Risk Management and Trade Criteria– Crypto Academy / S5W7- Homework Post for @reminiscence01

Good day everyone, how are you all doing?

Merry Christmas and happy new year to you all!!!

I welcome you all to the Crypto Academy S5W7 course which is about the "Risk Management and Trade Criteria", the course was thought by professor @reminiscence01 who takes his time and energy to explain the course for all student understanding. And I will also be explaining the homework questions asked.

Q1. What do you understand by "Risk Management"? What is the importance of risk management in Crypto Trading?.

For every trader or any financial organization, it is very important to have a good and stable risk management strategy whenever they are trading because the risk management will help the trader to cut losses and also help them in minimizing their losses when trading, with risk management in play, then traders don't have to lose all of their assets whenever trading goes sideways.

Most traders tend to lose most of their assets when trading and at the same time they will end up making more losses than making a profit because of the lack of experience and also because not all traders make use of risk management, it's probably because they don't know how important it is to have a risk management strategy when trading.

And one of the most important aspects of trading is the aspect of risk management, though it is said that a "successful trader is the one who takes a risk", even though traders can take certain risks while trading, it is also important for traders to know when not to take any unnecessary risk which can cause them to lose all their investment or asset. This is why we have a risk management strategy that can help traders to avoid any unnecessary risk that will cause them a fortune, with a good strategy traders were able to predict the market fluctuation, knowing when the market is trending on the Bullish trendline side or the bearish trendlines.

And they are some few mistakes traders makes, the mistake is most common among the newbie traders, one of the mistakes they make is being overconfident, most newbies tend to be overconfident when entering a trade because most of them have seen their colleagues doing well when trading so they also feel like it will be a piece of cake for them too, though it is good to be confident when trading but confidence without a good strategy and good risk management, almost 90% of new traders end up losing most of their asset in their first trading. It is good to have the confidence of being able to pull off the trade but it is best if new traders have all the necessary strategies before entering the market.

What is the importance of risk management in Crypto Trading

From the explanation of what risk management is, we can see that risk management is very essential to all crypto traders, it also helps all traders in avoiding any unnecessary loss, it also makes it possible for traders to see the clear picture of what direction the market will be fluctuating to which also helps the traders to maximize their profit on each trade they enter.

Risk management also helps most traders to know the right strategy they are to use whenever they want to start trading, this also helps to build confidence in most traders and with the risk management in place, many traders were able to bypass the critical situation that most traders tends to lose confidence in when trading.

And also with the help of risk management in place when trading many traders were able to perfect other trading strategies because with the risk management, they were able to focus their full attention on other areas while trading because they know that with risk management, even if they will make a loss in any trading, then the loss won't affect their asset much, all crypto traders knows that the trading involves taking risks and sometimes you can make some losses same way you make a profit, so all traders are mentally prepared for what's to come either profit or loss, but in order not make too much loss while trading that's why we have the risk management

Q2. Explain the following Risk Management tools and give an illustrative example of each of them. (a) 1% Rule. (b) Risk-reward ratio. (c) Stop loss and take profit.

(a) 1% Rule

The 1% rules in risk management tools are one of the rules that are mostly used and adapted by traders when trading because most traders believe that it is better to play safe than sorry, which is also the reason why some traders mostly adopt the use of the 1% rules because with the use of the 1% rules traders will be able to save more of their asset when trading and traders will also be taking less risk when trading, they won't be faced with the fear of losing all their asset all at once.

To understand how the one percent rule works let's assume I open up my trading account, and I fund the account with the sum of $500 for start-up, then I set up my risk management at 1%, which means that I will only be using 1% of my total asset in trading, it doesn't matter how many time I am making an entry, with the one percent rule in place, it will save me from blowing off all my asset all at once and I will be able to make more than one entry.

Illustration on how it's been calculated

When you have a total asset of $500 and you set your risk management rule to be 1%, it can be calculated as follows:

First, we multiply our asset by 1% which is (1% x $500) which will give you $5, what this means is that you will be risking $5 asset which is a far cry to the total asset you have in your account which is $500 asset, you can also derive the calculation some other ways but you will still end up with the same answer, we can divide 1/100 then multiply it by the total asset (1/100 x $500) which will also give $5.

Let assume that we make more than one entry, assuming you make 10 entries a day and unfortunately you lose all the 10 entries, you will then realize that even after your 10 entry you still have many assets remaining, so assuming we make 10 entries which mean (5 x 10) which will be $50, after that, you will still be left with $450, if you continue to make your entry and make your adjustment on your entry due to the few loss you have, you will found out that within a short period you will be able to recover your loss and make more profit from your trade-in no time, so with the use of the 1% rules, most traders were able to avoid making too much loss while also maximizing their profit.

(b). Risk Reward Ratio (RRR)

Among the Risk management tools, the risk reward ratio is also one of the tools you can rely on if you want to minimize your losses and maximize your profit when trading, to make use of the risk-reward ratio, traders have to know how to navigate their way around it and know how to set up the risk-reward because most times when traders tend to set the risk-reward ratio without the knowledge on how to go about it ends up making a huge loss instead of making any profit at all especially those that are new to the trading system, they find it hard to navigate their way around the risk-reward ratio without the prior knowledge of how it operates.

To set the risk-reward ratio, the first thing to consider is that when you are setting up the risk-reward ratio you have to set your risk to be lower than your reward pool, which also means that if your reward is lower than your risk then you might have a destabilize trading system where you can fall on loss than making a profit. So it is very important when setting up the risk-reward ratio, traders have to pay close attention to the percentage of risk and the reward, at least the ratio of the risk and the reward given should be within the range of 1:2 for traders to have a normal risk-reward ratio.

