[Cryptocurrency Triangular Arbitrage]-Steemit Crypto Academy | S4W4 | Homework Post for @reddileep

1- Define Arbitrage Trading in your own words.

Arbitrage trading is a technique of trading in which a trader can earn a good and quick profit if performed with some skills and experience. Here I'll try to explain arbitrage trading in very simple language which will be useful to other users also.

I remember in December 2017 where P2P trading was not much in use, people were rely on different websites and applications to buy bitcoin. There was a platform named Zebpay. The difference in the price of buying and selling was so huge (approx. 1.5k to 2k USD). This was due to a monopoly in the market at that time. Then, many exchanges started providing services of buying and selling and then the difference was reduced to much extent.

Now, if talking about Arbitrage trading, here a trader take advantage of the variation in the price of the same asset in different exchanges.

Let us suppose, the price of bitcoin in binance exchange is 45000 USD and at the same time, it is 45300 USD in localbitcoin.com ( I have purchased many BTCs from this website). Here, the opportunity comes for a trader trading with an arbitrage strategy. If he is buying 1 bitcoin from the binance and transferring it all to the localbitcoin.com website, he will get around 300$ (considering transfer fees) very quick profit in a very short time(considering 25-30 minutes delay in transferring the bitcoins).

The same pattern can be followed in one exchange where a trader buys a coin and exchange it to next two coins and return to his previous coin. He finds that the amount of initial investment increased a little.

Here, to make this strategy more profitable and to increase its assurance to be successful, a trader needs to be quick enough to avoid the big price change because sudden price change in the opposite direction can give huge loss also.

Also, if performing this strategy in two different exchanges, a trader should not avoid transfer fees because very low capital profit can be reduced or result in loss. So, always high initial capital is recommended to achieve good profit.

2- Make your own research and define the types of Arbitrage (Define at least 3 Arbitrage types)

I have done my research and studied a lot about arbitrage and its types. As asked in the question, I will discuss only three types of arbitrage trading.

a). Exchange Arbitrage:

Talking in context to crypto-only, in this type of trading, the trader takes advantage of the difference in the price of crypto at different exchanges. He buys a crypto coin from an exchange at a lower price, transfers the coins to a different exchange and immediately sells those coins at a higher price.

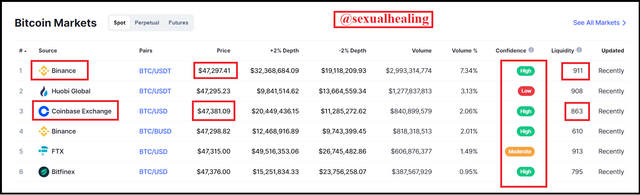

To know the price variation of any crypto, I prefer to search it on coinmarketcap.

source

source

To choose the best exchanges, we should watch the volume and liquidity. Also, I use to prefer those exchanges in which coinmarketcap indicates high confidence. Usually, price varies due to variations in volume and liquidity. Small exchanges such as Kucoin have less volume in almost every coin.

In the above screenshot, I have searched the price of BTC in different markets listed on coinmarketcap. We can see that Binance and Coinbase exchange having high liquidy, volume and high confidence indication, the BTC is trading at 47297$ and 47381$ respectively. The difference in the price of Bitcoin is 84$.

That means for a one time buy and transfer of coins from binance to the selling of coins in coinbase exchange, it is giving 84$ sure-shot profit and in very short interval.

b). The risk or Merger Arbitrage:

This is the arbitrage strategy that is usually seen in stocks trading. Most of the time, we see the news of merging small companies with big companies. For example, Facebook acquired WhatsApp and Instagram, merging different banks and industries. This type of news usually put a bullish impact on the shares of small companies. A trader takes advantage at the right time and buys many shares of small companies which are in the news of merging and hold till the big boom.

Mostly a trader takes good profit in these types of news but sometimes another news comes that this news was fake and it was circulated due to hacking of the Twitter account of the CEO. In such a case, the trader affords a big loss.

c). Triangular Arbitrage:

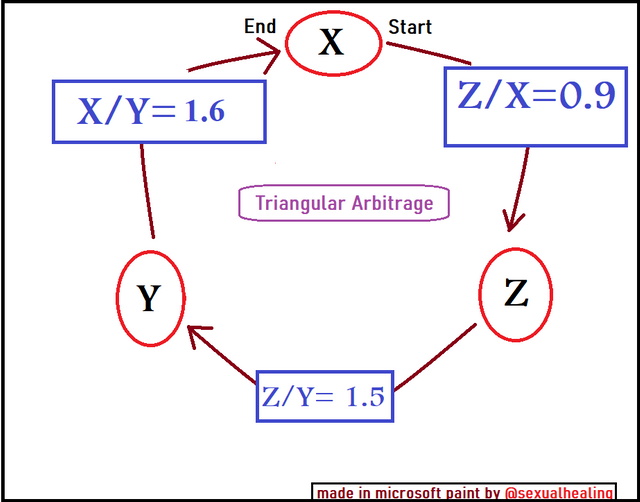

This type of trading is very interesting and requires little alertness. This can be done in a single exchange or more than one exchange. In Triangular arbitrage trading, we choose three different crypto coins and trade them simultaneously and return them back to starting currency to achieve good growth in the value of initially invested coins.

