Steemit Crypto Academy Contest / S15W2 - Stock to Flow Model

Assalamualaikum everyone!

Welcome to the post. Hopefully, all of you will be doing well and enjoying the time with the grace and blessings of Almighty Allah. Today, I'm here to be a part of the week 2 contest in our beloved SteemitCryptoAcademy. The topic of discussion for this week is super cool, Stock to Flow Model. So, let's start the fun without any wastage of time.

Explain in your own words the Stock to Flow Model, what is its function?

We all know that the supply, demand, stock, and confidence have always been the most important things which play a very important role in the price determination of any asset, even in the daily life. Just consider a collection of anything, say toys.

The more toys you have, the less value each one becomes, correct? It's just an example of the fact that the more supply of a commodity or asset, the lesser will be it's value. This is scarcity in action. The Stock-to-Flow (S2F) concept in cryptocurrency follows the same logic as digital assets such as Bitcoin.

Talking About It's Working...

There a few fundamental terms that should be understood before having a good concept of the Stock to Flow model. These are as below,

Stock: This is the total amount of cryptocurrency that is currently in circulation. in simple words, we can say that it is the amount of crypto token which is present in all the markets at a particular time.

Flow: This is the rate at which new cryptocurrency is created, similar to how many new toys are produced each year. In the case of Bitcoin, the rate is about halved every four years.

Rratio: Divide the stock by the flow to get the S2F ratio. This indicates how long it would take at the current production rate to create as much cryptocurrency as already exists. A larger ratio indicates greater scarcity, such as having fewer toys than the total number produced.

The Function: According to the S2F model, when the S2F ratio increases (due to reducing flow over time), the price of the coin should rise due to its increasing scarcity. Consider how fewer toys are made each year, increasing their value.

Things to Always Remember...

The S2F model isn't a magical formula. It's a simplistic view, and many other factors can influence cryptocurrency pricing, such as market mood, laws, and acceptance, etc.

The model has had some success predicting historical Bitcoin price fluctuations, but it is not flawless and should not be relied on for certain future predictions.

The approach is mostly applied to Bitcoin, but some have attempted to adapt it to other cryptocurrencies with various degrees of success, but we should remember that it is not applicable on any kind of crypto coin or token.

So, while the S2F model is a tool for understanding the possible influence of scarcity on cryptocurrency pricing, it's important to note that it's only one piece of the puzzle and should not be used to make investment decisions without taking other factors into account and completing additional research by our own.

What would be the advantages and disadvantages of the Stock to Flow Model?

From the above discussion, it is clear that the S2F is a very effective tool for the future prediction of many cryptocurrency coins. So, let's dive into the potential advantages and possible disadvantages of using this model.

Advantages of S2F Model...

The first and the most important thing is the Simplicity and Intuitive of this model. The concept of scarcity driving pricing is simple to grasp, even for those with no financial background.

Another important thing is that this model is quantitative and measurable. Both stock and flow are easily accessible data elements, making the S2F ratio simple to calculate and compare across assets.

The S2F model focuses on fundamental scarcity and it is an impressive thing. Unlike technical analysis indicators, the S2F approach emphasises the underlying asset's inherent scarcity, providing a potentially distinct viewpoint.

The S2F model has shown some success explaining and predicting Bitcoin price changes in the past, especially in its early years. So, it is trust-able to a great extent.

The S2F ratio enables comparisons between other cryptocurrencies and even other rare assets such as gold, providing a broader context for pricing of the assets.

Now, Talking About the Disadvantages...

The basic advantage is over-simplicity of this model. The model fails to account for many other price-influencing elements, including adoption, restrictions, market sentiment, and technology improvements.

We all know that the past performance does not guarantee future outcomes, and the S2F model has not always accurately predicted price fluctuations.

The S2F model implies steady demand for the asset, which may not be practical in unpredictable markets.

Because of the fact that the concept is designed specifically for Bitcoin, it may be difficult to adapt to other cryptocurrencies with different issuance procedures.

Another important point to be noticed is that the model's simplicity might lead to misinterpretations and overreliance, potentially resulting in false expectations or unsafe investments.

Make an analysis of the Stock to Flow graph, https://www.lookintobitcoin.com/charts/stock-to-flow-model.

