Crypto Academy / Season 4 / Week 1 - Homework Post for @awesononso (The Bid-Ask Spread)

Hello All...

This week has entered a new season, I am very happy to be able to participate in the previous season, and I will be joining again in this 4th season. As for me, I will take the @awesononso class. let's try to discuss the questions given this week.

.jpg)

Background from canva

1.) Properly explain the Bid-Ask Spread.

when trading on the order book, of course, we see the bid price and ask price, this is a market activity that is being carried out by sellers and buyers.

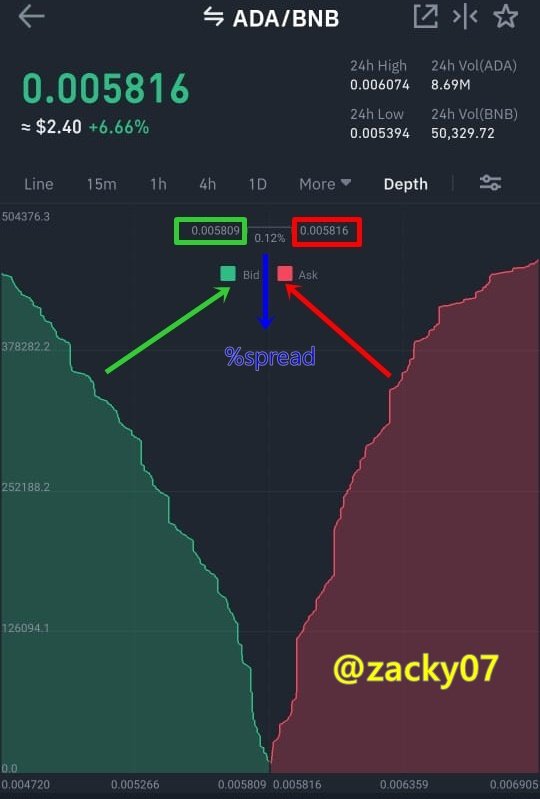

Screenshot from Binance

From the picture above, we can see that in the ADA/BNB trade there is an order book and we can see the bid price and the ask price

a.) Bid Price

The Bid price is the highest price for an asset that buyers are willing to buy in the market, in the picture above the bid price can be marked by a green wave on the market.

b.) Ask price

Ask price is the lowest price of an asset that sellers are willing to sell in the market, in the picture above the ask price can be marked by a red wave on the market.

From the brief explanation above, we can define the Bid-Ask Spread to see the liquidity that occurs in the market. This can be seen by looking at the difference between the bid price and the ask price. to find the price spread on an asset is very easy with the formula (ask price-bid price). so by understanding the basic concept of spreads, it is very helpful for traders to know the market is experiencing liquidity or not, this can all have an impact on the speed of transactions between sellers and buyers in the market.

2. )Why is the Bid-Ask Spread important in a market?

Knowing the Bid-Ask Spread will provide traders with important information about the liquidity of cryptocurrencies in the market. This is very helpful for traders to know the activities that occur between sellers and buyers in the market.

So if an asset is experiencing high liquidity, it can be indicated by the difference between the bid price and the ask price is smaller. This means that if the price spread is small, the activities of buyers and sellers are busy making transactions on the asset in the market so that the asset will be easily sold and bought. and vice versa if the price difference between the bid and ask prices is very large, then we can know that the cryptocurrency in the market is dealing with small liquidity. this gives us information that the activity between sellers and buyers in the market is very small, this has an impact on our assets that we will do buying or selling transactions will be difficult to sell or buy because of the lack of cryptocurrency transaction activity on the market.

3.) If Crypto X has a bid price of $5.00 and an ask price of $5.20,

Known from the question above :

- Bid price = $5.00

- Ask Price = $5.20

a.) Calculate the Bid-Ask spread.

Answer :

Bid-Ask Spread = Ask Price - Bid Price

Bid-Ask Spread = $5.20 - $5.00

Bid-Ask Spread = $0.20

b.) Calculate the Bid-Ask spread in percentage.

