SLC S21W5 : Advanced Strategies Using On-Chain Data and Sentiment Indicators.

|

|---|

Hope you all are doing well and good and enjoying the best days of your life. This is me @shahid2030 from Pakistan and you are here reading my post. You all are welcome here from the core of my heart.

This is my participation in a contest Advanced Strategies Using On-Chain Data and Sentiment Indicators organized in SteemitCryptoAcademy by @crypto-academy.

Question1: Understanding On-Chain Data Metrics. Explain the importance of on-chain data metrics like wallet activity, exchange inflows/outflows, and token holding distribution. How can these metrics indicate market sentiment during a bull run? |

|---|

On-chain data metrics are very important tools that we use for analyzing the cryptocurrency market because they really help us in providing a real-time insights into blockchain activity. These metrics can offer valuable information about market sentiment and behavior, most importantly during a bull run. Here's an explanation of the importance of key on-chain data metrics:

1. Wallet Activity

Definition: Tracks the number of active addresses, including new and recurring wallets interacting with the blockchain.

Importance:

If we see increase in wallet activity during a bull run, it suggests growing interest and adoption of a cryptocurrency.

A surge in new addresses means their is an indication that retail or institutional investors are entering the market.

High wallet activity signals a strong network utility, which often aligns with bullish sentiment.

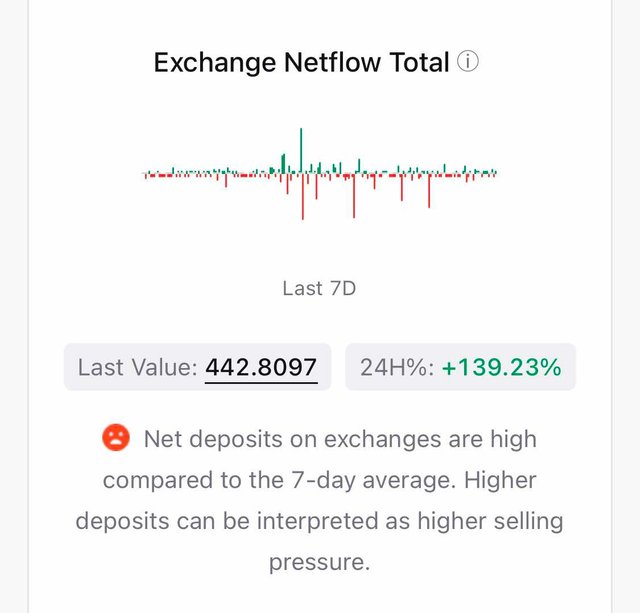

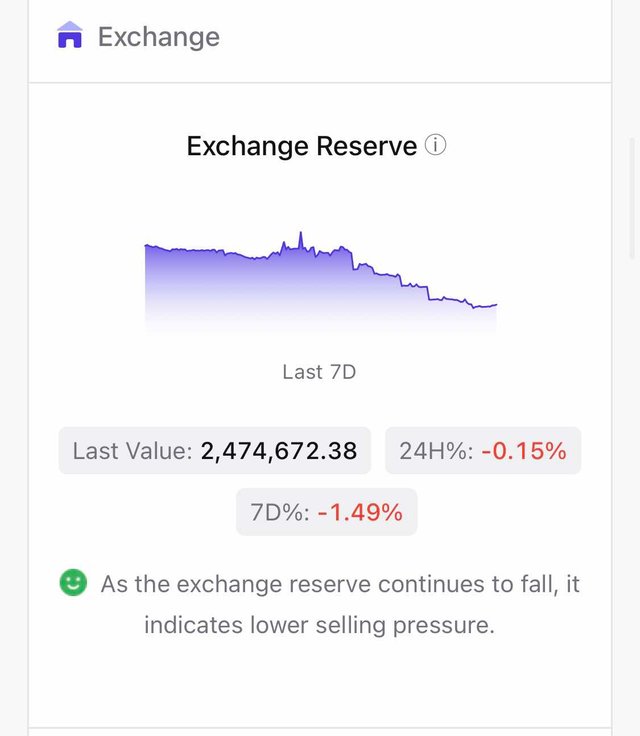

2. Exchange Inflows/Outflows

Definition: It is the Measurement of the volume of tokens being transferred to and from cryptocurrency exchanges.