3- Explain the Triangular Arbitrage Strategy in your own words. (You should demonstrate it through your own illustration)

As discussed in the above question about Triangular Arbitrage, it is the trading where the trader trades in three coins simultaneously and when the trader returns to its initial currency he finds that some value has been increased in currency. I have explained this in the picture below.

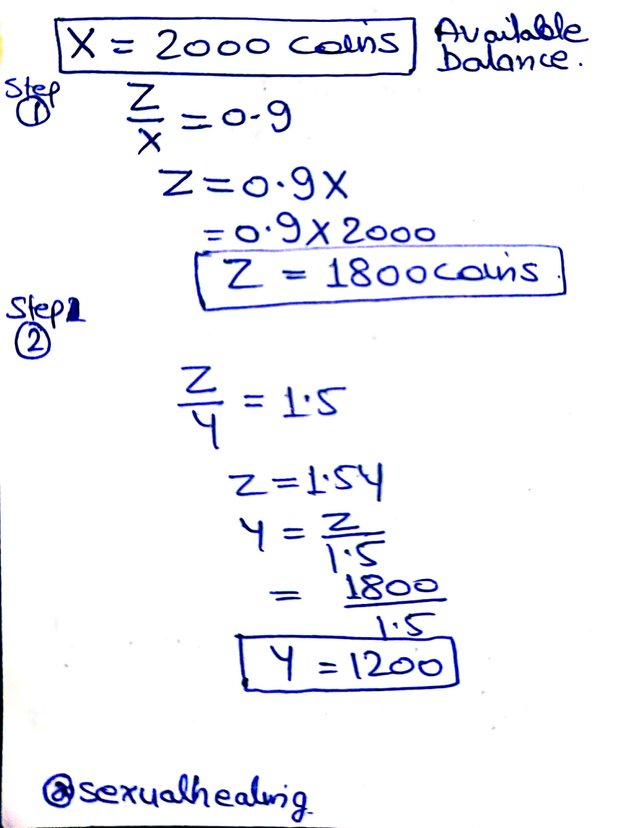

Let me explain it hypothetically,

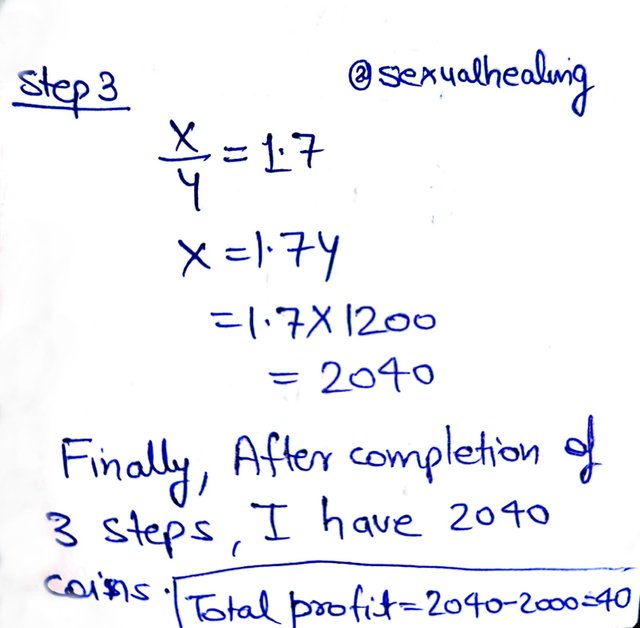

Suppose a trader has 2000 coins named X as initial funds. Now he exchanged it with another coin named Z with a current price of Z/X = 0.9. He got 1800 coins of Z. Now, in the second step, he exchanged all the coins of Z with the coin Y with the exchange rate of Z/Y = 1.5. He got 1200 coins of Y. In the third step, he exchanged all the coins of Y to the initially invested coin that is X with the exchange rate of X/Y = 1.7. Now, he has 2040 coins of X.

That means he got a profit of 2040-2000 = 40 coins

See the screenshot (1) and (2) below.

4- Make a real purchase of a coin at a slightly lower price in a verified exchange and sell it in another exchange for a higher price. (Explain how you get your profit after performing Arbitrage Strategy, you should provide screenshots of each transaction showing Bid, Ask prices)

To perform this task, I have chosen two different exchanges that are Kucoin and Binance.

I saw that there was a good variation in the price of TRX/USDT.

