The Bid Ask Spread (Part II)- Steemit Crypto Academy- S4W3- Homework Post for @awesononso

Good day steemians,

The topic is the bid-ask spread part 2. Here is my homework presentation based on the questions given.

Question 1

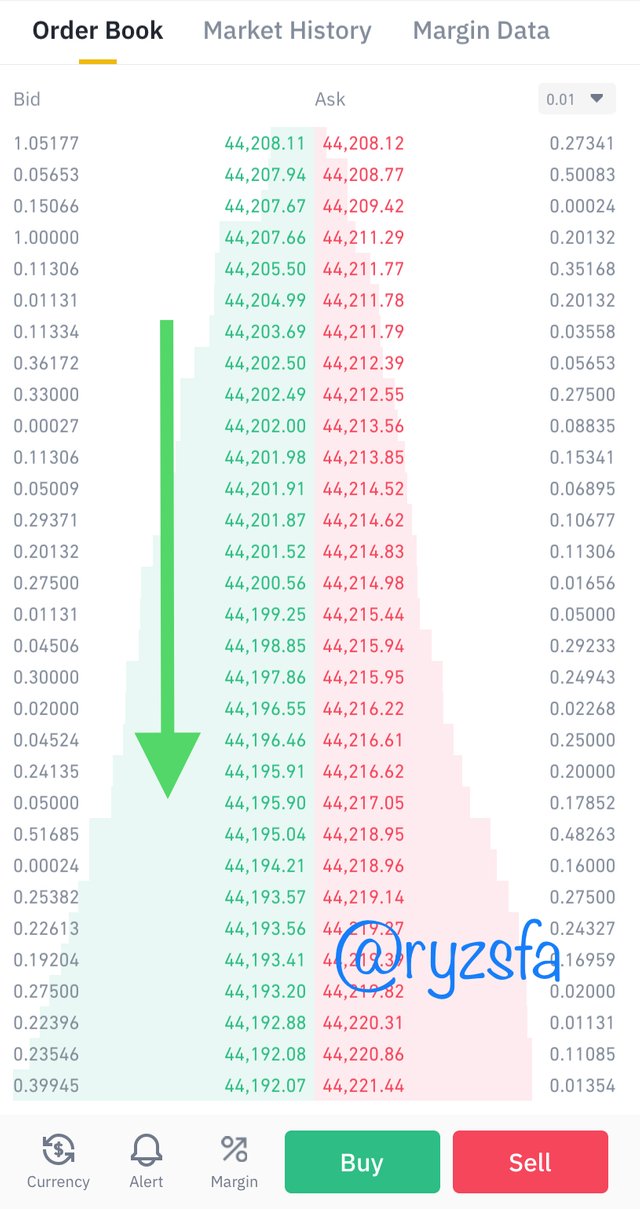

Order book in this case is termed basically as the list of open orders for a crypto asset be it a buy or sell order issued by traders. Order book displays all transactions made on a crypto asset. When we look at an order book it consists of two sections known as the Ask and the Bid. The Ask side represents sell transactions made on a crypto asset where as the Bid side also represents the buy transactions made on a crypto asset.

emphasis on the Bid side of the order book

Screenshot from the Binance exchange

Screenshot from the Binance exchange

For this section we realized it’s highlighted in green in various exchanges which represents the buy orders airing. Moreover, for the buy orders section it’s always arranged in the descending order of price as shown. The bid represents the highest price a trader is willing to buy a crypto asset. Within the bid section we have two columns known as the bid price and quantity. The bid price represents the opened bids at that moment displayed at the right side. Also having at the left side the bid quantity displaying the amount purchased at that bid price.

emphasis on the Ask side of the order book

Screenshot from the Binance exchange

Screenshot from the Binance exchange

The Ask side, it’s highlighted in red in various exchanges which represents the sell orders at that moment. Also for the sell orders section it’s always arranged in the ascending order of price as illustrated beside. The Ask represents the lowest price an investor is willing to sell a crypto asset. However, within the Ask side are two columns known as the Ask price and quantity. The Ask price represents the opened Ask for that period displayed at the right side. We have at the left side the Ask quantity displaying the amount sold at that Ask price.

Question 2

Within the market are these two types of traders thus the market makers and the market takers. Looking the two types of traders in the market, it’s quite self explanatory of their functions.

Market makers

These type of traders are traders who enters into trade by issuing a buy and sell order respectively below and above the market price. This is as a result for using the limit order process of buying crypto. These traders do not accept the current market price and hence set their own price. These type of orders usually takes time to complete since its been held pending in the order book.

Market takers

These type of traders are traders who decides to issue the order be it buy or sell at the current market price. Unlike the market makers, these traders orders are filled at that same moment not incurring any time wasting like the market makers.

Question 3

Market Order

Market orders are the type of orders issued by the market takers. This type of order is placed at the market price available at that moment. This type of order is usually instant and doesn’t need to reflect in an order book unlike limit order.

