Steemit Crypto Academy | Season 2: Week3-- JustLend

Background

Traditional finance is not open to all, millions are left out of the global cross-section of the traditional financial system. Even if it is accessible to a particular section, it is centralized, the terms are dictated upon the users, it is not without higher fees, lacks transparency, etc. Last but not least it does not shield you from a banking failure.

That is the reason why we witnessed the breakout of financial services into decentralized Finance and its epic rise in the year 2020 and its effect is magnanimous. The financial products/services are now reshaped & recreated to proliferate "Banking the unbanked".

But wait, even within the DeFi segment, we have grey areas, we have problem interface. Take the example of Etherum Blockchain, most of the DeFi projects are concentrated in the Etherum ecosystem, but what about gas fees, is it affordable for a user who deals with small-scale transactions? Is it feasible to take a micro-loan in the Etherum ecosystem where the gas fee is as high as 15- 25 USD? How fair is the interest rate?

As per the report of FDIC in the year 2017, most of the users are left out of the traditional financial system because they deal with small-scale transactions, they don't have enough money to comply with the minimum saving balance.

Further, the supply/Lending protocol is one of the most popular DeFi use-cases. If a DeFi ecosystem does not facilitate a micro-loan owing to high network fees, then it does not solve that problem interface of a traditional financial system despite being decentralized & transparent.

Therefore the parameters to gauge a DeFi should be--

- Transparency

- Permissionless & Smart contract based

- Low Network Fees

- Borderless to create a better financial network

This publication will focus on JustLend, a DeFi Application on the top of Tron Blockchain, a Money Market Protocol with transparent & effective pricing. It complies with all the parameters of a DeFi, the notable ones are-- Low Network Fees, micro-lending, etc.

JustLend

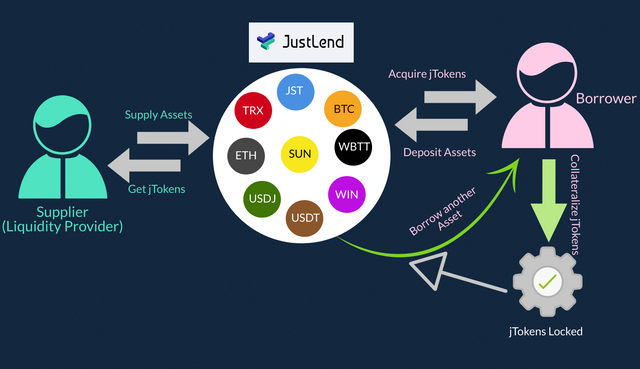

JustLend is a decentralized money market protocol powered by smart contracts in the Tron ecosystem, that establishes two pools-- Supply Pool and Borrow Pool, and based on the demand and supply a dynamic interest rate is defined. A Supplier earns a floating interest rate whereas a borrower pays a floating interest rate.

Unlike the traditional p2p protocol, the users interact with the pool in JustLend, therefore better liquidity than the traditional p2p market.

If the liquidity is higher in the supply pool, and the demand for the token(to borrow) is lower, then the interest rate decreases and vice versa. Instead of a daily interest rate, the floating interest rate in JustLend is determined every 3 seconds.

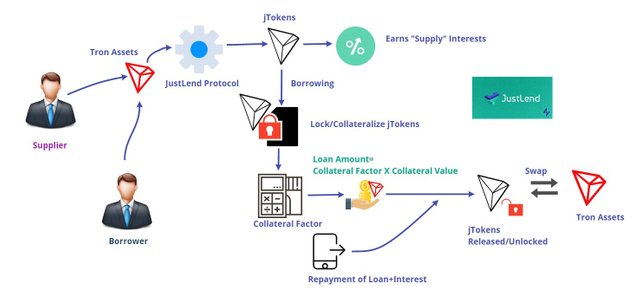

There is a collateral factor that varies from 0 to 1, with a lower value indicates low liquidity and a high value indicates better liquidity. The collateral factor multiplied by the collateral value is the loan amount for the borrower.

At any given time, the Collateral value has to be greater than (Loan value + Accumulated interest), otherwise, it will be deemed unsafe and will trigger the liquidation of the asset.

