Yield Farming - Yearn Finance - Crypto Academy S5W3 - Homework Post for @imagen

Greetings to fellow users of this platform. It is great to have you all in the 3rd week of Crypto Academy Season 5.

This lesson is mainly based on yield farming. I have read the lesson post and hence, would tackle the given tasks.

Yield Farming

Yield farming is one of the popular methods of generating passive income with cryptocurrency.

Yield Farming is a process whereby investors (called liquidity providers) contribute their assets in a liquidity pool for the sole purpose of obtaining interests over a period of time.

The interests obtained from locked assets can either be the same crypto asset that has been locked, or an addition of other crypto assets.

The interest yield mechanism of yield farming platforms is based on the APY, and this yields compound interest on the assets staked.

Examples of platforms that offer yield farming are:

- Aave

- Compound Finance

- Synthetic

- Uniswap, etc

Staking

Staking is a consensus algorithm that is used in the mining process of certain cryptocurrencies.

Staking involves the locking up of cryptocurrencies in a pool, which would act as nodes for the validation of blocks. On validation of a block, a reward is given to the node that is responsible for the block validation. The reward is always the cryptocurrency staked in the protocol.

Staking has proven to be a better alternative to the traditional Proof of Work mechanism which requires sophisticated devices with large computational power. Large computational power would result to great energy consumption for the mining process

The chances of validating a block to obtain rewards are improved by the amount of assets that are locked up by an individual.

Differences Between Yield Farming and Staking

Although yield farming and staking are greatly interchanged and confused in speaking, they are two different concepts.

| Yield Farming | Staking |

|---|---|

| The sole purpose of yield farming is to generate income by receiving interests on locked assets | The sole purpose of staking is for contribution to the validation of blocks in a network. |

| APY rates can reach up to 100%, therefore yeild farming is seen as a more profitable venture | APY rate is between 5% to 15% , making it a less profitable venture |

| Platforms that offer yield farming make use of Automated Market Maker as the technology for its interest mechanism | Staking is possible for networks that make use of the Proof of Stake consensus algorithm for its validation and security. |

Yearn Finance

Yearn Finance is a project built on the Ethereum network that offers lending and trading services.

The project has the following features:

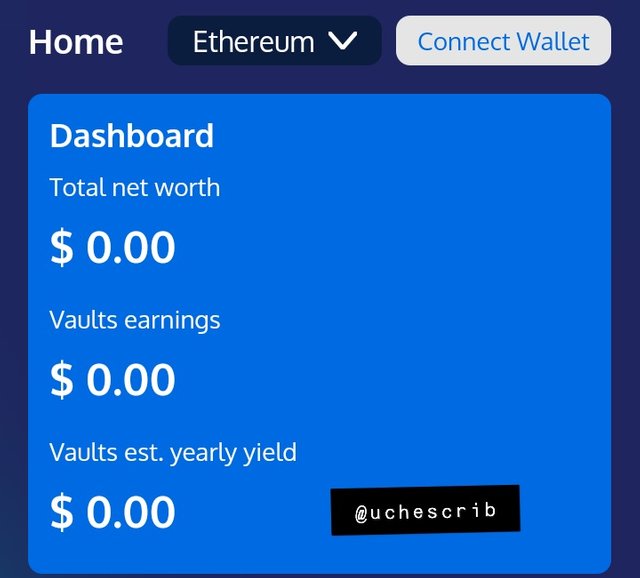

Dashboard

This displays the value of assets in USD owned by a user.

Wallet

This is used in storing assets that are not being put to use.

