Dark Pools in Cryptocurrency - Crypto Academy / S5W8 - Homework Post for @fredquantum

Hello all, it's a great pleasure to be a partaker on the dark pool course, and I would be answering the given questions by our prestigious professor @fredquantum.

Discuss Dark Pools in Cryptocurrency in your own words. How does dark pool works

We are aware of the level of privacy and anonymity adopted by the blockchain system. which has made it an unmanipulatable system due to its transparency.

The blockchain network shows all kinds of transactions by users in the protocol, starting from the address of transactions, date and time, amount transacted, and so on.

This transparency in a way is not full privacy to some users, in the sense that transactions made should not be exposed to outsiders on the platform (system).

We could see how a user's account can be traced and read based on their past transactions and activities on the system. Despite not showing the name of the user, people still want a more Anonymous and private system where transaction views are limited.

Due to the user’s choice over a more private network, the mimblewimble protocol was adopted. This protocol depicts the transaction details only to users who are involved in the transaction.

Now we can see that, unlike the conventional blockchain network which is also known as a public network, that the transactions done here cannot be viewed by anyone except for users involved in the transactions.

This protocol mechanism is what the dark pool system makes use of in other to grant users a more private and anonymous system. Not just about the privacy involved, but also, users want a system where they can sell their assets at a prearranged price without being affected by market slippage.

So, understanding how the blockchain system works we would plunge into the dark pool network to find out more distinctive features that it possesses.

DARK POOL

A dark pool is a discreetly coordinated protocol where financial exchanges are carried out for trading securities. The Dark pools network permits traders to trade without disclosing their trades until the trade has been completed and recorded.

The dark pool protocol has no order book where transactions or trades placed by investors are shown. This is a unique feature that helps in the abortion of fear in the trading system.

We can tell that the conventional trading platforms make use of the order book, where users who logged into the platform wishing to carry out some transactions would see the various orders placed by people.

For instance, when I logged into my binance app, I wanted to purchase BTC/USDT pair, seeing the huge amount of sold BTC worth $200,00 for USDT imposed fear into my body over selling impact on the aforementioned asset.

Dark pools adopt an alternative trading system (ATS) mechanism that provides the opportunity for distinct investors to execute a large order and as well trade without revealing publicly their intents while searching for a buyer or seller.

Dark pools deal with very few asset exchanges which are formulated to add liquidity and improve anonymity for traders who trade large blocks of securities. As I mentioned earlier on the primary goal of the dark pool, which is the omission of the order book in other to turn away the public eye from large blocks.

Highlights of dark pool in cryptocurrencies.

The dark pool provides anonymity and privacy to users for trading large blocks.

The dark pool consists of two different methods, which are the limit order and market order

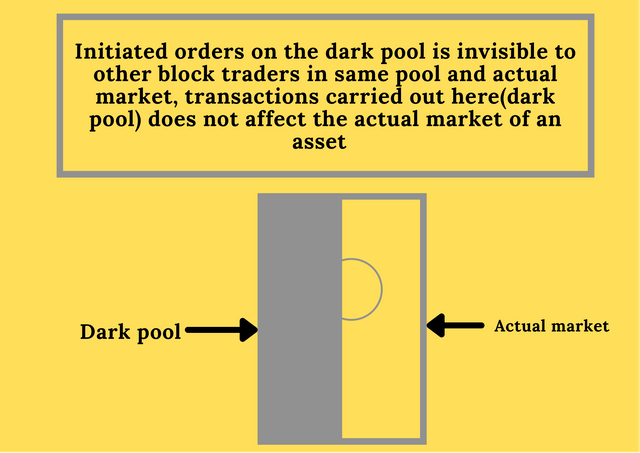

Block trades carried out in the dark pool do not have any impact on the actual market. This is just like an asset in the dark pool is unaffected by the market volatility.

Assets are traded in private in the dark pool and as well at a predetermined price using the limit order.

HOW DOES DARK POOL WORK?

In other to discuss how Dark pool operates, we would see the limit and market orders, for which the limit order is used by most dark pools.

Limit orders :

Block trading can be carried out in different methods on the dark pool for which the limit order is one of it. The limit order is a predefined amount set by a trader for which a particular asset is sold or bought without slippage.

These assets placed from trading using the limit order is not affected by market volatility giving the dark pool an enormous advantage compared to other cryptocurrency exchanges.

As we are all aware that trading deals with volatility which could either be against or for the trader, and that the price of an asset is determined by the rate of volatility in the market.

Having the Dark pool which is not affected by market volatility in trading of assets is a very big advantage to investors. The limit order is mostly adopted by dark pool.

The limit order predetermined by the user is met with a potential buyer or seller at the predetermined price of sale, and this is what the trade earns for the trade.

Market orders:

Just like I said earlier on the different methods a block trade can be created in a dark pool, the market order is another method of trading a block trade. Here, an already predetermined price is set by traders which others as well scan through the predetermined price on which the can either buy or sell at the predetermined price by another trader.

