Steem Blockchain: STU, Reputation, Author/Curator Ratio, etc.- Steemit Crypto Academy- S4W7- Homework Post for @sapwood

Hey steemians,

In this post i will be submitting my homework task for professor @sapwood.

Q1. What is STU? What is the break-up of STU? Take a real example to indicate the STU and calculate the different rewards that Author and Curators generated from your last Post Payout? (Screenshot required)

STU is an acronym that stands for Steem token unit, this term is used by some of the developers in the steem blockchain to represent the post payout.

Post payout in the steem blockchain shows its value in USD even though the post payout contains both SBD and USD, the author gets SBD which was pegged to 1 USD by the steem blockchain to attain stability and to be used as convertible notes in the form of SBD(now worth approx 7.2 USD) along with SP(in USD) and Steem( in USD), to be concise and more precise, at the time of payout(after 7 days of the post), the author gets the reward in the form of (SBD, SP and Steem) and (SBD and SP), considering the debt ratio and SBD print rate.

Break down of STU(Steem Token Unit) depends upon the debt ratio and SBD print rate, in this section I will be focusing on the 50% SBD/50% SP rewards. We all know that the STU is distributed between both author and curator into equal amounts(50%/50%). For rewards 50% SBD/50% SP, the author gets rewards in terms of SBD, SP and Steem(considering Debt ratio) while the curator gets the reward in terms of only SP.

(1) Case 1, When debt ratio is at 9: when the debt ratio is at 9, the SBD print rate is 100%, the author's share is 50% of the STU and the rewards for the author are in the form of SBD(25% of STU) and SP(25% of STU), the curator's share is 50% of the STU and the reward for the curator are in the form of SP only(50% of STU).

(2) Case 2, When debt ratio is above 9 and below 10: when the debt ratio is above 9 and below 10, the SBD print rate can vary from 10% to 90% depending on the debt ratio, the author's share is 50% of the STU and the rewards for the author are in the form of SBD, Steem and SP, the curator's share is 50% of the STU and the reward for the curator are in the form of SP only(50% of STU).

(3) Case 3, When debt ratio is at 10 or above 10: when the debt ratio is at 10 or above 10, the SBD print rate is 0%, the author's share is 50% of the STU and the rewards for the author are in the form of Steem and SP(not SBD), the curator's share of the STU is 50% of the STU and the reward for the curator are in the form of SP only(50% of STU).

Note: As I mentioned earlier SBD is given in the form of SBD, not in USD but SP and Steem are given in the form of USD and distributed considering price feed. To calculate the print rate of SBD, I have used a formula that I have stated in the following question.

