[Charts] - Steemit Crypto Academy Season 5 - Homework Post for Task 10

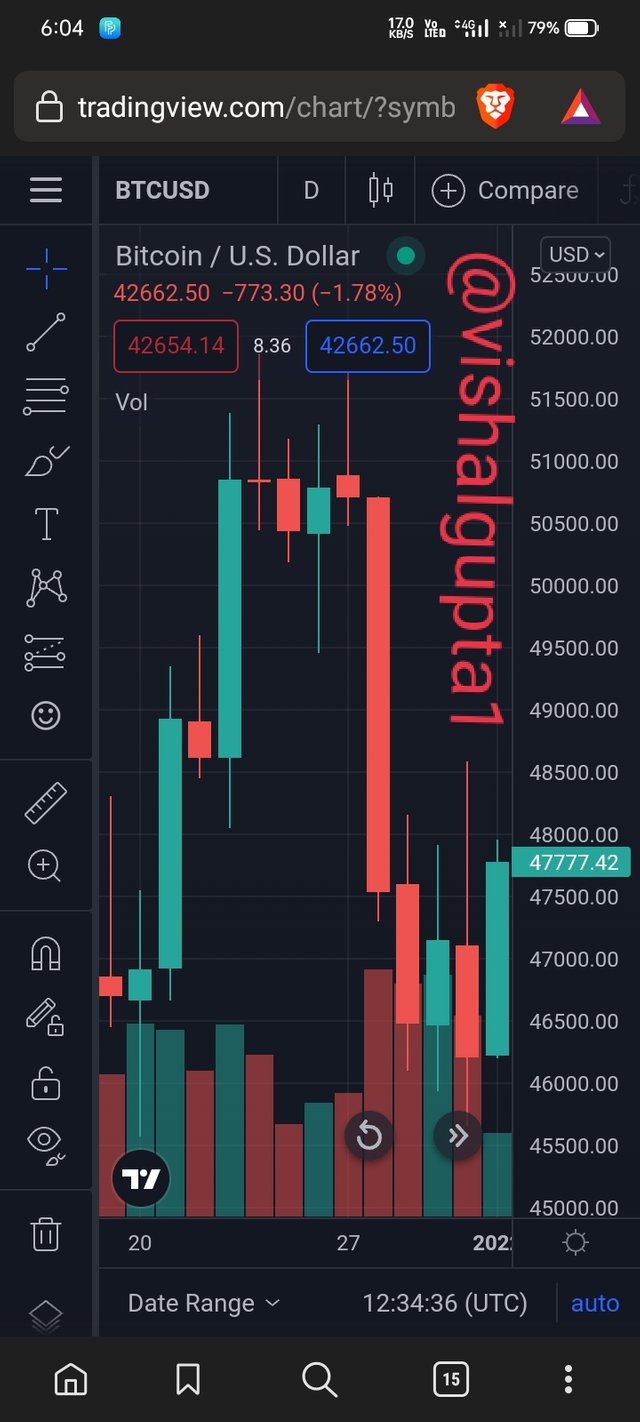

a) Explain the Japanese candlestick chart? (Original screenshot required).

b) In your own words, explain why the Japanese Candlestick chart is the most used in the financial market.

c) Describe a bullish and a bearish candle. Also, explain its anatomy. (Original screenshot required)

a) Explain the Japanese candlestick chart? (Original screenshot required).

Cryptographic money market is exceptionally unpredictable and it requires an excellent information on market pattern specialized investigation prior to settling on an exchanging choice.

Prior to including in market pattern specialized investigation, brokers should as a matter of first importance have an excellent information on candle diagram design, since that is the nuts and bolts of specialized examination.

Japanese Candlestick is the most famous specialized investigation instrument that merchants use to diagram and examine the value development in cryptographic money market.