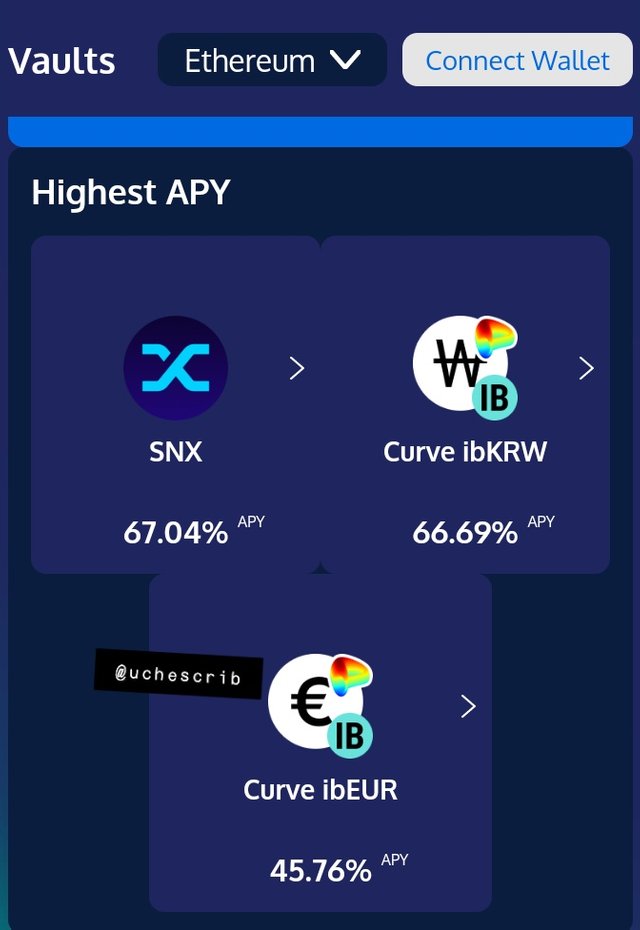

Vaults

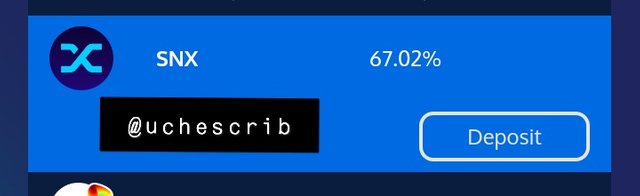

This offers pools where assets can be locked to generate income. The pools are ranked from the greatest to the least according to their APY rates.

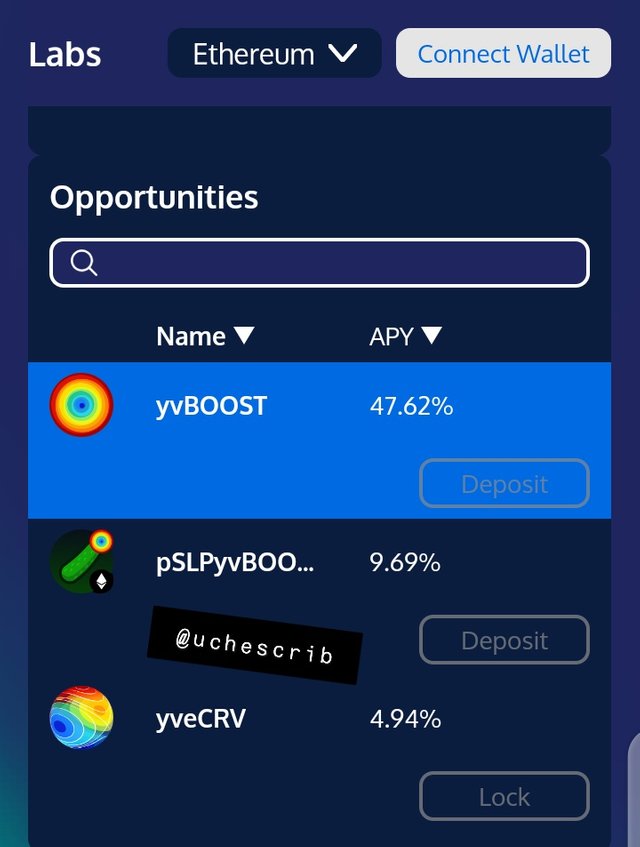

Lab

This feature gives first-hand information on the latest opportunities in the platform.

