Steemit Crypto Academy | Season 2: Week7-- Liquidity Mining (Tron- Sun.io)

DeFi is a strong & enduring force in the crypto segment. It does solve the major problem interface of traditional finance. "Banking the unbanked" is now a reality with DeFi.

The intermediaries are completely replaced by Smart-contract in DeFi. The utilitarian value of crypto in DeFi combining with stable coin caused people to rally en masse around DeFi in 2020. The expansion of financial and business use-case together with ever-rising total locked value in DeFi is a testimony to that.

The DEX once plagued with fragmented liquidity issues for a long time solved with the introduction of the AMM mechanism.

DeFi has been catering to the use-cases of Lending, Borrowing, Supplying assets to the Liquidity pool & earning APY, exchange, etc.

Today we will cover Liquidity Pool, Liquidity Mining in detail. We will keep it central to the Tron DeFi ecosystem-- Sun.io

Liquidity Pool

In an order-book model(CEX), there is a list of bid and ask values, and the difference between the bid and ask is known as the spread. In a highly liquid market, this spread is narrow, competitive, and offers the best value of exchange to a trader. In contrast in an illiquid market, the spread goes higher, and hence exchange value could be worst for a trader.

Generally, the popular CEXs do not suffer from liquidity issues in comparison to DEX.

In contrast, the major problem with DEX is that the liquidity is fragmented as there is no such centralized pool, the liquidity remains in the decentralized wallet of the individual traders.

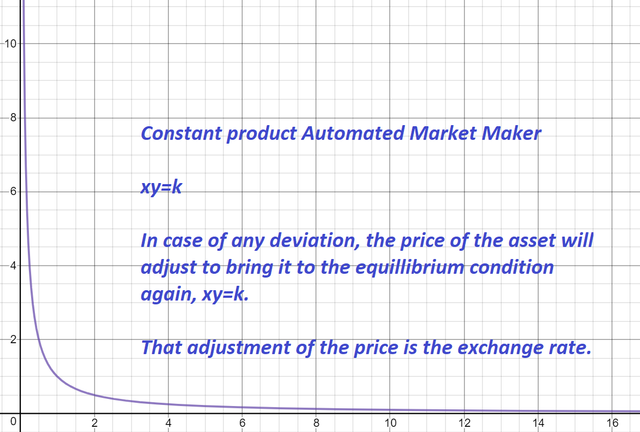

AMM mechanism solves this problem interface of DEX and introduces a constant product market-making mechanism(xy=k), as a result Liquidity Pool(LP) is created in which x and y represent the two sides of the pool.

The product of x and y at any given time is a constant.

So the equilibrium condition is xy=k.

If xy is not equal to k, then the price of the asset will adjust itself to bring it to the equilibrium condition-- xy=k. That adjustment of the asset is known as the exchange rate. This is the underlying principle of AMM-based DEX.

Justswap relies on this principle to create a liquidity pool for each pair where the users are free to contribute to the pool and based on their contribution ratio w.r.t the total pool size, they earn their share.

When you contribute to a pool you have to contribute equivalent value to both sides (x & y).

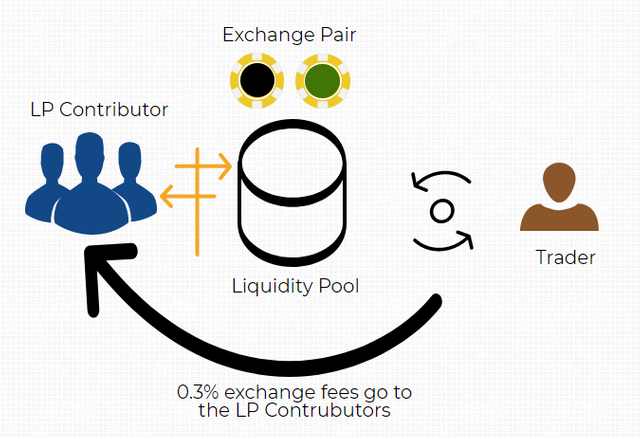

AMM model exchange creates an opportunity for the investors to pool their tokens and earn exchange fees from each trade. Ideally, in a decentralized exchange, the liquidity providers earn 100% transaction fees. At any given time, the fund is in absolute control of the owner.

