Bitcoin's Trajectory || Crypto Academy - S4W5 || Homework task for [@imagen]

Hello Everyone,

I’m much grateful participating in this week homework post by prof @imagen. The detailed lesson provided on Bitcoin's Trajectory was very comprehensive.

1.) How many times has Bitcoin been “halved”? When is the next expected? How much do Bitcoin miners receive today? Name at least 2 cryptocurrencies that are or have been "halved".

How many times has Bitcoin been "halved"?

Bitcoin was the first cryptocurrency that was initiated by the anonymous Satoshi Nakamoto on the 3rd of January, 2009. The first block, that is , Block 0 or Bitcoin Genesis block contains 50 transactions, this means that Satoshi Nakamoto earns 50 BTC as a reward for mining the first block. Bitcoin uses the Proof of Work consensus algorithm for verification and validation of transactions to be stored on block. These validation and verification is mostly done by miners by solving complex algorithms with the used of computations power and complex machines.

Bitcoin Halving referred to reducing the reward earned by creating a block on the Bitcoin blockchain by a factor of two after a predetermined number of blocks created. From estimation it’s mostly every Four years or after creating 210,00 blocks. Bitcoin halving occurs several times after first 50 transactions created by Satoshi. The first halving occurred in 2012 where the initial 50 earned for creation a block was halved to 25 BTC. Also, in 2016 the 25 BTC earned per block was halved to 12.5 BTC for each block created. The current halving which occurred in 2020as the 12.5 earned for creating a block was again halved to 6.25 BTC for each block. As the Bitcoin halving occurs every four years, it is estimated that Bitcoin halving will end in 2140.

Halving is a way in which new Cryptocurrencies are released in to the market. With halving, the supply of Cryptocurrencies to the market is limited and the demand keeps increasing, this as well increase the price of Cryptocurrencies.

When is the next expected?

The Bitcoin halving is estimated to occur every four years, so the last one being in 2020, from calculation the next halving will occur in 2024 which is four years from the last halved. With the next half, miners will receive 3.125 BTC for creating each block.

How much do Bitcoin miners currently receive?

With the last halved in 2020 BTC miners currently receive 6.25 BTC for each block created. Even though miners don’t actually appreciate halving but the good thing is that price of BTC keep increasing.

2 cryptocurrencies that are or have been "halved".

Litecoin

Litecoin just like Bitcoin takes the approximate four years cycle of halving. The first halving was on the 25th of August, 2015 where the initial 50 transactions per block created was halved to 25 per block. Also, the second halving occurred on the 5th of August 2019 where the 25 LTC per block was again halved to 12.5 LTC per block. The next halving is expected to occur in 2023 and miners receive 6.25 LTC per block created. Litecoin is expected to stop its halving in 2142.

ZCash

Zcash is another cryptocurrency that has ever been halved. After it’s launched in late October 2016, Zcash experience it’s first halved 18th November, 2020. Four year after the launched of the coin.

2.) What is a consensus mechanism? How are Proof-of-Work and Proof-of-Staking different?

Consensus Mechanism

This is a Fault tolerance protocol mostly used in blockchain system for the common agreement between interconnected nodes in verification, validation and storage of transactions on blocks. Before a transaction is stored on a block in every blockchain, this transaction must first be verified and validated by all nodes on the blockchain. All nodes or blocks must come to a consensus before this transaction must be validated to proof the decentralized nature of the blockchain. There several consensus algorithms employed by different blockchain networks and some include; Proof of Stake, Proof of Work, Proof of Capacity, Delegated Proof of Stake and many more.

Proof of Work (PoW) Consensus Mechanism

PoW is a consensus mechanism employed by several traditional cryptocurrencies like Bitcoin, Litecoin and Ethereum. POW aimed to prevent fraudulent activities like double spending and denial of services attacks before verification and validation of transactions to be stored on blocks on any blockchain network by requiring services from miners or user.