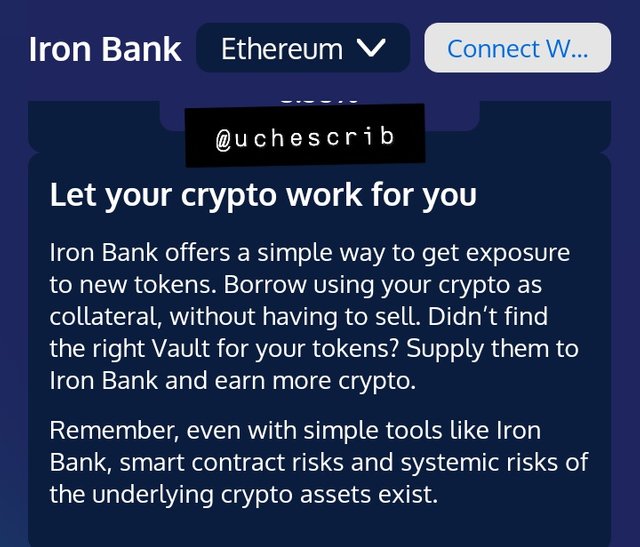

Iron Bank

This feature allows users to borrow from the pool and also supply to the pool. Also, assets can be kept in the iron bank if a user doesn't find a suitable pool. The assets locked in the iron bank would also yield interests.

Wallet Connect on Yearn Finance

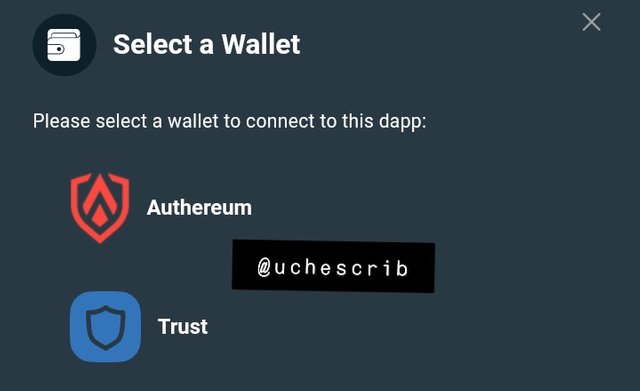

Step 1: For mobile devices, open the Yearn Finance site on a wallet with a web 3.0 browser. For my illustration, I used Trust Wallet.

Step 2: Select "Connect Wallet".

Step 3: Select Trust Wallet.

Step 4: Wallet Connect successful.

To transfer funds to Yearn Finance after wallet connect, simply transfer funds to the wallet address of the connected wallet. All funds would be deposited to the platform as long as the wallet is connected.