Different Markets

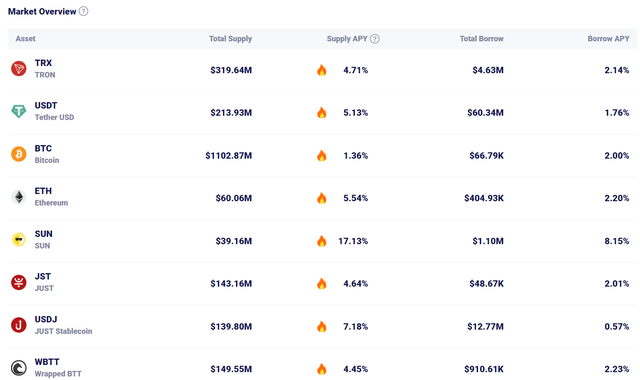

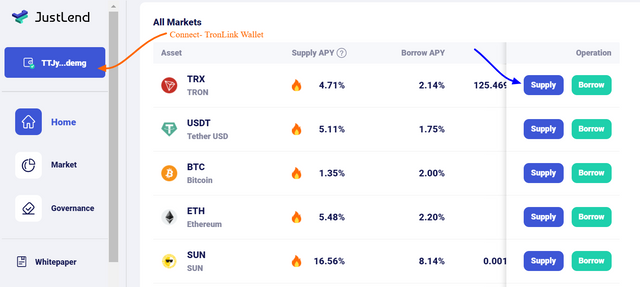

In JustLend, there are 9 different markets-- TRX, USDT, BTC, ETH, SUN, JST, USDJ, WBTT, WIN, etc.

Supply Pool

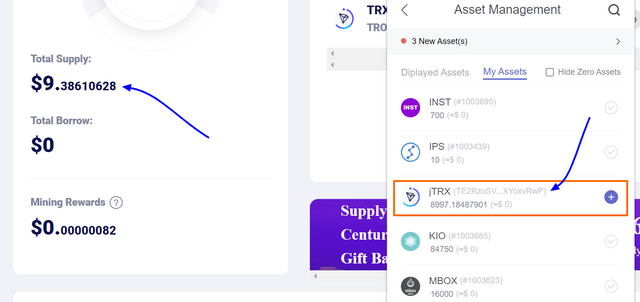

If you add liquidity to the supply pool, you earn an interest rate based on the Supply APY. You will be issued jTokens. For example, if you add TRX to the TRX pool, then you will be issued jTRX tokens. At any given time, a supplier can remove the liquidity. There is no such restriction or timeline.

Borrow Pool

To borrow, you need to collateralize your jTokens. You will be issued jTokens when you contribute to a Supply Pool, then you can collateralize jTokens to borrow any asset(listed in JustLend) of your choice.

A borrower can unlock the jTokens only after repaying the borrowed asset. After unlocking jTokens, a borrower can remove the liquidity from the Supply pool.

Put simply, for a Borrower, the collateral is locked, for a supplier, there is no such restriction, they will keep earning & accumulating the floating interest rate each block(3 seconds) and at any given time they can pull out their tokens from the pool.

Ho does it work?

.jpg)

Liquidity, Collateral Factor, Risk, Liquidation in JustLend Market

To check the liquidity of different pools in JustLend, visit-- https://www.justlend.org/#/market.

- If the total supply in a pool is higher, the Supply APY is lower.

- If the demand of a particular market is higher, the Borrow APY is higher.

Note- The supply APY consists of base APY & mining APY. Upon removal of liquidity, a supplier will get his asset+base APY immediately. The mining APY in the form of a TRON Gift Bag will be unlocked and delivered to the Tron Wallet within six months.

The supply and demand of a particular market determine the interest rate in JustLend and it's very dynamic in nature.

Further, each market has a collateral factor that varies from 0 to 1. And the borrowing capacity is determined based on the collateral factor of a particular market.

A higher collateral factor(close to 1) signifies better liquidity whereas a lower collateral factor(close to 0) signifies lower liquidity of a particular market.

A Borrower first needs to acquire jTokens(by supplying an asset), collateralize it to borrow any listed asset. So the worth of jTokens is the collateral value of a Borrower.

A Borrower can borrow up to an amount (Collateral Value * Collateral Factor).

Interest is accrued & accumulated every 3 seconds.

At any given time (Collateral Value * Collateral Factor)> (Loan Amount+Accumulated Interest), otherwise liquidation will trigger.

