Steemit Crypto Academy | Season 2: Week7 || Exchange order book and its Use and How to place different orders?

Hello All,

As-Salaam-mu-Alaikum !

I am @yousafharoonkhan, your crypto professor and I am from Pakistan. And this is my 4th class season 2 week 7.

First of all welcome students to week 7 course and as you all know

In our previous lecture we talked in detail about decentralized and centralized system in simple words and tried to understand these two systems in simple words and we discussed social media in the last lecture and the difference between decentralized and centralized social media. Tried to understand and see how Steemit is currently the best decentralized social media in the world.

Dear students, I hope you enjoyed the previous lecture.

Dear students,

In today's lecture we will try to understand the Order book in simple words. In addition, we will look at how we can estimate the market by looking at the order book. Also in this lecture we will try to learn how to place difference buy and sell orders and how order book help to gain the profit in trading. In this lecture, I will tell you the basics in a very simple way so that new users who want to learn trading can also understand.

So let's start today's lecture

Exchange Order Book

If we look, we can understand from the meaning of order book that a book in which the details of order (sell/buy)are written. Thus order book plays a very important role in this business. Because through order book we can know which items are currently priced in terms of market value and what is in demand in the market.

I will try to explain the order book with the example of everyday life because I think we all deal with the daily order book.

For example, we go to the vegetable market or fruit market every day. In this market, various vegetable and fruit sellers are selling their wares and when the customers come to them, the customer wants to buy a vegetable or fruit at his own price.

Thus in a vegetable market or any other market, different businessmen sell the same thing at different prices and other hand ,customers want to buy from seller at their own price. The record of all this process is gathered in one place. We can call it Order book in the local market .

If we try to understand the order book in cryptocuurency, we can say that the crypto order book works like the local market, but there is a difference between the market and the crypto order book in pairs. Whenever we trade in crypto, we You have to observe the order book in the pairs that you have to trade using.

By pairs we mean that what I am buying and selling in the currency is called pair. Suppose I am selling you bitcoin and you giving me a tron in return, it will be called a pair. So when we trade crypto on an exchange, we first have to see in which pairs we will trade.

So far we came to know that there are pairs in the order book. In this way we can say that order book means the total record of sell and buy in a particular pair. This is the simplest definition we can give. We can also say that order book refers to the information which gives us information about the buy and sell situation in a particular pairs and at what price the traders are selling and buying a cryptocurrency in a particular pair.

There is a very popular order book definition that you will often find on the internet that will give you detail concept to understand the above given detail

An order book is a list of trades, either electronic or manual, that an exchange uses to record market interest in a specific security or financial instrument. Shares are normally listed in an order book by volume and by price level.source

How to Understand / Read Cryptocurrency Order Book Trading, Key Points

I am trying to inform you about order book in very simple words. I hope you have already understood what is meant by order book. Now we move on to exchange and I will try to explain through screenshot about order book what other features it would have. There are things that need to be understood.

When we login to the exchange and search the market, we see a lot of cryptocurrency details that are currently being traded on the exchange by order.

So we have to go to the trade of this coin to trade in any crypto coin and when we go to the trading area of this coin we see the order book of this coin.

But it is very important that whatever coin you want to see in the order book, you should also keep in mind which pair of the coin you want because one coin is being traded in different pairs on the exchange and the order is according to the same pair. The book is being generated.

How to find an order book

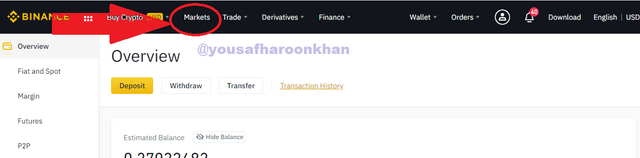

After logging in to the exchange, click on Market as seen in the screenshot. These screenshots are taken using Binannce exchange.

