Head and Shoulders and Inverted Head and Shoulders Pattern- Steemit Crypto Academy- S5W2- Homework post for @utsavsaxena

Greetings steemians ! I'm elated to be a part of this great and wonderful topic that has its base on further sources of quality technical analysis.

Congratulations professor on your first lesson which is a already a big source of knowledge to us. My homework task is below !

The lesson explains the head and shoulder & inverted head and shoulder patterns and we understand chart patterns to be a set of previous chart data about an asset that's implored to foretell or estimate its future price.

These head /shoulder and inverted head and shoulder chart patterns are very useful and interesting trend reversal patterns

Note :"They aren't trend continuation patterns" Let's talk more about it !

1.) Explain head and shoulder and inverse head and shoulder patterns in details with the help of real examples. What is the importance of volume in these patterns (Screenshots needed and try to explain in details)

One of the beauty of crypto-naming of patterns is their ability to explain their selves just by their names. In saying this, I mean that some crypto patterns, by their names, are self explanatory. The Head and shoulder pattern could just be likened or attributed to a living body bearing a head and two shoulders. The hierarchy of these patterns is such that the Head, remains the biggest close, while the two shoulders that is the left and right close are very similar in height and these three closes, complete the formation of head and shoulder patterns.

This pattern like I said in the first paragraph, are strictly trend reversal patterns and not continuation patterns that is used to draw /foretell prices over a period of time

The head and shoulder chart patterns have several parts and a forming anatomy which I'll love to explain :

The Left shoulder :

The left shoulder in a head and shoulder chart, is made by the a bullish movement in the value of an asset accompanied by a price reversal

The Head :

The head is the close higher than the rest two so, at the point higher than the left shoulder which is already formed, we see the Head

The Right Shoulder

The right shoulder is directly parallel to the left shoulder and similar in highs which makes a retracement and the shoots again.

Aside the fundamental three parts of the head and shoulder charts there is another basic part too known as the neck line and this is an underlying line that shows where an upward trend is begun and where a downward trend too is reversed

An example of head and shoulder pattern below

The inverse head and shoulder patterns :

The inverse head and shoulder patterns could be seen as different or even opposite from the original head and shoulder patterns. The inverse head and shoulder patterns could be defined as a pattern that shows a potential bullish reversal trend after a previous bearish trend over a period of time. The same way we gave an example of a human being's head and shoulders, this one too could be likened to a human being turned upside down ie opposite of the former. This is a very powerful and useful indicator in the market

The main parts of this inverted head and shoulder patterns include the right shoulder, left shoulder and head

Left shoulder :

when an asset experiences a bearish trend and a bullish reversal comes up afterwards, a left shoulder is formed.

Head :

The fall of the value of the asset to a lower level than the left shoulder's forms the head. Remember it's lower than the left shoulder unlike the previous one where it was higher

Right shoulder :

after the fall bringing about the head position, there is a bullish reversal that finally forms the right shoulder at almost the same point of the left shoulder

There is also a point where the bearish trend is begun and a bullish trend too reversed

below is an image of inverse head and shoulder

Importance of volumes on head and shoulder patterns :

In the Head and shoulder pattern,volume is very beneficial and important compared to other patterns in that, the increased price on the left shoulder, is accompanied by volume and the formation of the head shows a fading volume ie indicating that there's a reduction in the of demand assets and after the zeal to buy is completely exhausted by the buyers, new sellers are opportuned to buy while the older buyers are gone

On the Inverted head and shoulder pattern :

The importance of volume in inverted head and shoulder patterns is over emphasized since the formation of left shoulder increases volume and at the head point, the zeal and force to buy is reduced unlike in the left shoulder and finally at the right shoulder, the zeal to sell is no longer present in the market and the bulls take hold of the market

2.) Explaining the market psychology in Head and shoulder pattern and in Inverse head and shoulder patterns with screenshots

The psychology of these patterns, simply refer to the response, factors and behavior behind the formation of these patterns and I'll be taking the Head and shoulder chart patterns first

Under the Head and Shoulder patterns, we have the several parts that lead to it's formation and we'll start with :

Left shoulder :

The left shoulder is formed by buyers getting hold of the market (ie an upward trend) after which a reversal trend follows (buyers hold back the market) and here the initial aggressive way buyers bought is changed and instead the market is over supplied by sellers which leaves the trend bearish

The Head :

The head works and operates by buyers gaining control of the market and being intense and zealous in demand which leaves the market very bullish and this doesn't last for ever too as sellers tend to take hold again.

The right shoulder

The right is the basis of sellers taking hold of the price once more but in this case it doesn't exceed the former buyers hold as it still remains in same level of the left shoulder though sellers have taken hold

Here we'll be considering the psychology behind the formation of Inverse Head and shoulder pattern.

We must still consider what I said previously as it's the opposite of the original head and shoulder pattern.

Left shoulder :

The inverse head and shoulder pattern opens with sellers having hold and lead on the market, it's a bullish trend and buyers are struggling to hold the market and once more they do and zeal-up in buying and gain control of the market once more

The Head :

After the gaining back of the market by the buyers, the sellers aren't concluded up as they tend to hold up the market once more, which leads to a deep hold of the market and here they tend to supply much more but buyers are still trying to gain back hold which they finally do by reversing the trend but the initial hold of the market by the sellers is more outstanding here

The right shoulder :

The right shoulder aims to keep its level with the left shoulder as the head is always above the shoulders and this close begins with the hold of the market by sellers and heavy supply by them but in a short while, the struggling buyers aggressively take hold of the market and the trend is reversed to a bullish trend.

