Crypto Academy Season 3 | Advanced course : CeFi - DeFi - Yield

Hello All,

Welcome to Steemit Crypto Academy Season 3, My self @stream4u, I am from India, and one of your crypto professors. I welcome you all to my class.

Previously we learned one of the biggest sources for Crypto Prices & Market that is COINMARKETCAP.COM. I am sure you got many more and important things into the COINMARKETCAP.COM.

Now we will learn more about CeFi, DeFi & Yield.

While we are into the crypto words we should know about how they manage the Economic and our funds, the current traditional finance system is a centralized system that issues currency which further uses in every part where transaction comes, the only central authority have power and control to circulate currency.

Sometimes we move our funds into other organizations like fund managing, Banks and give them control over our funds, in this we expect some good and high returns.

In this process, your fund goes into the centralized system and all power is with the centralized to manage your fund, however, Risk is also involved in the centralized, even sometimes you get limitations on your own fund, this means even if it is your fund but you do not have 100% power on your own money.

We put or hard money in BANKS and some financial organizations, whatever profit earn we decide to re-deposit which mean re-invest.

Further, BANKS and other financial institutes used your money and invest it into the Stock Market, also give loan to other with some high interest, here the BANKS and other financial institutes just give you a small amount of profit and they get huge with using your money and even you don't have 100% power on your own money.

While we talking about investing so our money gets managed by the fund advisor and they are also not 100% correct all the time, they may also face risk in the market, when money into the Banks, so during inflation, you did not what is commented, then you will have to manage with the situation.

Now here's why DeFi comes For.

Decentralize Finance is the full name of DeFi in which the following things can be found Assets, Smart Contracts, and dApps created on a blockchain. Ethereum was the primary platform for the Defi applications but it is not the only Blockchain platform.

DeFi gives you an open financial ecosystem in which you can make a lot of small financial services in Decentralize pattern. Defi application created on a specific Blockahin hence it can be modified according to the needs.

What DeFi Gives You?

The major and the main benefit of DeFi is that it gives you 100% control over your own assets/money. Here, anyone can invest their assets and earn good returns than traditional financial services, since there is no mediator to handle your assets so you have all control over your investments.

Some DeFi Products.

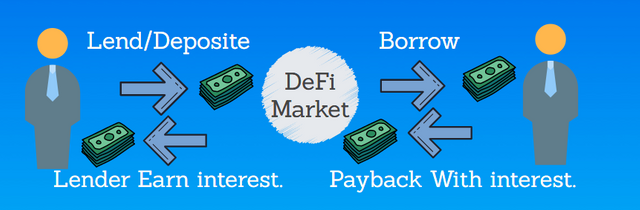

Lending

Similar to the BANKs, people can deposit their money and when other borrow the assets, he earns good interests. Here, Smart Contract acts as a mediator which performs the loan pattern and connects lender-borrowers, due to no mediator the earn high returns.

The Lending system works on Public blockchain and it provides some advantages as compared to the traditional.

- Lending and Borrowing Of digital assets.

- Collateralization for loan default.

Stablecoin.

Not similar to the other cryptocurrency which has huge volatility in the market, Stablecoin holds and is stable on a specific price. Stable coins pegging with the fiat currency like U.S dollar 1:1 ratio.

Decentralized Exchanges.

It has a peer-to-peer transaction on a blockchain with no other mediator, the advantages in this is no need to sign up, no identity verification, and fees.

Yield has now become one of the top projects in decentralized finance, it is basically known as Yield farming.

Yield farming is a project in which it allows users to lock their assets and in return, investors receive rewards for it. Now let's understand its process and some other important things.

Yield Process.

Yield farming is a process that allows cryptocurrency users to earn rewards for holdings in their assets. In yield farming, the investor deposits assets into a lending protocol to earn interest from trading fees. Some users also get additional yields from the protocol’s governance token.

The Bank work in a loan process similarly Yields farming works. When Bank gives us the money in the form of a loan and then we return back with the interest further it is bank process to distribute the received interest in bank profit and depositor profit, here we received very less profit comparing what the bank receives. But in the Yield farming process, we are the BANKs which means the investors are acts the same.

Yield Liquidity pools & Liquidity providers.

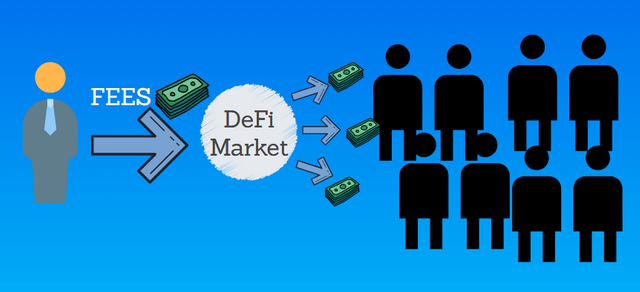

Yield farming functions based on a liquidity provider and a liquidity pool through which the DeFi market gets power. Here investors act as liquidity providers who deposited their assets into the smart contract wherein the liquidity pool is a smart contract with cash deposited by the investor.

Yield farming AMM Model.

AMM means Automated Market Maker, this model is used in decentralized exchanges. AMM model removed the normal order book which has Buy and Sells orders on cryptocurrency exchanges. Instead of using a normal order book and the price set for assets to trade, with the help of using smart contracts, AMM creates liquidity pools. These pools triggered buy and sell trades based on defined algorithms.

The Automated Market Maker(AMM) is depending on the huge liquidity providers who invest their assets into the liquidity pools, these pools are the main base for the majority of DeFi markets where users can borrow, lend and swap their tokens.

When a DeFi trader pays fees to the DeFi Market, further DeFi market distributed and shares those fees into the liquidity provider based on their shares into the liquidity pool.