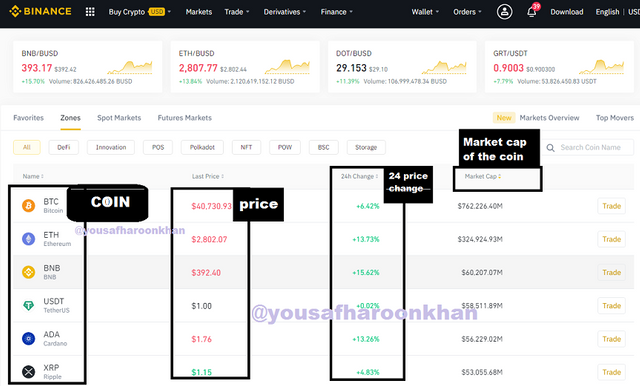

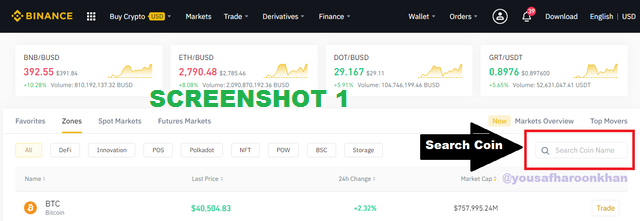

So when we click on the market button, we see a lot of futures, as I have highlighted in the screenshot. We can see the names of all the coins and then observe the prices for a total of 24 hours and we can also see the total market cap of any cryptocurrency. This is the view of the market over all the coins that we see in the market area.

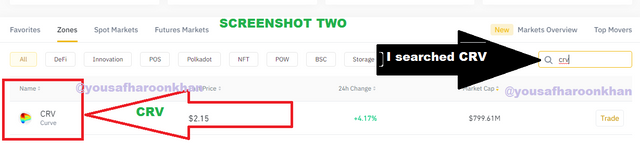

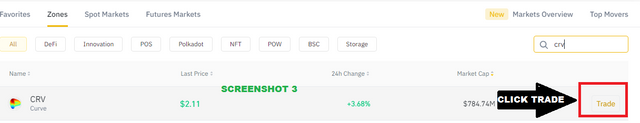

- Now if we want to see the order book of a particular coin from this market area, we have to type the name of the cryptocurrency in the search option in that area. You can see in the screenshot below how I am searching for Curve DAO Token (CRV) coin. And when we find the coin then we have to click on the trade button which you can see in screenshot number 2,3 and after clicking on trade you have to choose in which pair you put this coin. to trade Thus, after all these steps, you will see the order book screen in the pair of your choice of this coin.

Key points /feature of the order book

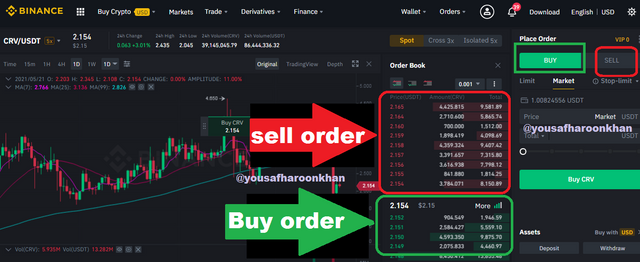

i hope you understanded all of the above steps. Now when we click on Trade and choose to trade in a selected pair, the Binance system takes us to the Order book page. The way you see the screenshot of the order book in the above image. The most important points or futures of the order book here are Buy and Sell. It is very important for both of them to understand what Buy and Sell are. Because the purpose of our course is to acquaint the new user with the basics.

You can see the screenshot above. This is a screenshot of the Order Book and here we have to understand two very important things Buy and Sell. Because many new users who are looking at the order book for the first time do not understand what it is Sell and Buy. So we try to understand them both in simple words. The order book has two basic components, one is Sell and the other is Buy.

With sell and buy we also include market fluctuations and prices and order placement is also included in the order book components but we will look at the basics now.