Importance

Exchange Inflows:

If we see Increase in inflows during a bull run, it could signal that investors are in selling mood and they are preparing theirselves to take profits, potentially indicating an upcoming price correction. Along with it a large inflows from whales (high-net-worth wallets) might suggest heightened selling pressure.

Exchange Outflows:

A huge outflows often indicate that investors are moving assets to cold wallets, reflecting long-term holding sentiment. During a bull run, sustained outflows suggest a continuation in price of the commodity.

3. Token Holding Distribution

Definition: It Analyzes how tokens are distributed across wallet sizes (e.g., whales, mid-sized holders, and retail investors).

Importance:

Whale Accumulation:In market we know large whales are the market movers. When large wallets increase their holdings, it often signals confidence in the asset’s for long-term, supporting bullish sentiment. However, changes in distribution quantity can also indicate whether whales are selling off or accumulating, offering clues about potential market reversals.

Retail Activity: A rising number of small accounts of short term holders suggests broader adoption, typically bullish in a growing market.

Using These Metrics During a Bull Run

Confirming Sentiment: When we see a high wallet activity and steady outflows from exchanges, it reinforce the bullish narrative by showing increased participation and confidence. It suggests that buying or holding surplus the selling activity.

Identifying Overheating: Spikes in exchange inflows can act as early warnings of potential profit-taking or corrections. This is the time we have to get exit of the market by taking profit.

Spotting Trend Shifts: Changes in token distribution, such as a decrease in whale holdings, may also indicate a shift in sentiment from bullish to cautious.

Question 2: Using Sentiment Indicators to Analyze Market Trends Discuss how sentiment indicators, such as the Fear & Greed Index or social media sentiment, provide insights into bullish or bearish market conditions. Provide examples of how these indicators have historically predicted reversals. |

|---|

Sentiment indicators gauge the mood or psychology of investors in the market, offering insights into market conditions and potential trends. By analyzing these indicators, traders and investors can have a better understanding whether the market is in a bullish (optimistic) or bearish (pessimistic) phase. However Sentiment indicators do not reflect actual market fundamentals, but rather the emotional state of participants. It also act as a contrarian tools that help predict the market reversals.

Key Sentiment Indicators

1Fear & Greed Index

Created by CNN Money, this index consolidates various metrics (e.g., stock, crypto market and forex etc) into a score ranging from extreme fear (0) to extreme greed (100).

Interpretation

High levels of greed mostly indicate the market overbought conditions, signaling a potential market top (bearish reversal).

On the other hand high fear may suggest oversold conditions, means Market is at bottom now (bullish reversal).

2 Social Media Sentiment Analysis

This involves analyzing the tone, sentiments and frequency of market-related discussions on platforms like Twitter, Reddit, and StockTwits. Certain famous tools like AI algorithms and NLP models evaluate whether the sentiment is predominantly positive (bullish) or negative (bearish).

Interpretation

Excessive optimism or we can call it a hype around a stock or market might signal an upcoming correction.

Conversely, extreme negativity or FUD may indicate a contrarian buying opportunity.

Historical Examples of Sentiment Indicators Predicting Reversals

Fear & Greed Index during the COVID-19 Crash (March 2020):

During pandemic in 2020 the Fear & Greed Index plummeted to extreme fear levels (below 20) as markets were sold off due to fear in the pandemic.

Outcome

This extreme fear reached the market to an extreme bottom level in March 2020, after which global markets rebounded sharply, and marking the start of a strong bull run.

2 Social Media Sentiment and the GameStop Saga (January 2021):

During the GameStop short squeeze, retail investors coordinated through Reddit platform like WallStreetBets. It results in social media sentiment turning overwhelmingly bullish, which has helped driving the stock's price exponentially higher.

Outcome

The overhyped sentiment eventually led the market to unsustainable levels, triggering the stock to a sharp correction as reality set in.

