Crypto Academy Week 3 Homework Post for [@besticofinder](100% power up)

Hello guys, hope you're all doing well? I'm here to submit my assignment on Spot Trading and Margin Trading by @besticofinder. I did not get to participate in the former assignments of week one and week two but I've gone back to read up, thanks a lot.

Spot Trading

also known as a spot transaction, refers to the buying and selling of a foreign currency, financial intelligence, or commodity for instant delivery on a specified spot date. Spot markets are composed of an order book, buyers, and sellers. Buyers input the marketplace with a selected buy rate or bid, that is the amount they want to spend.

Buying on Spot Trading

Spot trading on its own to me, simply is just purchasing crypto such as Bitcoin or Ethereum and holding it until the value increases or using it to buy other altcoins that you "believe" may rise in value later.

I'll also like to share with you done terms used in Spot trading, their meanings and applications also.

- Taker and Maker

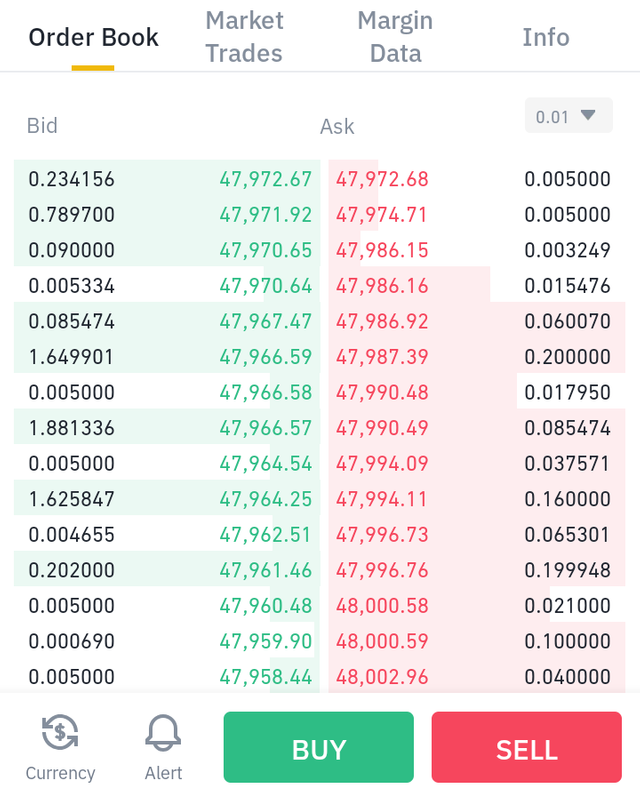

- Bitcoin Spot Trading Order Book

- Limit order

- Market order

- OCO

Taker

When you place an order that trades immediately, by filling fully or partially, before going on the order book, those trades will be "taker" trades. Takers generally, are either large investment firms or companies looking to buy or sell big blocks of stocks or hedge funds making bets on short-term price moves.

Maker

This is any subsequent trade from an order that goes on the order book partially or fully (such as a limit order placed via the trading screen on binance.com).

