Trading Steem with Elliott Wave Theory.

Describe the Five Impulsive Waves of Elliott Wave Theory. Explain the characteristics of the five impulsive waves in the Elliott Wave Theory and the key criteria that differentiate impulsive waves from corrective waves. Use the STEEM/USDT trading pair as an example to illustrate your explanation.

Five impulsive waves in the Elliott Wave Theory.

- Wave 1.

This normally occurs during the first move in a new trend. This is frequently triggered by a change in traders sentiments or positive/negative news which causes the market to start moving in a new direction. At this point, traders may still be doubtful of this new move for future viability, resulting in the traders reacting to this change as the market moves slowly and carefully . This unpredictability is represented in Wave 1 moderate strength in comparison to the next impulsive waves.

- Wave 2.

This phase acts as a corrective wave, reversing an area of Wave 1. It generally pulls back between 50% and 61.8% of the first move, showing continuing uncertainty about the new trend's potential. During this period, market sentiment is doubtful or unclear, as traders fail to believe that the trend has fully developed itself. This retracement gives an opportunity to buy chance for those who missed out on Wave 1.

- Wave 3.

Thia wave crosses the high point of wave 1 which indicate the direction about the new trend. The movement in wave 3 goes above around 120% of wave 1. This movement shows a strong and long-term movement that influence most traders that the trend is valid.

- Wave 4.

This wave is the second corrective wave, however it is usually smaller in size than Wave 2. It often retraces about 38.2% of Wave 3, indicating a softer pullback as traders gain trust in the trend's direction. This wave frequently produces a consolidation pattern, but there is less selling pressure than Wave 2. The short duration of this pullback suggests that the market is getting ready for the next push of Wave 5.

- Wave 5.

This is the final phase of the impulsive wave pattern. It is frequently less powerful than Wave 3, which indicates reducing pressure as the trend approaches the possible end point. The trader's emotion remains the same as bullish, at the same time the trend may show that the trend may be losing and indicates a potential trend reversal or the beginning of a corrective phase, which will be represented by the following corrective waves A, B, and C.

The key criteria that differentiate impulsive waves from corrective waves.Use the STEEM/USDT trading pair as an example to illustrate your explanation

The Impulsive waves are identified by the way they move in the direction of the current market trend. They are made up of five separate waves, labeled 1 to 5. One of the main criteria for defining an impulsive wave involves the fact that Wave 3 should not be the smallest of Waves 1, 3, and 5 is typically marking the strongest push in the trend. Wave 4 should also avoid overlapping with Wave 1 price in order to keep the impulsive pattern validity. These criteria ensure that the market maintains a consistent, clear momentum throughout the impulsive phase.

The Corrective waves are three waves that move in the opposite direction of the current trend. They are called A, B, and C. These waves have a more advanced pattern and may take on multiple patterns such as zigzag, flats, or triangles. Corrective waves indicate a pause or temporary pullback in the trend, when traders settle their holdings and analyze market direction.

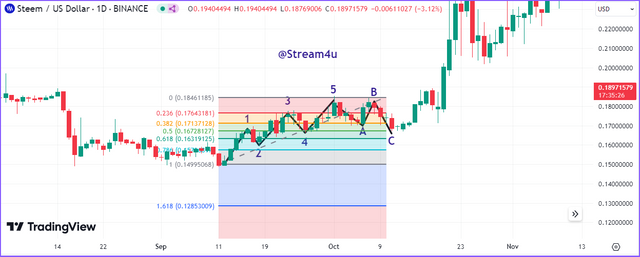

The below image of Steem/USDT chart is to illustrate the above key criteria wherein we can see how Impulsive waves and Corrective waves are formed and identified on a price chart.

Identify Impulsive and Corrective Waves on a Steem Chart. Using a historical Steem price chart, identify the impulsive and corrective waves over a given period. Explain why certain waves are impulsive and others corrective. For this analysis, use a daily or weekly time frame.

To explain this topic, we will use the same chart as above and identify impulsive and corrective waves.

The above Steem/USDT price chart is from 12 September 2023 to 11 October 2023. Starting from the left we can see after a short consolidation movement the price sharply moved up, from the starting point to 1st high point labeled with number 1 is a 1st Impulsive wave.