Limit Order

In most exchanges can be found this method of buying and selling crypto assets. This type of order is in relation with the market makers thus it’s used by market makers. Limit order is a form of placing an order for a crypto asset at one’s own price level be it above the market price or below the market price. These orders placed are to be filled in the future once the market price reaches the set price level indicated.

Question 4

As said earlier, limit order is in relation with the market makers whiles the market order is also in relation to the market takers. Moreover, this is because for market makers, they use the limit order form to place an order out of the market price. It can be below or above the market price. These type of orders placed are been displayed by the order book and when there are so many limit orders placed we say the market is in liquidity. When market makers places enough limit orders it provides more liquidity since market orders issued by the market takers will be easily filled.

However market takers accepts the liquidity provided by accepting the market price to issue their orders. In this case the set up price by a market maker is been taken by a market taker so when there is plenty of limit orders there will be enough price level for the market takers to easily fill their orders.

Question 5

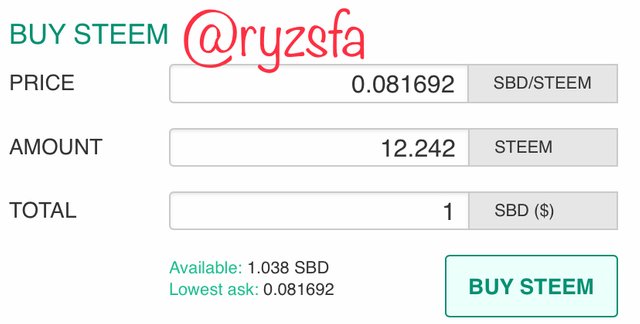

a) accepting the Lowest ask. Was it instant? Why?

b) changing the lowest ask. Explain what happens. (Make sure you are logged in to your wallet).

a) When the order was about to be placed, the lowest ask value was 0.081692. So, as a market taker I placed my order at the lowest ask as of 0.081692 for 1 SBD.

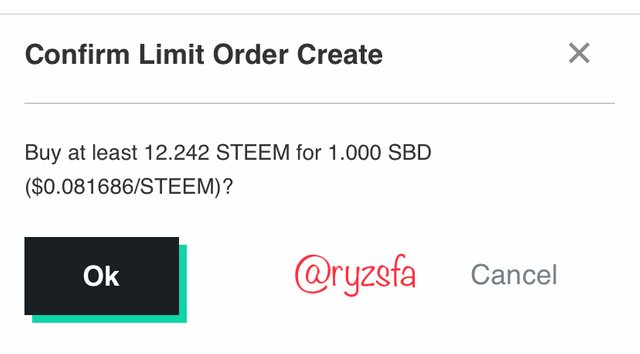

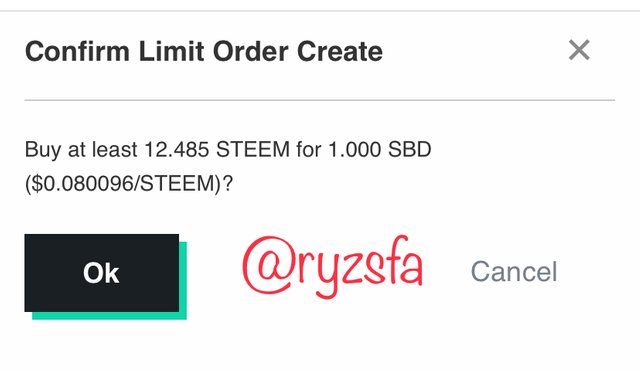

After clicking the Buy Steem button, the confirmation page pops up and then you confirm.

immediately it was confirmed the order was filled. This was because the market price at the time was equivalent to a limit order opened at that price.

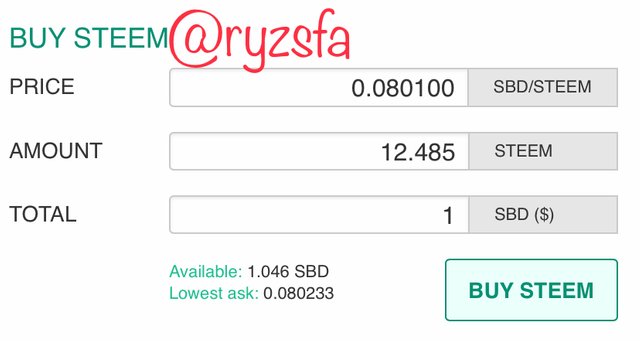

b) When the order was about to be placed, the market price was 0.080233. So, as a market maker I placed my order at the lower ask of 0.080100 for 1 SBD.

After clicking the Buy Steem button, the confirmation page pops up and then you confirm.

immediately it was confirmed the order goes into the order book waiting to be filled. This is because the market price at the time is not equivalent to a limit order opened at that price.

So until a limit order is opened at that price the order will remain pending in the order book.

