Leverage with Derivatives Trading Using 5 Mins Chart - Steemit Crypto Academy S6W1 - Homework Post for Professor @reddileep

Hello Steemians, I welcome you all to the first week of season 6 in the Steemit Crypto Academy. I'm glad to be part of the lesson delivered by professor @reddileep on Leverage Trading of Derivatives using the 5 minutes chart. Leveraged trading is one of the efficient methods of trading in the financial market that have made it possible for traders to participate in trading activities no matter the amount of capital they possess. Leveraged trading is also a very risky type of trading that can lead to a total loss of trading capital. Therefore, it is required that a trader apply a good trading strategy to profit from leverage trading.

Understanding Leverage Trading

Trading has been simplified in recent times for everyone to participate in it. Right now, there's no limit to the number of trades you can purchase no matter your account size. Traders can be able to purchase assets 10x greater than the amount in their capital. Leverage trading is a type of trading that gives users a higher purchasing power in the market with little capital.

In leveraged trading, users are allowed to purchase assets with borrowed funds provided by the exchange platform or broker. This serves as a great advantage for traders to make more profits trading cryptocurrencies with little capital when their prediction is correct. However, things can get catastrophic in leveraged trading when the market goes against your prediction. Your account might be exposed to the risk of liquidation if you don't deposit enough money to cover up your losses.

Leveraged trading is not meant for beginners who are not well-grounded in technical analysis. Leveraged trading is meant for professional traders who understand the risks involved in the trading system. Also, trading with leveraged funds comes with good risk management to have a successful trading journey.

In the next few sections, we will be looking at a trading strategy we can utilize to increase our trading success when trading with leveraged funds.

Benefits of Leveraged Trading

Leveraged trading is beneficial for crypto users who want to participate in the financial market with limited funds. In this section, we will be looking at the benefits of leveraged trading in the market.

- Leveraged trading allows users to have more purchasing power with little capital. Here, users can be able to purchase assets 100× their trading capital. This means that a trader with $10 capital can be able to open a trade position worth $1000. This is the power of leveraged trading.

- With leveraged trading, users can make huge profits in trading cryptocurrencies with little capital. We believe the crypto market has a lot to offer and traders are sometimes not taking advantage of this opportunity due to low funds. Leveraged trading has enabled traders with relatively low funds to capitalize on the market and make profits.

- Leveraged trading enables traders to diversify their positions in different assets. Due to high purchasing power, traders can open different positions on different assets which will help them to manage potential risks instead of putting all their trading capital in one position.

- Leveraged trading enables us to secure our account when the market goes against our prediction. Here, traders can have the opportunity to add more funds to their positions using features like cross margin. This will help to protect them against the risk of liquidation.

- Trading leverages also allows users to manage their positions when either in profit or in a loss. Here, users can be able to close their traders in partials when in profit or loss without closing the full position.

- Leveraged trading is mostly utilized in scalp trading where traders want to make quick profits within a short period. With leverage trading, a scalper can make huge profits with a short movement of price.

Disadvantages of Leveraged Trading

In the previous section, we discussed the benefits of leveraged trading, and sounds so enticing that you want to start it with a 1000× margin. Let's look at the disadvantages of this trading system.

- Leveraged trading is a very risky trading system. A trader is likely to lose his entire trading capital when things go wrong in the market.

- In leverage trading, a trader's position is exposed to the risk of liquidation when there are not enough funds to cover up the losses.

- Leveraged trading comes with a lot of trading fees and also charges for holding trades overnight. This is different from spot trading where minimal fees are charged and there are no charges for holding your coins for as long as you want.

- Leveraged trading is not for beginners without professional knowledge of technical analysis and risk management. To profit from this trading system, a trader is required to have professional skills in predicting future prices. So even with your little capital, leveraged trading is still a no-go area if you don't have professional experience in trading.

