Investment through Private and Public Sales - Crypto Academy / S4W6 - Homework Post for @fredquantum.

Hello friends and welcome to my assignment task by professor @fredquantum, In this assignment, I will talk about the basis and concept of Investment through Private and Public Sales. I hope you enjoy the class.

Question 1

What can you say about Crypto Investment?

In my opinion, crypto investment is a zone where traditional financial barriers are broken like discussions on government regulation (centralized finance), controlled exchange, banks hold of users' finance for the sake of generating profits, and a host of others. Because it challenges governmental infrastructures, a lot of countries have sanctions given to their citizens who choose to violate the law by involving in trading or investing in cryptocurrency (for example, Nigeria and China). Nevertheless, though these countries fight it, they understand beneath their display of ignorance or unclear policies that the idea of cryptocurrency is basically one of those scientific revolutions that the world would undergo. It is basically technology coming to wipe out the old means and it would not care if there would be accepted immediately but one can be sure there would be.

Cryptocurrency is simply the new age currency; a digital way of spending, it works in a way that is familiar with a company’s stocks, if an individual is able to possess a company’s stocks, he is able to make profit and depending on the number of shares he holds, his profit will increase, and same as loss if there should be. To the best of my knowledge, investing in cryptocurrency is a way to stake fiat currencies against digital currencies and holding to take advantage of its imminent rise in price to increase profit. The question one would ask then is that: “is cryptocurrency safe to invest in?”

The real truth to that answer is that cryptocurrency is a risky investment, it is plagued by the fact that some cryptocurrencies blockchain/wallet are vulnerable to crypto-hacks or cyber-attack keeping the finance of the investor at risk, as a result of this fear, many have chosen to use hardware or paper wallets to save their cryptocurrencies but they also face the risk of losing their private key (a means of access to the hardware). It is also a risky investment because it is highly competitive; with so many platforms inexistent, it feels like they are in competition with each other and this makes it risky to invest in it as high competition means high risk. There is also the risk that government regulations against the use of crypto in a particular society can affect investment returns.

Also, there is no saying as to how well a cryptocurrency will prove to be a valuable investment except through technical analysis which may also go wrong because analysis alone is not responsible for moving the market, but fundamentals are.

Finally, cryptocurrencies are highly volatile; basically just as they can have 1100X Profit in a day, it can take a loss of that same magnitude. Basically, investments in cryptocurrency are unpredictable, even if they offer 100% positive returns, they can come crumbling one day through mitigating conditions, so it is best to diversify.

How to properly utilize the investment tools available to make the right decisions?

In investing in cryptocurrency, there are so many tools involved; from the analysis tool to the tools involved in keeping and preserving the coins obtained, it is important to understand that both tools, as well as the decision behind which to use, must be done in a manner that encourages effectiveness.

Crypto wallet

The first investment tool to be discussed here is: Choosing Crypto Wallet. In order to invest, you will need to purchase a crypto unit and store it in a wallet; almost like the traditional wallet but digital, it accounts for proof of possession and transfers if there be a case of that. It also has access to a bunch of private keys that helps facilitate decisions like purchase, sell, withdrawal (in some instances), and transfer. There are many wallets out there, some even being a part of their host blockchain features (for instance Binance Smart Chain has the Binance Wallet, etc.).

With the discourse of wrapped coins encouraging interoperability between cryptocurrencies, it is easy to find most of all the cryptocurrencies one wants to invest in one place. However, when choosing a wallet, there are basic questions to ask oneself, and they include: how much access do you want to your wallet? This can be a serious factor because investors who want to be able to see their investment and make easy decisions swiftly may opt for digital wallets as opposed to the hardware.

There is also the discourse of how much security a wallet can offer. What is the essence of investing if one is not sure that they are secured from hackers or cyber thieves (attacks)? In picking a wallet (especially digital), it is important to pick one with tighter security features (especially in buying and selling processes. An easy way to do this is by hopping on popular and effective wallets like Binance, Coinbase, Gate io, etc.) however, it is still important to understand how their security features work so that one does not become susceptible to scams.

Other features to look out for when utilizing the investment tool in making decisions include: user-friendliness of the wallet (as a user, you want an interface you can understand and maneuver), you want something mobile too (accessible anywhere, this is where the digital wallet tops it).