3. Explain 1 demo trade for Head and Shoulder and 1 demo trade for Inverse Head and shoulder pattern. Explain proper trading strategy in both patterns seperately. Explain how you identified different levels in the trades in each pattern(Screenshot needed and you can use previous price charts in this question)

DEMO TRADE EXPLANATION FOR HEAD AND SHOULDER PATTERN

there are basic steps to start a trade using the head and shoulder pattern although it is not so easy but it is achievable

firstly you need to identify the left shoulder, identifying the left shoulder is quite understandable as you will be looking for a bullish movement with a corresponding retracement ready to shoot again.

watch and ensure that the head is perfectly formed higher than the left shoulder and gives a retracement ready to shoot again for the right shoulder

Thirdly identify the right shoulder as it will have similarities with the left shoulder then we are almost set for a reversal.

fourthly draw the neck line and ensure that it touches both end of the left and right shoulder.

ensure that the price breaks through the neck line and creates a reversal then it is a great entry point for a sell

MAKING AN ENTRY WITH HEAD AN SHOULDER PATTERN

STOP LOSS

Ensure that the stop loss is placed on the peak point of the right shoulder.

TARGET

There are several considerations to take to ensure that your target level is accurate

find the difference between the head peak and the low point of either shoulder

subtract the difference from the neck line and your target level is achieved.

DEMO TRADE EXPLANATION FOR INVERSE HEAD AND SHOULDER PATTERN

there are basic steps to start a trade using the head and shoulder pattern although it is not so easy but it is achievable

firstly you need to identify the inverse left shoulder, identifying the inverse left shoulder is quite understandable as you will be looking for a bearish movement with a corresponding retracement ready to fall again.

watch and ensure that the inverse head is perfectly formed lower than the inverse left shoulder and gives a retracement ready to fall again for the right shoulder

Thirdly identify the inverse right shoulder as it will have similarities with the inverse left shoulder then we are almost set for a reversal.

fourthly draw the neck line and ensure that it touches both high of the inverse left and inverse right shoulder.

ensure that the price breaks through the neck line and creates a reversal then it is a great entry point for a buy

MAKING AN ENTRY WITH HEAD AN SHOULDER PATTERN

STOP LOSS

Ensure that the stop loss is placed on the low point of the right shoulder.

TARGET

There are several considerations to take to ensure that your target level is accurate

find the difference between the head low and the high point of either shoulder

add the difference from the neck line and your target level is achieved.

4. Place 1 real trade for Head and Shoulder(atleast $10) OR 1 trade for Inverse Head and Shoulder pattern(atleast $10) in your verified exchange account. Explain proper trading strategy and provide screenshots of price chart at the entry and at the end of trade also provide screenshot of trade details.(Screenshot needed.)

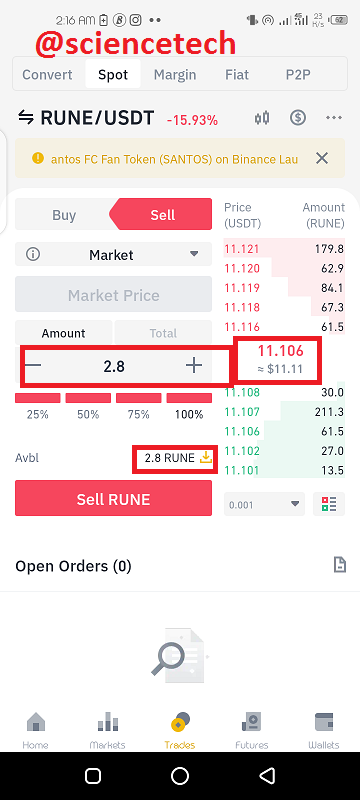

in order to place this trade, I will be using the chart of RUNE/USDT for the head and shoulder pattern. I took time to observe that the left shoulder , head were already formed, I waited hopefully fo the right head to form after the retracement from the head and luckily for me it was formed.

I set my stop loss, placing the stoploss at the high of the right shoulder as we can see below waiting for the price to break the neck line.

Immediately, I place my trade on my binance with the available rune that I had for a sale order.

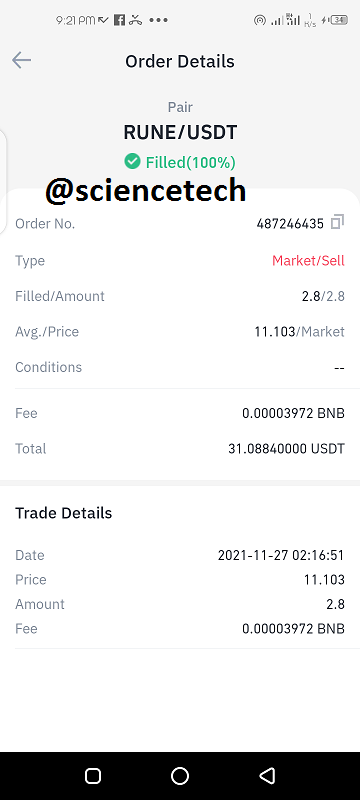

This is the detail of my order

After some time I went back to the chart and saw that it continued in the bearish trend aafter creating a reversal, there was also a retest of the neck line which some professionals wait for before making an entry.

CONCLUSION

Honestly it wasn't easy getting any of the charts used above as the pattern is rarely seen because it has over 80% accuracy. but in all I was able to learn the head and shoulder pattern, I also learnt the inverse head and shoulder pattern.

I learnt how to place the stop loss and how to calculate the required target in order not to affect the risk and reward ration. the knowledge of how to place the neck line as easy as it looks is really a great one as the price might tend to retest the neck line after a reversal has occured.

Thank you all for reading my post and I am deeply grateful that I learn something new today