Crypto Academy Week 14 - Homework Post for @levycore

Hello everyone. It has been wonderful so far in the Steemit Crypto Academy. Professor @levycore has thoroughly explained crypto currencies, how they work, and their advantages and disadvantages in this week's lesson. Without wasting any time, I would begin the homework Task.

Cryptocurrency

Cryptocurrency is digital currency that is built upon blockchain technology and managed by this same technology. Blockchain technology is a distributed network in which transactions are recorded on every node in the network.

The first cryptocurrency was created in 2019 by Satoshi Nakamoto. Although there had been other attempts to create digital money, Bitcoin was the first successful digital money.

Now the innovation of Bitcoin has led to the creation of other cryptocurrencies. The decentralized nature of these currencies, which is offered by blockchain technology, is the major reason why they are generally accepted.

The Fundamental Difference between Cryptocurrency and the Conventional Financial System

The major difference between cryptocurrency and the standard financial system is seen in their management and decision-making systems.

The standard financial system is centralized in nature. This implies that there is an authority that handles management of the system and controls decisions that are made in the system. Let's take an illustration from a typical banking system. There is a limit to how much an account holder can withdraw in a day from the ATM. There is a limit to how much online transfers that can be made. Everything about a customer's account is handled by the bank and as a result of this, the account can be frozen for whatsoever reason. There isn't total access of the account by the account holder in the typical banking system.

In contrast to this, cryptocurrencies are built on a decentralized network. This means that control, management, decision making, are all handled by every participant in the network. A Bitcoin holder has totally control over all his digital currency. There is no existence of any third part or central authority that controls the cryptocurrency. This is the beauty of cryptocurrency and blockchain technology. There is no limitation to how one can use his digital currency in the network and assets cannot be withheld by any entity for whatsoever reason.

Why Decentralized System is Needed

Decentralization has always been a necessity. The innovation of cryptocurrencies has stressed the need for decentralization in so many aspects of life. Here are reasons why a decentralized system is needed:

Transparency: This is the major reason for the need of a decentralized system. Decentralization offers transparency. This means that everything that happens in the network is not hidden in secret.

Control: A decentralized system offers 100% control of personal activities in the network. In the case of cryptocurrencies, decentralization entails that coin holders can use their digital currencies with total freedom. There is no higher authority to restrict activities in the network

Invulnerability to System Failure And Hacking: Decentralization entails that the network is built using a distributed model. As a result of this, failure of one system does not affect the functionality of the network. In the same vein, a decentralized system has high hacking resistance. If one system in the network is hacked, it doesn't disrupt the total functionality of the network. In most cases, it changes nothing at all.

Development: A decentralized system brings development in various levels. An example is seen in the Ethereum blockchain. Because of the decentralized nature of the network, decentralized apps (dApps), new cryptocurrencies, et cetera, can be developed in the same Ethereum blockchain.

What Affects the Value of Cryptocurrencies

Cryptocurrencies, just like every other valuable entity, have factors that influence their values. The value of cryptocurrencies are affected by the following:

Supply and Demand: This is a basic factor. The law of supply and demand affects the prices of so many commodities. In the case of cryptocurrencies, if the demand for a cryptocurrency is greater than the supply available, then the value of the coin would increase. Also, if there is little demand for a cryptocurrency compared to its supply, it would lead to a decrease in value.

Utility: The value of cryptocurrencies is affected by what they can be used for. Cryptocurrencies were initially created as a medium of payment and to serve other monetary functions. This has changed over time. An example is Ethereum. The Ethereum blockchain is not only used to facilitate a medium of payment, but also used as a programing language for the development of different applications and programs. This greatly influenced the value of Ethereum.

Scarcity: Scarcity imposed on cryptocurrencies influence their values. Coins are usually created with a maximum supply. This means that there is competition to obtain a significant number of these coins before the max supply is reached. This in return affects the value.