Unlike the limit orders, the market order traders bear the slippage cost in the transaction. For instance an asset worth $200,000 at the time of the transaction is sold at $198,000. The slippage cost involved in the transaction is Not associated with the limit orders method, rather it is for the market orders takers.

Discuss any crypto exchange that offers a dark pool. How does its dark pool work?

Their are quite a number of crypto exchanges that offer dark pool, they are; coin base dark pool, Kraken dark pool, Bitfinex and others. But here I would be talking on the kraken dark pool

KRAKEN DARK POOL

The kraken dark pool is built on Solona network.

Kraken dark pools is a diverse order book invisible to the other markets. This is such that Each trader knows their orders, and also allowing traders to largely buy or sell orders anonymously undisclosing their transactions to other traders.

Kraken dark pool aims at the effect of large orders in the normal market. This large orders by traders cause the mark to deviate unfavorably when seen by other traders, making it harder to fill the order at your intendend price.

The dark pool order has helped in resolving the unfavorable price movement which is as a result of disclosed order book.

The dark pool offers an advantages of reduced market impact and considerable price for large exchanges. The dark pools order are matched with distinct dark pool orders.

Kraken removed the market order in the dark pool due to its risk precautions...Since market orders are placed when the trader sees the order book. This has led to the use of only the limit order to which other dark pools exchanges are imitating this standard.

It is difficult to determine if a trader is a market maker or a market taker in the Dark Pool, so the fee difference between the two where removed in other for all users to follow the exact fee structure.

Traders choose a predetermined price in other to create an order (limit) for the intended trade On Kraken Dark pool. And we should also bear in mind that this transactions are not visible to others.

The network matches limit orders executed on the exchange in other to complete each block trading as selected by the trader.

How can kraken dark pool order be placed:

The dark pool kraken are eligible for advanced traders who's motives is to carry out trades. They following steps involved are as follows;

The dark pool trading pairs can be accessed after the creation of an account on Kraken.

enrolling for pro level verification.

