Steemit Crypto Academy Contest / S3W4 – Cryptocurrency Trading by @rubilu123

Image designed on canva

We have come to the last week of the steemit engagement challenge for season 3. This time around I am participating in the crypto academy contests which seek to know about the knowledge we have in cryptocurrency trading.

As usual, I will like to encore users to take this opportunity to interact with the posts of other users by leaving valuable comments on those posts. Now let's get into the contest.

Discuss in your own words what is cryptocurrency trading? And tell us what type of trader are you or do you see it more effective? Justify your answers

Whenever I hear the word trading, there are only two words that come to mind. These words are buying and selling off an asset or commodity. In the real world, we refer to trading as buying something from a vendor for our use or a vendor selling something to make a profit. In the real world, a vendor's role is to make sure he gets the commodity at whatever price it is and make sure he adds something small so that he or she could make a profit.

When it comes to crypto trading; it is the act of buying a coin at its lowest and selling it at a price higher than when you bought it(this is the simplest definition) anyone should know. Now, what if I buy a coin high and sell it lower than the price that I bought it? This means I have made a loss, does it still qualify to be called a cryptocurrency trade? Yes. The moment you buy or sell, buy and sell it is been considered a cryptocurrency trade.

There are different types of trading in the cryptocurrency market; They are

- Spot trade( Scalping, Long term buying)

- Leverage Trade(Futures trading)

Spot trade

When we say spot trade, it means to buy a coin at a low price and look to sell it at its highest. Now there are also different types of a spot trade. Some are scalping and long-term buying.

Scalping involves buying an asset for a very short time during a bear market. This strategy works best on a 5 minutes chart. When the market is falling the market provides opportunities to scalpers. A scalper is someone who looks to make small profits and with those profits, he or she goes back into the market at the slightest buy opportunity.

Eg: Let's say the price of BTC is at 20k. A scalper will enter the market at the slightest buy opportunity. The moment the price of BTC rises a bit( let's say to even 21k) he sells and waits for another 20k or lesser price target.

A long-term trader buys a coin at whatever price it is and looks to hold it for a long time to take a profit. A long-term trader knows what he is about. He buys the asset and has a target price to sell. So this means when the asset price doesn't reach that price he won't sell. He is prepared to wait for the price to reach his target. This is what we mostly hear as HODL.

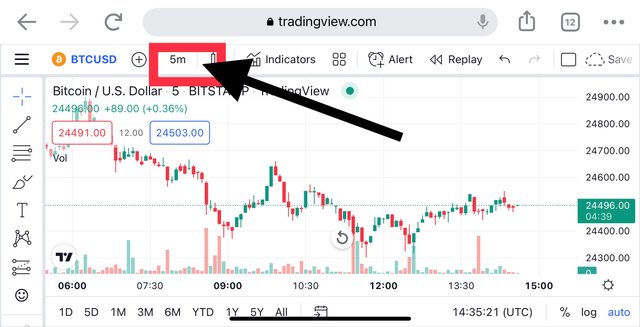

I prefer scalping. I prefer buying an asset in the short term. I use the 5 mins chart whenever I am trading. For me, this is the most effective way of trading in the crypto market. Don't get me wrong. A long-term trader can make a very huge profit in the long term but a strategised short-term trader can make double or triple that by buying and selling in the short term.

The following are the reasons why I prefer scalping

- Financial constraints

- The 5 minutes chart displays the market trend earlier.

- A short-term trader can take advantage of the short-term squeeze in the market.

Have you tested several time units? What Timeframe and Crypto Asset Pairs Are Best for You? Why?

Well, I've tested the several times unit. I've used the 5 minutes, 15 minutes, 30 minutes, 45 minutes, 1 day, 1 week etc times frames in my years of trading. I've grown to love the 5 minutes time frame depending on the trading style that I like. So I will say that the 5 minutes time frame is best for me simply because I am a scalper. In a 5 minutes time frame, the market trend can be seen earlier on that chart. A reverse of the market is predicted earlier. When using the wider time frame, a trader misses the opportunity to trade on time, in other words, they mostly give out late signals.

