Cryptocurrency and Exchange Regulation - Steemit Crypto Academy Season 4 - Homework Post for Task 7 by @rich-ben

Can cryptocurrencies and exchanges be regulated? How do regulations affect the crypto world? Name some countries with regulations.

Can cryptocurrencies and exchanges be regulated?

While the regulation of cryptocurrencies continues to be elusive, it is not impossible to regulate these cryptocurrencies. It can and is being regulated, even though present regulations may not be sufficient enough. Some of the reasons that have made cryptocurrency regulation very difficult to achieve are its decentralization model, anonymity protocol, and its adaptability in terms of definition.

Supervisory Authorities:

Cryptocurrencies are depicted as utility tokens, securities, assets, investment instruments depending on the purpose it serves, as dictated by the developers of cryptocurrencies. These variations in definitions by developers, organizations, and countries make it pretty difficult to be able to regulate cryptocurrencies and exchanges because crypto transactions are not limited to the national financial parameters of a country. It is mostly international; hence there is a need for an agreed definition of cryptocurrency by countries of the world.

The European Union has made some progress to this effect through its Anti Money Laundry Directive (AMLD5) legislations on cryptocurrency and exchanges, with the United States lagging, even though some of its state supervisory authorities have somewhat established some stipulations on cryptocurrencies and exchanges.

Cryptocurrencies have ushered in a lot of opportunities for investors. The world seems to be fascinated with this radical system of finance - its security, decentralization model, anonymity, fast transactions, high liquidity are some among many merits of the crypto space that thrill enthusiasts of cryptocurrencies.

However, all these benefits do not erase the scandals that have been associated with the crypto space since its inception. From tax evasion to money laundering and illicit financing (drugs, terrorism, trafficking, and pornography, etc), the world has hurdled through the bumps being created by the crypto space - cryptocurrency blockchains and exchanges alike.

Apart from the obvious crimes associated with cryptocurrencies, countries of the world seem to be wary of this new technology. This new technology threatens the centralized control of finance by governments. They don't like that. Unstable economies also fear devaluation and neglect of local fiat currency.

The threat cryptocurrencies pose to investors and countries has called for the need to regulate cryptocurrencies. The question is Can cryptocurrencies be regulated?

From a subjective and reasonable point of view, the answer to this question is YES, cryptocurrencies can be regulated but anti-regulation should not be mistaken for regulation.

This is a sensitive issue as many argue that some of the present regulatory laws surrounding cryptocurrency do not take into consideration the very essence or underlying technology of cryptocurrency, thus disrupting the technology behind cryptocurrency. It is advised that regulatory bodies should employ crypto experts when making these laws.

Here are some of the ways cryptocurrencies and exchanges can be regulated.

- Creation of a Unanimous representative overarching cryptocurrency body:

This will help root out many cryptocurrency discrepancies between countries of the world. This crypto body would be responsible for determining the following among many others:

the acceptable definition of cryptocurrency, thus shedding appropriate light on how it should be regulated

The standard that must be followed in raising ICOs by start-ups

Number of cryptocurrencies that should ever be allowed into existence (the crypto space currently has over 10,000 coins)

Cryptocurrencies that should be banned worldwide because of their valueless nature

However, this body would have no power to directly influence the price of a coin, as that would be left to the market forces of demand and supply.

A major disadvantage here is that politicization of this body can occur, and may consequentially attack the very core of the blockchain technology in a bid to shift financial power from the people to a centralized few.

- Implementation of the KYC protocol:

KYC stands for "Know Your Customer". It is a means by which organizations collect and validate the data of customers. It was first formally introduced in 2002 by the Indian Government for reserve banks in the country. Since then, it has been applied in different organizations all over the world and in diverse settings. Its tentacles now touch the crypto space because of the security purpose it serves.

Exchanges are mandated by supervisory authorities in various countries to incorporate KYC protocol into their system. Many exchanges have since complied with this directive. Binance is one exchange that has a sophisticated verification protocol in comparison to others.

KYC aids supervisory authorities in tracking criminal transactions and tax evaders. The European Union has included virtual currencies and exchanges to the list of financial institutions that are mandated to incorporate KYC protocol in its Anti Money Laundry Directive 5 (AMLD5) release. Non-compliance attracts punishment.

In North America, the USA and Canada have also seriously implemented the use of KYC for virtual currencies and exchanges. Asian economies like Singapore, South Korea, and Japan are furthering the course of crypto while ensuring strict compliance to the adoption of KYC for crypto exchanges and investment firms.