3 Bitcoin and Crypto Market Trends (2021-2022):

Bitcoin's price surplus over $60,000 and made it's ATH in 2021 was accompanied by extreme greed on the Fear & Greed Index.

Outcome:

This excessive optimism results into a subsequent downturn in 2022, when the market entered a prolonged bearish phase. We have witnessed extreme fear levels during late 2022 signaled a potential bottom.

Challenges and Limitations

Lagging Indicators: the short back of sentiment indicators are they often lag behind price action, leading to delayed signals.

False Signals: Extreme readings do not guarantee reversals, especially in trending markets. We don't know where the market will stop or where is the actual bottom. For example when BTC was at 25k level the market was at extreme fear, but still it went to 14k level. In short extreme fear and greed indicator don't give us the actual bottom.

Context Dependence: These indicators are more effective and give us accurate data, when combined with technical and fundamental analysis.

Question 3: Integrating On-Chain Data with Sentiment Indicators. Describe how on-chain data and sentiment indicators complement each other to provide a holistic view of market sentiment. Use examples from Steem/USDT to illustrate their combined application. |

|---|

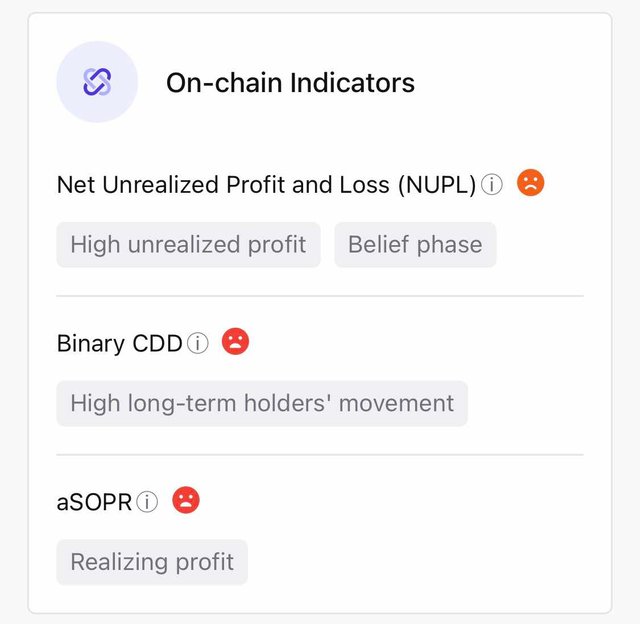

On-chain data and sentiment indicators are most important tools for predicting and analyzing cryptocurrency markets. Together, they provide us too much authentic and a more comprehensive view of market sentiment by combining quantitative blockchain activity with qualitative market perceptions.

How They Complement Each Other

1 Validation of Trends:

On-chain data can reveal rising activity or accumulation with in the platform, but without sentiment analysis, the motivations behind these trends remain unclear. For example, if on-chain data shows an increase in Steem transaction volume, now sentiment indicators should clarify whether this is driven by bullish optimism or panic selling. If we get the result we should go accordingly.

2 Contextualizing Anomalies:

Anomalous on-chain activity, such as if we see a sudden spike in Steem wallet activity, it could be linked to specific events identified through sentiment analysis, such as a major partnership announcement with major developers or regulatory concerns.

Enhancing Predictive Power:

Combined insights can improve market predictions. For an instance, if on-chain metrics point out high staking activity in Steem (indicating confidence) and sentiment indicators also reveal strong community enthusiasm, it suggests a better bullish outlook. Conversely, negative sentiment despite healthy on-chain data may signal a hidden concerns or impending volatility.

Application to Steem/USDT

Let's have a look to steem statistics on one of the major crypto exchanges Binance.