A borrower should not utilize the full borrowing capacity because of two reasons:-

- Accumulated interest every 3 seconds

- Fluctuating price of an asset.

Interest Rate

The interest rate in the JustLend Market is governed by:-

- The exchange rate between jTokens and an underlying asset

- Utilization rate- How much of the total pool is being utilized for loaning out to the borrowers

- Reserve Factor/Collateral Factor

- Borrowing interest rate

- Supplying interest rate

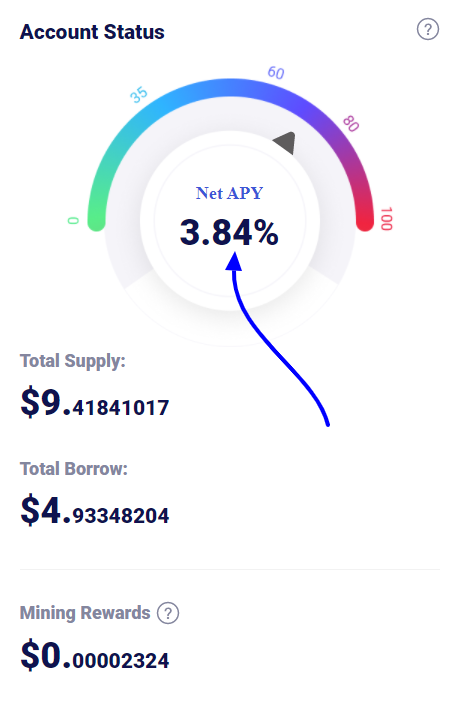

Net APY

JustLend is a true money market and way better than the p2p lending protocol. In the traditional p2p model, you don't earn any supply APY even when you supply & collateralized it to take a loan.

In JustLend, when you borrow money, you first supply an asset, acquire jTokens, and then collateralized it to borrow another asset.

Since in the entire process, you supply and borrow both, you earn Supply APY and you pay a borrowing interest rate as well. So we can calculate the P&L of an asset(Supply) & Loan using Net APY.

Net APY = [∑ (Value of Supplied Token × Supply APY) - ∑ (Value of Borrowed Token × Borrow APY) ] ÷ Value of Total Supply

The Net APY may not necessarily be negative always, it may be positive in some cases.

So just imagine when the net APY is positive, that literally means that you are earning an interest rate by borrowing an asset.

Supply an asset to acquire jTokens

- Go to https://www.justlend.org/

- Connect your TronLink wallet

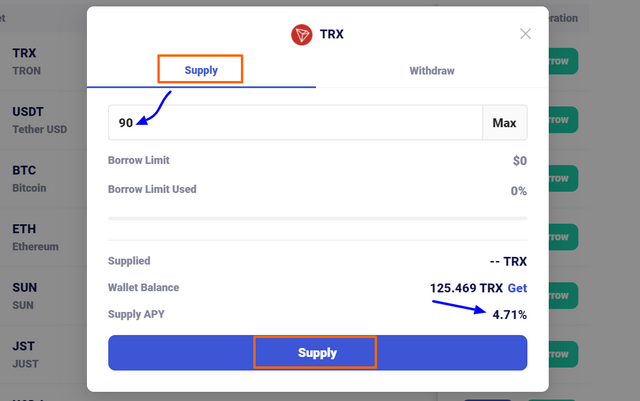

- Chose a market of your choice, click on Supply. e.g. TRX

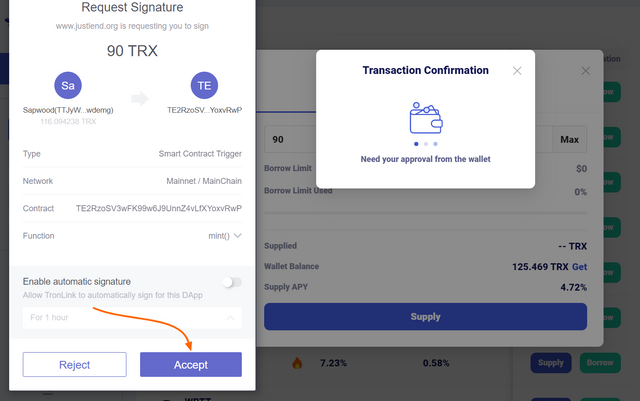

- Enter the supply amount & sign the transaction in TronLink Wallet(JustLend will interact with your TronLink Wallet, powered by smart contract).