Question 6

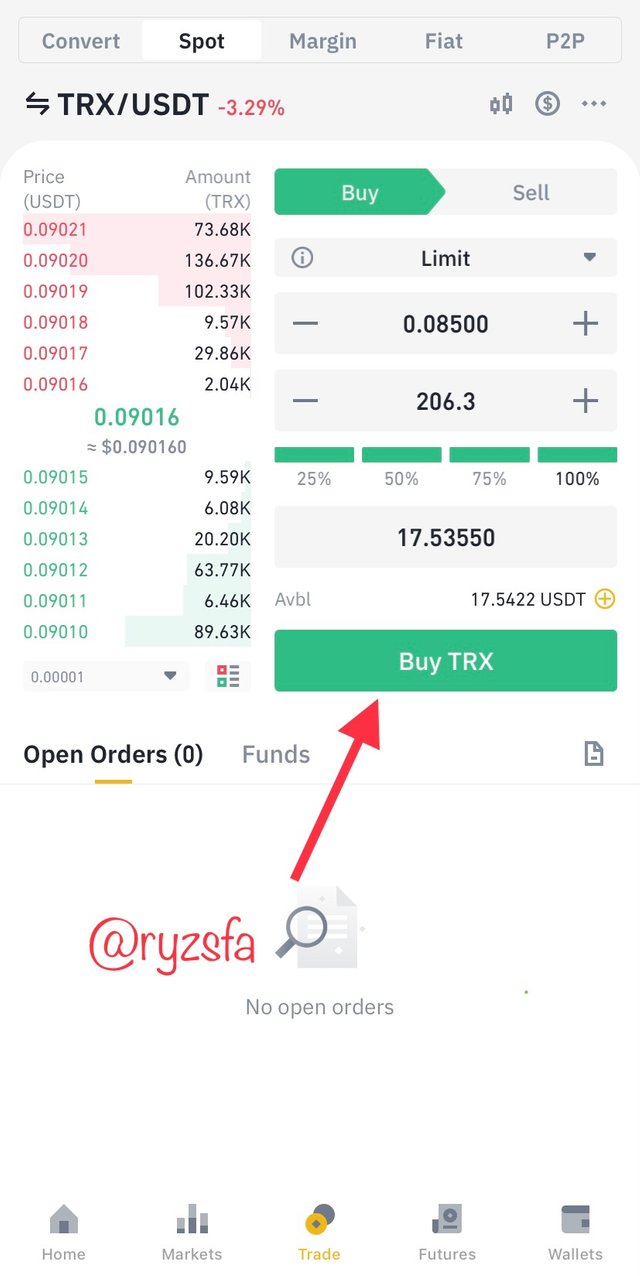

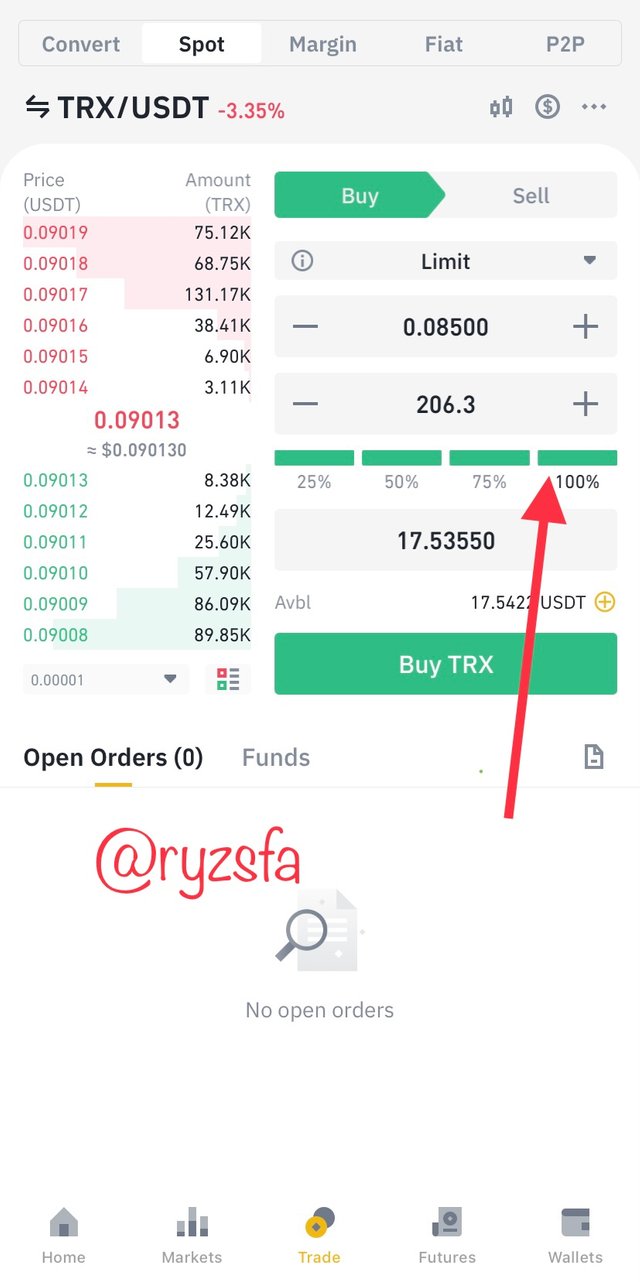

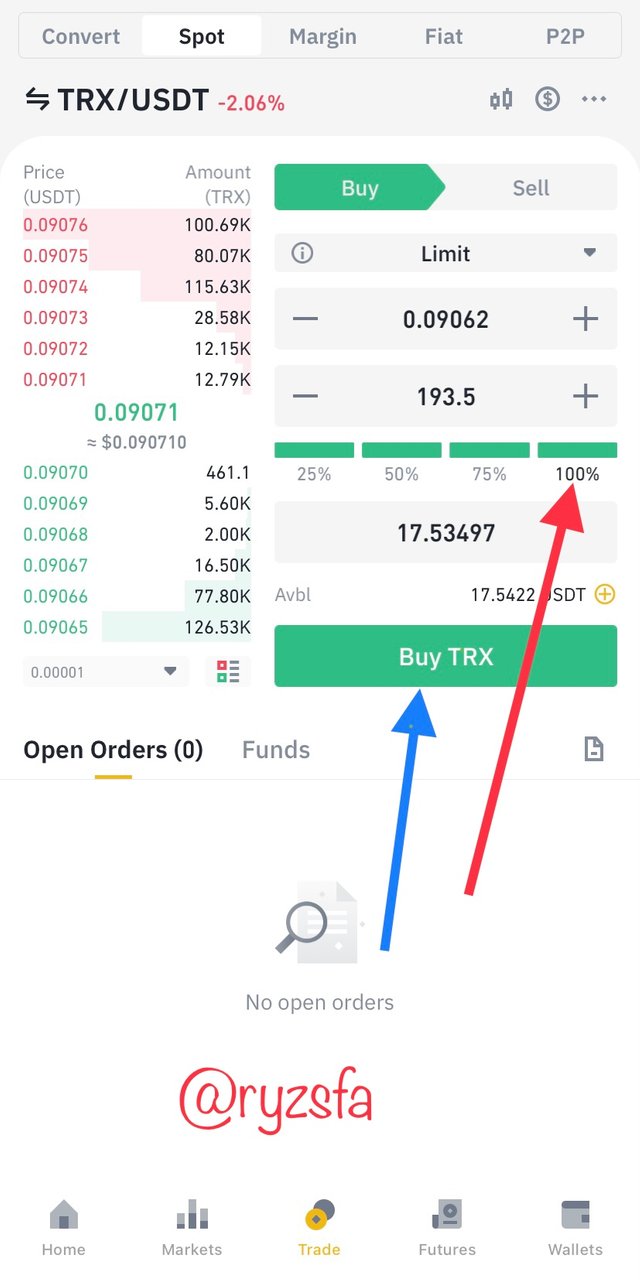

Placing a buy limit order on the TRX/USDT pair in the binance exchange at a fairly lower price than the market price.

