Steemit Crypto Academy | Homework Task 7 For @stream4u | Money Management & Portfolio Management

✍ INTRODUCTION

The essence of learning Money Management and Portfolio Management is one of the best lectures here in Steemit Crypto Academy tho I am new to this but this topic intrigues me as it is one of the foundations before you manage your cryptos. Thanks to professor @stream4u for sharing his views regarding this matter and assigning us to do homework about this anyway without further ado.

Photo is from Pixabay

✨ Money Management

Money management is a method of reducing or increasing the size of a position to reduce risk while maximizing profit from a trading account. There are positive and negative components that makeup money management, and the right approach fixates on both your account's risk and reward factors. It helps in expanding your account while maintaining a risk-adjusted balance. Money management is used when trading in any market because it is particularly reliant on account performance.

It's important to wonder what type of trader you are before you decide on the best money management strategy. There's no one with the same personality as you and everybody's diverse. Trading is a psychological undertaking that requires the best approach to your character.

✨ Money Management Plan

Traders use a great deal of time to look for charts and to analyze, use or combine technical or fundamental analysis. While these are all excellent things to focus on, not all traders devote enough time to risk management and, more specifically, position sizing. I see a lot of new and experienced traders and investors who trade only to see their accounts blown up by taking random positions with no plan.

✅ Tips on How to Manage Your Money or Assets

❶ Proper size of your position is a vital point in risk management and it is possible to establish whether or not you live to trade another day. The number of shares you take on a trade is your position size. It can prevent you from too risky a business and expand your account. You can end up in businesses which are far too large for your account without knowing how to size your positions properly.

❷ When trading or investing, the size of your position, or trade, is more important than the timing of your entry and exit. You might have the suitable approach in the planet, but if your trade size is too large or small, you'll be taking too many or too few risk.

❸ There is also the opportunity cost of taking a position that represents a significant portion of your money. You'd have to forego other trades that you might have been interested in. Position sizing is a crucial issue that a trader should be aware of ahead of time and avoid doing on the fly.

✨ Portfolio Management

Any successful trader desires to make a profit. You must take some risks in order to make a profit. There is frequently a link between risk and profit. The greater your risk, the greater your reward. But don't forget about the drawbacks. High risk entails substantial losses.

As a result, a good trader understands risk management. Trading is, in fact, all about managing risks while increasing your capital. So, why would you diversify your cryptocurrency portfolio with a portfolio of cryptocurrencies?

✨ Portfolio Management Plan

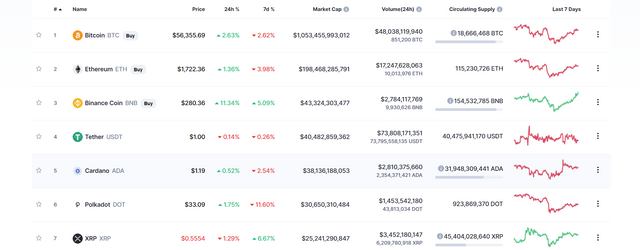

Photo is from coinmarketcap

By combining a variety of different investment strategies, diversification serves the single purpose of risk management. Your goal is to put together a group of investments that will expose your portfolio to as many different areas as possible, lowering your overall risk. The idea is that your portfolio will be able to withstand adverse events without losing too much value.

Here are the tips when I didn't diversify my assets last year!

❶ In the event that the Bitcoin price falls, you will only lose half of your portfolio's value because you were wise enough to diversify between two types of products. As a result, a well-balanced portfolio will aid you in surviving the worst market downturns.

❷ Let's first learn how to use the diversification of industry to manage risks. The idea is to expose your portfolio to as many industries as possible. In the event that a certain industry is badly hit, the diversification you have applied can absorb your portfolio.

❸ You can then invest in various kinds of products or solutions. For example, between newly developed blockchain platforms, new protocols and new tools or services such as wallets or data providers, you can spread your investment.

✍ CONCLUSION

Don't expect to find the golden crypt diversification portfolio to try and reduce the risks as much as possible. All events like Coronavirus can lead to the collapse of the world market and nevertheless slash your portfolio.

Remember, therefore, that investment is risky, but to some extent you are able to manage risk. In order to reduce the effect of global trends on your portfolio drastically, you can make smarter investments. Thanks and regards to prof @stream4u.

Hi @sennysen

Thank you for joining Steemit Crypto Academy and participated in the Homework Task 7.

Your Homework task 7 verification has been done by @Stream4u, hope you have enjoyed and learned something new in the 7th course.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

Thanks again sir @stream4u I just wonder when can I get an upvote?

thank you so much @stream4u that's a high rating! Thanks again, hope you are well

Sorry to tag you again professor @stream4u and @steemcurator02, my article doesn't have an upvote yet :( thanks!