- Check your TronLink Wallet to find the jTokens, e.g. jTRX (if you have supplied TRX tokens).

.png)

.png)

.png)

.png)

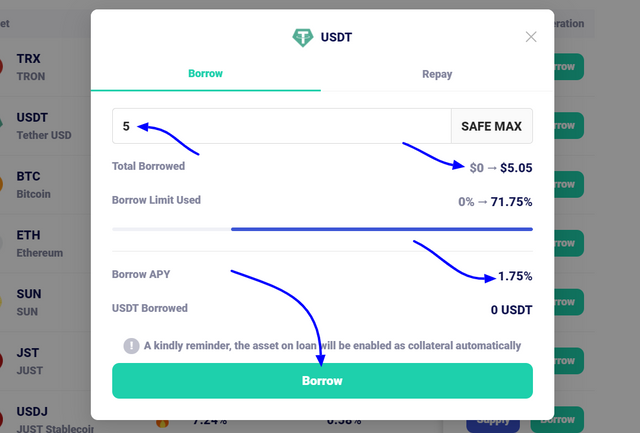

Collateralize jTokens to borrow an asset

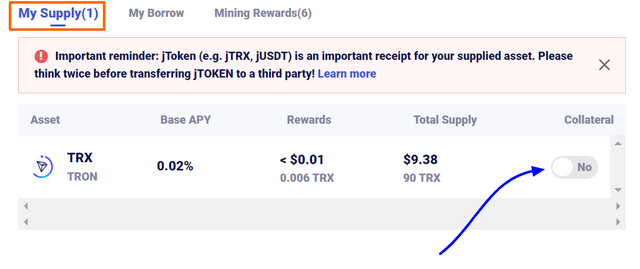

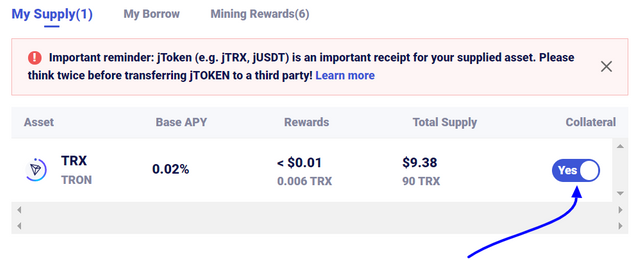

- After supplying an asset it will be automatically listed under "My Supply".

- You can collateralize your supply(literally your jTokens issued against the supply) by enabling the collateral button. Slide the button to enable it.

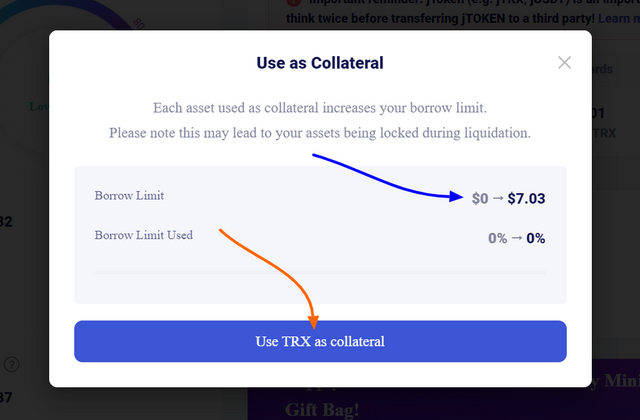

- A pop-up will appear, where you can find your borrow limit(75% of the Supply in the case of TRX). Now click on Use TRX as Collateral. Sign the transaction.

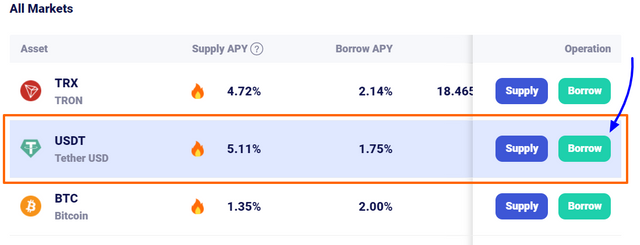

- Go to the JustLend Market, and then borrow any asset of your choice. e.g. I will borrow USDT.

- Enter the amount(e.g. 5 USDT), click on Borrow, sign the transaction.

- 5 USDT as a loan is now delivered to your Wallet.

