Risk Management and Trade Criteria - Steemit Crypto Academy - S5W7 - Homework Post for @reminiscence01

Image was made with Canva

Merry Christmas and a blessed new year to all my fellow steemit and crypto gurus in the crypto academy community. This is season 5 week 7 and it has been such a great experience so far.

My name is kenechuku ogbushi @sonofremi and today I will be taking the course from professor @reminiscence01 on risk management in crypto trading.

I will then proceed to answer the homework questions.

Q1 WHAT DO YOU UNDERSTAND BY "RISK MANAGEMENT "? WHAT IS THE IMPORTANCE OF RISK MANAGEMENT IN CRYPTO TRADING ?

Risk is an inevitable concept of life, everyone takes risk everyday, risk that can cause them their whole life, but it has to be taken, in a very sensible and manageable manner.

Risk will always be taken and without them there is always a very little chance of winning or making breakthroughs. But when we take these risks without observing proper calculations, methods and processes, there is always a very big chance of failing or losing in whatever he/she ventures into.

In the crypto verse, risk is also a very inevitable concept, it must be taken but with adequate consultations and calculations to prevent massive crumbling of a trader's account.

The crypto financial market is a very flexible and unpredictable sphere, anything can happen at any time. That's why it is very essential and important to possess a very effective and efficient trading setup and strategy to easily predict the next course of price movements.

This setups comprises indicators patterns and dynamic strategies used on the price chart to determine price breakouts. They help a trader function properly in the market, hence lower losses and higher profits.

When all this is applied on the price chart it creates more assurance and confidence to step into the market, but it is not enough to rely on just strategies, indicators and patterns, an effective trader must always know how to manage his/her risk.

Managing in the sense that he/she must be able to control their profit and losses. This gives them a very good advantage when making entries into the market.

In the process of crypto trading, it is very important to combine. We have to combine trading strategies with proper risk management, it is very important. Without them a trader's entry into the market can always prove unprofitable, just full of losses, leading to destruction of any trading account.

A lot of traders today make market entries without proper risk management and that always leads to loss of trading capital.

RISK MANAGEMENT

Let's define risk and management:

We can define risk as a projected undertaking that may lead to either positive or negative results.

Management can be defined as the ability to control or contain a situation, a body or venture.

From these two definitions, we can define risk management as the processes and methods taken before an order is taken in the market. To minimize losses and maximize profits. It is simply referred to as measures and methods adopted by a trader to reduce losses when he/she steps into the market. It's that simple.

When a trader places a trade or a buy order in the crypto market there is always a very big chance that He/she might encounter losses, losses that might destroy one's account, how he/she controls the situation of losses is simply known as RISK MANAGEMENT.

Risk management has proven to be one of the most essential and important tools used by crypto traders to manage their accounts, it has to be given special consideration because without it in a market entry there is always going to be chaos and loss of capital.

From all the illustrations above it is quite clear and visible the importance and effectiveness of risk management in crypto trading. Risk management gives extra reinforcements to traders when going into the market. More confidence, finesse, insurance and skills to manipulate the price chart to their favor.

Let's briefly explain some of the importance of risk management in trading.

- It helps to minimize losses

As said above, the crypto market is a very volatile and active environment, prices fluctuate, move up and down in what we can call random price movements, it is therefore very essential to have a proper process of risk management, this is to help a trader reduce his losses and increase his profits when stepping into the market.

In a trader's capital management, it plays a very important and vital role.

- It boosts any traders confidence

When a trader is about to take any order in the market, it is very important to be confident and sure of the trade, whenever risk management is applied by a trader it gives him assurance that his/her trade is safe, and there is a high chance of making profit, even when the trade takes a wrong turn his/her losses will be at a minimal.

- Promotes consistency in application of strategies.

Risk management as explained above promotes assurance in a trade, it helps a trader choose the right trading setup, the trader is always confident in his strategies and this allows him to apply his strategies consistently without doubt even when he is on a losing streak.

We can say that risk management reduces the chances of a trader applying or jumping from one strategy or trading setup to another.

- It helps a trader control emotions

As always traders are humans with feelings, it is always very natural for someone to push harder and harder whenever he fails or meets a hard wall, without risk management, traders can always be deceived by their emotions.

For example, when a trader makes an entry order in the market, he faces either profit or losses, in a situation where he faces losses, he/she will always fight feelings pushing him to jump back into the market, he/she will always have that feeling that he will recover if he keeps pushing and this in most cases brings about massive losing and destruction of trading accounts.