There are two types in which the interest gets calculated.

- Annual Percentage Rate (APR)

- Annual Percentage Yield (APY)

Annual Percentage Rate (APR).

It is the percentage of early rate of return applied to the borrower but paid to the investors/depositors.

Annual Percentage Yield (APY).

It is the annual rate of return charged to the capital borrowers and later on it is paid to the lenders.

Theoretically, these both look the same so let's under the major difference in these.

Simply APR does not include the compounding interest, you just simply earn for lock your assets for a certain period of time, for example, let's suppose you see APR offer 100% for the year, so if you lock your $1000 assets, after a year you will receive $2000 wherein $1000 was your initial investment and $1000 is Annual Percentage Rate.

In APY, it gives you compounding returns which means your daily profit gets reinvest automatically to get more profit. To understand this let's take an example. Suppose you see APR offer 100% with daily profit then divide APR in 365 days and daily received interest (0.27%), now reinvest this interest on daily. Here, the amount you will receive is $2,714.57, wherein $1000 was your initial investment and $1714.57 is the Annual Percentage Yield.

Homework Task.

Hope you liked this course as we can see that DeFi has come with the many opportunities for the crypto holders/investor to earn more.

While making a Homework Task kindly make sure that this is the Advance Level course hence before start to work on this Homework Task, I will request first understand the questions and accordingly work on it, research more, and then prepare a task with the details.

You also need to focus on a presentation while working on a Homework Task, make sure you submit the homework task with a good presentation, try to use markdowns to highlight the important note in your task.

If your homework task does not get visited within 24 hours after your submission, please send the homework task link under the comment section of this course post.

The title for the Homework Task will be in the format, Crypto Academy / Season 3 / Week 4 - Homework Post for [@stream4u] …....

Below are the questions which you need to explain through your Homework Task.

What Is the Importance Of the DeFi System?

Flaws in Centralized Finance.

DeFi Products. (Explain any 2 Products in detail).

Risk involved in DeFi.

What is Yield Farming?

How does Yield Farming Work?

What Are the best Yield Farming Platforms and why they are best. (Explain any 2 in detail)

The Calculation method in Yield Farming Returns.

Advantages & Disadvantages Of Yield Farming.

Conclusion on DeFi & Yield Farming.

Make sure you submit your Homework Task in the Steemit Crypto Academy community.

Users having a reputation of 60 or above, and having a minimum SP of 500(excluding any delegated-in SP) are eligible to partake in this Task.

All information contained in a Homework Task should be your own as plagiarism will not be tolerated.

Use images from copyright-free sources.

Add tag #stream4u-s3week4 & #cryptoacademy in your Homework Task and should be in the first two tags. Tag correctly otherwise the Task will not get visited in a sequence.

Add me as @stream4u somewhere in your Homework Task.

This homework task will run from 19th July 2021 To 24th July 2021 Till Time- 11:59 PM UTC, make sure to submit before the time ends.

For any concerns, doubts, questions on homework tasks, you can ask me in the comment section below before making Task.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

https://steemit.com/hive-108451/@olawalium/crypto-academy-season-3-week-4-homework-post-for-stream4u

Thank you, Prof.

My homework post prof

https://steemit.com/hive-108451/@chenty/5g4vx8-steemit-crypto-academy-homework-post-for-stream4u

excellent lecture professor @stream4u

1st question. In APY are there chances of losses also possible? Like in the profit and loss banking system?

2nd question. Is there any word limit on every question individually lke we had in your previous assignment? Because out of the 10 assigned questions in this lecture, 1 or 2 questions may have short answers.

thank you in advance

-> Sorry but I cant provide you the information on this now because it is a quite similar question that is a part of the Homework Task. If you will be making homework tasks then you will need to do research on it.

The previous task was on one of the sites and thought that people will give information on features just like definition and not more in-depth, hence previously I set some words condition so that people can first understand the feature with some hands-on experience and then it will be easy for them to achieve those words limitation.

In this task, I have not set word limitations because it's completely theory part and there are a lot of things you can find, research, learn on DeFi and Yield. If you feel there are short answers to any question then I will suggest doing more research on it because it's an Advance Level Task and homework tasks will be check accordingly.

Just a tip I will say try to explore the topic as much as with every possible detail.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

#affable

Thank you professor for your reply. Got it.

Please 🙏 my post will soon pay out prof @stream4u it was done by you and has not been upvoted

Nice and informative lecture as usual. I liked APY and APR explanation. However, i feel asking 10 Q's is a bit laborious because more Q's hinder thorough research.

Thank you.

Fantastic lessons from prof @stream4u but the number of Questions really needed to be low to allow for quality post.

Please Prof @stream4u my post is yet to be upvoted and it will soon payout. in a matter of hours with a rating of 7/10

https://steemit.com/hive-108451/@chirich/crypto-academy-season-3-or-task-3-multiple-transfers-batch-send-at-one-click

Okay, checking.

Hello prof.

Can you please tell me what should I need to explain about Defi products I mean products is for Defi Projects or defi exchanges?

Anything, Defi Projects, and defi exchanges all these are one of the Defi products, you have to give in-depth about it.

Thanks for the great lecture professor @stream4u. I present below the link to my task below.

https://steemit.com/hive-108451/@fredquantum/crypto-academy-season-3-week-4-homework-post-for-stream4u-or-cefi-defi-yield

Thank you professor. This is my own entry below:

https://steemit.com/hive-108451/@opeyemioguns/crypto-academy-season-3-week-4-home-work-post-for-stream4u

hello professor @stream4u

here is the link to my assignment

My post I just hours to payout and haven't been upvoted yet

https://steemit.com/hive-108451/@chirich/crypto-academy-season-3-or-task-3-multiple-transfers-batch-send-at-one-click