Stability in Digital Currencies- Steemit Crypto Academy- S4W5- Homework Post for @awesononso

![Screenshot_20211005-054954[1].png](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmNk3zQGwqJZDF3y99JH1qG7DdD7cPoUkb1XrZAQTHXLkN/Screenshot_20211005-054954[1].png)

Hello everyone and welcome back to the 5th week of the season. I will be attempting questions from the interesting lecture by prof @awesononso on Stability in Digital Currencies. I hope I am able to explain to the best of my understanding. That been said, Let's dive right in...

Why Stability is important in Digital currencies.

As the saying goes "stability is everything". it is though?. Naturally, people tend to place their trust in a more stable system, business or organization. At the very least the chances of you having your trust broken is slim.

Digital currencies have been know for their highly volatile nature and as such can not be associated with the word stable. However, if stability was to become a norm for digital currencies we can say they can become a store of value.

Stability will ensure that the money you have invested will not only yield interest but your money would not depreciate or be totally lost. You can be certain of your outcomes.

This would also put investors mind at ease and encourage them to spend their money, there by reducing the rate of increase over a given period of time .

Also, it would encourage the day to day use of digital currencies for everyday transactions and as a form of digital cash. This will ring a level of trust and would be a currency widely accepted in the market.

Do you think CBDCs would be good in the future? Weigh the pros and cons in your own understanding and state your position.

My honest opinion, I do think not think the CBDC would be good in the future. I will be stating my reasons as a Nigerian .Let's see reasons

As much as it would eliminate the issue of having to deal with physical banks. It is still a technology based currency and even in this time and age some people merely do not trust having a Local Banking App or even an ATM card. They prefer to deal with their money issues in person makes them feel heard.

Another area of trust is the mere fact that it is centralized. Most people who are conversant with cryptocurrencies would not like the idea of been monitored by the government and as such might not really pay attention to this currency.

Then there is a possibility of been hacked. For whatever domain used to build on this would need to be properly secured, to avoid clones and masses loosing their money.

Using it as an approved legal tender is a good advantage, however, the very fact that it is a peer-to -peer might be very risky which most likely would be left to have ties with existing Bank accounts.

It is not a good Idea, neither would it in the future. It would not gain as much attention as the government might like it to. Seeing as they can easily change whatever they feel like at any time would not be a welcomed idea. It would inevitably not satisfy people who are already accustomed to the decentralized blockchain. The mere fact that it is not going have any benefit except been just a digital currency, it would only benefit the government more. Since the very essence is out of fear and to reduce the traction that cryptocurrency is getting.

Explain in your own words how Rebase Tokens work. Give an illustration.

Rebase Tokens are price elastic, circulating supply adjust accordingly to price fluctuations be it increase or decrease. This is referred to as the Rebase Mechanism. This adjustments are made without altering or changing the value of the tokens.

How Rebase Token Works

Its automatic nature to adjust would mean that if the demand for token is high, price would increase and when there is an increase in price this would mean an increase in supply.

Price increase= supply increase

This does not change the value of the token.

Also same for when demand for the token is low this would mean that the price would decrease and when there is a decrease in price there would be decrease in supply.

price decrease=Supply decrease

To elaborate, if Elvis has 2AMPL, which doubles in value to become $4, the supply will expand during the rebase period. There by reducing the value of AMPL, this means that Elvis' 2AMPL will decrease to 1AMPL, still the value will still $2. Since 2AMPL is now worth $4. It has adjusted to the price.

Go to the https://www.ampleforth.org/dashboard/. Check the necessary parameters and calculate the rebase %. What else can you find on the page?

Calculate the Rebase %

Rebase % =[ (Oracle Rate - Price Target) ÷ Price Target] x 100] / 10

Oracle Rate=$1.021

Price Target=$1.061

Rebase %

=[(1.021-1.061)/1.061]x100/10

=[(-0.04/1.06)]x100]/10

=(0.021x100)/10

=2.1/10

=0.21%

I can also see

- the Time for the Rebase

- The circulating supply/Total Supply

- Market Cap

Trade some tokens for at least $15 worth of USDT on Binance and explain your steps. (Give necessary Screenshots of the transaction).