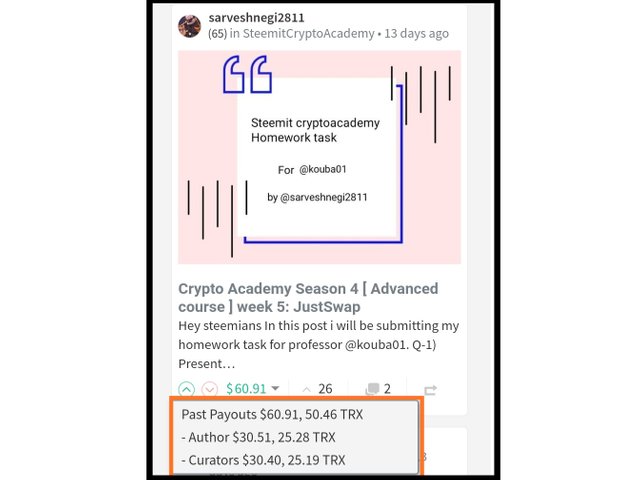

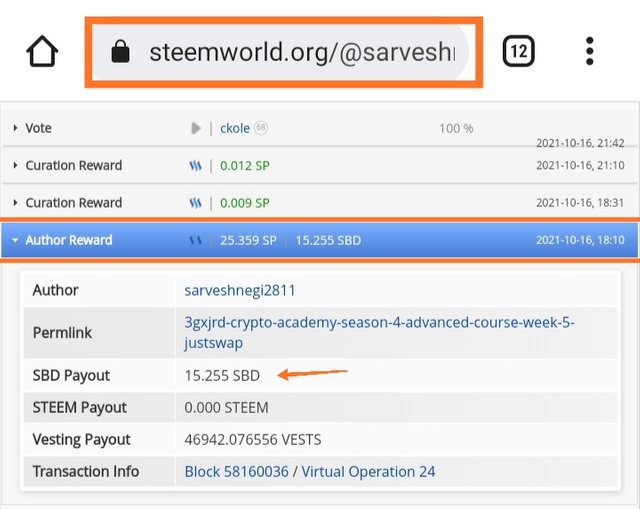

Post payout or STU: $60.91

Author's payout: $30.51

Curator's payout: $30.40

I checked the SBD print rate at the time of writing this article and it was 100% as you can see in the post below.

If the SBD print rate was 100%, the author would get rewards in the form of SBD and SP.

Calculating SBD generated as a reward for author: Author's payout/2

SBD generated as a reward for author: 30.51/2 = 15.255

Now the remaining part of the author's payout will generate SP according to the price feed of that time.

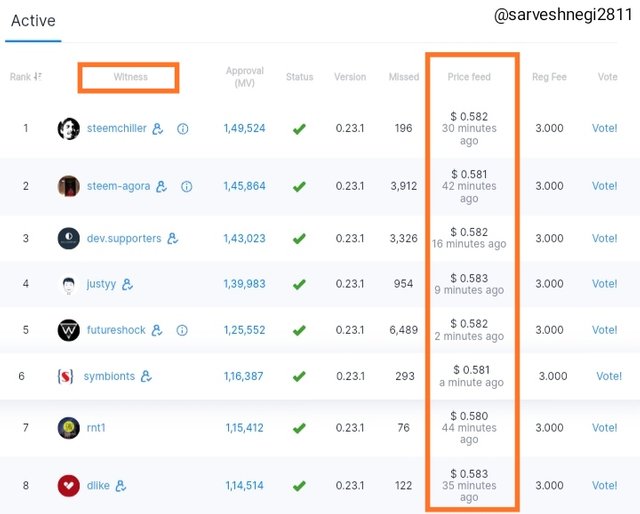

The price feed at the time of my payout was $0.601.

So, Stem power generates as a reward for the author was: 50% of Author's Reward in USD/Price feed

15.255/0.601 = 25.35 SP.

So the author(I) get 25.35 SP and 15.255 SBD.

Note for price feed: Witnesses are chosen by the steem power holders for publishing the price feed and in return for publishing price feed Witnesses are paid.

Curator's reward would be 50% of the STU and is equal to $30.41.

SP generated as a reward for curator: Curator reward in USD/Price feed

SP generated as a reward for curator 30.40/0.601 = 50.58.

So the curator gets 50.58 SP

I didn't post any screenshot here because there were 26 upvotes on my post so i had to check 26 accounts on steemworld.org and then see their Curation reward on my post and then add them to get 50.58 SP, it would be a cumbersome procedure instead I have shown the rewards for author. Hope you understand.

2. Indicate the Raw reputation score of your Steem Account and calculate your Reputation? Cross-check it with the Reputation score displayed in Steemworld.org?

Reputation on the Steemit platform tells us about the trustworthiness of a user which he/she has earned by working under proof of brain concept.

Reputation increases by the upvotes and the extent of increasing reputation depends on the steem power(Vested steem) of the curator and voting weight(0-100%). Reputation can also decrease when a curator with a higher reputation than the author downvotes the article of the author and the extent of decreasing reputation depends on the steem power(vested steem) and voting weight(0-100%).