Liquidity Mining

In Justswap, every time an exchange happens, the trader pays 0.3% fee, and then the fee is distributed proportionally among the LP providers.

So when you supply coins(both sides) to a Liquidity Pool, you are entitled to a Liquidity provider fee, in proportion to your liquidity contribution.

But it does not stop here. Sun.io is a dedicated DeFi segment in Tron that docks different DeFi projects of Tron to offer you a variety of mining options. You can further galvanize your position as a Liquidity Provider. For example, if you are a liquidity provider in Justswap you can further stake your LP tokens to earn mining rewards(SUN-TRX LP offers the highest APY, 37.04%). Similarly, if you have supplied assets in JustLend, then you can stake it to start JustLend supply mining.

So if you are a liquidity provider in Justswap, you are issued LP tokens, then you can stake your LP tokens to start mining and you are entitled to century mining rewards. Please pay attention to the different cycles and phases of century mining.

- As an LP provider, you earn your share from exchange fees

- By staking LP tokens, you start mining in Sun.io. You can mine 5 different tokens(TRX, JST, BTT, SUN, WIN).

Note- Recently BTCST token is added to Tron Century Mining, so instead of 5 different tokens, you will now earn 6 tokens(TRX, SUN, BTT, JST, WIN and BTCST) as mining rewards.

Your contribution(staking LP token) weighted with "duration & percentage of the total LP" will determine your mining rewards.

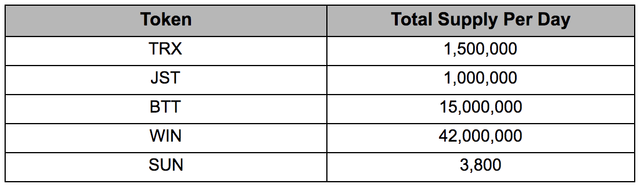

Depending on a particular phase in Century mining, the mining reward of 5 tokens(supply per day) is defined. Then 70% of the mining supply goes to Justswap Liquidity Mining and the remaining 30% goes to JustLend Supply mining.

The third phase of TRON Century Mining is currently running: May 3rd, 2021 21:00 — Jun 7th, 2021 20:59 (SGT)

Mining rewards(Supply per day)- Phase 3

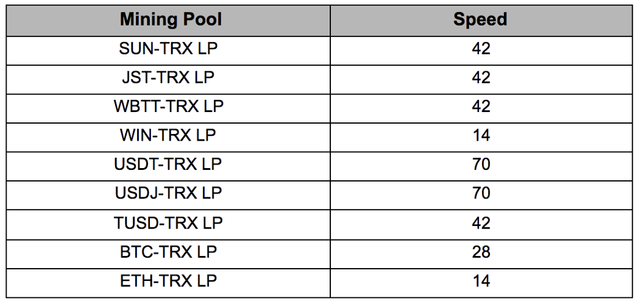

Speed of Mining

Different LP mining has different schedules of speed. And that could vary from one phase/cycle to another.

Unlocking of mining rewards

The mining rewards are unlocked & distributed on a weekly basis over a total span of 24 weeks. In other words, you will keep getting your rewards(5 different tokens- TRX, SUN, BTT, JST, WIN) every week until the 24th week.

33% of the SUN rewards can be unlocked at any time. The remaining of the SUN along with the remaining 4 tokens can be unlocked as per the regular schedule, i.e. can be unlocked on a weekly basis over a span of 24 weeks.

It must be noted that you are getting additional rewards through century mining by utilizing/staking your LP tokens. So it's an additional bonus on top of your Liquidity Provider fee that you directly generate from the exchange fees collected/distributed in Justswap.

How does it work?

.jpg)

How do I obtain LP tokens in Justswap

To obtain an LP token, you have to provide liquidity to the both sides of the pool. First, go to Sun.io and check what are the different LP mining pools available and accordingly choose a suitable pair in Justswap to provide liquidity to obtain LP token.