.png)

.png)

.png)

.png)

.png)

.png)

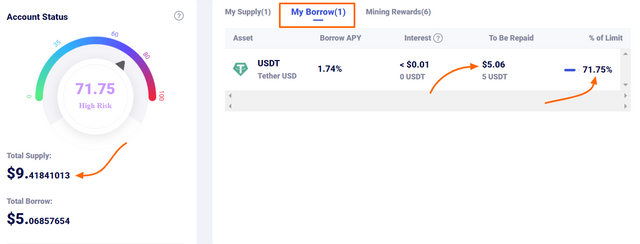

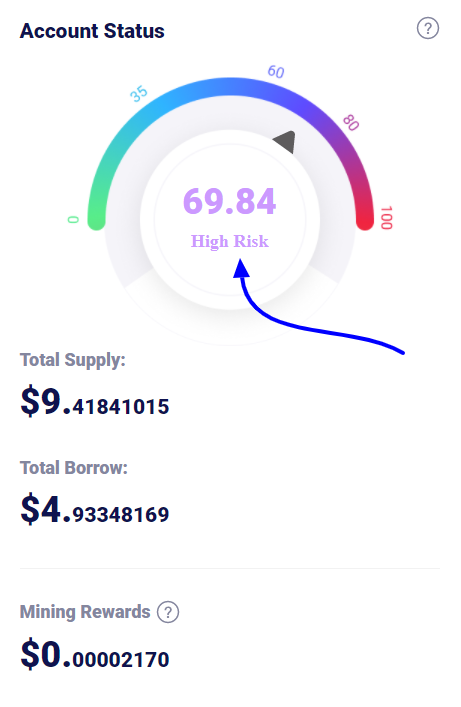

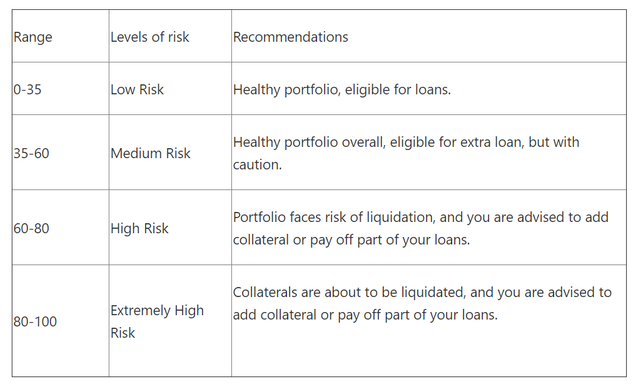

Account Status(Risk Value)

Always pay attention to the Account status. Make sure it does not reach 100%, once that reaches 100%, the collaterals will be liquidated.

.png)

Ideally, you should keep the risk at 50% or below, considering the volatile market condition. If due to unfavorable market conditions, it approaches 100%, you should supply additional assets and collateralize them to avoid liquidation of assets or pay off the loan partially.

Net APY

I have supplied 90 TRX, getting a Supply APY of 4.75%.

I have collateralized jTRX(with a collateral factor of 0.75) to borrow USDT.

I have utilized 70% of my borrowing capacity to borrow 5 USDT. The Borrow APY in USDT Market is 1.74%.

The Net APY I earn(as indicated)= 3.84%.

.png)

Conclusion

The JustLend protocol powered by Smart contract is definitely a low-cost & effective DeFi project as compared to the other popular DeFi on the top of Etherum Blockchain. It definitely creates an avenue for those who deal with small-scale transactions and seek a micro-loan. A loan amount as low as 1 USDT is possible & feasible in JustLend.

With the dynamic interest rate, a concept like net APY, most of the time, the borrowers earn an interest rate in JustLend. There is no expiry/no restriction/no timeline.

Thank you.

Homework Task (Season 2/Week-3)

(1) What are the different Markets available in JustLend, which market offers the best Supply APY, and which market offers the lowest borrow APY?(Screenshot needed)

(2) How do you connect TronLink Wallet to JustLend, and How do you supply a token(e.g. TRX, SUN, JST, etc) to earn Supply APY? (Screenshot Needed)

(3) How do you acquire jTokens, after supplying a particular token, check your TronLink Wallet and indicate how much jTokens you have acquired? (Screenshot Needed)

(4) How do you collateralize jTokens to borrow another asset? Borrow any asset of your choice(e.g. USDT), you can borrow a micro amount(as little as 1 USDT), include the entire process with screenshots?