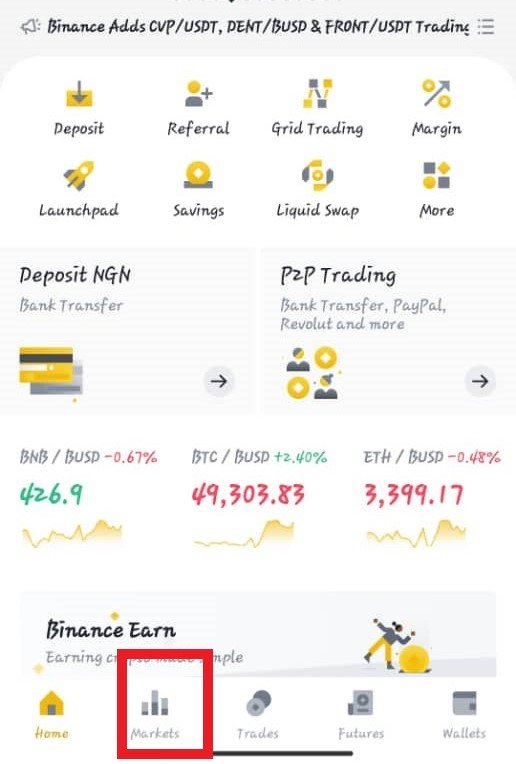

Step 1 :Open your Binance. On your homepage ,Click on market

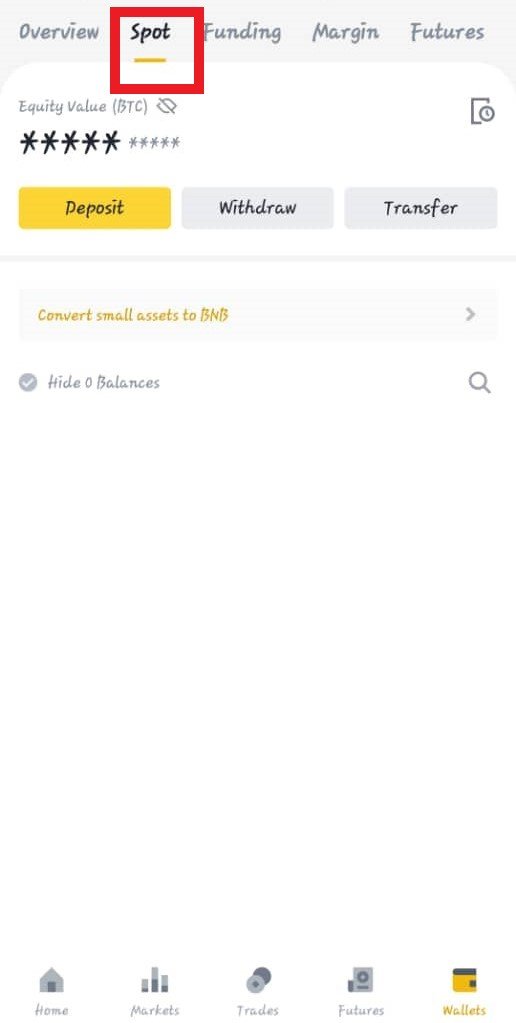

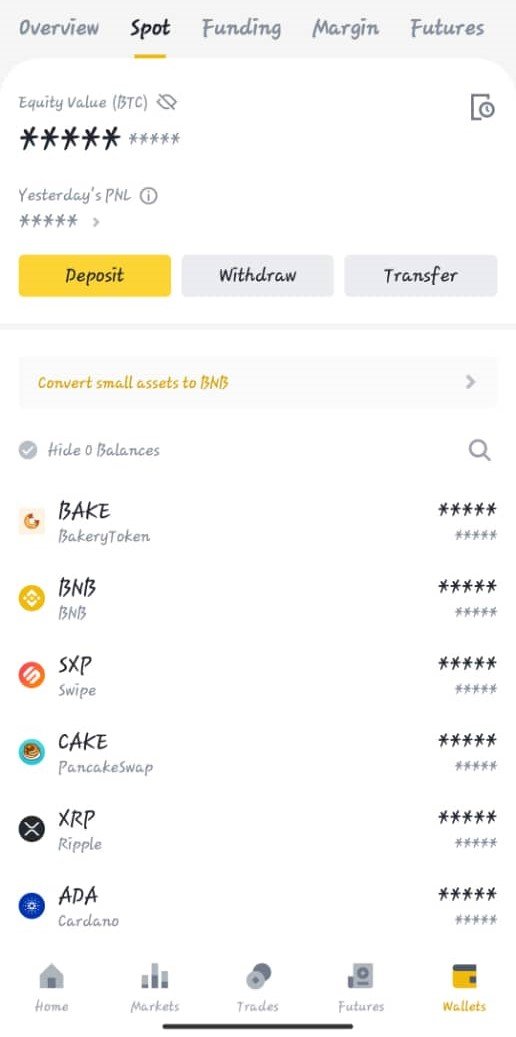

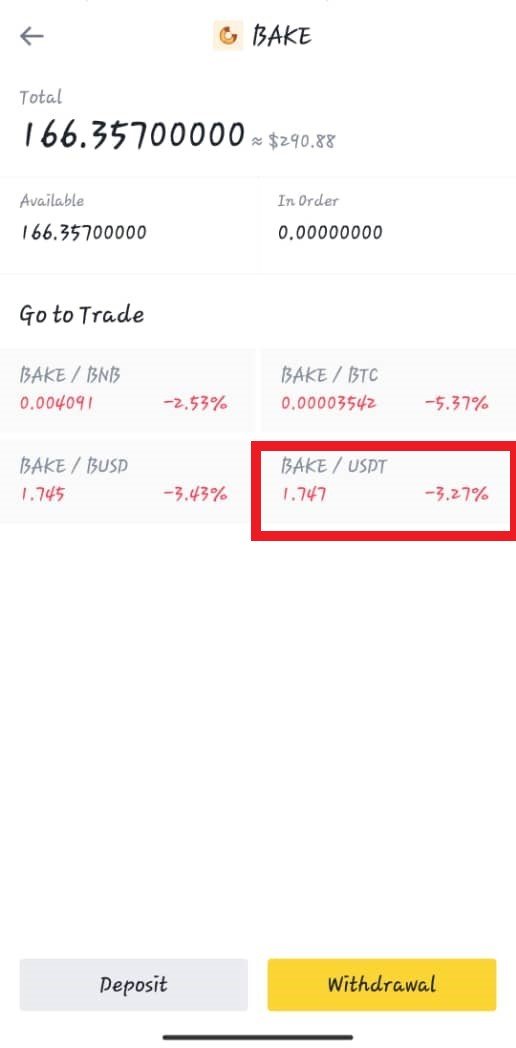

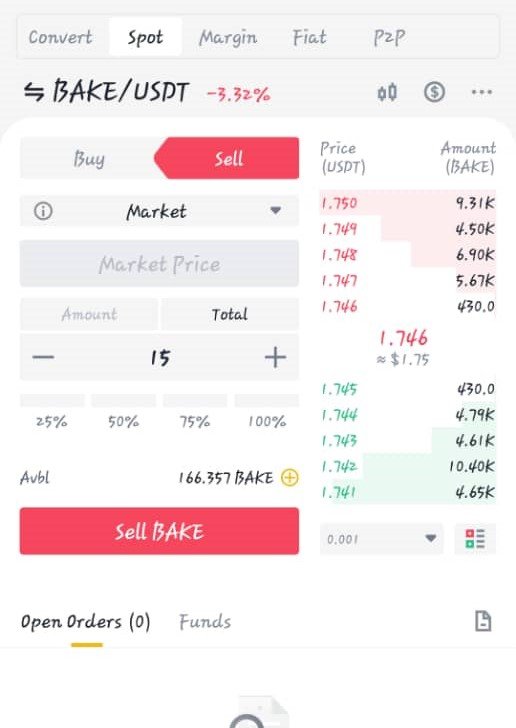

Step 2: Click on Spot and select your desired token. In this case BAKE

Step 3: select BAKE/USDT

Step 4: Select market and Input your price. Click on sell

You are done.

Transfer the USDT to another wallet with the Tron Network. From the transaction, what are the pros of the stablecoin over fiat money transactions? (Give Screenshot of the transaction).