I've traded a wide range of assets. BTC/USDT, ETH/USDT, SOL/USDT, STEEM/USDT etc. Well, these are the pairs I have been involved in most. If I were to choose the one that I deal with most it will be the STEEM/USDT pair. This is because of the steemit rewards.

Have you had regular trading activity over the last few months?

I think these last few months have been my most actually time as a trader. I've traded a lot but due to the luna crash, I had a lot of trading activity last 4 to 5 months. At that time, the crypto academy rolled out the trading contest. During this time I found myself in the market always as I looked to make profits instead of losses to make my entry eligible for the weekly win.

As I said earlier, the Luna crush contributed to a regular trading style too. As soon as the coin crushed I wanted to take the opportunity and make more money. So I scalped a lot. The luna token was making quite some good ups and downs.

Tell Us what you have learned from this experience eg: Over the long term do your, so your gains exceed your losses?

Well when it comes to the market, I hardly go in long term. But the few times I have tried holding for a little bit longer have only ended up coming out with losses. With this, I have learned that

No matter your trading style you need to have a plan.

For a long-term trader you should always wait for when best you think the price has bottomed out

When trading futures always make sure to go in with a small x (5x - 25x) don't be too greedy and go for the 100 x -200x. At this rate your liquidation price will be much shorter.

When your profit levels hit, leave the market.

If you know you will be greedy when the profit levels hit, set a take profit.

Always set SL for your trades.

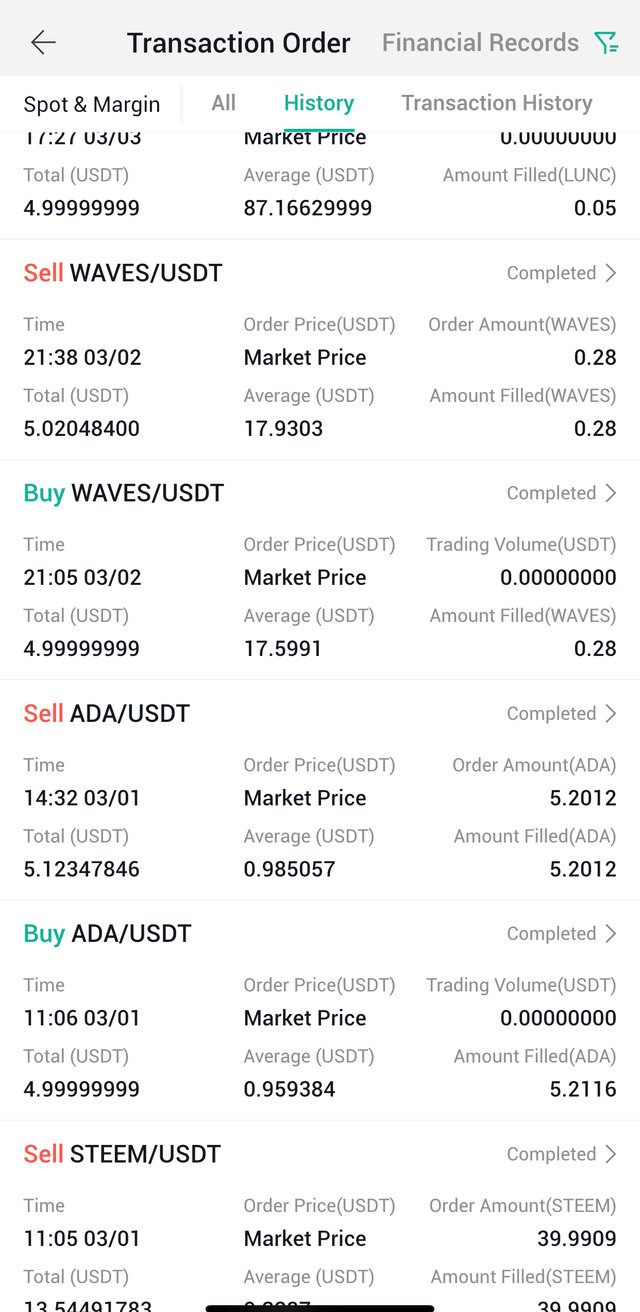

Do you have a method of recording and reviewing your trades to improve your performance? refined your trading system after being dissatisfied with its results?)

