Crypto Academy Week 6 - Homework Post for @stream4u by @shahjahanjamot

Hey steemit community, Hope you’re doing well.

Going to do first homework for @stream4u so let’s do it.

Question 1 Differences in Large Capital - Mid Capital - Small Capital and how they will affect to the Investment?

Large Capital-

The assets/companies which have more than $10 billion market capitalization and in the top 10 assets are fall under Large Capital.

Well in large capital if you invest you will not see profit coming at fast pace, the growth in this is slow because it is safe and also for us, we won’t make huge investments so not much profit for us.

The profit doubles the investment if you stay patient for a year or two. The market is very rapid in change so there is a lot of risk, but as of us, we won’t make huge investments so that change won’t be much harmful for us.

Mid Capital-

The assets/companies which have a market capitalization in between $1 To $10 billion and under the top 10-50 assets are fall under Mid Capital.

The mid capital has a lot better growth than the large capital and with that comes greater risk. A risk at a level that no one knows what is going to be happening in the future.

In this Exchanges play an important role in the volatility because at every exchange there’s a different rate.

Mid capital is like a rollercoaster. You can see huge profits in a small span of time like 6 months but you can go down to the base in one day or maybe you can go down in the basement which is loss. If you keep a good eye on the market and play along with it, you will make huge profits.

Small capital-

The assets/companies which have a market capitalization are below $1 billion and out of the top 50 lists fall under Small Capital.

These companies are do or die. Sometime after they were introduced, you won’t see them introducing any new product or the companies disappear because the owner had a big hit.

If there’s a certain pump in the market, your money will start going down, if not go down, it will remain flat for a long time.

There’s risk in everything, in small, mid, large so what’s the point to invest in small cap?

Because in this your investment is very small compared to others so is the loss. The loss is small in this. The profit can go from 10-100 but for that you’ll have to be patient for a long time.

Question 2 Your view, Which type of Asset capital can be more profitable? Why? Advantages and Disadvantages. (Explain only 1)

In my point of view, small capital companies can be more profitable. See everyday a new company introduces something new, and if it gets some value a lot of people invest in it and with time the value decreases. Even if it doesn’t the investment was very less so not much loss unlike mid capital or the large capital. You gain profit if you stay constant.

Advantage

The biggest benefit of this the small investment. If the value blasts it gives you a lot of profit, you just have to wait.

Disadvantage

The companies do not stay constant. That is a big disadvantage. As I have discussed above, they don’t introduce any new products, major small assets/companies gone easily due to investor or founder itself dump them to zero.

Question 3 Thoughts on Risk Capital and Penny Cryptocurrency.

Risk Capital

Risk capital is the small amount of money. It is the money that you spend on daily basis. You don’t remember that money after investing it. It goes into loss, it doesn’t matter because you spend something to eat, you don’t remember it, this is just like that. You ate/invest and after you don’t remember it.Penny cryptocurrency

It is an asset that has a value like $0.0004 (INR 0.02) OR $0.02 (INR 2)

These are assets which we can get in very cheap. If you have a good amount of money and you want to invest it, this is the best choice. You get huge amount of currency and after one pump in the market you can make double the profit but there’s risk too, you can go into the dump too.

So why invest in penny cryptocurrency?

Let’s take altcoins for an example. Why invest in altcoins today?

Altcoins offer high-risk reward ratios. Many penny cryptocurrencies are undervalued, and we can expect the value of altcoins to increase in the near future due to the potential for mass adoption of blockchain technology.

Question 4 What is the Role of Watchlist? Best way to set Watchlist. Additionally, For Example, show your watchlist if you have configured it and give a short description of it.