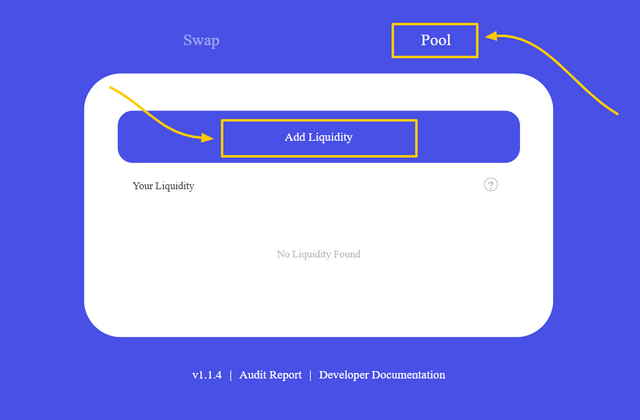

- Go to https://justswap.io/

- Select Pool, Then click on Add Liquidity

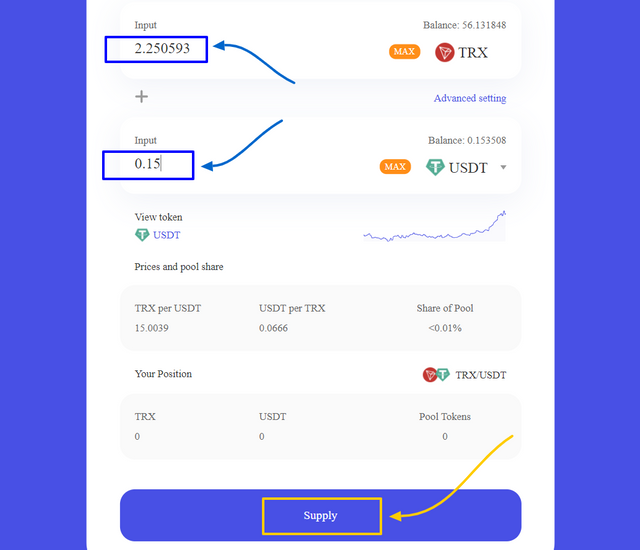

- Select the pair of the tokens(e.g. USDT/TRX) in Justswap. Please check the different LP mining pools available at Sun.io and accordingly select a relevant pair.

- Enter the amount.

- Click on Supply. Then confirm supply.

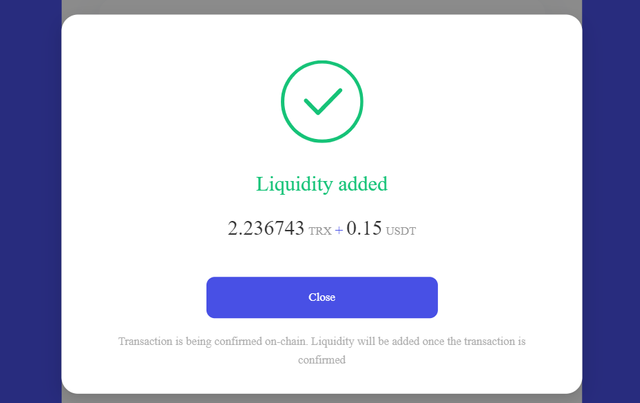

- Then a pop-up will appear, asks you to sign the transaction. Click on Accept.

- Liquidity added now.

- Now check your wallet(or explore Tronscan) to locate your LP token.

.png)

.png)

How do I stake LP tokens to start mining (5 different tokens)

At the moment, there are 9 different LP mining pool on Sun.io. Select any one of your choice, but make sure you have the LP tokens to stake.

- Go to Sun.io

- Connect your wallet.

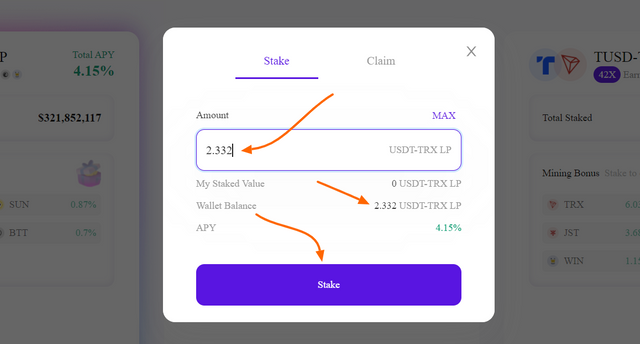

- Select a specific LP mining pool, e.g. I will select USDT-TRX LP.