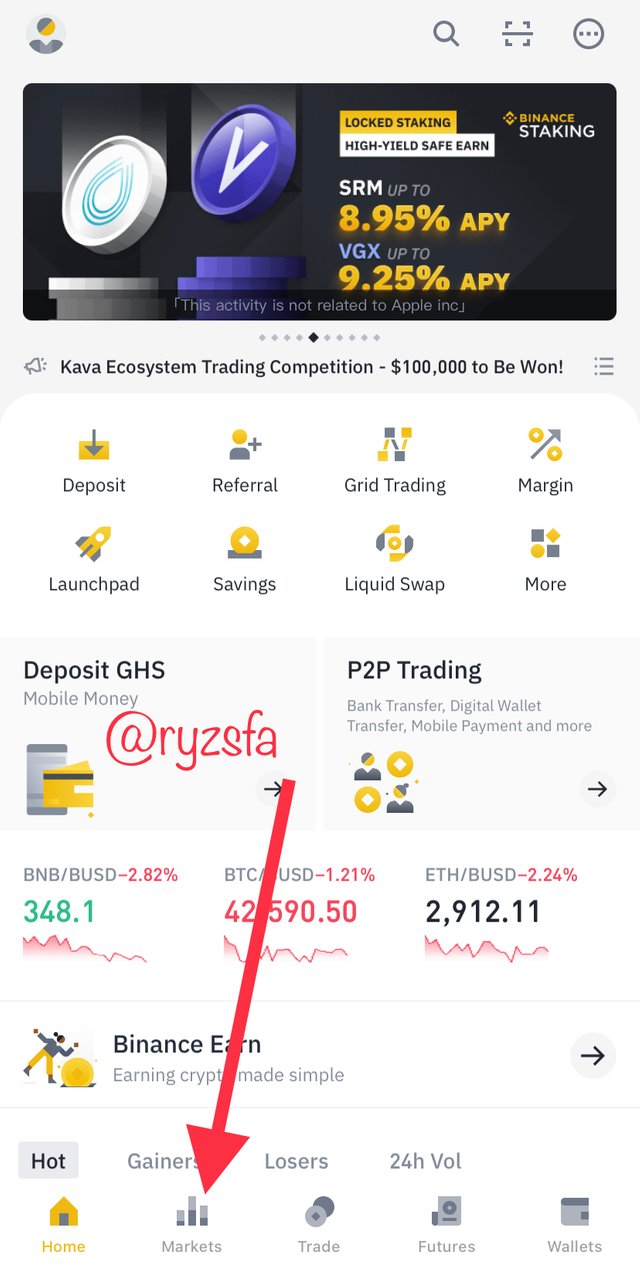

Launch your binance app, go to market and make a search for TRX/USDT pair.

After searching, select and move on to place the order.

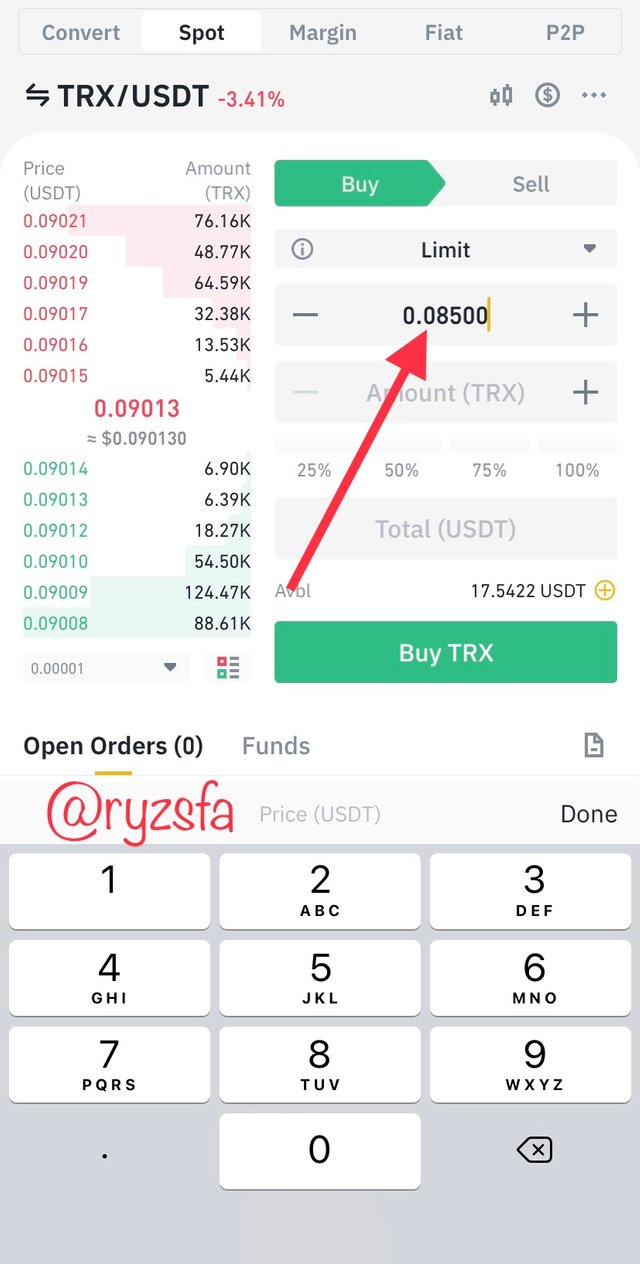

My set price which I will like to buy TRX

Select the amount in USDT. Here I chose 100% thus buying with my entire money in USDT. Proceed buy tapping Buy TRX