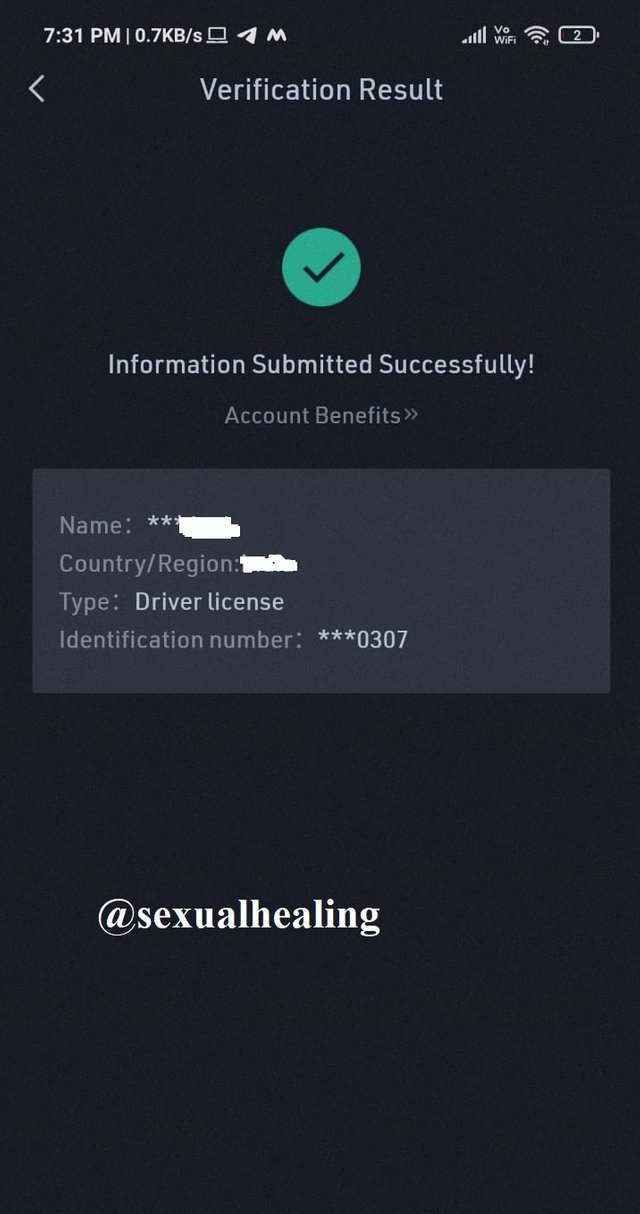

First of all, I am showing a screenshot of my verified Kucoin exchange.

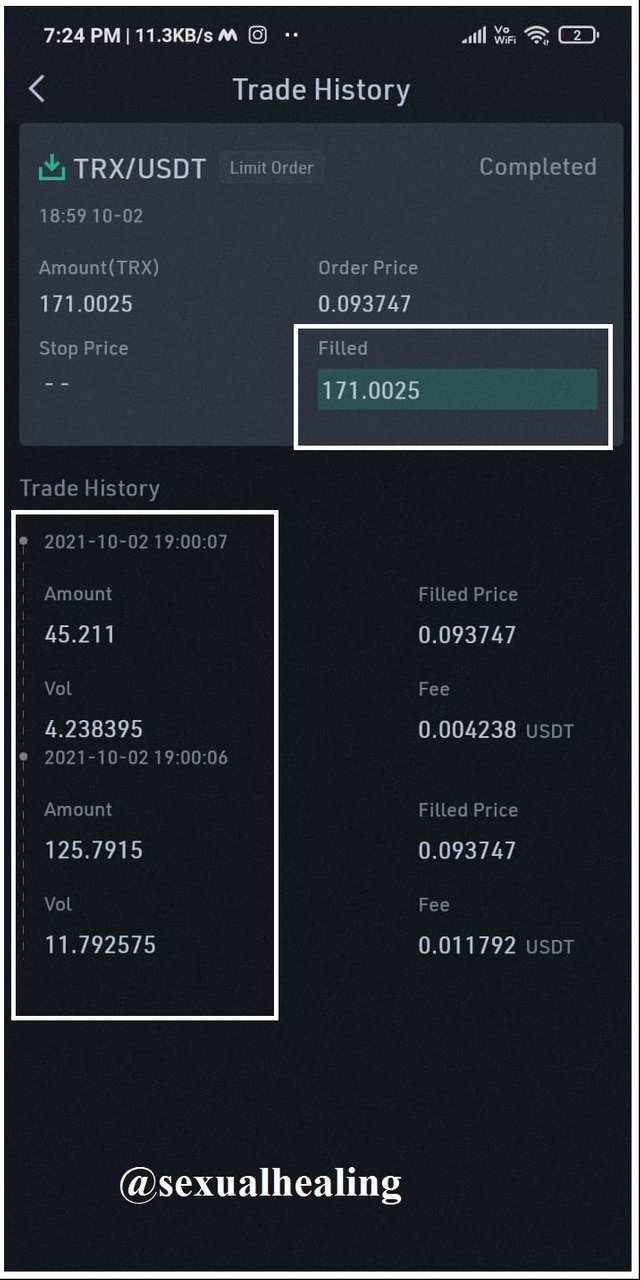

In the screenshot below, you can see that I have bought 171.0025 TRX with a total of 16.03097 USDT which was available in my kucoin.

