Stable Coins: DAI (Crypto Academy Week 6 - Homework Post for @yohan2on)

First introduced in 2015, MakerDAO was launched in December 2017 by CEO and Founder Rune Christensen.

Running it is the Maker protocol — the same architecture where the DAI stablecoin runs on.

There are a number of factors that sets MakerDAO's DAI apart from other leading stablecoins – one of them being its unprecedented degree of decentralization as its feature, meaning there is no one entity that is in control regarding the issuance of DAI, unlike other stablecoins (such as Tether) who offers cryptocurrency with a reserve of fiat assets at its back, which, in turn, is then managed by a central organization. However, those who are interested to have DAI must submit Ethereum-based assets via a smart contract, which uses them as collateral to maintain DAI's U.S dollar peg.

Next, compared to most stablecoins that are collateralized against a cryptocurrency or a single fiat currency, DAI uses ETH, BAT, and USDC, three different cryptocurrencies in total, as collateral. Initially, Ether was the only collateral supported by the Maker Protocol, although come November 2019, today's multi-collateral DAI system was updated so as to also include BAT and USDC. This allowed the user's risk to be more diverse and increased DAI's price stability.

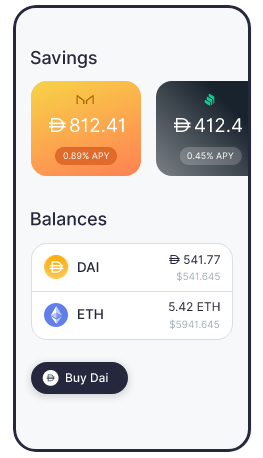

Token holders from DAI also earn interest on their DAI while those holding MKR (MakerDao's native governance token) acts as guarantors for the DAI and set the savings rate for DAI, enabling them to liquidate the tokens should the system crash. With this incentive structure in mind, the guarantors, therefore, ensure that the DAI system and its collateralized tokens are functioning properly.

As an ERC-20 token, DAI can be purchased via either centralized or decentralized exchanges (DEXs). You can also borrow DAI or generate it if you open a Maker collateral vault with the help of MakerDAO's Oasis Borrow dashboard, just make sure you have Ethereum-based assets that you can deposit as collateral. To make sure that the borrowed DAI would be returned, there are smart contracts that hold the collateral until the condition is met. These are previously called collateralized debt positions, although they are more known now as maker collateral vaults. As DAI is one of the most integrated digital assets in the blockchain ecosystem, your collateral deposit must always be greater than the value of the issued DAI. Should your collateral's value fall below the DAI Tokens issued to you, liquidation of your collateral should be expected. All the same, DAI, as a digital asset, can be used in a number of places, blockchain-based games, and decentralized finance (DeFi) applications to name a few.

How to get Dai

- Go to https://oasis.app/dashboard

- Login with your email

- Buy Dai

- Start sending and saving

Stability – its advantage and security feature for DAI Holders

Compared to the value of the U.S. dollar, DAI is comparatively soft-pegged. Brought by increased price stability, DAI stablecoins have changed the investor's perspective on them, as they have only been a long-term value of stability before. However, as cryptocurrency systems expanded greatly, investors now see their value as an option for day-to-day transactions.

Account Minimum not required

There is no amount of minimum balance needed for one to use DAI.

Value Stability

For people living in an economically unstable location, DAI can be used as a financial inclusion or as an alternative currency.

Freedom from Centralization

Since DAI uses a transparent and no-permission system, it gives users peace of mind since they are ensured that they will have no restrictions in accessing their wealth. Since there are governments who are known to limit the citizen's ability to access by putting a cap on their daily or monthly withdrawal.

Generation of Income

DAI Tokens provides leverage for users to earn income by interest generation. Through the network's own consensus mechanism, the Ethereum blockchain does not have its own staking mechanism. However, this lets the MakerDAO system allow the DAI owners to earn returns through their smart contract, therefore securing the user's investment and letting them withdraw at any time.

Low Price and Efficient

Oftentimes, people have to pay a ludicrous amount of transfer fee for international wire transfer, despite the fact that finalization takes too long. Transparency and efficiency of such is another advantage as DAI has a minimal transfer fee for a faster processing time.

Accessibility

Usually, institutions of finance have limited hours of operation, therefore being a hindrance as transactions remain in the pending state for quite some time. Through the Ethereum blockchain, however, transactions can be done no matter what time of day and can be completed in a few minutes.

Security

The MakerDAO system has tight security through audits and research, therefore ensuring the platform's safety. Developers do this by thoroughly analyzing the mechanism of the protocols through the system's internal structure.

Yesh! That concludes my research on the cryptocurrency stable coin called DAI by the MakerDAO platform. Thanks to @yohan2on for an awesome topic, it was surely challenging to research on. Also to my brother @ljhaytorres for asking me to write on Steemit again. Tagging curators @steemcurator01 & @steemcurator02.

Images are from MakerDao's official websites for Maker and Oasis. Headers were made by me using photo editing tools.

Hi @yeshtorres

Thanks for attending the 6th -Crypto course and for your effort in doing the given homework task.

Feedback

This is excellent work. Well done with your research study on Dai.

Homework task

10

Thanks a lot professor yohan2on, I really tried my best to make a good research! Have a good day!