- Enter the amount. Click on Stake.

- Sign the transaction(Click on Accept)

.png)

.png)

.png)

.png)

.png)

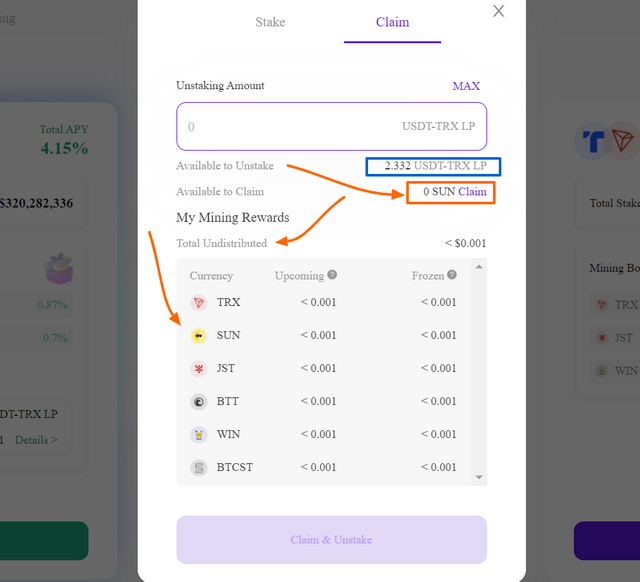

Now you can manage your staking here. In other words, you can add an additional stake or you can also withdraw part or full. Please pay attention to claim. There are two parts-- one is Available to claim(SUN) and the other part consists of total undistributed rewards. 33% SUN can be withdrawn at any time. But the undistributed rewards can be unlocked as per the fixed schedule(i.e. weekly basis over a total span of 24 weeks).

Please note that you can unstake LP tokens at any time. But the unlocking of the mining rewards will follow the defined schedule(i.e. weekly up to a total of 24 weeks).

Conclusion

The docking arrangement of different DeFi projects with Sun.io has earned additional bonuses for the Liquidity providers in the recent past. The dividend for Liquidity providers is not limited to earning a share from exchange fees, Sun.io has created an avenue through LP mining to generate an additional reward for Liquidity providers in five different tokens(TRX, SUN, JST, BTT, WIN). It's a win-win scenario as staking LP token now earns five different tokens and definitely adds a new dimension to DeFi.

Note- Recently BTCST token is added to Tron Century Mining, so instead of 5 different tokens, you will now earn 6 tokens(TRX, SUN, BTT, JST, WIN, and BTCST) as mining rewards.

Thank you.

Homework Task (Season 2/Week-7)

(1) How do I connect my TronLink Wallet to Sun.io?(Screenshots needed)

(2) What are the different liquidity mining pools? Which one offers the highest APY? How many different rewards do I get by staking LP token? (Screenshots needed)

(3) How do I obtain LP Token by adding liquidity in Justswap? What is the quantity(Explore through your wallet/Tronscan)?(Screenshots needed)

(4) How do I stake LP Token to earn five different tokens on Sun.io? (Screenshots needed)

(5) Which reward(out of five different rewards) can be withdrawn at any time? How do claim that (indicate that in the screenshot)?

(6) What is the schedule of unlocking the mining rewards? Indicate the total undistributed/distributed mining rewards in the screenshot?

(7) Include the real example of your interaction with Justswap and Sun.io as required in this task? Indicate how a "stake"(in Sun.io) function consumes different "Energy & Bandwidth" than "obtaining LP token" (in Justswap)? You should add/remove a small amount of liquidity to obtain/redeem your LP token(as little as 1 USDT worth)? (Screenshots needed)

(8) How do I unstake LP token and claim mining rewards(Sun.io)?

Important Note-

With the rise of STEEM price, the purchasing power of Steemians has greatly improved, therefore we expect the participants of this task to showcase a real example using Justswap & Sun.io. You can do a micro-transaction (if you don't have sufficient funds). This will help you gain real experience.

