Stability in Digital Currencies- Steemit Crypto Academy- S4W5- Homework Post for @awesononso

Hello,

Professor @awesononso, I’m very grateful for your humble service as a Steemit crypto Academy professor and I’m also very glad to be your student. My sincere regards to other professors as well.

Here I’ll be present my homework accordingly based on the questions.

Today’s topic is Stability in Digital Currencies. Here is my homework presentation based on the questions given.

1. Explain why Stability is important in Digital currencies.

Stability of a digital coin means the coin isn’t volatile thus capable of maintaining its initial price or with a slight change in price. Digital currencies initially are introduced volatile, this is so because they are decentralized and the stability or volatility depends on the public. However not all digital currencies are volatile. Whenever we say digital currencies, basically we refer to crypto currencies. Some crypto currencies like the Tether well known as USDT have earn the record of stability for a good time now due to it’s different nature thus they are pegged with a worldly asset such as fiat currencies. Stable coins like the USDT is very important in digital currencies because the rate of fluctuations in digital currencies are astonishing. You never know for sure when the price will fluctuate although there are indicators to help know the price movement.

With stability in digital currencies, traders are able to keep their assets from fluctuation. Due to the decentralized nature of some crypto currencies, the price of these crypto’s are controlled by the traders. Here is a scenario why stable coins are important. A trader using an indicator to predict the price trend of a crypto, knowing its trend went into trade and gained more profit. Leaving the gains including the initial capital at the unstable coin is very harmful for it could face a gross depreciation which will lead to loss of assets, however the trader is to keep the crypto at a stable coin to avoid loss. Stable coins are however centralized because they are pegged to a world asset which is under authorization and control.

2. Do you think CBDCs would be good in the future? Weigh the pros and cons in your own understanding and state your position.

Sincerely I will say it’s a good project and will aid a lot in the future. I firmly say this because the currency is being broadened such that it’s able to be used in various way or have variety of uses. The world we now live in is gradually transforming into a digital world. As time runs out digital currencies would be of great use as decades ago these digital currencies we have today were not accepted in the beginning but now accepted and used for various purposes.

The CBDCs do not harm the price of the currency such that there is fluctuation or inflation but rather the country initiates certain policies which will aid maintain the price of their currencies unless there is improper management of the countries affairs.

As we all know CBDCs are centralized and for that matter all the activities on the platform will be managed by the central government unless there is mismanagement, the currency will be stable and activities will run smoothly. Risk of hackers is another problem which is associated with CBDCs. CBDCs will really aid traders trade more easily as it will be easier and cheaper to transfer one currency to another.

3. Explain in your own words how Rebase Tokens work. Give an illustration.

Rebase tokens are unique cryptocurrencies that has an ideal nature. It uses a procedure known as rebase mechanism to ensure stability of the token. This is to tell us how unique it is since it’s not back by a real world asset like the fiat currencies but are token which are stable.

Rebase tokens are also named Elastic supply tokens because of its nature. When there is excess demand for such token, the total supply also increases as a result of increase in the price of the token. Base on this the taken remains the same as the rebase mechanism adjusts the total supply of the token to stabilize it. That’s its nature or how it’s designed. They are stable tokens pegged at $1

On the other hand when the demand of the token descends from normal, the price also depreciates causing a decrease in total supply of the token as a result of the rebase mechanism adjusting it for stability.

Here is a scenario

If I have 20 rebase tokens which is worth $20 in my wallet where each rebase token is equivalent to $1 and there is excess demand over time, price increases causing a higher total supply, with this my rebase tokens also increases. Considering a 20% increase I will now have 24 rebase tokens which will still worth $20. Where as if there is a fall in demand over time reducing the price value, the total supply also decreases. If at a rate of 10% will reduce my rebase tokens to 18 which will still worth $20.

4. Go to the https://www.ampleforth.org/dashboard/. Check the necessary parameters and calculate the rebase %. What else can you find on the page?

