Trading the News: Strategies for Steem/USDT

|

|---|

Welcome to my participation once again. This week's discussion is on trading the news, i.e., how traders and investors reacts to the market based on news received. Like I will always say, I hope you get to learn something new as I attend to the hints provided.

Understanding News-Based Trading |

|---|

Trading the news is an important aspect in the cryptocurrency or any financial market because it helps traders to capitalize on price movements caused by important events, so by staying informed and reacting quickly, we can potentially make profits. However, we must also be cautious of the risks involved as well. So then, what does it even mean to trade the news?

Trading the news is simply a strategy where traders buy or sell cryptocurrencies or any asset based on news events and announcements. We experience this even in our everyday life around. For instance, let's say you bought bread from a bakery for 1 Steem, then you heard the news that there is no other bakery with bread or the flour company is closing, and you go back to buy more, you will be surprised that the same bread you bought for 1 Steem is now worth 5 Steem.

This also happens in the finance and crypto market. This therefore means that when something important happens in the world of crypto, such as new regulation, a partnership or a technological breakthrough, traders get to react quickly to that information, hoping to profit from the price changes that might follow. How does it work then? Here is how;

News Impact:

When big news breaks it can cause prices to rise or fall dramatically. For example, if a major company announces it will start accepting Bitcoin as payment, many traders might rush to buy Bitcoin which can lead to a price increase in Bitcoin. Whereas, if there is negative news, like a government banning cryptocurrencies, traders might tend to sell the ones they have not to be caught unaware of, which can cause prices to drop.

Timing is Key:

The key to trading the news is timing. Therefore, traders need to be aware of upcoming events like earnings reports or regulatory announcements and be ready to act quickly as prices can change immediately within seconds of the news breaking, so being informed and ready to trade is crucial.

Volatility:

The cryptocurrency market is known for its volatility which means prices can change quickly and dramatically. However, news events can amplify this volatility even more, thereby creating opportunities for traders to make profits. However, it also means there is a risk of losing money if the market reacts unexpectedly against us.

Research and Analysis:

Successful news trading requires research just like every other business, so traders often follow news sources, social media, and market sentiment to gauge how news might impact prices. Therefore, analyzing past reactions to similar news can also help predict future movements.

Now that we know what news trading is all about, what is its significance then? Well, the significance of news trading in the crypto market lies in its ability to create opportunities for profit and to influence price movements in ways such as;

Influencing Price Movements:

News can cause rapid changes in cryptocurrency prices where positive news can lead to a surge in buying whereas a negative news can trigger selling. Hence, traders who act quickly can benefit from these price swings.

Market Sentiment:

News affects how people feel about the cryptocurrency market where good news tends to boost confidence and attract new investors, while bad news tends to create fear and uncertainty. Therefore understanding this sentiment helps traders to make better decisions.

Increasing Market Volatility:

Crypto market trading is only possible because of its ups and downs (volatility), to which news events tend to help fuel a further increase in this volatility, providing traders more chances to make profits, while also increasing the risk of losses.

Making Informed Decisions:

By keeping up with new events, traders can make more informed decisions as knowing what is happening in the market helps them anticipate price changes and adjust their trading strategies accordingly.

Knowing what trading the news is all about and what it brings to the table in the form of its significance, then we can now understand that trading the news with Steem/USDT can offer us opportunities to make profit and also gain insights into market sentiment, but then having it at the back of our minds that it also comes with risks. Therefore, when we are trading the news of Steem/USDT, here are some advantages and risks we should consider.

| Advantages: |

|---|

Opportunity for Quick Profit:

As earlier stated, good news tends to hike the price, so if there is a positive news about Steem, like a new partnership or an upgrade to its platform, then the price of Steem against USDT might rise quickly. For example, if a major social media platform announces it will integrate Steem, traders might buy Steem expecting its price to increase. Hence, if they act fast, they can sell later at a higher price for a profit.

