Crypto Academy / S4W8- Homework Post for @reminiscence01: submitted by @verdad

Hello fellow Steemians, I hope you are all doing great. Below is my assignment submission for professor @reminiscence01

source

Decentralized finance (DeFi) is a global or an open system that makes available decentralized applications or financial products built primarily on the Ethereum blockchain network. It enables permissionless peer-to-peer interaction between traders, borrowers, and lenders without the involvement of any central authorities during transaction processes. Also, the users are the only ones who hold the private keys to their wallets and control their assets.

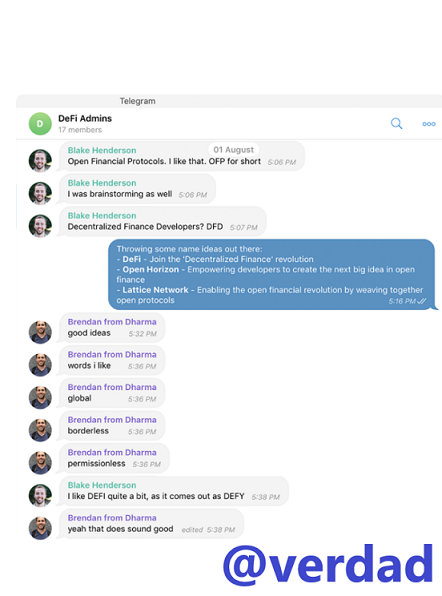

The term DeFi was born in a telegram chat between entrepreneurs and Ethereum developers namely, Blake Henderson of ox, Brendan Forster of Dharma Labs, and Inje Yeo of Set Protocol in August 2018. A lot of names were suggested including Lattice network, Open Horizon, Open Financial Protocols during their conversation on how to call the innovative financial decentralized applications that they were developing, but they all agreed to go with DeFi after Brendan Forster suggested it.

In case you are considering developing some of the most popular types of DeFi applications for your business, LimeChain is one of the best options for you. Below are some of the DeFi applications to consider.

Liquidity mining platforms.

Non- custodial wallets.

Staking platforms.

Decentralized exchanges.

Question 1. a) In your own words, explain DeFi products and how it is shaping the present-day finance.

DeFi products are products (built on the Ethereum network) that open up financial services to any individual with an internet connection and are owned and maintained by them. Transactions between users are carried out without the involvement of third parties, unlike the traditional financial systems such as exchanges and banks.

The main goal of DeFi products development is to totally redefine traditional financial services such as borrowing, lending, trading, and payments with the help of an advanced blockchain technology and smart contracts (a self-executing contract stored on the blockchain that runs when predetermined conditions between traders are met) to disrupt the role of intermediaries.

1. b) Explain the benefits of DeFi products to crypto users.

Transaction Speed:

Transaction speed is very important to blockchain adoptions and sustainability and DeFi products provides exactly that to its customers with the use Smart Contracts stored on its blockchain. Opening an account with a bank to transfer funds to friends and family is very complex, long, and a tiresome process, but smart contracts does the work almost instantly.Security:

All Decentralized Finance products operates on a blockchain, hence are protected with powerful cryptographic algorithms making it almost impossible for intruders access funds of its customers.Low interest rates:

The interest rates with DeFi products are very attractive as compared to traditional financial services. The limit to enter to borrow is extremely low as compared to banks or financial assistance platforms.Permissionless and decentralized:

There are no limits as to who can use DeFi products. This eliminates central authorities and allows for greater participation. Customers are also allowed to retain their private keys and be in control if their assets.

Question 2.) Discuss any DEX project built on the following network.

- Binance Smart Chain

- Tron Blockchain

PancakeSwap is a decentralized finance product launched in September 2020. It is an automatic market maker using liquidity pools (permissionless) that runs on behalf of BSC. Pancakeswap allows its users thus; investors and traders to exchange/swap BEP20 tokens (BNB, ALPHA, e.tc ) fast and secure. The liquidity pools we are talking about here contain Funds deposited by the users to receive LP (Liquidity Provider) which is used to reclaim a portion of their trading fees and shares. PancakeSwap is becoming popular as each day goes by, because it solves many problems that have plagued the industry so far. Through innovative methods and a commitment to safety, PancakeSwap was developed as a viable alternative to Uniswap.

