Stability in Digital Currencies- Steemit Crypto Academy- S4W5- Homework Post for @awesononso

Made on @canva

Hello Steemians!

I hope you are doing well in your life. I hope you are keeping your health in this pandemic as first priority. So this is my homework post for @awesononso. The topic today is Stability in Digital Currencies, so let's get started.

QUESTION 01

Explain why Stability is important in Digital currencies.

ANSWER:

As we all know the basic purpose of currencies is to retain its value, to be a sort of payment method and exchange between assets for transactions. Fiat currencies have been serving this purpose for ages and also has a factor of store of value which means in any fiat currency you can store the value of your asset. Now, comes the digital currencies, of which the main goal was to rule out the fees and high frictions between the transactions of physical currencies by the means of banks and whatnot. But, due to this market that is cryptocurrency being highly volatile in nature, these transactions could not be done because of the high fluctuation in the price action of a particular crypto/digital currency. To serve this purpose the idea of stable coins was given out, as the investors, transactors will have more trust as the value will be stored regardless of the market movement and transactions can be done much easily and it also gives the factor of store of value to this digital currency world. Stability in digital currencies is important in the same way stability is important in physical currencies (fiat currencies), to have trust of people over the value of the currency and to use it as a medium of exchange. Although, bitcoin has also made its way towards this “store of value” goal regardless of it being highly volatile in nature.

QUESTION 02

Do you think CBDCs would be good in the future? Weigh the pros and cons in your own understanding and state your position.

ANSWER:

Central Bank Digital Currency or otherwise known as CBDCs is a type of digital currency owned and controlled by the central government of any country. It is an advancement made by the central banks of different countries to adapt and overcome the upcoming challenges and technological advancements of the World. It is a digitized form of any local currency which will have the same value as the native currency of that country, so the question here arises that what would be the merits of it and how will it help a developing nation in the future. I personally think that crypto/digital currency is the future of finance and my country should not be left behind. That being said I think that CBDCs would definitely be good in the future though like any other thing it also comes with some pros and cons which are as follows;

Pros

1. Transactions made efficient, fast and secure:

Through the use of CBDCs, the central bank can eradicate much bigger and frictional problems that is the transactional time and fees which is quite high in fiat money. The use of banks will not matter all that much as all the transactions will be done by intermediary sources and backed by the central bank of every country by which the exchange of money will become more and more efficient and retail transitions can be done by P2P and online sources and the security of store of value of the native CBDC will increase.

2. Legality:

CBDCs issued by the government is backed and regulated by the central government which is beneficial two ways, for the government too as they will have all the data of the transactions done and for the regulation of crypto market in a country too.

3. Cross-border transactions:

The cross-border transactions which includes huge amounts of remittances (high fees and time for transactions) will be eliminated using CBDCs which is a major advancement in a country’s economy, all by regulating CBDCs.

Cons

1. Centralized blockchain:

The most important and if you ask at this time – a major con of CBDC will be its use of a centralized blockchain. Due to it being backed and controlled by the central bank of any country, you will not have the complete access to your money and your digital wallet will be directly connected to the server or the blockchain of the central bank. All the policies made by the government regarding it will be affected upon you and your digital money.

2. Bank runs:

Once after the issuance of a CBDC, the local and private banks of the country will experience a backlash as the users will withdraw huge amounts of money and deposit it into CBDCs. This may cause severe problems for example higher deposit rates offered by these banks, and several bank runs may come in existence etc.

3. Privacy:

The privacy factor is always here when we talk about centralization, most of the crypto projects especially the new generation ones are moving towards De-fi (decentralized finance) and CBDCs are the exact opposite of that causing the users to worry about their money being in control, same way as the banks have been doing so.

QUESTION 03

Explain in your own words how Rebase Tokens work. Give an illustration.

