Steemit Crypto Academy | Season 2: Week1-- P2P Market-USDT (Binance/Huobi)

Background

With the plethora of exchanges and their varieties in the crypto domain, we all have so many choices to trade crypto assets. Whilst trading crypto-crypto is quite easy, trading crypto-fiat may not be that easy owing to regulatory scrutiny. Many of us are familiar with popular exchanges like Binance, Huobi, etc. The crypto trades have not yet reached a point with a friendly regulatory framework, therefore at times, you may find it difficult to trade your crypto assets for fiat and vice versa(depending on country/region).

Exchanging crypto for sovereign currencies/other fiat options may encounter some sort of regulatory scrutiny, depending on the region/country. If that is the case, then the P2P market is the last bastion to deal with exchange issues on regulatory scrutiny.

P2P Market can be both centralized and decentralized. In today's reality, both co-exists. However, your immediate requirement/priority will determine the choice of a particular avenue.

Today we will discuss in detail the various aspects/features of the P2P Market (USDT Market in Particular), and we will also keep it central to Binance and Huobi P2P Market, as both of them are quite popular and have a sufficient volume of trade, and a wider user-base.

P2P Trading (Binance/Huobi)

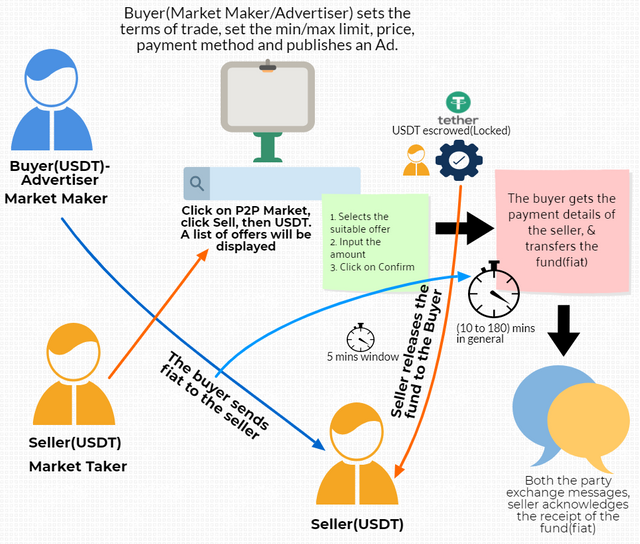

The objective of the P2P market is to offer you more flexibility and freedom. In essence, in a P2P market, it is the user who sets up the trade terms, it is the user who sets the min and max limit, the type of payment method, price, etc.

.png)

.png)

The P2P platform extends escrow service to shield you from fraudulent trades and both the buyer & seller remain in good standing with trade with escrow protection.

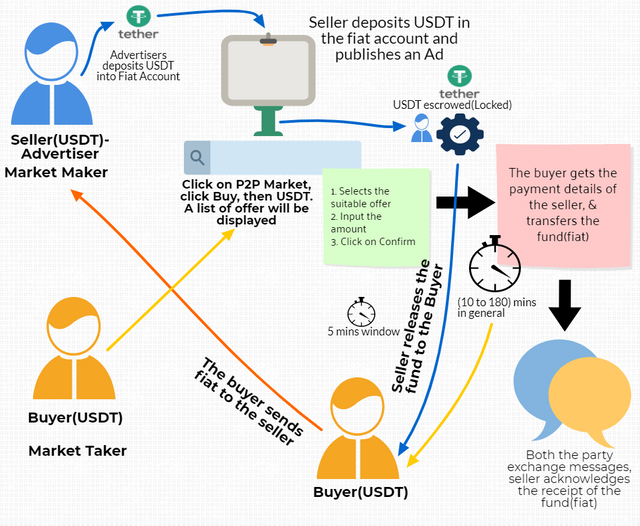

There are two types of traders in a P2P Market- Market Maker(Advertiser), Market Taker.

