Steemit Crypto Academy Season 3- Week 8 ; Advance Course - Trading Sharkfin pattern

Introduction

Hello fellow steemians it's the 8th week of the steemit crypto academy season 3 and this is the last lecture for the season. It's been a great privilege to be able to participate in the season 3 of the crypto academy course. I have learnt a lot so far. From trading strategies to technical analysis. This week course by @cryptokraze is on how to trade using Sharkfin pattern.

Let's get started

1. What is your understanding of Sharkfin Pattern. Give examples

This is one of the strategy for trading reversal trend. We notice sometimes that after the price has created a swing high point it will reverse the trend immediately the creation of the swing high and the reverse are fast. Due to the quick reverse the trend form a V shape.

The reverse trend occurs in both trend I mean when the price is bullish and bearish. When the trend form the V shape it's for a bearish trend changing to a bullish trend but when the V is inverted like upside down its for a bullish trend changing into a bearish trend. This reverse strategy is mostly common in volatile markets.

This strategy is known as the Sharkfin Pattern. This pattern is used to spot strong reversal trend at a very early stage in the market.

Example of Sharkfin Pattern on chart.

I will show examples on three cryto chart of Sharkfin Pattern for both bullish and bearish trend.

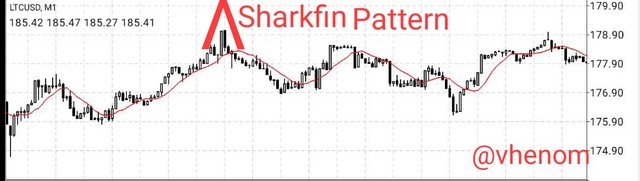

First for LTCUSD Chart

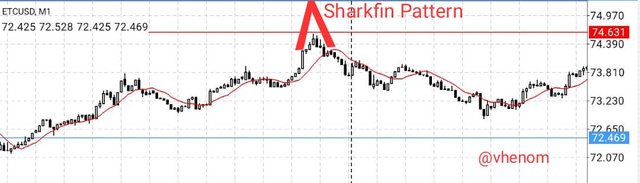

This is the set up in ETCUSD chart

The set up in BTCUSD chart

2. Implement RSI indicator to spot Sharkfin Pattern.

The essence of implementing RSI indicator to trade Sharkfin Pattern is for confirmation purposes. We use the RSI to confirm either the set up is valid or not. Because just looking at the chart we will see many set up inform of the Sharkfin Pattern which are not valid.

Now to get a valid Sharkfin Pattern we have to add RSI for confirmation of the set up. You might be wondering how is it done but it's a simple one. For a valid Sharkfin Pattern when the trend is bullish the RSI indicator must go above 70 before the trend reverse otherwise it's not a valid one/ I will say a fake setup and for a valid Sharkfin Pattern when the trend is bearish, the RSI must go below 30 before reversing the trend otherwise it's a fake setup.

If we don't get the confirmation before entering the trade, we might run into loss. Because we have to see that trend has reversed before entering the trade.