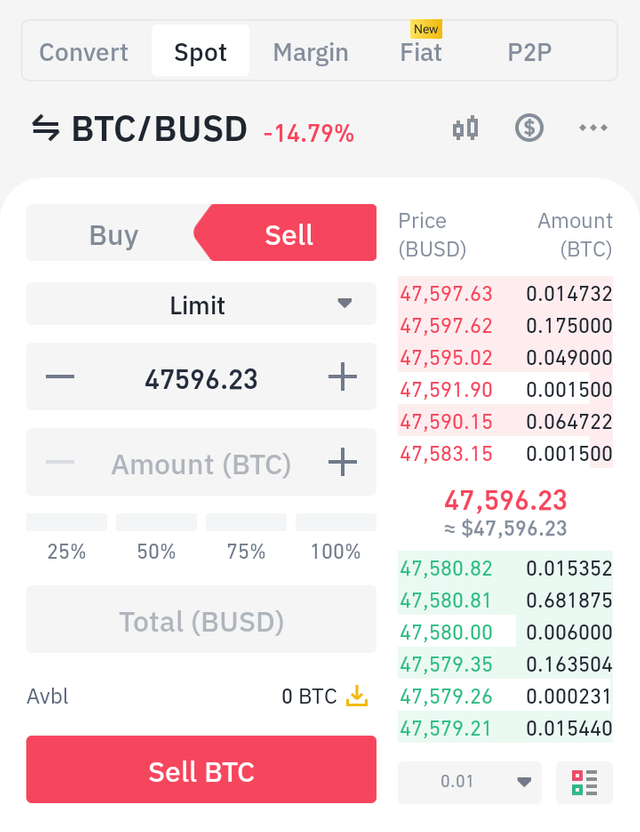

Selling on Spot Trading

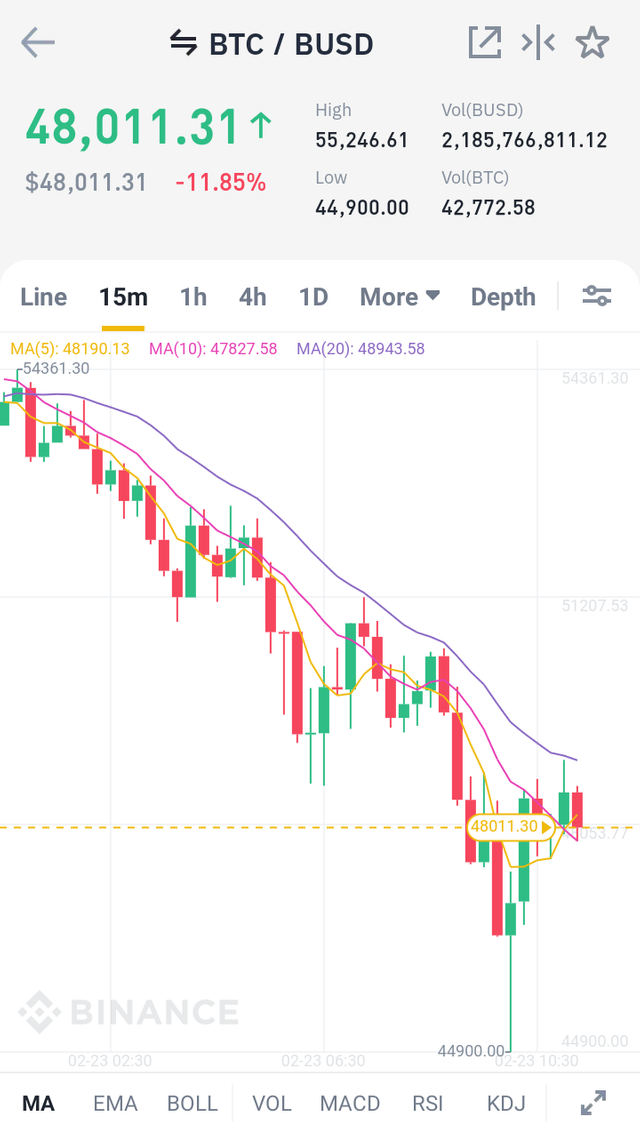

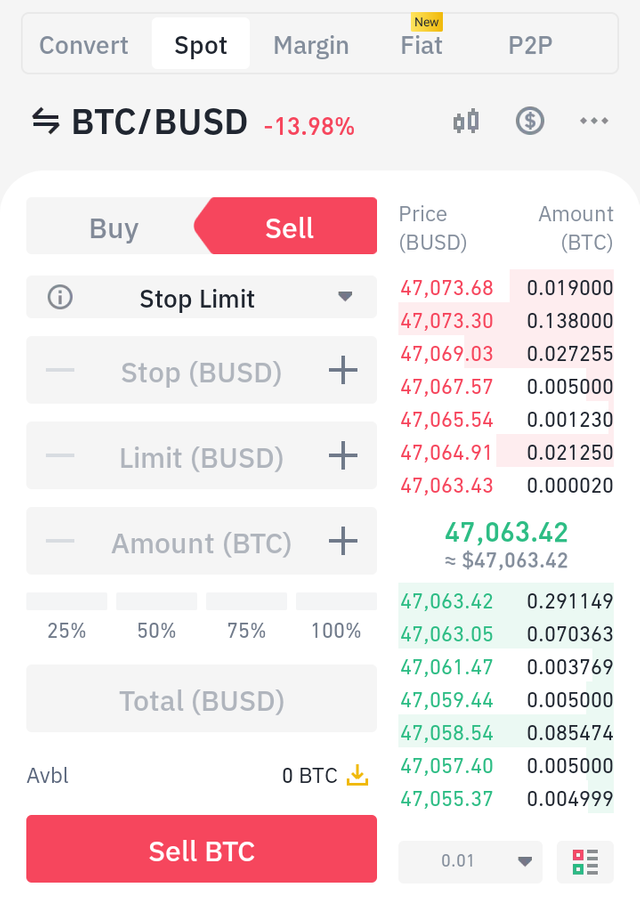

Bitcoin Spot Trading Order Book

In this particular market, you could buy BTC with BUSD or you may sell BTC for BUSD. You will see BTC to buy on nice amounts that sellers are currently willing to sell. In green, you will see the maximum fees that customers are ready to buy BTC, once more bid in value in BTC. The BTC column suggests how many BTC is supplied for each fee, at the same time as the price of BUSD column suggests you the way each amount is worth.

Spot trading market is where trades are done immediately (in pidgin, "sharp sharp")

Binance Spot Trading Order Book

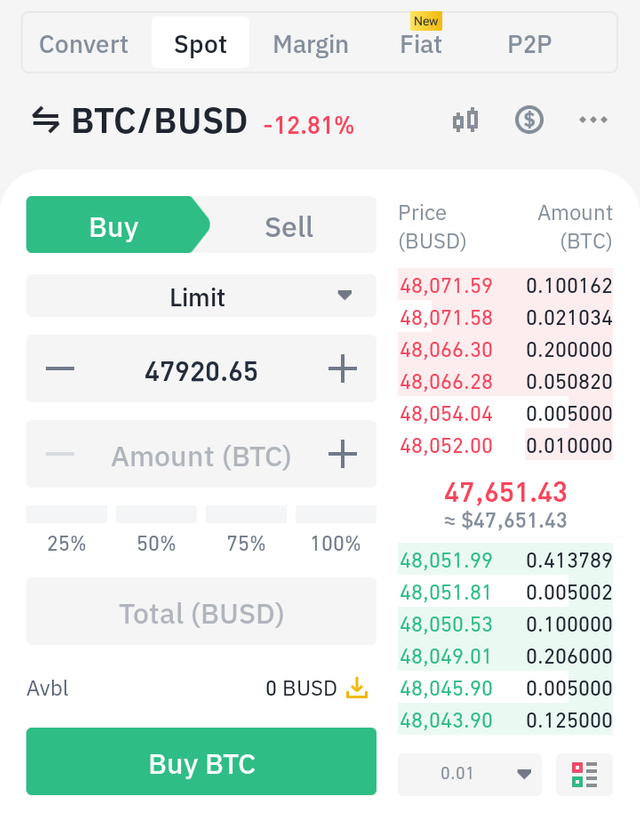

Limit Order

This may be done at a fixed or better charge, after a fixed stop fee has been achieved. While the forestall rate has been carried out, the prevent-restriction order becomes a restrict order to shop for or sell on the restriction (limit) price or better.

Limit Price

The set rate that the stop-restriction (limit) order is to be finished.

Stop price

If the marketplace asset fee receives to the set stop rate, the stop-restriction order will proceed to buy or sell the asset on the set restriction (limit) fee or better.

Marketplace Order

Marketplace order offer you with the opportunity to make a transaction straight away at the current marketplace rate.

OCO

This a system wherein through One-Cancels-the-other (OCO), for instance orders are combined together, a stop-limit order and a limit order. If any of them is achieved then forestall fee may be brought about for forestall limit order,and the other may be canceled automatically.