Market Maker, also known as Advertiser is the one who creates an offer, setting his own terms to trade, choice of fiat payment method, price, min & max amount, window time to complete the order.

A Market Taker is the one who responds to an offer created by the Market Maker.

In Both Binance and Huobi P2P Market, an advertiser needs to set up a username(which can't be changed). In Huobi, you also need to set a Fund Password, the equivalent thing in the case of Binance is OTP.

In other words, when a seller releases USDT to the buyer, he has to enter Fund Password(in Huobi) and OTP(in Binance).

The zero trading fee in the P2P market of Binance and Huobi makes it attractive for traders.

In the P2P market, you can trade a wide variety of crypto assets with popular ones like BTC, ETH, BNB, USDT. But USDT market is a highly liquid market for obvious reasons. Hence most of the concentration of traders you can find in the USDT market.

.png)

.png)

How does it work?

Buy/Sell USDT

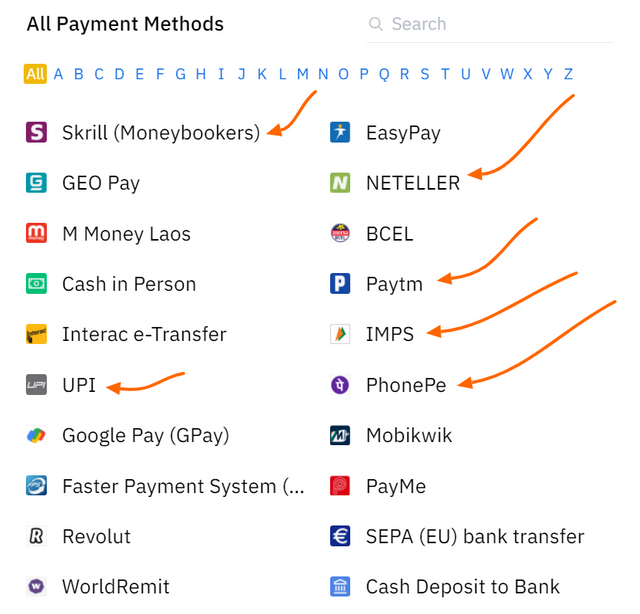

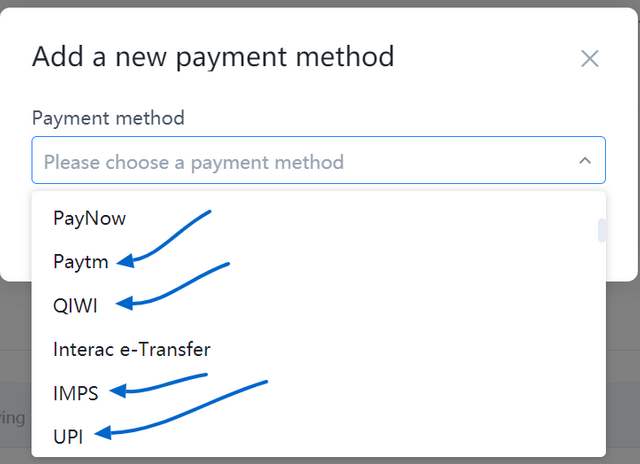

If you are a Market Maker, then you have to set a username and fund password in the Fiat account chose at least one payment method(you can also add multiple payment methods). It is always better to do KYC, as the traders prefer to trade with a KYC verified merchant.

If you are a Market Taker, then select at least one payment method(fiat), then simply go to the P2P Market, check the lists and find the most competitive offer, do check the Terms of trade and also the min and max limit, then perform the trade(either sell USDT or buy USDT by paying fiat), upload the screenshot in the chatbox and ask the seller to release your USDT. Please do note that there is window time(set by the Advertiser) within which you need to send the payment, otherwise it will automatically timeout.

Sell USDT(Advertiser)

.png)

Buy USDT(Advertiser)

.png)

Being a Market Maker you also have the flexibility to use a filter such as-- who do you want to trade with(KYC verified only, or all), blocking a user, setting the window time of a trade, etc.