Analytical tools

The second investment tools are analytical tools. They include software basically that helps you analyze market direction and they are a whole lot (the number one leading right now is Trading View).

They are very important tools for a crypto investor, they allow for the implementation of mathematical processes that are based on theories (for example, demand and supply theories, wave theories, etc.) and then they allow users access to predict a cryptocurrency’s likelihood to be a good investment. Most of them are technical and involves you understanding the technicalities behind them before they can be used. An investor would take advantage of this only by involving himself with the means to gain more knowledge on the whole process.

Under analytical tools, there are tools like indicators (which helps with news, rumors, and charts about the cryptocurrency), Stop Loss (a tool to help you prevent excessive loss), Take Profit (reverse of the Stop Loss but gives you profit and takes you out of the trade), and analysis tools.

In conclusion, it is important to understand that while analytical tools may predict directions of market, market swings in direction are usually affected by fundamentals and discourses like market capital, and so if a user wants to actively use analytical tools, he must not entirely rely on them but take to account the fundamentals of the investment as well (basically its portfolio).

Question 2

Talk extensively about the following. Also, highlight the benefits and risks associated with each.

- Private Sale in Cryptocurrency

Private Sale is a crypto phenomenon that usually occurs in the early stage of any investible funds creation. It involves the sourcing and invitation of potential investors to come to partake in the token created. As at the time this is done, these tokens have not been listed; basically cannot be found on any crypto wallet or cannot be seen by the general public easily except they have been contacted to invest in it. As the term “private sale connotes”, it is done in private, most times the public may never know who these investors are but their transaction most times usually can cause large moves in the market because they hold significant positions.

The function of this is to raise capital for the facilitation of ideas that the blockchain has been set to accomplish and the investors are rewarded with tokens belonging to the blockchain. Investors have to risk the idea of placing their funds in hope that this digital currency being worked upon would work and achieve the ideas its developers intend it to before it is listed. And when it becomes listed and later investors arrive to make the market swing upwards, they make profits. It is basically buying shares in a company but in this case, a digital asset.

The risk here is really high for investors as not all projects become successful and some are scams investors, there is also the risk of capital being tied down for a long time with no access to it, and on the private sale, it is longer.

- Presale in Cryptocurrency.

As said about Private sales that it was the initial start in the creation of investible funds, the Presale stage is the second stage. This stage involves a shift from the traditional/early investors in the private sale and seeking more investors. As the word “presale” connotes, it involves the process before the actual sale. Here, more investors are sought to be a part of the blockchain’s goals, and what is flaunted to entice them is not just the goals but how much investors in “private sale” process have put in. Here, tokens are sold at discounts and it often is at a price that would be cheaper than when it hits the public.

The same risks that exist in the Private sales also exist in the presale but in this case, it is medium risk. Here, investors do not have to be the first parties and can rely on the information or activities of those in the private sales.

- Public Sale in Cryptocurrency.

This is the final phase of investible funds. At this point, the coin is closer to being listed. The enticement is based on hype and blockchain’s incredible technology and how it intends to be a revolution. Enticement can also be based on market capital, use case, etc. investors here are not given discounts like in the presale stage and the investors here are usually the public. In all the above sales techniques, this is the lowest risk/reward phase.

Question 4

What are the mediums used for Private/Pre/Public Sales in Cryptocurrency?

From the class exposition, there are two main mediums used in private/Pre/Public Sales in cryptocurrency and they are the Issuer’s Website and Crypto Launchpad. Another minor medium used is social media.

Issuer Website: the issuer website functions to help investors get information about investment; basically acting like a consensus mechanism for investors to see what is happening with the crypto asset during the process of fund-raising. It also shows how much the token to be invested in is equivalent to the investor's input.

Typically, investors always would bring existing crypto assets (like Bitcoin and Ethereum, amongst others) to be able to be a part of the investment, and what the website does also provides a transparent conversion rate allowing investors to know what they stood to gain.

If I, WhiteStallion chose to invest during a presale the sum of 4.25BTC when the token is being issued at 0.4 USD, the transparency works to show that proportionate to my investment, my entitlement will be XYZ.

