SEC S18-W3 || Psychology and Market Cycle.

|

|---|

Hope you all are doing well and good and enjoying the best days of your life. This is me @shahid2030 from Pakistan and you are here reading my post. You all are welcome here from the core of my heart.

This is my participation in a contest Psychology and Market Cycle organized in SteemitCryptoAcademy by @crypto-academy.

Describe the psychological progression of investors through the stages of optimism, excitement, euphoria, anxiety, denial, fear, despair and hope. How does each step influence investor behavior? |

|---|

The psychological progression of investors via these stages reflects the common emotional responses of them to market behavior. Each step influences the investor behavior in it's own way. By understanding this progression, it helps the investors to recognize the emotional biases that can lead to poor investment decisions. In market experienced investors always strive to remain objective. They employ strategies to mitigate emotional responses and making decisions based on fundamental analysis rather than market sentiment.

Let discuss these stages one by one.

Optimism

The investors are in the positive mood with the hope that their investments will yield good returns. The positive news, strong economic indicators, or initial gains are the various reasons giving them positive vibes about market.

Behavior: They are more interested to invest additional capital, feel very much confident about their decisions and they don't care small setbacks.

Excitement

The initial optimism turns into excitement as the investments start to perform well. When Investors see their portfolios growing and they are gaining profit, it thrill of their potential and heightens their enthusiasm.

Behavior: This is the stage where the traders are too much encouraged and hopeful. They might increase their risk tolerance, and do more aggressive investments. This is a self-reinforcing cycle, where you sometime convince other to join you.

Euphoria:

This is the peak of emotions, where the traders are too much sure that the market will continue to rise indefinitely and they will get high profit from the market. It make the traders more and more greedy.

Behavior: The Investors become overly confident. They start buying frequently at inflated prices, leveraging their positions, and somehow ignoring warning signs. This stage often precedes a market bubble.

Anxiety

At this stage the market starts volatility, due to which some investment starts losing values. It makes Investors anxious as the market no longer meets their heightened expectations.

Behavior: They are a bit anxious about their decision but often hold onto their investments, hoping for a rebound.

Denial

As losses start accumulating, investors may enter a state of denial. They refuse to acknowledge that the market has turned against them. They cling to the belief that the downturn is temporary.

Behavior: They are not ready to accept the lost. They keep holding it, and hold until double down on their investments. They try to convince theirselves that prices will recover.

Fear

Denial when continue leads to fear. Due to ignoring losses become too significant. Here finally the realization that the market might not recover soon sets in.

Behavior: Investors become risk-averse. They sell off their assets to prevent further losses. It's most often the worst possible time, the market is in extreme decline phase.

Despair

This is the worse emotional point, where investors feel a sense of hopelessness and regret. Too many are already exited the market, having already done significant losses.

Behavior: This is the abandonment phase for many investors. The abandon the market entirely, vowing never to return. This capitulation most often occurs near to the market's bottom.

Hope

This phase starts as the market begins to stabilize and show signs of recovery. It gives hope to some investors in the market. They re-enter the market, with hopes driven by the desire to recoup losses and participate in the recovery.

Behavior: The investors try to focus on more safer investments. They diversify their positions to manage risk better.

Using a chart showing a recent movement in the price of a cryptocurrency (without date/time), identify which emotional stage of the market cycle the chart likely represents. Justify your answer by discussing behavioral signs that investors might exhibit at this stage. |

|---|

For the identify of the emotional stages of market cycle, we need to analyze specific patterns and trends that reflect investor sentiment. Let me give a hypothetical description of different stages of recent cryptocurrency on price chart.

Optimism

Chart patterns: It has a gradual upward trend with occasional minor pullbacks. You can see here on chart. This is one hour chat of STEEM/USDT pair, which is in gradual uptrend with minor pullblacks.

Investors behavior to such market: The buying interest increase, results in steady accumulation of the cryptocurrency, positive sentiment and Investors looks confident.