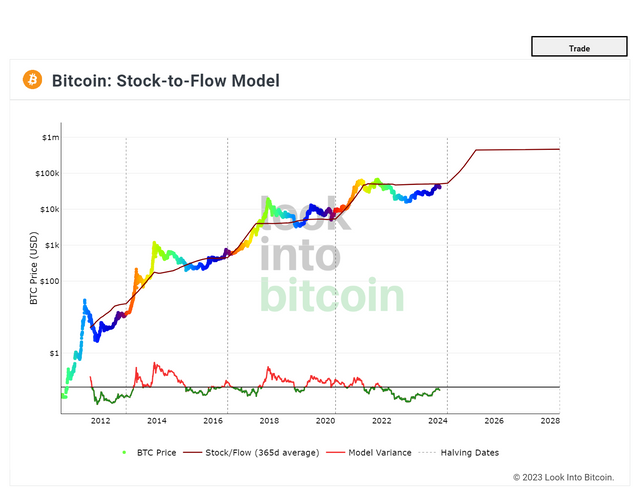

As I have already said that the Stock to Flow model is very much effective and beneficial tool for the prediction of the future prices of the cryptocurrencies, especially designed for the Bitcoin. now, have a look at the S2F model grapgh which is actually used for these predictions.

In the above chart, there are various components which are important to understand in order to get the exact results from this tool. There are 4 major components which are as below.

- The Rainbow Line:

In the above graph, you can see a colourful (rainbow) line. This line actually tells us about the price of the Bitcoin. we can also say that it is the price action line of Bitcoin.

- The Brown Line:

In the above chart, the brown line tells us about the Stock/Flow ratio of the Bitcoin cryptocurrency and it can be seen above the price action line, always.

- The Vertical Dotted Lines:

The third component of the chart is the vertical dotted lines which are actually plotted at a distance of every 4 years. These dotted lines tell us about the halving of the Bitcoin which actually happens every 4th year.

- ** The Model Variance:**

Another important component of this graph is the Variance line which is actually present at the very bottom of the chart. This line shows the difference between the actual price (rainbow line) and the S2F ratio (brown line). When the actual price is above the brown line, this variance line becomes red and it turns green otherwise.

So, these are some basic components of the S2F model graph which is actually used to determine the future price. It is a noticeable thing in the above graph that the brown line (ratio line) always pumps to a good extent at every halving of the bitcoin (dotted vertical line). Have a look at the below screenshot in this regard.

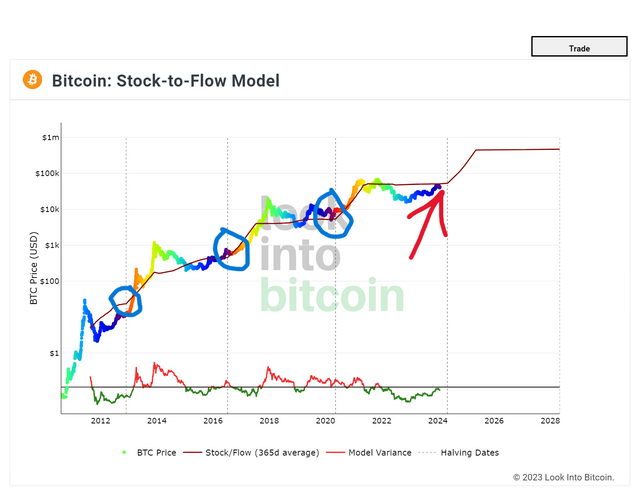

In the above screenshot, I have mentioned the precious halving events with the blue colour circle. And, the red color arrow shows the time of the next halving event which is going to be in this year 2024 and we can hope for a good pump in the Bitcoin, as per the predictions from the S2F model.

Can this model be applied to STEEM? Give reasons why this Stock to Flow graph model can or cannot be applied.

from the above discussion, it is clear that The Stock-to-Flow (S2F) model is a popular tool for projecting Bitcoin's price. But, but, but it does not apply to STEEM according to my views and thinking. There are some important reasons behind saying so.

The first thing is that The S2F model is founded on the concept of scarcity, and it says that the price of an asset rises as it becomes scarcer. Bitcoin's scarcity is caused by its fixed issue schedule, which means there will only ever be 21 million Bitcoins in existence.

However, STEEM does not follow a set of fixed schedules. Instead, its supply grows at a rate of 10% every year approximately as it is continuously being mined. This means that the S2F model cannot be used to forecast the price of STEEM because its fundamental premise of a fixed supply is not met.