Crypto Launchpad: aside from the website, this is another medium used for fundraising in cryptocurrency market. This process is used for declaring IEO’s and IDO’s of the new token with the hope that it attracts investors before public sales. The IEO meaning Initial Exchange Offering is a replacement for ICO’s. It basically allows investible funds companies to raise capital by declaring utility tokens available for sales on an exchange. IDO’s (Initial Decentralized-Exchange Offerings) are basically assets representation on a decentralized exchange. They also act like a consensus mechanism for investors to understand what they have staked. If Mr. WhiteStallion for example invests 3ETH in a sale when the total invested is 270ETH, the mathematics of Mr. WhiteStallion entitlement is Commitment/Total Commitment multiplied by the total supply.

An example of a crypto Launchpad is the Tronpad which was built for the Tron blockchain, currently because it has gone public as well as the lack of need for investors when you visit the Launchpad site, you are replied with a “No projects currently open” feedback and a promise that another project is coming soon.

Finally, in a world moved by social media influencing, it is not weird or abnormal to find investible assets using social media to create rave for their projects, acting as an advertisement. In this case, it may not be used in the Private Sales stage, but it may be used in the Presales and Public sales. It is an easy way to make a loud call to those who would want to benefit from the value created.

Question 5

Research about any recent (2021) successful ICO or IEO and give detailed information about the project. (Note: BETA token is excluded).

For the purpose of this, I choose the BXR project which proves successful on October 12, 2021, it had started on the 7th of June, 2021. The Blocker project claims to be the only full-featured social network that is specifically created to function in cryptocurrency and blockchain communities. It does this by giving news access to crypto-enthusiast and those interested in crypto; Hodlers, investors, bloggers, etc. access to every fundamentals and news on crypto. It also is the first project to be launched on the Blockfunder platform.

BXR After Listing:

It had raised a capital of $22,500,000 and price moved from $1 to $2.25.

As can be seen in the above chart, which prove successful in the beginning, price shut up from 1$ to about $1.60 at the completion of the IEO. In order to calculate how much profit was made, the mathematics will be ATH-Initial price/ Initial Price X100.

Therefore= 1.60-1.0= 0.60

0.60/1.0= 0.60

0.60x100=60%

May not have been the biggest of booms but it is capable of yielding more for investors, and is still an example of how much risks investors take when they partake in Private/Public sales.

Question 5

Create an imaginary token. Write about the project including its use case. Develop an ICO which includes Private sales (3 stages) and Public sales (1). Note that: You are expected to explain what the funds are intended to be used for, your Private sale should have 3 stages, and specify the initial supply available, and the price you are issuing the token in each stage. Also, specify the price you are issuing the token at the Public sale phase (including the supply).

A dream I definitely would love to see come through, fantasy maybe…my imaginary token will be (WHS) Whitestallion.

The WHS is home to the WhiteStallion blockchain, a blockchain with a wide variety of usage especially in gaming programs, it is highly scalable, it is modeled after TRON blockchain but designed to be faster, handling 3500 transactions every second. It uses the DPos consensus algorithm just like TRON blockchain.

The purpose of the blockchain is to allow for the processing of payments through multiple platforms like TRON, ETH, and ADA, and it does this through its wallet called TESTALLION. The blockchain also assists in the deployment of smart contracts and the empowerment of dApps.

WHS Token Tokrn Cap: 200,000,000 WHS

Max Supply: No Maximum

Initial Token: 70,000,000 WHS

Private Sales

Stage 1; Make available 10,000,000 WHS for this stage. Chat with businesses and investors to be involved with the goals of WhiteStallion blockchain and the profit it can bring to their income. Engage them to invest, and as at now, the price of WHS/USD will be 1/0.65$. All funds gathered will be used solely for obtaining material that would facilitate WhiteStallion blockchain development, all major workers shall rely on entitlement to their wages paid in WHS as signed in our agreements. It is important to show investors that the information of their transaction would be on the project’s website.

Stage 2: A repetition of Stage one but with the availability of 15,000,000 WHS basically 3weeks after the first. The money here would be used for expansion; physically, location-wise, a befitting headquarters. WHS/USD =1/1

Stage 3: In this scenario, 7 days after, we conduct the third round of Private sales. In this instance, 30,000,000WHS will be declared available to investors who would have indicated that they wanted to be a part of the blockchain’s success. The price would be doubled from its initial price now WHS/USD being 1/1.3, however, some of the investments will be transferred towards payment of social media publicity on WhiteStallion blockchain across all social networks in gear for listing and public listing.