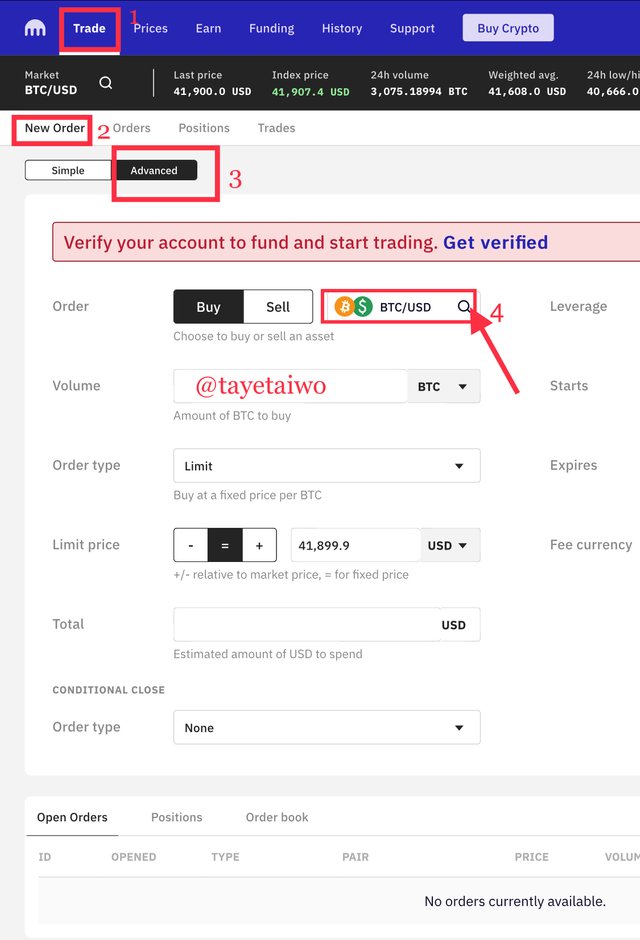

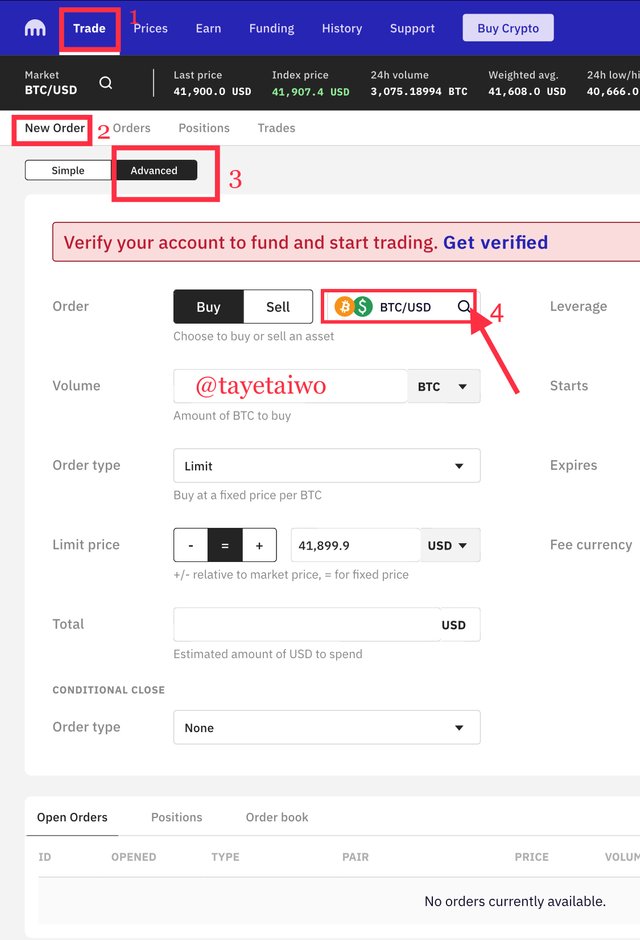

Then, on the home page, click on Trade, Nee orders, them select to Advanced.

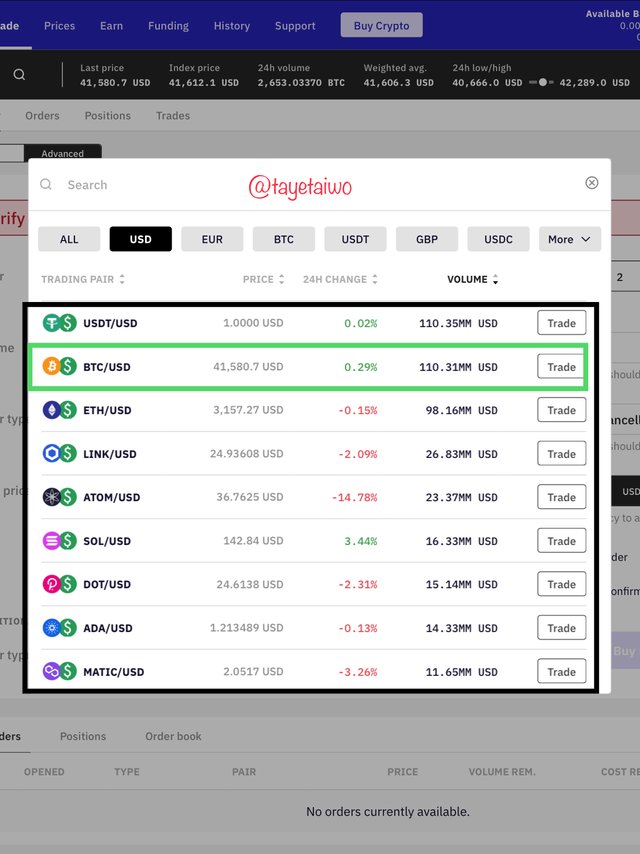

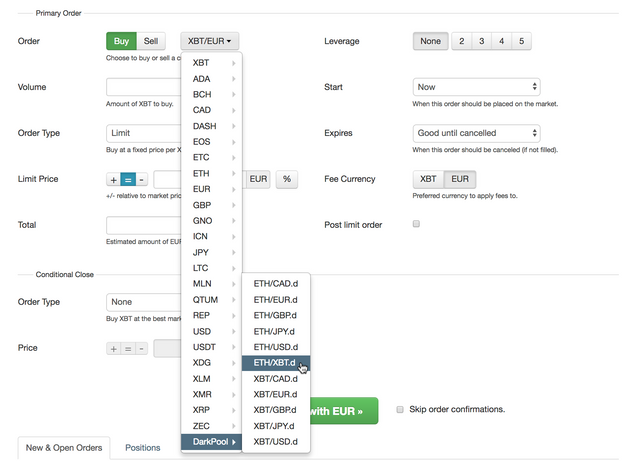

Under the search bar for pair selection, click on it and select the dark pool of preference.

What are the supported assets on the dark pool mentioned in (2) above? What are the requirements for getting involved in dark pool trading on the platform? Is there any fee attracted? Explain.

There are few but vast crypto pair assets supported on kraken dark pools.