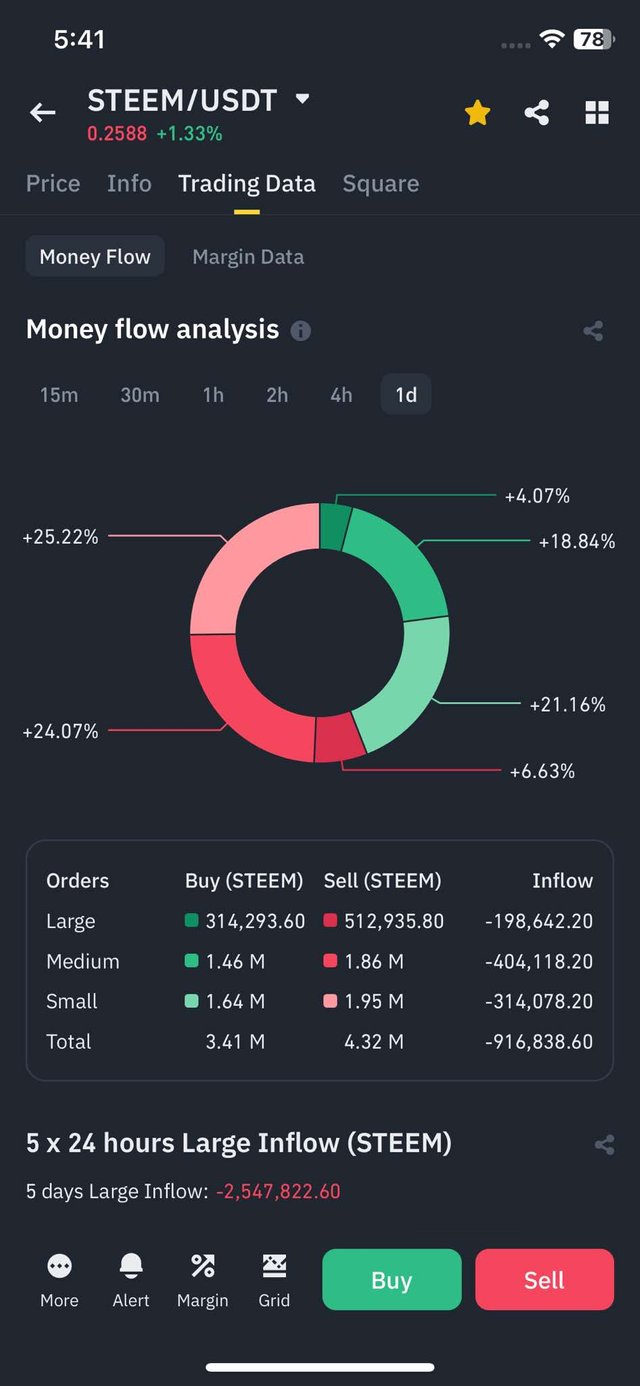

Money flow analysis

If we look in the one day chart of STEEM coin we find a difference of approximately 1 million steems. 4.32m steems are sold while 3.41 are bought. Approximately a 1 million inflow difference.