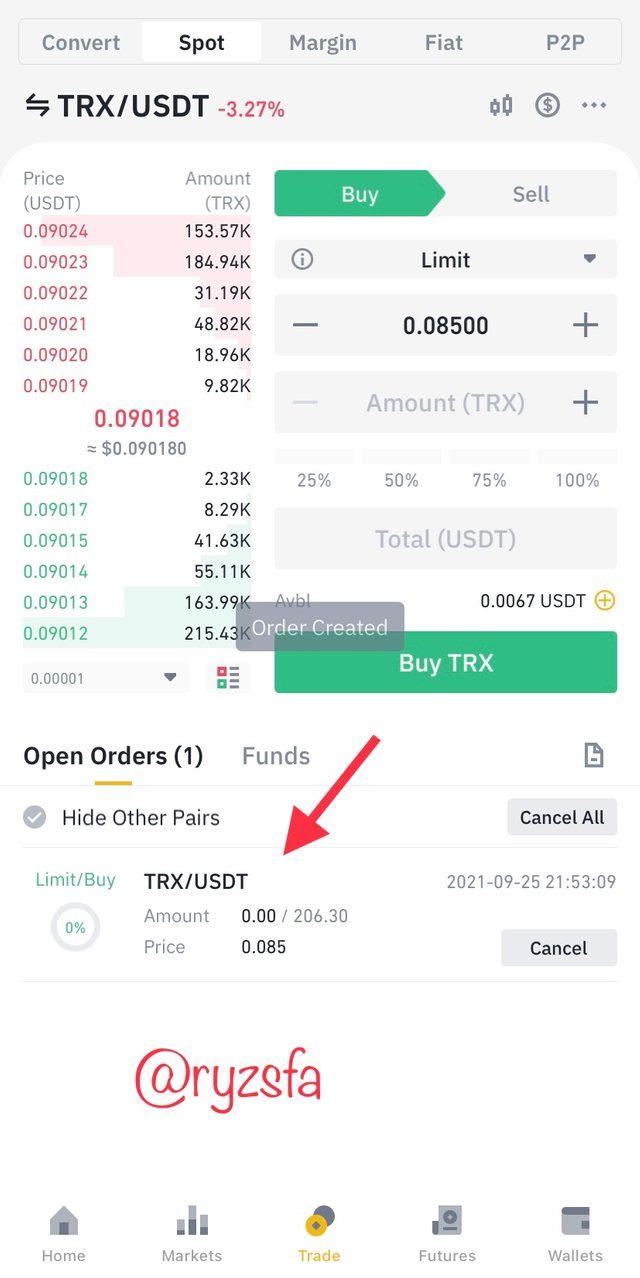

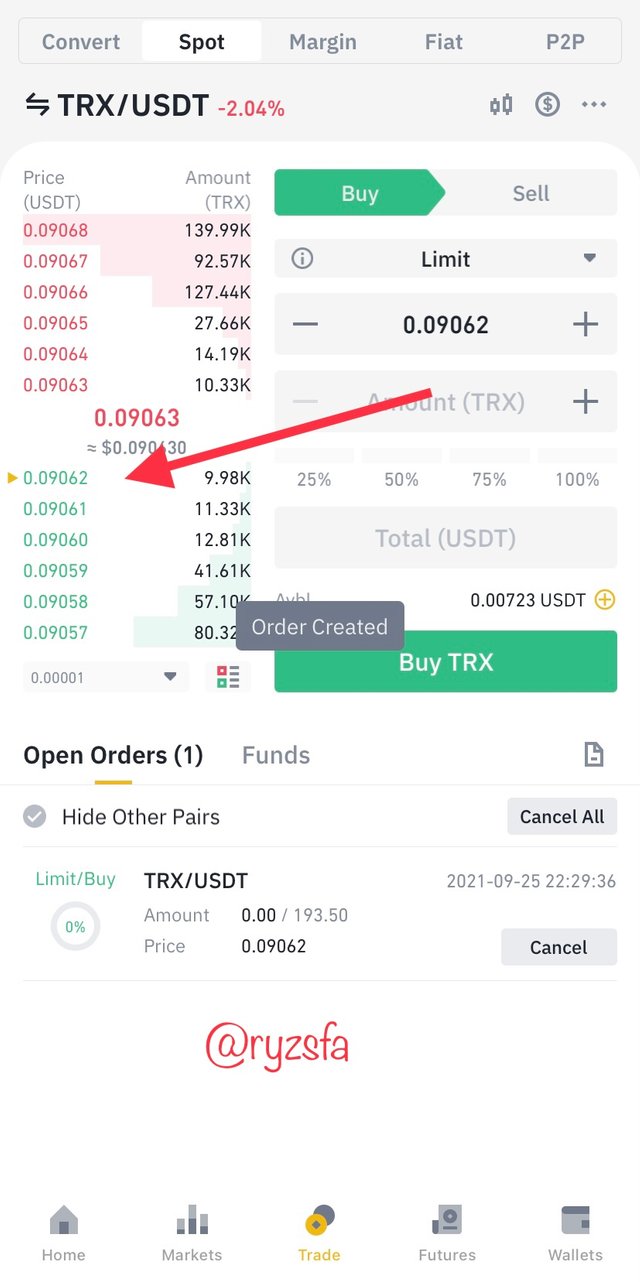

My limit order created

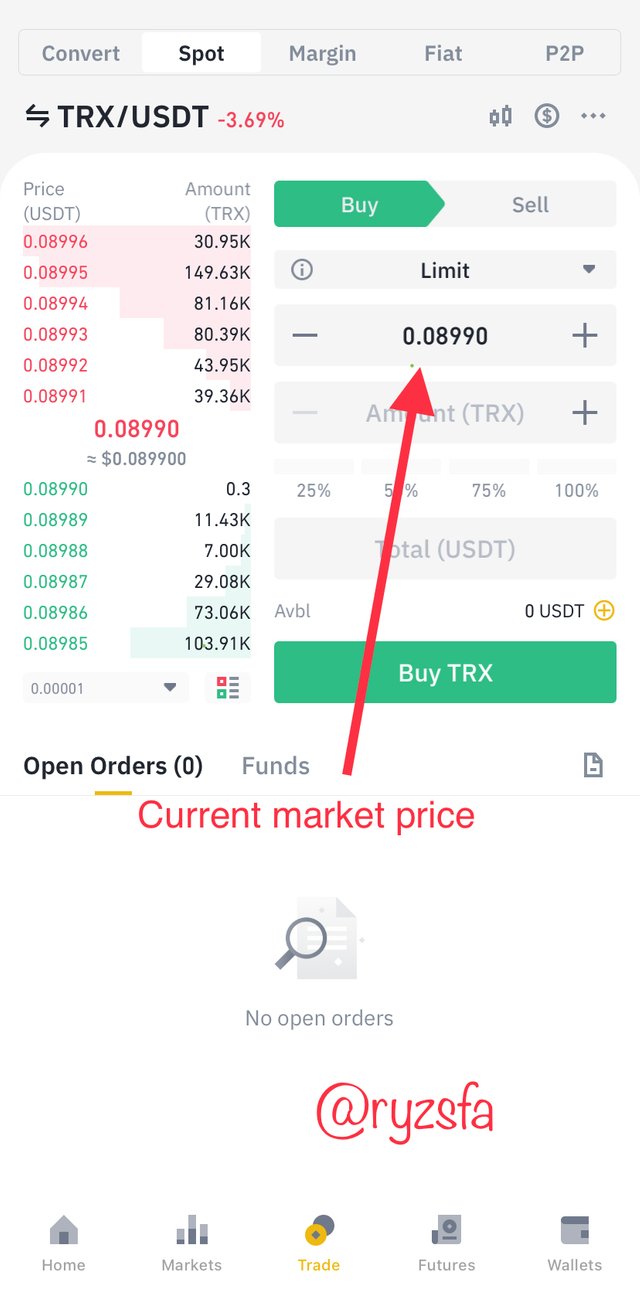

impact of the order in the market

The limit order created adds liquidity on the TRX/USDT pair.

Question 7

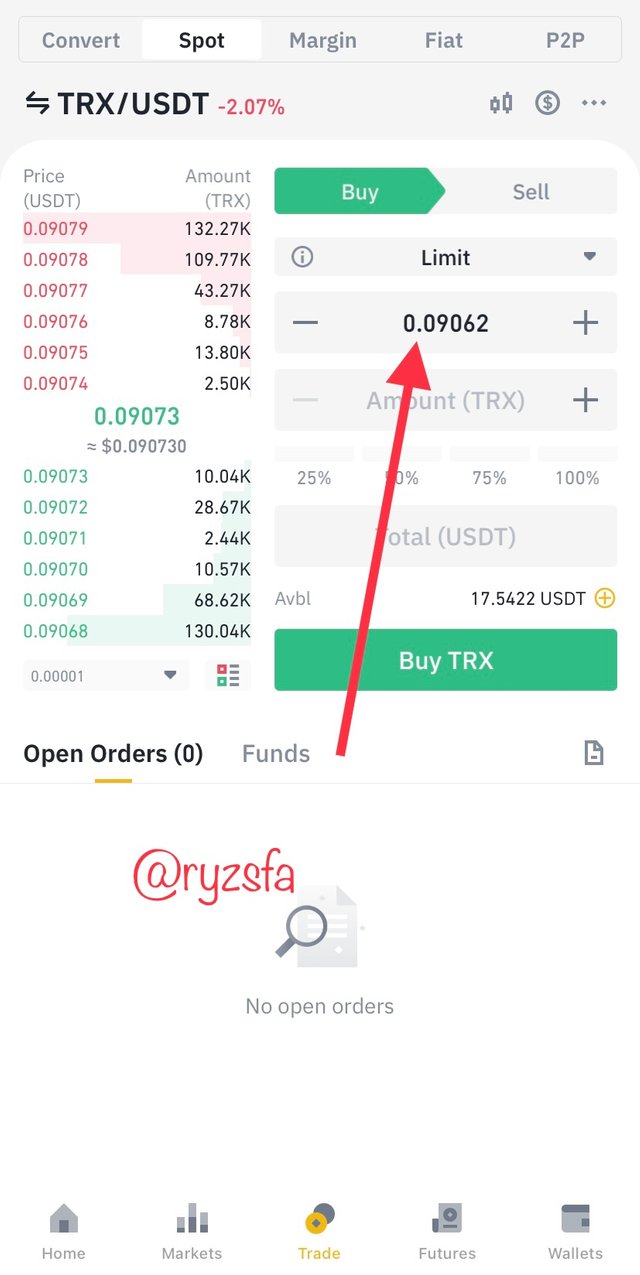

Placing a buy Market order on the TRX/USDT pair in the binance exchange.

The current market price is 0.09062. Where I decided to place my order.

I then choose the amount I want to buy and the tap on Buy TRX.

Immediately I placed my order it got filled. This is as a result of lots of limit orders matching the market order.