Excitement

Chart Pattern: This is sharper upward trend with increasing trading volume. We see huge liquidity in the market. Here is an example of SOL/USDT pair on one day time frame chart. We can see a steep upward move with increasing volume.

Investors Behavior to such market: They are more aggressive in buying, sentiments in market becomes more positive, and new investors start entering the market. Everyone is hoping a huge profit at this stage.

Euphoria

Chart Pattern: This is a steep upward spikes, possibly parabolic moves, with extremely high volume. Here long candles are made with high volume. You can see STEEM/USDT pair on one hour time frame have steep upward move with long spikes. The volume indicator show a huge volume during this period too.

Investors Behavior to such market: Their is a widespread belief from investors that prices will continue to rise indefinitely, and they are expecting high liquidity here. They go for long position with huge leverage. The Investors show overconfidence and completely ignore risk matters.

Anxiety

Chart Pattern: We see raise in volatility. The market takes sharp pullbacks followed by attempts to recover, but with lower highs. This is again STEEM Coin on 15 minutes time frame, here we see a down trend followed by many pullbacks. Some are large pullbacks, while some are small ones. The market is making lower lows, which we can say that we are in downtrend.

Investors Behavior to such market: The Investors start getting nervous. They are curious about their positions and questioning it. There could be an increase in cautious discussions, but many of them still hold onto their investments hoping for a rebound.

Denial

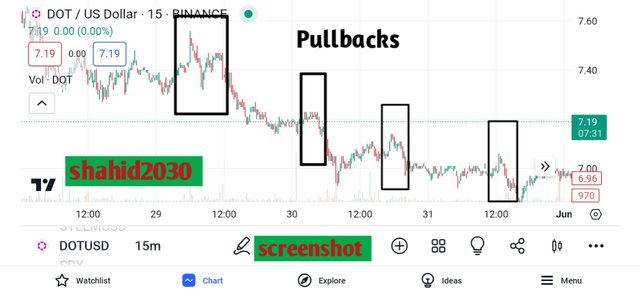

Chart Pattern: A significant downtrend but with some sharp upward corrections, we mostly call it, dead cat bounce. This is DOT/USD pair on 15 minutes time frame. We see dead cat bounce in this chart. DOT is moving downward, but also shows some pullbacks.

Investors Behavior to such market: The investors are still holding there positions, convincing themselves that the downturn is temporary and the market will recover soon. They refuse to accept market has gone against them.

Fear

Chart Pattern: This is now a confirm downtrend, which breaks previous support levels with high volume on sell-offs. It's the same DOT/USD pair on one hour time frame. Here we see a breakdown of major support by the market. It's in fear stage now.

Investors Behavior to such market: We see too many negative things happening together, Panic selling, significant reduction in trading volume, and pervasive negative sentiment. Those Investors who focus on minimizing loss, leads to double lost to them.

Despair

Chart Pattern: This is a prolonged low prices with too less volatility, and a flat downtrend with low volume. This is WLD/USDT pair we see a flat down trend with very low volume. You can see the volume indicator is giving a low volume during this down phase of the market.

Investors Behavior to such market: This is the most hurting situation for the investors. They are almost out of the market. Their mood is extremely negative, and many vow never to return to investing.

Hope

Chart Pattern: We see early signs of market recovery, a slight upward trend with increasing volume. This is again WLD/USDT pair on one hour time frame, we see a little up move in it's price and also some liquidity came during the early upward movement.

Investors Behavior to such market: Optimism begins to re-emerge. We see some investors coming back and start to re-enter the market, looking for signs of a sustained recovery. They have again positive believes about the market.

Discuss how an incorrect mindset, such as the belief that "this time it's different," can affect an investor's decisions and potential returns. How does this mentality typically affect a person's performance in the market during volatile phases? |

|---|

The belief that this time it's different may significantly impact investor's decisions and potential returns to them. It most often leading to poor performance, especially during volatile phases of market. Here’s is some of my points how this mindset can influence investor's behavior and outcomes.