)

)

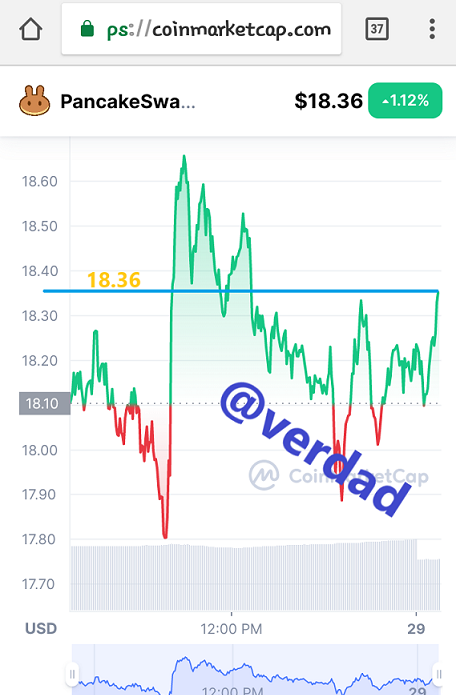

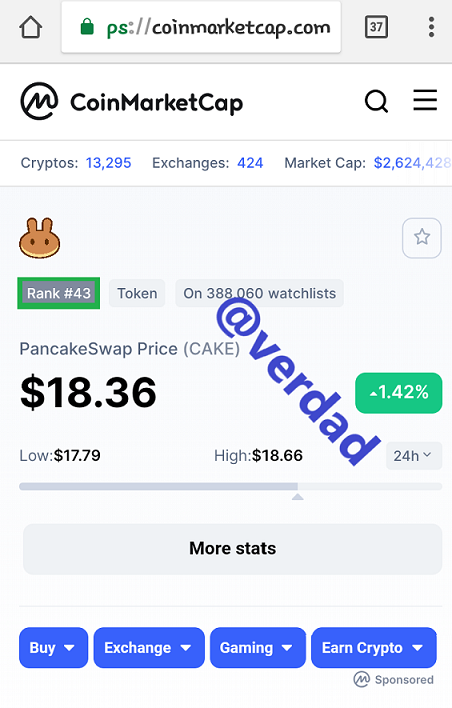

From CoinMarketCap, the live PancakeSwap price today as at when the below screenshot was taken is approximately $18.36 USD with a day trading volume of $299,929,198 USD. It is ranking #43, with a market cap of $4,340,568,214 USD.

Customers earn more CAKE (PancakeSwap native token) or tokens from other BSC projects such as LINA and DODO by either staking or using them in SYRUP pools in PancakeSwap.

With the use of Binance Smart Chain network and BEP-20 tokens, transactions in Pancakeswap takes less than 5 seconds on average to complete with low fee payments as well (ranging from $0.04 to $0.25).

PancakeSwap can be used or accessed by anyone around the world to transact assets without any know your customer (KYC) requirements unlike centralized exchanges which requires it users to provide documentations to proof their identity which invades their privacy.

It has no native wallet and the processes involved with Binance Smart Chain (BSC) is very complex.

PancakeSwap has a very complicated staking process hence extremely not beginner friendly as compared to centralized exchanges.

Predictions (gambling) in PancakeSwap can result in losing funds/assets quickly.

Because Binance Smart Chain is cheaper to use, several BSC scam tokens have been created on the Ethereum blockchain and traded on PancakeSwap.

