Trading Cryptocurrencies - Crypto Academy / S4W6- Homework Post for @reminiscence01

Thankyou Professor @reminiscence01 for the lecture that you gave us this week, I really enjoyed the topic.

Cryptocurrency trading is something that steemians all over the world need to learn. Because it is directly related to the platform's native cryptocurrencies Steem and Steem Dollar. Trading is one way we can invest using Steem and SBD.

Spot Trading is the most basic type of trading that is usually used by beginners. In spot trading, the process of buying or selling an asset is done directly at that time. We can decide to trade (buy/sell) cryptocurrencies depending on the trend we see or the strategy we have. The key in spot trading is that we just buy the cryptocurrency we want, then hold it for a while and when the price goes up we can sell it for profit.

The advantage of spot trading is that we as beginners can start trading with small capital, so we can buy cryptocurrencies at low prices, and sell them when prices are high for profit. We can also hold our assets when market conditions do not match our predictions, and when the trend turns bullish we can sell them again.

Then the disanvatadge from spot trading is that there is a possibility that we hold an asset for too long after buying it because of high market volatility so there is a risk that the price will continue to fall so that if we sell the asset during a bearish trend or the price continues to decline, it will continue to lose the capital we have. For beginners like me, they often make mistakes when reselling assets because they can't wait too long.

Margin trading is a trading method using funds provided by a third party such as a trading platform. In general, the trading platform will act as a party that provides funds in the form of leverage.Traders with margin accounts will be able to open positions and increase positions through large amounts of capital in the market.

Traders/Investors on margin trading do not require large amounts of capital to be able to get high positions in the market because third parties will give traders/investors the freedom to determine the leverage used in margin accounts. This of course increases the purchasing power of traders who have limited capital. In addition, margin trading also increases the potential for traders to earn faster profits if this technique is used properly.

Margin trading can help traders increase profits drastically but on the other hand it can also cause much bigger losses, like a double-edged sword. In addition, the broker can liquidate the assets of traders who are unable to fulfill the agreement while the leverage has been deposited.

For those who are no longer beginners, there is a method that is being developed namely futures trading. Unlike Spot and Margin Trading, Futures trading is trading based on an agreement to buy or sell an asset at a later date at a predetermined price. This method is also known as a derivative instrument because its value depends on the underlying asset. Buyers expect price increases on the underlying asset to make a profit whereas Sellers bet on price draws to make a profit.

Investor who use futures trading can hedge and can relax during periods of high volatility. Moreover, it can reduce risk and increase bets when the right strategy is applied. Professional traders often use future trading to better position both sides of the market. Apart from that, Future Trading also allows one to reduce their holdings without holding stablecoins.

Disanvatadge in future trading, we as investors are like holding a double edged sword because we can get huge profits and also the possibility of losing all assets. The risk is too high, so it requires good skills and strategies to predict asset growth. Therefore Future Trading is not recommended for beginners.

There are various types of orders in the cryptocurrency market, which are distinguished according to their respective functions. Below will be explained about the types of orders.

Market orders are the simplest orders of the various types of orders that exist. Because this order is useful when we want to quickly enter or exit a position. When using market orders we make purchases or sales according to the current price in the market. For example, when the current price of TRX/USDT is $0.5, then we only need to spend $5 for 10 TRX.

A pending order is a type of order that allows traders to define positions according to their beliefs based on their analysis. When Traders/Investors believe the price of an asset reaches a certain level in the market. When they believe that the price will reach a point to buy and sell the asset based on confidence in their analysis and strategy.

There are several types of pending orders in cryptocurrencies which will be explained below.

Limit order is an order made by a trader/investor containing instructions to the trading provider to wait until the price reaches a certain limit and then a transaction is carried out according to the instructions.