ANSWER:

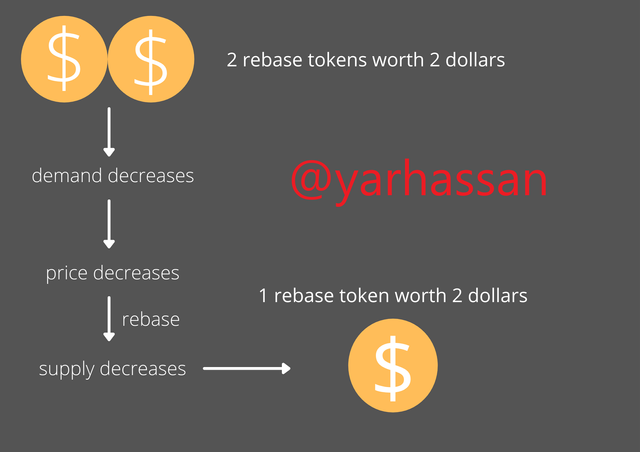

A rebase or elastic supply token is a very interesting concept and the main motive behind it is to achieve stability by a special type of mechanism called the rebase mechanism.

A rebase mechanism works in a way that a particular price of the token is fixed and it is achieved by adjusting its circulating supply, simple demand and supply mechanism works here and can be understood by simple examples. The price movement of an asset depends on its demand and supply and the same mechanism works in the digital currencies too. The more the demand the more its price increases, now to adjust the price back to that specific price value the circulating supply of that particular token increases which then cause the coming back of the price to its intended value. This process is called “Rebase” which works on the basic law of supply, “the more the supply, the less the value”. This thing not only works when the price of the token increases but it works the other way around too which is when the price decreases and demand doesn’t meet the supply, it readjusts itself so that the circulating supply becomes less and meets the demand rate and the price of then elastic supply tokens comes back to their original or intended price.

A basic example of how a rebase token would work is, imagine you have 2 rebase tokens and during the time interval in which a rebase is scheduled, the demand decreases and so does the price of the token. After the rebase happens then the circulating supply adjusts itself and meets the demand which causes the supply to decrease as well. Now the rebase tokens in your wallet after the rebase happens will be 1 but the value of it will be the same as the 2 tokens before.

QUESTION 04

Go to the https://www.ampleforth.org/dashboard/. Check the necessary parameters and calculate the rebase %. What else can you find on the page?

ANSWER:

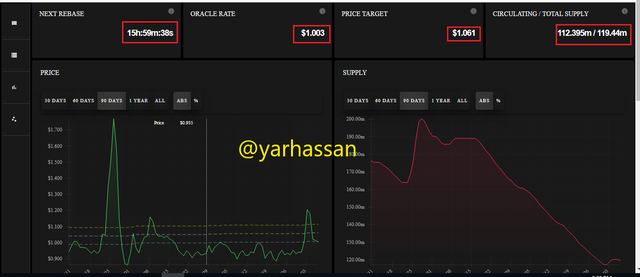

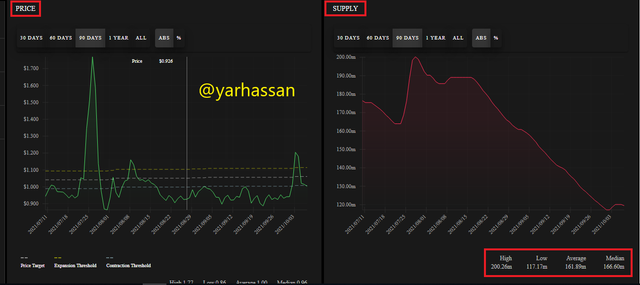

Ampleforth (AMPL) is a rebase token which has an intended price value $1, when this price goes above this level a positive rebase happens and when the price goes below this level a negative rebase happens after every 24 hours at 2:00 UTC. The rebase % can be calculated using the formula,

Rebase % = {[(oracle rate – price target) / price target] x 100} / 10

Visit the Ampleforth website and the interface that will appear is given below

With this we can easily look at the oracle rate, price target, circulating supply and when the next rebase will occur. We can extract the values from here and put them into the formula given above;