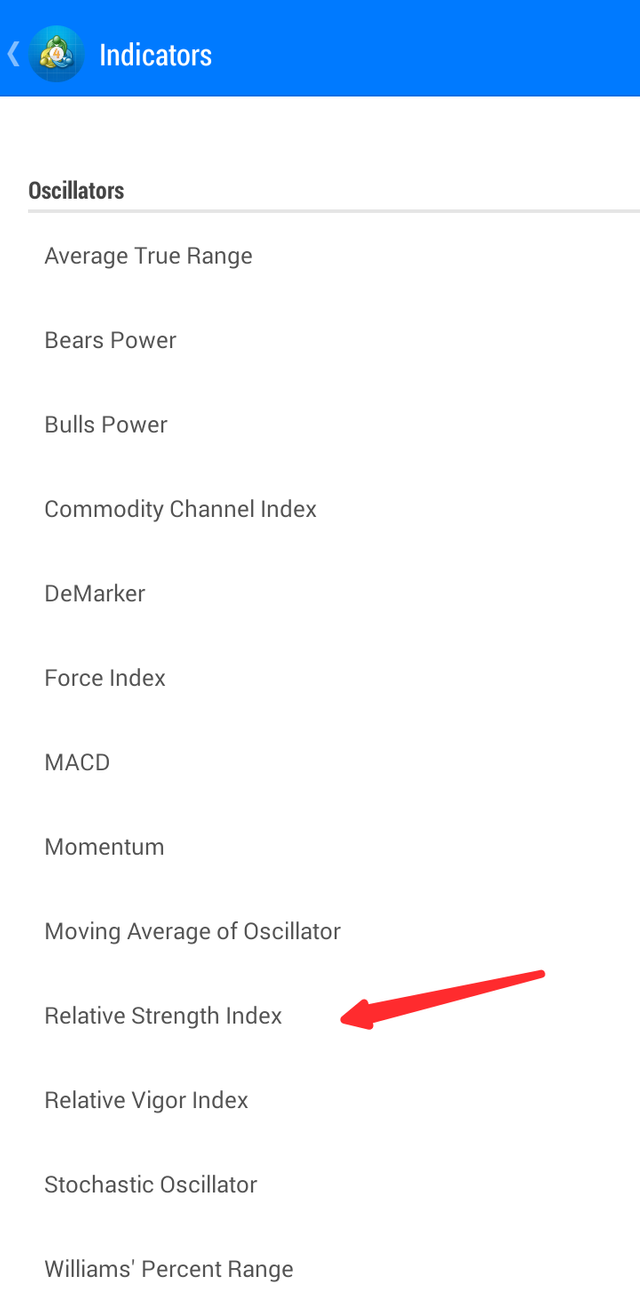

So how do we set up/add RSI indicator to our chart. I will show how I added the RSI to my chart on the metatrader4 app.

First launch the app then I double tap the screen you can see the circle symbol showing different sign in it.

I clicked on the f sign

I clicked on the f sign Then f+ meaning adding indicators

Then f+ meaning adding indicators Then I swipe up till I see the RSI indicator then I clicked on it

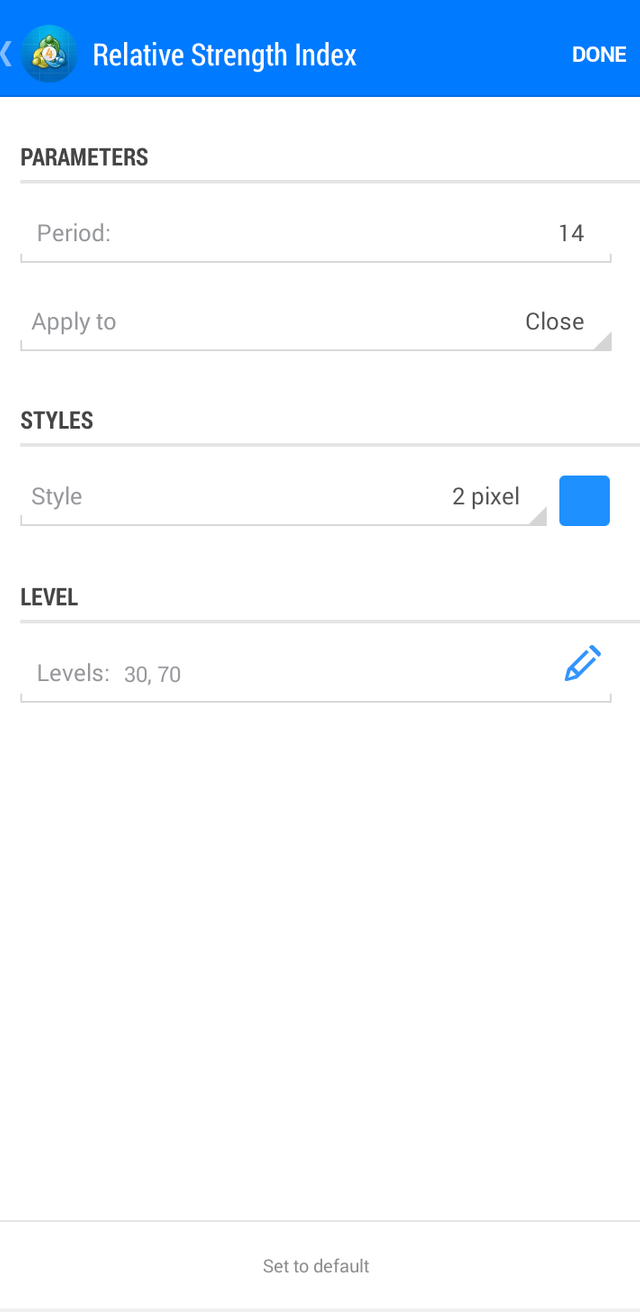

Then I swipe up till I see the RSI indicator then I clicked on it You can see it's in the default settings you don have to change it.

You can see it's in the default settings you don have to change it. This is the outcome

This is the outcome

That's the step by step process of how to add rsi indicator to chart on metatrader4 app.

Now that I have added the RSI indicator let me show cases of how the indicators is confirming the Sharkfin Pattern. I will show for both cases uptrend and downtrend.