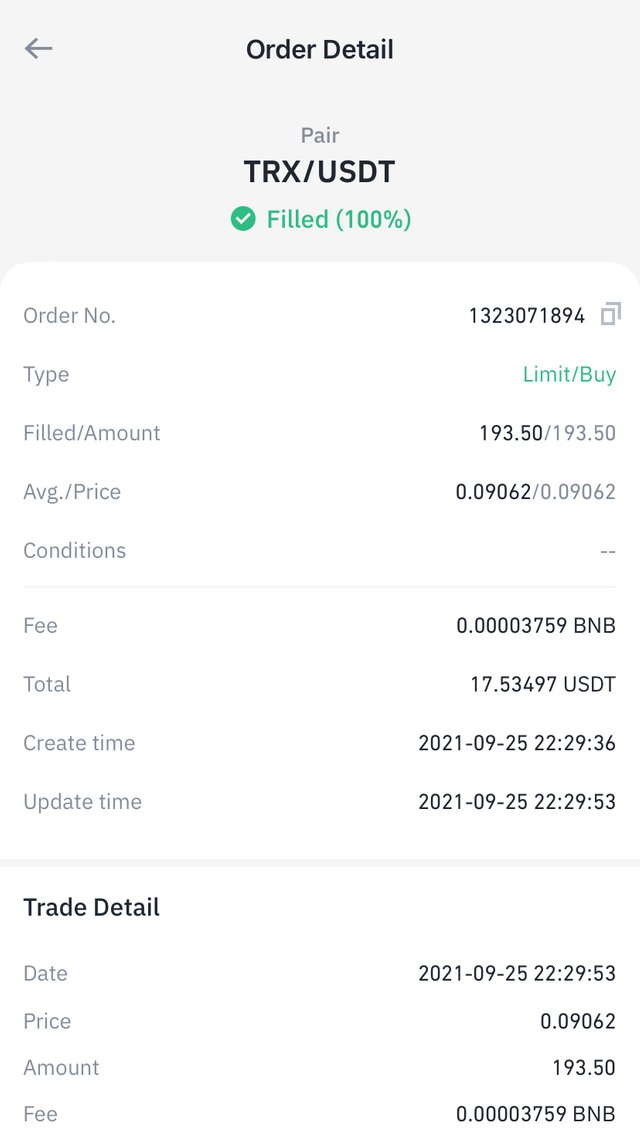

Details of the order as shown above.

Question 8

a) Calculate the Bid-Ask.

b) Calculate the Mid-Market Price.

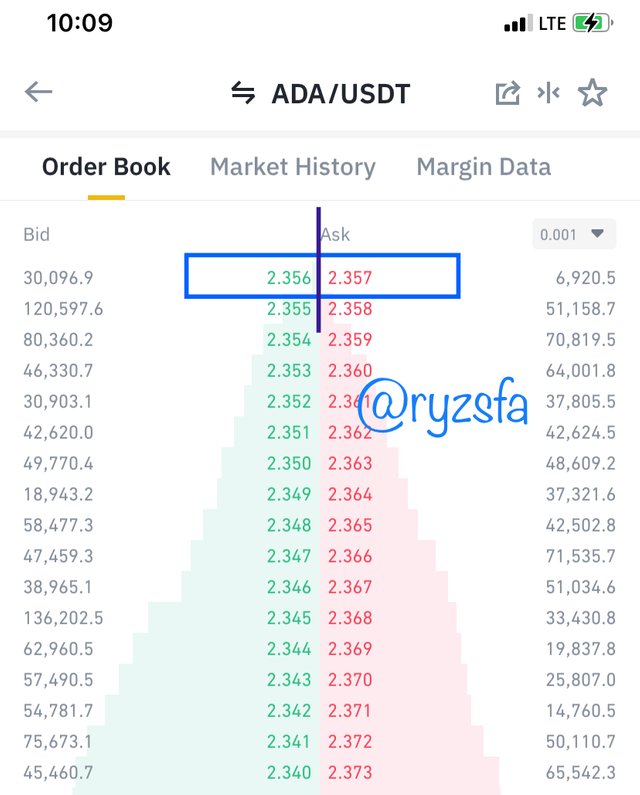

Here is my screenshot of the order book of ADA/USDT pair from the binance exchange.

a) calculating the Bid-Ask

From our earlier class we learnt that

Bid- Ask spread = Ask price - Bid price

Ask price = 2.357

Bid price = 2.356

Bid- Ask spread = 2.357- 2.356

Bid- Ask spread = 0.001

b) calculating the Mid-Market Price

Mid-market price = (Bid + Ask)/2

Ask price = 2.357

Bid price = 2.356

Mid-market price = (2.356 + 2.357)/2

Mid-market price = ( 4.713 )/2

Mid-market price = 2.3565

conclusion

I will to acknowledge professor @awesononso for this was a very good topic which was very well explained. Thanks for the humble service for I have understood the lecture very well.