Set up your fiat account in P2P

- Set a username/nickname

- Set Fund Password(in Huobi), the equivalent thing is OTP(in Binance)

- Chose payment method. You can add multiple payment options.

Create an Ad(For Market Maker)

- Set the price for USDT. Here you can enter a fixed price or floating price. In floating price the traders generally put a certain percentage higher than the base price(to keep a margin of profit). You can also keep a fixed price.

- Enter the min and max limit.

- Verify and publish the Ad(You need to enter the fund password)

.png)

A market taker generally responds to an Ad, you will get a notification once someone responds to your ad, then you can have a chat with your counterpart, ask the counterpart to make the payment(in case you are selling USDT) and you can make the payment to your counterpart(in case you are buying USDT). Once you acknowledge the payment from the buyer, you should proceed to release the asset. In the case of a dispute, you can raise an appeal and then the third party(Binance/Huobi Team) will intervene, check the evidence and release the asset to the rightful owner.

The Market takers should take note of the following when they take up a trade with a Market Maker(Advertiser):-

- Always pay attention, whether the Advertiser is online or not. An online Advertise can quickly release the asset.

- Whether the advertiser is responsive in the chatbox or not.

- Always check the advertiser's profile to check the history of trades-- nos of trades, average release time, etc.

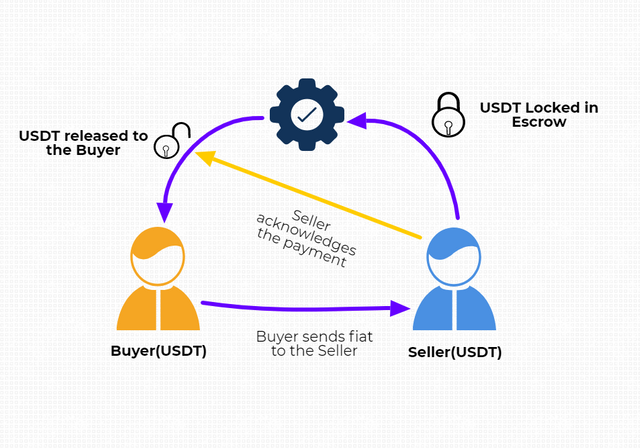

Escrow Protection

Huobi, Binance, etc are the trusted third parties in the P2P Market. They offer escrow protection to ensure safe, fair trading for both buyers and sellers.

So whenever the buyers/sellers initiate a trade, the crypto assets are automatically locked(escrowed) which serves as a guarantee for the counterpart to make the payment.

.png)

Please note that either the seller or the trusted third party(Binance/Huobi) can release a locked(escrowed) crypto asset to the buyer.

The buyer can either perform a trade(by making the payment) or cancel the trade.

There is a chat interface in the P2P market where both buyer and seller can exchange messages.

When the buyer sends the fiat payment, the seller confirms it (he/she may ask the buyer to provide the proof of payment--screenshot/payment voucher) and then release the asset to the buyer.

The trusted third parties intervene only when there is a need for dispute resolution. So in case, there is a dispute between buyer/seller, either party can escalate it and then the trusted third party intervenes and verify the facts/evidence/chatbox, and then release the asset to the legitimate party.

USDT Market & Leveraging TRC-20 USDT to move fund from one exchange to another

USDT market is the most logical(being a stable coin) and highly liquid market in both Spot trading and P2P trading. Therefore exchanging crypto-assets for USDT first and then from USDT to fiat is a very generic use-case. That is why the P2P market of USDT is very very popular today.