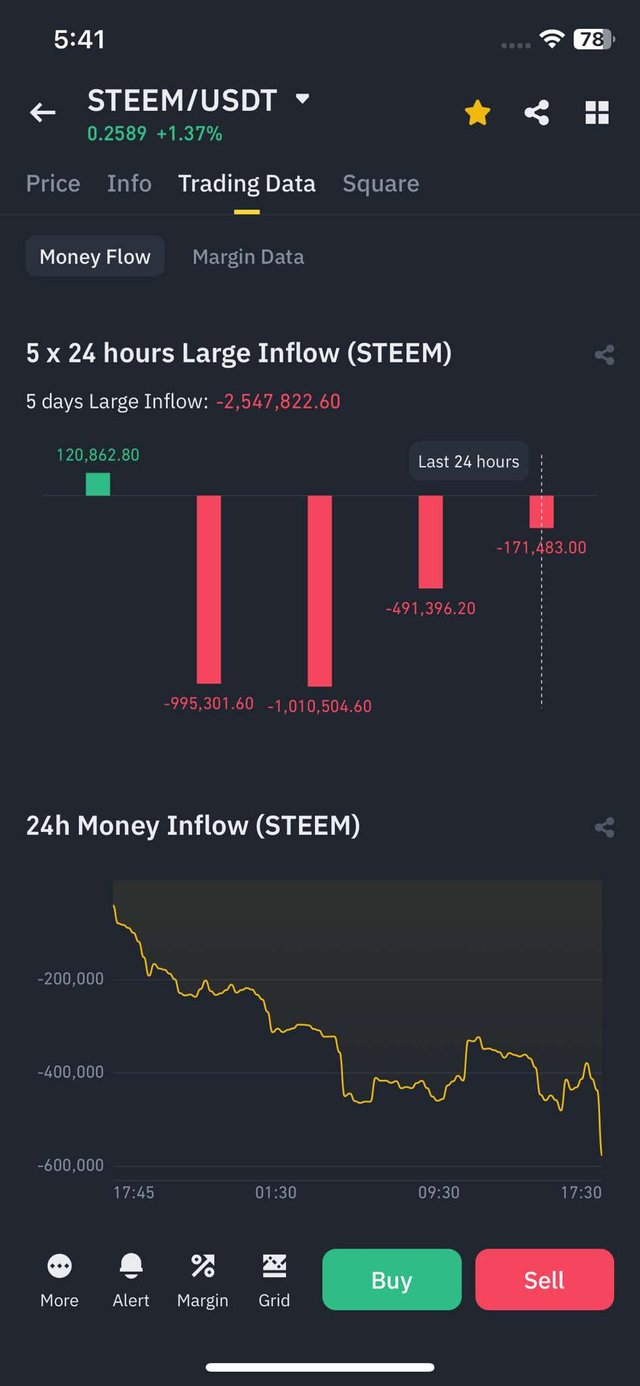

5 × 24 hours large inflow (STEEM).

Five days steem chart is also bearish. The first day is bullish while the remaining 4 days are showing selling pressure.

