Steemit Crypto Academy Season 5 Beginners' course -Homework Post for Task 5: [Bitcoin, Cryptocurrencies, Public chains] by @sathsara for Professor Stream4u

.jpg)

Designed by Canva

💫Introduction💫

Hi Everyone!...

I will be addressing the second question of the task:

Entire Question

(2) What Is Bitcoin and what was the Aim Behind Bitcoin Invention? Is Cryptocurrency Good For A Business To accept As Payment? Why?

Bitcoin💰💰💰

From 2008 till date that word has been thrown around by numerous men, and it is just acquiring and more foothold as the years pass by. In the present day, on the off chance that you haven't found out about Bitcoin, you probably been hiding away for the beyond 10 years. In any case, albeit many have known about Bitcoin, a couple of individuals really know what it is, and surprisingly less expertise it works. In this undertaking, I will give a valiant effort to insinuate us on the thought behind Bitcoin, Bitcoin itself, the manner in which it works, and why you ought to presumably get it, on the off chance that you don't have some as of now.

Trust all of you appreciate reading!

🟢What Is Bitcoin and what was the Aim Behind Bitcoin Invention?

Bitcoin is the first successful cryptocurrency.

But no, this is not the best place to start. To explain this better, and for you to fully understand, let's start with understanding money, and why Bitcoin had to be.

💰What is cash?

We have all heard anecdotes about the development of cash, so I will skirt the exhausting subtleties and go straight into it. Basically, people have fostered far from the trade framework where one needed to trade one thing for one more which they considered having equivalent worth, to a framework by which one can trade a specific measure of cash for labor and products. Yet, what brings in cash, cash?

Cash is, basically, a store of significant worth, a mode of trade of significant worth, and a unit of record. For cash to be cash, it should satisfy these three capacities. It should likewise be claimed by sufficient individuals, and shippers should acknowledge it as a type of installment.

🟢 Aim Behind Bitcoin Invention

During the monetary emergency of 2008, the worth of fiat cash (government-upheld money) dwindled so a lot, and the swelling rate was entirely high, to the point that it slammed a lot of organizations and developed into a worldwide financial emergency. As the worldwide economy slammed, numerous national banks chose to impact a procedure called quantitative facilitating for example they printed more cash.

In a bid to forestall a re-event of the Great Depression (1930), national banks drove more cash into the business sectors and cut financing costs to approach zero figures. This caused gigantic changes in fiat monetary standards and a lot of national banks started to seriously degrade their money to make their economy more practical. States needed to rescue banks thus they printed more cash, which cheapened their money significantly more.

To rescue the banks, there was a net exchange of obligation to the public handbag, expanding liabilities of future citizens. This was just one of the numerous extraordinary impacts of quantitative facilitating. Individuals became fomented in light of the fact that the national banks and the state-run administrations were brought into unfamiliar waters, and were downgrading the cash just to make all the difference for the economy. Furthermore, this monetary strife was what welcomed the production of Bitcoin

Bitcoin is a decentralized monetary framework with nobody in control/no legitimate moneylender.

Bitcoin was made to be "a shared electronic money framework". The maker, Satoshi Nakamoto, planned to make a trustless monetary framework, dispensing with the mediators (the public authority or banks) and accomplishing decentralization. This implies that Bitcoin is possessed by everybody, and nobody, and proprietors of bitcoin, is in full control of their resources. It is intriguing to realize that the author of Bitcoin, Satoshi Nakamoto is, right up 'til the present time, obscure.

Since we know the point behind the innovation of Bitcoin, let's check out what it is, and how it works.

Bitcoin is computerized money, implying that there are no real physical "Bitcoins" in presence. The bitcoin money is based on the Bitcoin blockchain and was the principal fruitful execution of the blockchain innovation. The blockchain is the thing that makes digital currency so exceptional. Thus, to see how Bitcoin works, we want to get what a blockchain is, and what it does.

🟢What is blockchain?

A Blockchain is in a real sense simply that; a chain of squares. In any case, the creation, and connecting of these squares is the thing that makes bitcoin so progressive.