Basic Indicators for Leveraged Trading

Leveraged trading is a risky type of trading especially in the cryptocurrency market where volatility is high. A trader is required to have all the basic price information before making any investment decision. Identification of trends remains the most basic signal a trader should look for before making an entry position. This will enable you to look for trade opportunities in the direction of the trend. For this purpose, we can utilize sole useful trend-based indicators like the Exponential moving average (EMA), Parabolic SAR, Supetrend, Moving average convergence divergence(MACD), etc. Let's look at some of these indicators in detail.

Parabolic SAR

The parabolic SAR is one of the trend-based indicators developed by J.Welles Wilder. The parabolic SAR is mainly used in a trending market to identify the market directions and also spot reversals. Traders can also utilize the parabolic SAR to spot buy and sell signals in the market.

The parabolic SAR is graphically represented on the chart using dots which progress into the future and change with price movements. When the dots appear above price, it signals a downward trend and an opportunity to look for a sell position. Similarly, when the dots appear below price, it signals an uptrend and an opportunity to look for a buy position.

Furthermore, when the dots switches from bullish to bearish, it serves as a trend reversal signal. The chart below shows an example of Parabolic SAR on the chart with its default settings.

Exponential Moving Average (EMA)

The EMA is another basic indicator we can use in leverage trading to identify trends in the market. The EMA was developed to fix the lag in simple moving average by placing greater weights concurrent price data points. The EMA is used to identify potential trends in the market and the indicator reacts faster to the current price compared to the simple moving average.

When price is trading below the EMA, it signals a bearish trend and an opportunity to look for a sell position. Similarly, when price is trading above the EMA, it signals a bullish trend and an opportunity for traders to look for a buy position. Furthermore, the crossing of the EMA line above and below price signals a trend reversal in the market.

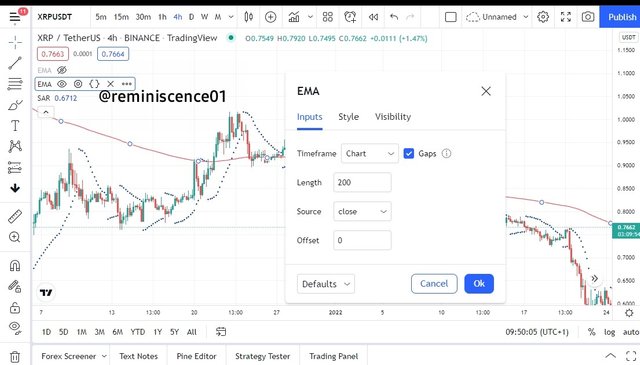

For the purpose of the leveraged trading strategy in this study, we will be adding the EMA with 200 period. This will put into account price data points over the last 200 days. The trader can decide to change the EMA color to their trading style. An example can be seen on the chart below.

Relative Strength Index

The RSI is another basic indicator that can be used in leveraged trading. The RSI is a volatility-based indicator that can be used as a trend reversal confirmation tool for the Parabolic SAR and EMA. The RSI measures price volatility by determining overbought and oversold regions.

The RSI is useful for spotting price reversals. When the RSI enters an overbought region (above 70 thresholds), it shows weakness and exhaustion in the uptrend. Price is expected to reverse at this point. Similarly, when the RSI enters the oversold region (below the 30 thresholds), it shows weakness and exhaustion in the current downtrend. Price is expected to reverse to the upside at this point.

The RSI information when combined with the Parabolic Sar and the EMA can be used to look for buy and sell trade positions with greater confidence.

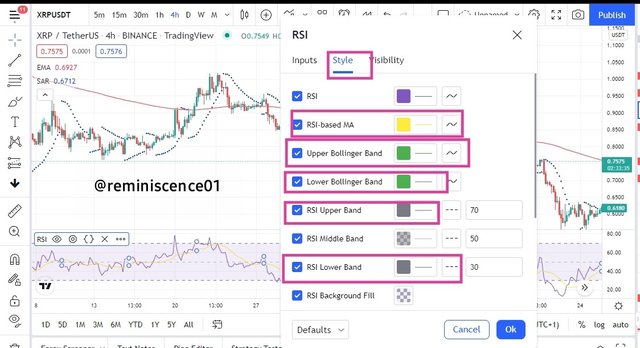

An example of the RSI is shown on the chart above. We will be modifying a few settings in the style menu. We will be unchecking some of the unnecessary parameters that are not needed. These include 'RSI-based MA', 'Upper Bollinger Band', 'Lower Bollinger Band', 'RSI Upper Band" and 'RSI lower Band'. The background color and the middle line of the RSI can also be modified to a trader's trading style.