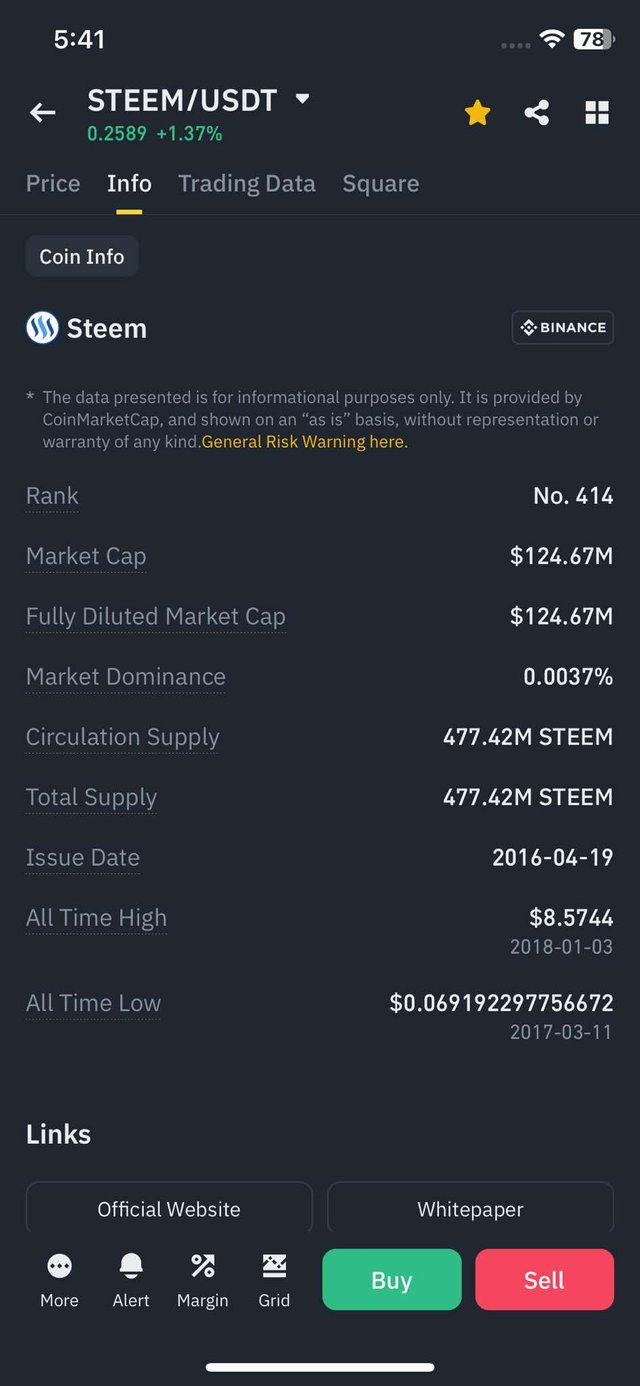

STEEM Info

You can see a complete data analysis of STEEM which is available on Binance and coinmarket Cap. Here you can see it's total market cap, supply, ATH and many other things.

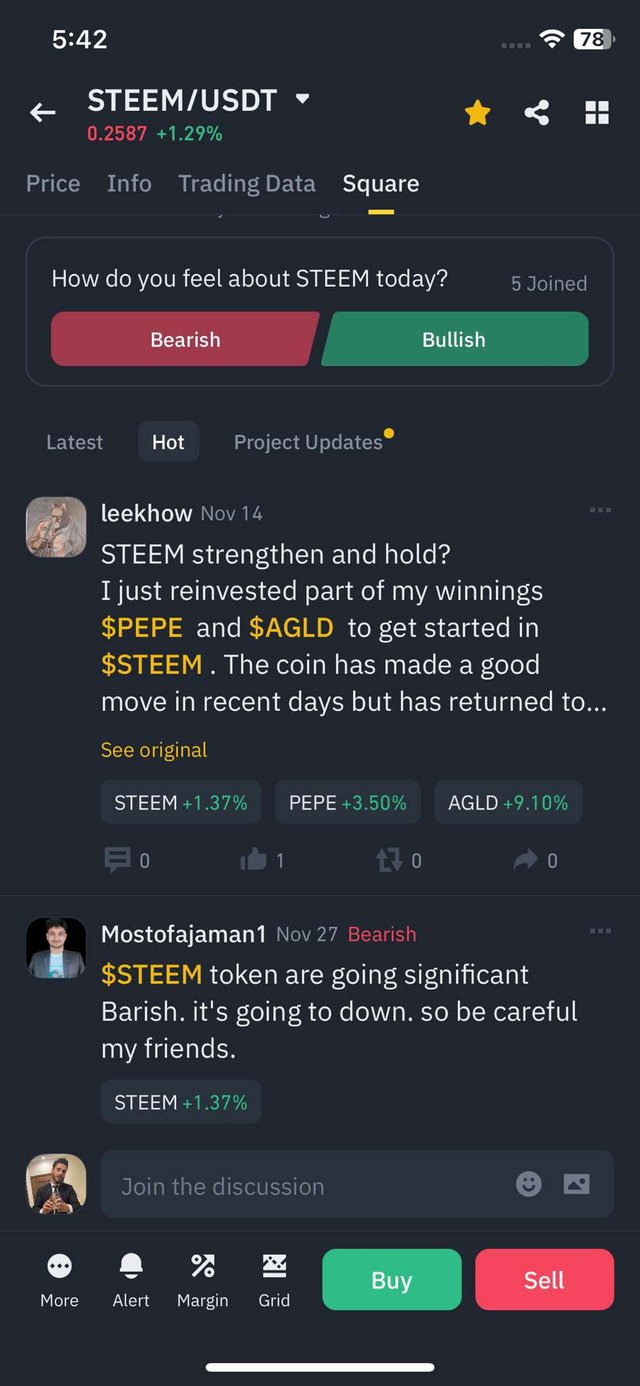

How do you feel about Steem today?

Here yo you can read people sentiments about Steem coin, which really help us a lot deciding our future plan for this coin. Many reviews are in favor of bearish trend continuation for STEEM. If we see it with other data analysis it was bearish too. So this is how we practically keep these news parallel and go for our final decision.

