SEC S18-W3 || Psychology and Market Cycle

|

|---|

Greetings friends and welcome to my participation in this week's engagement challenge where we are to learn about trader's psychology and how to use it to master the market cycle. Hope you get to learn something new today as I attend to the hints provided.

Describe the psychological progression of investors through the stages of optimism, excitement, euphoria, anxiety, denial, fear, despair and hope. How does each step influence investor behaviour? |

|---|

Psychology is all about peeking into our minds to understand why we think, feel, and act the way we do. Therefore, it is all about exploring our thoughts, emotions, and behaviours to figure out things for ourselves. Hence, understanding the psychology of investors is all about the various feelings they feel as they navigate through the process of trading.

Investors go through a rollercoaster of emotions when dealing with their investments. What is common among investors is that at first, they might be all excited and hopeful, thinking they will make a lot of money. Then, when the market gets bumpy, they start feeling anxious and worried, wondering if they should sell or hold on.

As things start looking up again, they might feel relieved and optimistic, believing they are on the right track. But then, if the market takes a nosedive, fear and panic can set in, making them question their decisions and causing stress. These different stages of emotions are considered the various stages of progression of Investors in the market.

|

|---|

But then, how does each of these steps influence investor behaviour?

It is no secret that each of these steps can impact how investors behave in the market, so let's look into how each of them works.

Denial:

When investors are in denial, they tend to ignore obvious warning signs or false information about their investments, hence they could convince themselves that everything is fine even when the reality is different, which can lead to overlooking potential risks and making poor decisions based on false beliefs.

Fear:

Fear can make investors feel anxious and worried, especially during market downturns or volatile periods which can cause them to make impulsive decisions like selling off investments hastily to avoid further losses. Fear could also cloud judgment and prevent rational thinking, leading to knee-jerk reactions that may not be in their best interest.

Despair:

Despair mostly sets in when investors feel overwhelmed by losses or setbacks in the market, leading to a sense of hopelessness and discouragement, making it challenging to see a way out or make sound investment choices. Hence, investors in despair may become paralyzed by negative emotions, hindering their ability to think clearly and make strategic decisions.

Hope:

Hope inspires optimism and resilience in investors because when they have hope, they believe that things can improve, even in challenging times. This positive mindset can drive them to stay invested, ride out market fluctuations, and make strategic decisions based on long-term goals rather than short-term emotions.

Optimism:

When investors are optimistic, they see the glass as half full, believing in positive outcomes and opportunities in the market, which leads to confidence in their investment decisions and a willingness to take calculated risks for potential rewards.

Excitement:

Excitement makes investors feel enthusiastic and energized about the market, and it can stem from new investment opportunities, successful trades, or positive market trends. While excitement can be motivating, investors need to balance it with caution to avoid making impulsive decisions driven by emotions.

Euphoria:

Euphoria is an intense feeling of joy and exhilaration often experienced during market booms or when investments are performing exceptionally well. However, euphoria can lead to overconfidence and irrational exuberance, potentially clouding judgment and increasing the risk of making reckless investment choices.

Anxiety:

Anxiety can bring a sense of unease and worry to investors. It may arise from uncertainty in the market, volatility, or the fear of potential losses. When investors are anxious, they might struggle to make clear-headed decisions, leading to hesitation, indecision, or impulsive actions that could harm their investment portfolio.

Using a chart showing a recent movement in the price of a cryptocurrency (without date/time), identify which emotional stage of the market cycle the chart likely represents. Justify your answer by discussing behavioural signs that investors might exhibit at this stage. |

|---|

|

|---|

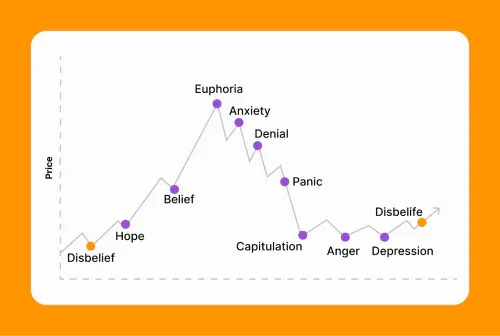

The above screenshot shows the BTC/USDT pair under the daily time frame where each psychology progression of investors is labelled out. From the screenshot above it's clear that as the price of BTC begins to rise, traders and investors alike become hopeful of good things to come, and as it progresses further they begin believing in greater things to come, and as their investment grows, they become filled become exceptional excited of new heights (Euphoria). All this is visibly displayed on the left-hand side of the chart.

Whereas on the right-hand side, as the price begins declining investors are gripped with anxiety for the unknown, and as it continues declining further, their subconsciousness whispers to them it will bounce back, bringing about the denial phase, but then it continues in it's downward trend, which brings about panic among investors as they seek to cut losses.

At the point where the trend did seem to have reserved, they sought hope and solace that it was the moment when things turned around for them, but then unfortunately as the downtrend continued they became angry about their past decisions so far which would lead to depression and regret.