PoW consensus mechanism uses an on-chain network in which miners compete against one another in creating the next block on the blockchain. Miners are in race to solve complex mathematical puzzles with a complete proof with the help of computational power nodes. Whoever wins the complex puzzle race gets a chance to create a new block and broadcast it on the blockchain network. Though this puzzles are difficult to solve but it’s solutions are very easy to check. When the first miner gets the puzzle right other miners then verify if he really gets the puzzle correct and he will be awarded with the native token of the blockchain. Solving these complex puzzles require complex machines which consumes a lot of power and that’s why not all get the chance to be miners.

In the case of Bitcoin, when transaction is initiated, it is first sent to the unverified transaction pool and miners the compete in a race in verifying and validating the transaction by solving complex puzzle the winner then create the next block to stored the validation transaction and broadcast it across the blockchain network.

Proof of Stake (PoS) Consensus Mechanism

PoS is a consensus mechanism that rally PoW, it was developed to maintain the strong and healthy consensus mechanism without the use of complex machines that consumes high electric energy like PoW.

PoS uses a system of validators which are randomly selected statistically based on the validator’s wealth, staking age and randomization to create new blocks on the blockchain. Validators can constantly be repeated if they dominate in terms of staking age and number of toke stake. Users who are interested in creating new blocks can do so by staking their tokens and the highest staker has an upper hand in selection for the creation of new block.

Proof-of-Work and Proof-of-Staking differences

Proof of Work and Proof of Stake differ in many ways and some include;

- Verification and Validation of transactions and Creating of new blocks.

PoW involves miners in a race to solve complex mathematical puzzles in verifying and validating transactions and the winner gets the chance to forge new block. While PoS uses a system of validators who are pseudo-randomly selected based on their wealth, staking age and randomization.

- Resources and Energy efficient

PoW require expensive complex machines which consumes high electric power in mining new tokens. While PoS require staking of a token and does not need a complex expensive machines.

- Reward Gain

In PoW first miner to solve the puzzle gets the native token of the blockchain while in PoS validators collect network fees as reward.

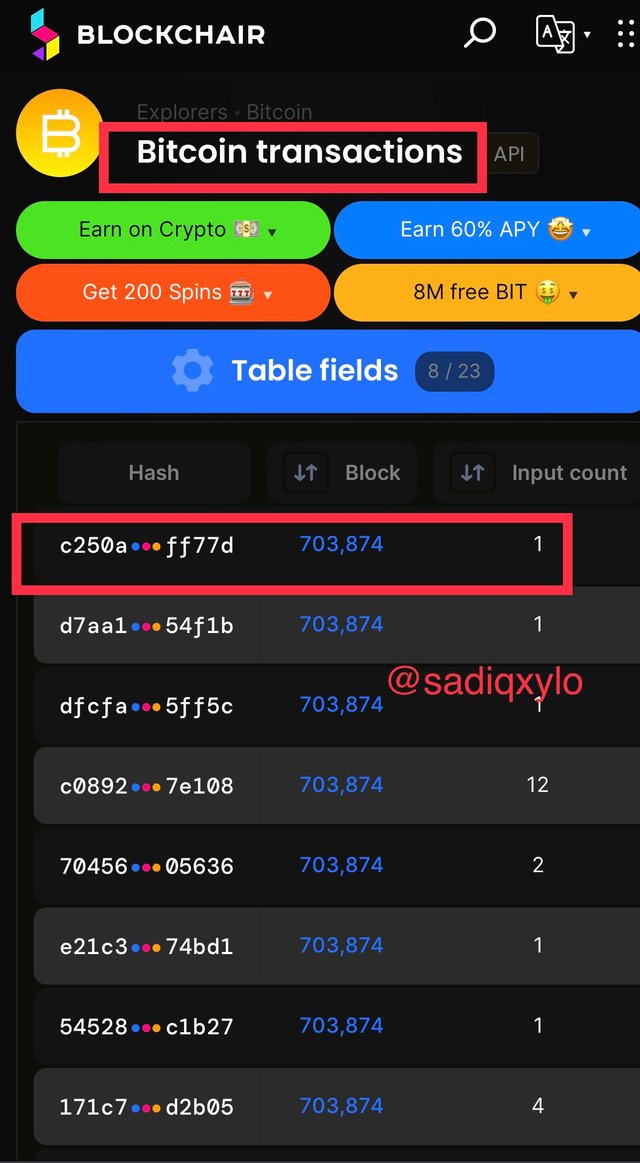

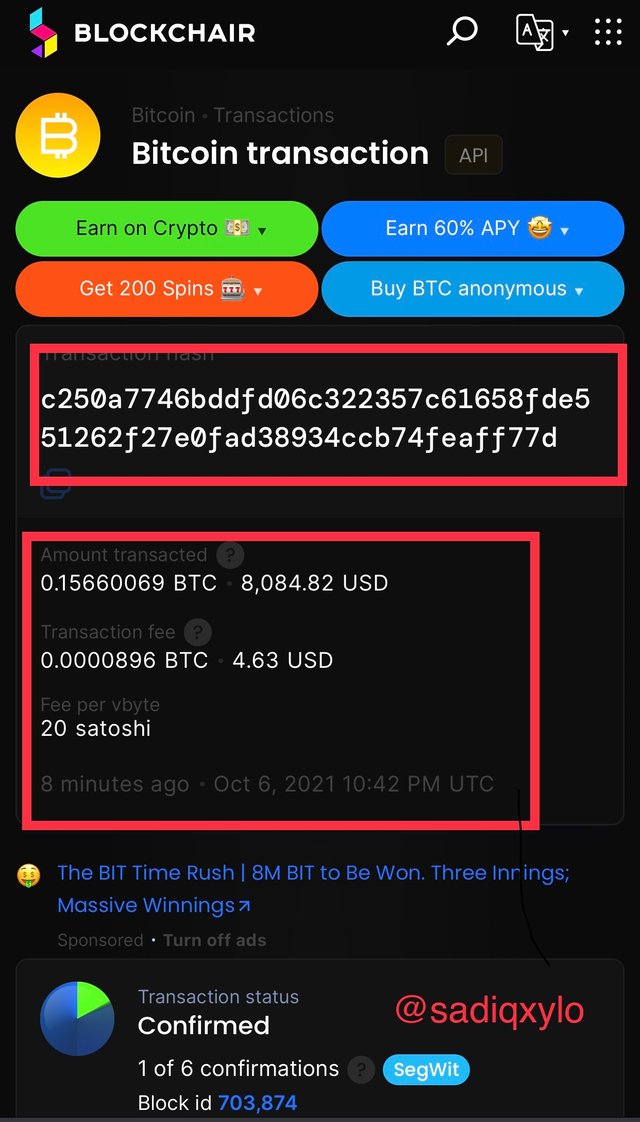

3.) Enter the Bitcoin explorer and show the hash corresponding to the last transaction. Show Screenshot.

In performing this task, I will use blockchair

The last transaction as at the time of my homework post

Transaction hash : c250a7746bddfd06c322357c61658fde551262f27e0fad38934ccb74feaff77d

Transaction block 703,874

4.) What is Altcoin Season? Are we in Altcoin Season? When was the last Altcoin Season? Name and show 2 Altcoin charts followed by their growth in the latest Season. Give reasons for your answer.

Altcoin Season

In crypto market altcoin season is a period when the alternative coins like LCT,Steem, Doge and many others perform better than the mother coin, Bitcoin. This time period happens to be 90 days where 75% of the top alternative coins show significant increment in market price value than Bitcoin. This mostly happens be a traders make enough profit with Bitcoin and decide to exit Bitcoin market into the various alternative coins.

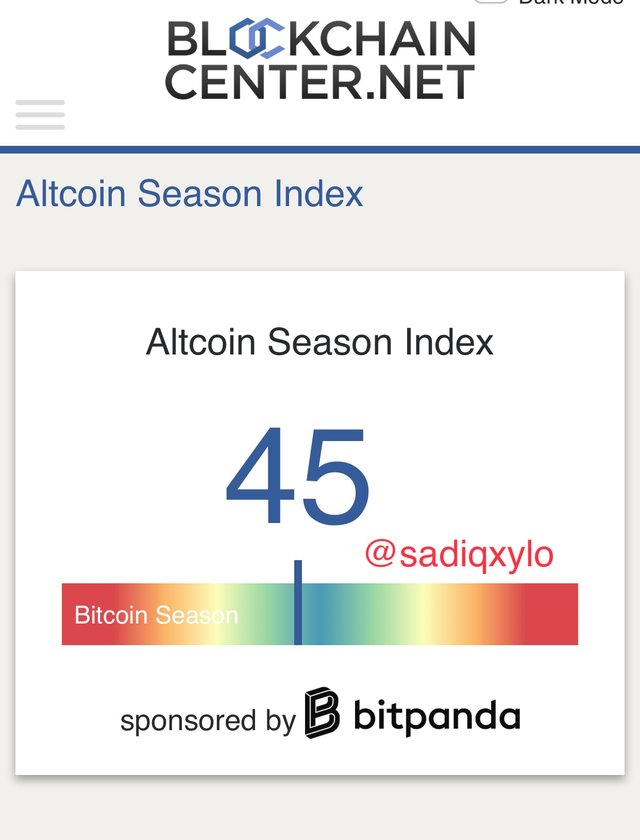

Are we in Altcoin Season?

From the screenshot presented above it can be seen that the current altcoin index is 45. This means that over the last 90 days period only 45% of the top 50 alternative coins performed better that Bitcoin. The conclusion we can derive from this is that, we are currently not in altcoin season.

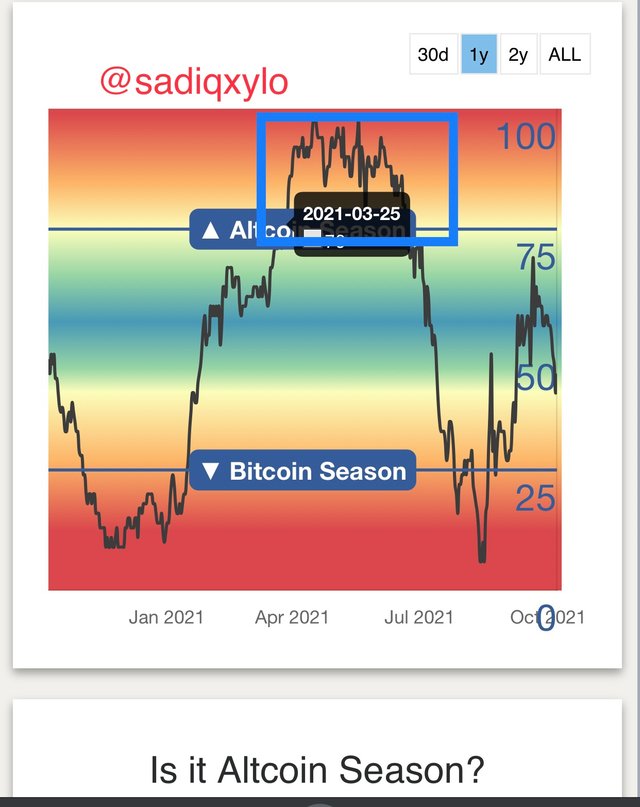

When was the last Altcoin Season?

From the screenshot presented above, it is seen that the last altcoin season started on the 25th of March this year where 76% of the top 50 altcoins perform better than Bitcoin within 90 days period and ended on the 20th of June this year.

2 Altcoin charts

To performing coins for the last season.

Here I’m choosing AXS and LUNA as the two performing coins and showing it’s charts.

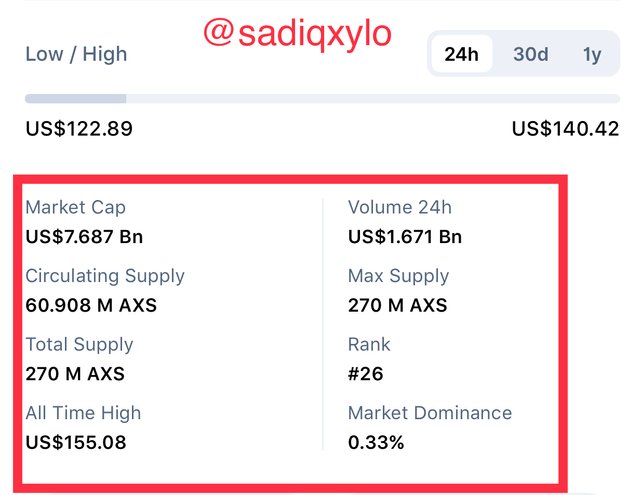

AXS (Axie Infinity )