- Collection and storage of Participants data by exchanges in blockchain transactions:

This is already being implemented. It was first introduced by the Financial Action Task Force (FATF) of France, one of the leading crypto regulatory bodies in the world. It termed this regulation, the "travel rule", where Virtual Asset Providers (VASPs) such as exchanges are liable to report the transactions of participants to regulatory bodies in the country since they (exchanges) already have the KYC (Know your Customer) of these participants.

The IRS of the United States is keen on following this approach. Every authorized exchange located and operating under the laws of the United States is liable to provide reports of blockchain transactions for the basic purpose of taxing and tracking down illegal transactions. The IRS claims that profit gained from swapping one cryptocurrency to the other or buying/selling one cryptocurrency for another is taxable.

Some time ago, IRS requested a blockchain transaction that occurred from 2013 - 2015 by US citizens from Coinbase a renowned crypto exchange. Coinbase found it difficult to comply with this request and was sued in court by IRS. Binance has also been probed seriously by the IRS while seeking reports on participants transactions. The exchange was accused of being used to conceal criminal transactions.

The point here is that transactions in cryptocurrencies can also be taxed and evasion of tax can result in punishments as gross as a jail term. Also, the crypto space is being made less anonymous for illicit activities by defaulters.

Notwithstanding the progress made by supervisory authorities in the regulation of cryptocurrencies, they are heavily criticized for imposing traditional draconian policies that do not take into consideration the nature of blockchain technology.

- Employment of Blockchain experts:

If the governments or supervisory authorities must get it right with regulations on cryptocurrencies and exchanges, then it must do away with its rigid traditional hold on blockchain as if it were some invention in the 1900s. Blockchain technology touches engineering, mathematics, economics and even philosophy, thus should not be addressed using the traditional financial approach. Brains that are well acquainted with blockchain system analysis should be encouraged to work together in deriving regulations that would provide a safer and more liable crypto space without strangling it.

- Regulation of mining rewards:

The government of a country can impose taxes on the mining rewards received by miners or they can encourage mining in their countries by providing subsidized power and other resources that are necessary for mining. Either way of approach will eventually impact the value of cryptocurrencies since miners are primarily responsible for the circulation of cryptocurrencies in the crypto market.

- ICOs Scrutinization:

Crypto start-ups moving to raise Initial Coin Offerings (ICO) should be thoroughly scrutinized. The market is full of cryptocurrencies that have nothing to offer. These start-ups should be measured against a standard requirement before being accepted as a cryptocurrency.

In countries where cryptocurrencies are regulated, the government ensures that ICO start-ups register with some regulatory bodies in the country to ensure that these ICOs are put in check.

People use crypto tracking software to track transactions so they can be able to know the taxes that accrue to them. A good example is Delta (recommended). Like banks, some major exchanges give out transactional details to customers for tax purposes.

All the possible regulations discussed above and those not discussed, does not in any way downplay the difficulty associated with regulating cryptocurrencies and exchanges. Let's say centralized exchanges are effectively regulated: can decentralized exchanges also be regulated? Can inter-exchange transactions be effectively tracked? There are so many other questions that are yet to be asked to ascertain the possibility of effective all-round regulation of cryptocurrencies and exchanges.

.

.

How do regulations affect the crypto world?

Successfully implemented regulations can impact the crypto world in the following ways:

- Safer Crypto Environment:

Measures that are put in place by regulations will enable a more secured crypto environment. Crypto regulations are originally reactions to the criminal and evasive nature of cryptocurrencies and exchanges. Regulations will help protect countries, corporations, and investors from the loopholes that are inherent in the crypto space.

Money laundering in the crypto space is seriously being tackled through these regulations. Taxation is another area that is being addressed because of the increase in tax evasion on exchanges that support crypto trades. Regulations have also been put in place to ensure that illicit transactions are monitored.

Though regulations may have their side effects, an unregulated crypto space will greatly increase insecurity in finance and the world at large.

- Less Anonymity for Crypto users:

Regulations on crypto will take away some of the flavors that draw its enthusiasts - decentralization, and anonymity. The proposed anonymous and decentralized nature of cryptocurrencies was the attraction for many as people had become weary of the centralized operation of financial institutions like banks.

Then comes all the scandals like the Silk Road scandal and many others. The crypto space is deemed unsafe and the need for regulations becomes an uprising matter. Fortunately or not, regulations are presently and will yet be carried out in countries of the world in their dealings with cryptocurrencies. The aftermath of these regulations will at best create a pseudo-anonymous and decentralized crypto space and at worst significantly alter the underlying crypto concepts of anonymity and decentralization.

