Crypto Academy Season 3 Week 5 Homework Post for (@imagen) Market Patterns and Blockchain Projects

This week, the professor took a detailed look at Blockchain projects and Market Patterns. I read the professor's article carefully. I've done my research and now I'm writing the homework.

1.) Choose at least 1 of the following cryptocurrencies.

- Axie Infinity AXS

- Chilliz CHZ

- Cardano ADA

- VeChain VET

Make an investment of $ 12 or more. Show screenshots of the process.

I looked at fundamental and technical analysis of AXS, CHZ, ADA and VET. Some assets had risen a lot in recent days and exceeded their real value. Some assets were also not suitable for investing in terms of fundamental and technical analysis. So I decided to buy EOS.

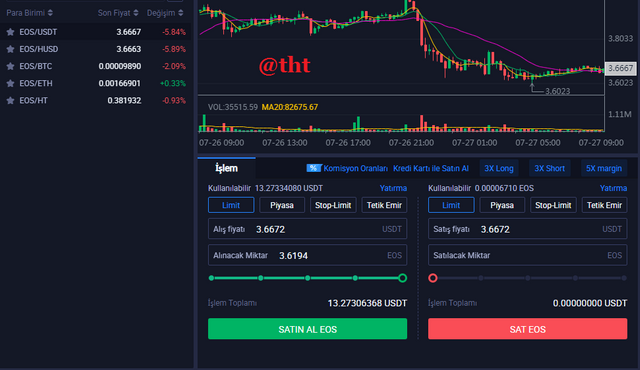

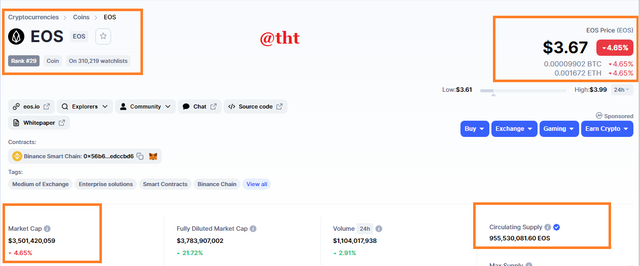

I logged into my Huobi account. I typed EOS in the search box. I chose the EOS/USDT trading pair. I placed a purchase order at $3.6672. I bought about 3.6194 EOS.

As you can see in the screenshot, my purchase was successful. I bought $13.27 worth of EOS.

Why did you choose this cryptocurrency?

In May, the company that supports EOS, Block.one, announced that they will open a stock market with an investment of 10 billion dollars. He supports many strong investor companies and stock markets, especially Peter Thiel, one of the founders of Paypal. The name of the exchange is Bullish Global. The stock market is not yet operational. It will be operational towards the end of the year. Thus, the EOS network will be revived, which will positively affect the price of EOS.

We know how valuable exchange-backed tokens are. We've all seen how much the price of BNB, which was under $1 a few years ago, has risen. There has also been a lot of price increase in tokens such as FTT Token and Gate. Bullish Global, the newly opened stock market, will increase the price of EOS considerably. I find it useful to buy EOS when the EOS price is low.

What is it Market Capitalization?

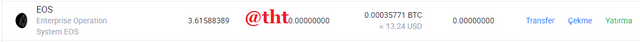

To learn about EOS market capitalization, we can visit https://coinmarketcap.com/currencies/eos/. To find out the market capitalization of a cryptocurrency, we multiply the circulating supply by the asset price.

EOS Market Capitalization: Circulating supply X EOS price

EOS Market Capitalization: 955,505,599.24 EOS X $3.67

EOS Market Capitalization: $3,501,420,059

What is it position in the cryptoasset rankings?

It is ranked 29th according to the ranking on coinmarketcap.com. This year, after some negative news, it dropped to 40th place. The price of EOS fell considerably as a result of the resignation of Daniel Larimer, the CTO of block.one, the company that supports EOS. The price of EOS rose after the statements made on the plan to establish the Bullish Global stock market. However, I think it will make its real rise at the end of the year. EOS, which was once known as "Ethereum killer", managed to become one of the top 5 cryptocurrencies in terms of market value.

What is the objective of the project behind this coin? Who founded this coin? Show the roadmap. What is the specific purpose of the cryptocurrency?