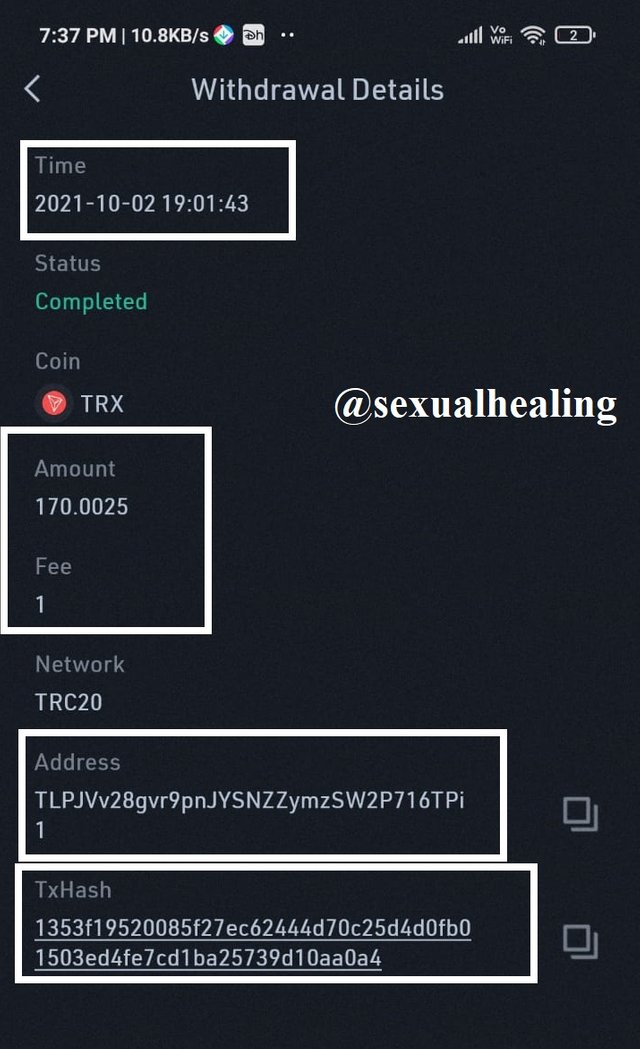

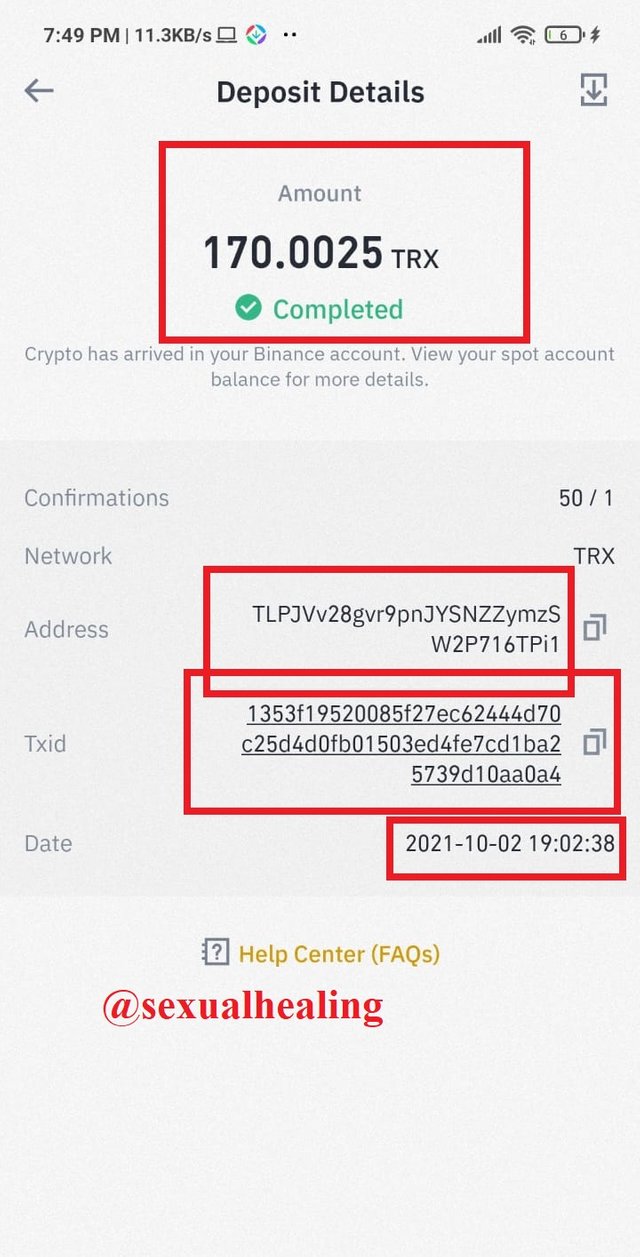

Then I made an instant withdrawal of 171.0025 TRX coins to the verified binance exchange. You can see that I have received only 170.0025 TRX to the binance exchange because 1 TRX was deducted as transaction fees.

In the screenshot below, I have also provided TXN ID so that my real transaction can be tracked.