We have seen many recent cases where users tried to buy upvotes from the bidbots to increase their reputation and make themselves pass the barrier of reputation needed to work on Cryptoacademy and to pass the levels of the academy(from beginner to intermediate and from intermediate to advance). In my opinion, it is the wrong thing to buy votes and also an injustice to all those who have worked hard for several months and years to increase their reputation.

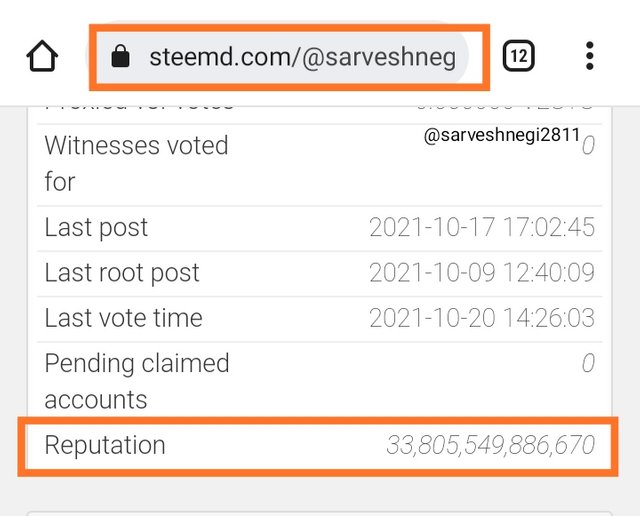

Now, we will calculate my reputation using the raw reputation score of my Steemit account.

So the formula for calculating reputation is:

Reputation: (Log10(Raw Reputation Score)-9) * 9)+25

For calculating reputation, we use a log function with base 10 and raw reputation score(aggregated rshares received by an author).

Now, my raw reputation score is 33,805,549,886,670

Reputation: [(Log10(33,805,549,886,670)-9)×(9)]+25

Reputation: (13.528-9)×(9)+25

(4.528)×(9)+25

40.76+25

65.760

For every 10× into raw reputation score, an increase of 9 units can be seen in the reputation.

10,000,000,000(RRS): 34 Reputation

100,000,000,000(RRS): 43 Reputation

1,000,000,000,000(RRS): 52 Reputation

10,000,000,000,000(RRS): 61 Reputation

33,805,549,886,670(My RRS): 65.760 Reputation

RRS: Raw reputation score

I cross checked my reputation with the steemworld.org and it was exact as you can see in the screenshot below.

Note: Every new user has granted with a reputaion of 25 and it increases and decreases as per the activities of the users, if a user is doing good work under PoB concept, he/she can get upvotes and increase his/her reputation but if he/she is scamming and phishing other users, he can get downvotes from the users and his/her reputation can decrease provided that the user downvoting a scammer possess higher reputation than the scammer. Task of increasing reputation gets tougher as the reputation of a user increases.

3. What percentage(of the Post Payout) was generated as liquid rewards(SBD) from your last Post in terms of USD equivalent? Explain how the rise of SBD has shifted the supply dynamics? As per your last post payout calculate the ratio of Author:Curator Reward in terms of USD equivalent?