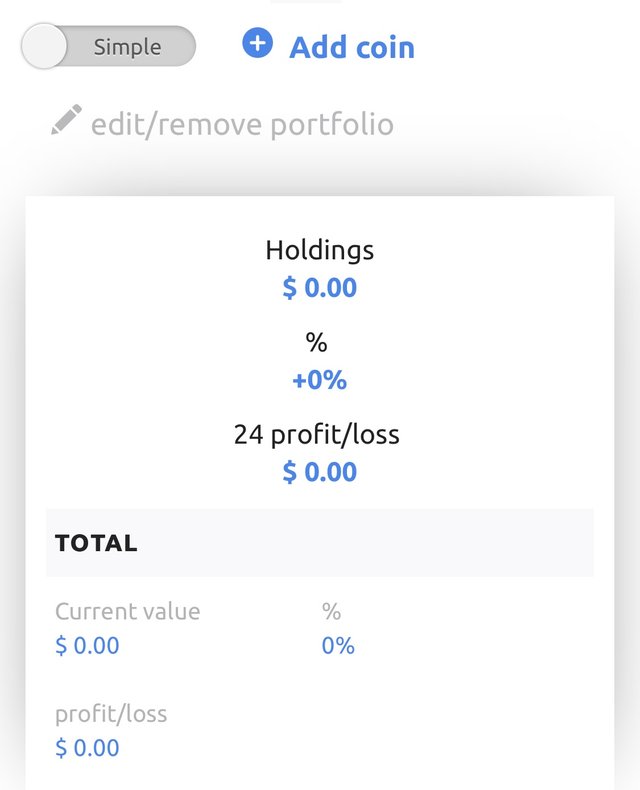

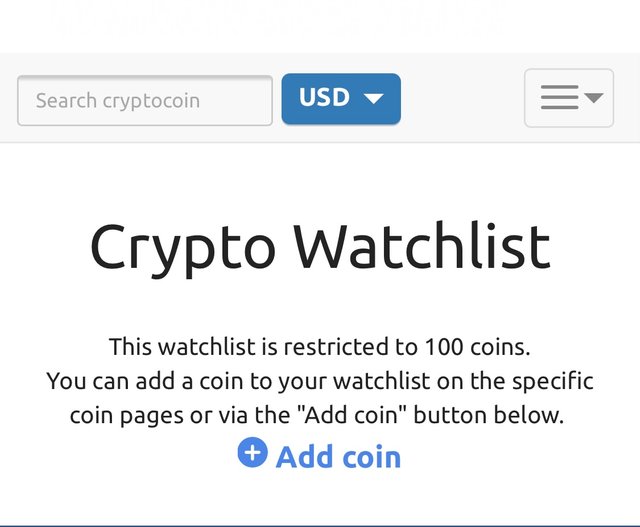

This is a list of all of the cryptocurrencies that we want to invest in or learn more about. We can't keep track with all the cryptocurrencies on the market because there are too many. What we should do is select a few of the best and most interesting coins, list them, and then keep track of them on a regular basis.

Now how to set a watchlist?

Here are steps-

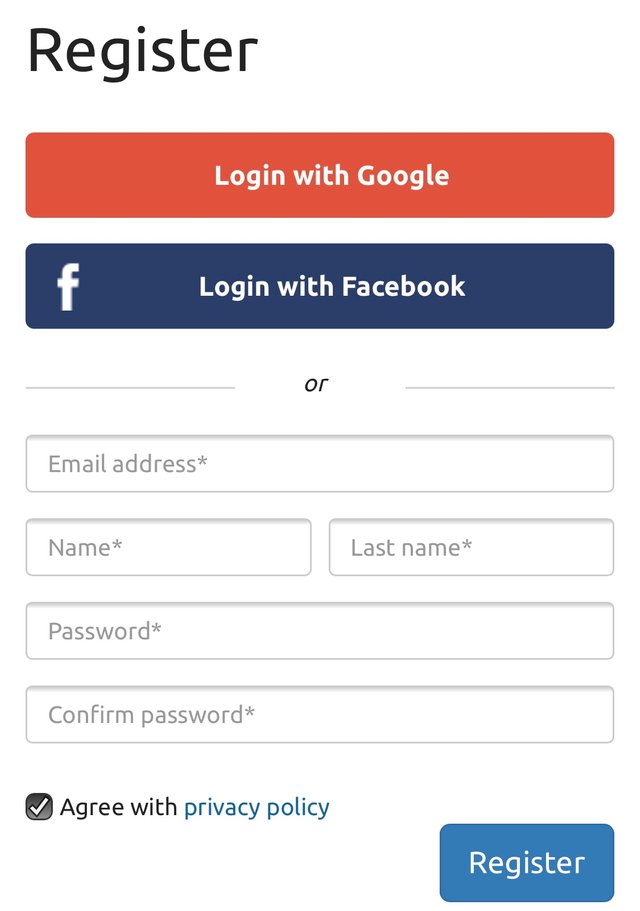

Well, go to any website that provides you with the watchlist. Sign up using email or Facebook, add all the coins that you want.

Conclusion.

There’s risk in everything, you just have to decide where there is less risk and where to invest.

I believe small cap is the best choice for investing because less loss more profits.

Penny cryptocurrencies are bumpy. Do or die situation.

Penny cryptocurrencies can give you a lot of profits too.

Watchlists are good to monitor the cryptocurrency. I believe they are very beneficial.

Today’s homework is done.

@stream4u all the work is plagiarism free, please check.

Thank you!

Hi @shahjahanjamot

Thank you for joining Steemit Crypto Academy and participated in the Homework Task 6.

Your Homework task 6 verification has been done by @Stream4u.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy