[Trading Cryptocurrencies] - Crypto Academy / S4W6- Homework Post for @reminiscence01

Hello,

Good day professor @reminiscence01, I’m very grateful for your humble service as a Steemit crypto Academy professor and I’m also very glad to be your student. My sincere regards to other professors as well.

Here I’ll present my homework accordingly based on the questions.

Today’s topic is Trading Cryptocurrencies. Here is my homework presentation based on the questions given.

1. Explain the following stating its advantages and disadvantages:

-Margin trading

-Futures trading

Basically, trading refers to the the process of buying or selling an asset which is bond to happen between two individuals known as the seller and the buyer where an asset is being exchanged for another. Here in this case, trading is exchanging a cryptocurrency for another cryptocurrency which equally take place between buyers and sellers.

Spot trading

This form of trading is relevant to beginner traders. This is because of its unchallenging nature. Spot trading is said to be a piece of cake which is widely practiced by individuals who are new to trading. The whole idea behind spot trading is possessing a crypto asset bought at a low price so that if or whenever the price of the crypto asset jumps up, the trader sells his crypto asset at the current price of the crypto asset which is at a higher price than the price bought the crypto. This is a very simple process and also the simplest way to earn with trading because it involves no technical knowledge.

Pros of Spot trading

This form of trade is simple and can even be performed by individuals who are new to trading.

Traders have in possession their crypto asset and also have complete authority over them.

it allows traders with low capital to be able to trade so as to earn profit, this is because there is no limit to amount required to trade.

Cons of Spot trading

the volatile nature of cryptocurrency makes traders unable to trade in some time period.example a time frame where the price is low the price bought. He is forced to wait the right moment.

possibility of loosing proportion of initial capital of the crypto. This is when the crypto is sold at a relatively lower rate than bought. This happens as a result of knowing the future trend of the crypto falling beyond imagination. This however curb loses.

Margin trading

This form of trading allows traders with low capital capable of buying crypto exceeding their purchasing power. This is as a result of extension of purchase power buy loaning additional capital from the third party; could be another trader or from the exchange.

This form of trade however cautions traders level of risk they bare if there is predictions failure. Unbearable loss would be incurred if this is to happen. Moreover traders who makes appropriate technical analysis of the market and realizes the trends tends to enjoy gross profit with an initial low capital if trade is performed base on those analysis. The level of leverage used to maximize profit will be equal when a loss is to be incurred.

Pros of Margin trading

trader enjoys more profit if trade and predictions were accurate.

it allows traders with low capital to trade at high leverages to earn them more profit.

it gives traders the opportunity to loan capital from third parties to use for trades.

Cons of Margin trading

trader incurs more loss if trade and predictions are inaccurate and he bond to pay for the losses with his initial capital.

it’s not recommended to traders without trade experience but rather expert trader who are able to make accurate or fairly accurate analysis of the market trends to avoid incurring big losses which you are bond to pay to avoid liquidation.

risk of account liquidation. Traders who are not able to pay their loans after a great loss however faces liquidation as penalty.

Futures trading

Futures trading is a form of trading that is recommended to trade experts who are able to make accurate or barely accurate predictions of the market trends. Due to the volatile nature of cryptocurrencies, a trader needs to make technical analysis of the market trends in other to realize the trend movement of price before entering into trade. This is why beginner traders are not advised to futures trade because they lack the knowledge and experience to enable them realize a trend. In futures trade, the investor with the help of his experience as well as his knowledge on making good technical analysis of the market trends tends to enter trade using high leverage so as to maximize profit. In this case if a wrong prediction is made will lead to great loss due to the high leverage used.

Pros of Futures trading

trader enjoys more profit if trade and predictions are appropriate and accurate because of the leverages at disposal.

it gives expert traders a room to grow financially.

traders are able to earn higher profit although they have low capital which could yield such profits.

Cons of Futures trading

traders run a big loss when there is wrong predictions of the market because the level of profit which is earned from aid from leverages is equals the loss incurred.

Not every trader is able to use this form of trading due to the technicalities involved compared to spot trading.

they lack complete authority over the asset because no underlying asset is being possessed.

2.a) Explain the different types of orders in trading.

In trading, there just few types of trading format. Namely are Market order, limit order, stop-limit order, OCO.

Market order

This refers to the type of order which is ranked the fastest. When this type of order is placed, it gets filled up immediately because it accepts the market price available for that crypto asset. Market price is basically the current price available to sell or buy a crypto currency.

Traders who wishes to complete a trade instantly for a purpose or due to some circumstances like realizing a drastic fall in the crypto you are holding are recommended to use market orders to complete such trades to avoid loss. Traders who accepts the market price are termed the market takers. Thus they go along with any price the market makes available.

This type of order doesn’t need to reflect in an order book unlike limit order.

Limit order

This is a type of order that is placed by market makers. Market makers are traders that do not accept the current market price but rather initiate an order setting his own price. This type of order usually take time to get filled unless there is more liquidity of the crypto which will aid get filled at a lesser time.

When a limit order is placed, the trader sets his own price he is will to sell or buy the crypto asset regardless of the time to get filled. This could be below or above the market price which ever he chooses. Example, I have 200 TRX coins and I will like to trade for Bitcoin (BTC), currently knowing the market price was 0.00000170, I decided to place my sell limit order at a rate of 0.00000180. With this it will be sent to the order book adding more liquidity. This order placed is to be filled in the future once the market price reaches the set price.

Stop-limit order

In this type of order, there are two sections involved known as the stop price and the limit price. With this type of trade, the trader is able to initiate two different ideas to help maximize profit or minimize loss. For a buy stop-limit order, the trader sets the stop price below the market price such that when the price of the crypto asset falls to that level, a limit order is placed at the limit price. Example using the sell stop-limit order.

I have 200 TRX coins and will like to trade for BTC, currently knowing the market price was 0.00000170, I decided to place my stop price at a rate of 0.00000172. Also placing my limit price at 0.00000175. With this when the price rises to the stop price my limit order will be placed at my limit price. When the price also reaches the limit price, it gets filled and the order is completed.

OCO

This is a form of order that contains two types of orders in one. These orders are the limit order and stop limit order. Its name best explains it functions thus OCO which means One cancel the Other. This explains that when there is trigger of one order the other is canceled. Let’s take for instance I have 200 TRX coins and will like to trade for BTC using the OCO order method, I will place my limit price above the current price and also place my stop price below the current price. With this the stop-limit order should trigger when the price falls to the stop price causing the limit order to cancel. Where as if the price rises to the limit order, the order gets filled causing the stop-limit order to cancel.

2.b) How can a trader manage risk using an OCO order? (technical example needed).

Risks are obligatory encounters which traders are bond to face during trading. However knowing this fact, it’s always every traders main objective to make sure risks involved in a trade is curbed in the best possible way for a successful trade.

The OCO order type is one best way which traders use to minimize risk. This is because of its nature which are the combination of two different order types to give traders alternative during trade.

With the OCO type of order, a trader is at disposal of two different order types in one order. These orders are the limit order and the stop limit order. During trade, the trader is given alternative as to whether profit is earned or a slight loss is made. This will base on the traders predictions of the market.

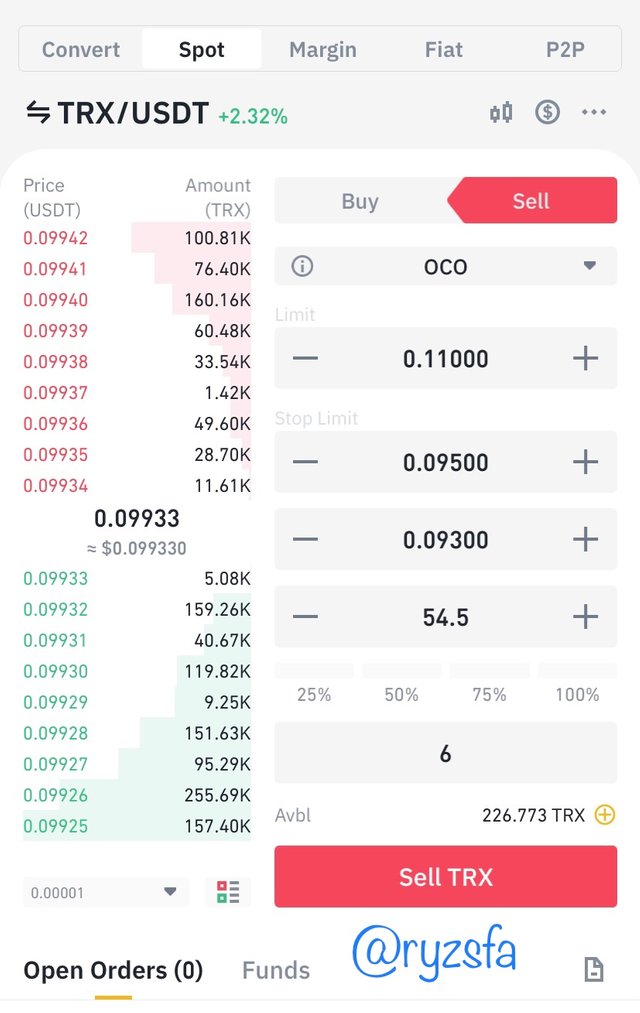

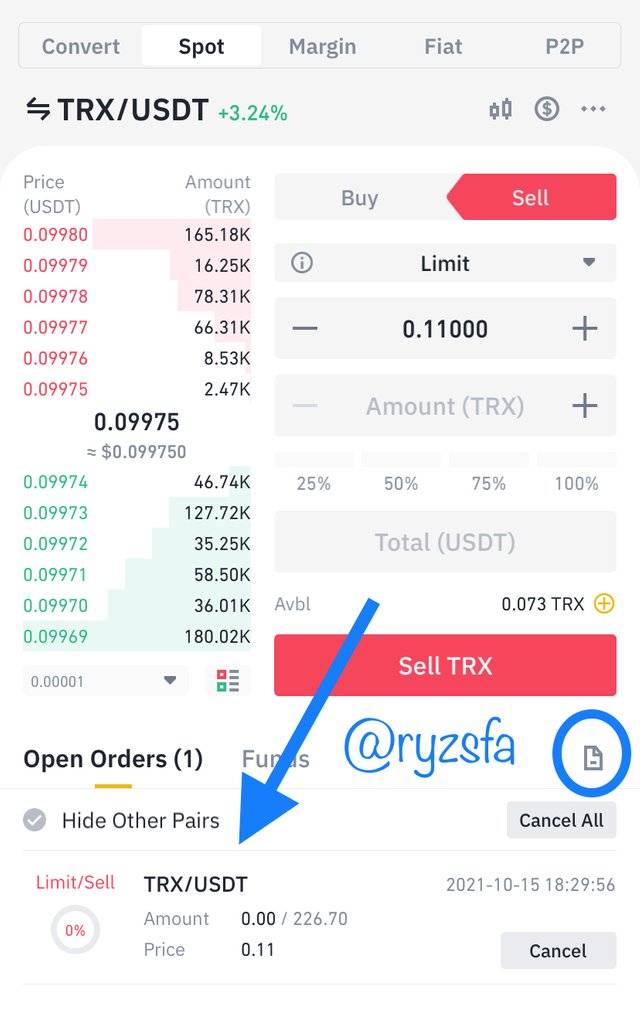

Using the image of a sample OCO order below.

As a trader who is to sell my TRX coin using the OCO order, i placed my limit price (0.11000) above the market price (0.09933) and also placed my stop-limit order (0.09300) below the market price with my stop price(0.09500). This means which ever gets triggered first will be your profit or stop loss base on the traders predictions. if my predictions are correct that there is going to be a bullish trend I will maximize profit because I placed a higher limit price which will eventually get triggered.

Traders can also place their stop-limit order just slightly below the market price to avoid relevant losses if wrong predictions are made.

3.a) Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed. (Screenshots needed from any cryptocurrency exchange).

First of all I will like to use the binance exchange for my illustration.

- Launch your binance application.

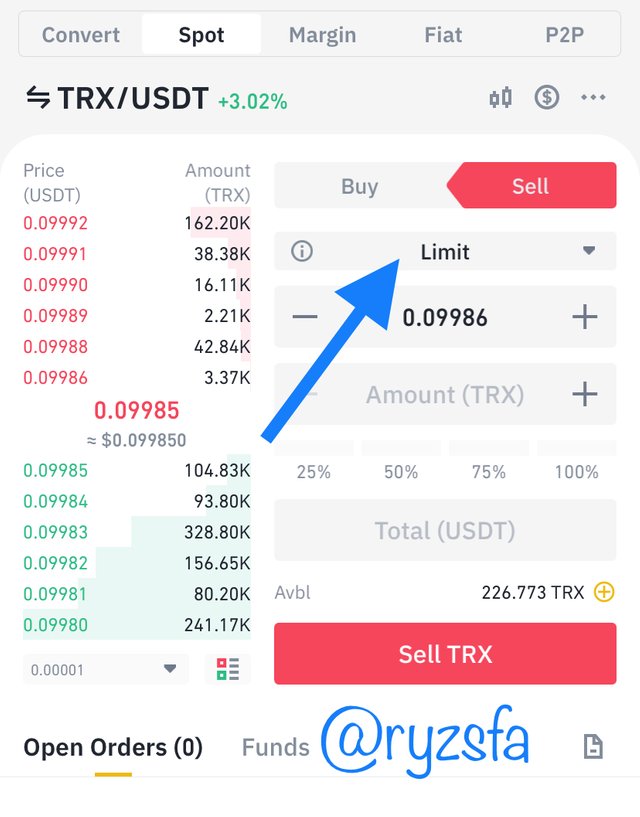

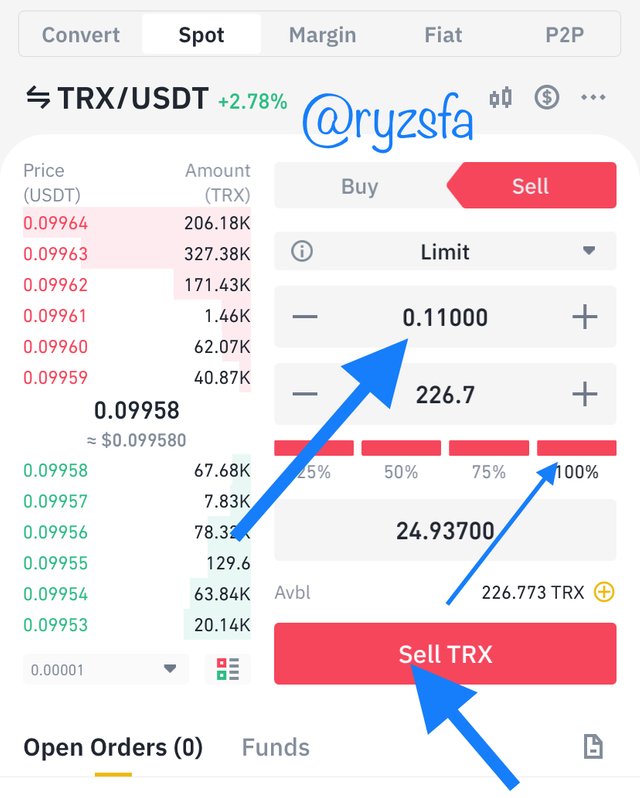

- Go to market and then go to spot. Now you can search for the pair of crypto currency you will like to use. Here I chose TRXUSDT pair for my illustration.

- make sure you select limit order as the type of trade willing to proceed.

- set your limit price which you will like to place the order. Now enter the amount of TRX you will like to sell.

Here I chose 100% which is my entire capital.

- place your order by tapping on sell TRX

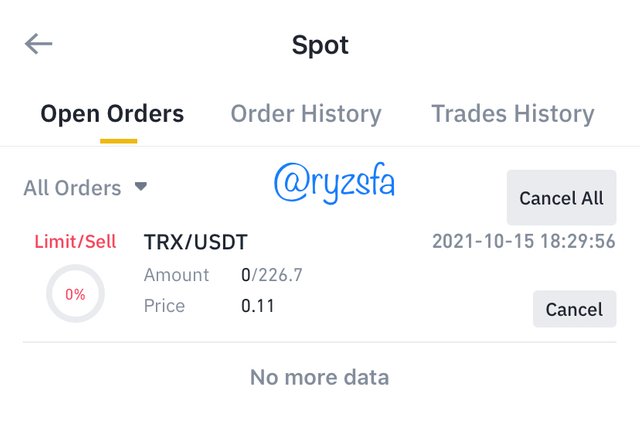

Below is my open order displaying my limit order created.

4. Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset. The following are expected.

Using a demo account to trade on paperview on TradingView.com.

Using the ETH/USDT pair in buying ETH

In this case I will like to use the random index indicator also known as KDJ indicator for my illustration.

the chart above, indicates that the KDJ is 10.77 which signals a buy entry. So we place the order and set a stop loss below the support levels. I decided to go into a buy order because oversold market was realized. With KDJ indicator, it involves three oscillating lines namely the K-line , D-line and the J-line. The J-line is one that helps determine oversold and overbought.

i)Why you chose the crypto asset

I decided to choose those crypto asset because of its popularity trust and growth it has earned over the years in crypto world.

ii)Why you chose the indicator and how it suits your trading style.

I chose the KDJindicator because it’s very relevant to expert traders since it has earned the trust of making good analysis of the market trends to aid trades. It’s a very reliable indicator which is widely used by traders.

Conclusion

Initially this was a lesson I decided to embark on for some time now. Although I was getting the understanding little by little. However, with this lesson which was very well explained, I have clarified many doubts and now have a clear view of the trade forms . Trading is a very challenging concept but very profitable

I will acknowledge professor @reminiscence01 for this was a very good topic which was very well explained. Thanks for the humble service for I have understood the lecture very well.

Hello @ryzsfa, I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Thanks for the feedback prof.