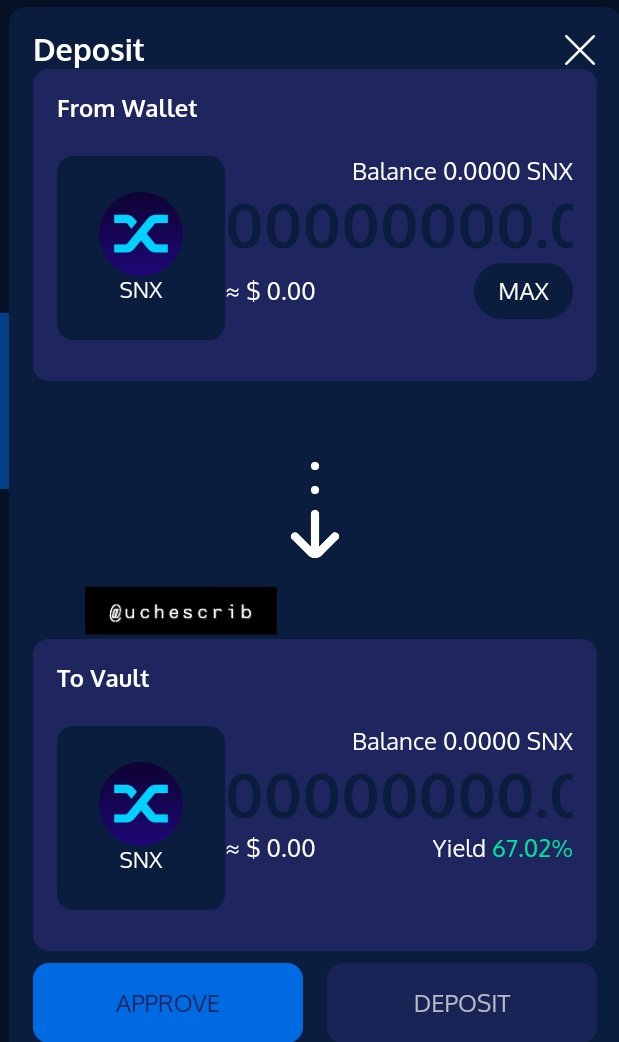

Locking Assets

Step 1: Select preferred pool for locking assets.

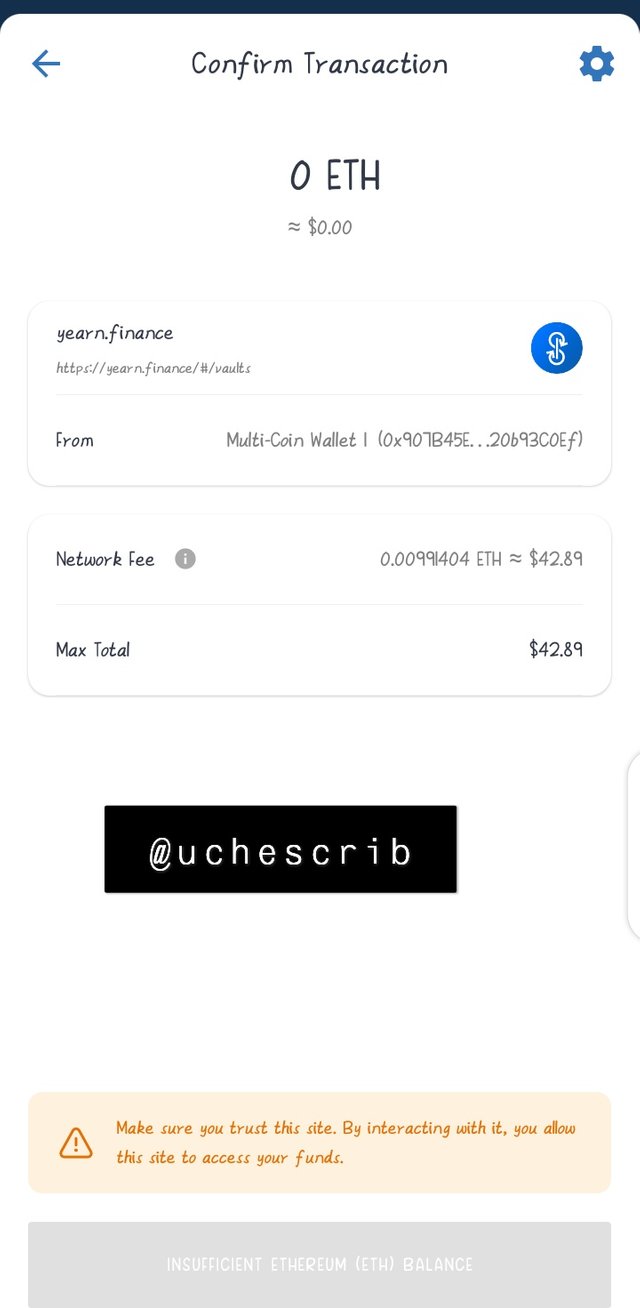

Step 2: Approve.

Step 3: Approve smart contract on wallet. In my illustration, I have insufficient balance. Therefore, I can't approve the smart contract.

Step 4: After approval, proceed to deposit into the desired pool.

Collateralization in Yield Farming

In a real world situation, in order to obtain a loan, an individual or organisation would have to put up a collateral. A collateral is basically physical asset(s) that the lender would obtain if the borrower fails to pay back the loan.