Discuss how an incorrect mindset, such as the belief that "this time it's different," can affect an investor's decisions and potential returns. How does this mentality typically affect a person's performance in the market during volatile phases? |

|---|

Thinking "this time it's different" is often seen as being optimistic, but then it can mess with an investor's head if it's not backed with solid information and research. Here is why;

When an investor believes that "this time it's different," they might start to think that the usual rules of investing don't apply to the current situation. It is like saying, "Forget about analysis and risk management, things have changed now." This mindset can be risky because it can lead investors to underestimate potential risks and overestimate potential returns.

By thinking this way, investors might become overly optimistic and ignore warning signs or historical data that could help them make more informed decisions. They might take on more risk than they realize because they believe the current situation is unique and won't follow the same patterns as before.

Therefore, when investors fall into the trap of thinking "This time it's different," they could be setting themselves up for disappointment. Hence, investors must stay grounded, consider past trends, and not let the belief in exceptional circumstances cloud their judgment when making investment decisions.

When investors start thinking "This time it's different" during volatile market phases, it's like they're being blinded to reality. This is because this mindset can make investors take bigger risks than they should by jumping into investments without doing their usual homework. After all, they believe the usual rules don't apply.

Secondly, during volatile phases, emotions can run high, and this mentality can make investors act impulsively and they might panic to sell off investments at a loss or dive headfirst into risky ventures without thinking things through. This is more like being on a rollercoaster without a seatbelt.

Lastly, believing this statement can cloud judgment as investors ignore clear warning signs and historical data that could help guide them to make smarter decisions.

Examine a specific incident where significant FOMO (fear of missing out) or FUD (fear, uncertainty, and doubt) impacted the price of the STEEM token. Discuss how this sentiment influenced trading behaviors and the price of the STEEM token. Also suggest strategies that STEEM investors could use to avoid making decisions driven by these emotions. |

|---|

|

|---|

FOMO and FUD are like those little monsters that mess with people's heads when it comes to trading. FOMO (Fear of Missing Out) is when someone see others making money and feel like they are missing the boat, so they rush in to buy, even if the price is high.

Whereas FUD (Fear, Uncertainty, and Doubt) is when scary rumors or bad news spread like wildfire, making people panic and sell off their investments, even if things aren't as bad as they seem.

Therefore, when FOMO kicks in, and everyone's rushing to buy STEEM because they see its price going up, it creates a buying frenzy, which inturn increases the demand can drive the price of the token even higher, like a snowball rolling downhill.

On the other hand, when FUD takes over, and people start spreading rumors about STEEM, saying it is not a good investment or there are issues with the platform, thereby causing a massive sell-off were this flood of sellers can push the price of the token down rapidly, like a domino effect.

So, FOMO and FUD can really swing the price of the STEEM token like a pendulum, up and down, based on people's emotions and reactions rather than the actual value of the token itself. Therefore it is important for investors to stay level-headed, do their research, and not get swayed by these emotional rollercoasters when trading in volatile markets.

Therefore, to stay balanced, STEEM investors can use the following strategies to avoid getting swayed by these emotional monsters.

One way is to set clear goals and have a plan in place, it is like having a map before going on a road trip where you define your investment goals, whether it's long-term growth or short-term gains, and create a strategy to achieve them. This way, when FOMO or FUD show up, you can refer back to your plan and stay on track.

Another helpful strategy is to do your homework, and this involves carrying out the needed research on STEEM, its technology, the team behind it, and its potential for the future. Therefore, by understanding the fundamentals of the token, you will be more confident in your investment decisions and less likely to be swayed by emotional reactions to market movements.

Additionally, consider setting stop-loss orders, as these are like safety nets that automatically sell your STEEM if the price drops to a certain level and it helps to protect your investment from drastic losses caused by sudden market swings driven by FOMO or FUD.

Lastly, Diversification, don't forget to diversify your investments. Instead of putting all your eggs in one basket (or all your money in this case in one token), spread your investments across different assets. This way, if one investment is affected by FOMO or FUD, your overall portfolio won't take too much of the hit.

Explain the logic behind the “buy red and sell green” strategy. Create a hypothetical scenario in which this strategy could be applied effectively and discuss the psychological challenges an investor might face when trying to implement this strategy amid an actual market downturn and subsequent recovery. |

|---|

The crypto market is like a rollercoaster, where prices are going up (green) and down (red). Hence, the "buy red and sell green" strategy is like saying, "when prices drop (red), buy, and when they rise (green), sell."

For the scenario, let's say you noticed a popular asset you've been keeping watch on takes a hit and its price drops significantly (red zone). You decide to buy some at this lower price, expecting that when things turn around and the asset rises (green zone), you can sell them for a profit. This is the basic idea behind the strategy.

However, when the market is in a downturn, it can be tough to stick to this strategy as emotions like fear and uncertainty might creep in, making it hard to pull the trigger and buy when everyone else is selling because it is like trying to swim against a strong current.

If you could overcome that fear to buy the dip, and the market starts to recover and prices turn green, there is also the temptation to hold onto investments longer than you planned as greed might kick in, and you think, "What if it goes even higher?" which can lead to missing out on selling at a good profit or even turning a profit into a loss if the market dips again.