The Japanese candle is a showcase of activities or collaborations between the purchasers (bulls) and the dealers (bears) at a specific resource's cost. I think they are called candles since they are formed like candles. The Japanese candle outlines were set during the 1700s by a rice broker in Japan. It is among the most generally acknowledged and involved graphs in the monetary business sectors. Crypto dealers utilize these candle diagrams to get thoughts regarding future value developments or headings. Candles are typically comprised of four sections, and they are open cost, greatest cost, most reduced cost, and close(final) cost.

The red tone portrays a vertical pattern in the graph and the green shading candle portrays a descending pattern in the diagram. A graph can either be bullish or negative contingent upon the adjustment of cost. They are four sticker costs in the Japanese candle which are the excessive cost, the nearby value, the open cost, and the low cost.

b) In your own words, explain why the Japanese Candlestick chart is the most used in the financial market.

The Japanese candle outlines are for the most part utilized in the monetary market on account of their utilization in examining costs with specialized dealers. They offer more data outwardly from showing the market's greatest cost to the most minimal cost and from the initial cost to the end costs.

The Japanese candle gives clear and simple examples that are profoundly precise in foreseeing market patterns. Utilizing these examples with a tad of fundamental specialized investigations, you can see the example arising in the market which you can for your potential benefit.

The candle design is used in light of the fact that it is the most broadly utilized on the lookout and is the least difficult way to deal with comprehend market patterns.

The candle configuration is comprised of two tones, one red and the other green. These two tones help financial backers and merchants in breaking down the market and deciding if they ought to enter or stop the market.

The candle diagram can be utilized to conjecture future costs just as give knowledge into what is happening in the personalities of dealers and investors.At work, there is an organic market game that has developed into a candle design. The arrangement of a green candle for any resource shows that purchasers are more hopeful than dealers about the item. Purchasers are less hopeful with regards to the resource when the red candle happens, and venders are selling their resource, bringing about negative examples.

Candle designs are more hard to comprehend than bar and line outlines. Perusing a few sites or in any event, watching a decent talk might show an amateur a few sorts of candle designs, yet getting bar and line outlines is significantly more troublesome.

These are an accessible in a wide scope of tones and styles. The body size of the candle design additionally shows the worth of different resources. Candle designs give dealers a mark of how much people are trading.

There are four focuses in the candle outline: opening, shutting, high, and low.

c) Describe a bullish and a bearish candle. Also, explain its anatomy. (Original screenshot required)

Bullish Candlestick

A bullish candle design illuminates individuals that the resource is rising. The shade of the two candles can be changed to the client's decision. In other words, it's anything but a consistent shading. The following is a picture showing the upturn of the bullish candle.

Bullish candlestick anatomy

High

This shows the most exorbitant cost recorded throughout a particular timeframe. The most exorbitant cost might be mistaken for the end cost in situations where the candle has no upper shadow. All things considered, the excessive cost is equivalent to the nearby cost.

Close

This shows the last cost recorded in a candle and is right underneath the upper shadow. It is situated toward the finish of the upper shadow.

Open

This shows the beginning of the development of cost. starting here is estimated to decide how long the pattern will be vertically. It is situated toward the finish of the lower shadow.

Low

This at last shows the most reduced cost recorded throughout a given timeframe. Also very much like the excessive cost, in situations where the low cost has no lower shadow, then, at that point, it is recorded equivalent to the open cost.

Bearish Candlestick

The bearish candlestick is used to represent the negative momentum (I.e decrease in price) of a price as a result of increase in sell than demand. This momentum is mostly denoted with a red colour. This candle opens at the upper shadow and close at lower shadow.

Anatomy of Bearish candlestick

Open: Otherwise called opening value, it is the start of the negative candle arrangement subsequent to taking over from past. In negative candle, Open is situated at the upper shadow.

Close: It is the point that the candle stops/complete it development. It situated in the lower shadow of a negative candle.

High: It is the most noteworthy negative value force that a resource/ware include reach inside explicit time before the arrangement of another candle. It is situated at the highest point of the candle wick (upper shadow).

Low: It is the most reduced negative value force inside a specific time. It is situated at the buttom of the candle (lower shadow).