Crypto Academy Week 12 | Homework Post for @ stream4u | Trading Crypto Margin & Trade Token with Leveraged crypto

Hello, sir. @ stream4u, I am happy to learn from you once again. Your studies have always taught me so much. thank you for lecturing us week after week. I'm also very excited to add my submission to this week's assignment.

What is Crypto Margin Trading?

Margin trading is when you take power with borrowed money or funds to increase your stage. The cryptocurrency exchange will lend you money.

When you trade on margin, you are borrowing money or funds against money or funds that you already have in your account. This requires borrowing money with a relatively high interest rate to maximize you. Margin trading allows you to maximize your purchasing power while still increasing your profit potential. If the markets and trades shift in your favor, margin trading will no doubt increase your income and leverage, but also come with an increased possibility of losses.

Leverage is at the heart of crypto margin trading. Margin trading is a form of leverage used by traders. When you trade cryptocurrencies on margin, you gain more buying or selling power with leverage. Leverage allows a person to swap positions that are larger than their trading account balance.

Exchanges that provide the best Crypto Margin Trading:

BINANCE

COINTREE

BitMEX

POLONIEX

Kraken

Houbi

Advantage

Increased purchasing power is one of the advantages of Margin trading whose ability to take greater control by borrowing from your broker using your current equity is the most obvious gain on margin.

It also allows you to build a portfolio with greater versatility.

Deficiency

Let's talk about the risks involved. Being able to control a larger-than-average role means that not only your profits, but your losses, will be even greater. This is the reason, when using margin, you must be very careful and adhere to very strict risk exposure and money management.

It's also very stressful.

How To Plan Trading In Crypto Margin Trading.

Margin trading is a high-risk investment technique that is based on short-term market fluctuations. Before you start cryptos margin trading, you should consider the following activities and strategies to help you plan

Increase trade size: it's better to start with a smaller size and lower leverage to understand a solid understanding of the process.

Know the fees and interest involved in advance: You will pay interest on the capital you put in when you open a position. Cryptocurrency margin trading entails ongoing fees that can eat away at your stage quickly.

Lower your risk and set a target: When it comes to margin trading, you need to have a clear risk management plan. This plan should define simple profit targets, which you must adhere to. It is very important to set a stop-loss threshold and stick to an exit strategy.

To use demo trading before you start real trading: New traders can practice trading in a trading simulated trading environment. Although the demo trading platforms do not accept real money, they do represent current market prices. New traders can use demo trading to test their strategies without losing their own money.

The names of the crypto exchanges that provide margin trading services and what margin do they provide?

- BINANCE

Cross and Isolated margin up to 10x

POLONIEX

Isolated crosses and margins up to 5x

CRAKEN margin - up to 5x

HUOBI GLOBAL

Cross margin - 3x

Margin - up to 5x

BitMex

Isolated crosses and margins (up to 100x)

What is Leveraged Token Trading

A leveraged token that enables you to scale up leveraged trading in digital assets without having to run the hassle of managing margins.

ERC20 tokens that reflect long or short ratings of leverage in crypto assets are known as leveraged tokens. The main benefit of this new crypto derivative token is that it allows you to take leveraged positions without worrying about collateral, rates, margin management or liquidation.

They have received a lot of attention since their launch because of their simplicity.

We should also know that the Leveraged Token is not there to be stored. Binance also offers Binance Leveraged Tokens (BLVT) with a leverage range of 1.25x to 4x.

Advantage

Leverage tokens can be stored transparently and stored in private Ethereum wallets as they are found on the Ethereum blockchain as ERC20 tokens.

This allows users to benefit from market volatility.

In order to avoid the risk of liquidation, they automatically invest the income and sell a portion of them if the market is down.

Deficiency

The level of transparency provided by the leveraged token is determined by the exchange you use.

They are very risky. If you don't know enough about the Leveraged Token prior to it, you may lose money. Not recommended for new traders.

How To Plan Trading With Leveraged Tokens?