In yield farming, the borrower needs to put up collateral to obtain a loan. The collateral is always higher than the amount to be borrowed in order to avoid liquidation. This concept is known as overcollarterization.

Different platform that offers yield farming set up different collateralization ratios. A collateralization ratio of 500% would imply that for every 100usd supplied to the pool, 20usd can be obtained. This protocol is set up to keep the collateral value above the threshold that has been set by the platform.

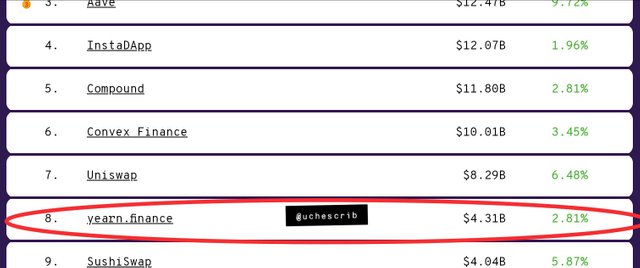

TVL of the DeFi Ecosystem

The TVL of the DeFi ecosystem is $106.85 billion.

TVL of the Yearn Finance Potocol

The TVL of Yearn Finance Protocol is $4.31 billion.

Market Cap / TVL ratio of the YFI Token

Market cap = $1,081,993,414.17

TVL of YFI token = $4.31 billion

Therefore, Market Cap / TVL ratio of YFI = $1,081,993,414.17/$4,310,000,000

= 0.25104255549187935034802

≈ 0.25

Is the YFI Token Overvalued or Undervalued?

The YFI token is undervalued. Why? First of all, let's take a look at the market cap to TVL ratio. The value of this ratio is 0.25, which is a number less than one. In most cases, if the market cap to TVL ratio of a coin is less than one, then the coin is said to be undervalued. This is one of those cases.

Secondly, the YFI token has a good number of uses cases as the native token of a network that offers yield farming. With it's rising value and the development of the project, the YFI would be more than a token used for providing liquidity in a yield farm. When compared to coins like Bitcoin which is just used as a method of payment and a store of value, the YFI token is greatly undervalued.

If on August 1, 2021, you had made an investment of 1000 USD in the purchase of assets: 500 USD in Bitcoin and the remaining 500 USD in the YFI token, what would be the return on your investment in the actuality? Explain the reasons.

From August 1 till date (November 29), Bitcoin has made a +47.05% movement in price and YFI has made a -3.99% movement in price.

Total Yield from BTC = $500 × 147.05 / 100 = $735.25

Total Yield from YFI = $500 × (100-3.99) /100 = $480.05

∴ Amount after investment period = $735.25 + $480.05 = 1215.30

Net profit = $1215.30 -$1000 = $215.30

∴ ROI = ($215.30/$1000)×100 = 21.53%

Risks of Yield Farming

Just like every potential investment, yield farming is also a risky venture. Most of the risks involved in yield farming are as follows:

Bugs in the program (smart contract) of the DeFI can lead to loss of assets. Because the DeFi is a program, it is prone to code errors and even attacks that can alter the digital code, causing mass loss of investment across the network.

Impairment loss can occur in the network. Impairment loss is a situation where there is a sudden or drastic fall in the price of the asset, which would cause the value of interest and investment to be lower than the initial value of the investment. This creates a heavy loss for investors in the twinkle of an eye.

Liquidation is a situation whereby the value of the collateral drops so low that it is insufficient to cover the amount of the loan taken. In this situation, the collateral and loan is lost to cover up for the loan taken. As a result of the problem of liquidation, collateral is usually very much higher than the value of loan taken.

Conclusion

Yield farming is a very profitable venture in which investors can earn passive income. Although confused with staking, yield farming is a much more profitable (and risky) business.

It is best to gain sufficient knowledge on yield farming before going into such venture, so that losses would be avoided.

Special thanks to @imagen

Image sources:

- https://yearn.finance/#/home

- https://defipulse.com/

- Trust Wallet

- TradingView