To calculate for the rebase % use the formula below,

Rebase % = {[(Oracle Rate - Price Target) / Price Target] x 100} / 10

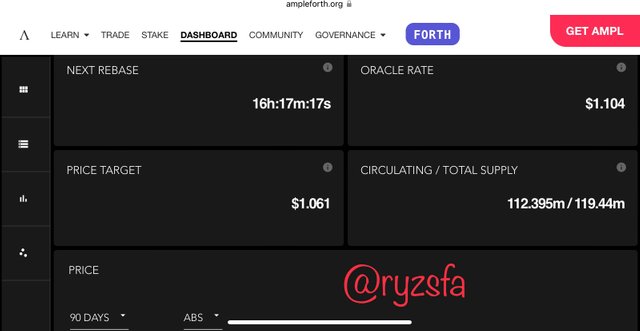

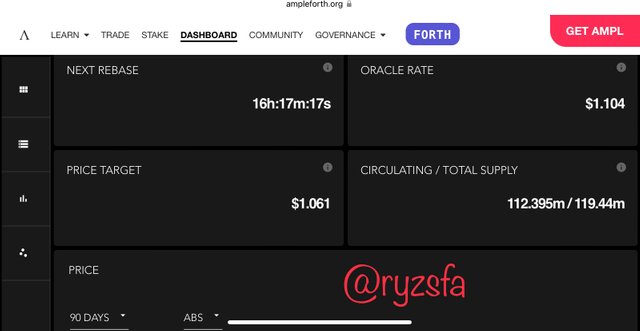

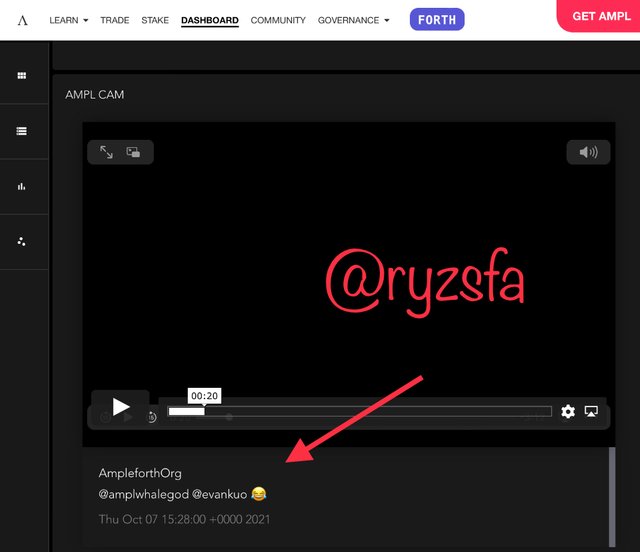

Using the parameters from the image below

- Oracle Rate= $1.104

- Price target= $1.061

Rebase% = {[(1.104-1.061)/1.061]×100}/10

Rebase% = {[(0.043)/1.061]×100}/10

Rebase% = {0.041×100}/10

Rebase% = {4.1}/10

Rebase% = 0.41%

What else can you find on the page?

Here on this particular page, you can find the total supply as well as the remaining time for the next rebase aside the Oracle Rate and price target on the upper section of the page indicated below.

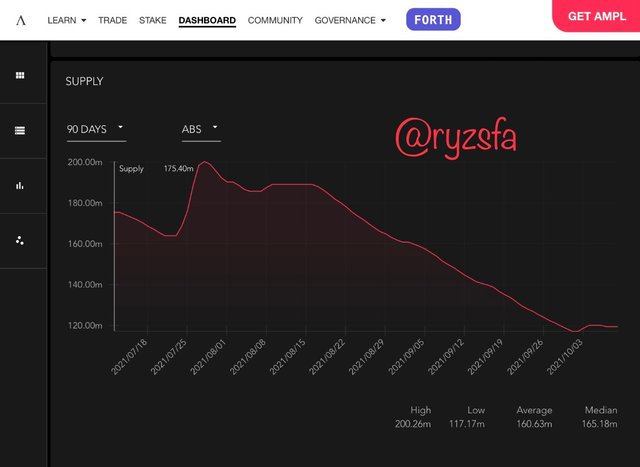

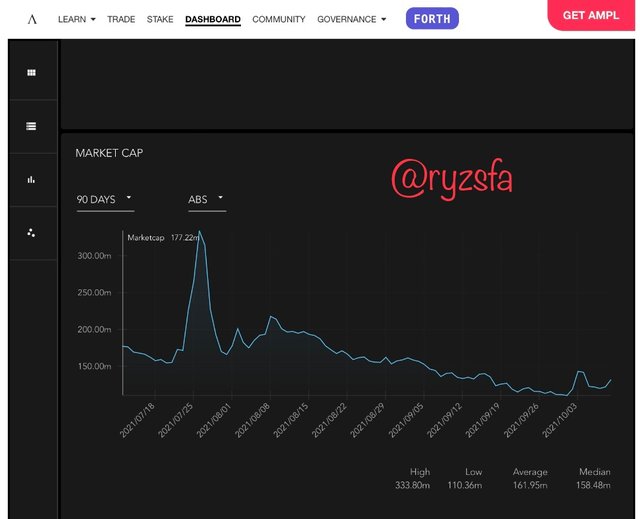

Moving below the page can also be found the price chart, supply chart, chart of market cap for a 90days period. Below are the images of charts mentioned.

source

Also at this particular part of the page left a link to the Twitter account indicated with the arrow.

Note: Beside the page are there other boxes aside the main page box. The remaining box displays the supply chart and history, asset performance, weekly returns, correlation heat map, market oracle, CPI oracle, CPI history and rate history.

5. Trade some tokens for at least $15 worth of USDT on Binance and explain your steps. (Give necessary Screenshots of the transaction).

