Steemit Crypto Academy Contest / S9W3 - STEEM Inflation

Cover image designed by me using Pixellab App

Cover image designed by me using Pixellab App Hello everyone,

Greetings to you all in this community as the Steemit Engagement Challenge Season 9 week 3 is here and this is my entry for the theme of this week's contest from this community.

Use your own words to explain the concept of inflation in general and does it affect cryptocurrencies? |

|---|

Inflation is said to be the rise in prices of goods and services over time. Hence, it can also be interpreted to be the decline in purchasing power of a currency over time.

This is usually a measure of how much more costly a pack of goods and services have become over time, usually measured in a year. The formula thus for calculating inflation is given below as;

Inflation = ((New price - Old price)/Old price) X 100.

An example would be the rise in the average price of petrol in Nigeria from NGN 180 last year, to NGN 230 this year. Using the above formula, the given example is said to have an inflation rate of about 27.77%. Inflation is caused by many different factors but is usually bottled down to the change/effect of supply and demand.

Inflation is indeed an Economic concern as it can make money saved today less valuable tomorrow and have the power to reduce a consumer's purchasing power.

I believe since inflation's root cause is Supply and Demand, and Cryptocurrencies live on the principle of supply and demand, the Crypto world is not left off by the impact of inflation. Cryptocurrencies not being governed by any central bank or government monetary policies tend to serve as a protective base for people to save their valuables rather than usual inflation-reeked fiats.

Cryptocurrencies tend to be a more viable and promising ground to avoid inflation, as it encourages savings in a secure and decentralized medium with minimal or no inflation rates.

Explain the difference between deflationary and inflationary cryptocurrencies. And clarify what is the strategy followed by the Steem token and show how it works. |

|---|

Deflationary cryptocurrencies are cryptocurrencies that the supply of the tokens decreases over time. These types of cryptocurrencies use various means to decrease their supply, with their coins either destroyed through transaction fees, halving, or burning via coin-burning methods.

Coin burning involves sending a certain amount or percentage of coins to an inaccessible address, instantly expelling them from circulation. Halving is the process of trimming the rewards of mining in half.

Inflationary cryptocurrencies are crypto tokens the supply of these tokens increases over time. That is, inflationary crypto encourages a steady increase in the supply of its coins into the cryptocurrency market.

These types of cryptocurrencies work in the way of distributing recently minted coins to network participants using dedicated consensus mechanisms, such as proof-of-work (PoW) and proof-of-stake (PoS), through which new coins can either be mined or allocated to network validators. Examples of such coins include Bitcoin, Ether, Steem, etc.

| Differences between inflationary and deflationary cryptocurrencies. |

|---|

| Supply decreases with time | Supply increases with time |

| Coins are destroyed through transaction fees, burning, and halving | Coins are distributed through PoW and PoS mechanisms. |

| Have a predetermined deflate rate coded in the protocol | Have a predetermined inflation rate coded in the protocol |

| Increased scarcity over time | Offers flexible monetary policies |

| Incentive holding and discourage spending | Discourages hoarding |

| Fixed total token supply as the inflation rate decreases | Fixed or flexible total token supply, depending on the mechanism/governance applied. |

For our loving STEEM, I would say it is a hybrid of both Inflationary and Deflationary. My reasons are;

It can be said to be Inflationary because it has no fixed amount of supply, and yields the same amount of tokens into circulation. Steem also makes use of the DPoS mechanism, which is a subsidiary of the Proof of Stake mechanism used by Inflationary cryptocurrencies, by using several witnesses (usually 20-21) to validate transactions and distribute newly minted Steems on the Steem Ecosystem where a block is produced every 3 seconds in ruins.

It can also be considered a Deflationary Cryptocurrency as it adopts the mechanism of deflationary currencies to control inflation. Currently, there are two procedures taken by the Steemit blockchain to reduce the amount of Steem coins in circulation (thereby reducing its supplies), this includes the burning mechanism with burnsteem25, which allows users to allocate 25% of their publication rewards to an inaccessible account @null, thereby removing them from circulation permanently. The other is the introduction of club statuses such as Club5050, Club75, and Club100 which encourage users to save 50%, 75%, and 100% respectively of their earnings as a means of incentive holding, thus discouraging spending.