Crypto Assets supported on Kraken Dark Pool:

Kraken dark pools permits only Bitcoin and Ethereum pair, and Bitcoin-Ethereum the are as follows;

Ethereum pairs

ETH/EUR

ETH/CAD

ETH/JPY

ETH/GBP

ETH/USD

Bitcoin pairs

BTC/EUR

BTC/GPB

BTC/CAD

BTC/JPY

BTC/USD

Bitcoin -Ethereum

- ETH/BTC

Requirements for kraken dark pool:

There are following requirements needed in order to partake in the activities of the dark poll...the following requirements are as follows;

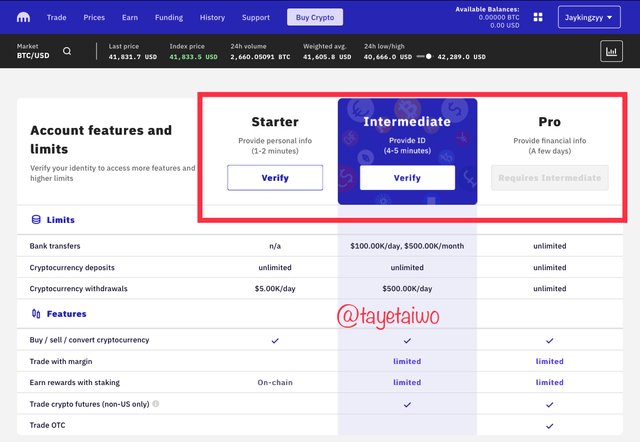

Client's are required to be verified to the pro level either personal or business.