Insights on Market Sentiment

News can give traders insight into how the market feels about Steem. Therefore, if a prominent figure in the crypto community like Elon Musk praises Steem, it could lead to increased interest and investment. Hence, traders who pay attention to such news can position themselves to benefit from the resulting price increase.

Increasing Volatility for Profit:

The crypto market is known for its volatility, so if there is a sudden announcement about Steem, like a regulatory change affecting its use, the price might swing dramatically where traders can take advantage of these swings. For instance, if the news is bad and the price drops, traders might buy Steem at a lower price, expecting a rebound later.

| Risks: |

|---|

Rapid Changes in Price:

While quick profits are possible, the opposite is very possible too. i.e., if negative news breaks about Steem, such as security issues or poor performance, the price could plummet. For example, if a major exchange announces it will delist Steem due to regulatory concerns, the price could drop sharply, leading to losses for traders who bought in before the news.

Overreaction from Traders and Investors:

Sometimes, the market overreacts to news and if traders panic and sell after hearing bad news, the price might drop more than it should. Later, if the situation stabilizes, the price may recover, leaving those who sold at the low with losses. For instance, if there is a rumor that Steem is facing legal issues, the price might fall sharply, even if the rumors turn out to be unfounded.

Timing Challenges:

News trading requires quick decision-making so if traders wait too long to act, they might miss the best opportunity. For instance, if a positive announcement about Steem is made, and a trader hesitates, the price might already have increased significantly by the time they decide to buy.

Analyzing the Impact of News Events |

|---|

Steem itself has witnessed a few ups and downs in the market due to news events such as;