Illustration

Like we stated earlier, assuming that we have $500 on the trading account, we want to set our risk to be 2% of the account asset which is around _$10, which means that if we are to set our _risk reward ratio to be 1:2 then we will be expecting double of the asset we set to market which is $20 if we are to collect our profit, in this case, your account won't have to suffer too much loss even if you're to make s loss on your trading, you will still have enough asset to make another investment which is likely to make you a huge profit because you will be learning from your first loss.

(c). Stop Loss and Take Profit

Stop Loss and Take Proft is also one of the important tools of Risk Reward management, in Crypto trading, all traders must learn and know when is the right time for them to set up when they want to Take Profit and When to Stop Loss because Stop Loss and Take Profit are essential to all traders who want to make a profit and minimize his/her loss, Stop Loss and Take Profit can also be seen as an exit order which can safeguard every trader's asset against making an unnecessary loss.

The Take profit is setup when traders are about to enter the market, the function of take Profit is that when the market reaches a specific period then the market should close when you are making a profit, the stop loss is to be implemented when the market is not in your favor and you are making a loss so it is meant to stop your loss earlier before losing all your asset.

All crypto traders need to know the right time to set up the stop loss and take profit because most traders tend to lose their assets because they didn't set up their take profit and stop loss at the right time and some traders even enter the market without setting up their stop loss and take profit before making an order, so it is very important to set up your stop loss and take profit when you make your order so that you can take your profit when the trade is in your favor and you can stop loss when the trade is not in your favor.

Q3. Open a demo account with $100 and place two demo trades on the following;(Original Screenshots on Crypto pair required). (a) Trend Reversal using Market Structure. (b) Trend Continuation using Market Structure.

The following are expected from the trade.

• Explain the trade criteria.

• Explain how much you are risking on the $100 account using the 1% rule.

• Calculate the risk-reward ratio for the trade to determine stop loss and take profit positions.

• Place your stop loss and take profit position using the exit criteria for market structure.

Trend Reversal Using market structure

BITSTAMP

I will be making use of the BITSTAMP on trading view to explain the entry and the exit criteria for making a trade.

Entry Criteria

On this task i will be making use of BTC/USD, which create a new series of higher highs and higher lows, when drawing our trendline which is shown on the image below, on the image we can see that the trendline created a higher lows and higher highs respectively, they was a period where the trend failed to create a new high and then break the former lows.

Along the trendline, it can be seen that the market price fluctuate between the buyers and the sellers which caused a reversal in the market, after the breakout in the market structure, we tend to see a new break in ,market which can also be use as another resistance, after that we enter our trade when the market is trending towards the bearish signal

Exit Criteria

To set our stop loss, the stop loss have to be set above the resistance line, which means that the we can set out take profit and stop loss structure immediately after the breakout. When setting it up we have to make sure we set the risk reward ratio to be 1:2 which signifies that the risk is lower than the reward, the image above shows the trade setup.

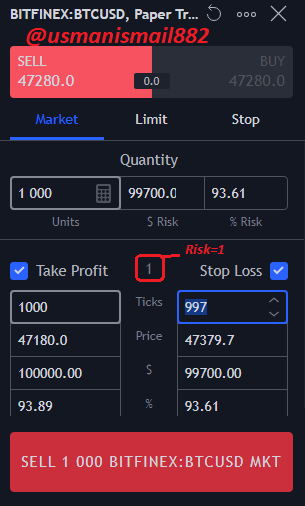

Calculating the Risk reward ratio to determine the stop loss and take profit

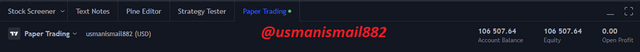

On my trading view demo account, my asset is about $100,000, which is shown in the image below

So from my asset shown above, i decided to risk just 1% of my asset which is $1,000, this also signifies that i will be trading with just $1,000 everytime i make an entry, to get the accurate amount to use for trading, all you have to do is follow the below calculations.

1/100 =0.01

0.01 x $100,000

=$1,000

So i placed my entry to sell at 1065.08 and to stop loss when it is at 47409.7 and to take profit when it is at 47210.0, this also indicate that is have short for the market to be decided, if luck is on my side then i will be going home with a smile but if not then i will be making a loss.

After which i calculated my loss with the formula below

Profit/loss = size x profit/lost x 10

where 10 is given as constant.

loss=0.1 x 1000 x 10

loss=$1000

For the profit we have

Profit = 0.1 × 2000 × 10

Profit = $2000

The above signifies that if if i am to lose out of the trade then i will be losing about $1000 from my asset and if i am to make a profit then i will be making around $2000.

Now after i saw the pattern the market is taken, then i decide to sell some of my asset instead of buying because i noticed that the market is in favor of the sellers as of this time which makes me to make my entry, and set my risk reward ratio at 1:2.

Few hours after making my entry, i was lucky to make some short profit which was allowed to take profit.

From all our explanation, we can see how wonderful the risk management is, how important it is for all traders to know how to make use of the risk management when trading, after that we were able to show how to make use of the different tools which are under the risk management.

Special thanks to @reminiscence01 for the wonderful lecture on the course.

Hello @usmanismail882 , I’m glad you participated in the 7th week Season 5 of the Beginner’s class at the Steemit Crypto Academy.

Unfortunately, it is observed that you haven't powered up to 150 Steem in the last 30 days. This is a requirement to participate in the homework tasks.

Remark: Homework task disqualified.