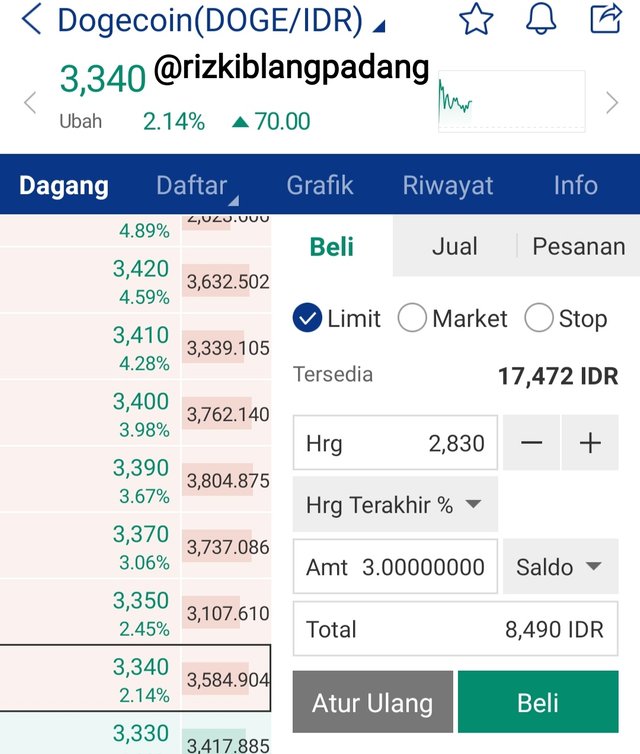

For example Dodgecoin (DOGE/IDR) the current price of one DOGE/IDR is 3,340 IDR on the Upbit platform, I set the buy limit at 15% from the last price of 2,830 IDR. I placed an order of 3 DOGE/IDR coins which are equivalent to 8,490 IDR.

My order will occur when the DOGE/IDR price has dropped to 2,830 IDR, so before reaching that number my order will be pending by Upbit.

There are similarities between stop orders and limit orders, the difference is the placement in the order book. Limit orders are placed in the order book and can be seen by anyone, while stop orders are not sent to the order book until the conditions are met.

For example, if the DOGE/IDR price reaches 2,000 IDR, the stop order gives instructions to immediately make a sale. That does not mean that a DOGE/IDR purchase will be made at a price of 2,000 IDR. However, when the price of 2,000 IDR is reached, an order will be placed immediately to buy at the best price at that time, it may be lower than 2,000 IDR.

One Cancels the Other Order (OCO) is an order that allows us to place two orders at the same time. The concept combines limit orders and stop-limit orders. But only one of the two can be done, in other words one executed order automatically cancels the other order.

For example, the DOGE/IDR price trend is going up, but we doubt whether it will continue to go up or reverse to go down. We can place OCO trading in this case, to minimize the risk of our loss in the event that a reverse happens. When the chart is already in a resistance condition at the price of 3,500 IDR we can place a limit order at that number for take profit and place a stop order at the price of 3,300 in the event of a price reversal. When a price reversal occurs automatically stop orders are executed and limit orders will be cancelled.

There are two types of orders on exit orders in cryptocurrency market namely stop loss orders and take profit orders.

Stop loss is an automatic order to close a position that is useful for limiting losses within a certain value. These orders are usually placed when the market goes against our predictions. These orders help you protect your trading capital during a market crash because there is no guarantee that the price will always make a profit.

Take Profit is an order to close a position when the price is in our favor. When the price movement touches the take profit, the system automatically executes the order. Basically all trading is for profit, of course, investors don't want to lose so this order is very important for us.