Question 4: Developing a Sentiment-Based Trading Strategy. Create a sentiment-based trading strategy for Steem, incorporating both on-chain data and sentiment indicators. Outline entry, exit, and risk management criteria tailored to bullish and bearish sentiment phases. |

|---|

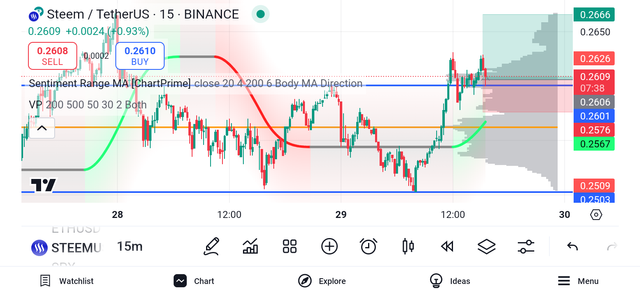

This is the current STEEM/USDT market on 15 minutes time frame. You can see a sentiment indicator along with some support and resistance lines. Let's make our trade using technical analysis, sentiment indicator and onchain value such as volume.

If we see the current market we are having a good opportunity here for long position. We can see an up spike from sentiment indicator which signals an uptrend. Technically the market as at support level too and volume indicator also show us a huge volume zone. Increase volume mean more buying and selling occur at this place. Technically if the price is in upward movement and volume is increasing too we should see for an up ward move.

Our entry point here in this trade is 0.26. Our Stop loss is 0.2576 and we can take profit at 0.2666. This is 1:2 risk to reward trade.

Question 5: Limitations and Best Practices in Sentiment Analysis. Discuss the challenges and limitations of market sentiment analysis, such as delayed reactions or misleading signals. Provide tips for improving the reliability of sentiment-based trading strategies. |

|---|

Delayed Reactions Sentiment data most of the time reflects past events and they might not align with real-time market conditions. For an instance, social media sentiment or news articles may lag behind price movements, causing traders to react too late.

Misleading Signals The biggest drawback of sentiment indicators that, it could be influenced by irrelevant noise, such as fake news, rumors, or coordinated efforts to manipulate perceptions. Such false signals always mislead traders into making suboptimal decisions.

Data Source Bias Relying solely on specific platforms (e.g., Twitter or Reddit) can introduce biases, the opinions on these platforms might track us, as they don't represent the real broader market sentiment.

Overreaction to Extreme Sentiments We can see a situation where markets may temporarily overreact to extremely positive or negative sentiment, it results in creating short-term volatility but not always reflecting long-term trends.

Lack of Universality

It's not hundred percent guaranteed that sentiment analysis will work consistently across all markets, sectors, or asset classes. Sometimes we can see a quite unexpected result. For instance, sentiment-driven strategies might be more effective in cryptocurrency markets, but it might not work in traditional equities.

Integration with Other Factors

We can't go for sentiment analysis only. It alone is rarely sufficient for making any decisions. It ought to be combined with technical, fundamental, or macroeconomic analysis, which adds complexity.

Best Practices to Improve Reliability

Use a Multisource Approach Always try to collect sentiment data from diverse sources, such as news, social media, and other forums, to reduce platform-specific biases. It will help you gaining too much confirmation.

Combine Sentiment with Other Indicators Always use sentiment as a complementary tool alongside technical and fundamental analysis to validate trends or signals. Also try to employ advanced techniques to filter noise, detect fake news.

Time-Sensitive Analysis Give Priority to real-time sentiment analysis and do align it with short-term trading strategies to capitalize on immediate market reactions.

Monitor Extremes for Contrarian Signals Extreme sentiment (e.g., excessive optimism or pessimism) can show us overbought or oversold conditions, presenting the best opportunities for contrarian strategies.

Backtest Strategies Must test sentiment-based models on historical data inorder to evaluate their effectiveness under various market conditions and situations and improve predictive reliability. We should Integrate macroeconomic and geopolitical factors into sentiment analysis to make sure a broader perspective and view of the market, as sentiment often interacts with these elements.

This is all about my blog for today, hope you guys have enjoyed reading it. See you soon with a new amazing and interesting topic, till take care.

| I would like to invite: @goodybest, @ripon0630, @beemengine, @tommyl33 to participate in this Contest |

|---|

Your presence here means alot

Thanks for being here

Regard shahid2030