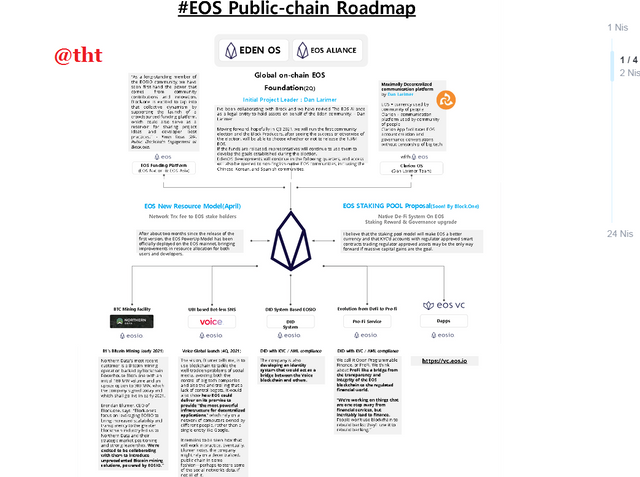

EOS is referred to as Ethereum killer. The aim of the project is to create decentralized applications on the blockchain network. In addition, to ensure that transfers and transactions in the network take place in a very short time. To radically solve the scaling problems in Ethereum and similar networks.

As I said before, there is a company that supports EOS. The company name is block.one. The company's CTO was Daniel Larimer, one of the Steem blockchain creators. He resigned from the company a few months ago. The CEO of the company is Brendan Blumer.

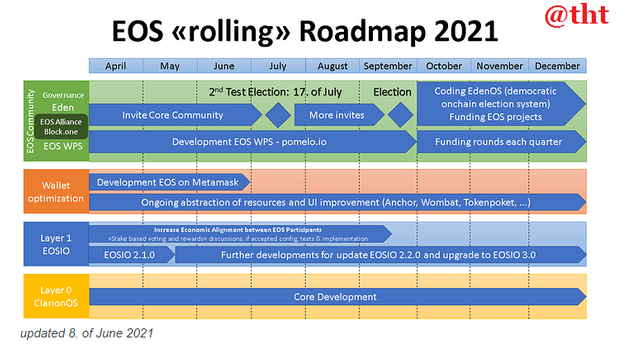

I found this roadmap on the EOS community. Users in the community are schematizing this roadmap.

EOS has many plans for 2021. There are updates on many topics such as Staking, Wallet, Voice.

EOS blockchain developers are putting a lot of effort into solving scaling issues. Transfers and transactions on the EOS network are very fast. They want to develop this further. EOS support company block.one has two important goals that it intends to complete by the end of the year. The first is the social media project voice.com. The other is Bullish Global stock exchange. Voice.com is currently in beta, and at the end of the year, every user will be able to earn tokens by producing content, as in the Steem blockchain. Integrating the Bullish Global exchange onto the EOS network. With the opening of this exchange, the EOS network will begin to be used more. The stock market has a goal of entering the New York stock market.

EOS seems to have achieved the specific purpose it initially announced. It has overcome scaling problems using the dPoS consensus algorithm. Transactions happen very quickly.

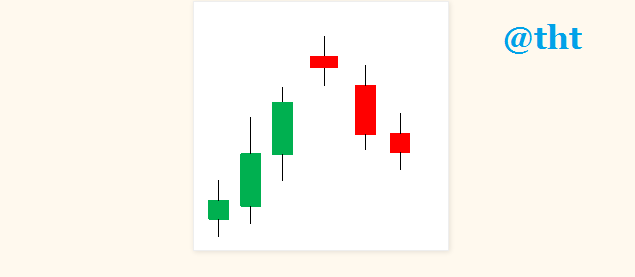

2.) Explain in your own words what the "Evening Star" pattern consists of.

What is the Evening Star?

The evening star is one of the candlestick formations that indicates the possible reversal of an uptrend. The evening star candlestick pattern is the opposite of the morning star candlestick pattern. Evening star pattern occurs after an uptrend while morning star pattern occurs after a downtrend.

It is a chart model that is highly regarded by technical analysts. The evening star pattern consists of 3 candles. The first candle is a large-bodied green candle. The second candle is a small body red candle. The third candle should also be red.

Things to Know:

- The Evening Star candlestick pattern is used by traders to predict future downward price reversals.

- The evening star candlestick pattern is the opposite of the morning star candlestick pattern.

How is the Evening Star Formed?

The Evening Star candlestick pattern is cited as an important reason for future price declines. It takes 3 days to complete the candle formation.

The price of any asset rises sharply. first day long body

A green candle is formed. This occurs after strong purchases. The increase continues on the second day but slightly slower than the first day. The second candle is a bearish candle with a small body above the closing price of the first candle. The second candle is defined as the "star".