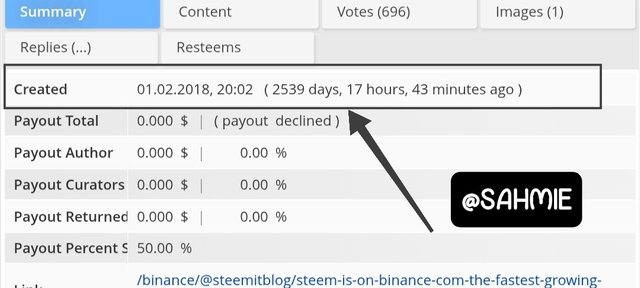

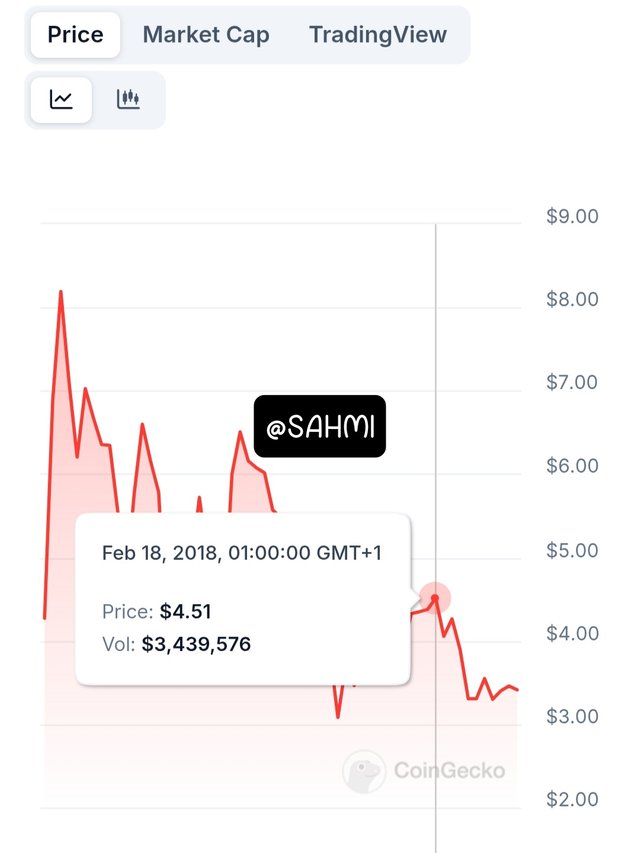

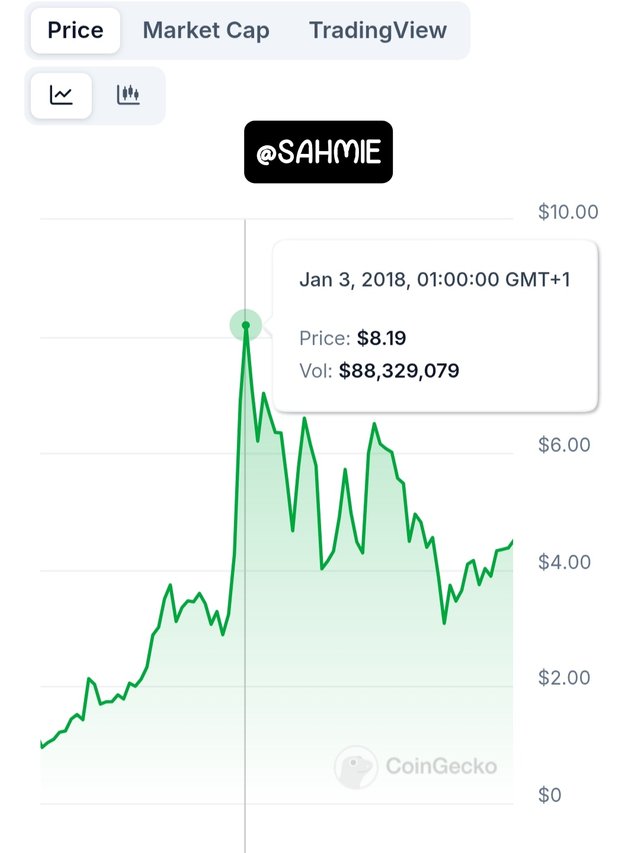

Binance Listing (Positive Event):

When Steem was listed on Binance back in the year 2018, it marked a significant milestone for the cryptocurrency as binance is one of the largest and most popular exchanges globally, therefore being listed there provided Steem with increased visibility and credibility.

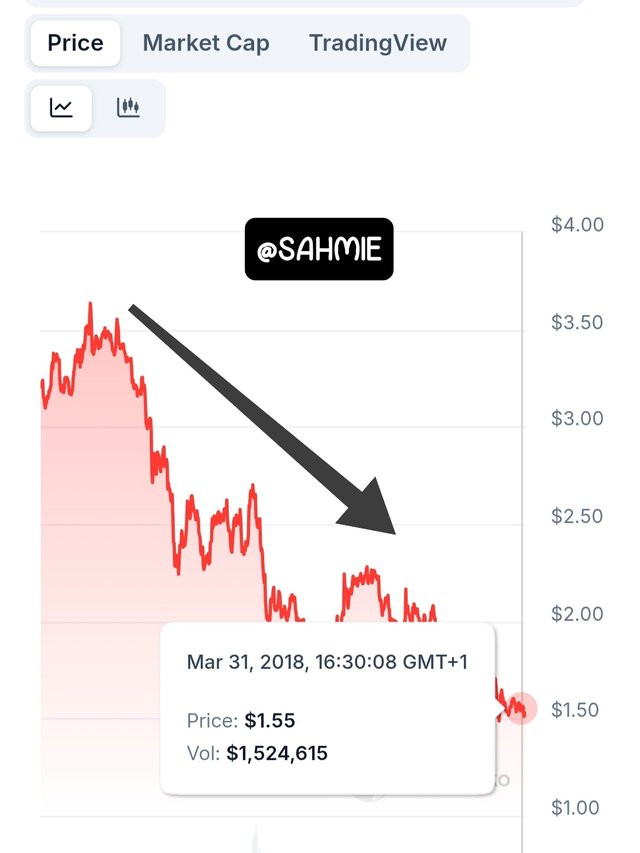

|

|---|

|  |  |

|---|

This being good news, the announcement led to an increase in the trading volume of Steem as many traders rushed into buying Steem, with the belief that the listing would drive demand. Therefore, this influx of new investors would result in an increase in the price of Steem, where in the weeks following the listing, Steem's price rose sharply, reflecting the excitement and optimism surrounding its potential for growth.

