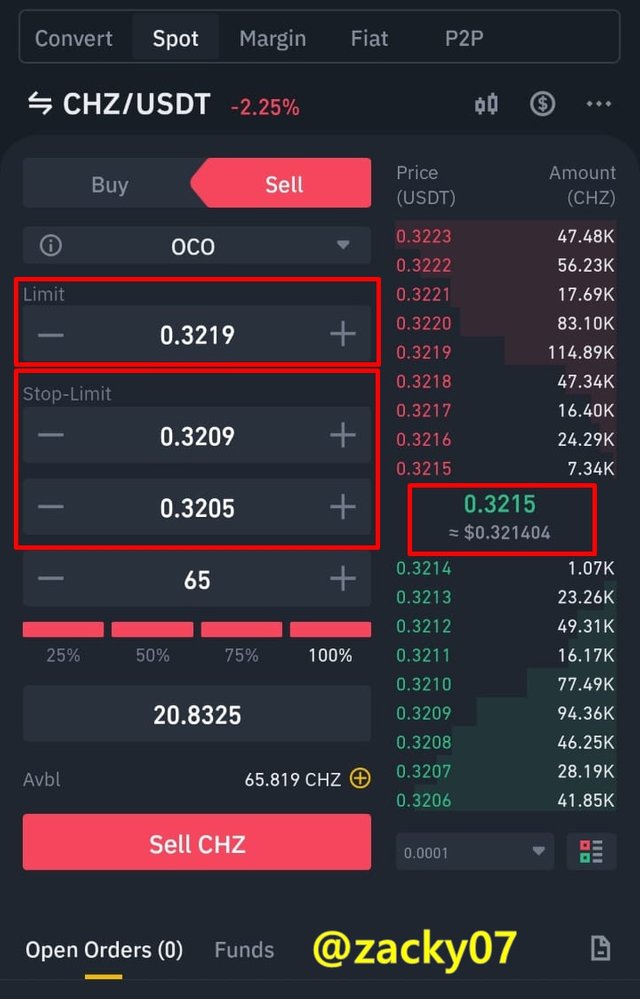

This combination is very helpful for traders when starting their orders on the market because they can place 2 types of orders at once. and can lock in their profits and losses before the order is executed. when the limit order has been executed the stop-limit order will be cancelled. if the trade does not go as predicted then a stop-limit order will be executed and the limit order will be cancelled. for more details let's see the catch from my Binance account below.

Screenshot from Binance

Screenshot from Binancefrom the screenshot above we can see together that I will sell 65 CHZ. the CHZ price when the order is placed is 0.3215 USDT. then I set a limit with a target of 0.3219 USDT. To reduce the risk of loss when the price drops I also placed a stop-limit order of 0.3209 USDT and 0.3205 USDT. so I waited a while before the price was executed, this type of order is very useful for traders in managing their risk of loss when they want to maximize their profit.

3.) Open a limit order on any crypto asset with a minimum of 5 USDT and explain the steps followed. (Screenshots needed from any cryptocurrency exchange).

Alright, I will try to make a purchase with my Binance account, as for I will buy Chiliz (CHZ) coin with USDT trading pair.

- First I log into my Binance account then I search for the CHZ/USDT trading pair. after that, you see the order book and then click buy.

Screenshot from Binance

- Then I used a limit order and bought 63 CHZ using 20.59 USDT as shown in the image below. after that click Buy CHZ and wait for the order to be executed, after that you can see the details of the transaction as shown below.

Screenshot from Binance

4.) Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset. (Screenshots required).

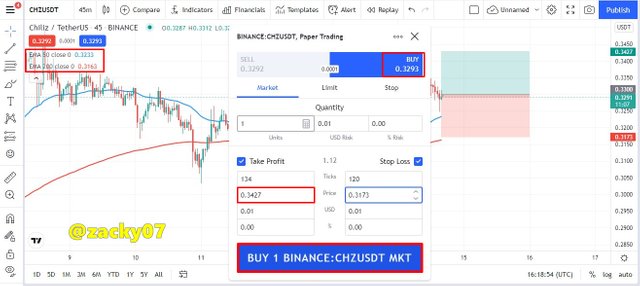

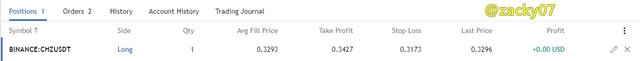

Well, I will try to do technical analysis on the CHZ/USDT trading pair. using the help of the Exponential Moving Averages (EMA) indicator. i do the Tradingview platform on my trades.

Reasons for choosing Chiliz (CHZ)

I chose CHZ because this token has great potential in the future, CHZ is a token that has collaborated with one of the platforms that have very good potential, namely socios.com, this platform is a very good platform because it is engaged in the sports industry and the arts industry other. This platform aims to bring fans closer to the club they love. With a very large number of fans from sports clubs, it can be said that CHZ has great potential in the future. so with a very good CHZ strategy and have a very good background in fundamental analysis, so I think CHZ is one of the cryptocurrencies that are very suitable for trading and investing.

Technical analysis (CHZ)

Alright, let's do technical analysis and open a buy/sell position using a tradingview demo account.

Screenshot from Tradingview

on the CHZ/USDT trading pair I use the Exponential Moving Averages (EMA) indicator with the 50 and 200 EMA line settings. The EMA indicator is a trend reversal indicator, so when I see the 50 and 200 EMA lines crossing each other (Golden cross), this is a reversal signal trend, then I place a buy entry (Long entry). and I set take profit and stop loss with a ratio of 1:1. You can see my trading details as shown below.

Screenshot from Tradingview

Alasan memilih Indikator Exponential Moving Averages (EMA)

Indikator Exponential Moving Averages (EMA) merupakan indikator yang sangat cocok digunakan dalam analisa teknis. dengan kombinasi 2 garis EMA kita akan mendapatkan signal pembalikan tren sehingga kita dapat menetapkan posisi jual/beli. 2 garis EMA yang saling bersilangan biasanya disebut golden cross ketika pembalikan dari downtrend ke uptrend dan death cross merupakan pembalikan tren dari uptrend ke downtrend. sehingga dengan informasi yang diberikan dari indikator ini akan sangat membantu para pedagang dalam menetapkan posisi masuk mereka dalam perdagangan.

Conclusion

In trading, there are many types of trades that we get, all of which have their respective functions when we trade, if someone is new to trading then he is advised to start with spot trading, and if someone is an expert in trading and wants bigger profits then he can Doing margin and futures trading, the greater the profit, the greater the risk of loss, so it is necessary to carry out careful analysis and decision making on this trade.

In the trading platform, there are types of order types, this is very helpful for traders in making trades. such as market orders, limit orders, stop-limit orders, OCO, stop loss and take profit. These types of orders have different functions in executing traders' orders on the market. so this type of order can be used according to the needs of traders

Hello @zacky07 , I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.