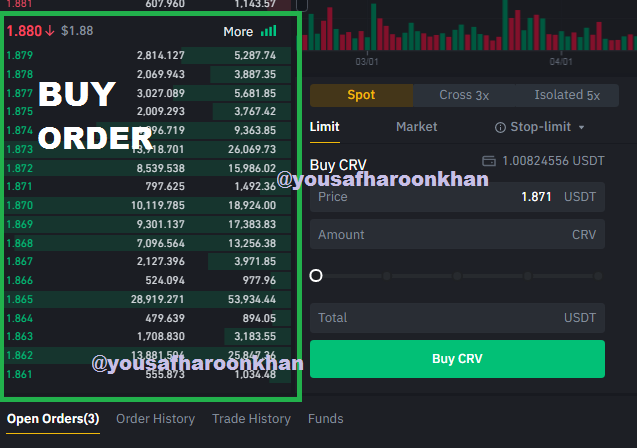

Buy Order Book

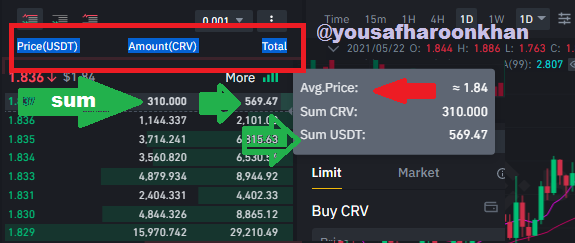

Whenever we check the order book with a particular pair of any cryptocurrency, we will see a green Buy area and Buy means the price at which different traders or buyers want to buy something. You can also say that the order of the buyers that they want to buy this coin. Buy is also called Bids. This means that when a buyer buys a crypto at his own discretion, he will place bids on the coin.In the screenshot, all the buy orders can be seen in order. Thus, whenever a buyer places his order to buy a coin, his record will be recorded in the buy order book. In this way, we can see in the order book In which coin we want to trade at what price we want to buy. And we can also see what the average price buyer is in the market for the coin.

Price(USDT-Pair) ,Amount(CRV Coin) ,Total,Avg Price, Sum CRV, SUM USDT

I have chosen to pair CRV with Usdt. This is because Usdt has a stable coin and I mostly trade in Usdt pairs. This way you can see the Avg coin price in the screenshot. And then you can see the total crv buyers want to buy. This way we can see all the trade related information in detail in the order book.

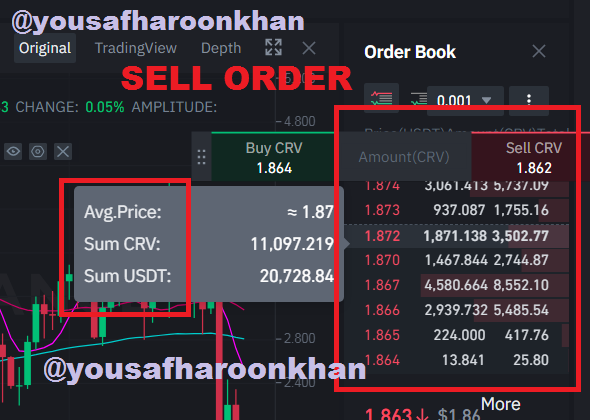

Sell Order Book

Just as a buy order informs us of a buyer's order, so a sell order gives us information about the current Ask price in a particular pair of a particular coin. Ask or sell order refers to the seller at what price. The crypto wants to sell and the price at which the seller wants to sell the coin is called the seller order or ask order. And remember that the red order that appears in the screenshot is called the seller order. And so we can see the details of average sale price and total order in sell order. As you can clearly see in the screenshot.

How to place Buy and sell order

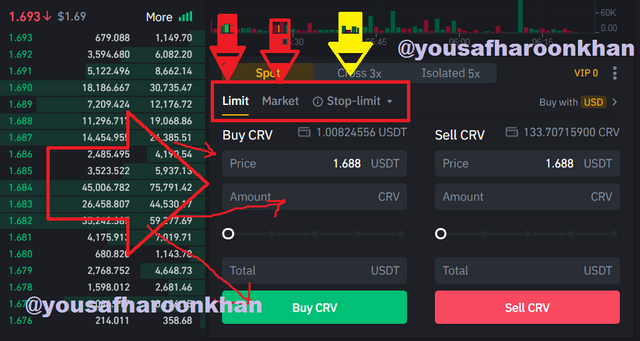

In the above topic we have reviewed the order book and now we will try to learn how to place our order in the order book. For example, if you want to buy or sell a coin with a particular pair, how will they do it? I will try to explain the details through binance exchange here. If you go to the order book of binance exchange, you will see different options for placing order. You can choose to buy or sell order using these options. Option means you will find different types of orders like Limit order, Market order, and stop limit order are all types of orders. As you can see in the screenshot.