Calculate the Current Inflation Rate (the day of preparation for the publication) |

|---|

To calculate the inflation rate of our Steem, I would love to borrow the knowledge of our great friend @Kouba01, who has given us a great formula for that. The formula given is;

Inflation rate at time t = (978 - (header_block_number / 250,000)) / 100

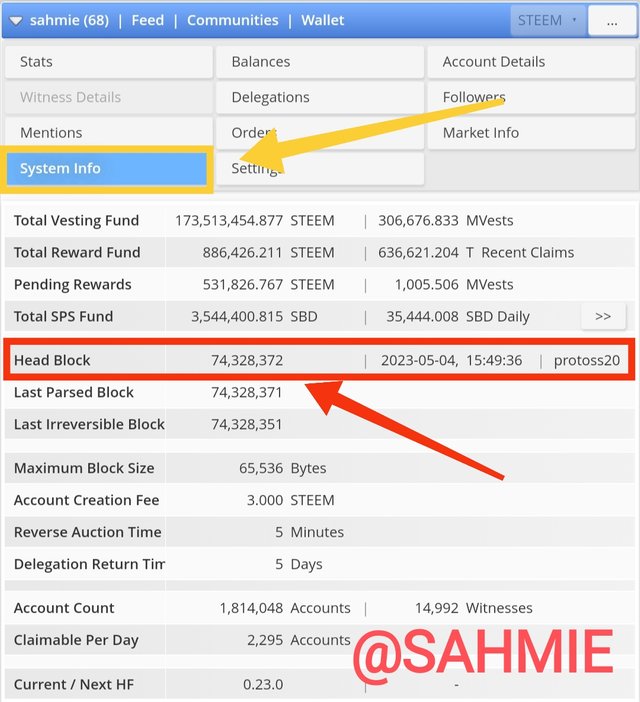

Where 978, 250,000 and 100 are constants and the header block number can be gotten from Steemworld under system information. To get the block header number, go to Steemworld, then click on System information under the feed, community, and wallet header.

screenshot from Steemworld

screenshot from Steemworld From the screenshot above, the information of the header block number obtained in the steemworld.org tool at the time of writing this post, May 4, 3:49 pm is 74,328,372. Substituting this header block number into the formula will give us;

Inflation rate = [978 - (74,328,372 / 250,000)] / 100

Inflation rate = [978 - 297.31] / 100

Inflation rate = 680.69 / 100

Inflation rate = 6.806%

Therefore, the inflation rate of Steem at the time of this post is 6.806%

By tracking the rate of inflation for the next few years, interpret how easy or difficult it will be to earn STEEM rewards, and would that drive you to build your SP right now? |

|---|

To determine how easy or difficult it will be to earn Steem in years to come, we will have to calculate the number of Steem produced as block rewards annually putting in mind the inflation rate is on a decrease of 0.01% for every 250,000 blocks. To calculate the number of new still rewards, the formula below is required

New Steem = (Virtual supply × Inflation rate) / Number of blocks per year.

For this, Virtual supply can be gotten from Steemworld, Inflation as previously calculated in the last question, and the number of blocks produced annually which is a constant. So, the variables are;

To get the virtual supply, go to Steemworld, then click on market information under the feed, community, and wallet header. Doing just that,

Virtual supply = 481,326,189.317

Inflation rate = 6.806%

The number of blocks per year = 10,512,000 since; A block is produced every 3 seconds, number of blocks yearly is gotten from;

(60 seconds X 60 minutes X 24 days X 365 days) / 3 (number of seconds per block)

Since 60 makes a minute, 60 minutes make a day and 365 days make a year;

Hence;

Number of blocks annually = (60 x 60 x 24 x 365) / 3

Number of blocks annually = 31,536,000 / 3

Number of blocks annually = 10,512,000

Substitute the values into the formula and solve.

New Steem = (Virtual supply × Inflation rate) / Number of blocks per year.

Gives us;

New Steem = [(481,326,189.317 x 6.806) / 10,512,000] / 100

New Steem = 311.6 / 100

New Steem = 3.116 Steem

This means, 3.116 Steems are produced at the current inflation rate of Steem; having in mind the rate of inflation is on a constant decrease of 0.01% every 250,000 blocks to end at the inflation rate is down to 0.93%.

The decrease in the inflation rate of Steem will decrease the amount of new Steem rewards production, thus making it more difficult to earn rewards as time goes on.

For Example, let's look at the difference of 5 years from now.

It is believed that the inflation rate of Steem decreases by 0.01% after every 250,000 blocks and it will continue like this until the inflation rate reaches 0.95%.

If it takes 3 seconds to mine 1 block, it will take 750,000 seconds to mine 250,000 blocks from 3 x 250,000.

Therefore, it will require 8.681 days for the inflation to decrease by 0.01% from, 750,000 / (60x60x24), as 60 seconds, make a minute, 60 minutes make an hour and 24 hours make a day.

Thus; 750,000 / (60 x 60 x 24)

= 750,000 / 86,400

= 8.681 Days

Hence, the Steem inflation rate decreases by 0.01% after every 8.681 days.

Then, the decrease in inflation annually is given as;

Annual inflation rate = (365 / 8.681) x 0.01

Annual inflation rate = 42.046 x 0.01

Annual inflation rate = 0.42%.