- step 1

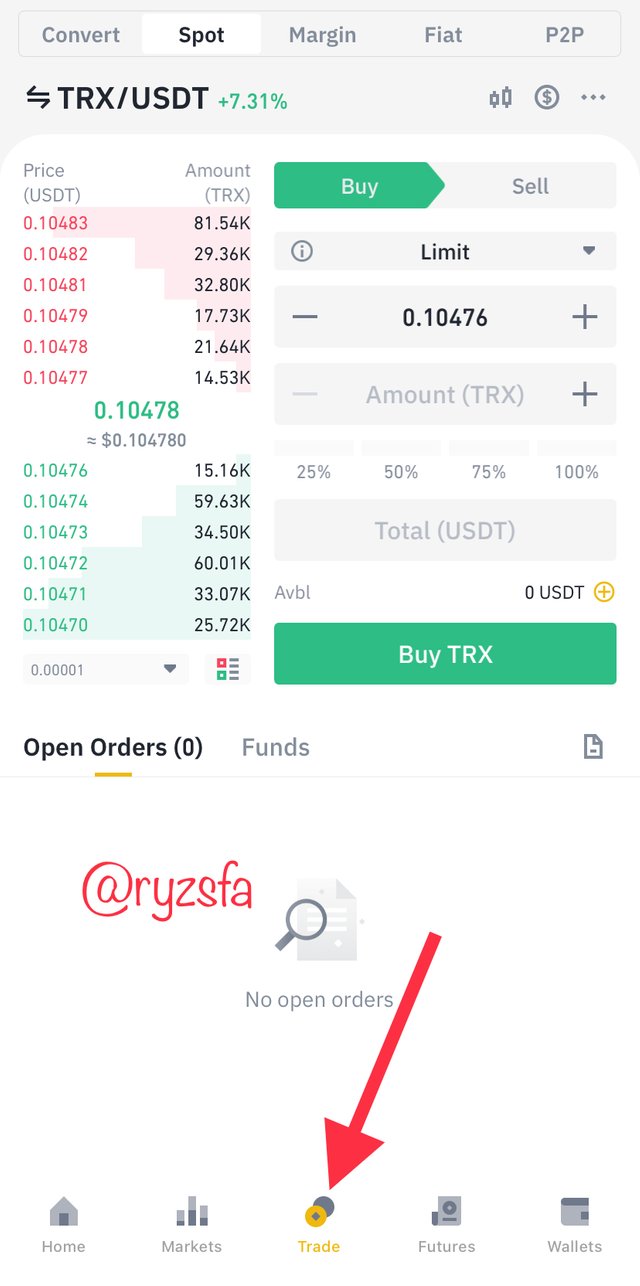

First of all you need to launch your binance application and then go to trades as indicated below.

- step 2

Select the pair of crypto you will like to trade in. Here I chose TRX/USDT pair due to the low fee charged for TRX.

In this trade I will be selling TRX for USDT.