From the to 50 performing coins last season it can be seen from the screenshot above that AXS was the best performed coin among all the available coin. From the top performing coins chart it is seen that AXS has a total growth of 709.5% form it’s initial release of price $0.15 to a current price of $126.22. AXS has obtained an all time high of $155.08 making it’s all time growth to be around

913%.

As the time of my homework post AXS was ranked at 26th from the coinmarketcap site.

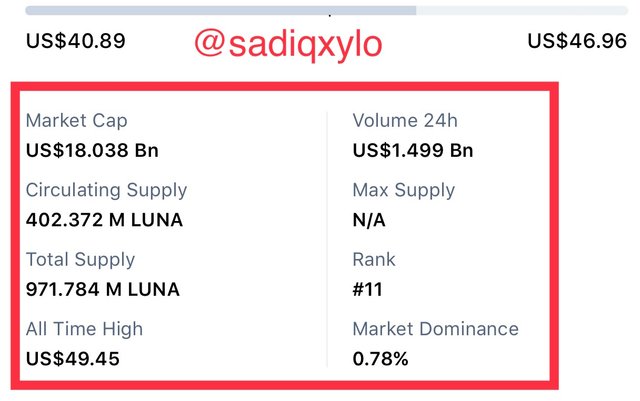

LUNA

From the top 50 performing coins last season,LUNA was the the fifth most performed coin with growth of 481.9% and a current price value of $44.83 as at the time of my homework post. UNA is currently ranked 11th on the coinmarketcap site with all time high of &49.43.

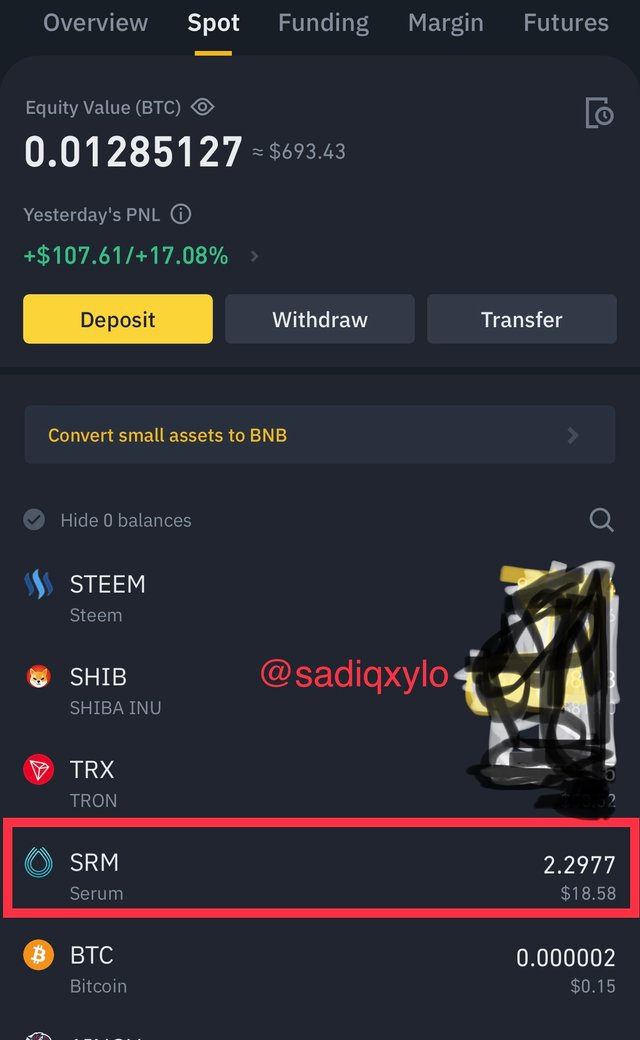

5.) Make purchases from your verified account of your preferred exchange of at least 15 USD in a currency that is not in Coinmarket's top 25 (SBD, Tron , or steem are not allowed). Why did you choose this coin? What is the goal or purpose behind this project? Who is the founder/developer? Show ATH currency and current price. The reason for your answer. Show Screenshot.