Public Sales: In this final round, 15,000,000WHS will be made available to the public and sold at 2$/WHS, profit made at this point indicates success, so salaries can begin to be paid while workers still are entitled to the WHS token they were paid in prior to the listing.

Question 6

What are the criteria required for listing a token on CoinMarketCap?

To list a token on coinmarketcap, a whole lot of criteria must be adhered to on the part of the token companies and on the part of coinmarketcap itself.

CoinMarketCap in admitting any token follows three rigorous tests:

Test of Credibility: in this case, CoinMarketCap focuses on the token company’s ability to prove with supporting evidence that his use case is credible?

Test of Verification: is every information provided by the token company verifiable? What sources can they be found on and how credible are those sources?

Accordance with their methodology: is it in accordance with the methodology they follow?

The methodology they follow is what totals as the framework/criteria in which to get a token listed on coinmarketcap:

1. Online Submission form: This is done through: https://support.coinmarketcap.com/hc/en-us/requests/new. Indeed there are other channels to monitor and communicate with CoinMarketCap but it states that all applications must first go through this medium, and on this link, documents are expected for submission and it is these documents that CoinMarketCap uses in its criteria to prove credibility. There are also guidelines of approach to the situation including polite conversations and methods of redress if denied or no feedback is given. A violation of this automatically puts the investible company in the dark, meaning CoinMarketCap may never list it.

2. Cryptoassets assessment: CoinMarketCap states further that there are guidelines it expects those who apply to adhere to and it involves the availability of peer-to-peer technology, functional website, block explorers, must be publicly traded and must have a representative of the project whom communication can be exchanged with.

3. Evaluation: CoinMarketCap warns that its evaluation is done qualitatively and quantitatively, and it makes inquisitions into factors like trading volume and market pairs, community interest and engagement, traction/progress (including investors, networks, etc), transparency of team and professionalism, product/market description, the impact and practicality of the token, its uniqueness, and innovation, as well as the possibility of the longevity of the project.

Is there a criteria for listing an asset on a Centralized Exchange? If Yes, use an exchange for your explanation in response to the question.

Yes, there are numerous centralized exchanges and with their individual exchanges comes their criteria for listing an asset on it. For the purpose of this answer, I will use Gate iO.

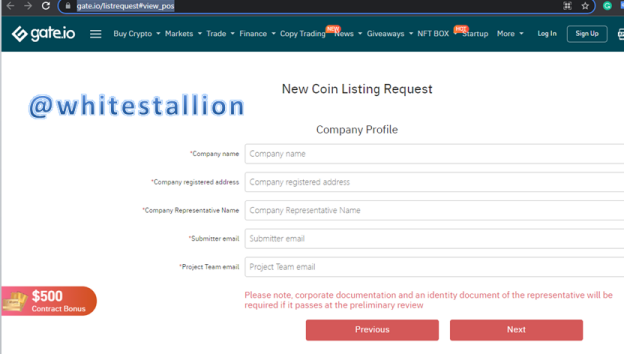

When I made my research on Gate iO’s website, I discovered that the criteria to get listed include submission of email, Token’s full name, Token symbol, project’s website, white paper link (basic information about technical concepts provided to investors), and why it is recommended. This process is done on the website: https://www.gate.io/listrequest#view_pos and this is just the first step.

After this application, successful applicants are contacted via email and then further documents are requested, and all these are done for free and in accepting listing, Gate io considers the following: Coin/Token Viability, Use case, Transparency, Security and Scrutiny of Team management.

Conclusion

For me, this was an exposition into how much risk and profit potential is in availability to investors at the onset of a crypto/token release. While Private sales may be the most rewarding, it is apparently the riskiest, also coupled with the fact that not everyone has access to being a part of it. From this, the next move is towards listing the project and as discovered, centralized wallet like Gate io, Binance, etc. are easier to list before heading to CoinMarketCap. In fact, in my opinion, listing with the decentralized exchanges should be the first step to getting to CoinMarketCap. It is also incredible to see how much scrutiny is in the CoinMarketCap process of admitting projects also shows that there is some sort of security for users as well. Therefore permitting something that is safe to bank on as an investment option.

Special thanks to Professor @fredquantum