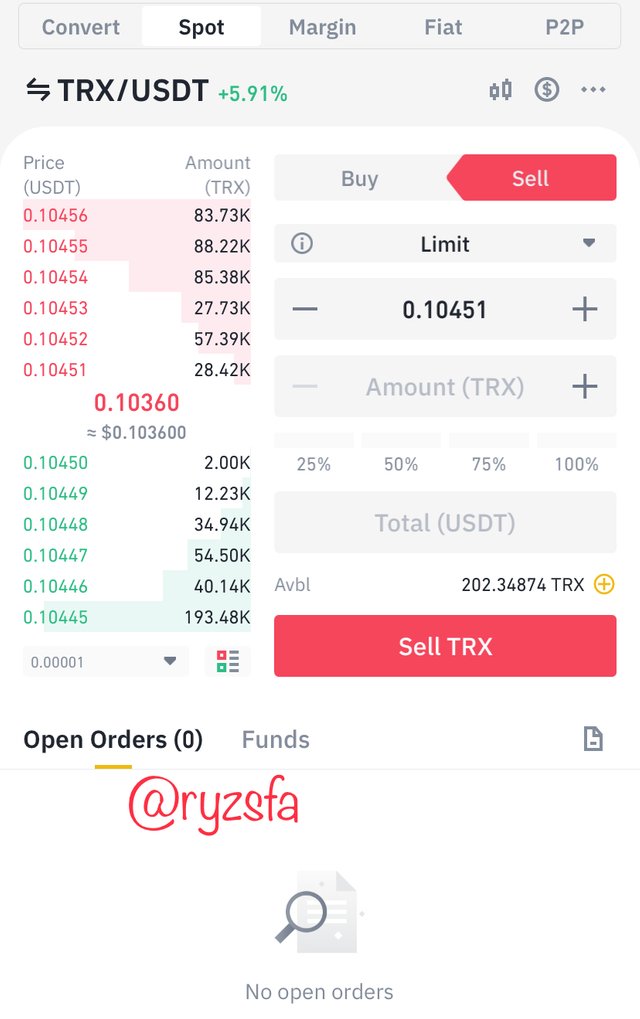

- step 3

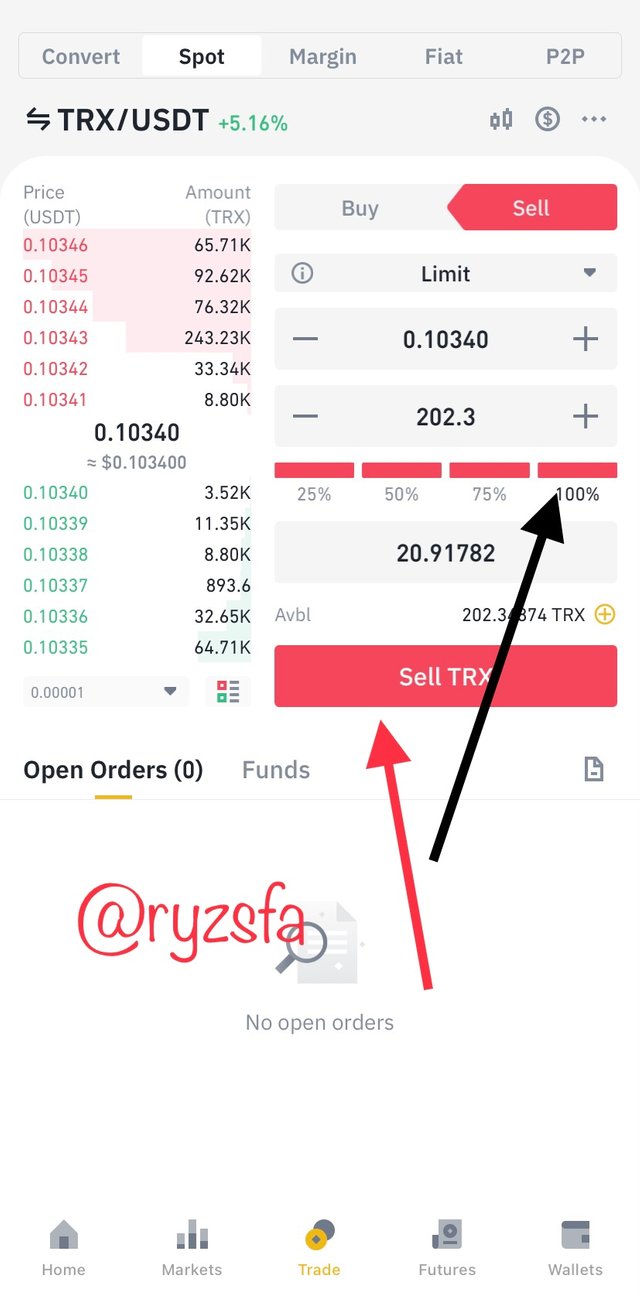

I then entered the amount of TRX I will like to trade where I chose 100% which is my total TRX worth over 20 USDT.