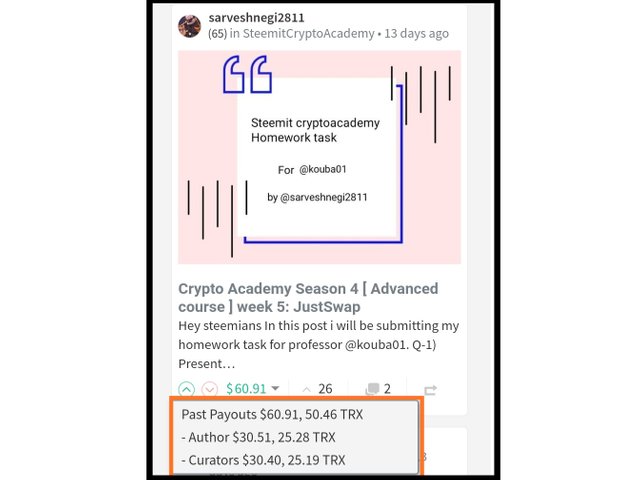

The payout of my last post was worth $60.91(Steem token unit), I had set my rewards to 50% SBD/50% SP as the Debt ratio was at 9 and the SBD print rate was 100%, if the Debt ratio was above 9 and below 10, I would be getting Steem, Steem Power and SBD, If the Debt ratio was above 10 or at 10, I would be getting rewards in Steem and Steem Power.

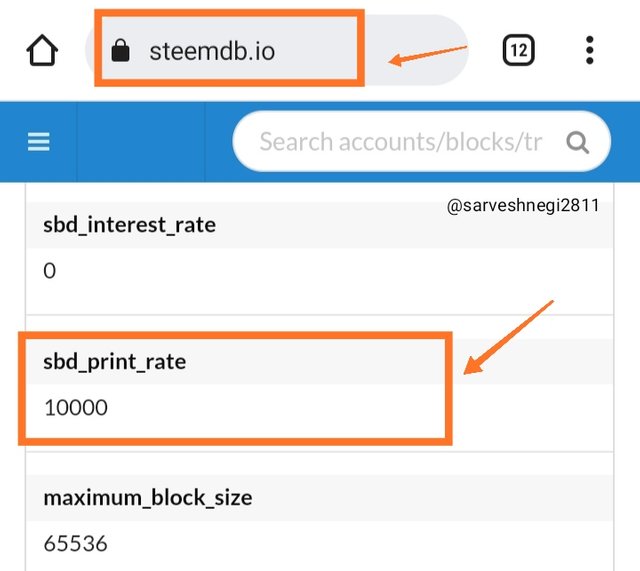

It can be understood easily by the formula

SBD Print Rate: 100%×(10 - Debt ratio)

So at the time of my payout, the debt ratio was at 9 and it is still 9 at the time of writing this article. So,

SBD Print rate: 100%×(10-9)

SBD Print rate: 100%×(1)

SBD Print rate: 100%

Now, my last payout was distributed between Me(author) and Curators(Those who curated by giving upvotes and having enough SP to distribute rewards in my post), so now my(author) payout was:

Author's reward: $30.51

I have to tell about only liquid rewards so I will be dividing it again by 2 as I had set my rewards to 50% SBD/50% SP.

My liquid reward(SBD): 30.51/2

My liquid rewards(SBD): 15.255

I got 15.255 SBD which is equal to 15.255 USD according to Steem blockchain irrespective of the market value outside the Steemit platform which is around 7 dollars lately.

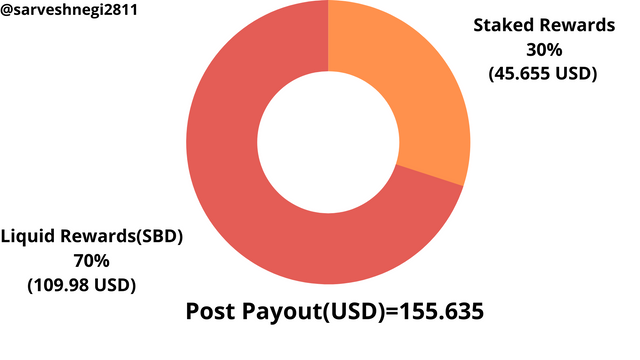

So the real worth of my liquid rewards in USD is 15.255×$7.21(at the time of writing this article), by solving this it becomes 109.98 USD.

Now all the rewards of my post: 109.98 USD(Liquid rewards from SBD) + 15.255 USD(Author SP) + 30.40 USD(Curator's reward in SP).

So total payout of my post was 155.635 USD.