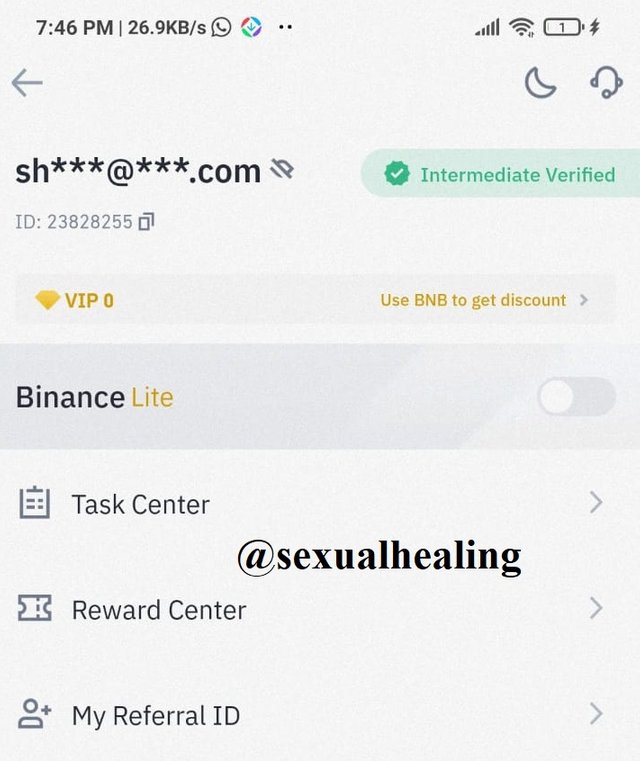

Now, I am sharing the screenshot verified binance exchange.

Now, I am sharing the screenshot of the binance exchange where I received 170.0025 TRX.

After receiving I instantly sold the TRX at the current market price which was higher than the buying price.

Here from the above screenshots, you can see that I bought TRX at the price of 0.093747 USDT from the Kucoin exchange and sold all TRX at the price of 0.094080 USDT.

That means I received a profit of 0.094080 - 0.093747 USDT = 0.000333 USDT per TRX coin

For a total of 171.0025 TRX coins, I received a profit of 171.0025 X 0.000333 = 0.05694 USDT

As my capital was not very big, so certainly profit is very lesser. Big capital gives big profit in arbitrage trading.

5- Invest for at least 15$ worth of a coin in a verified exchange, and then demonstrate the Triangular Arbitrage Strategy step by step using any other coins such as BTC and ETH. (Explain how you get your profit after performing Cryptocurrency Triangular Arbitrage Strategy, you should provide screenshots of each transaction)

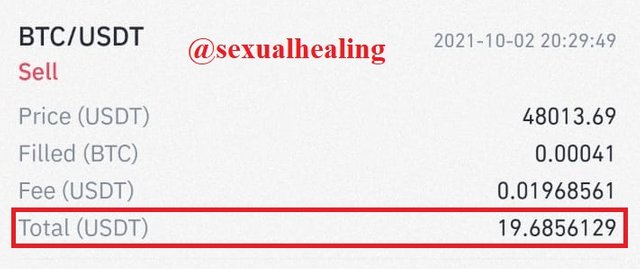

I initially had some BTC which I have converted to USDT to show the value worth >15 USD as asked in the question.

Here you can see that I had 19.6856129$ capital in terms of USDT so I am considering my initial capital equal to 19.6856129 USDT.

To demonstrate a triangular arbitrage strategy I have chosen USDT as the first crypto, WRX as the second crypto and TRX as the third crypto asset. I will exchange all three coins in a row and I will return finally to my initial form of cryptocurrency that is USDT. So, here it goes.

I bought WRX coins with all USDT.

.jpeg)

We can see little variation in the amount of USDT because when you buy or sell your crypto, a very little amount of crypto is always left in your balance due to differences in transactions fee. This can not be corrected so I am ignoring this.