If the Annual Inflation rate reduces by 0.42%, in Five years, it will be;

0.42 x 5 = 2.1%

The difference in inflation currently from the calculation above 6.806% if in five yes time it's reduced by 2.1% the difference is;

5 years Difference rate = Current rate - change in 5 years

5 years Difference rate = 6.806 - 2.1

In 5 years the Inflation rate = 4.606%

This means by the year, 2028 the inflation rate of Steem will have dropped to 4.606%

And since the ratio of New Steem rewards is directly proportional to the inflation rate, this decrease will lead to a decrease in New Steem produced.

Would this drive me to build up my Steem Power (SP) is a definite Yes. By building my steel power now, I stand the chance of profiting more in the long run because the decrease in New Steem rewards production, leads to a decrease in supply. By the law of demand and supply, a decrease in supply may lead to an increase in demand which subsequently leads to an increase in price.

CONCLUSION |

|---|

The Steem cryptocurrency to me is a hybrid of both Inflationary and deflationary cryptocurrency as there's a constant increase in Steem supply, but uses a constant reduction mechanism to reduce not only the inflation rate but also the number of tokens in circulation by the application of Token burning and club status to improve staking which is expected to benefit it's users in the long run, hence encouraging users to power up for brighter and better future. I like to invite the following users @jeuco, @yakspeace, @ruthjoe, @starrchris and @petface

THANK YOU!

NOTE: Always have a smile on your face, as you are never fully dressed without one.

Upvoted! Thank you for supporting witness @jswit.

TEAM 5 CURATORS

This post has been upvoted through steemcurator07. We support quality posts anywhere and with any tags. Curated by: @chant

@chant I appreciate your effort in seeking out my content as a quality content. Thank you.

Great job @sahmie for explaining the concept of Steem inflation in such a clear and concise manner . your post provides a great overview of the Steem blockchains inflationary model which is a crucial aspect of understanding the Steem Econom . your analysis of the inflation rate & its impact on the value of Steem is particularly insightful . It's great to see community members like you contributing to the Steemit Crypto Academy helping to educate others on important blockchain concepts . thank you for sharing Your knowledge With us!

Thank you for your kind words. I only tried my best researching and sharing the knowledge I gained from my research. The real tutors are the ones who brought us such an interesting topic. Greetings.

Hello dear friend @sahmie. I hope that you will be doing well and enjoying the time well. I must praise the way you have completed this task. You have beautifully described each and every part of the task well.

First of all you have discussed your thinking about the inflation rate. I agree with you that when our the supply of a currency is increased then it's value depletes because it's purchasing power decreases.

You are right here. Actually, Steem token is inflationary in nature because it's supply increases with the passage of time but some Deflationary elements are also followed by Steem to manage the balance between inflation and the token's supply.

Thanks a lot for sharing such a beautiful entry and I wish you a very good luck for the contest.

Awwwnnn... It is heart warming as your remarks gave me butterflies. I really appreciate your kind words. Thank you for your time and wonderful remarks. I really appreciate.🥂

You're welcome 😀

A very good post. It’s good to see how you gave a very good difference between a inflationary and deflationary cryptocurrency. Your calculation on the current inflation rate of steem it very elaborate. You did a very good job. Your overall answers were clearly stated and very easy to understand. Well done and I wish you success.

Thank you brother for your appreciative remarks. All the best.

Alright

Well done 👍🏼

Saludos amigo.

Muy buen punto de la inflación.

Me ha gustado mucho el cuadro comparativo de las criptomonedas fiduciarias e inflacionarias.

Además, me sorprendes tus cálculos, yo no soy buena con matemáticas jejeje... Pero noto que lo has hecho muy bien.

Gracias por realizar una publicación bastante detallada y espero algún día hacerlo como tú.

Éxitos

Funny how you said you are not good with mathematics, but I did learn a lot from your own contribution. Its indeed an honor to have you here. Thank you. I really appreciate your support and kind remarks.

Hi dear @sahmie,

thank you so much for this informative article in the entry of this week of engagement challenge your points show that you have a good knowledge about the inflation and its impacts

we know that rarity of every thing may cause the inflation so it is not exception that when the cryptocurrencies or any form of currency become low in supply and it become more rare and that's why it become more inflation rate

you have also calculated the current inflation rate and it is correct the steem token will become more difficult to earn in future that's why power ups is the best option now

success for contest

Thank you for your support it is indeed a motivation come from you someone I so much look up to.

Greetings, my friend @sahmie! 🙋♂️ I really

appreciate your insightful explanation of inflation & its impact on cryptocurrencies. Your post reflects your hard work a& dedication. In particular, your explanation of how cryptocurrencies, like Steem, offer a secure & decentralized medium to combat inflation is commendable. Keep sharing such quality posts and fantastic work , as they contribute valuable knowledge to the community. 👍📚

I am over the moon right now. Your nice words gives me confidence that I did great even as I felt short of the task at hand. Thank you for your warm comments. Stay blessed my friend.

I follow you, you follow me