Limit Order

As I mentioned, we have different order facility in order book and new traders do not understand what all these are and how to use them in order placing, so first we talk about limit order. limit order I will try to explain this with an example. Suppose the price of a coin is ten dollars at the moment but if you want to buy the same coin for seven dollars then you can buy that coin through limit order. But your order will be full fill only when the price of this coin will be seven dollars. This way you can also place a sell order using the limit order at the price you want. To place an order, place this coin in your respective pair. You will enter the price at which you want to buy the coin and in the amount area you will write the amount of coin you want to buy. And place order by clicking on Sell or buy.

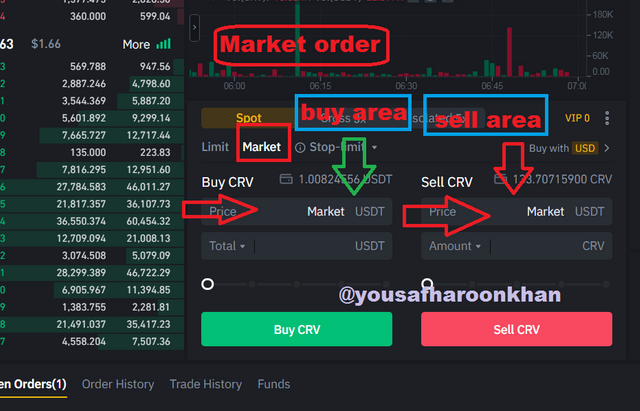

Market Order

There is a difference between market order and limit order. When we trade in market order, here we have to buy and sell according to market trend and in market order we cannot put our own price as we did in limit order. What is Market order means that our order will be completed at whatever price the purchase or sale will be in market at the time of placinging order. And when we click on the market order, the market order buy and sell will open in front of us and the market will be written in the price space. This means that your order will be sold or bought at a price that is the market price. This way we can place order through this market order.

Stop-limit Order

Now we talk about stop-limit order. A stop limit order is an order in which a trader voluntarily puts his order in the market and then completes the order with his limit price. A trader wants to buy or sell a CRV coin and he wants to complete his order through stop limit order.

So it means that you choose support and resistance level and place your order accordingly. Let's place in stop limit order. Let me try to explain with an example. Suppose you want to buy a coin with understanding of support and resistance level,i feel that to use this order ,we need to understand about support and resistance hope you all already know about it .

We will first understand here when and at what price we will buy the coin we are buying because when and at what price to buy is actually the main point of the stop limit order to understand this order placing. I do not know , you will agree with me on when at what price to buy a coin we can use the stop limit order by checking the support and resistant level.

Suppose we want to buy a Coin Crv and now we want to place a stop limit order, then we will first observe the support level and where we think that if the price of CRV falls to from this support level then our buy order will be placed in the market. And then after being placed, our order will be bought at our limit price. so it is simple way of understand the stop limit order