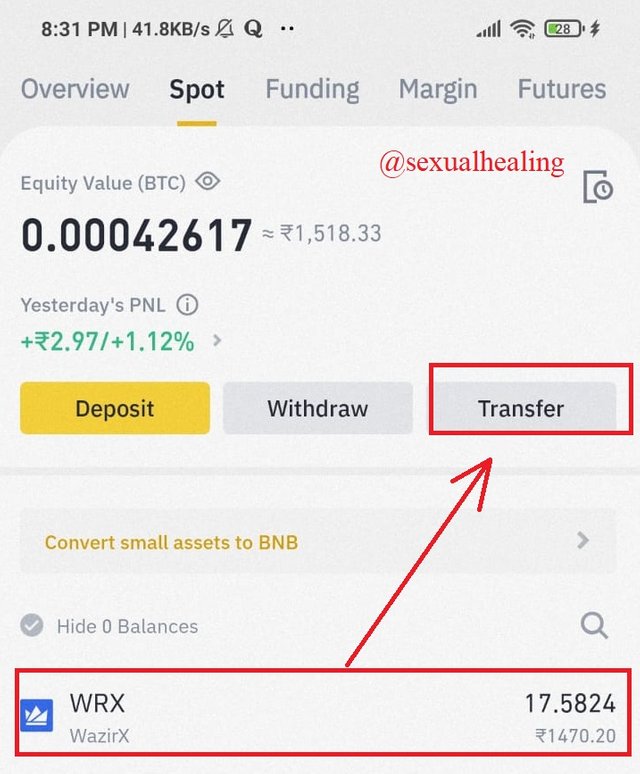

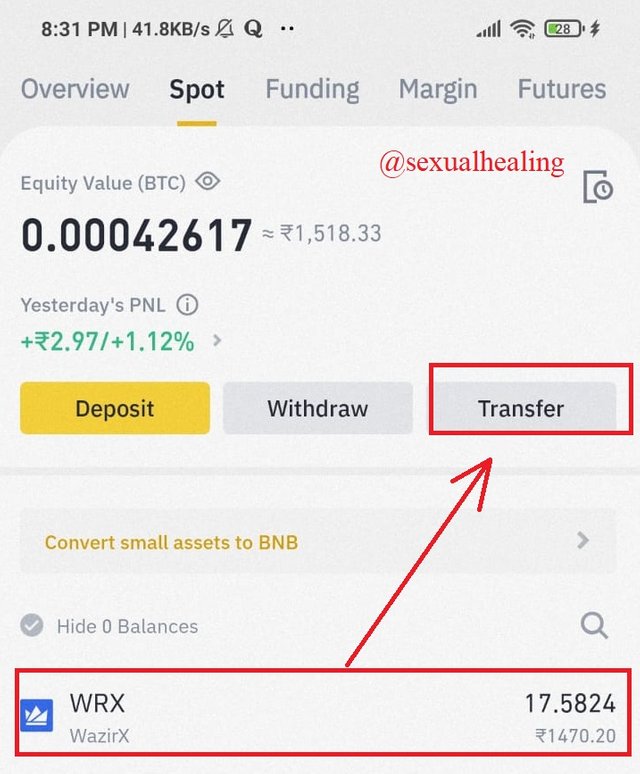

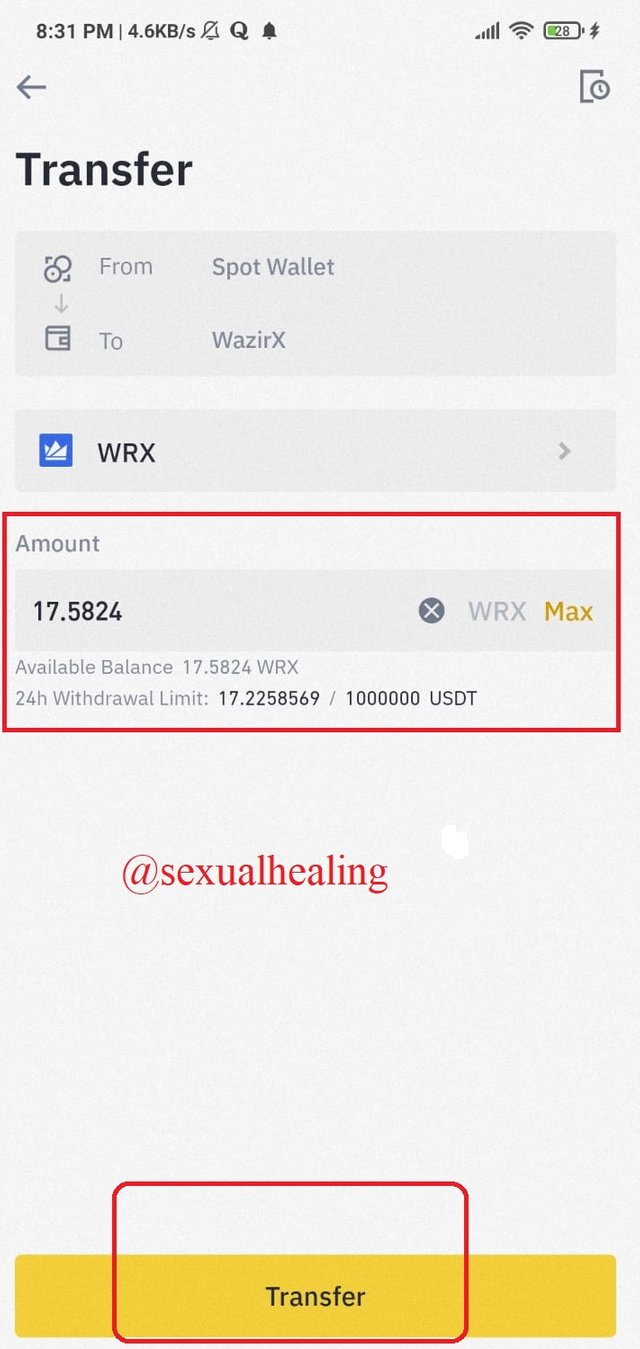

Now I transferred all WRX coins to the WazirX exchange.