MARGIN TRADING

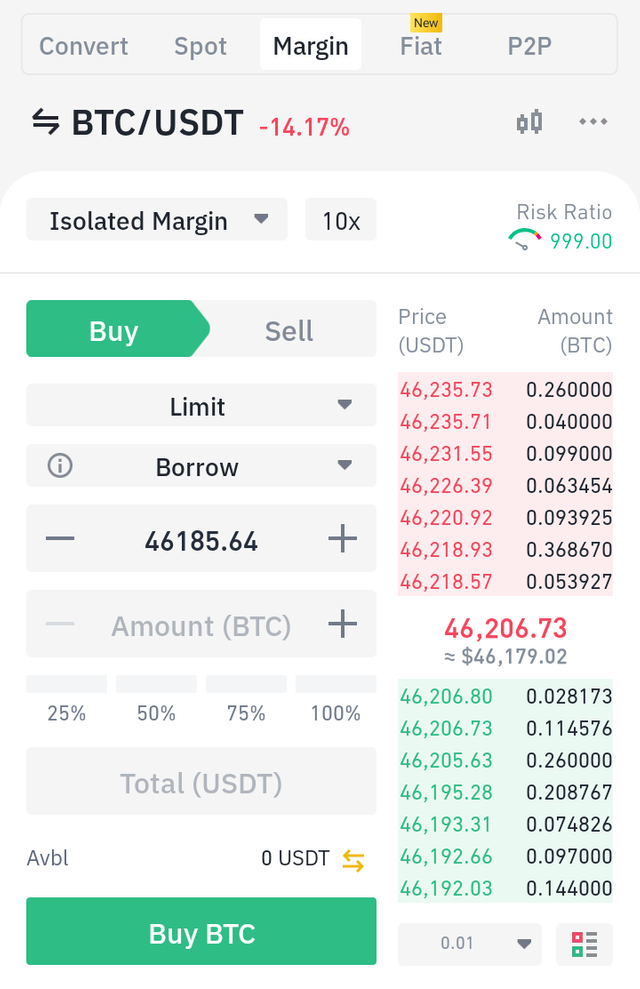

Margin Trading is a system of buying and selling crypto currencies /assets with borrowed money after providing collaterals, that is to be paid back with interests. It additionally allows you to get big capital to leverage positions. Margin trading also multiples your buying and selling so that you can get extra earnings / profits on your trades.

Leverage

Leverage is the increased “trading power” available when using a margin account. It allows you to trade positions LARGER than the amount of money in your trading account. Leverage is expressed as a ratio.

The best part about Margin trading is that investors / traders are supplied with nothing less than 3X~10X leverage asset depending on the platform you're trading and based to your mode of Margin buying and selling.

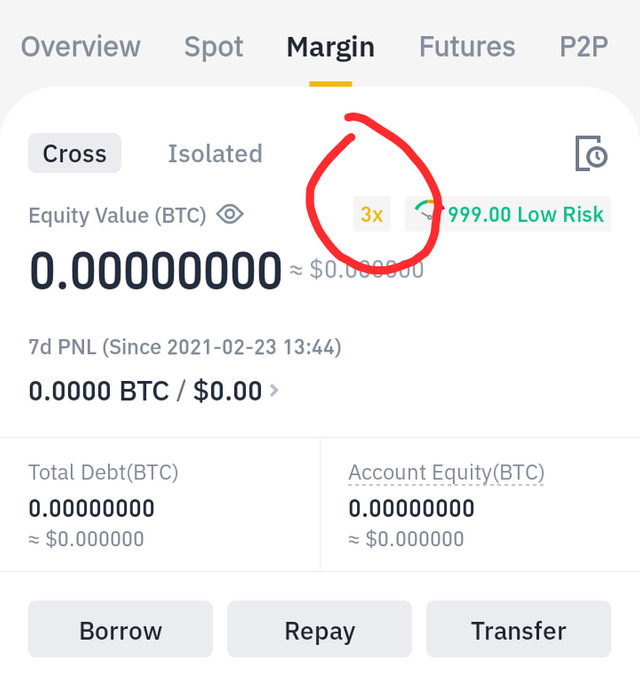

How to Borrow in Margin Trading?

To borrow a coin/token, select the coin you want to borrow, click on [Borrow/Repay] and choose [Borrow]. The system will calculate the maximum amount you can borrow based on the estimated BTC value of your collateral and individual borrow limit for that particular asset. You will also be shown the daily interest at the same time for the amount that you’re going to borrow.