A blockchain is an extremely durable, decentralized, computerized record. It is, basically, a persistently expanding rundown of records that is safely connected together utilizing progressed numerical hypotheses and cryptographic strategies. Every one of the records is known as a square, and these squares contain explicit sorts of data. For the Bitcoin blockchain, this information is basically the exchange information, a timestamp, and a pointer to the past block which joins it to the past block and guarantees that the data in each square can't be changed.

Blockchains are intended to be un-modifiable, and this empowers them to record certain and super durable exchanges between various gatherings productively. This is the thing that makes the decentralized and trustless nature of Bitcoin digital money.

The Bitcoin digital currency alludes to the resources based on top of this blockchain, which can be moved between parties straightforwardly, without the requirement for a focal moneylender, or agent.

🧿Here is a portion of the advantages of Bitcoin:

No focal bank/agent, so there is the opportunity for exchange.

Bitcoin can be gotten to by anybody, anyplace with a web association.

Bitcoin can be utilized as a store of significant worth.

Irreversible exchanges, the diminishing danger of extortion.

🟢Is Cryptocurrency Good For A Business To accept As Payment? Why?

Yes... And No...

Why Yes and No?

All things considered, this is vigorously subject to the cryptographic money being utilized.

Digital currencies contrast in their utilization and capacity, just as vary by adaptability a throughput, exchange expenses, decentralization model, brilliant agreement support, and blockchain model, just as different variables. As of the hour of composing this post, there are more than 6,500 cryptographic forms of money in presence, all with various capacities and use cases.

As I would like to think, it would not be a smart thought to utilize bitcoin as a type of installment for a business. This is a direct result of the great exchange expenses related to the move of bitcoins and the significant expense of Bitcoin. Bitcoin, as cryptographic money, works better as a store of significant worth, than genuine implementable cash. Bitcoin is to the digital money world what gold is to the money world. Also, actually like you wouldn't utilize gold for your everyday exchanges, I accept bitcoin ought not to be utilized for deals.

Likewise, bitcoin is exceptionally unpredictable and not steady cash. This implies that what 1 Bitcoin is esteemed at today, or even this second, may not be exactly the same thing it will be esteemed at by tomorrow, or even in an hour. This is alright for somebody who is wagering on the fate of digital money in general, yet for a business where one might need to take benefits to grow, the fluctuating cost and high unpredictability would represent an enormous danger.

Then again, they are numerous other digital currencies that can be utilized as a method of installment in organizations, without presenting a lot of hazard to the business or entrepreneur. These incorporate digital currencies based on third-era blockchains; these intend to take care of the issues of costly exchange charges and versatility found in Bitcoin. These incorporate digital currencies like SOL from the Solana blockchain and ADA from the Cardano blockchain.

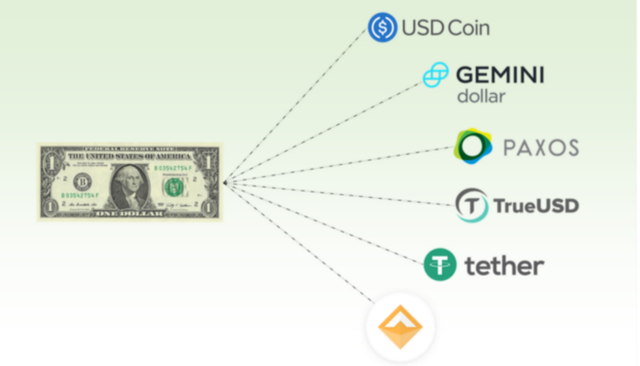

One can likewise utilize stable coins as a solid, implementable method of installment for their business. Stablecoins are cryptographic forms of money whose worth are fixed to fiat cash. Stablecoins experience practically zero instability, consequently radically lessening the danger of misfortune for the business while permitting the business to advance into the digital money world. Instances of stable coins incorporate USDT, USDC, BUSD, and many others.

In this way, as should be obvious, there are kinds of digital currencies that would be reasonable and commonsense to use as a method of installment for one's business, albeit few out of every odd cryptographic money.

Conclusion

The talk was an awesome one to go through, and in this errand, I have spoken widely on the beginning of Bitcoin, and why it's such an interesting and progressive idea.

This is all about my homework task 05 and I like to thank Professor @stream4u because preparing a meaningful lecture.

Thank You!

@sathsara