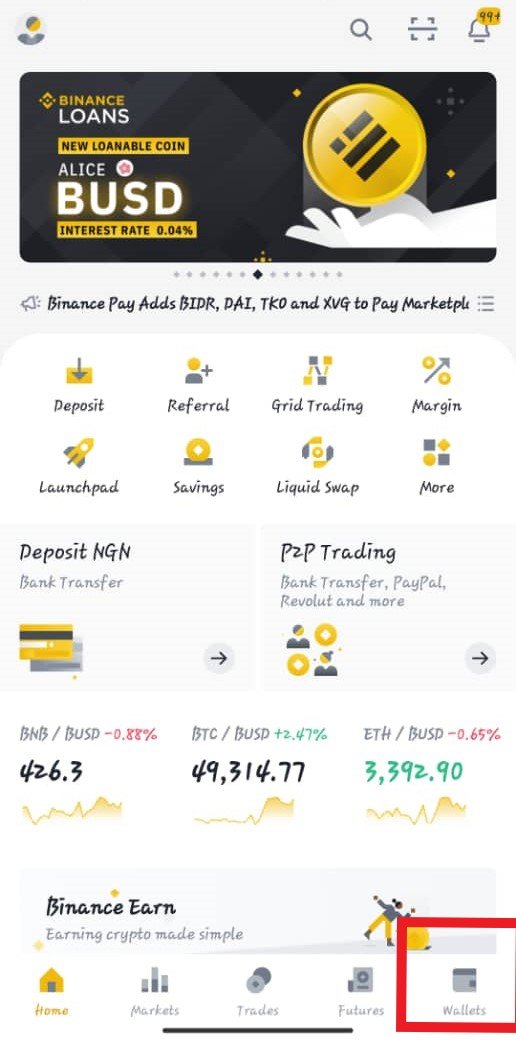

Step 1: Open your Binance. On the home page ,click on Wallets

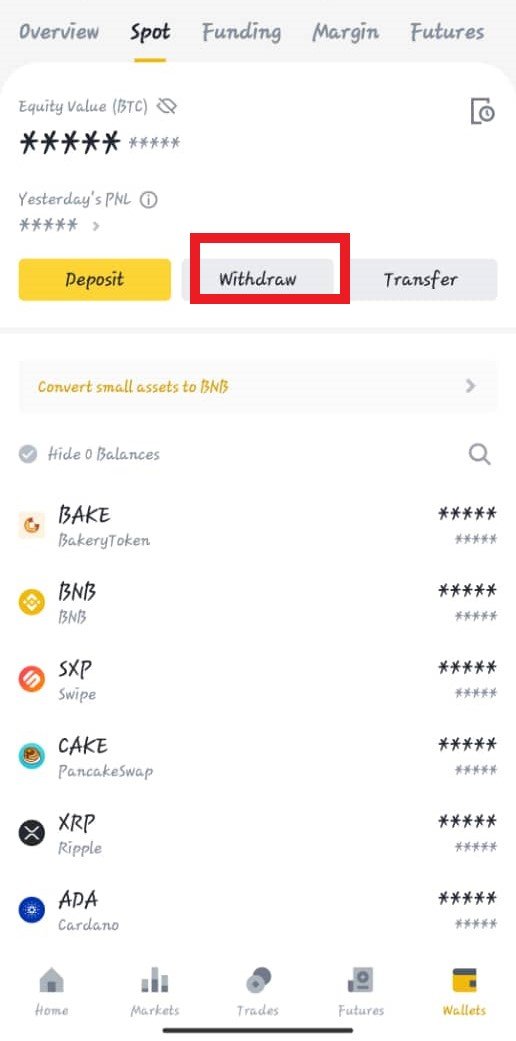

Step 2: It would bring you to this Page. Click on withdrawal

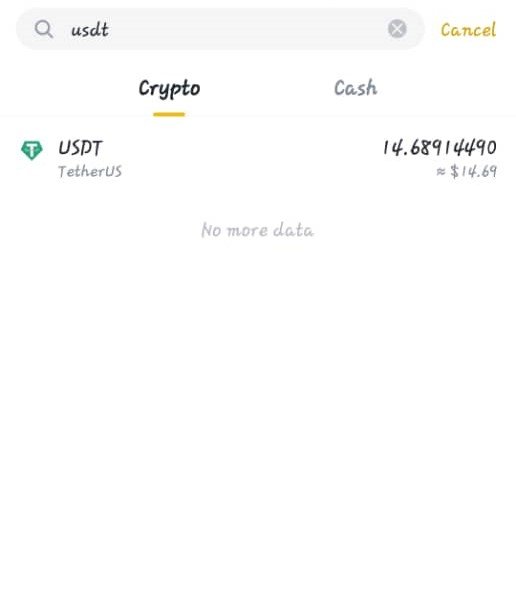

Step 3: On this page Search for USDT and click on the appropriate one.