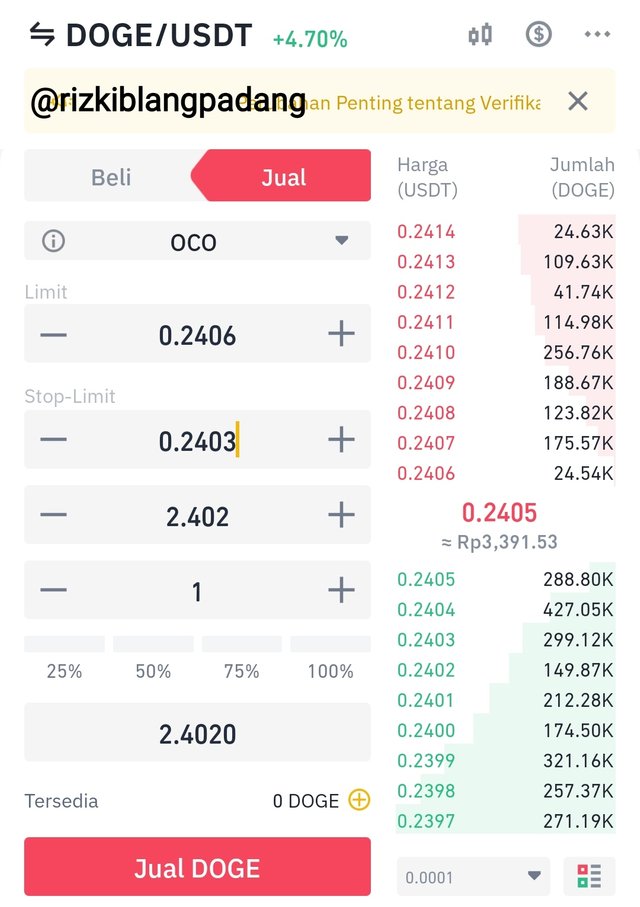

Minimizing risk is one of the advantages of using OCO Order, indeed not all platforms provide OCO features. In this case, Binance is my choice to place orders using OCO. As I explained above that OCO is a combination of Limit Order and Stop Limit Order, both have different roles but support each other. Limit orders are in charge of taking profits and Stop limit orders are in charge of preventing losses that we get in the event that prices continue to fall.

An example is when the DOGE/USDT price reaches the price of $0.2404 we feel that there will be a possible reversal and the trend reverses down.

We can place a limit order at $0.2406 to take profit, set a stop price at 0.2403 and set limit order to sell at $0.2402 to prevent further loss of profit.