Above are screenshot showing how RSI indicator is confirming the Sharkfin Pattern. For the case of above 70 the trend goes bearish afterwards and for the case of below 30 the trend goes bullish. This is typically how to use the RSI indicator to confirm this pattern.

3. Write the trade entry and exit to trade Sharkfin pattern.

I will explain trade entry and exit for both buy and sell order since I'm using metatrader4 and we can place both buy and sell order for entering the market.

Buy Entry Criteria

To place a buy order using Sharkfin Pattern we have to first add RSI indicator with period 14 / default settings so a to confirm the pattern.

We then wait for price to set up the Sharkfin Pattern that is (make a swing high point then reverse back forming a V shape.)

We then use the RSI to confirm this set-up. If the RSI doesn't go below 30 during the swing low before reversing then the set up is not strong/ valid. We have to wait for another one.

After confirming that the RSI went below 30 before the reverse and forming a V shape it's self .

It's advisable to wait for the candlestick that started the reversal trend before we enter the trade. This is mostly for scalpers or intraday traders since they are trading in lower time zone so after the closing of the candle we can the place a trade.

Then we can place our buy order.

Buy Exit Criteria

Before we place the trade we have to consider our risk management. Because not all trade will go in our favour see we have to consider risk management

In considering risk management we have two major things in play which are take profit and stop loss and risk : reward

Risk : Reward is the amount we are will to risk to get something. So it's advisable we use 1:1 meaning we are ready to risk 1% to get 1% for example in an investment of $100 a trader can set his risk reward ratio in a way that he is ready to risk 50$ to get 50$. That an example of 1:1 risk reward ratio.

So we use this ratio to set our take profit and stop loss. When we input our buy price, we also edit the take profit and stop loss in a way that one won't be more than the other.

After we have edited this position we can then place the buy order

The take profit and stop loss positions are our exit point depending on the market. If it's in our favour, we take profit otherwise stop loss will reduce the loss.

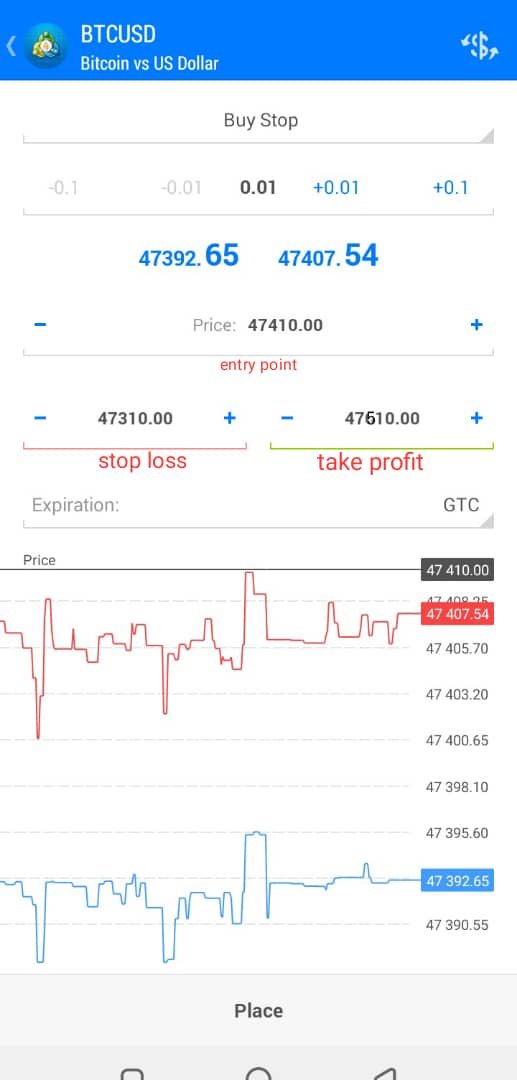

Check screenshot below

Sell Entry Criteria

To place a sell order using Sharkfin Pattern we have to first add RSI indicator with period 14 / default settings so a to confirm the pattern.

We then wait for price to set up the Sharkfin Pattern that is (make a swing high point then reverse back forming an inverted V shape.)

We then use the RSI to confirm this set-up. If the RSI doesn't go abovr 70 during the swing high before reversing then the set up is not strong/ valid. We have to wait for another one.

After confirming that the RSI went above 70 before the reverse and forming a V shape it's self .

It's advisable to wait for the close of the candlestick that started the reversal trend before we enter the trade. This is mostly for scalpers or intraday traders since they are trading in lower time zone so after the closing of the candle we can the place a trade.