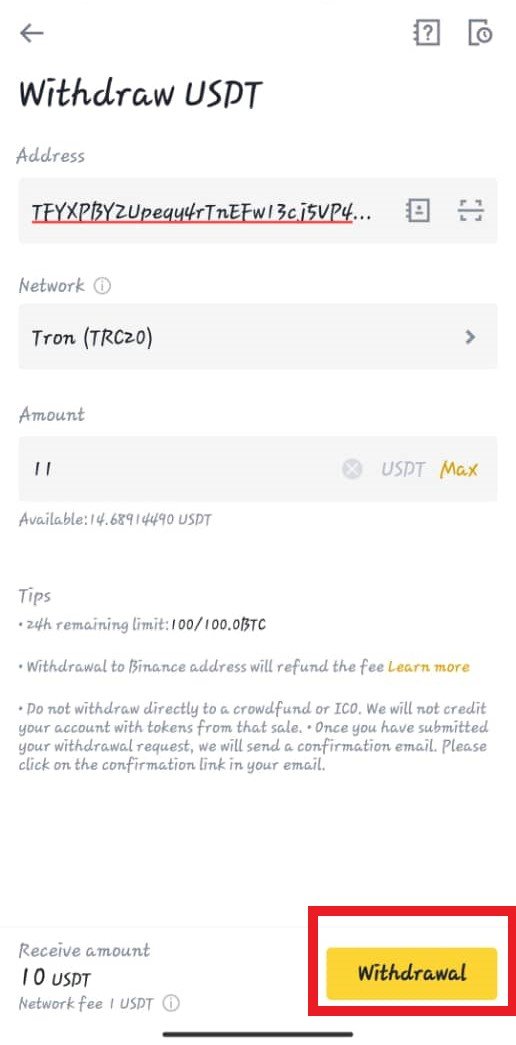

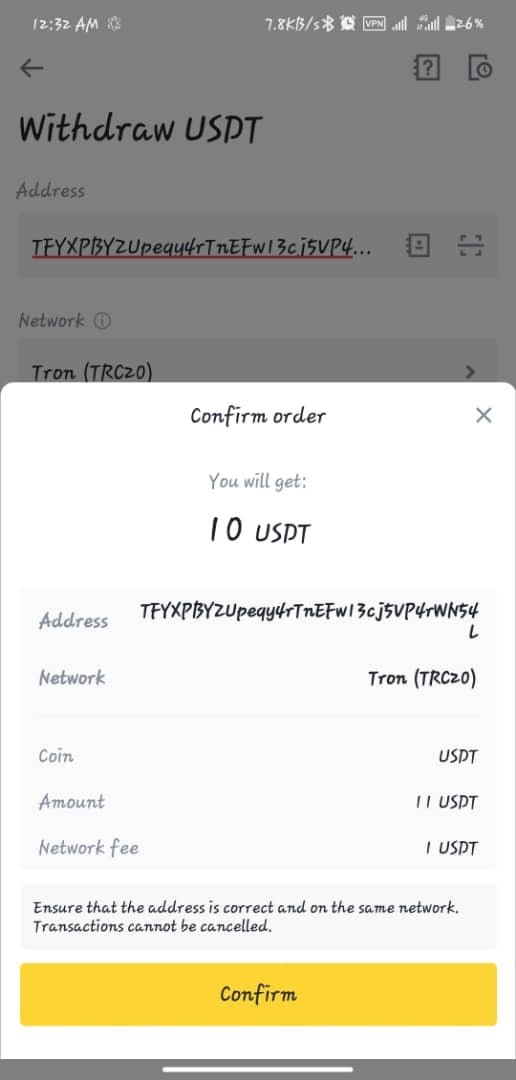

Step 4: It would proceed to this page where you input the receivers information and amount. Click on withdrawal

Step 5: Confirm your order. And you have successfully transferred to your Tron wallet

Pros of the stablecoin over fiat money transactions

- They are not under the control of the government and central banks unlike fiat.

- Transaction using stable coins charge less transcation fee unlike Fiat currencies.

- Stable coins are pegged at a value and as such saved from price volatility . E.g The Binance Pegged dollar owned by Binance and it is always pegged at 1:1 ratio to USD.

Conclusion

We have discussed Stability of Digital Currency and also looked at a very interesting token , The Rebase Token. Also discussed the eDigital currency. I will like to thank @awesononso for the lecture.

.png)