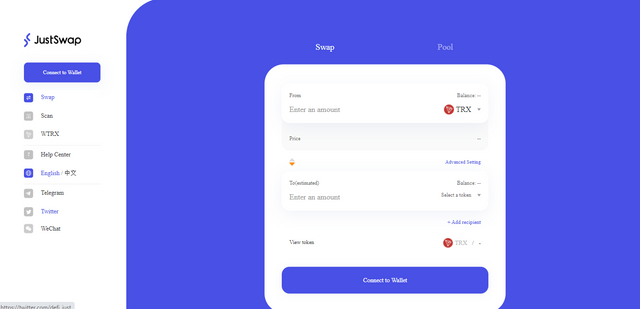

JustSwap is a decentralized exchange protocol on TRON that allows customers to trade TRC-20 tokens instantly based on system price for automated supply of liquidity without the involvement of central authorities.

JustSwap is the first platform to allow users to exchange liquidity pool (LP) tokens and was launched in August 18, 2020. Users of JustSwap earn transaction fees and commission by becoming liquidity pool providers. There are no entrance restrictions in JustSwap. It provides limitless liquidity to its users or customers.

The high gas fees due to the several DeFi demands on the Ethereum network has been addressed by JustSwap with less fees and 200 times faster with instant settlement as said by TRON foundation CEO below.

Question 3) In the DEX projects mentioned in question 2, give a detailed illustration of how to swap cryptocurrencies by swapping any crypto asset of your choice. Show proof of transaction from block explorer. (Screenshots needed)

In this section, we are going to learn how to Swap any cryptocurrecy asset in PancakeSwap and JustSwap (DEX projects built on Binance Smart Chain and Tron blockchain) respectively.

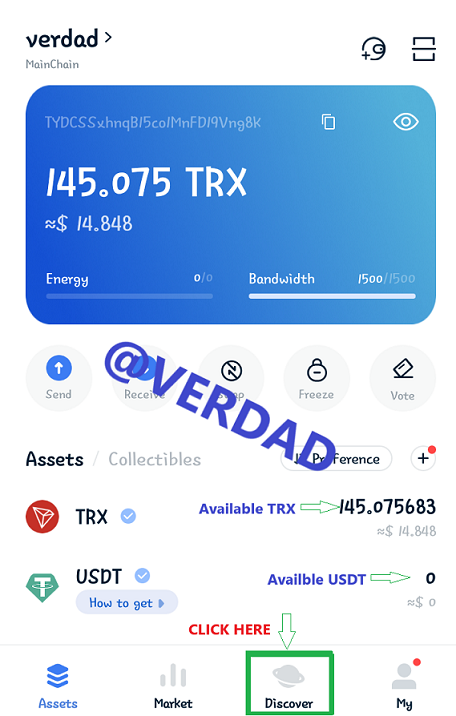

- To Swap cryptocurrecies in JustSwap, open your TronLink wallet and click on Discover to access decentralized applications (DApps).

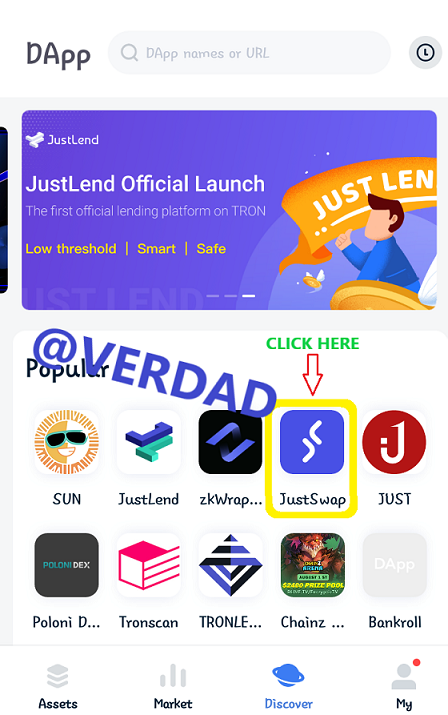

- Click on the JustSwap icon located in the Popular DApps to access its homepage.