- step 4

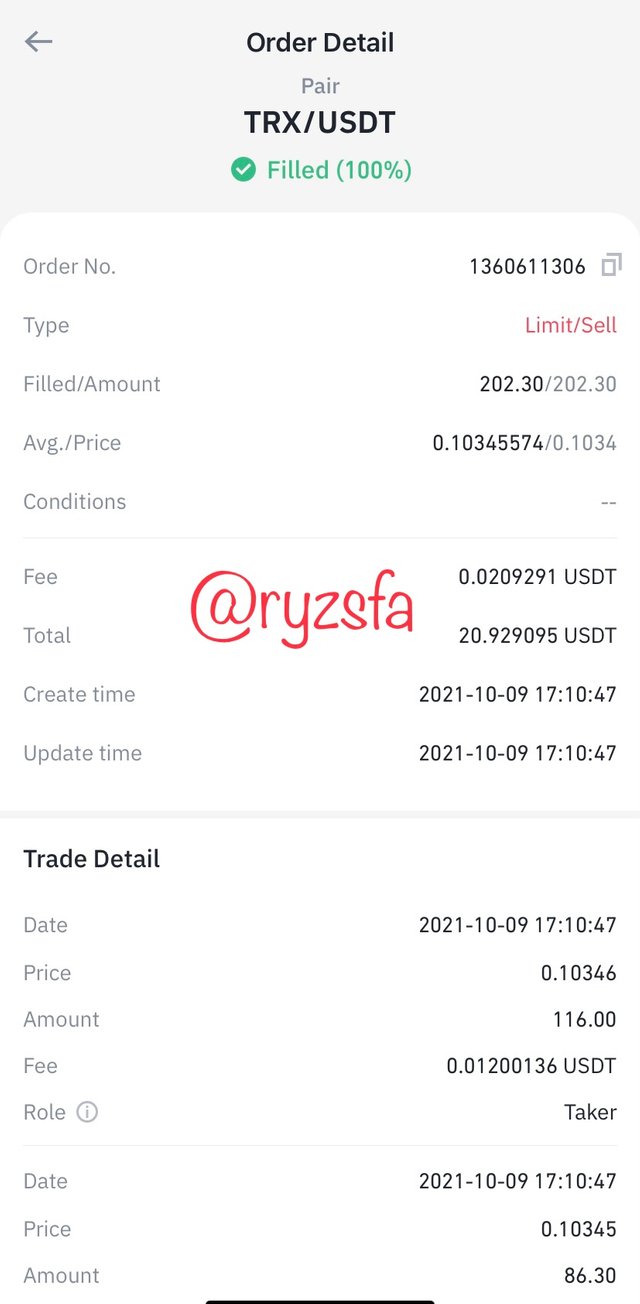

Tap on sell TRX below and wait for confirmation. Actually the order was instant because I chose to be a market taker.

Below is the prove of transaction.

6. Transfer the USDT to another wallet with the Tron Network. From the transaction, what are the pros of the stablecoin over fiat money transactions? (Give Screenshot of the transaction).

Here I will be illustrating the transfer using the binance exchange and the tronlink wallet.

After the early trade which was made, I now have my assets in USDT which I will be transferring to my tronlink wallet. Below are the steps involved.

- step 1

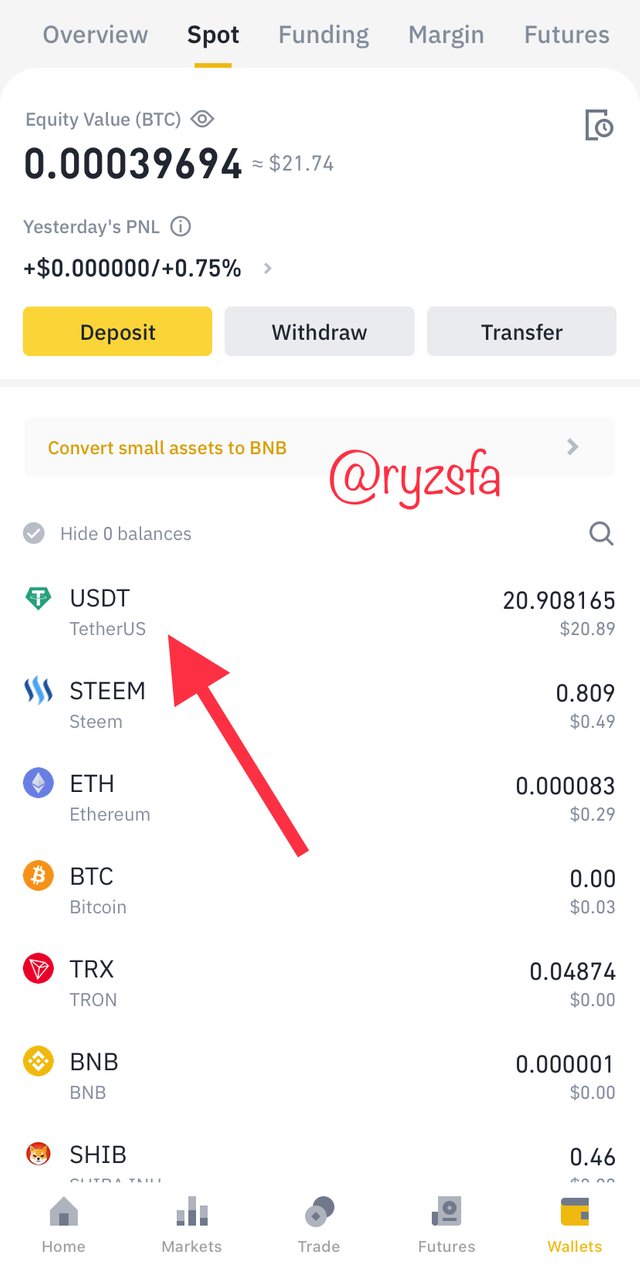

Go to your wallet and then go to spot, there you will find all the crypto assets which you possess respectively. So then I locate my Tether (USDT) and tap on it.