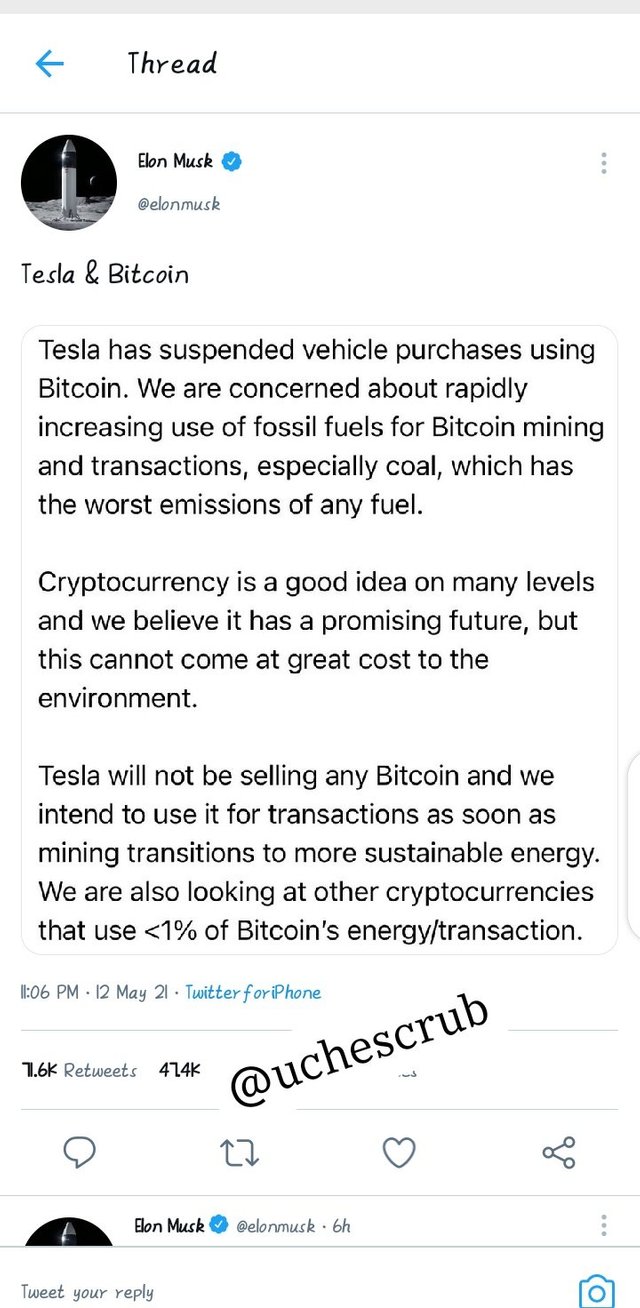

Media: The media affects the value of cryptocurrencies to a great extent. If there is frequent news on a cryptocurrency, about its potential and whatsoever, it would cause the price of the cryptocurrency to rise. The reverse is also the case. An example is seen in the image below where a tweet by CEO of Tesla, Elon Musk, caused a drop in the value of Bitcoin.

source

Node Count: Node count is simply the active number of wallets in a blockchain network. This shows how active people are in using the cryptocurrency. A high node count would result it a rise in value of a cryptocurrency whereas a low node count would cause a decrease in value.

Why Everyone Can't be a Miner?

.jpg)

Bitcoin uses the Proof-of-Work consensus algorithm for it's mining process. This means that computer systems in the networks have to compete to solve complex problems. The first system to solve the problems gets rewarded with Bitcoin. This is done to validate blocks. This what is known as Bitcoin mining.

Different networks make use of different consensus algorithms such as Proof-of-Stake, Proof-of-Capacity, Proof-of-Brain, etc. These algorithms are usually faced with some common difficulties and others faced with independent problems.

Not everyone can become a Miner because of these problems. Here are a few:

High Energy Cost: Although Bitcoin mining may seem very profitable, the cost of energy is outrageous. Reports state that the energy required to mine Bitcoin is greater than the energy usage of over 150 countries. Everyone wants to mine Bitcoin but not everyone can cover the energy cost.

Sophistication: Mining requires sophisticated computational power. These machines require high energy and incurs a lot of cost to be purchased, set up and maintained. As a result of this, everyone can't be a miner because not everyone can afford these computer systems.

Mining Difficulty: This describes how difficult and time-consuming it is to validate a block. As more nodes join the network, mining becomes more difficult. As a result of this, miners need to upgrade their system to be more efficient in competing to validate blocks. Because some people can't meet up with this challenge, they are left behind and their chances of mining becomes very minute.

Why Cryptocurrency Transactions can be called More Transparent

Cryptocurrency transactions are recorded on a blockchain. Blockchain technology offers a distributed ledger type. This means that data is not stored on a main system, instead it is recorded across all nodes in the network. Cryptocurrency transactions are more transparent because they are recorded across every node in the network irrespective of the time the node joined the network and the time of the transaction. Once transactions are validated and recorded in the blockchain, the data cannot be altered. This is the reason why cryptocurrency transactions can be called more transparent.

Development of Cryptocurrency in Nigeria

Nigeria is home to so many financial markets. Nigeria offers access to crypto exchanges such as Binance, Poloniex, Coinbase, Huobi, etc. In 2019, Nigeria also launched a crypto exchange called Roqqu for the development of cryptocurrencies in the nation.

On the 14th of September,2020 SEC (Securities and Exchange Commission of Nigeria) announced it's intentions to normalize digital assets.

But everything turned around when the Central Bank of Nigeria placed a prohibition on transactions with cryptocurrency, threatening to shut down accounts that make transactions with cryptocurrency exchanges. This was on February 5th, 2020.

However, CBN made a statement later in March that detailed it's prohibition on cryptocurrencies. It stated that it was never a ban on cryptocurrency trading.

With this development, cryptocurrency has found a place in Nigeria so far. Shutting down of accounts stopped and there is freedom to invest and trade in digital assets once more.

Conclusion

Cryptocurrency has found a place in the world. Although it may never ( and I believe will never) replace fiat currency, it has proved to be a force to be reckoned with. Cryptocurrency is becoming a standard in the world and although not everyone has cryptocurrencies, I believe the whole world has heard of it. We can only sit and watch as the future unfolds, for we do not know what part cryptocurrency has come to play.

Hi @uchescrib , Thanks for submitting your homework

Feedback: You have completed every point and you have understood the basics of cryptocurrency

Rating: 8

Thank you for the review prof