- Greater involvement by Corporations and investors:

A safer crypto environment, because of regulations, will encourage many global and local corporations to adopt cryptocurrency as means of payment. Presently, the global corporation, PayPal allows USA users to transact in cryptocurrencies (Bitcoin, Litecoin, Bitcoin Cash, and Ethereum). Though not confirmed, Amazon may soon welcome cryptocurrencies in its dealings as it has seriously been testing out blockchain projects for some time now.

The world is moving and I don't think any global giant will want to be left behind. All things being the same, it is not a matter of IF cryptocurrencies will be accepted as a means of payment by these large corporations, it is a matter of When.

This also applies to investors who are not already into cryptocurrencies. Many are probably still observing the crypto climate but I believe that with due regulations to secure the crypto environment, more investors would likely flood in. One would agree with me that the years, 2009 - 2021, have seen a significant increase in the growth of crypto investors.

- Acceptance as a legal tender:

More regulations will see cryptocurrencies accepted as a legal tender in more countries because the issues of evasive taxation, fraudulent transactions, and investors’ protection would have been solved to a large extent.

El Salvador becomes the first Country to accept bitcoin as a legal tender in May 2021 and the Panama legislature is making legislation to follow suit. Some friendly crypto countries are yet testing the acceptance of cryptocurrencies as a legal tender.

Some possible factors that may yet be holding back some countries from accepting it as a legal tender apart from its security are the usability by citizens. Another factor is that cryptocurrencies are not tied to any currency (exception of stable coins) or an asset like Gold or Oil, and as such are very volatile because their value is solely determined by the intricacies of demand and supply that are obtainable in the crypto space.

The induction here however remains that a safe crypto environment made possible by regulations would see more countries accept cryptos as legal tenders.

- Lesser volatility and higher liquidity:

Greater acceptance and more usage of coins like bitcoin by countries and global corporations will increase liquidity and therefore reduce volatility. Wider usage of these coins may narrow the Bid-Ask Spread because of the likely increase in supply and demand. This remains very hypothetical because the role of whales in the crypto space is not put into consideration here.

As is peculiar with centralized networks, more regulations will also imply higher taxation for whales.

- Likely Reduction in the value of many Alt coins:

The value of low market cap altcoins may suffer if eventually more countries adopt cryptocurrencies as a legal tender. This is so because most countries may likely endorse bitcoin and few other popular altcoins, leaving out many others. If strictly adhered to in this manner, then the demand for so many altcoins would be cut short. Consequentially, this would impact the price of these altcoins

Possible Increase in transaction fees, development of local cryptocurrencies, more crypto pathways with Banks are other likely consequences of regulation in the crypto world.

Name some countries with regulations.

Countries of the world approach cryptocurrency and exchange regulations in different ways: Some are friendlier than others in terms of regulations while others have no regulation at all on cryptocurrency. Here are some countries and their regulations towards cryptocurrencies.

Australia:

Cryptocurrency and exchanges are legal in Australia. The country encourages the use of cryptocurrency and sees it as a property that is liable to capital gain tax (CGT). As of April 2021, all Digital Currency Exchanges (DCEs) in the country must register with **Australia’s Financial Intelligence Agency ** (AUSTRAC).

AUSTRAC necessitates that DCEs within the country must collect customer information for identification purposes. They also have to keep an eye on transactions, report large transactions and suspected fraudulent activities to AUSTRAC.

Other agencies to which exchanges must comply are Australian Securities and Investment Commission (ASIC) and Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF).

Canada:

Like in many other countries, cryptocurrencies are not legal tender in Canada. Canada classifies cryptocurrencies as securities, hence are subject to Capital gain tax. ICOs that do not fall into securities such as Game-oriented ICOs have their laws as stipulated by provincial regulators.

Exchanges are viewed as Money Service Business, hence must register with Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). A city in Canada by the name of Quebec aids mining by reducing the power that is needed to mine to 300 megawatts.

In May, 2021 Bitcoin exchange-traded fund (ETF) was established in Canada. The country is currently involved in cross-border blockchain experimentation with Singapore and England. Success with the project may see Canada develop a virtual version of the Canadian dollar.

The "travel rule" also applies here. Exchanges report transaction statements for auditing to appropriate authorities. In the matters of taxing, cryptos must first be changed to the fiat Canadian dollar before auditing.

Canadian Securities Administrators (CSA) and the Investment Industry Regulatory Organization of Canada (IIROC) are other regulatory bodies that have some jurisdiction over cryptocurrencies in the country.

USA:

Cryptocurrencies are legal in the USA but not legal tender.