Q2 EXPLAIN THE FOLLOWING RISK MANAGEMENT TOOLS, AND GIVE AN ILLUSTRATIVE EXAMPLE OF EACH OF THEM 1. 1% rule 2. Risk reward ratio 3. Take profit and stop loss.

It is always very important and essential to keep in mind the fact that the crypto market is a very risky and unclear place to be investing one's money or funds. Venturing into this sphere without proper caution and planning can prove detrimental to crypto traders. That is why it is important to have a proper risk management plan alongside an effective and efficient trading setup, this will surely lead to massive profits and minimized losses.

Here in this question 2 I will be explaining some risk management tools, they include:

1% Rule

Risk reward ratio

profit and stoploss

This type of risk management tool is utilized by traders in the market with the sole purpose of minimizing losses and maximizing profit, from the name it simply refers to a situation whereby a trader only risks 1% of the total trading assets in his/her account. That means he is stepping into the crypto market with just only one percent or highest 3% of whatever amount of money he has in his trading account. He is risking just one percent.

This is a really effective tool of risk management in trading as it helps secure a trader's capital on the market and it also prevents over-trading.

This tool helps keep a trading account very healthy and it prevents account destruction or explosion.

For an illustration let's take for instance, that I have just $500 in my account and I am applying the 1% rule before taking a trade order. Below Is the calculation to determine one's profit and losses

From the calculation above we can see that I would only be losing $5 out of my total trading amount in my account ($500) if the trade goes bad.

In a situation where I made 7 trade orders with the same amount I will just be losing (5×7)=$35 out of my total trading account, we can see that my losses will be minimal. It is clear that I still have more than enough capital($465) in my account to recover my lost funds.

Let's make an illustration where I used 15% of my total funds in my account to place an order.

From the calculations above, in a situation for 7 trade orders we will be losing a total of $440. This is a massive loss, as more than half of the trading account has been lost, making it almost impossible to recover the lost funds.

This clearly shows the importance in the application of the 1% rule, it helps to safeguard a trader's capital while stepping into the market.

And prevents over-trading.

Traders are never advised to step into the crypto market without establishing a standard risk to reward ratio. What do I mean by risk to reward?.

This simply means the difference between the amount of money invested or placed for an order and the amount of money expected if the trade goes well(profit) .

Yes this risk management tool is very important, as any effective and efficient trader should always have a target when he/she steps into the market. Some traders don't apply this concept and it can be very dangerous.

A trader should always target ×2 of his risk as his profit at the end of any trade. For example, if I invested $3 on an order, I should have a target for my profit and that is ($3×2=$6). Always strive for double the invested amount.

In different situations, some traders go into the market with a risk to reward ratio of 1:1, any order taken with this risk reward ratio is not worth the risk. Any good order or entry into the market should have a risk reward ratio of about 1:2 that is 1= Risk, 2= Reward ratio.

As the name implies, stop-loss and take profit are levels set on the price chart during a trade, to manage losses and profits.

The stop loss level is set to close or end a trade at a particular level during loss, in a particular trade entry.

And take profit levels are set to close or end a trade at a particular level during winning, in a particular trade entry or order. They are both levels put in place in the management of both losses and profits.

When stepping into the financial market a trader must bear in mind that any trade placed can go out of line with the projected plan, and unwanted losses can occur, that is why it is important to set these two benchmarks, in order to manage both profits and losses.

A good trader employs different strategies and tools while setting up his/her stop loss and take profit levels, this tools may include :

- Indicators

- Support and resistance line.

These tools can be utilized by a trader in setting up stop loss and take profit levels.

It is also of paramount importance that traders set their stop losses at a particular point also in line with the total amount of money they are willing and able to lose, to prevent an account from exploding. And on the other hand, profit should be set at a particular level that is twice the amount of the stop-loss.

Q3 Open a demo account with $100 and place two demo trades on the following;(Original Screenshots on Crypto pair required). (a) Trend Reversal using Market Structure. (b) Trend Continuation using Market Structure.

The following are expected from the trade.

• Explain the trade criteria.

• Explain how much you are risking on the $100 account using the 1% rule.

• Calculate the risk-reward ratio for the trade to determine stop loss and take profit positions.

• Place your stop loss and take profit position using the exit criteria for market structure.