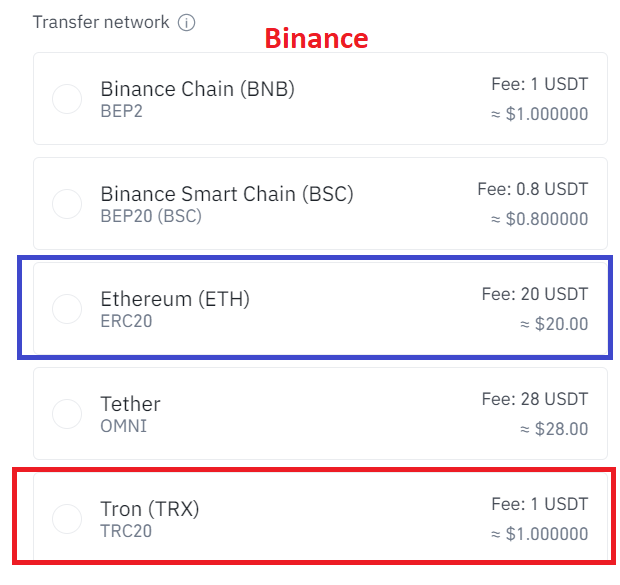

Furter how cost-effective to move USDT from one exchange to another is also an important aspect for the traders.

With the rise of crypto asset's value in this bull cycle, the network fees have gone up significantly and that may not be a cost-effective solution particularly for the micro/small traders who deal with an amount below 100 USDT.

For example, to move ERC-20 USDT from Binance to Huobi will cost you $20 USDT. So if someone transfers 100 USDT then it will be 20% net fees he/she has to pay to move USDT from one exchange to another or from the exchange to the Tron wallet.

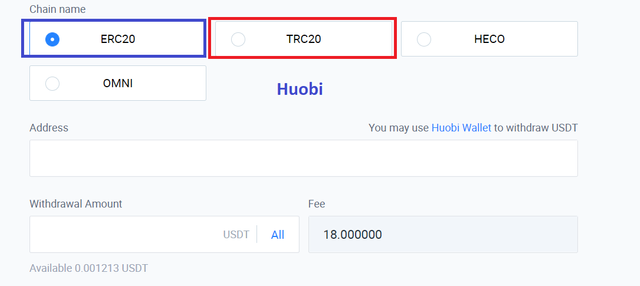

In such a case you should leverage the use of Tron Network. If you transfer your USDT through Tron Network, it will cost you $0, however, Binance and Huobi charge a nominal fee of $1. That is still better than paying $20.

If you can move the USDT from one exchange to another, then you can also optimize your position in arbitrage trading.

For example, you might get USDT at a lower rate in Binance and you can sell it in Huobi at a higher rate, just keep following the trend, prices and accordingly take advantage of these market-making opportunities. If that has become possible today then credit goes to Tron Network, because TRC-20 USDT is the most cost-effective network to transfer/move funds.

Make sure the two exchange under consideration supports the transfer of TRC-20 USDT token. For example, if TRC-20 USDT is supported in Binance and Huobi both, then you can easily transfer it from Binance to Huobi and vice versa. Similarly, you can easily transfer it to your Tron Wallet.

TRC-20 USDT has made the P2P Market more general than ever, definitely, it has created Market Making opportunities in terms of arbitrage trading, which is never possible when you don't have a cost-effective way of transferring USDT. Further, TRC-20 USDT is the true friend of micro/small traders who often deals with an amount below 100 USDT. In other words, it has lowered the barrier to entry and opens up an avenue for micro traders as well.

Advantages/Disadvantages

Advantages

- Zero trading fees in the P2P Market of both Binance & Huobi.

- More fiat options including sovereign currencies. So it fosters a sense of global Marketplace.

- More freedom and flexibility for both buyers and sellers to trade their assets for fiat & vice versa.

- The min and max limit is defined by the traders, not by the trusted third party(Binance & Huobi)

- Better Market Making opportunities.

- Escrow protection.

Disadvantages

- In the case dispute, the wait time can be longer than 24 hrs depending on the complexities of the case, however, the fund will remain safe in escrow protection.

Conclusion

P2P Market is a gateway for crypto adoption because the value flows from the traditional market into crypto and that further galvanizes when you have a wide variety of fiat options including sovereign currencies.