Special Trading Strategies for Performing Leveraged Trading

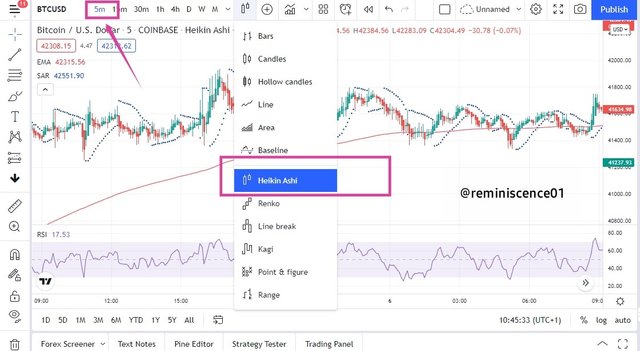

In this section, I will be explaining a special strategy for leveraged trading. This strategy will require us to switch to Heikin Ashi Charts to filter and smooth out the market trends. Also, the 5mins chart will be utilized in this strategy.

Looking at the chart above, we have changed the chart to Heikin Ashi Chart and also changed the chart to a 5 minutes timeframe.

Buy Position Strategy

The first thing to look out for is the EMA for trend direction. If the price is trading above the EMA, it signifies an uptrend and a buying opportunity. Here, a Buy position should be considered by the trader. Secondly, we look at the Parabolic SAR indicator. We have indicated in the previous section that if the Dots are below the price level, it signifies a bullish movement and we only look for a Buy position.

The final confirmation is the RSI indicator. The RSI indicator serves as a confirmation tool for the buy signals on the Parabolic SAR and the EMA. Here, we can confirm the buy position if the RSI is below the middle line (Below 50 threshold). Furthermore, taking a buy long with RSI below level 20 strengthens the signal and increases the chances of the buy position being positive.

Please understand that the 3 indicators must be in confluence before you consider taking any buy position. An example of this can be seen in the chart below.

From the chart above, we have identified a buy trade strategy on BTC/USD chart. First, we can see that price is trading above the 200 EMA which signifies a bullish trend. Also, I saw that the Dots are trading below price which also gave me a buy trade signal. Finally, I checked the RSI and noticed it is below 50. This gives a good confirmation to take the Buy long.

Stop loss for this position can be in two strategic positions. The first can be below the 200 EMA while the second position can be below the Dots. Take profits for this position can be seen as the Dots appears above price which shows that selling pressure has come into the market.

Sell Position Strategy

In this section, we will discuss the Sell Position Strategy for taking a Sell short opportunity. For a sell position, we can take a sell short when the parabolic SAR begins to show Dots above price. Also, the EMA should be trading above price for a potential sell short position. Finally, the RSI is used to confirm the sell short position signal from the parabolic SAR and the EMA. Before taking the sell short, ensure that the RSI is above or almost at level 50. RSI above 70 strengthens the sell short signal. An example can be seen in the chart below.

Looking at the chart above, we can see all the sell short setups we have discussed above. The dots and EMA are seen trading above price. Also, the RSI is seen above level 50 which confirms the sell short position. Stoploss for this trade can be below the 200 EMA or below the Dots. Take profit for this trade is seen as the parabolic SAR dots begin to appear below price.

Performing a Real Leveraged Trading

In this section, I will perform technical analysis on a crypto pair using the leveraged trading strategy discussed in this post. This analysis will be carried out on Tradingview.com and the position will be executed on the Binance exchange.