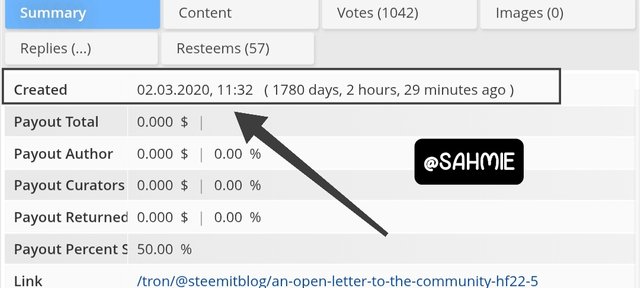

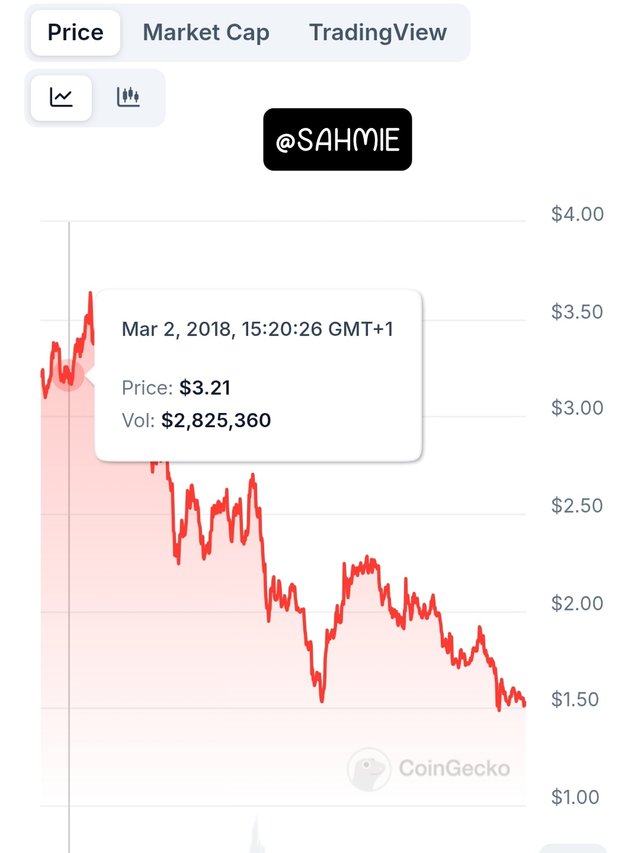

Hard Fork Controversy (Negative Event):

In March 2020, Steem faced a hard fork that brought about a split in its community. This situation was said to have happened when a major stakeholder attempted to take control of the blockchain, thereby leading to disagreement among users about the governance and management of the platform.

|

|---|

Therefore, the hard fork created uncertainty as many investors were unsure about the future direction of Steem and its ecosystem, and as a result, the market reacted negatively, leading to a decline in Steem's price.

|  |

|---|

This happened because investors are also humans like us who tend to often shy away from assets that exhibit instability, and so, this incident caused many users and investors to sell off their holdings and it contributed to a downward trend in the market. source

Crypto Market Crash in 2018 (Negative Event):

This particular event affected the entire landscape of the cryptocurrency world including Steem itself.