Now the percentage generated as liquid rewards from my last post in USD:

Liquid rewards(SBD In USD)/Total rewards of the post(Author and curator both)×100%

(109.98/155.635)×100%

70.66% of my last post rewards was liquid rewards in terms of USD.

As I mentioned above that SBD was introduced in the steem blockchain for providing stability and used as a convertible note. To do this the value of 1 SBD was pegged to 1 USD in the steem blockchain but now due to the increasing demand for SBD in the market, the price of 1 SBD is around 7.21USD. Irrespective of the market price of 1 SBD, the steem blockchain consider 1 SBD equal to 1 USD.

Now, with the increase in the price of SBD the supply dynamics of the Steem blockchain shifted in the following ways:

(1) Effect on liquid reward: considering that the author has set his rewards at 50%SBD/50% SP and the price of 1 SBD is 1 USD , the author will get 25% SBD of the STU means 25% rewards are the liquid rewards.

But in today's scenario where the SBD is worth $7.21, the amount of liquid reward is far greater than the staked rewards. It can be understood via the example below:

My last post payout: $60.91

Author's rewards: $30.51

Curator rewards: $30.40

When SBD is worth $7.21, my liquid reward was: 109.98 USD(approx 70% of the post payout or STU)

When SBD is worth 1 USD, my liquid reward will be: Author's reward/2 = 30.51/2 = 15.255 USD. (Approx 25% of post payout or STU)

You can see the difference between the liquid rewards when SBD is worth more than 1 dollar($7.21) and 1 USD. More liquid rewards mean more chances of assets of a platform being exchanged and transferred to different wallets and exchanges. Thus making it a short time investment on a platform.

(2) Effect on the curator's reward: As I mentioned earlier the post payout or STU is distributed between curator and author in equal amounts (50%/50%). But due to the increasing value of SBD, the author's share in a post has increased by several per cent. We can understand easily this by an example:

Post payout or STU: $60.91

Author's payout: $30.51(SBD+SP)

Curator's payout: $30.40(SP only)

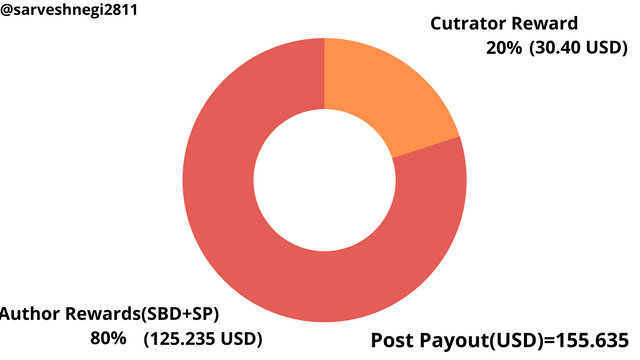

When SBD is worth $7 .21, the author:curator reward percentage is: 80:20(in USD)

When SBD is worth 1 USD, the author:curator reward percentage is: 30.51:30.40 = 1:1.

By the above example, you can see that when SBD is worth more than 1 USD($7.21), the author is getting 80% of the reward whereas the curator is getting only 20%, it defies the ratio of the distribution of payout rewards between author and curator which was set at 1:1.

Now, the ratio of the author to curator in terms of USD is as follows:

I have stated above that the rewards(STU) on my last post was worth $60.91, out of which $30.51 was the authors share that includes (30.51/2)15.255 SBD along with 15.255 USD(Steem power) according to 50% SBD/50% SP rewards setting and 30.40 USD(Steem power) was distributed to the curator as curation rewards.

Now taking the ratio of the author to curator rewards in terms of USD:

Author reward(USD): 109.98 USD(SBD) + 15.255 USD(Steem power) = 125.235

Curator reward(USD): 30.40 USD(Steem power)

Author:Curator(USD) = 125.235/30.40

Author:Curator(USD) = 80.46:19.54

If we take approximation it becomes 80:20(author:curator).

