MAKING YOUR CRYPTO CURRENCIES WORK FOR YOU...HOMEWORK TASK BY @richben to Professor @fendit

Big thanks to @fendit for this insightful and educating lecture. I would like to dive right into the task and get it done as me mind is bubbling with the knowledge I have gotten from the lecture.

I go straight to answer the questions.

- write a post explaining which of these products you find more appealing and why?

As for me, the product I find most appealing is providing liquidity via a launch pool. This is because its a less risky investment. Another reason I chose it is because I have a low tolerance for risks. My main platform is Binance, this is due to the easy user interface on Binance. In engaging in this type of investment, my option of the token to invest is BUSD specifically. This is due to the stable nature of the token. It means I wont be loosing money while staking because BUSD is a more stable coin as compared to tokens like 1inch. My reason for choosing the BUSD token is because if an investor provides liquidity with a token that fluctuates, in the case of a bearish market sentiment, the original cost of the token will depreciate in value due to the token loosing value. In that case the investor would be loosing money while trying to make more.

2 Explain in your own words Fixed and Flexible savings, High risk Products and Launch Pools.

• FIXED SAVING: This can be described as an investment where the investor has to invest his funds for a stipulated fixed time, before having access to withdraw the invested funds. The time ranges from 7 to 90 days according to the investor’s decision. This kind of investment usually comes with a higher reward as compared to flexible savings. The only problem with it is that the investor does not have access to the investment for the agreed time frame. So in a situation where the market sentiment becomes bearish, the investor cannot sell off his staked tokens or even set a stop loss.

• FLEXIBLE SAVINGS: In a flexible saving investment, the investor can earn passive income on his/her investment, and can also withdraw such investment with the already earned interest whenever he/she feels like. It does not usually have a stipulated time attached to it as compared to fixed saving. This kind of investment usually gives a lesser yield when compared to the fixed saving investment. It’s usually for those with a low level of risk tolerance.

• HIGH RISK PRODUCTS: High risk products are investments that involve a higher risk to the invested capital of the investor. It must also be understood that it also has a higher level of yield. Meaning that if it does well, the investor would be smiling to the bank. However the investor can lose big time if the project fails. Example of a high risk investment on Binance is the dual investment.

• LAUNCH POOL: A launch pool is a system that allows investors the ability to stake their tokens in order to provide liquidity for a new project. The investor in turn receives some of the newly launched token as a reward for providing liquidity. For instance, Binance allows you to stake either BNB or BUSD. They sometimes give a third option. In this kind of investment, the investor’s fund is very secure and the investor can decide to take out his profit and investment fund anytime he chooses.

3 Details on how to set the investment I chose on Binance

Its really very simple like I said before that Binance has a very simple user interface

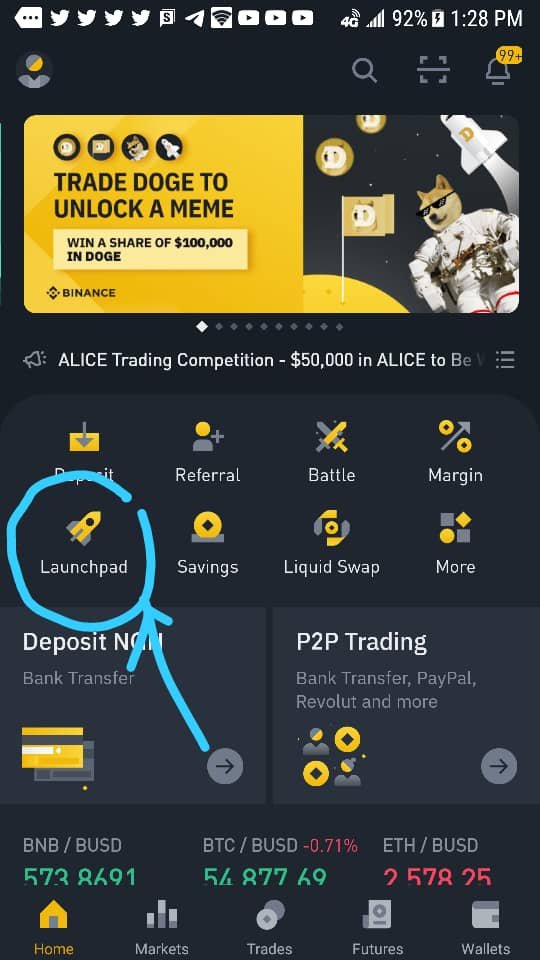

so the first thing to do would be to click on the home icon on Binance. it would take you to a page that looks like the one below

[source](binance mobile application)

The next thing to do is to click on the launch pad icon as circled in the picture above. It would then take you to a page that looks like the one below

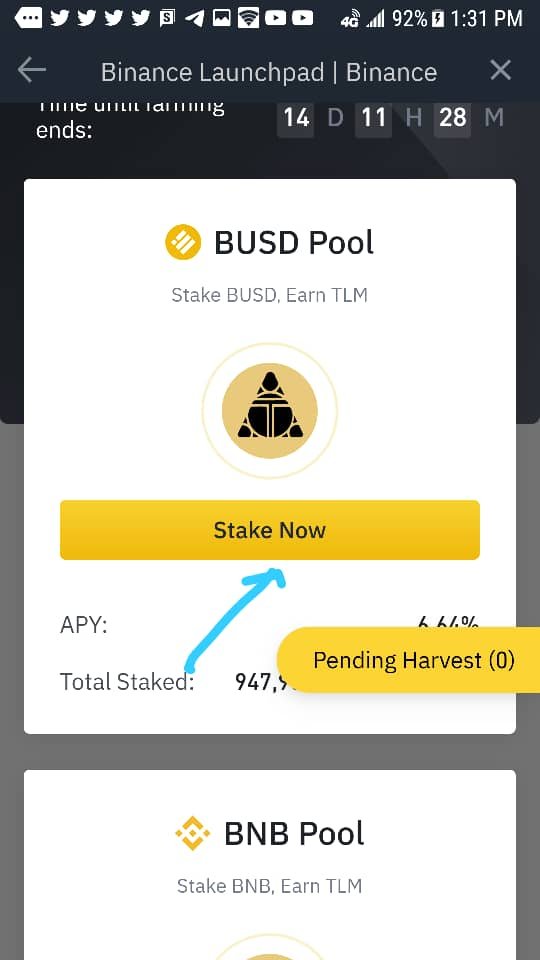

[source](binance mobile application)

[source](binance mobile application)

The investor would then scroll down so as to select any project of his/her choice.

but for me I choose to stake BUSD as its a more stable token. Presently the only available token to provide liquidity for with either BNB or BUSD is TLM, as shown below. I chose to stake BUSD as earlier stated.

[source](binance mobile application)

you would then click on stake now and input the amount of BUSD you are willing to stake, then confirm the transaction. And that's it...

Am saying a big thank you to @fendit for this educative lecture, it has really made me increase in knowledge.

Thank you for being part of my lecture and completing the task!

General comment:

Nice work! All explanations were really good and clear! :)

If you want to deliver a better post, focus a bit more on applying markdowns. You have done a very good job and it could be a lot more polished if you gave it some markdown :)

Overall score:

6/10