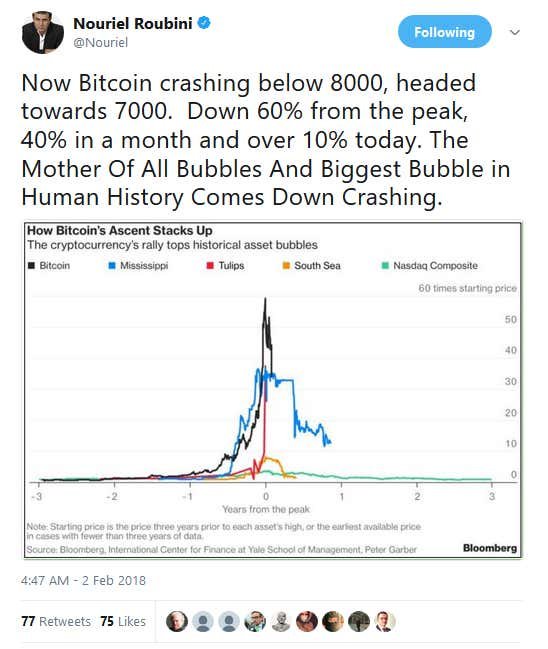

In early 2018, the cryptocurrency market experienced a significant crash also known as the Bitcoin Crash or the Great Crypto Crash that affected nearly all digital assets, including Steem. This was said to have occurred because Facebook was rumoured to have ban crypto adverts and countries like Korea, China and Germany are preparing a crackdown on digital assets (regulatory issues) 1, under history, 2, 3 .

This led to the overall market sentiment being negative as many investors began to panic and sell off their holdings in response to declining prices across the board. Steem, like many other cryptocurrencies saw its price drop sharply during this period as the fear and uncertainty in the market led to a loss of confidence, with many traders exiting their positions, making the situation worse and severe for the downward trend. This crash also highlighted how interconnected the cryptocurrency market is, where negative sentiment can quickly spread and impact even fundamentally strong projects, while also giving Bitcoin the leading role as Nouriel Roubini (the then chairman of Roubini Macro Associates) described bitcoin as "The Mother Of All Bubbles" on twitter. These instances mentioned above illustrate how such news events can influence the Steem market, affecting both investor sentiment and price movements. There are many more instances, like STEEM/Tron partnership, STEEM MEXC listing and many other scenarios like the many Hard forks and Soft forks Steem underwent. However, time will fail me so I have picked out just this few, as positive, negative and general effects. Now, when we talk about price action, we are referring to how the price of Steem moves up or down over time, while Market sentiment on the other hand is about how investors, users and traders feel about Steem and the overall market, i.e., if they are feeling positive (bullish) or negative (bearish). So let's take a look at how these events mentioned above played out in both price action and market sentiment. Binance Listing (Positive Sentiment): It is just like a popular concert, where tickets are placed on sale and as fans rush to buy them, this leads to an increase in demand which drives the price higher. Therefore, during this time, the market sentiment was very positive, and the price reflected that enthusiasm. Hard Fork Controversy (Negative Sentiment): Just like when a rumor is spread that a concert you are looking to buy tickets for or have already bought tickets for might be canceled, you might decide not to go anymore and even find ways to sell off the ticket you've bought for a discount price, and if more people hear the rumour as well, it will lead to fewer ticket sales and lower prices. Market Crash in 2018 (Overall Negative Sentiment): Going back to our concert example, this is like when the concert is poorly reviewed and people start deciding to skip it, leading to a drop in ticket sales and prices. Therefore, price action is a show of how Steem's price changes in response to events, while market sentiment reflects the feelings of traders and investors which is influenced by positive or negative news where positive news tends to drive prices up while negative news can lead to declines. To effectively trade the news in the Steem/USDT market, we can follow certain structured strategies that help us select impactful news, using the right tools, and establishing clear entry, exit, and risk management rules. Such as; Market Relevance: Market Sentiment: Timing: Volume of Coverage: News Aggregators: Social Media: Economic Calendars: Technical Analysis Tools: Entry Rules: Enter a position after a significant news event that aligns with your analysis of its impact on price. For example, if a positive announcement is made, consider buying Steem. Use a confirmation signal from technical analysis, such as a breakout above a resistance level, to validate your entry. Exit Rules: Set a target price based on historical price action following similar news events. For instance, if the price of Steem rises by 10% after positive news in the past, then set your target accordingly with this knowledge. We can as well use a trailing stop-loss to lock in profits as the price moves in our favor, thereby allowing us to exit at a good position if the market turns against us. Risk Management: Learn to limit our position size to a small percentage of our total trading capital, i.e., don't use up all the capital in one trade to help us manage risk effectively. Using stop-loss orders can help protect us against significant losses, therefore we should learn to place them below key support levels or a certain percentage value from our entry point. Be prepared for increased volatility around news events, therefore, you should consider a wider stop-loss levels during these times to avoid being stopped out prematurely with fake outs. I believe by following this strategy, we can effectively navigate the Steem/USDT market during news events, to help us make better trading decisions while managing our risk as well. As we are trading the news, we should have it in the back of our minds that there are risks that come with it, therefore, by being aware of these risks we can make more informed decisions to help us protect our investments better. Some of such risks are; Slippage: Overreaction: Misinformation: Timing Issues: Market Sentiment: Now that we have these risks in our minds, how do we go about our activities to help us mitigate the risks and improve our decision-making? Well, here are some practical measures we can take: Setting Stop-Loss Orders: Staying Informed from Reliable Sources: Using Limit Orders: Diversifying Our Investments: Having a Trading Plan: Monitoring Market Sentiment: Limiting Trading During High Volatility: Practice Risk Management: Sentiment analysis algorithms, trading bots, and real-time news aggregator tools can indeed help improve news-based trading strategies by providing timely insights and automated decision-making. But then, how can these tools be of help to us traders? Here is how; Sentiment Analysis Algorithms: Trading Bots: For instance, if a trading bot is programmed to buy Ethereum when its price drops by 5%, it can automatically make that trade without waiting for the trader to react. And for example, platforms like 3Commas and Cryptohopper offer trading bots that can be customized to follow specific news triggers and trading strategies. Real-Time News Aggregators: DISCLAIMER: Everything on this publication is not in any way a trading advice but just a piece of my understanding for learning purposes. I wish to invite @bossj23, @ngoenyi, and @ruthjoe. NOTE: Always have a smile on your face, as you are never fully dressed without one.