The above ratio defies the reward splitting mechanism between curator and award which was said to be 50/50 and the reason for the increasing author reward is the increasing value of SBD which was pegged to 1 USD on the steem blockchain.

4. Explain how & why an initiative like #club5050 can shift the demand/supply dynamics in favor of STEEM?

Steemit community uses debt and ownership instruments for attracting capital and investors, ownership can be bought in the form of Steem(liquid reward) and Steem Power(Staked reward) and debt can be bought in the form of SBD(convertible note). Both ownership and debt plays a vital role in the economy of the Steemit platform. Steem(liquid reward) is used as a liquid currency that can be transferred, bought and sold at exchanges. Steem power is like a long term investment in the platform and SBD is used as a convertible note to provide stability in the steem blockchain.

But due to the increasing price and demand of SBD, the price of 1 SBD which was pegged to 1 USD is now worth $7.21, and because of the increasing value of SBD, the amount of liquid rewards generating is far more than what it has to be. (70%>>>25℅)

In the above questions, you have seen that my liquid rewards contain 70% of my post payout or STU. 70% liquid rewards that can be transferred or bought and sold at any time after converting them into Steem is a huge amount.

Steemit always tries to maintain debt to ownership ratio, when the debt to ownership ratio gets high the economy of steemit becomes unstable as the conversion of SBD will become high whenever the user is getting a higher number of steem for an SBD, conversion of SBD for steem forces community to issue new steem tokens and it all leads to a huge debt on the ownership instruments and lower price of steem token in the market. It is very important to maintain this ratio to attract capital and investor in a platform or project.

#Club5050 is an initiative launched by the steemit community for encouraging users to power up 50% of their liquid rewards(convert SBD/steem into SP). By doing this the percentage of liquid rewards that was 70% earlier(on my post) can reduce by some extent.

I will take an example for this:

My post payout: $60.91

Author's rewards: $30.51

Curator's reward: $30.40

Curator's rewards are all staked rewards so we need to focus on the author's reward which contains both SBD and SP.

I got 15.255 SBD from my latest post, if I join #club5050, I will have to convert (15.255/2)SBD into Steem tokens and then power up those steem tokens.

(15.255/2) SBD = 7.6275 SBD

Now converting these SBD into Steem tokens: 7.2675×11.9= 90.76 Steem tokens. (11.9 steem per SBD at the time of writing this article)

Now taking liquid and stayed rewards ratio:

Liquid rewards(USD): 7.2675 SBD × .721 USD(the price of 1 SBD in the market) = 54.99 USD

Stakes rewards(USD): 90.76 SP(powered up steem)×$0.601(price feed) + $30.40(curator reward) + $15.255(author staked rewards)

Staked rewards: $54.456 + $30.40+ $15.255 = $100.111

Liquid reward:Staked reward = $54.456:$100.111

= 35:65(liquid:staked)

So you can see by the above example how the amount of liquid rewards that are constantly going outside the platform for selling and buying is now stakes on the platform with the help of #club5050. Still, it isn't near the ideal value of 25:75(liquid:staked), but it will make an impact on the steem blockchain as the number of the Steem tokens going out of the platform will go down and the price of Steem token will rise again.

In my opinion, encouraging users to power up their 50% liquid rewards will help correct the ratio of liquid reward to staked reward and as I mentioned above SP is like a long term investment and a community or platform can't grow if the users exit the platform by taking capital instead of raising additional capital for the platform. And at last i think it is a very good initiative that can help grow steemit platform as well as attract capital.

5. Consider a user having a reputation lower than you, upvotes your Post-- Does it affect the Payout and increase the Rep? If the same user goes for a downvote, does that affect your Payout and Reputation both? Explain Why & How; with Examples?