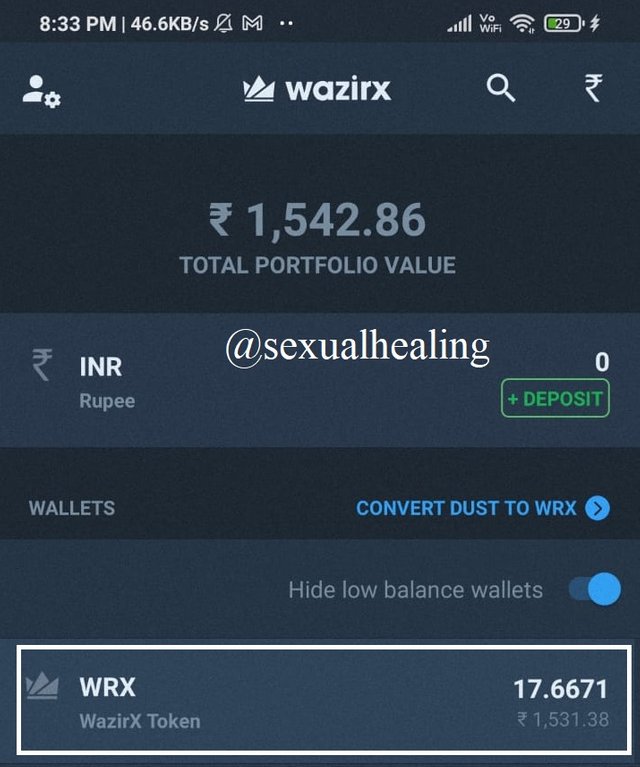

Here we can see that my balance reached to WRX exchange.

In the above screenshot, I am showing that in my portfolio little amount of WRX was already added because it was residual from few previous transactions but I have tried to exchange only that amount of WRX which was available for arbitrage strategy.

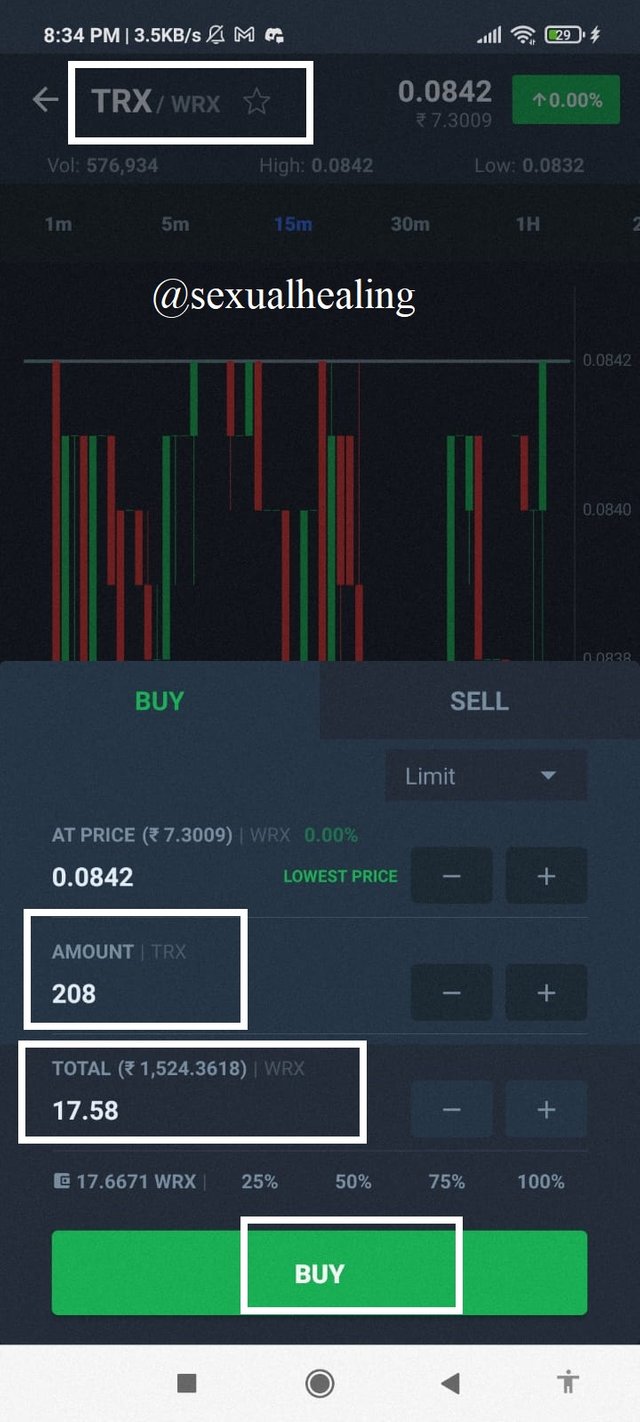

Also, from the above screenshot, we can see that I am getting 208 TRX on exchanging it from 17.58 WRX.