Well, I've never really thought about it. Now to think of it. I've never sat down to think of a strategy to use to help me in cutting down my losses any time I trade. The only time I did this was when we had the crypto trading contest. I always had to record my trade so I could send it to the professor through his form. During this period I went back to the exchange with which I traded and tracked back to when I bought the asset. After checking this I made sure to sell the coin whenever I had a profit even if it was little.

Now going forward I think I will have to think of a method to help me out in the market.

What impact does artificial intelligence have on crypto trading in the short and long term? Have you used before or want to handle an automatic trading robot? Tell us the causes of your choice

Artificial Intelligence; most people claim this is the future. Believe it or now artificial intelligence is already here with us. We can see it in self-driving cars, automated vacuum cleaners and others. Now the crypto space has not been left out in this kind of discovery.

I think artificial intelligence will have a big impact on the way traders enter and leave the market. I like artificial intelligence but it's not easy to understand at times. Because it's a bit that has been programmed to make decisions for you it might leave the market too early or end up entering the market too early and then the trade will take a long time.

Unlike humans, trading bot(artificial intelligence) has no emotions. It doesn't become too greedy for more when it realizes a profit, it doesn't hold on for far too long for the market to dip further when it sees a buying opportunity.

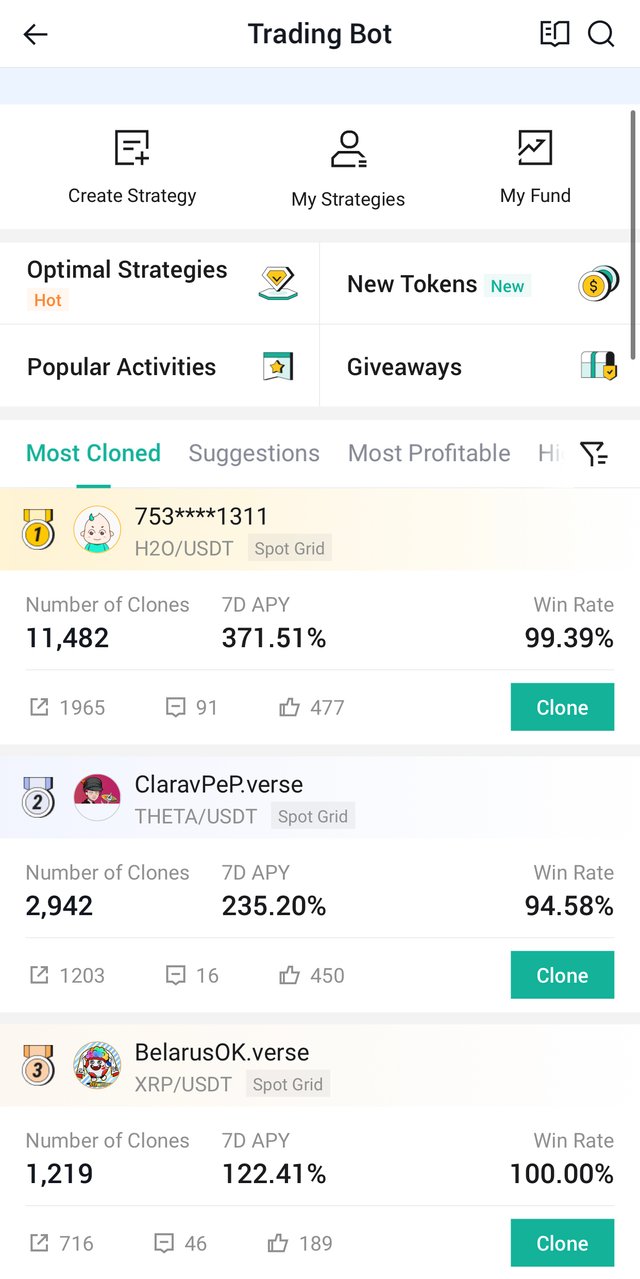

Houbi trading bot

In my training experience, I have tried using a trading bot only once and it didn't go very well. What happened was I saw an opportunity with the coin that was listed at that time. The name of that token is optimism(OP). At that time it was falling so I decided to use a trading bot, at that time I didn't understand it so much before using it. The moment my started using the grid bot I didn't understand what was happening to my coins. It started dipping and in a day or two, I didn't realise any gains so I left the market with a loss. Now after leaving the market, I realize that the grid bot was like leverage trading but unlike leverage trading, you don't have a liquidation prize.

Going forward I will like to use a trading bot more often but I think this time around I will be the one to clone my one grid not. Something that suits my trading style.

Trading requires a lot of patience no matter the trading style you use. Like many people say “ the market always gives you an opportunity” so don't rush into the market. Waiy for it to do what it wants it will surely go back to the prize at which you want to buy.

Patience is the key.

Thank you.

You choose USDT pair and I think it's right and I choose USDT too. USDT is a stable coin unlike other coin pairs.

I also share cryptocurrency trading posts, if you have time please take a look. I would be happy.

Yep I do like the USDT pair a lot but apart from that one I like the BNB. Pair too, as they barely have trading fees on binance.