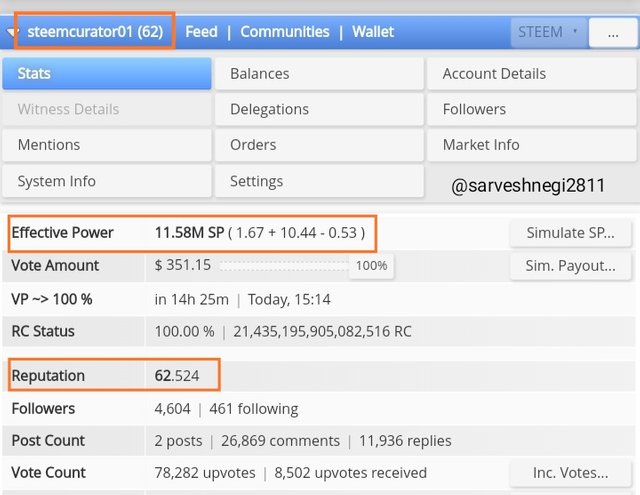

If I were to consider a user having a reputation lower than mine, I would consider steemcurator01, user steemcurator01 stands at 2nd number in the ranking of steem power holders and have effective steem power of 11.58M further the reputation of user steemcurator01 is 62.524 which is lower than my reputation(65.76).

Now what impact on my post will the user steemcurator01 put on my post by upvoting me can be seen below:

(1.1) Effect on post payout when steemcurator01 upvotes my post: Post payout mainly depends on two things, steem power of the curator and voting power.

More steem power and voting power means more distribution of rewards on my post by the curator. Simply put, the user with a high amount of steem power and voting power at its fullest(100%) can distribute high rewards on a post.

So yeah users like steemcurator01 who have significant steem power and lower reputation than me can increase my post payout by upvoting it and post payout varies with the voting power, variation in the distribution of rewards concerning voting power is given below:

(1.2) Effect on reputation when steemcurator01 upvotes my post: Whenever steemcurator01 upvotes my post, my reputation increases because of the steem power(11.58M) and voting power(0-100%), the reason behind it is the increase in raw reputation score, whenever steemcurator01 votes on my post the aggregate number of my rshares increases and my reputation too. As we have already seen above in the formula for calculating Reputation, the raw reputation score is directly proportional to the reputation.

So whenever steemcurator01 upvotes my post with enough voting power, my post payout as well as reputation increases even though steemcyrator01 has less reputation than mine.

Now if steemcurator01 downvotes my post, what impact will it make on my post and reputation is stated below:

(2.1) Effect on post payout when steemcurator01 downvotes my post: if steemcurator01 downvotes my post, it will send my reward back to the Steemit reward pool concerning the voting weight of the steemcurator01. Simply put, having a downvote from someone with significant or enough steem power results in losing rewards on the posts as the rewards are sent back to the Steemit reward pool.

(2.2) Effect on my reputation when steemcurator01 downvotes my post: My reputation will have no effect when I get a downvote from steemcurator01 because I possess more reputation than steemcurato01. Simply put, a downvote from a user having a reputation lower than you can't affect your reputation whether the user contains steem power in millions.

In this case, if I change the curator from steemcurator01 to sapwood who possess a 75.698 reputation higher than mine(65.76), now if I get a downvote from sapwood, it will decrease by reputation concerning the steem power and voting weight used to downvote me. Simply put, a user having a reputation higher than you can decrease your reputation and send reward of your post back to the reward pool by downvoting.

So i have stated all the 4 cases that can happen while upvoting and downvoting by a user having lower reputation than you.

That was all from my side

Thank you!

For the attention of professor @sapwood

Do not use the #club5050 tag unless you have made power-ups in the last 7 days that are equal or greater than any amount you have cashed out.

I didn't use that intentionally and I tried to remove it but It didn't get removed. I think it is there because of the use of club5050 in homework task.

Thank you!

Happy Birthday to you Brother ♥️♥️😁😁

Thank you!! 😇

Happy Birthday to you ☺️❤️

Thank you!! 😇

Happy Birthday to you ♥️♥️😀😀

Thank you!!😇