Leveraged token trading requires proper planning as the risks involved are very high. If you use this method to buy leveraged tokens as a long-term investment. Long-term investing in leveraged tokens can seem very deceptive. Because there is a huge risk involved in doing so. Many investors don't realize that leveraged tokens are rebalanced and reused in response to market movements. As a result of how the compounding effect functions differently, the long-term confidence of the leveraged token is uncertain.

Leverage trading tokens generates more money on the trade and on margin. However, if you misinterpret the market and prices go up / down in the opposite direction, you may lose a lot of money. So this one should be very good at reading price predictions.

Name of Crypto Exchanges That Provide Leveraged Token Service and What Margin Do They Give In Leveraged Token?

Binance

Leverage up to 4x

Polonix

Leverage up to 3x on the leveraged token

- Huobi Global Levers

up to 3x on the leverage token

Coinbase Levers

up to 3x

Price Forecast For Crypto Assets XXXXXX. (This is a similar question from the previous course, take any Crypto Asset Chart chart, according to the current price and the market trend predicts the future price only for the next week, what is the future price for the next 1 week. You can predict for any direction. up or down but explain correctly on what basis you predicted the price. What are the likely low and high levels for the next week.).

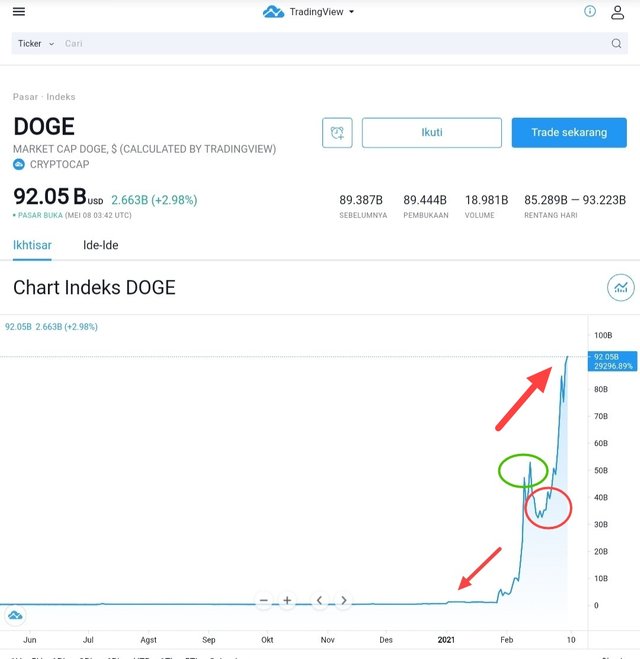

Let's recap the price forecast before we move on. In my previous homework for prof. @ stream4u i definition of price forecast as an approximate estimate of future value. In my previous assignment, I used BTC to describe the price forecasting trend. In today's homework I will use doge coins. The Doge coin has been over the top thinking over the last few days or weeks.

In analyzing the doge coin chart above let's take a look at their resistance and support levels which will help me analyze the trend. The blue dot that is circled is referred to as the resistance level which has dropped to the support level which is green which is circled to move up again. Doge coin started recently and in the last 2 weeks the doge was around 0.2-0.22 which is now 0.6391 as it is now. In our last lesson on price forecasting, we learned there are 3 types of price forecasting and we have fundamental, technical and sentimental analysis.

The Doge Coin is one of the tokens that uses sentimental analysis to drive its sales. Sentimental analysis is the type in which traders take advantage of the fact that each new piece of information goes up or down in the coin price. Doge's coin has come under the influence of the media and some prominent people. Seeing the recent waves and hype it has had and so many celebrities pumping so much money into it. I see the doge going up to $ 1 in the coming weeks. If Doge is able to hit a dollar in the coming weeks, then the huge potential for hitting $ 2-3 in the coming months has great potential. And as always thank you.

Hi @valhein

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task.

Your Homework Task verification has been done by @Stream4u, hope you have enjoyed and learned something new.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

#affable

cc @sapwood

Thank you so much.

I will update it in the sheet now.