The United States has different regulations for cryptocurrency at the state level. However, there are Federal agencies that provide general regulations on cryptos.

SEC (Securities and Exchange Commission) regards cryptocurrencies as securities. This means that the laws binding on securities like stocks, equity, and shares are also binding on crypto exchanges, crypto investment firms, and wallets. CFTC regards cryptocurrencies, particularly Bitcoin and Ethereum, as commodities.

Exchanges must comply with the regulations of the Bank Secrecy Act (BSA) because they are under its jurisdiction. What this means for exchanges is that they must follow similar steps banks and other financial reserves in the country follow as regards customer identification, record keeping, and transactional auditing and report.

BSE requires that exchanges within its jurisdiction obtain a license from Financial Crime Enforcement Network(FINCEN) and act in accordance with obligations made by Anti-money laundering(AML) and Combating the Financing of Terrorism (CFT). BSA recently developed its own version of the "travel rule" that was originally established by FATF in 2019.

The IRS (Internal Revenue Service) regards crypto as taxable property. The IRS is notable for its hard stance against exchanges that are not complying with appropriate laws in the country.

Japan:

Japan is quickly evolving with the crypto space. The Payment Service Act (PSA) of Japan approves cryptocurrencies as legal property but not legal tender.

All cryptocurrency exchanges in the country must register with Financial Service Agency (FSN) and act in accordance with AML and CFT obligations. Profit made from cryptocurrency transactions is taxed because they are treated as "Miscellaneous income".

Recordkeeping, data collection, exchange registration, customer rights protection, compliance to money laundry regulations are some of the results of cryptocurrency regulations in Japan.

South-Korea:

Cryptocurrency investment is highly favorable in South Korea because cryptos are neither seen as a legal tender or digital asset/property. This means that profits made from crypto transactions are not taxable.

The body responsible for crypto regulations in South Korea is theFinancial Supervisory Service (FSS). AML/CFT obligations also apply here as exchanges must comply with their obligations.

It became mandatory for crypto exchanges and VASPs in South Korea to register with Korea Financial Intelligence Unit (KFIU) since September 2021.

South Korea allows automated bank deposits and withdrawals for major exchanges in the country.

The representatives of 14 Korean digital currency exchanges including Bithumb. OKCoin and Upbit released their self-regulatory guidelines on 17th April 2018 for currency exchange. They are:

To manage the digital coins of the client and their own in separate accounts

They should be able to cope with any abnormal transactions quickly

New digital currency can only be floated with some extra protection for the clients.

Minimum held equity should be KRW2 billion

Regular audit and finance report publications are mandatory.

China:

China has been unstable in the matters of cryptocurrency regulations. China, a country that once accounted for over 60% of the bitcoin mining pool in the world placed a ban on bitcoin mining in May 2021.

The centralized nature of the country has moved it to also ban exchanges from operating in the country, claiming that exchanges aid public financing without the government's approval.

El Salvador:

El Salvador becomes the first country to accept bitcoin as a legal tender against the warning of the World Bank on September 7, 2021. The country has imposed bitcoin on its citizens even against the opinion of a majority in the country though some see it as a welcomed development.

The country has embarked on installing machines all over the country that would facilitate the conversion of dollars into bitcoin. The country forwards its course by giving free $30 in bitcoin to its citizens.

El Salvador’s autocratic government claims the decision was made to boost the country's economy. Analysts think otherwise.

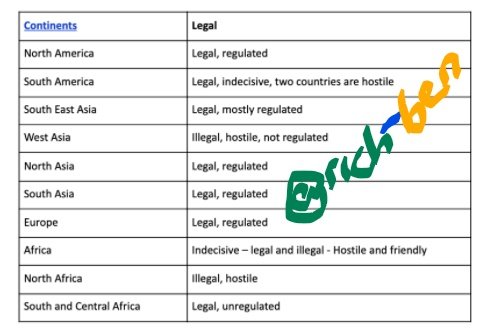

Here is a table showing cryptocurrency regulation status in continents of the world.

Cryptocurrency and exchange regulation are creating a new awareness in the societies of the world. Many countries are moving to see how they can tame this innovative technology to suit their financial environment and economy. There are the aggressors, the friendly, the cautious, and the adapters e.t.c.

On the one hand, some people welcome the idea of regulations, on the other hand (likely the majority); others prefer that the underlying technology of cryptocurrencies is left untouched. The future holds the reality.

Finally, I would say laws should be enacted or a body should be set up in various countries to oversee the protection of crypto technology. This is to make sure that anti-regulation is not used interchangeably with regulation.

Thank you, prof @imagen for the lecture.