Answer :

%Spread = (Spread/Ask Price) x 100

%Spread = ($0.20/$5.20) x 100

%Spread = 3.85%

4.) If Crypto Y has a bid price of $8.40 and an ask price of $8.80,

Known from the question above :

- Bid price = $8.40

- Ask Price = $8.80

a.) Calculate the Bid-Ask spread.

Answer :

Bid-Ask Spread = Ask Price - Bid Price

Bid-Ask Spread = $8.80 - $8.40

Bid-Ask Spread = $0.40

b.) Calculate the Bid-Ask spread in percentage.

Answer :

%Spread = (Spread/Ask Price) x 100

%Spread = ($0.40/$8.80) x 100

%Spread = 4.54%

5.) In one statement, which of the assets above has the higher liquidity and why?

From questions 3 and 4 we can see the difference between each of these cryptos. on crypto X spread it is known = $0.20 while on crypto Y spread it is known =$0.40. from the above comparison, Crypto X has a smaller spread than Crypto Y, so Crypto X has higher liquidity. in this case, it proves that transactions between sellers and buyers occur more in crypto X so that Crypto X has higher liquidity and has a smaller difference between the Ask Price and the Bid Price.

6.) Explain Slippage.

A slippage is an event that occurs in the market when an asset is experiencing low liquidity. because cryptocurrency assets continue to fluctuate in price every time it will affect the bid price and ask the price before the order is executed. this can be a gain or a loss depending on the price of the asset being increased or decreased at the time the order was made.

for example, when a trader wants to trade TRX/USDT of 100 TRX in exchange for 9.3 USDT when market liquidity is low, the activity between the seller and the buyer is so small that it takes some time before the order is executed. This is very influential on the price of TRX at that time which was experiencing fluctuations. so because there is a time lag before the order is executed the price of 100 TRX becomes 9.5 USDT. This kind of event is known as slippage.

7.) Explain Positive Slippage and Negative slippage with price illustrations for each.

Positive Slippage

A positive Slippage is an event that benefits traders when orders are executed late due to a lack of liquidity in the asset that is experiencing price fluctuations. This can happen to buy orders or sell orders. on a buy order, the executed price is lower than the price that was first ordered, while on a sell order the price sold is higher than the first price ordered.

a.) Buy Order

For example, a trader wants to buy one of the cryptocurrencies for $30. however, due to the market's lack of liquidity, the order was executed at a price of $29 so the trader made a profit of $1. with the breakdown $30 - $29 = $1.

b.) Sell Order

For example, a trader wants to sell one of the cryptocurrencies for $30. however, due to market lack of liquidity, the order was executed at a price of $32 so the trader made a profit of $2. with the breakdown of $32 - $30 = $2.

Negative Slippage

A negative slippage is an event that harms traders when orders are executed late due to a lack of liquidity in the asset that is experiencing price fluctuations. This can happen to buy orders or sell orders. on a buy order, the price executed is higher than the price that was first ordered, while on a sell order the price sold is lower than the price on the first order.

a.) Buy Order

For example, a trader wants to buy one of the cryptocurrencies for $40. however, due to the market lack of liquidity, the order was executed at a price of $42 so the trader made a loss of $2. with the breakdown of $42 - $49 = $2.

b.) Sell Order

For example, a trader wants to sell one of the cryptocurrencies for $40. however, due to market lack of liquidity, the order was executed at a price of $37 so the trader made a loss of $3. with the breakdown of $40 - $37 = $3.

Conclusion

For a trader to understand market conditions is the most basic thing that must be known such as the Bid-Ask Spread. By knowing the concept of the Bid-Ask Spread, a trader will know the condition of the market is experiencing liquidity or not, the liquidity of the asset is influenced by the activity of the seller. and buyers in the market. all of these can have an impact on the speed of transaction processing.

If the market liquidity is low it will result in slippage which results in profit or loss for a trader. so conditions like this must be considered by a trader before trading cryptocurrencies on the market.

Hello @zacky07,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

The definition of the spread and slippage need to be clearer.

Some other statements are also not very clear. Always write carefully and clearly.

Thanks again as we anticipate your participation in the next class.