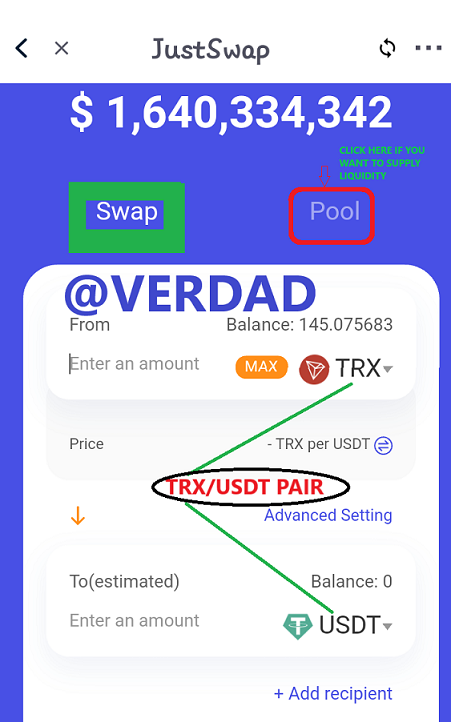

- On JustSwap official homepage, you can either choose to add liquidity by Clicking on Pool or Swap cryptocurrecies by Clicking on Swap. Since I will be swapping cryptocurrecies, I clicked on Swap.

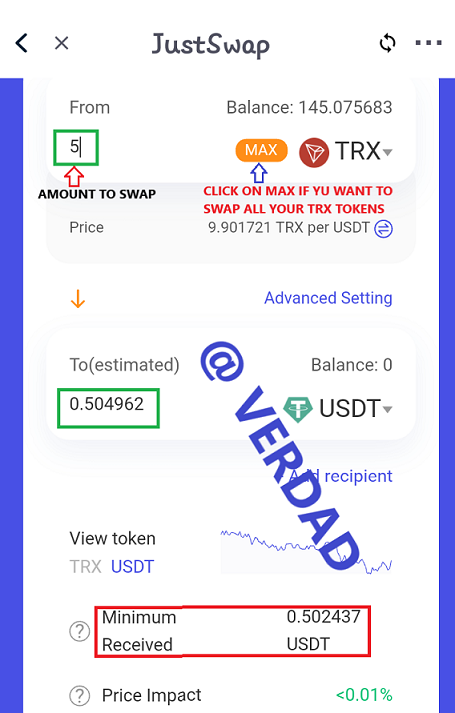

Select and enter the amount of Token pair that you wish to Swap as shown in the below screenshot (I will be swapping TRX for USDT).

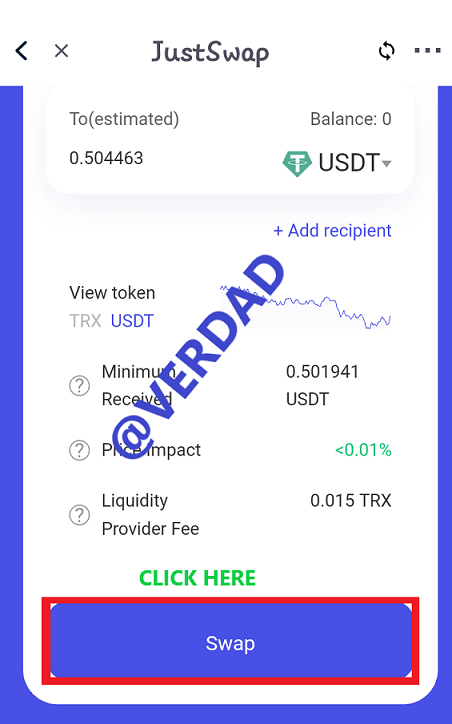

I entered an amount of 5 TRX to be swapped for an amount of 0.502437 USDT with a liquidity provider fee of 0.015 TRX.