Both Binance and Huobi P2P market(USDT) is a thriving economy for many individuals as traders can open their exchange niche to set their own terms of trade, price, limit, etc. In other words, it has also earned a living for many individuals.

TRC-20 USDT has further made it cost-effective as the traders/merchants can easily(with low/nil fees) & quickly move funds from one exchange to other and take advantage of arbitrage trading.

Thank you.

Homework Task (Season 2/Week-1)

(1) Explain how you set up your exchange niche in P2P Market(Binance or Huobi)- Market Maker/Advertiser?

(2) Explain how you buy/sell USDT in the P2P Market of Binance or Huobi for fiat? (Screenshot needed)

(3) How does escrow protection help a buyer and seller?

(4) What are the different payment methods (fiat options) available in Binance or Huobi? (Choose any one exchange to demonstrate) Have you ever used any of the fiat payment methods to trade your USDT? Examples/Screenshot?

(5) What is the minimum amount you can trade in the P2P Market(USDT) of Binance or Huobi? (Choose any one exchange to demonstrate)

(6) Have you ever transferred TRC-20 USDT from Binance to Huobi and vice versa? How much cost do you save using Tron Network as compared to ERC-20 USDT?

Important Note- With the rise of STEEM price, the purchasing power of Steemians have greatly improved, therefore we expect the participants of this task to showcase at least one P2P trade(buy/sell) using Binance P2P or Huobi P2P. You can do a micro trade worth $1(if you don't have sufficient USDT). This will help you gain real experience in the P2P Market of Huobi/Binance.

Guidelines

- Your article should be at least 300 words.

- It is always better to gain user experience before submitting your article.

- Refrain from spam/plagiarism. This task requires screenshot(s) of your own experience. Use images from copyright-free sources and showcase the source, if any.

- This homework task will run until 18th-April'2021.

- Add tag #sapwood-s2week1 #cryptoacademy in your post and should be among the first five tags. You can also use other relevant tags like #p2p #blockchain #market or any other relevant tag.

- Those who include the real examples/screenshots will score better.

(Please feel free to join the comment section if you have any doubt on Homework-Task)

Cc:-

@steemitblog

@steemcurator01

@steemcurator02

Hello Professor @sapwood, please this is my assignment for your assessment. Please kindly look into it. Thanks STEEMIT CRYPTO ACADEMY/SEASIN 2: WEEK 1--P2P MARKET-USDT (Binance/Huobi) @justiceanietie

Thanks Prof@sapwood. I thank this platform for bring in new professors who will educate and make us to know more about trading as prof has just did. @justiceanietie is saying a big thanks for a work well done .

My home work task

https://steemit.com/hive-108451/@salemumar5/home-work-task-steemit-crypto-academy-or-season-2-week1-p2p-market-usdt-binance-huobi-for-sir-sapwood

My home work task I had postedd my post 4 days ago please review it sir @sapwood

https://steemit.com/hive-108451/@salemumar5/home-work-task-steemit-crypto-academy-or-season-2-week1-p2p-market-usdt-binance-huobi-for-sir-sapwood

Hello prof. This is my assignment. Please i wish to know my performance. Thanks

RE: Steemit Crypto Academy | Season 2: Week1-- P2P Market-USDT (Binance/Huobi)

Very nice to see that leaning process has resumed and that too with improved rules and regulations. Will be participating soon.

Hello. My first experience in participation in the cryptoacademy. Homework.

https://steemit.com/sapwood-s2week1/@borisss/homework-steemit-crypto-academy-season-2-week1-p2p-market-usdt

Hello prof.

This is my homework submission.

https://steemit.com/hive-108451/@rubilu123/steemit-crypto-academy-or-season-2-week1-homework-task-by-rubilu123-for-sapwood

Hello! My work here: https://steemit.com/hive-108451/@greatketty/steemit-crypto-academy-or-season-2-week1-p2p-market-usdt-binance-huobi

Hello, professor @sapwood,

here is my entry

Crypto Academy Week 9 - Homework Post for @Sapwood

Thank you for the lecture