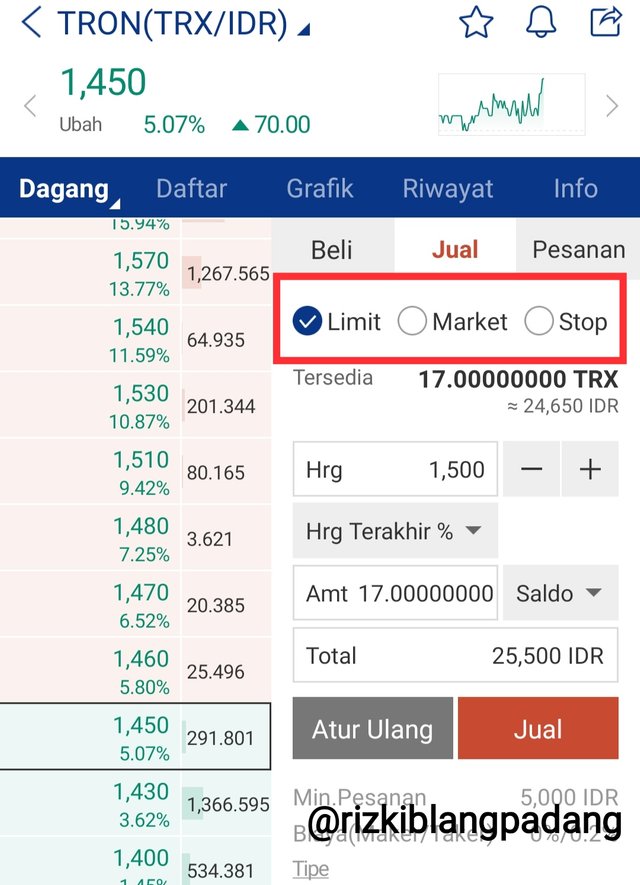

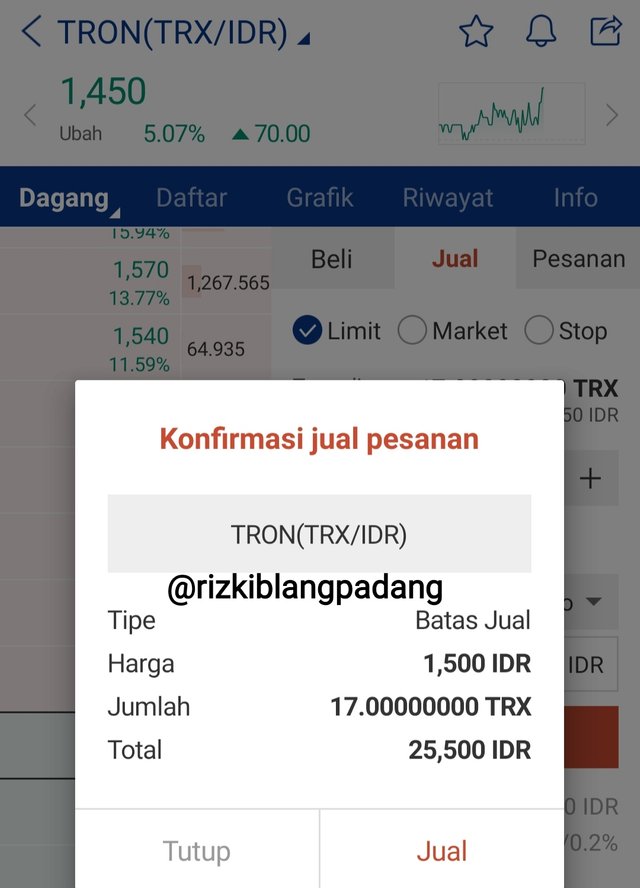

First log in to your Upbit account, you will find many cryptocurrencies that we can order in homepage and search for the desired crypto asset, in this case I'm using TRX/IDR.

We will find a transaction page there, there are 3 order options namely limit, market and stop. I chose a limit order to sell 17 TRX/IDR at 1,500 IDR.

Then we are asked to confirm the transaction that we did.

After that, we just have to look at the open orders in my trading menu.

We just have to wait for the price to reach 1,500 IDR, and the transaction will automatically be carried out by Upbit. Forgive me because I want to do real trading, I use my Upbit account whose language I have set to Indonesian and the balance is not even 1 USDT.

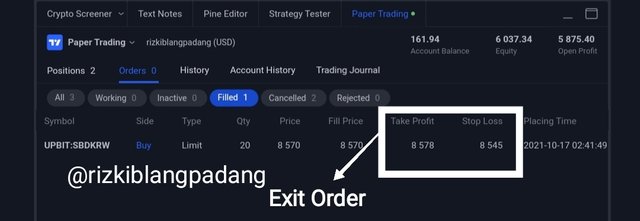

In this question I was given instructions to use a demo account, this time I used Paper Trading. I opened the chart and chose to see the trend of SBD/KRW. SBD/KRW is one of the cryptocurrencies on the steemit platform, so its development is closely related to me as a steemian, that's why I chose SBD/KRW.

It turns out that on the SBD/KRW chart there is a bearish trend, the current price per coin is 8580 KRW. I chose to combine two of my favorite indicators, Bollinger Band and RSI. The reason I chose to combine these two Indicators, is because I can see two things. The first is the price on the upper or lower band. The second is whether there is a divergence in the RSI indicator.

From the chart above, it can be seen that a bearish trend is occurring and has touched the middle band (SMA) and possibly the bearish trend will continue until it touches the lower band. The RSI has not yet given a Divergent signal because it is still in the middle number.

I set the exit order at 8578 KRW for take profit and 8545 KRW for stop loss to minimize my profit loss.

Cryptocurrency trading is fun to learn, starting from the various types of trading such as spot trading which is recommended for beginners, futures trading and margin trading for senior investors. In addition to the type of trading, we also have to learn how to differentiate orders.

One of the interesting orders is OCO because it really helps us in combining limit orders and stop limit orders to reduce the risk of losing profits. In trading cryptocurrencies, we should learn trading strategies by utilizing various technical indicators.

That's my little understanding of trading cryptocurrencies. Of course, there are still many mistakes and shortcomings in this homework post. Thank you to my brothers at TSS who never get tired of guiding and directing me. You Are Amazing, Guys.

Hello @rizkiblangpadang, I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.