- step 2

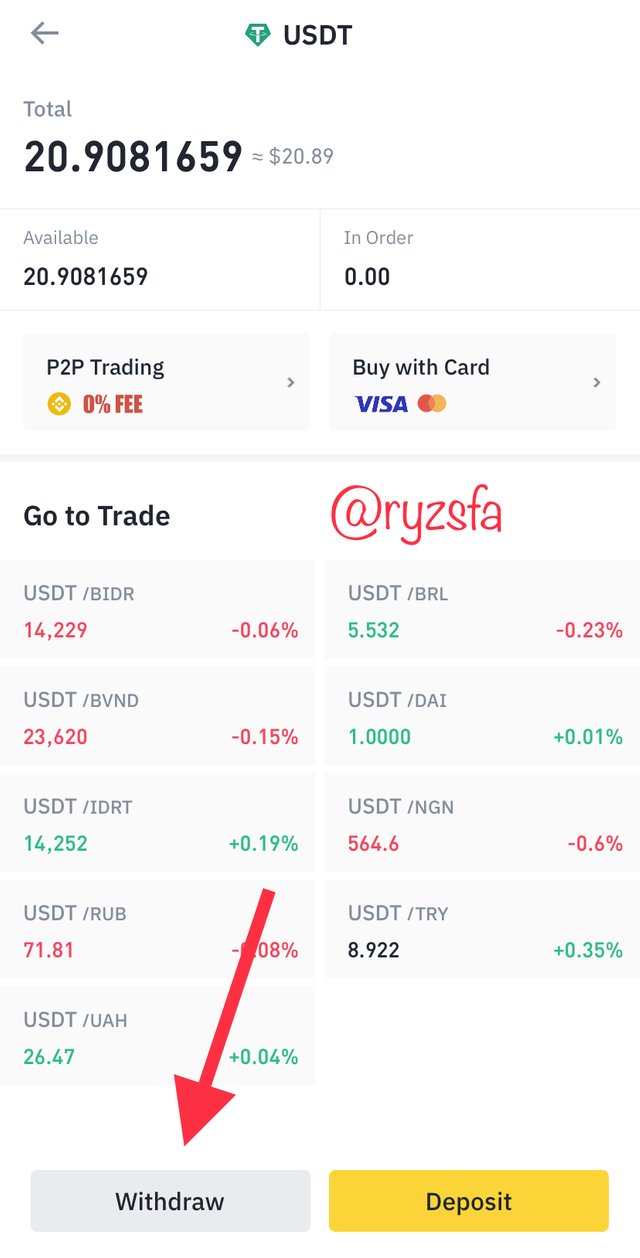

Next you will go to withdraw below the page.