Minimum order amount for BTC pair exchange is equal to $100,00 US.

Minimum order amount for ETH pair exchange is equal to $50,000 US.

The supported method in kraken dark pool is based only on limit orders.

What are the fees:

The Trading fees required for each order transaction in Dark Pool goes from 0.20% to 0.36%. This is an additional 0.20% compared to the normal rates in limit orders which ranges from 0% to 0.16%.

The Rates varies, and the are dependent on traders trading volume (equivalent to USD) for 30 days. The lower the fees on more trades executed for 30 days trading volume on kraken dark pool.

For the chosen dark pool, give a brief illustration of how to perform block trading on the platform. (Screenshots required).

First of all we would need to create an account in other to perform various block trades on kraken dark pool, and these are the following steps;

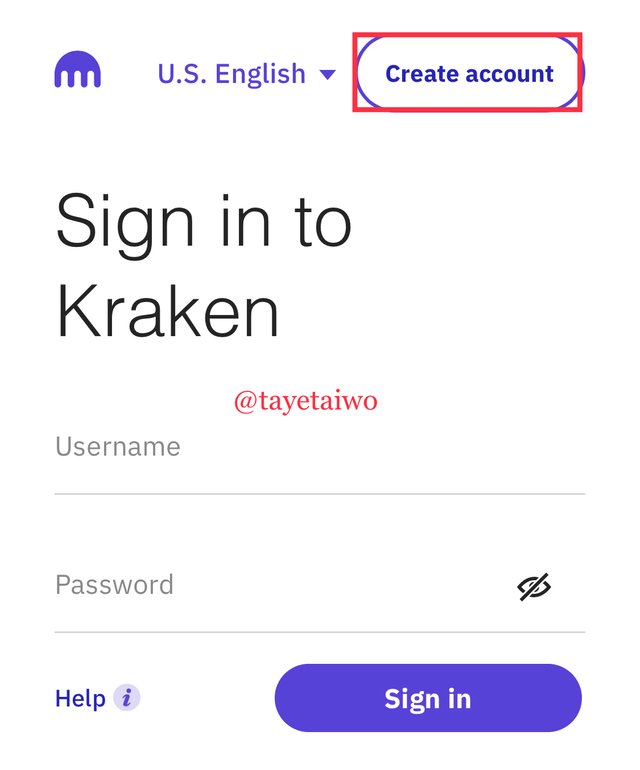

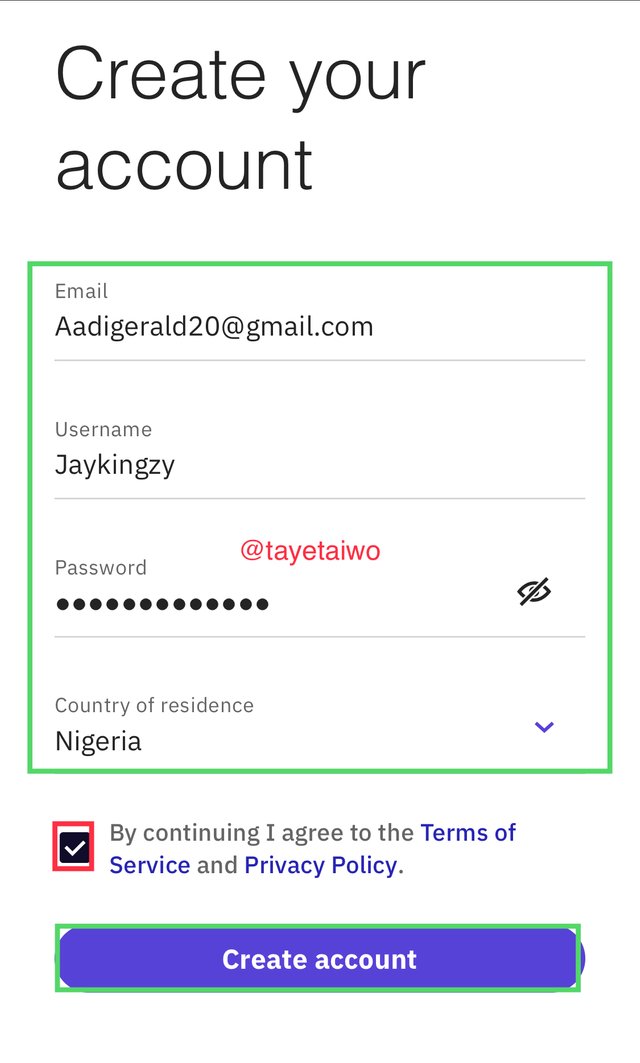

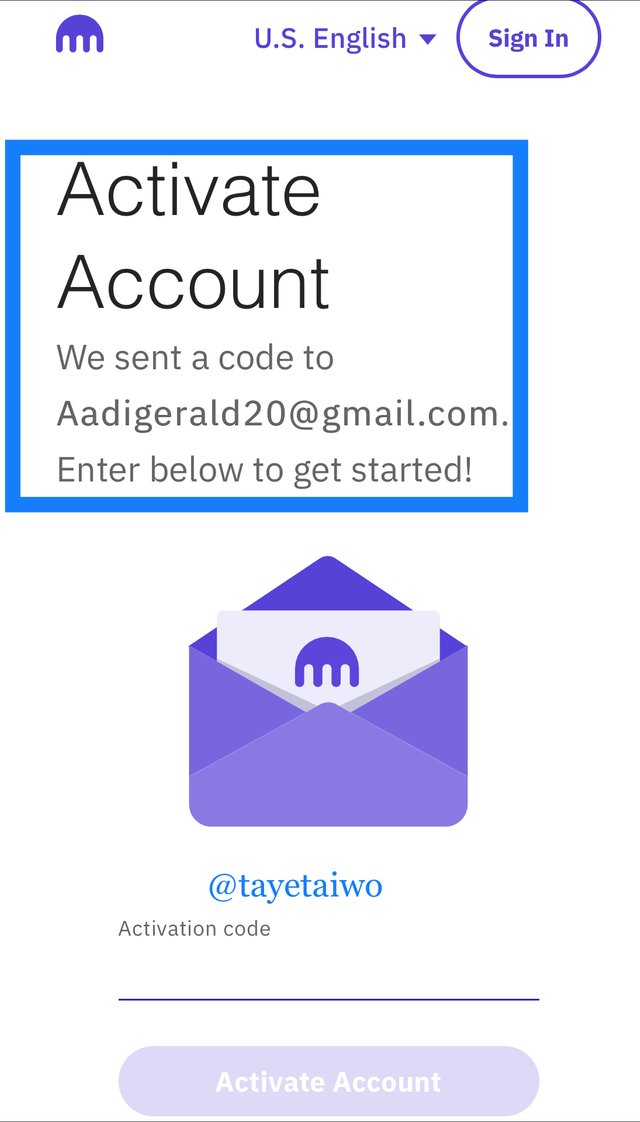

- In other to participate in block trading on the Kraken protocol, the user must first create an account. First login to the website kraken.com. Click on create account

Next, input your Gmail and password, select your country/region, then accept their terms and conditions boy clicking on the small red labelled box. After creating your profile click on create account