Overlooking Historical Data

In crypto history does repeat itself. Some investors may ignore historical data and trends, keeping believes that the current market conditions are unique and that past performance is irrelevant. This increase a losing chance of them in the current scenerio, and it happens only because of their disregard to the valuable lessons learned from previous market cycles.

Underestimating Risk

Some traders underestimate the current market situation. The believe that the market is an unprecedented situation and also assume that traditional risk factors do not apply, which leads to overexposure in certain assets or sectors.

Herd Mentality

This mindset often coincides with herd behavior, where the investors are effected by FOMO. They follow the crowd under the assumption that the market is experiencing a unique paradigm shift and it might give them a good profit. This behavior of them create bubbles, and when the bubble bursts, these investors suffer significant losses.

Poor Timing Decisions

Wrong time entry is the problem with many investors and the greatest reason is they are not psychologically ready for crypto trading. Investors who think "this time it's different" come under this category, who always enter or exit the market at the wrong times. During market peaks, they may continue to buy into overvalued assets, because they can't control their emotions seeing an asset growing so rapidly. They expect it will continue to grow. The same thing they do in down trend, they don't sell their assets, hoping it will rebound which results in double lost.

Ignoring Diversification

Diversification is the best strategy of investment. In crypto it really help a trader reducing lost risk. Some investors completely neglect the importance of diversification. They invest heavily in specific sectors or stocks that are perceived to be part of the "new paradigm". They face big loss when the favored sector or stocks underperform.

Impact on Performance During Volatile Phases

Market Peaks: During market peaks, the mentality this time it's different may lead to buying at higher prices. The investors face a significant loss when the market set correction.

Market Downturns: In downturns, some investors think opposite. This time it's different concept make them holding on to losing positions for too long, hoping for a rebound that might not happen, leading to deeper and even double loss.

Recovery Phases:

During recovery phases, these investors might be too cautious. They miss out on potential gains, due to the trauma of previous losses. The market is really in recovery phase, but they still have a kind of disbelief in their mind.

The same happened to me during the recent crush of BTC due to LUNA. When it touched $15k level, I thought BTC's game is over, it will never gain it's value again. When it reached $30k level, in understood BTC has started recovering, but still had fear and trauma of previous crush in my mind. I missed out grabbing that opportunity to invest.

Examine a specific incident where significant FOMO (fear of missing out) or FUD (fear, uncertainty, and doubt) impacted the price of the STEEM token. Discuss how this sentiment influenced trading behaviors and the price of the STEEM token. Also suggest strategies that STEEM investors could use to avoid making decisions driven by these emotions. |

|---|

One notable incident that hit Steem, leading to create FOMO and FUD and significantly impacted the price of the STEEM token occurred in March 2020. This is a very famous incident and those know it better who is following steem for long time and know it's history.

It was the involvement of Justin Sun(the founder of TRON) in Steem Blockchain. He is ofcourse a prominent figure in the crypto world and his involvement in Steem token lead to many spiculation in the market.

Incident Overview and It's Background

In early 2020, Justin Sun purchased Steemit Inc. Steemit Inc is the company behind STEEM blockchain. STEEM community showed a huge response to this acquisition. They feared STEEM will loss it's decentralization and one person (Justin Sun) will get control over the blockchain.

However a group of STEEM witnesses (block validators) went with a new plan. They initiated a soft fork to limit Sun's influence by temporarily freezing the STEEM tokens owned by Steemit Inc.They think by doing so they will make STEEM Blockchain a completely centralized one like before. Now that incident led to FUD and FOMO at that time. Let's talk about it too.

FUD Phase

Announcement of the Acquisition:News of Justin Sun's acquisition greatly disturbed the community. It created uncertainty and fear among the STEEM holders. The greatest fear had in their mind was, that Sun would centralize control and alter the fundamental aspects of the blockchain, which they don't want at any cost.