ADA/USD: 5 minutes Chart

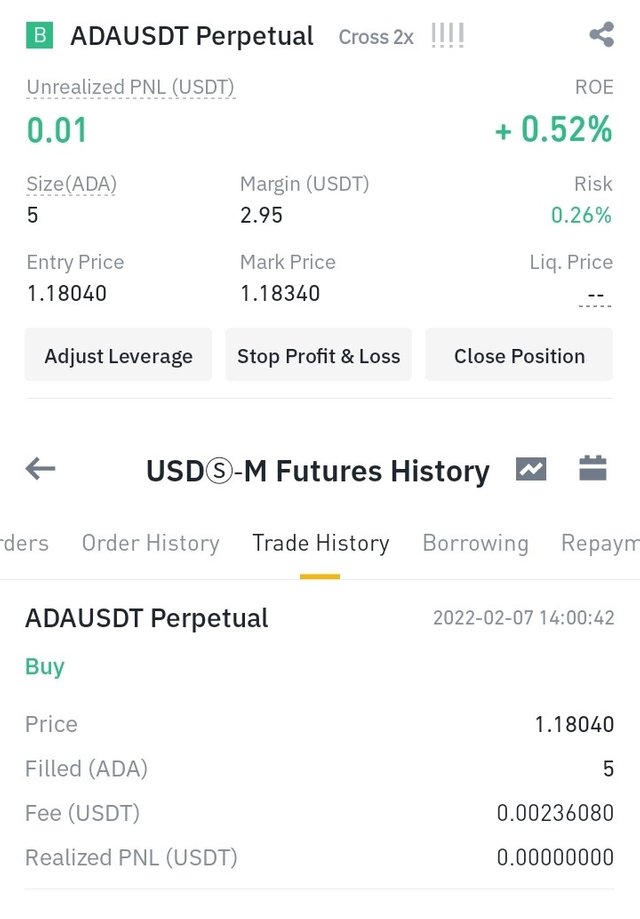

Looking at the chart below, I noticed that price is trading above the 200 EMA which signals a bullish trend and an opportunity to look for a buy long position. Also, the parabolic SAR started showing Dots below price which also signals a long buy position. I finally went down to the RSI for confirmation as the RSI was below the 50 level. I executed a buy long position on a leveraged account with a cross margin of 2× on Binance exchange.

The screenshot above shows the transaction details on the Binance exchange. I will be using an exit method discussed in this post which will be the appearance of parabolic SAR dots above price. That will be the take profit target.

After some time, I notice that the parabolic SAR DOT appeared above price. This signaled a bearish reversal of price. I took profits and close my position with little profit.

Conclusion

Trading Cryptocurrency is very risky, especially with leverage. In this study, we have discussed leveraged trading and its benefits to traders. We have also highlighted the disadvantages of leverage trading. Furthermore, we discussed a special trading strategy traders can use to make good investment decisions while trading with leverages. This includes the use of parabolic SAR, EMA, and the RSI in confluence.

Every trading strategy is prone to failure and there's no guarantee that the market will go in your favor. I strongly recommend leveraged trading for traders who have professional knowledge in technical analysis and risk management. Leveraged trading offers enticing benefits that traders might make traders overlook the risks involved in trading with leverages. I believe this study will serve as a guide in making good investment decisions in leverage trading. Finally, always invest what you can afford to lose while trading leverages and make good use of risk management.

Thank you @reddileep for this amazing lesson.

V good explanation by @reminiscence01

Thank you brother.

Welcome respected professor

You are very smart, I'm glad to know you

My pleasures. Thank you for your kind comment. Please do well to join the academy.

can i join in #SteemitCryptoAcademy

Currently, you are not eligible to participate in the homework tasks. You need to have a reputation of 60, possession of 250 own Steem power, and also a member of at least #club5050. Kindly visit @steemitblog for more updates on the academy.

Thank you very much sir

Because my reputation doesn't meet the requirements, then I have to delay in cryptoacademy, oh yeah why Professor doesn't come anymore?

Lol... You are almost at rep 60. You will join the Academy in no time.