Scroll down and click on Swap

)

)

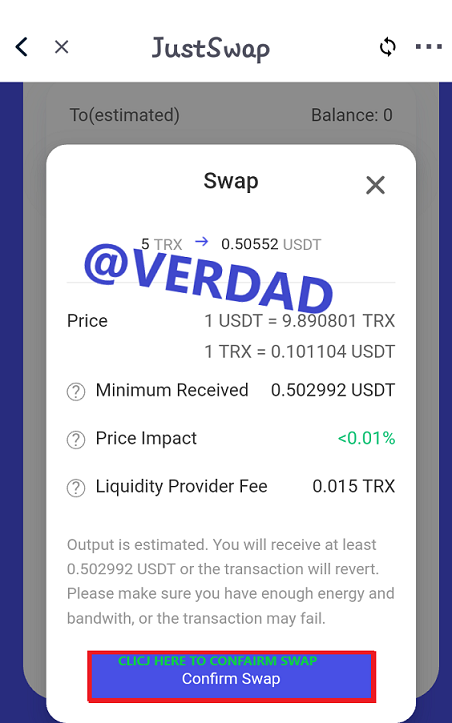

- Look through the transaction details and make sure that the amount you wish to Swap is correctly inputted.

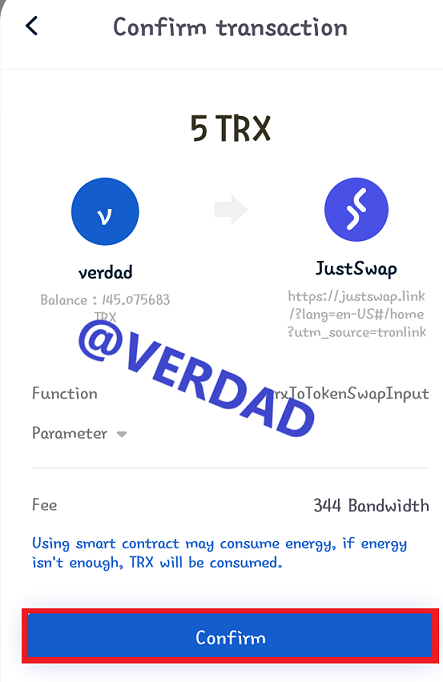

- Confirm your transaction after a smart contract has been initiated.

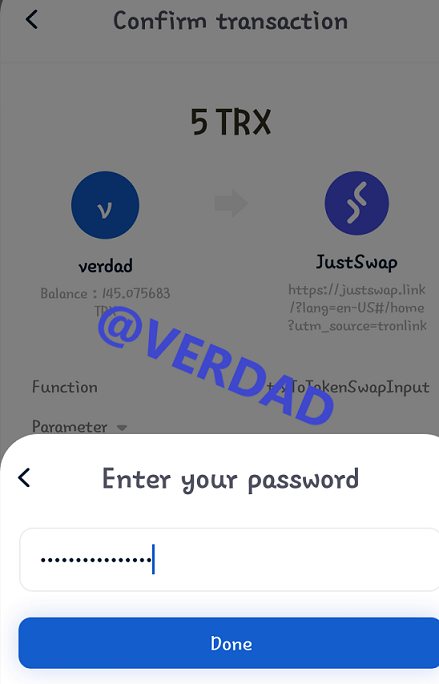

- Enter your password to prove ownership of the account. Click on Done to complete the transaction process.

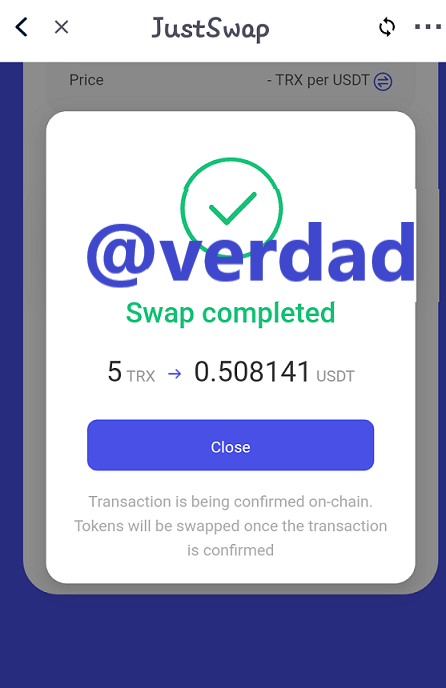

- I have successfully swapped 5 TRX for 0.508141 USDT as shown below.