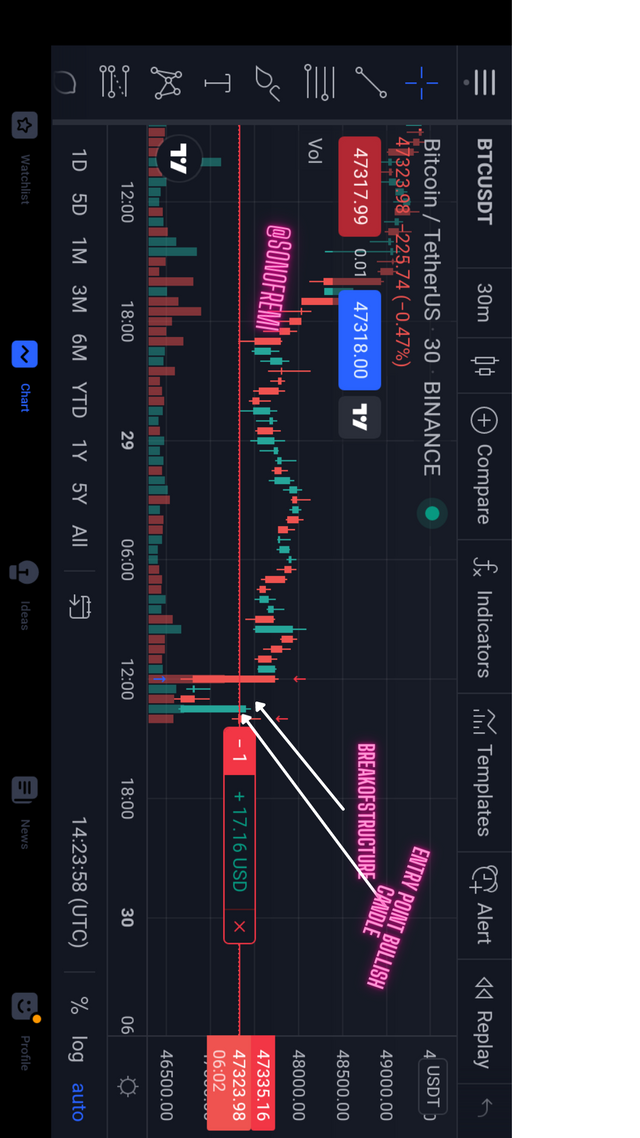

- Trend reversal using market structure:

- From the above picture we can see that it is a Btc/usdt chart configured on a one minute time frame. From the picture we can see that price kept on producing higher lows and lower lows which indicates that the market is in a bearish trend

- We can also observe that price failed to make a new low, a bullish candlestick was formed, indicating that a breakout might occur, and price might take a new direction. That is where my sell entry was then taken.

Now let's get to the stop loss order, I placed my stop loss level below the new support level. At 46671.91. And let's not forget that if price moves down and touches the stop-loss point, the trade would be invalid.

And the take profit was set to meet the nearest resistance level, having a 1:2 risk to reward ratio.

My demo trading account as at the moment I opened it was $100,000.