How to place stop limit order and OCO

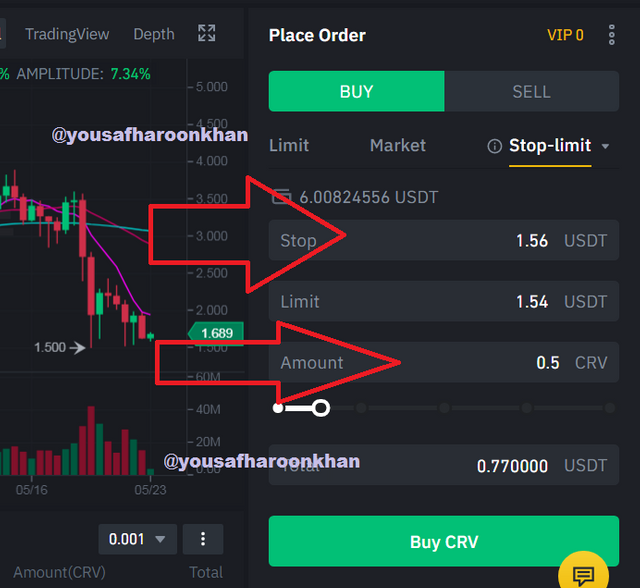

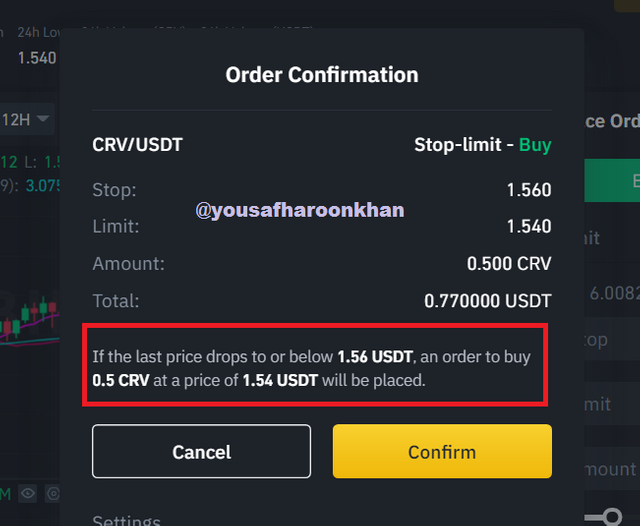

Regarding such an order, we can also say that if the price of a coin falls below this price, then the place in my order market should be triggered and then the coin should be bought on the limit price that I have imposed. We put the stop limit order in the purchase. I have written the price at the place of stop where I want to trigger my order in the market and at the place of limit I have written the price at which I want to buy coin CRV. I want. You can see in the screenshot.

You can see in the screenshot above that I wrote the price in Stop that if the price of this CRV falls below 1.56 then my order buy should be put in the market and my limit order should be placed at 1.54. Hope you understand the limit order now.

We use it exactly the same way in sell. And to protect himself from loss or gain, a trader writes the price in a stop that he wants if at that price CRV or any coin in which If you are trading, you can place a sell limit order. This is a very useful trading method.