When Steem got listed on Binance, it created a buzz in the community, which got people and users excited because Binance is a big deal in the crypto world, well this excitement led to more people wanting to buy Steem, in turn, pushing the price up.

When the hard fork happened in 2020, it caused a lot of confusion and disagreement among Steem users and some users felt uncertain about the future of Steem making them nervous. So like every human, when afraid we tend to take safety measures, the same happens to traders and investors, so when traders or investors are worried, they tend to sell off their assets to take safety measures and avoid potential losses. Therefore, this selling pressure drives the price down, showing a negative market sentiment.

Finally, during the market crash in 2018, the entire crypto market was hit hard, and when prices started to fall, fear spread quickly among traders and investors, and many decided to sell their holdings to avoid losing more money. This panic selling resulted in a significant drop in Steem’s price as well, reflecting a very negative market sentiment.

We should focus our interest on new events that directly affects the Steem ecosystem, such as major partnerships, platform upgrades, or changes in governance.

Look for news that can shift investor sentiment significantly, like regulatory announcements or major endorsements from influential figures in the crypto space.

Prioritize news that is timely and relates to upcoming events, such as scheduled announcements or releases that could impact trading behavior.

Monitor news that is widely reported across multiple reputable sources, as this often indicates higher market impact.

Learn to use platforms like CoinDesk, CoinTelegraph and CryptoSlate to help you stay updated on the latest news in the crypto world.

Follow relevant Twitter accounts, Telegram channels, and Reddit communities focused on Steem and broader cryptocurrency discussions for real-time sentiment analysis.

Utilize economic calendars that track important cryptocurrency events and announcements, which can help anticipate market movements.

Use charting platforms like TradingView to analyze price patterns and volume spikes in relation to news events.