Now we can place our sell order.

Sell Exit Criteria

Before we place the trade we have to consider our risk management. Because not all trade will go in our favour see we have to consider risk management

In considering risk management we have two major things in play which are take profit and stop loss and risk : reward

Risk : Reward is the amount we are will to risk to get something. So it's advisable we use 1:1 meaning we are ready to risk 1% to get 1% for example in an investment of $100 a trader can set his risk reward ratio in a way that he is ready to risk 20$ to get 20$. That an example of 1:1 risk reward ratio.

So we use this ratio to set our take profit and stop loss. When we input our buy price, we also edit the take profit and stop loss in a way that one won't be more than the other.

After we have edited this position we can then place our sell order.

The take profit and stop loss positions are our exit point depending on the market. If it's in our favour, we take profit otherwise stop loss will reduce the loss.

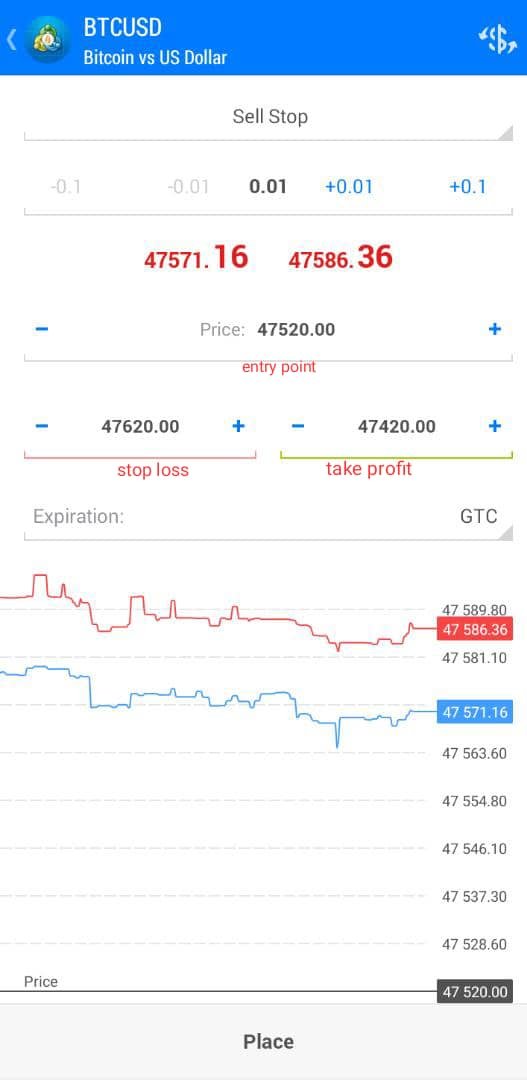

Check screenshot below

4 Place at least 2 trades based on sharkfin pattern strategy

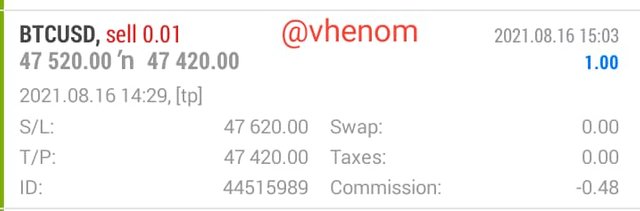

I have place two trade using the Sharkfin Pattern and obeying all rules guiding this strategy. I placed a buy order and a sell order or the btcusd chart using metatrader4. I place a trade of 1$ loss and profit for any loss I lose 1$ and for any profit I gain 1$.

This is when I'm placing the buy order you can see that I completely edit my order before placing the trade. I used buy stop because btcusd price is not stable so to get a perfect result I used the buy stop order.

After taking the position entry, Stoploss and take profit I placed the order as you can see the buy order is placed.

After some minutes the trade was closed with a profit of 1$. You can check my risk - reward ratio its accurate if I was to lose the trade I would also lose 1$.

This is when I'm placing the sell order you can see that I have edit my order before placing the trade. I used sell stop order because the price of btcusd is not stable so to get a perfect result I used the sell stop order. Where the order is higher lower than the current market price. Once the price gets to the order it validates it.

After taking my trade positions (entry, Stoploss and take profit) I placed the order as you can see the sell order is placed.

This is my profit after some minutes of trading.

Note the trade is a mini trade of 0.01 lot size and take profit and stop loss are calculated by pips. Trade is on 1min time frame.

Conclusion

The Sharkfin Pattern is a good strategy for trading reversal trend in a volatile market. The set up has to be confirmed with the RSI indicator for a valid set up.

CC @cryptokraze