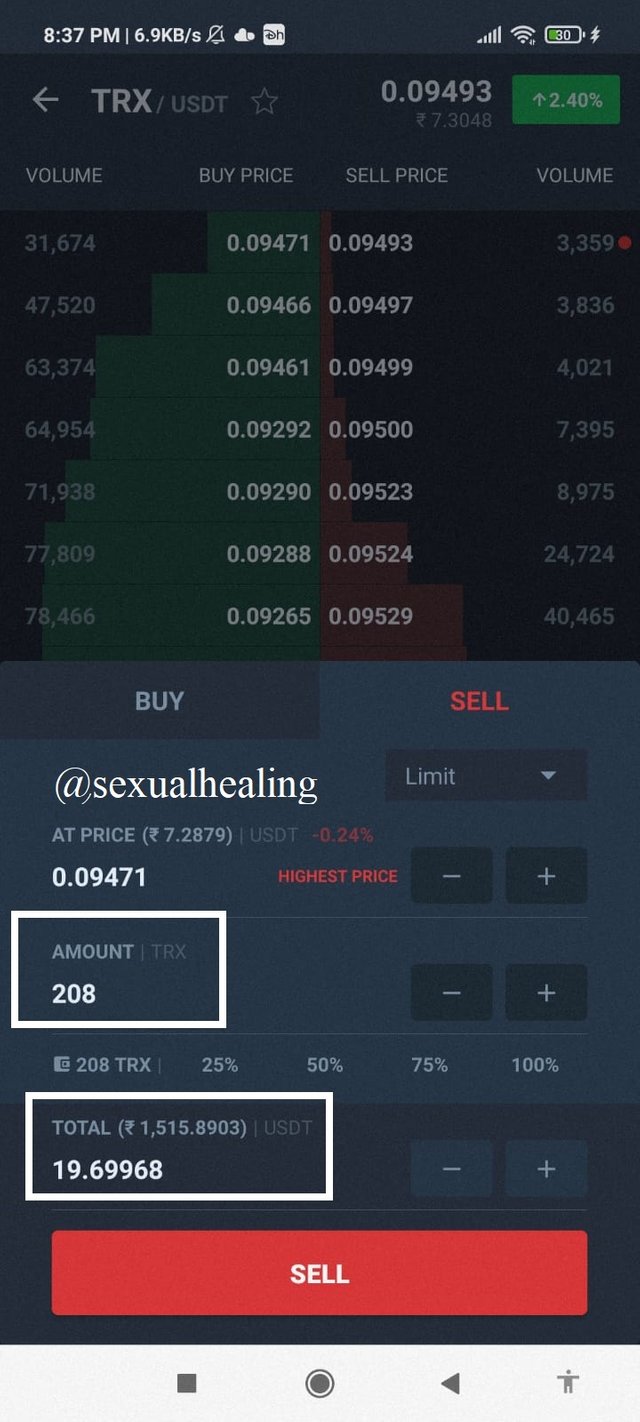

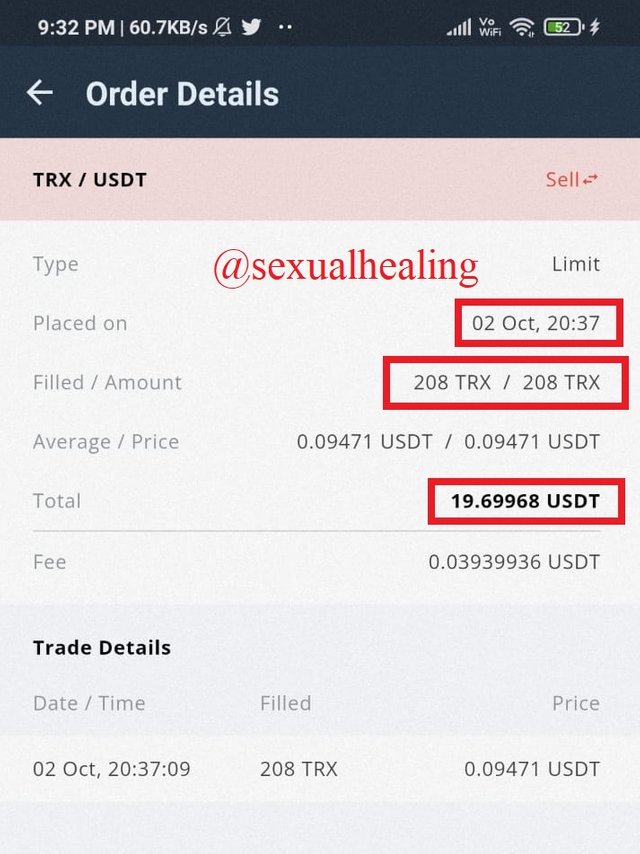

In the above screenshot, I am showing that I have exchanged all the 208 TRX with USDT to complete the triangular arbitrage and I am getting a total of 19.69968 USDT.

Remember, I considered my initial capital in USDT that was equal to 19.6856 USDT.

That means I am getting a net profit of 0.01408 USDT.

The profit I am getting is too small this is due to two main reasons,

i) The capital investment was too low and because of this profit achieved is consumed in overcoming transaction fees.

ii) The high volatility of the market minimised the difference in price at the time of buying and selling.

6- Explain the Advantages and Disadvantages of the Triangular Arbitrage method in your own words.

Advantages

- In arbitrage trading, traders do not think about waiting for clearing the bid for a long time as the trade is very quick.

- Performing arbitrage trading in a single exchange may give good profit without charging high transfer fees of different exchanges.

- This strategy is a quick profit generator and a little more promising compared to intraday or scalping.

- It is an "easy to learn strategy" which does not require professional technical analysis.

Disadvantages

- A trader may face a huge loss in a volatile market.

- Sometimes, due to low volume in exchanges, bids may take a long time to clear.

- Small funds gives very little profit which gets consumed as an exchange fee.

- For a new arbitrage trader, it becomes tough to choose the three coins for triangular arbitrage trading which can give profit.