- step 3

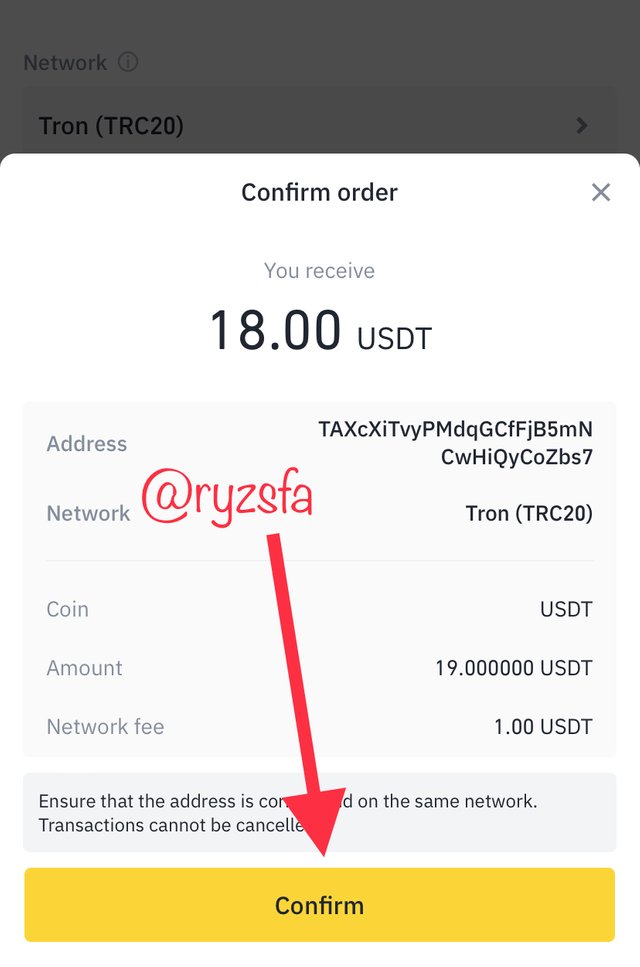

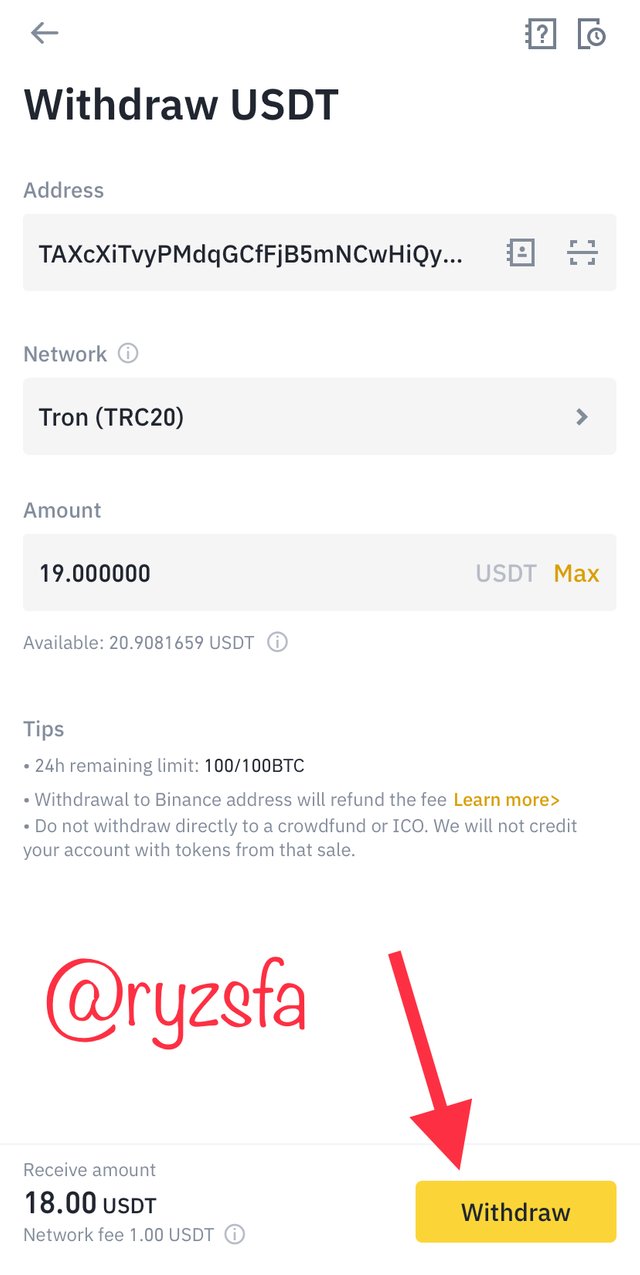

Fill in with your details thus the receiver address, indicate the network type which is Tron (TRC20) and the amount you want to withdraw. Note, the amount should be an odd value. Tap on withdraw and then confirm withdrawal. Fee charged for this transaction is 1 USDT.

- step 4

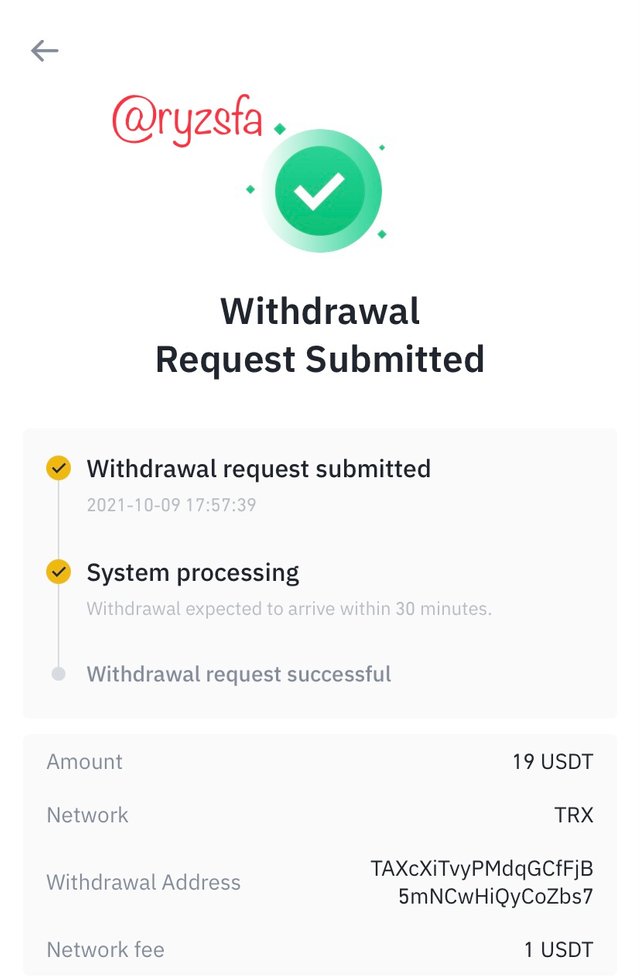

Now next to show will be Withdrawal request submitted information with details. Then we will have our transaction completed in a couple of minutes.