Therefore, the psychological challenge lies in staying disciplined, controlling emotions, and following the strategy even when it feels uncomfortable. It is like trying to stay calm in a storm and not getting swept away by the waves of emotions. Hence, by mastering these challenges, investors can potentially benefit from the "buy red and sell green" strategy in the long run.

CONCLUSION |

In conclusion, how trader's think (market sentiment), FOMO, and FUD play significant roles in the trading. Therefore understanding all these factors can help investors make more informed decisions.

I wish to invite @starrchris, @ngoenyi, @chants and @hamzayousafzai.

Thank You for your Time

NOTE: Always have a smile on your face, as you are never fully dressed without one.

@tipu curate

Upvoted 👌 (Mana: 7/8) Get profit votes with @tipU :)

Your post has been successfully curated by our team via @steemdoctor1 at 35%.

Thank you for your committed efforts, we urge you to do more and keep posting high-quality content for a chance to earn valuable upvotes from our team of curators and why not be selected for an additional upvote later this week in our top selection.

Thank you so much @steemdoctor1, I really appreciate your support and kind gesture.

Nice piece of write up. Some lines that caught my attention are :

You are right; understanding psychology is essential in many areas of life, including investing. By knowing why we think, feel, and act a certain way, we can make more rational decisions. This insight helps us control our emotions better, especially in the volatile world of trading.

That's correct, and I can relate to this. During market downturns, fear can indeed lead to hasty decisions that might not be in our best interest. In my opinion, learning to manage this fear is crucial for any investor to avoid making rash choices that could result in significant losses.

Oh yeah, I can totally correlate with this description. FOMO and FUD are powerful emotions that can cloud our judgment and lead to poor investment decisions. It's important to stay informed and not let these "little monsters" drive our actions in the market.

In my opinion, this is great advice. Setting clear goals, doing thorough research, and having a solid plan are all effective strategies to keep emotions in check. It's important for investors to remain disciplined and avoid making decisions based solely on fear or excitement.

Wish you all the best

Greetings friend,

Your understanding of the importance of setting clear goals and staying disciplined in trading is commendable. Thank you so much as you always take your time to leave a wonderful feedback. Good luck my friend.

"This time is different",.... You said it right friend.

For beginner traders like me, maybe I am very enthusiastic when the market moves up, I feel that this is the right time, and I will get a lot of profit. However, I don't think that's enough because market cycles can change instantly, or I don't really understand market movements before this bullish phase occurs.

In my country, trading is still taboo and has not become commonplace, maybe traders like me need more guidance on knowledge like this.

Good post friend, I hope you are lucky in this engagement...

Chaiyoo.... 👍👍👍

Greetings friend,

You're spot on. It's common for beginner traders to feel excited when the market goes up, thinking it's the perfect time to make a profit. However, it's crucial to remember that market cycles can change rapidly, and understanding market movements before the bullish phase is essential. It's great that you're eager to learn more about trading. Wishing you all the best.

Right, trading opposite to the market trend is difficult task it require proper analysis to get the best point to tale entry, then self trust and patience is must require..

Thank you so much for your wonderful contribution, indeed trading opposite to market trends seems nerve wrecking and yes trading in general needs patience.

You are right! "Fear can make investors feel anxious and worried, especially during market downturns." Absolutely, fear can lead to rash decisions! .Your insight on managing emotions is crucial.

Very true, fear can really mess with our heads in anything we do, especially for trader's when things get rocky in the market and it's true, fear can push us into making some impulsive moves. Thank you for your supportive contribution.

Just has always you have bombarded us with another mind blowing content on psychology of traders while trading and before trading. Also I love how you explained fear of missing out psychological emotions that cause traders to lose out due to rumors and news about the success of an asset.

Thank you so much friend for sharing sword high quality article at your free time you can also check my through the link belowhttps://steemit.com/hive-108451/@starrchris/steemit-crypto-academy-contest-s18w3-psychology-and-market-cycle

I'm glad you found the information on the psychology of traders intriguing. The fear of missing out can indeed lead traders to make impulsive decisions based on rumors and news, sometimes resulting in missed opportunities or losses. It's essential for traders to stay grounded, rational, and not let emotions dictate their trading actions. Understanding these psychological aspects can significantly impact trading success. Thank you so much for leaving such a heartfelt feedback.

Yes friend thanks for always sharing such high quality articles 👍🏼🙏🏼

Hola amigo @sahmie como siempre has estado presente en cada semana algo que aprecio y valoro mucho, lo que demuestra grandemente tu compromiso, además con gran calidad en el contenido.

El análisis del ciclo de las emociones es una experiencia vital para los amantes del trading, comprender y aprender a gestionar las emociones permitirá resistir las tentaciones de la ambición desmedida.

Las emociones nunca deben gobernar las operaciones sino las razones.

Gracias por compartir, saludos y éxitos.

Greetings friend,

Thanks a lot for your kind words. It means a lot that you find the stuff I share helpful. Keeping emotions in check when making investment decisions is super important. Letting logic lead the way can really make a difference. Your support and good vibes are much appreciated.