Further, the price moved almost 50% down according to wave 1, this downside is a corrective wave, the low point of this wave is labeled with 2. Then the price moved again up and crossed the wave 1 high point and made a new high point. This movement is again an Impulsive wave, the new high point labeled with 3 means Wave 3. Then the price falls again down but this time the down point does not cross the wave 2 low point, this is Wave 4 labeled with 4 and this is the corrective wave. The final movement is Wave 5 wherein the price crosses the wave 3 high point and creates a new high, this is the Impulsive wave.

Further the A, B, C are the correct trend and always go in the opposite direction of the trend which is created by Wave 1 to Wave 5.

Explain the Alternation Rule in Corrective Waves.Discuss how the alternation rule applies to corrective waves in Elliott Wave Theory. How could this rule influence a trading strategy for the Steem token? Provide an example of a complex correction versus a simple correction using a Steem chart.

How the alternation rule applies to corrective waves in Elliott Wave Theory?

According to Elliott Wave Theory, the Corrective waves can occur throughout both the impulsive and corrective stage. Due to the Alternation Rule, an impulsive loop with two corrective waves which is Wave 2 and Wave 4 will most likely change in form and complexity. This means if Wave 2 continues sharply and fast as a basic zigzag, Wave 4 may take for a longer time resulting in a complex pattern such as a triangle or double zigzag. This alternating pattern is important because it alerts traders about the possible shape and time frame of corrective waves, helping traders to plan more successful trading techniques.

How could alternation rule influence a trading strategy for the Steem token?

Recognizing the alternation pattern helps Steem Token traders to better predict market moves and prepare their trade orders accordingly. For example, if a Steem Token trader notices that the Wave 2 of a Steem price is a simple zigzag, then the Steem Token trader can plan for a more complex and lengthy drop in Wave 4. This expectation may affect buy and sell trades decisions , as well as risk management. Understanding the expected form of the correction allows Steem Token traders to prevent making rash entries and minimize the chance of being trapped in complex zigzag moves that can destroy earnings.

Provide an example of a complex correction versus a simple correction using a Steem chart.

Example of a simple correction.

Below the Steem/USDT price chart is an example of simple correction wherein we can see the waves are formed in a zigzag pattern.

Example of a complex correction.

Below Steem/USDT price chart is an example of complex correction wherein we can see that wave 4 is a more sharp drop than wave 2.

Plot a Trading Scenario for Steem Based on Elliott Waves Using a technical analysis platform like TradingView, plot a trading scenario for Steem based on a complete formation of the 1-2-3-4-5 impulse waves followed by an A-B-C correction. What would be your strategy for entering and exiting trades during each wave? Include Fibonacci levels for your entry/exit points.

The below is the Steem/USDT price chart on which we have identified and plotted a complete formation of the 1-2-3-4-5 impulse waves followed by an A-B-C correction.

In this scenario the trading strategy will be, first we will monitor the price movement, when price move above previous consolidation Wave 1, we will wait for the retracement Wave 2, when price bounce from around 50% of wave 1 retracement, we will prepare for buy trade and place it once it is break the Wave 1 high point. Further, we can see the Wave 2 has broken the Wave 1 high point, at the breakout level we will trigger the Buy trade.

Next, we will apply the Fibonacci levels to understand possible Impulsive and Corrective levels. In the above chart, we can see the Fibonacci levels have drawn a trend line which is a possible end of Corrective waves. As we have already triggered the buy trade and wave 3 high point is also formed, Wave 4 is expected and also possible low is shown by Fibonacci so we can hold till the price break below Fibonacci levels, if it breaks below before forming of wave 5, this means it will be invalid Elliott Wave Theory.

As we can see the wave 4 is reversed from the Fibonacci trend line, the next move of Wave 5 can be strong and break all high points of Wave 1 and Wave 3. So will wait for that point.

Next, the price has broken out of all these levels and moved up. Now for exit trade, either we can exit based on % profit means if the position is shos 20% profit which is good then exit the trade, or we can wait till the next corrective wave start which is opposite of Wave 1 to Wave 5 and break below to the Fibonacci trend line.