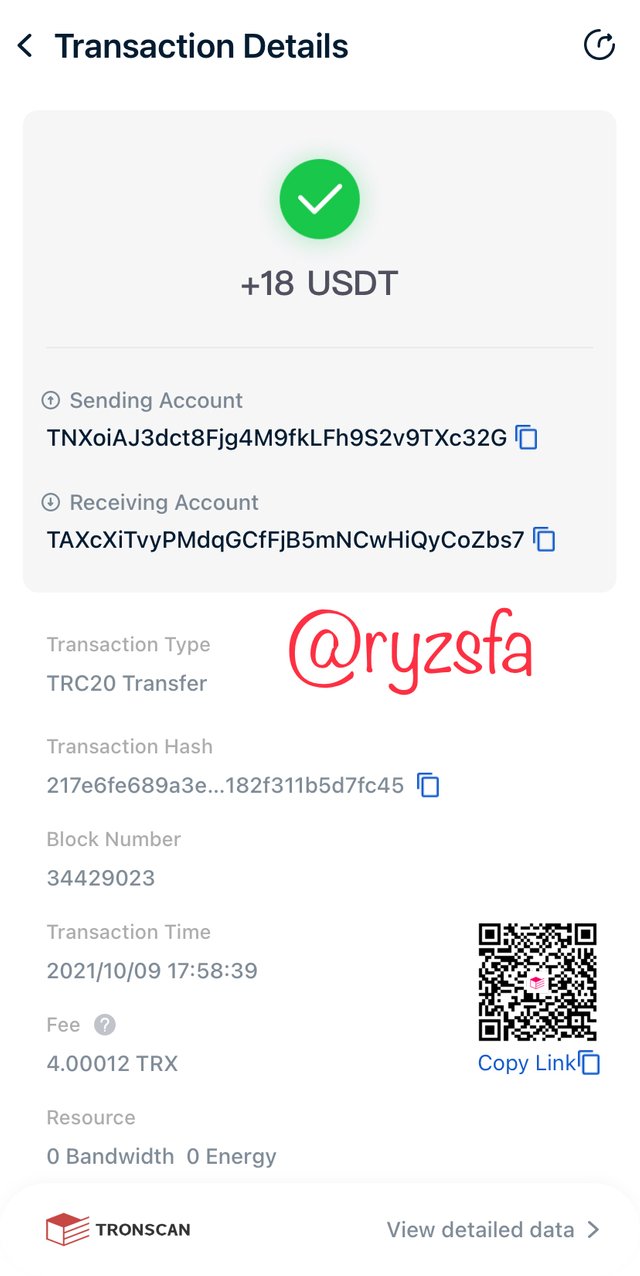

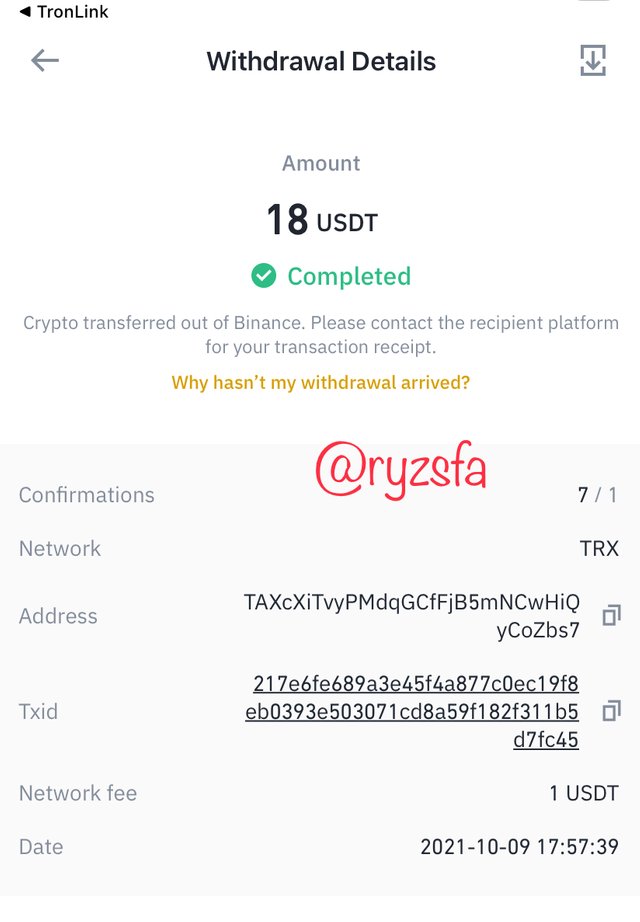

Below is the confirmation from both the Binance exchange and the Tronlink wallet of my successful transaction

from the tronlink wallet

from the binance exchange

Pros of stable coin over fiat currency transaction

With respect to transaction, stable coin offers a low fee rate compared to fiat currencies. Moreover I will also say stable coin do offer a faster transactions time period compared to fiat currencies.

Conclusion

I will say to be precise stable coins are really aiding a lot and for sure if more stable coins are introduced will bring about more convenience to traders since the CBDCs will provide a stable native coin which can be used to trade. Sincerely I think there should be stability in digital currencies.

I will like to acknowledge professor @awesononso for this was a very good topic which was very well explained. Thanks for the devoting your time to offer us this service. I’m glad to be your student.