Guidelines

- Your article should be at least 300 words.

- It is always better to gain user experience before submitting your article.

- Refrain from spam/plagiarism. This task requires screenshot(s) of your own experience. Use images from copyright-free sources and showcase the source, if any.

- This homework task will run until 29th May'2021, Time- 11:59 PM UTC.

- Users having a reputation of 50 or above, and having a minimum SP of 100(excluding any delegated SP) are eligible to partake in this Task.

- Add tag #sapwood-s2week7 #cryptoacademy in your post and should be among the first five tags. You can also use other relevant tags like #defi #tronscan #sun-io or any other relevant tag.

- Those who include the real examples/screenshots will score better.

- If you are using a wallet other than Steem integrated Tron wallet, you should mention it at the beginning of the post, so that we can verify the transactions required in this Task.

(Please feel free to join the comment section if you have any doubt on Homework-Task)

Cc:-

@steemitblog

@steemcurator01

@steemcurator02

This is the link to my assignment

https://steemit.com/hive-108451/@jimah1k/crypto-academy-season2-week7-assigment-post-for-sapwood-by-jimah1k

Hi prof @sapwood pls below is the link to my homework task.

https://steemit.com/hive-108451/@abu78/crypto-academy-week-15-or-homework-post-for-sapwood-or-liquidity-mining-tron-sun-io-by-abu78

I read your article, really good😊👍🏻 and I am new here. Plz check my post in SteemitCryptoAcademy and plz guide me.

THANK YOU😊🌸

Start from the newcomer's community and do the achievement tasks

Also explore other communities until you get to a reputation of 50

@kelechisamuel yes I do the achievement 1st Task

https://steemit.com/hive-172186/@aliya-14/achievement-1-introduce-myself

Being a newcomer, you should first enroll yourself in the Newcomers' community. By doing so you can develop a better understanding of this ecosystem.

@sapwood yes I introduce myself....in newcomers community

https://steemit.com/hive-172186/@aliya-14/achievement-1-introduce-myself

Mohon tinjauan professor @fendit atas postingan tugas pekerjaan rumah saya yang sudah dua hari

https://steemit.com/hive-108451/@nandacoa/steemit-crypto-academy-musim-2-minggu-6-or-or-teori-elliot-untuk-profesor-fendit

Stop tagging me and be patient.

Hallo professor @fendit apakah anda lupa dengan tugas saya

https://steemit.com/hive-108451/@nandacoa/steemit-crypto-academy-musim-2-minggu-6-or-or-teori-elliot-untuk-profesor-fendit

Sudah tiga hari bagaimana saya bisa sabar

Nice lecture @sapwood.

Dear professor @sapwood, the students who are listed in Black list, How they get out from black list? What should they after listed in Black list? and whether they will be removed from the blacklist or no?

Kindly guide

This is my homework assignment from professor @fendit, it's been 2 days but professor @fendit haven't checked it.

https://steemit.com/hive-108451/@ichsananggap/season-2-or-week-6-steemit-crypto-academy-homework-post-for-fendit-or-elliott-wave-theory-or

Please Check My Homework

Have patience dear.

All are being checked chronologically.

Thank you.

Please answer my question please.

How do I get out of the black list?

I have come to realize that yes i have plagiarize more than once in this community, I am commenting this to ask for a second chance for everybody in that blacklist.

@sapwood please consider my request because we have accepted that we are guilty but we are ready to change and be a better author if you just give us a chance please

@fendit sudah tiga hari belom kamu tinjau

https://steemit.com/hive-108451/@nandacoa/steemit-crypto-academy-musim-2-minggu-6-or-or-teori-elliot-untuk-profesor-fendit

@sapwood thank you for sharing such an informative post. Stay blessed and safe.

existe algún parámetro que cumplir para ingresar a la cripto academia? como me gustaria aprender sobre todo esto pero desde inicios es popsible?

Eligibilty Criteria--

Then visit https://steemit.com/trending/hive-108451

Go through the pinned posts to submit any Task of your choice (you can participate in as many as 5 tasks every week).

I hope it clarifies.

Thank you.

Perfecto entonces creo que puedo iniciar muy agradecida por responder