(5) How much interest did you pay, under what condition it will trigger liquidation? What is the net APY in your case? What is the Account Status(Risk Value) in your case? (Screenshot Needed)

(6) How do you repay & unlock your asset in JustLend?(Screenshot Needed)

Important Note- With the rise of STEEM price, the purchasing power of Steemians has greatly improved, therefore we expect the participants of this task to showcase a real example of supply/borrow using JustLend. You can do a micro-transaction (if you don't have sufficient TRX or other listed assets of JustLend). This will help you gain real experience in JustLend.

Guidelines

- Your article should be at least 300 words.

- It is always better to gain user experience before submitting your article.

- Refrain from spam/plagiarism. This task requires screenshot(s) of your own experience. Use images from copyright-free sources and showcase the source, if any.

- This homework task will run until 1st May'2021, Time- 11:59 PM UTC.

- Users having a reputation of 50 or above are eligible to partake in this Task.

- Add tag #sapwood-s2week3 #cryptoacademy in your post and should be among the first five tags. You can also use other relevant tags like #defi #justlend #market or any other relevant tag.

- Those who include the real examples/screenshots will score better.

(Please feel free to join the comment section if you have any doubt on Homework-Task)

Cc:-

@steemitblog

@steemcurator01

@steemcurator02

Here is my home work

https://steemit.com/hive-108451/@okoyejoshua/crypto-academy-week-11-homework-post-for-sapwood

Ok, so i try this and it EATS all my trx more then it should be.. what the heck it going on :-/.

This is my homework post

https://steemit.com/hive-108451/@kelechisamuel/crypto-academy-week-11-homework-post-for-sapwood-by-kelechisamuel

Buenas noches profesor @sapwood por aquí mi tarea.

Good evening teacher @sapwood over here my homework.

https://steemit.com/hive-108451/@adriancabrera/steemit-crypto-academy-or-temporada-2-semana-3-justlend-by-adriancabrera

This is a link to my post professor @sapwood:

https://steemit.com/hive-108451/@damzxyno/steemit-crypt-academy-week-3-home-work-post-for-sapwood-or-justlend

This is a link to my twitter post:

https://twitter.com/Damzxyno/status/1386957461802950664?s=19

Thanks for this great class, dear professor Justlend is a very interesting platform, here is my task is in Spanish

https://steemit.com/hive-108451/@ramsesuchiha/crypto-academy-week-11-homework-post-for-sapwood-justlend-esp

Hello dear sir. Here is my homework submission for this week.

https://steemit.com/hive-108451/@steemlover63/steemit-crypto-academy-homework-post-for-sapwood

Thanks a lot.

Thanks for the wonderful lecture professor @sapwood. It's a groundbreaking one from you again and I've made my entry, the link to it will be presented below. Thank you, sir.

https://steemit.com/hive-108451/@fredquantum/crypto-academy-week-11-or-homework-post-for-sapwood-or-justlend

Im having problem with the collateralization of jtrx. It is showing failed all the time .

That's because you don't have sufficient TRX.

Please note that every smart contract operated transaction will cost you some fees(in TRX, as insufficient energy will burn a few TRX to accommodate it), so make sure you have sufficient TRX before you carry out any operation in JustLend.

Thank you.

Thank you for the info , I will take care of it. And if I look for error it shows low energy .

Hello @sarveshnegi2811,

I had the same Issue. I had to fund my wallet with Tron then freeze some to provide energy and a little to provide bandwidth. Doing that, your Trx is not consumed. This is one of the things I learned while doing professor @sapwood's assignment.

Thank you , I am doing the same thing , I just wanted to ask you if you waited for your energy to go up again and again for transaction to get completed because it failed many times during the transactions .

No. Though the bandwidth given is 5000 daily, I still froze some trx in case. And Energy is not given daily, so its either you burn coins or you're smart about it and freeze enough. As you can see mine, I have enough bandwidth and energy to perform transactions.

Simply click on Energy then input a small amount of Tron to freeze in exchange for Energy. This frozen Energy wi be available only after a week, I can't really remember.

Thank you for your help 😇.

This is my homework entry, Prof @sapwood : Crypto Academy Week 11 - Homework Post for Professor @sapwood : JustLend.

Thanks.