Soft Fork 22.2: This was the community's response to Justin Sun's acquisition. They attempted to counteract Sun’s influence by freezing the tokens added to the uncertainty. It resulted to a significant debates and further divisions within the community.

FOMO Phase

Hard Fork 23: To counter the community's response, Justin Sun shown his own cards. He along with a few exchanges (Binance, and Poloniex, Huobi,), used their STEEM holdings to vote out the existing witnesses and replace them with ones obeying and are favorable to Sun. This incident created FOMO in the market, resulted in temporary spike in the price of STEEM as speculators rushed to buy in anticipation of potential changes and perceived opportunities.

Impact on STEEM Price and Trading Behavior

Initial Drop (FUD): The announcement of the acquisition and subsequent community's reaction caused a significant dump/drop in STEEM’s price. Too many Investors sold off their holdings due to fear factors. They afraid of centralization and loss of control, which led to a sharp decline.

Volatility Spike (FOMO): The unexpected counterattack by Justin Sun and the exchanges' involvement led to a huge increase in trading volume and price volatility. Many traders in the market have bought STEEM in anticipation of Sun's potential influence bringing positive changes or increased visibility to the token. They saw potential with in this token and many people have earned good revenue from it at that time.

Strategies to Avoid Decisions Driven by FOMO and FUD

Education is must: Investors should stay informed about both the fundamentals and technical news. They should investigate major events, as in case of STEEM 2020 was a crucial year for it. Better Understanding can provide a clearer picture and reduce lost risk.

Diversify Holdings: This is my most favorite trading strategy here in crypto trading. Diversification mean, avoiding putting all investments into one token and investing it across various cryptocurrencies. It helps mitigate the risk associated with the volatility of any single asset.

Set Clear Investment Goals: You much have a clear trading strategy and goal. The best thing is to have a long-term strategy and stick to it. Always define your risk tolerance and investment horizon, and must avoid making decisions based solely on short-term market movements.

Use Stop-Loss Orders:Implemention of stop-loss to your orders can help manage risk by automatically selling off assets when they reach a certain price point. It helps keep you safe against significant losses.

Seek Professional Advice:Consult an expert financial advisors or market analysts who can provide you an objective view and help make you informed about the market matters. Don't follow the crowd decision, try to make your own decision based on true fundamentals and technical analysis.

Explain the logic behind the “buy red and sell green” strategy. Create a hypothetical scenario in which this strategy could be applied effectively and discuss the psychological challenges an investor might face when trying to implement this strategy amid an actual market downturn and subsequent recovery. |

|---|

The buy red and sell green is simple investment strategy. It is an approach that suggests purchasing stocks when the market is declining (red) and selling them when the market is rising (green). The logic behind this specific strategy is rooted in the principle of buying low and selling high. It's aim is to capitalize on market volatility and investor overreactions.

Example through a Hypothetical Scenario

We have an investor Jeanie. She is monitoring a company having gold shares. This company is considered a strong one, have good fundamentals too, but a little volatile, because of market sentiments.

Let's suppose a global economic report causes widespread panic. This gold company's price drops 20% from $100 to $80 in a single day (market is red). Jeanie believes that the dump is temporary and is driven by fear rather than fundamentals.

She buys 100 shares of that company at $80 price each, with a total investment of $8,000. Remember the market is dump (red) here so this is now buying red. In the next few months, the panic subsides. Gold start recovering it's price and the company also shares some of it's strong fundamentals. The stock price rises to $120 (market is green).

Jeanie sells all her 100 shares with the price of $100, means she revives a total of $12k. This is sell in green market, so this is actually what we can green selling. She will get a profit of $4k which is the 50% of her total investment.

This is what we call Red buying and green selling and this is how we can get profit using this strategy.

Psychological Challenges

Yes ofcourse implementing Red buying and green selling in real life needs a lot of courage. Here are several psychological factors that make this strategy more challenging.