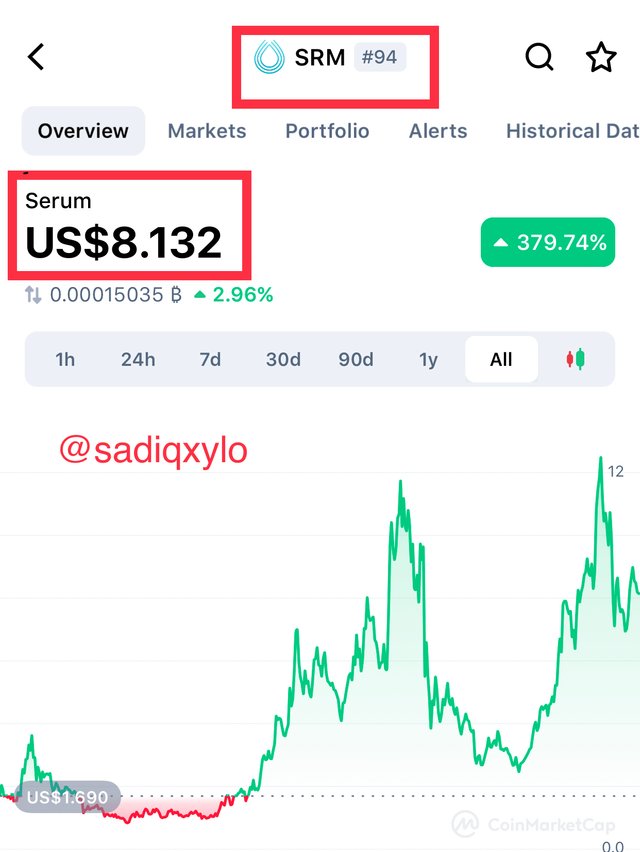

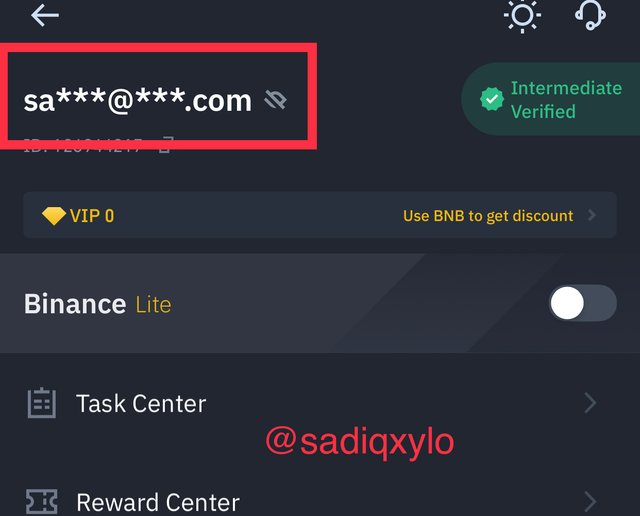

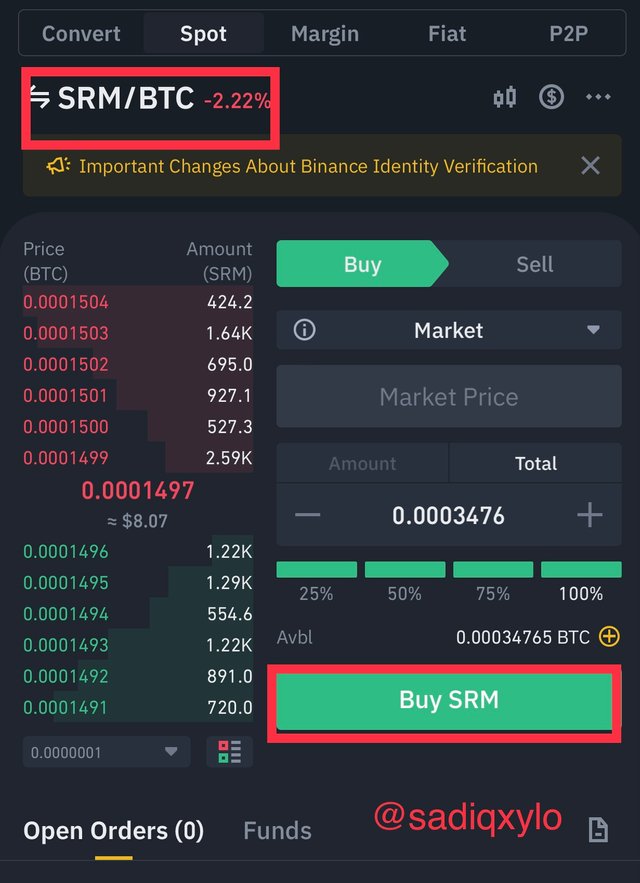

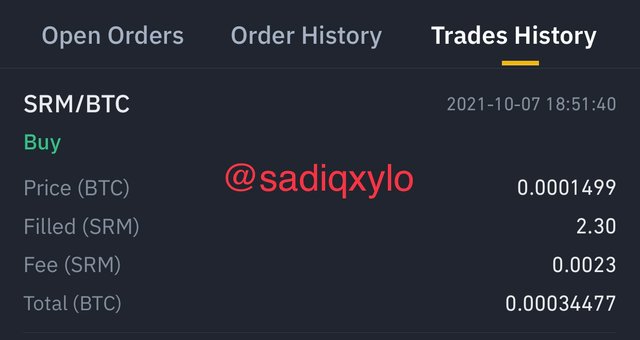

For this task I will purchase the serum token SRM. It a native token of the serum project built on the Solana network. It ranked 93 by the coinmarketcap and currently has a price of $8.132 as at the time of my homework post. It also made an all time high of $13.72.

Serum

Serum is a decentralized exchange DEX that is built on the Solana blockchain network and aimed particularly on decentralization and also enable greater speed and low cost of transaction. The Serum decentralized exchange takes up to sixty percent off fees from traders, eighty percent of the fees obtained from DEX go to Serum buy and burns while the remaining twenty percent of the DEX fees go to Serum stakers.

Serum DEX has an order book called the central to Serum's which is operated by smart contracts and are of three folds, Fully on-chain, Entirely limit-order based and has the ability to choose price, size and trade direction.

Why did I choose this coin

The Serum Dex allows users to perform cross-chain swaps in just some mini seconds .

listed on other exchanges such as OKEx, HBTC, Bitz and many others.

Built on Solana, Decentralized and Permissionless Swaps (No KYC).

it’s white paper outlines the following feature Orderbook, Serum Token, Cross-Chain Swaps, Ethereum and Solana Integration, Physically Settled, Cross-chain Contracts, SerumBTC, SerumUSD.

Goal of Serum Project

Serum's objective is to create a foundation that drives DeFi into regular industries and also enable greater speed and low cost of transaction fee.

Founder of Serum

Serum is a permissionless and an open source project created by a different companies such as FTX, the Solana Foundation and Alameda Research.

CONCLUSION

Halving in cryptocurrency is reduce the reward earned after forging each block on a blockchain by a factor of 2. Several coins like Bitcoin, Litecoin and many others practice this method by bringing new minted tokens.

Blockchain networks are decentralized and so consensus must come between nodes before validation and storing of transactions on blockchain. This mostly done consensus mechanisms such Proof of Work, Proof of Stake, Proof of Capacity and so on.

Altcoin season are period of 90 day in which 75% of the top alternative coins like SRM, Doge, SBD etc. perform better than Bitcoin. Altcoins are cryptocurrencies aside Bitcoin.

Thanks For Your Attention

Gracias por participar en la Cuarta Temporada de la Steemit Crypto Academy.

Felicitaciones!

Continua esforzandote, espero seguir corrigiendo tus asignaciones.