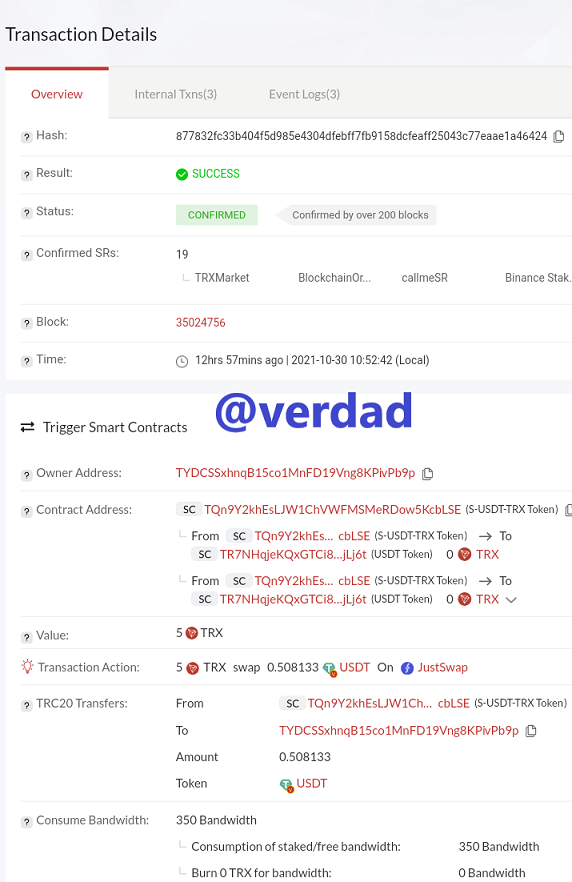

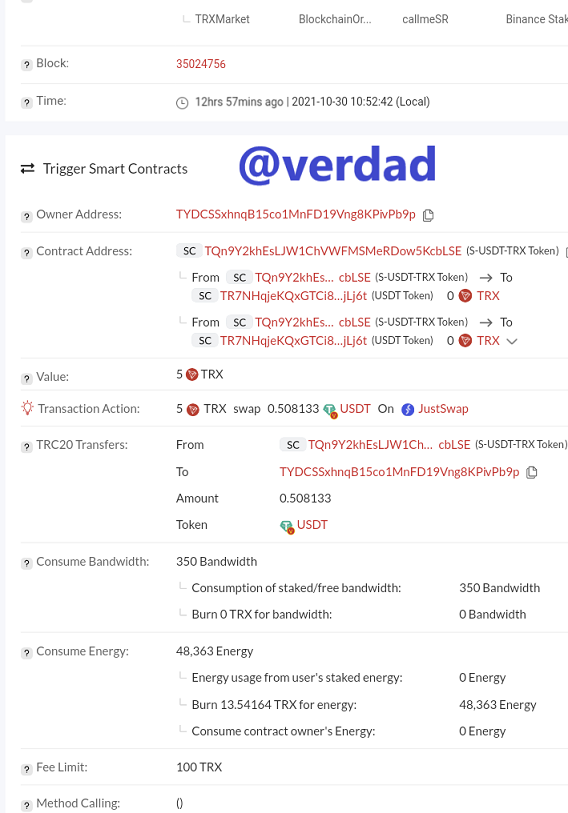

proof of transaction from the block explorer is shown below

)

)

Decentralized Finance (DeFi) plays a very important role in their customer’s lives by enabling them transfer funds to friends and family at a low cost without any authorization from central governments. DeFi also makes it possible for users to loan funds instantly from other users unlike the traditional financial systems where you have to join a queue and sign a whole bunch of documents before getting qualified for a loan.

It was a pleasure taking part in your task professor @reminiscence01, I really enjoyed your lecture. THANK YOU

Hello @verdad, I’m glad you participated in the 8th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observations:

This is not true, DeFi products are built across all blockchains.

Recommendation / Feedback:

-Your overall presentation is good.i But you need to improve your writing skills by working on your markdown styles.

Thank you for participating in this homework.

Professor @reminiscence01, I didn't receive any rating for the #club5050,why??