Oracle rate = $1.003

Price target = $1.061

Rebase % = {[(oracle rate – price target) / price target] x 100} / 10

Rebase % = {[(1.003 – 1.061) / 1.061] x 100} / 10

Rebase % = [(–0.058 / 1.061) x 100] / 10

Rebase % = (-0.05466 x 100) / 10

Rebase % = -5.4665 / 10

Rebase % = -0.54665%

Other than the parameters (oracle rate and price target) as we mentioned earlier there is circulating supply and the timer of the next rebase occurrence is there in the above snapshot and in the snapshot below the page also offers price and supply charts with highs and lows given below, the market cap chart and AMPL cam which provides you with informational videos.

QUESTION 05

Trade some tokens for at least $15 worth of USDT on Binance and explain your steps. (Give necessary Screenshots of the transaction).

ANSWER:

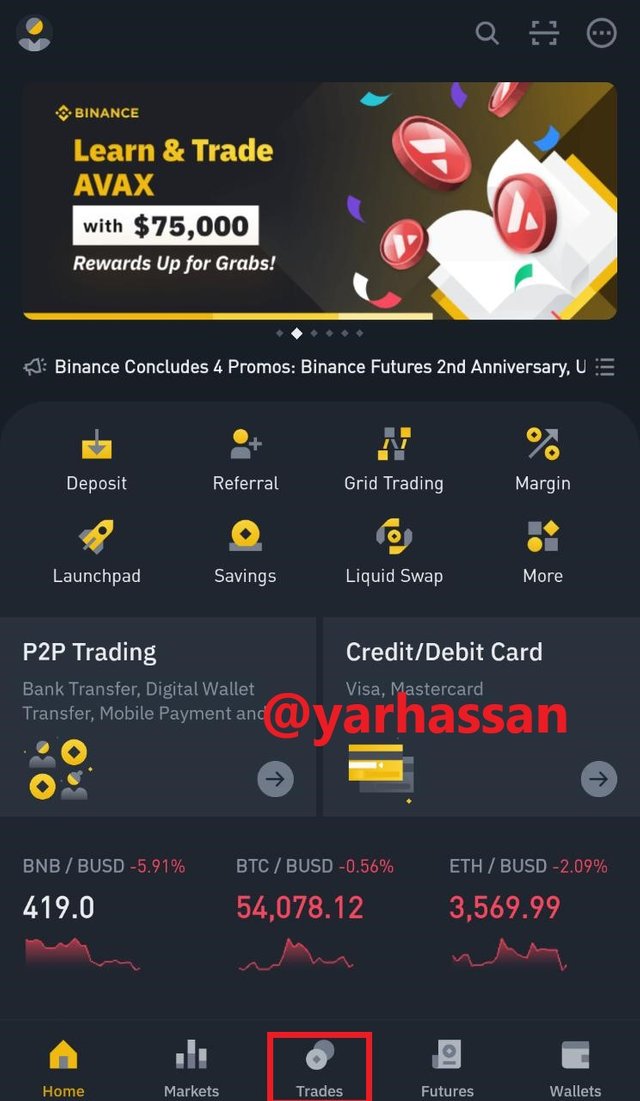

STEP 01

Open Binance app on your phone and below there is a panel with the third option being of "Trades" click on it