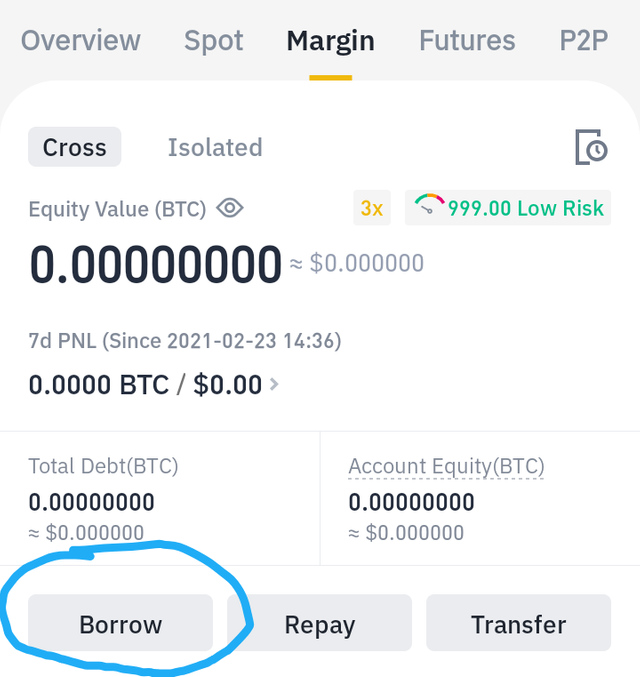

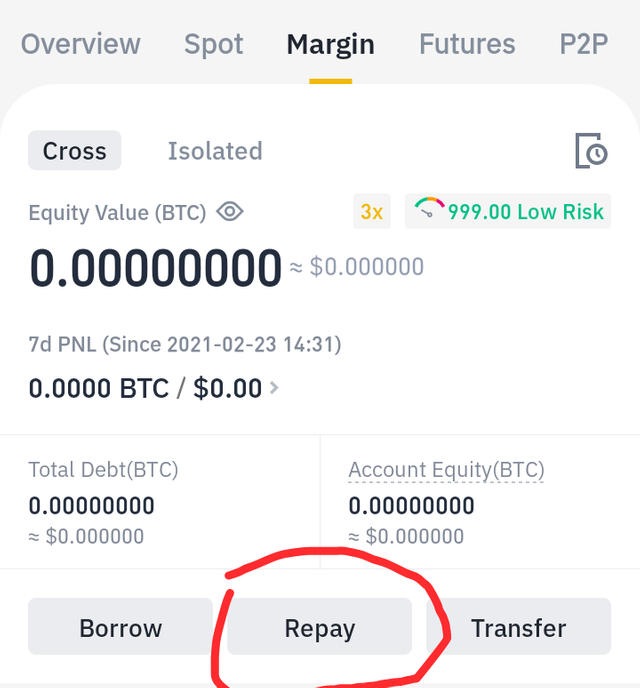

How to Repay Debts ?

To start, log in to your Binance account, go to [Wallet] on the upper right corner and click on [Margin Wallet] to enter the corresponding page.

Next, select the coin you would like repay and click the [Borrow/Repay] button. Select the amount and the balance (asset) you want to repay. You can choose to repay all of what you owe i.e 100% or repay part of it, but with whichever method you choose, the interest will be repaid first. The system will start calculating the interest rate of your loan from the next hour based on your new borrowed amount.

Now I'll like to share the Advantages and Disadvantages of both Spot and Margin Trading

Advantages of Spot Trading

- First and foremost, Spot trading gives you accurate prices of the assets since the spot price is the actual market price.

- It is good place for those that wants to buy immediately; remember from before, it has been shown that spot trading as a whole deals with immediate trades.

- It provides opportunity for investors that has low capital to also invest; for people like me that are students and have little incomes from pocket money and the rest of them, spot trading would be the best for us.

Disadvantages of Spot Trading

The major, most painful and general disadvantage of spot Trading is the rate of price fluctuation that have always created panic in the market. Even as a student and a low income investor spot trading has broken my heart countless number of times due to its fluctuations.

Advantages of Margin Trading

There are many advantages of Margin trading but I'll give a few.

- The ability to profit from share price declines;

After you borrow shares, you sell them and then buy them back at a later date, presumably at a lower price but In order to sell a security short, you must first borrow shares of stock from a brokerage firm, which requires that you have an approved margin account. - Flexible repayment system; So long as your debt doesn't exceed your margin maintenance requirement, you can pay your loan back on your own pace.

- Low interest rates; just like any other loan, you will incur interest charges with a margin loan. However, because margin loan rates are pegged to the federal funds target rate, your interest to be paid may be lower than what you would pay for a credit card cash advance or a bank loan, especially on larger balances.

Disadvantages of Margin Trading

We know well that what ever has advantages also has disadvantages and its just uninevitable, Whilst margin loans may be beneficial and convenient, they're in no way risk unfastened. Margin borrowing comes with all of the dangers that accompany any form of debt — including interest payments and reduced flexibility for future earnings. The primary risks of trading on margin are leverage risk and margin call threat.

This is my Introduction post here

I really appreciate you @besticofinder for this Lecture. Thanks a lot.

NOTE: All images here are screenshots from my phone on my Binance wallet app