Fear During Downturns

When the market is declining, its obvious that fear and panic are common emotional responses. Traders hesitate of buying more and they are afraid of further loss. This psychological discomfort of losing money might overpower the logical decision to buy low and they miss the best entry.

Greed During Upturns

Some investors hold their position for too long, a greed factor is involved here. In raising market greedy investors are always hoping of more and more gains, ignoring the risk of a potential downturn. Their profit sometimes make them overconfident that they completely ignore best signals to sell.

Herd Behavior

Some traders follow the crowd actions, rather than following the best fundamentals and technicals news. They buy during booms and sell during busts, which is completely opposite of buy red and sell green strategy.

Short-Term Market Noise

To understand volatility in the market is a major issue with many traders. Short-term price fluctuations creates doubt in their minds. They become afraid with just a little dump and start questioning their strategy. Many take wrong exit due to the fear of lost.

This is all about my blog for today, hope you guys have enjoyed reading it. See you soon with a new amazing and interesting topic, till take care.

| I would like to invite: @waterjoe , @willmer1988, @mile16, @pelon53, @goodybest, @ripon0630, @hotspotitaly, @hardphotographer, @kouba01, @msharif @cive40 to participate in this Contest |

|---|

Your presence here means alot

Thanks for being here

Regard shahid2030

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Nice information. I feel the emotions Excitement and Denial are the most important and investor should make self stong with these emotions.

Thank you so much dear friend for your beautiful comment. Keep blessing.

Your post has been successfully curated by our team via @steemdoctor1 at 35%.

Thank you for your committed efforts, we urge you to do more and keep posting high-quality content for a chance to earn valuable upvotes from our team of curators and why not be selected for an additional upvote later this week in our top selection.

Thank you so much dear for your precious support. It's really motivate me to work even more hard here.

You have articulated your contemt well. Here are my reflections on few points :

That's correct. Investors often go through similar emotions as the market changes. By understanding these stages, they can better manage their feelings and avoid making bad decisions based on emotions.

You are right. When investors feel optimistic, they believe their investments will be successful. This positive attitude can encourage them to invest more, but they also need to be careful of becoming overconfident.

Absolutely true. Thinking that the current situation is unique can lead investors to ignore past lessons. This can cause them to make risky choices, especially in volatile markets, and can result in big losses.

Good luck

Thank you so much dear for your brief comment here. Keep blessing.

Indeed , "FOMO and FUD significantly impacted the price of the STEEM token." It's crazy how emotions drive the market!

Yes dear you are right too. Thank you so much for your beautiful comment. Keep blessing.

😊😊😊

Greetings friend,

Basically, Our psych plays a big role in everything we do, therefore FOMO and FUD are emotions that can make people buy or sell cryptocurrencies like the STEEM token based on those feelings rather than the actual value or performance of the token. So, when a lot of people start feeling these emotions, it can cause big swings in the token's price. It's like a rollercoaster ride driven by how people are feeling at the moment.

Good 👍 luck in contest friend.

Hey dear friend your consistency in you creating high quality articles on this community it's top notch. Such high quality skill should be valued and should be rewarded.

One type of negative character or what I say negative psychological emotion that human being portrays when it comes to anything concerning finance or money is greed. Greed could make traders lose so much money due to the fact that they want more than they can ever have immediately.

Thank you so much friend for sharing sword high quality article at your free time you can also check my through the link belowhttps://steemit.com/hive-108451/@starrchris/steemit-crypto-academy-contest-s18w3-psychology-and-market-cycle

Thank you my dear friend for your precious response. Keep blessing.

There are many factors that influence market cycles to occur. Not because of minimal knowledge, but also because we are humans who want to profit from what we want, especially since trading is one of the easy ways to make money.

However, beginners forget that trading does not only require intelligence, there are rules and discipline that must be followed, including guiding oneself so as not to fall into the emotional game of the market.

Thank you for your post, good job friend, good luck in this week's contest....

👍👍👍