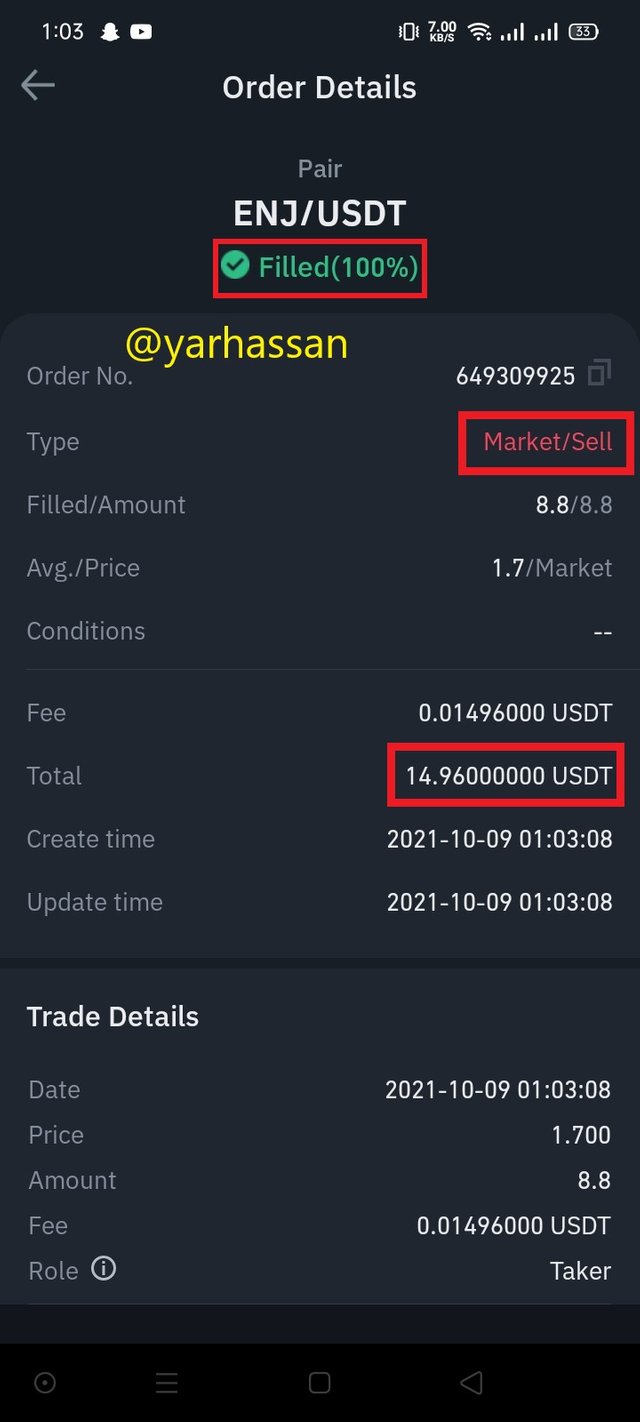

STEP 02

Now, the trading pair here is ENJ/USDT, fill in the total amount of USDT of which you want to sell ENJ (at current market price) and then click Sell ENJ

.jpeg)

STEP 03

The order is filled here as you can see in this snapshot, and we get 14.96$ worth of USDTs with some fee extracted from the original amount.

QUESTION 06

Transfer the USDT to another wallet with the Tron Network. From the transaction, what are the pros of the stablecoin over fiat money transactions? (Give Screenshot of the transaction).

ANSWER:

STEP 01

Open Binance app on your phone or desktop (I have it on my phone for now), below there is a panel given. Select wallet from there.

.jpeg)

STEP 02

select spot wallet on the top

then select USDT

.jpeg)