Another important thing to notice here is that the STEEM token's mining rate and that of the Bitcoin is very much different from each other so there are some complications while saying so.

While the S2F model does not apply to STEEM, there are other factors that can influence its price, such as supply and demand, regulation, and acceptance. It is critical to consider all of these considerations before making any financial decisions regarding any of the cryptocurrency.

Conclusions

The Stock to Flow Model is a very effective and beneficial tool for the prediction of the upcoming value of the cryptocurrencies especially, Bitcoin. It is actually based on the fact that the more scarce a coin is, the more will be the value of that coin in the market. It is important to note that the application of this tool is not effective for all coins and tokens. Other factors must be considered before making decisions in the market and this is the most effective strategy.

I would like to invite my friends @abdullahw2, @yancar, and @f2i5 to be a part of this amazing contest.

|  |  |  |

|---|

Hola amigo @steemdoctor1, que bueno que estas participando aportando como siempre tus mejores conocimientos.

Ciertamente la escasez es un factor importante que afecta la estructura de costos de cualquier producto. Aquí en Venezuela hemos hecho un máster en esa materia, desde la escasez de la pasta dental hasta la de gasolina siendo un país petrolero, los precios se dispararon al cielo.

Efectivamente el modelo S2F exclusivamente depende del nivel de escasez del BTC. Tal como lo indicas, este modelo es una visión simplista y no considera otros factores influyentes como el sentimiento del mercado, las regulaciones, la pandemia , las guerras, etc.

Tal vez el éxito que ha tenido la aplicación del modelo al BTC se deba al nivel de escasez que domina preponderantemente su estructura de costos y el resto de factores que están fuera de su alcance representan una menor parte dentro de este rompecabeza.

Es válida tu recomendación de combinar esta aplicación con otras herramientas analíticas que permitan tener una perspectiva más clara del futuro.

Gracias por compartir tus conocimientos en el tema magistralmente.

¡Saludos y éxitos siempre!

Thanks a lot for such a nice comment. It is the story of every developing country in this era that the scarcity of goods and services is increasing inflation. We can hope for the best. Thanks again 😊

X Share Link:

https://twitter.com/mrsheraz7588/status/1751536922437050824?t=LdjVqOh-yGaDbnWTsHqYxw&s=19

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Thanks @ridwant brother 🙂

My pleaaure sir!

Such a nice pose you have posted in this community and on the topic I love to read it. You talk about the total lines rainbow line and bro bro online to understand about these phenomena that's really cool to know and I am very impressed about your work.

And the explanation about the stock to flow model is extremely great 👍

Please keep on writing such beautiful and informative blogs.

Thank you dear 😊

Great explanation dear brother you have done a great job in writing that article I'm also very glad to read your publication. Thanks for mentioning me in your post. Best of luck 🤞

Thank you 😊

Dear friend just as expected you have proven why you are a professional in this field and I must say your professionalism in crypto related active is so overwhelming and lovely I must say please keep it up

Yes friend it's so important to not this the consensus mechanism and way of printing is totally different from that of Bitcoin so therefore meeting it quite difficult to use on Steem asset.

https://steemit.com/hive-108451/@starrchris/eng-esp-steemit-crypto-academy-contest-s15w2-stock-to-flow-model-or-or-modelo-stock-to-flow

Thanks for leaving a beautiful comment dear friend 🤠

@steemdoctor1

The stock-to-flow model is a tool that is used all the time to test Bitcoin's scarcity and to test things like gold and silver, so to speak, with a rare human who has no clue. No matter who he is from 2009 to 2024, everything that has been calculated or predicted has been proven correct and he has determined the value of Bitcoin in a very good way. And speaking, this tool was created in 2019 which became known to the common people but the maker of it is not known till date, speaking like this the stock to flow model is working. And if you talk about it, it's a really great method that we understand clearly to evaluate all the things, but if you talk about the benefits, the benefits, the pricing can be done if the losses. Speaking it discovers about all things ahead of time that means it is clearly understood by every human being else speaking you have created a great post which is worth understanding and I understand different topics in this, really it can be achieved in a good way. If I talk about your post, you will definitely get success in it. My prayers are with you.

Thank you Shabbir brother

Best post and so much detailed mashaallah keep doing great work