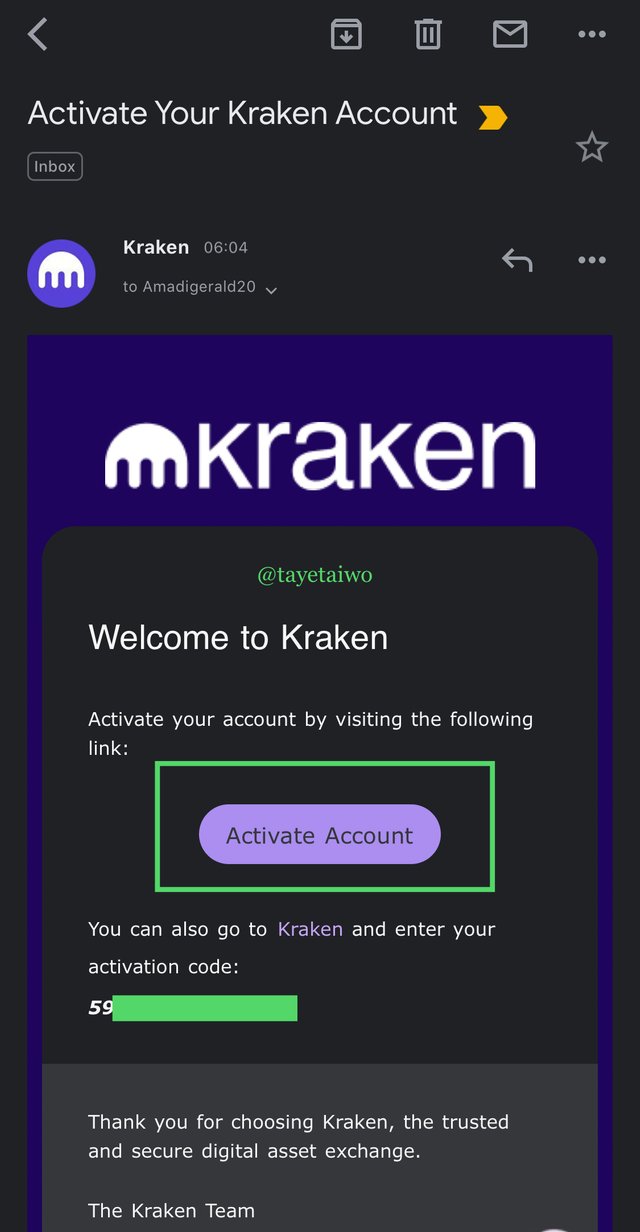

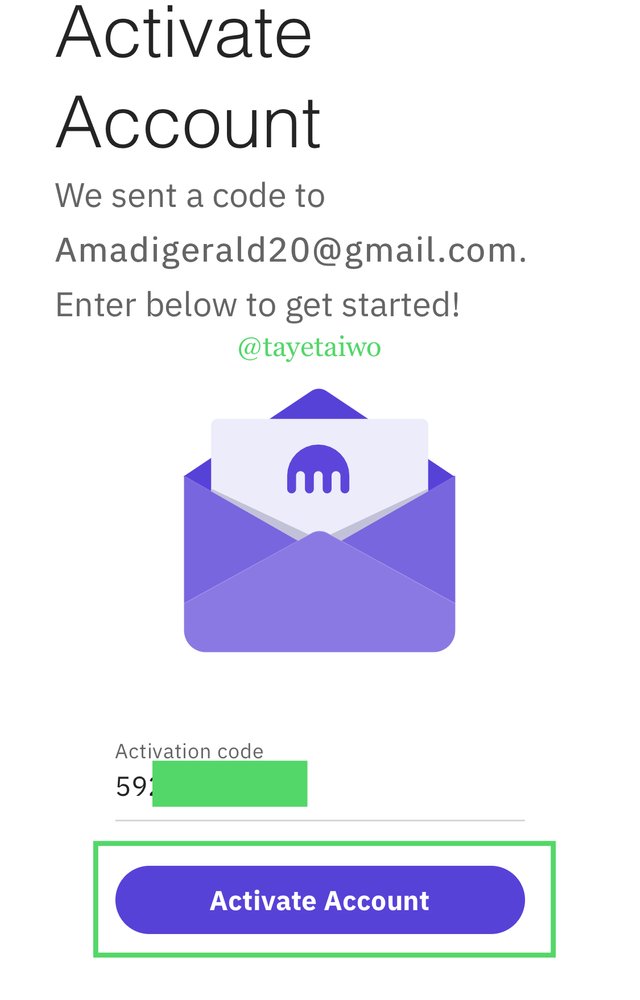

an email would be sent to you, login to you email and copy the activation code.

Input the activation code on the space provided on the next page, then click on Activate account.

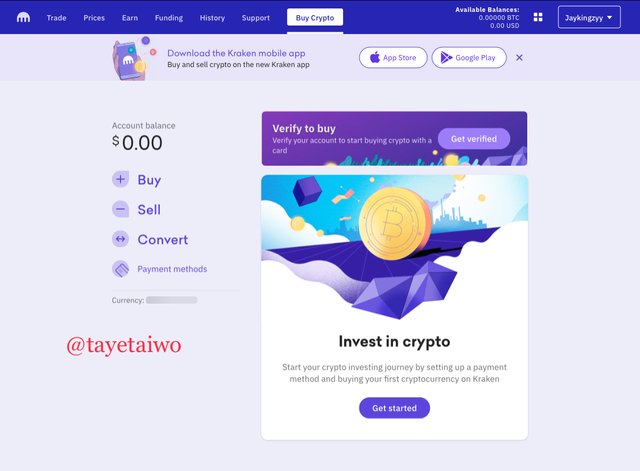

Your account is fully set and ready to use.

How to verify you account:

After the creation of an account in the dark pool exchange, you would need to verify your account in other to transact. Here, I could give an insight on how an investor could verify their account.

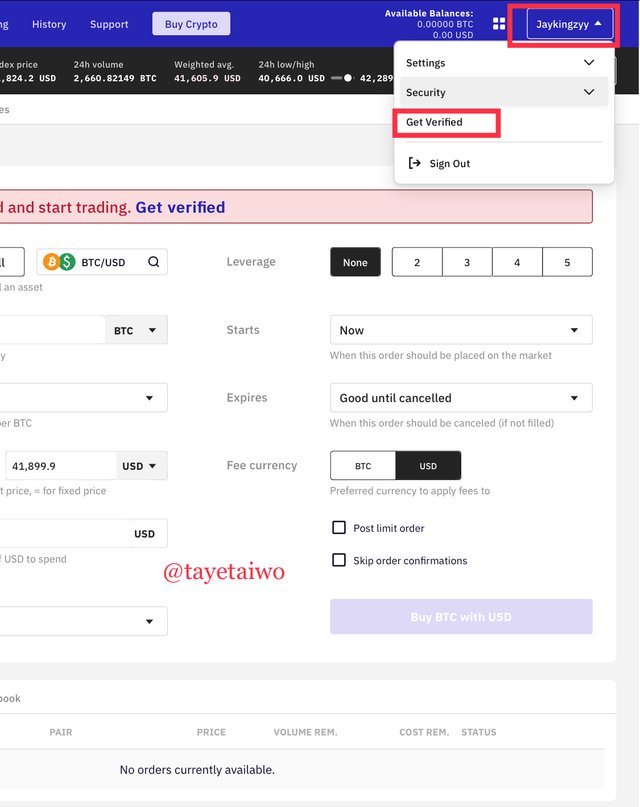

On the main page at the top right corner, click on the username icon which I indicated with a red box.