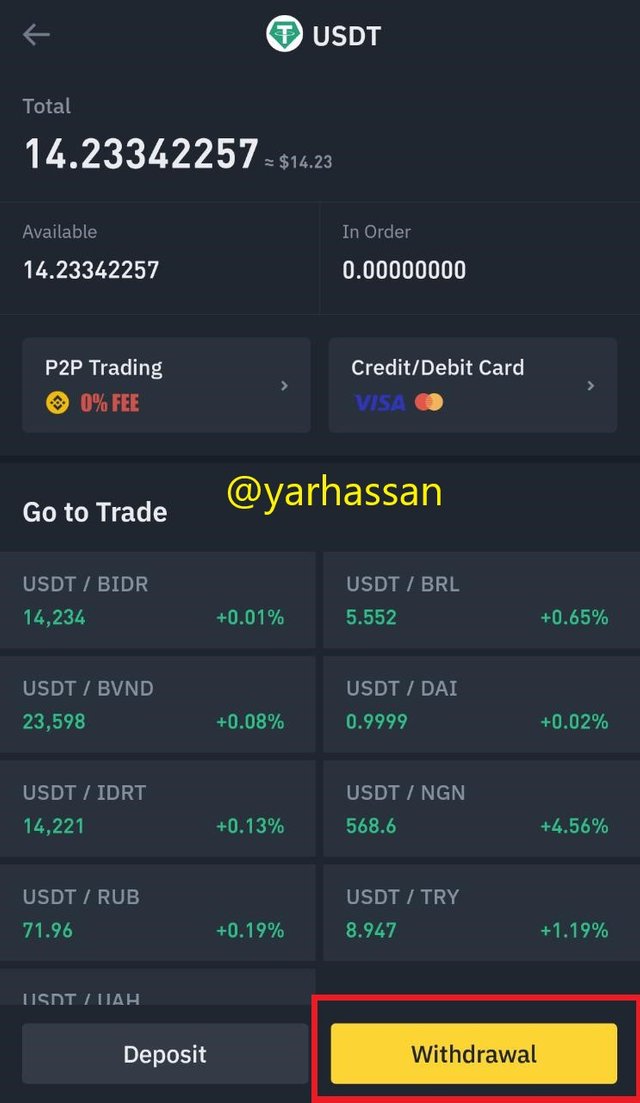

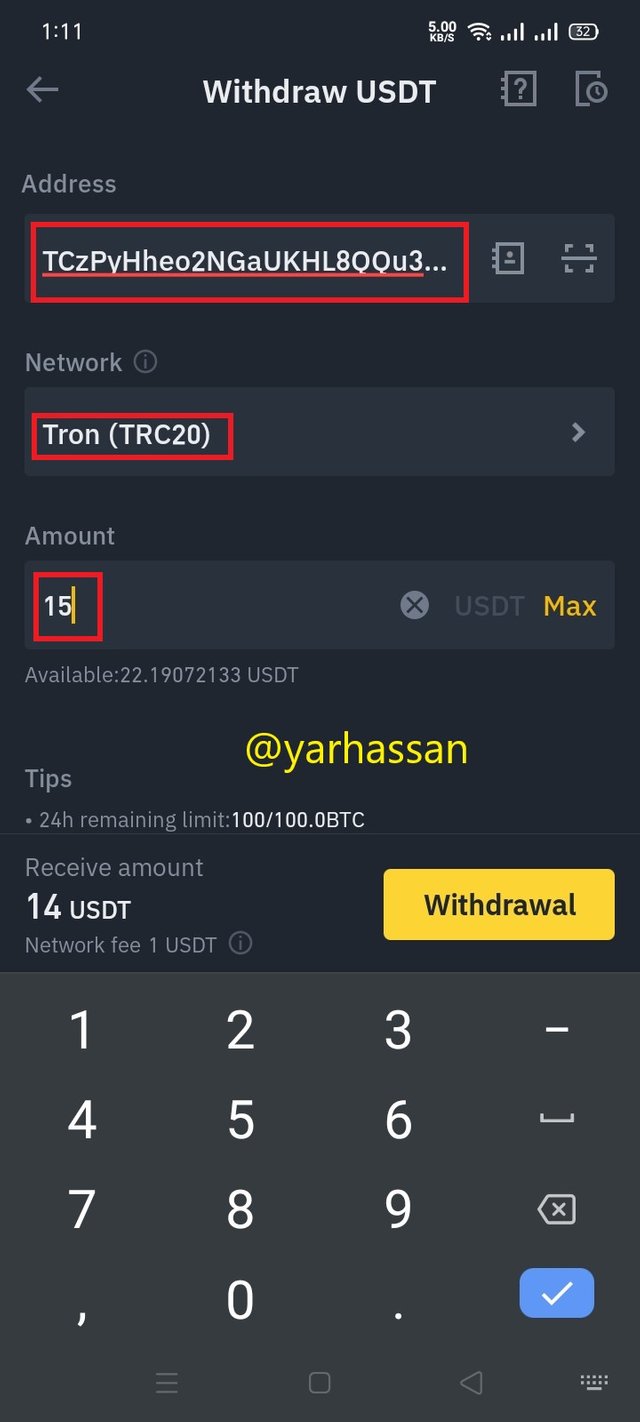

STEP 03

Click on withdrawal

fill in the amount of USDT you want to transfer, select