This happens when we want to buy or sell cryptocurrency at a certain price, but by the time our order goes through, the price has changed. For example, if you see news that makes you want to buy Steem at $1.00, but because there are lots of other people trying to buy it too, you might end up buying it at $1.05 instead. This difference in price is what we know as slippage and it can eat into our profits or increase our losses as the case maybe, especially if the market is moving quickly.

Sometimes, the market can react too strongly to the news. If there’s a positive announcement about Steem, prices might skyrocket, but this could be based on excitement rather than actual value just as we have witnessed with how Elon Musk's twitter post about Doge skyrocketed the price instantly. Similarly, if there is bad news, prices might drop sharply even if the news doesn’t have a long-term impact. This, we can call overreaction, and it can create volatility, making it hard to predict what will happen next.

In the world of trading, we should know that not all news is accurate, because sometimes rumors or false information can spread quickly, causing traders to make decisions based on what is not even true. For example, if someone falsely claims that Steem is being banned in a major market, it could lead to panic selling by traders and investors. Therefore, to avoid falling for misinformation, it is important that we verify each news from reliable sources before making any trading decisions.

News can come out at unexpected times, and if you are not paying attention, you might miss the moment to act.

The feeling and reaction of other traders can heavily influence the market also, if everyone is excited about a piece of news, it can create a bubble where prices rise too high and too fast. on the other hand, if traders are afraid, they might sell off their investments quickly, causing prices to drop sharply too. Therefore, having an understanding of the overall mood of the market is very important, as it can lead to unpredictable price movements.

For those who might not have an idea just yet, a stop-loss order is a tool that automatically sells your asset if it reaches a certain price. Hence, this can help limit our losses if the market moves against us after news is released. For example, if you buy Steem at $1.00, you might set a stop-loss at $0.90, so that if the price drops to $0.90, your order will be triggered, preventing you from further losses.

Ensure to follow only trustworthy news outlets and analysts, so it can help us reduce the chances of acting on misinformation. We can also learn to check multiple sources before making any trading decisions, especially during significant news events, to ensure we have accurate information.

Instead of using market orders that execute at the current market price, we can consider using limit orders (a type of order that allows us to specify the price at which we want to buy or sell). This way, we can avoid slippage by ensuring we only trade at a price we are comfortable with.

Like the saying, "don't put all your eggs in one basket" we should learn not to put all our money (or capital) into one single asset. Because by diversifying our investments across different assets, we can reduce the overall risk, in the case of one investment drops due to negative news, others may remain stable or even increase in value.

Before trading, create a plan that outlines your desired goals, risk tolerance, and strategies for different case scenarios, and this plan should include how you will respond to unexpected events and stick to your plan to avoid emotional decisions during volatile periods.

Pay close attention to how other traders are reacting to news by using tools like social media sentiment analysis and even technical analysis to give you an insight into whether traders are feeling positive or negative about a particular asset.

If you know a major news event is coming, consider reducing trading activities. This is because high volatility can lead to unpredictable price swings which makes it harder to make rational decisions. Therefore, sometimes it is better to wait until things settle down before entering the market.

The number one rule of trading is that we only invest what we can afford to lose. This means we should not risk our entire capital on one trade to protect our overall portfolio.

These algorithms analyze social media, forums, and news articles to gauge public sentiment about a particular cryptocurrency. For example, if a lot of people are expressing positive feelings about Bitcoin on Twitter, this could indicate a potential price increase. Examples of such tools include LunarCRUSH and Santiment which specializes in sentiment analysis for cryptocurrencies as they track social media trends, engagement, and overall sentiment to help traders understand market mood.

Trading bots are simple automated software programs that execute trades based on predefined criteria, and they can react to news much faster than a human can.

These tools collect and present news from various sources in real-time, allowing traders to stay updated on the latest developments. For example, CoinDesk and CryptoPanic aggregate news articles and updates from multiple sources, helping traders quickly identify important news that could impact prices.

Upvoted! Thank you for supporting witness @jswit.