Accordingly, we see in the chart that after forming the Wave 5 high point, the price went down and also broke the Fibonacci trend line below. Here, we will place the Exit trade and book the profit by assuming that the price will go down. We can see after Wave 5 the price breaks the Fibonacci trend line and goes below it, these are corrective levels labeled with A, B, and C which go in the opposite direction from Wave 1 to Wave 5.

We can see how the low point of Wave 2 and Wave 4 has reacted on the Fibonacci trend line, they bounce back from this trend line. Understanding this behavior we can plan our trade accordingly and exit from the trade once this price breaks and goes below the Fibonacci trend line.

Analyze Steem's Current Market Trend Using Elliott Waves. Analyze the current market trend for Steem using Elliott Wave Theory. Where do you think the Steem token is in its wave cycle (impulsive or corrective)? What are the next possible movements? Support your analysis with technical indicators such as the RSI or moving averages.

The below is the current Steem/USDT 1 Day price chart. We have applied Fibonacci levels and also applied RSI indicators.

Starting from left what I see on 5th August 2024, the Steem/USDT price has reversed from around 0.129 and reached to the 0.194, later it went down around 50%/60% of previous up movement, so we consider the previous movement as impulsive Wave 1 and 50%/60% downside is corrective Wave 2.

The price pulled back from Wave 2 so we applied Fibonacci levels to understand the possible up, down levels and the trend line. After pullback from point 2, the price does not cross the wave 1 and quickly short wave 4 retracement occurred, we can consider this is one of the complex correction patterns wherein the wave 3 is shorter than the wave 1.

Next the price falls as wave 4 and quickly bounce back after touching Fibonacci trend line and wave 5 begin. The highpoint of Wave 5 is just above the wave 1 and currently trading at this same point.

The RSI indicator is also currently trading close to upper level from where selling pressure is expected to decline in price. Considering this overall pattern, the Steem token is currently in Wave 5 phase. IF Steem token price crosses below to the Fibonacci trend line then possible next movement the three waves of Corrective waves which are A, B, C.

Disclaimer: The information provided in this blog is for educational and informational purposes only. It should not be construed as investment advice or a recommendation to buy or sell any securities mentioned. Investing in the stock and crypto market involves risks, including the potential loss of principal. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. The author of this blog is not liable for any losses or damages arising from the use of the information provided herein.

Author,

@steam4u

If you like this blog, you can join me in the comment section of this blog.

This is a phenomenal breakdown of Elliott Wave Theory using the STEEM/USDT trading pair! The detailed explanation of each impulsive wave and corrective phase makes it clear how traders can apply these patterns in real-time markets. I especially appreciate how you used Fibonacci levels to track potential retracements and reversals. The insights on the alternation rule, particularly how Wave 2 and Wave 4 tend to differ in form, are very helpful for planning trade strategies. Looking forward to trying these techniques on my next analysis — great work!

Your detailed description of the five impulsive waves in Elliott Wave Theory is amazing! In terms of STEEM/USDT, you targeted some useful models. The difference between impulsive waves and corrective waves is obvious, demonstrating the essence of market psychology and technical patterns. Nice work in organizing high-level ideas that otherwise are usually misunderstood!

Like every contest this time also you have presented and analyzed the indicator very nicely in terms of which we can estimate our current and future price.Thank you very much for sharing. We learned a lot from your post which was really important.

Hi @stream4u 👋

You have explained Elliott Wave Theory in great way. You have spotted all the impulsive as well as corrective waves correctly. The 5 impulsive waves and 3 corrective waves come turn by turn.

In my opinion current market of Steem is the extension of the corrective waves C. And currently Steem is undergoing correction and consolidation zone.

Nice to listen to your views about Elliott Wave Theory.

@stream4u I really appreciate how clearly you have explained the impulsive and corrective waves making it easier to understand the market trends and price movements. Your detail analysis especially using Fibonacci level and the RSI indicator provides valuable insights into predicting the next possible move for Steem. Its a great guide for traders aiming to improve their strategies. Good luck with the Contest

Thank you for the kind words.

On Twitter X - Trading Steem with Elliott Wave Theory.

Upvoted! Thank you for supporting witness @jswit.

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.