the network type as TRC20 and fill in the wallet address in which you want to withdraw the amount.

STEP 04

confirm it

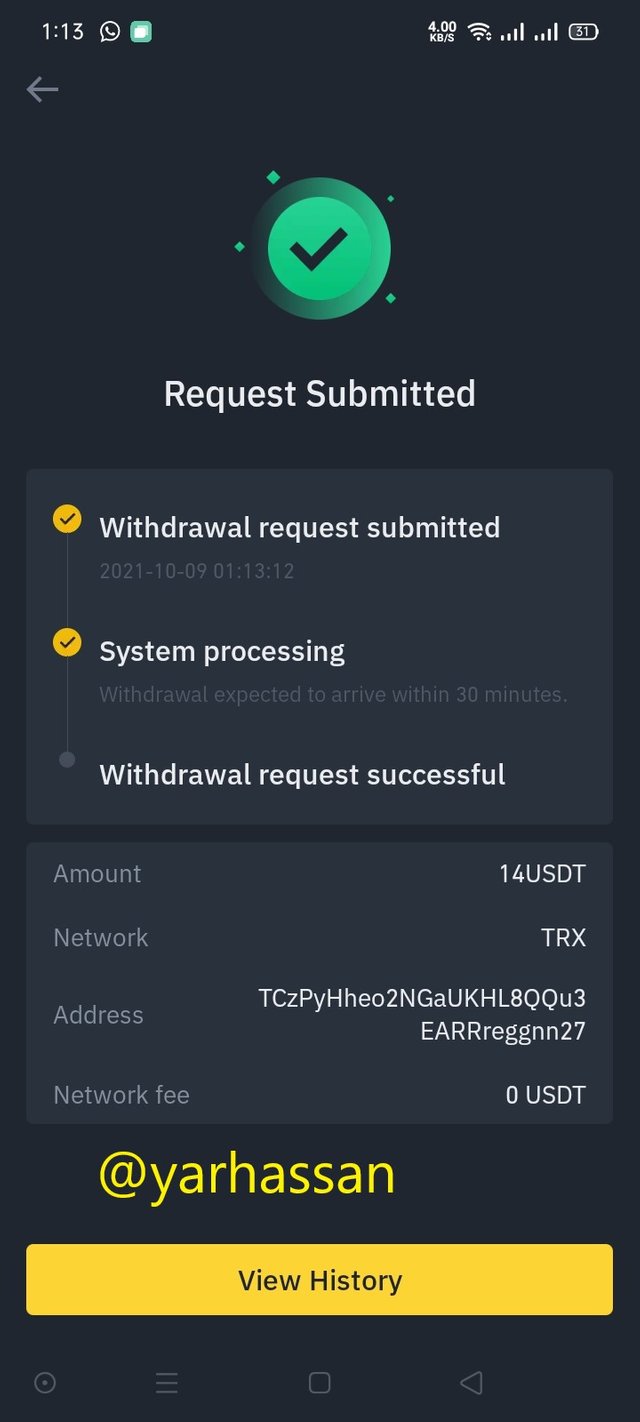

.jpeg)