The space between the first candle and the bodies of the second candle is called "Doji" or "Spindle".

The presence of the second candle or star indicates that the current trend is weakening. However, there is no certainty here. It is confirmed by the presence of the 3rd candle that the trend has reversed or the downtrend has started. The 3rd candle should be a red candle close to the length of the 1st candle.

If there is a gap between the 3rd candle and the body of the 2nd candle, the credibility of the evening star candle formation increases considerably.

In order for the credibility of the evening star candlestick formation to increase, the 2nd situation must occur.

- The body of the third candle can go down to the bottom of the body of the first candle.

- The volume of the third candle exceeds the volume of the first candle.

The evening star candlestick pattern is not the only downtrend pattern. In order to detect trend changes, it is necessary to consider other formations.

What is its hit rate?

American computer scientist Thomas Bulkowski has a book called "Encyclopedia of Candlestick Graphics". This book contains statistical analysis and trading strategies related to candlesticks. Evening star predicts low prices for candle formation with 72% accuracy.

3.) Explain in your own words what the pattern "Abandoned Baby" consists of. What is the percentage correct?

What is Abandoned Baby Pattern?

The abandoned baby pattern is used by traders during trend reversals. It is a pattern that occurs in both upward and downward reversal trends.

The abandoned baby pattern is similar to the morning and evening star.

The abandoned baby pattern is similar to the morning and evening star. However, there is a difference. In this pattern, objects and shadows do not overlap.

The abandoned baby model consists of 3 candles. The first candle is long and in the direction of the current trend. The second candle is very short body. It can also refer to a doji. The second candle is also in the direction of the trend. There are also gaps very far from the first candle. The third candle is in the opposite direction of the current trend. There is significant divergence from the second candle.

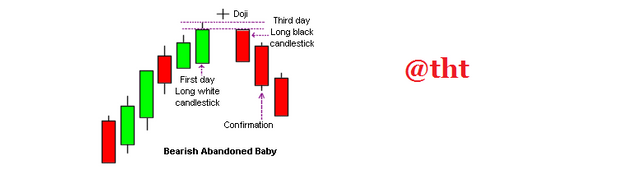

What is Bearish Abandoned Pattern?

When it occurs at the end of a bull period, it is referred to as an abandoned babysitter. The first candle is long and upward. The second candle is a short body candle or doji. There is too much gap between the first candle and the second candle (doji). The second candle's lowest price is above the first candle's highest price. Third candle gaps low. The highest price of the third candle is lower than the lowest price of the second candle. The trend direction of the third candle is downward.

Noticing this pattern, traders start selling or short positions. Because the asset price is expected to fall sharply.

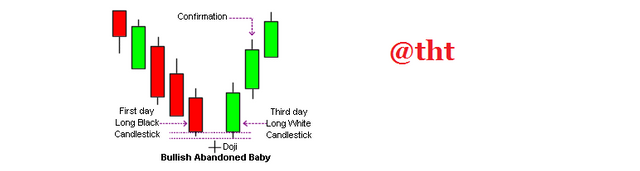

What is Bullish Abandoned Pattern?

It is the reverse version of the previous model. It occurs at the end of a bear period. It is called the abandoned baby base.

The first candle is long and bearish. The second candle is a short body or a Doji. The high price of the second candle is below the low price of the first candle. The third candle is long and bullish. The low price of the third candle is more than the high price of the second candle.

Traders who see this candle formation make a purchase or start to open a long position.

- Determine the trend direction.

- Find the abandoned baby mold.

- Enter buy or long, sell or short position.

- Set your loss or use stop loss.

- Determine your profit taking position.

What is the percentage correct?

The abandoned baby candlestick pattern is a very rare pattern. When traders see this pattern, they should confirm the formation with indicators like Fibonacci Retracement.

The success rate of Thomas Bulkowski working for Bullish Abandoned Baby is 70%. His success rate for Bearish Abandoned Baby is 69%. It is quite difficult to see such models in the charts. Investors should not confuse it with the morning star and the evening star. In the Abandoned Baby pattern, there are spaces on both sides of the doji candle. There is no need to have a Doji candle in the morning and evening stars. Also, there is no requirement to have a gap on both sides.

4. Perform analysis for 3 and 7 recent calendar days for Bitcoin Do you identify any patterns? Show screenshots

I will try to detect patterns that have formed in the last 3 working days and in the last 7 working days on the Bitcoin / USDT chart. These patterns are; There will be Abandoned Baby, Evening Star, Three Line Strike, Two Black Gapping, Three Black Crows.