Applying the 1%rule, below is the calculation

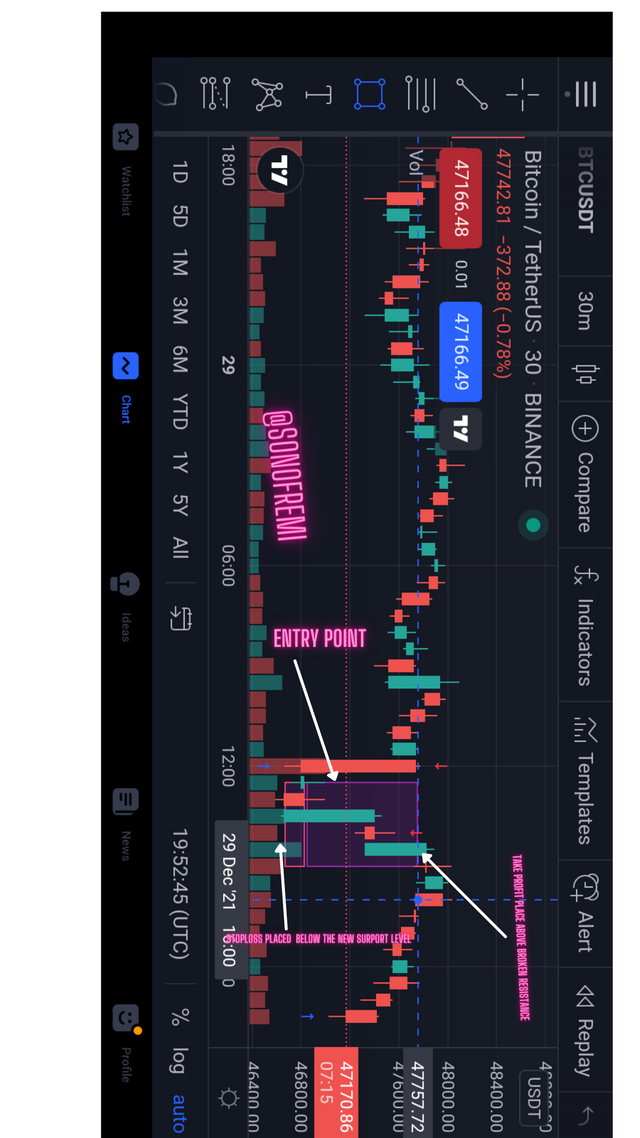

- Trend Continuation using Market Structure.

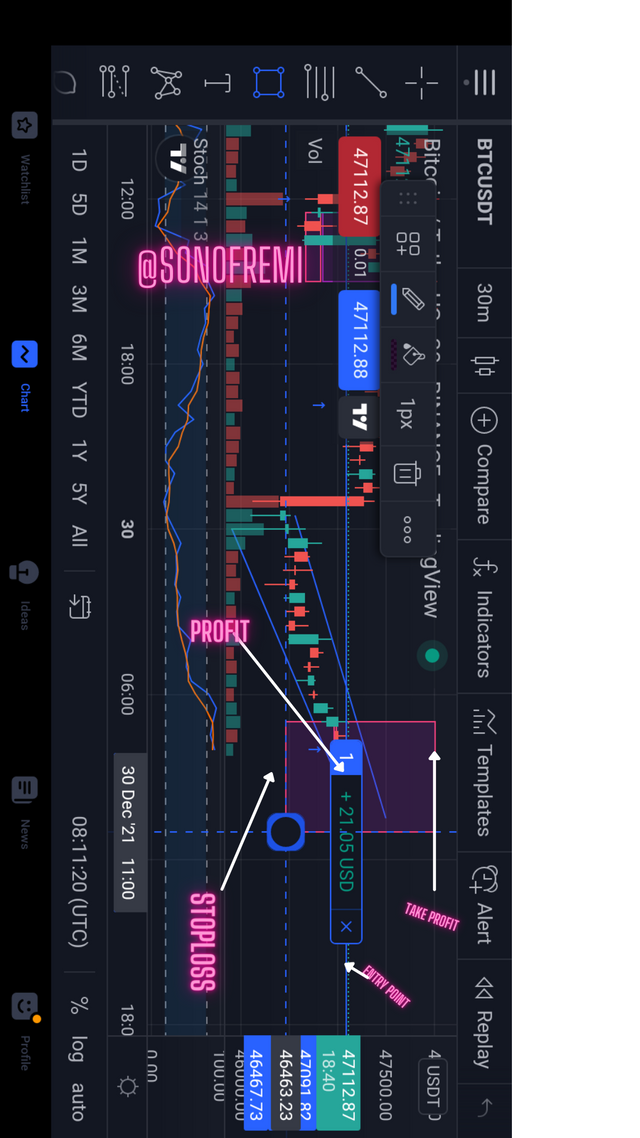

- Before I placed my buy entry, I had to carefully observe the price movements, price kept on making higher highs and higher lows indicating a new trend reversal. I carefully observed and placed a buy entry at( 47112.87) Immediately I placed the trade and I started making some profit.

- From the picture above it can be seen that the STOP LOSS level was placed slightly below or under the support level(46463.23), the trade would be invalid if price traces back and touches the stop loss level.

- Then the take profit level was set slightly above the resistance level (48000) with a risk ratio of about 1:2.

Before I made my entry I had also had a total of $99,000 in my demo account

Applying the 1%rule, below is the calculation

That means I would be losing just $990 out of my $99,000 if my trade takes a wrong turn.

CONCLUSION

In conclusion one can understand that from all the above illustrations, risk in trading is quite inevitable because of the volatility of the market, but it can definitely be managed.

Risk management in terms of trading is a very important and essential tool when it comes to management of resources. It helps a trader minimize losses and maximize profit.

Lastly, I want to say a big thank you to the professor in charge of this course @reminiscence01 for this great lecture on risk management. I had a great time doing it.

All screenshots were taken from Tradingview

Hello @sonofremi, I’m glad you participated in the 7th week Season 5 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observations:

That's correct.

Recommendation / Feedback:

Thank you for submitting your homework task.

Thank you very much, I really appreciate. I will always try to improve myself