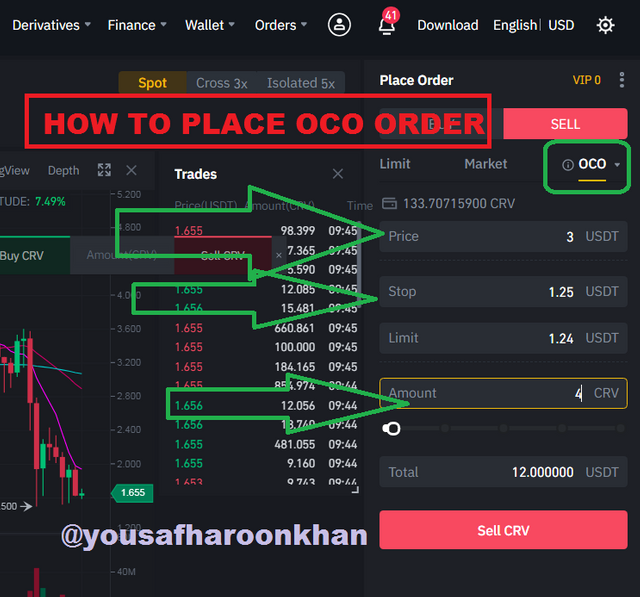

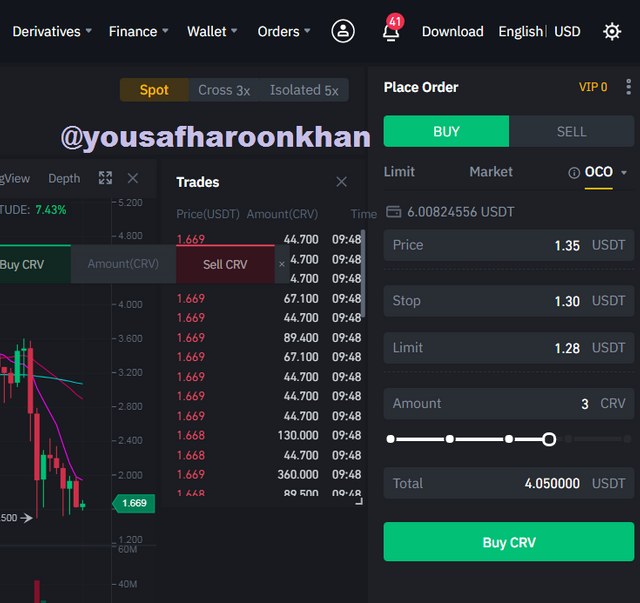

When we place an order in OCO, the difference is that we will also put a sell price on our profit price and thus if the market goes below our support level, we can stop our sell and put a limit order. ۔ Thus, if the market touches our resistant level, our coin will be sold at the price that we will write in the price. Thus, if the price goes below the support level, we can set our sell limit order by putting that price at the stop. If the price of CRV falls below the support level, then our order will be placed in the market at this price and will be sold at our limit price.

You can see in the screenshot that I have listed the price I want to sell at a profit, meaning if the price exceeds my purchase price of CRV. And thus I have entered the price in Stop that if the price of CRV goes down to that price then I will write that price in the limit order where I would like to sell CRV at a loss. I hope you understand.

How order book help in trading to gain profit

The order book can be very helpful if we understand the order book and use it in trade. We have many options for trade in order book which we use in trade such as limit order, market order and stop-limit order. Thus we can also do short term trade through limit order, for example if we buy steem coin at 0.60. If so, we can sell steem at 0.65 limit order and sell it at a small profit and then buy it again at a lower price through limit order. In this way, if we want to buy a coin for a long term, we can buy the same coin quickly from the market order and in this way we can buy and sell it at profit by placing an OCO order and we can also sell it at a small loss.

We can also see through the order book what the market trend is at the moment because when we look at the order book carefully we get the complete details of sell and buy orders what is the volume of a coin so we can see the quantity of order in the order book We can also estimate at what price the buying and selling trend of a coin is running and in this way we can take profit or we can safe asset from loss.

we can improve our trade by using the technical indicator in the order book and if we trade on any exchange then we can use all the technical indicators in the order book. Different technical indicators are used like MA, boll, Trix. , VOl and KDJ are popular in EMA and sub indicator and by understanding all of them, if we place order in order book, we can take profit and also save ourselves from more loss.

We hear a lot of about two words, support and resistance a lot and are also studying in courses so we get a chance to test support and resistant in order book and if we see all buy and sell order quantity and prices at what price to buy more a coin and sell And if there are sell orders or buy orders are more then , we can easily understand what the support level will be and where the first or second resistant breakout is taking place.

We can place different orders on different ponits. This way we can place different buy and sell orders using OCO trade by reading different technical indicators. If we use OCO trade then we can sell at profit and In order to protect ourselves from further losses, we can also use OCO through limit order and Stop. Thus, if we get some news that the price of a coin is going to go up, we can buy and hold that coin quickly from the market order. And then sell at a profit through limit order or OCO.

I share my experience with you. Whenever I traded, I would come to the order book and put the order of my choice on buy or sell but the profit was less and the loss was more but a friend told me that when I If do any trade then i should look in the order book what is the volume of buy order and look at sell orders like this then look at the chart of two day and fifteen minute one hour trade and then look at the amount of buy and sell orders at present time. I would like to place my sell and buy order and believe me I started this way and the trade and results were very good. So I am trying to explain through this course that the order book is very wide, it is not just for buy and sell, but it is a complete book that provides you with all the technical indicators from which we can profit from trade, can earn profit and can reduce your losses.

I hope you liked my this week7 course and I have tried to present my course in very simple words and did not use any difficult technical words. If you need more help, you can ask in the comments and I will try to answer you at the first opportunity.

All screenshots I have taken during the trade by logging in to my Binance account.