Patterns formed in the last 3 working days:

Evening Star

(tradingview BTC/USDT chart 1H)

As you can see in the screenshot, there is a rising period. After the bullish period, the trend will reverse. The first candle is long body and upward. The second candle is short-bodied. The price is up but the candle is red. The third candle is long-bodied and the candle is red.

In the first candle, the price rises after the heavy buying by the traders. Then, in the 2nd candle, the purchases are decreasing and the direction of the trend is weakening. At the 3rd candle, selling pressure is formed and a definite indication of a downtrend appears.

There are 2 clear indications that the evening star pattern is forming. The length of the 3rd candle is longer than the length of the first candle. The volume in the 3rd candle is greater than the volume in the first candle.

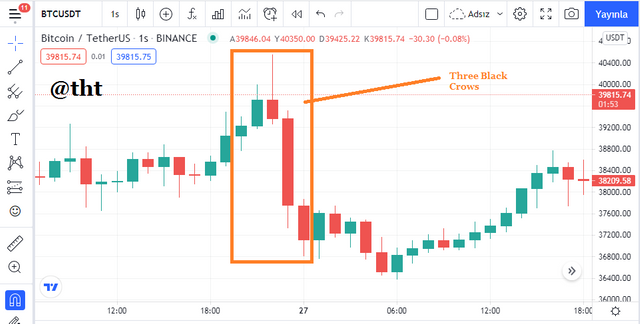

Three Black Crows

(tradingview BTC/USDT chart 1H)

As you can see in the screenshot, there is an uptrend before this formation starts. There are 3 red candles in this formation. Candles have short or no wicks.

As you can see, each candle rises close to the price of the previous candle, but strong selling pressure pushes the price down. The price will continue to drop gradually.

Selling pressure is quite strong against buying. This indicates that the downtrend has started.

Patterns formed in the last 7 working days:

No patterns formed in the last 7 working days. That's why I want to talk about patterns that I know but haven't learned in this lesson.

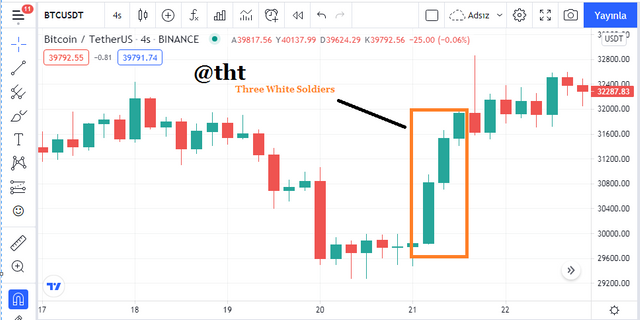

Three White Soldiers

(tradingview BTC/USDT 4H chart)

As you can see in the screenshot, there is a trend from a bear market to a bull market. There are 3 green and long body candles. The direction of the price is upwards.

In this case, the weakening or ending of the downtrend indicates that the uptrend has started. In case of overbought conditions, the downtrend may start again.

Candles must all be green. Each candle must be longer than the closing price or size of the previous candle.

What I want to add:

I found Evening Star, Three White Soldiers, Three Black Crows candlestick patterns on the Bitcoin chart for the last 3 and the last 7 working days.

Morning Star and Evening Star are the opposite of each other. I haven't been able to find the morning star in the last 7 working days.

The Two Black Gapping pattern is also hard to find in the last 7 working days. It is possible to find it in the previous working days.

The Abandoned Baby pattern is one of the rarest patterns. It is not possible to find this pattern in the last 7 working days.

Conclusion

When investing in a cryptocurrency, we should do this after detailed research and study. If our research has convinced us, we should invest. Otherwise we are not much different from a gambler.

In this lesson, we learned patterns that will be very useful for us. In addition, the patterns we are researching are the patterns that traders use extensively. The evening star pattern provides important indications that a downtrend will begin.

Many thanks to the professor for this useful and enjoyable lesson.

Cc:

@steemitblog

@imagen

Twitter sharing

https://twitter.com/Steemtht/status/1420256935690002432

Gracias por participar en la Tercera Temporada de la Steemit Crypto Academy.

Felicitaciones, realizastes un extraordinario trabajo, con explicaciones muy completas y detalladas.

Espero seguir corrigiendo tus proximas asignaciones.

Thank you.