Next, click on Get verified.

verify you account up until the *Pro level in other to unlock all features in the dark pool.

How to perform block trading on the platform:

click on Trade at the main page of the platform.

Under New folder Click on Advance.

then click on the search bar to find the dark pool pair of interest you wish to trade.

Dark pool is unavailable presently as of the time of this post on the Kraken exchange, their fore when you click on trade of any of the pairs in other to see the rest of the options it won't be able to open.

I would show an image on what the options look like when dark pool is available.

What's your understanding of the Decentralized dark pool? What do you understand by Zero-Knowledge Proofs?

A decentralized dark pool authorizes traders to place trades of large assets privately without the need of an intermediary or a third party. Meaning that orders created on the dark pool is invincible and unknown to public eyes and as well any facilitator.

This depict the absolute privacy in Decentralized dark pools. A Decentralized dark pool in general is the same with a conventional centralized exchange dark pool, but the decentralized exchange good pool consist if some differences in their functionality.

Contrary to other conventional decentralized trading networks, a decentralized dark pool does not rely on liquidity pools in other to commence a trade.

Rather, the dark pool makes use of the Atomic swaps which encompasses a peer-to-peer (P2P) transaction over various blockchains.

With the unique function it possesses, it aids In facilitating trades between an asset pair that could be liquidified, as executed trade would be withing two traders at a predetermined price omitting slippage and additional market effect.

Order placed are broken into considerably smaller pieces which are available to be matched, these various pieces are received by Different nodes which seek in matching them.

The merged pieces are then recorded on the network and the other unmatched ones being matched until the whole order is complete. Some amount of fees from the transactions are rewarded to nodes that make this match happen.

In other to ascertain a higher class of authentication, the Zero-knowledge proof technology is adopted in their operations.

The advanced technology known as the Zero-Knowledge Proof(ZKP), is an encryption and verification strategy which was described first by Shafi Goldwasser, Silvio Micali, and Charles Rackoff in the year 1985.

ZKP deals with prove that a data or piece of information in the networks is true but without disclosing further details on it, creating a secure and authentic information and communication.

ZKP occurs among two distinct parties Which ‘one’ is the prover with information and the other, the verifier who verifys if the prover** has the said information.

There are some unique properties adopted by the Zero-Knowledge proof, the are as follows;

Properties of Zero-Knowledge proof:

soundness

Completeness

zero-knowledge

Soundness:

The verifier remains doubtful If the prover fails to have the information. This depicts the fact that proven information must be confirmed by the verifier before a node can be created.

Completeness:

The prover has the ability to convince the prover when with the information.

Zero-Knowledge:

The details of the information should not be known to the verifier and it is dependent on if the prover has the information or not.

Transactions can be carried out without the users balance, volumes and transaction price being revealed. The nodes pertained to matching various orders can match orders without knowing the details of the order formed.

State one decentralized dark pool in cryptocurrency and discuss it. How does it work

The Republic protocol is a popular platform that delivers a decentralized dark pool, the republic protocol was founded by Taiyang Zhang and Loong Wan in 2017 as the Republic protocol but it was renamed in 2019 as Ren Protocol.

According to its Whitepaper, Ren protocol is a decentralized dark pool project that first applied the atomic swaps (A smart-contract technology, facilitating the exchange of one crypto asset for the other without the use of third-parties). in the Dark pool.

The Shamir Secret Sharing(SSS) which was formulated by Adi shamir is one of the first secret sharing in cryptography. Using the SSS in dark pools , orders are broken down and distributed to a system of Dark nodes.

Then two (2) Ethereum smart contracts are deployed, which consist of the judge and The registrat for the remaining processes.

After the order has been broken down and disseminated among the darknodes, it is prevented by the Registrar from joining back by the modification of nodes in a way that it would look difficult.

This nodes then execute several computations in other to match the broken pieces with that of a different order. The integrity of the computation is verified by the Judge with the adoption of Zero-Knowledge Proof without disclosing any data about them.

An Atomic Swap is introduced for the cryptocurrencies After the broken pieces of two orders have been matched properly. There are no projects suitably offering a decentralized dark pool presently.

According to some explorations done, the republic protocol after being rebranded to a new name called the Ren protocol, their priority was now based on interoperability, which is the ability of a computerized system to make use of data and carry out exchanges.

Compare a crypto centralized exchange dark pool with a decentralized dark pool. What are the distinctive differences?