wait for your request of withdrawal to be successful

STEP 05

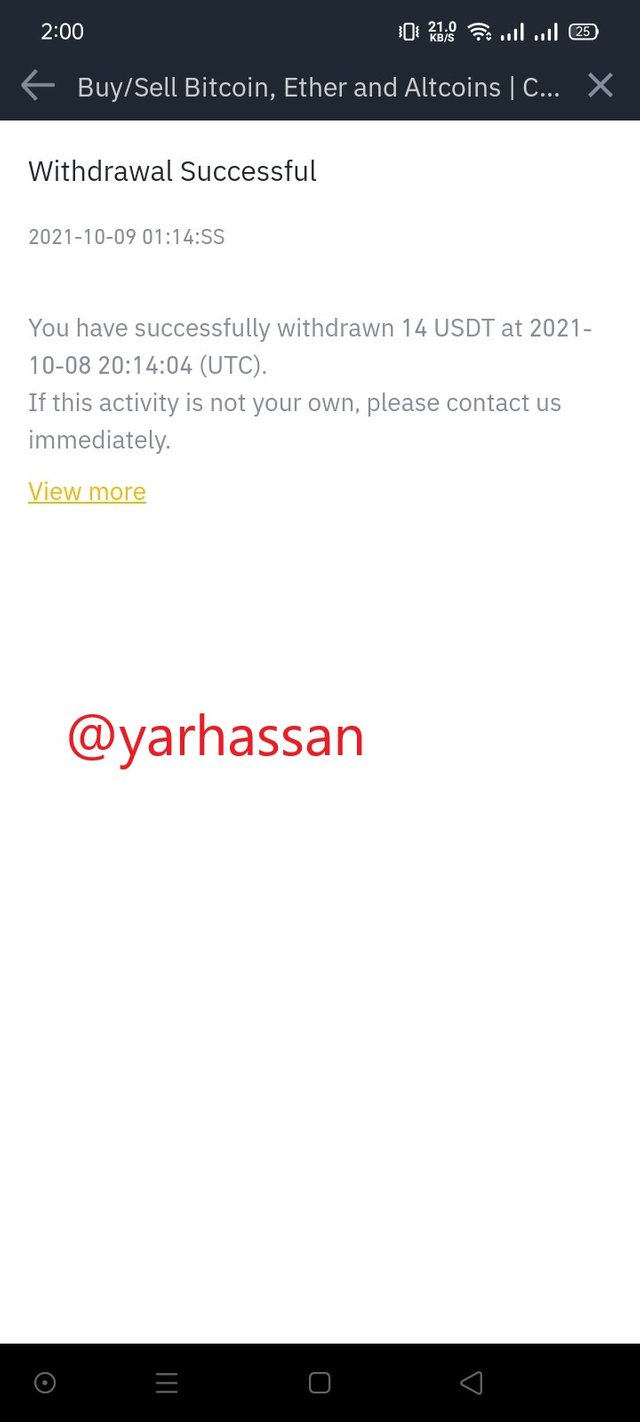

Make sure that the withdrawal is successful

Pros of stablecoin over fiat money transaction

The main purpose of digital currency was to replace fiat money as it is too frictional and costs a fortune to exchange. Stablecoins solves this problem that is the transactional fee is low and the time taken for the transaction to happen is nothing compared to the fiat money transfer time.

Another merit is the cross-border transactions which have too much friction in case of fiat money.

Stablecoins also are not controlled by a central body like fiat money which is looked upon and controlled by the government.

And there are no intermediary sources involved in the case of stablecoins unlike fiat money.

CONCLUSION

Stability in digital currencies has the same importance in anything else. With stablecoins in cryptocurrency market you can easily exchange, transact and secure your fiat money in digital money without having the fear of losing anything. Also we learned about how the rebase tokens work and what they are exactly.

Hello @yarhassan,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

You should have done better in question 1.

You should improve on your arrangement and markdown use. Also improve on the way you arrange your paragraphs.

Your illustration in question 3 could be better.

There are some parts that need to be clearer.

Thanks again as we anticipate your participation in the next class.

@Steemcurator02