It's true what you said.

This your definition is absolutely correct for anyone to understand. A lot of beginners trader do buy cryptocurrency at a higher price and sell at a lower price because of fear of losing their money. Thank you for letting us to know about that.

It's good to see that you prefer scalping trading than swing and others. As for me am okay with swing trade because of the little time that I have in the market. I can also see that you're a very experienced trader in the market. Honestly, you have written so well friend. Best of luck to you.

I think the scaling works for me very well. Am not attracted to long term because it never works for me 😂

Thanks for passing by😊

5 min trade is a actually a simple timeframe to view the market, you could easily look for position , and just as you said, you could as well trade the short term, as you can trade on or against the market, Good luck in your entry bro.

That’s exactly the reason why I love the 5 mins trade. It gives you a look at how the market is even before the other time frames are able to see it or display it.

Thank for passing by😊

“The market does give you an opportunity”. People are just too impatient. We don’t control the market and we know that but it still hurts us when it’s not moving in our favor.😅

Trading plans like you’ve pointed out are very important. I’ve said this so many times now that I think anyone following my comments will be fed up. I’m sounding like a broken record but having your plan is very important.🤭😂

I don’t understand the bots. I haven’t used one before and I think it will be a while before I try. At least you’ve learnt your lesson from risking to use the trading bot without so much knowledge.

Thanks for sharing.

Sorry for the loss of your asset when you used the bot, I have seen many people that used it and made profits out of it, while few encounter losses.

Your recommendations about cryptocurrency trading are good, panic and lack of patience will not help when holding assets for a long period.

I think the reason why I lost while using the bot was because I didn’t understand it at that time. And then I was scared for my money too😂.

Thanks for passing by😊

I like your concept of cryptocurrency trading, relating it to real word trade of buying at lower price and selling above to make little profit. You have also explained the type of trades, spot and future trading and went further to discuss scalp and swing trade. You have stated clearly that you’re a scalper.

With different timeframes, you have indicated your analysis on different timeframe, with 5minutes, 15minutes, 1hour, a day and a week timeframe. You’re clear stated your preference as the 5 minutes timeframe that suit your trading style. You have tried trading with different crypto pairs but you prefer steem/USDT.

You have written well my friend, the crypto trading competition during the steemit crypto academy program taught us a lot of things and one of the things i learnt that period was to keep track of the details of my transactions and in that way i was able to minimize my loss and maximize my profit. Always do this and you will have a clearer picture of your progress. I wish you success my friend.