Home Work Week 7

Question no 1 :

What is meant by order book and how crypto order book differs from our local market. explain with examples (answer must be written in own words, copy paste or from other source copy will be not accepted)

Question no 2 :

Explain how to find order book in any exchange through screenshot and also describe every step with text and also explain the words that are given below.(Answer must be written in own words)

- Pairs

- Support and Resistance

- Limit Order

- market order

Question no 3 :

Explain the important future of order book with the help of screenshot. In the meantime, a screenshot of your exchange account verified profile should appear (Answer must be written in own words)

Question no 4 :

How to place Buy and Sell orders in Stop-limit trade and OCO ,? explain through screenshots with verified exchange account. you can use any verified exchange account.(Answer must be written in own words)

Question no 5 :

How order book help in trading to gain profit and protect from loss?share technical view point, that help to explore the answer (answer should be written in own words that show your experience and understanding)

Conclusion

Rules

Important All Homework posts should be posted in the community Steemit Crypto Academy .

Your Homework should be at least 300-1000 words.(if any students want to explain more words ,it is allowed)

Only steemexclusive articles will be curated

Add tag #yousafharoonkhan-s2week7 #cryptoacademy in your post and should be among the first five tags. Also, tag me as @yousafharoonkhan

Use only copy-right free images

PLAGIARISM Will not be Accepted, make sure your content in the post is not copied and pasted from other sources.

Plagiarism and spinning of other users’ articles will not be tolerated in the homework task. Otherwise repeat offenders will be blacklisted and banned from the Crypto Academy.

This homework task will run until 29th May'2021, Time- 11:59 PM UTC.

Users having a reputation of 50 or above, and having a minimum SP of 100(excluding any delegated SP) are eligible to

participate in this Task.It is necessary to complete all given questions in the week 7 course to gain the full marks.

Thank You.

@yousafharoonkhan

Crypto Professors at Steemit Crypto Academy

Hey @yousafharoonkhan professor , very nice class from your side but I have a question.

I didn't understand this question , we should tell important feature of order book and what about the screenshot of your exchange account verified profile? Do we have to post our exchange account profile in homework task ?

Sometimes it happens that some user edits fake screenshot. Let's usev in homework and when you login to the exchange, it becomes clear that a user is logged in to their account. So you have to give a screenshot view of your exchange account. To find out if you are a real user

Yes you important feature there are many in order book that are like tool..for example technical indicator..sell order .buy these are count feature ..

Thank you

Lol, came here for the same doubt, although it was for the word "future", but it's feature in fact. Thanks for this 😊

Welcome 😇

its mean create your own account they ask for ID card or driving licence for 100% registration

so make your own Profile

Hello dear professor @yousafharoonkhan, Here is my entry of the assignment

https://steemit.com/hive-108451/@churchangel/steemit-crypto-academy-week15-homework-post-for-professor-yousafharoonkhan-exchange-order-book-by-churchangel

Here is my entry

https://steemit.com/hive-108451/@noraiz/crypto-academy-season-2-week-7-homework-post-for-yousafharoonkhan-exchange-order-book-and-its-use-and-how-to-place-different

I can't imagine more simpler explanation of the topic than this. Thanks alot.

#affable

thank a lot respected , i tried my best to use simple words and method to explain , it is my success you all satisfy,

Professor, @yousafharoonkhan you have uploaded a very good lecture. It gives us a very good guide because we do not spend so much time in the exchange. We are grateful for the informational post you shared.

Another great lecture professor. Thankyou so much for posting such an easy explanation. Professor I only have one doubt that in forest Question we have to tell different between local order book and crypto order book ?

Yes ...detail with example to explore view..

Good post, very clear.

Very knowledgeable and healthy explanation you elaborates each and every thing in a simple manner In sha Allah I will surely take part in this class.

My homework:

https://steemit.com/hive-108451/@gduran/crypto-academy-week-15-homework-post-for-professor-yousafharoonkhan

My homework

https://steemit.com/hive-108451/@toluwalase/crypto-academy-season-2-week-7-homework-post-by-toluwalase-for-professor-yousafharoonkhan

Thankyou

@yousafharoonkhan