The various exchanges I would use for this comparison is the Kraken which serves as the centralized exchange and the Ren protocol which serves as the decentralized exchange.

| Kraken Exchange | Ren Protocol |

|---|---|

| In kraken protocol orders are not broken to pieces | Orders are been broken down to much smaller pieces |

| Nodes are included | Nodes are included during the process |

| A higher KYC level is needed to be attained in this protocol in other to partake | KYC requirements are not needed here. |

| The orders created here are “crossed” in a centralized dark pool | The use of Atomic Swap between traders in a decentralized dark pool. |

| Trades are enabled by intermediaries | The Smart contract protocol is adopted here. |

| Orders created here can be viewed by the exchange | No body, including the exchange itself can view the orders created here. |

Research any recent huge sale in any market in the crypto ecosystem and how it has affected the market. What difference would it have made if the dark pool was utilized for such sales?

Coinbase whale drops BTC to $60k

As reported by coinbase, the price of Bitcoin dropped from $62k to $60k after an unknown whale executed a large sell order on coinbase.

These market sell order depicted by a big red wick dumped the BTC asset from $62k to $60k. It was considered a “scam wick”. A scam wick initiates a momentum change.

A huge amount of 246 BTC worth over $15 million US. The market sell order occurred withing a few minute which dumped BTC price as we can see in the image above.

From my understanding i would say that the unknown whale positioned an order(market) with the intention that his trade would not be executed if there was a limit order on the order book of BTC because other traders would sell off on seeing the order(limit) .

In as much as the fall wasn't for long because of the enormous amount of buy limit orders by traders at $60k level, the sell-off depicts an idea of the effect of sales on an asset in the market.

This kind of tremendous sell-off has the possibility of dumping millions of dollars from an assets market capitalization. The price of this coin is affected the more because when such a huge sell order is seen by other traders, the would likely start selling of their asset which depreciates the price of that asset.

The unknown whale making such huge transaction should have made use of the dark pool because If the dark pool was used, a limit order would have been placed conveniently at a price level.

The initiated limit order would have been invisible to other traders, avoiding fear of selling-off in the market. The trader would have executed his order at his convenient time which would not have affected the prove of BTC falling this much.

In your own opinion, qualitatively discuss the impacts of trades carried out in the dark pool on the market price of an asset. (At least 150 words)

Traders act with fear and sentiments when the see a large order on the order book. Just as Large buy orders gives traders a reason to purchase an asset, which in turn pumps money into the assets market capitalization and as well cause the price to increase, Likewise, a huge market sell order gives traders a reason to sell-off their asset which in turn, depletes money from the assets market capitalization and as well decrease the asset price.

This is clearly an application of fear and greed which represents the demand and supply in the market, where when the demand is greater than the supply, it forces the price to go up, and when the supply is greater than the demand, it forces the price to go down.

This effect does not take place in the dark pool because trades executed in the dark pool are invisible to the public on the order book, and can only be seen by the person executing the transaction. Meaning that orders created cannot be seen by other traders which can push them to either buy or sell the asset on sentiment.

There are no crucial change in the market at the end of each transaction in the dark pool, and this is because the demand and supply are relatively equal.

Given that trades executed in dark pools have an enormous size, we would anticipate the impact of the trade on the price of the asset. Selling off a trade, for instance; 600 pieces of BTC’ extremely outmatch the small market orders depicted on the order books of exchange. This makes the supply more than its demand which in turn causes the price of the asset to fall.

Nevertheless, using the dark pool system, large sell or buy orders are filled only when matched with a buy or sell order of the same amount, Which in turn offsets the demand and supply and as well not affecting the price.

Also, we should understand that the effects of trade executed in dark pool might be invisible when the trade is carried out, but these trades can be reintroduced later into the general market, which has the tendency to affect the future price sooner.

What are the advantages and disadvantages of Dark pool in Cryptocurrency?

There are various advantages and disadvantages in dark pools and this I would state in a tabular form.

| Advantages | Disadvantages |

|---|---|

| With The use of dark pool the intentions of the unknown whale would have been hidden from the public eye, reducing the sentiments and fear in the market, which would in turn prevent an large movement of price | The liquidity in the main market is reduced when the unknown whale begins to use dark pools. |

| Because orders can be placed at an intended price in Dark pool using the limit order, this helps to preclude slippage During exchanges | Dark pool as well gives an unfair disadvantage to small traders in the sense that the unknown whales would have the chance to execute orders at a price different from the actual market price and also have it placed at the exact price. |

| A Directs trade between assets which would have normally been liquidated is facilitated in the Dark pool | There are absence of transparency in the dark pool because of the invisibility of the order book. |

| The dark pool gives additional level of privacy to traders in the system | The dark pool prices may differ from prices depicted in the public market, which is a tremendous disadvantage to retail investors. |

From the above explanations on the dark pool we would realize the usefulness of dark pool as it has been successfully initiated in the monetary markets.

In as much as the dark pool technology has been ascertained useful, it is still inoperable in the crypto assets.

The dark pools in cryptocurrency aids in the reduction of a large trading volume effects on the actual market price of an asset. This is so because exchanges are delivered secretly from the actual market.

However as I mentioned earlier, the lack of transparency which is their biggest selling point is a huge disadvantage to the system.

Thanks for reading 🎊

CC:-