Crypto Academy Week 7 - Homework for [@gbenga ] // DEFI

Hello prof @gbenga !

I really love your lesson for the week , it was well explained and very brief . This week I will try my best to follow your instructions and the remark you gave on my previous post.

Decentralized finance is a new way to disrupt the middleman procedure in the finance system , DEFI simply mean Decentralized Finance is a blockchain project that use smart contract that automate agreements that don’t really need intermediaries to execute it , it is not owned or control by anyone.

One can trade , lend , borrow all financial tool that are Decentralized with no control form any central authority.

In most centralized Finance ( CEFI) we see daily fraud , high fees and many step involved in approving a single transaction unlike DEFI which use Smart contract to do this in few seconds .

DEFI are used for Lending and Borrowing , Decentralized Exchange , Insurance projects .

In this post I will be talking more about MAKER DAO .

This is among the most well known DEFI project that is use for lending and borrowing, and it make this simple than the way the traditional financial sector does .

MAKER DAO uses some Maker protocol which enable it users to borrow against a collateral unlike local Banks that require you to save with them for a period of time before they grant you loans , MAKER DAO allow users to deposited some cryptocurrency into smart contract to be able to take borrowed funds.

MAKER DAO is built on the Ethereum Blockchain and it uses Ethereum smart contract system .

Maker DOA was discovered in the year 2015 by Rune Christansen .

There two token Used in Maker DAO , the Dai token which is a stable coin and it is pegged to USD , when users want to borrow fund they deposite some supported cryptocurrency and they are given DAO that is a user will have to deposit ETH as a collateral to borrow DAI .

These borrowed DAI can be paid aback at any time in return of the collateral .

The system has another token call MKR. This token is use to provide backstop liquidity incase there is debt and holders of this MKR take part in the governance of the MAKER DAO platform.

In a simple for let me say a Maker DAO is Allie borrowers to use cryptocurrency as a collateral for loans to gain a stable coin call DAI , these borrowers pay interest on the loans but if the collateral use fall it is sold to pay off the loans .

Let note that the interest on the loan is payed in MKR tokens .

HOW TO USE MAKERDAO TO BORROW

- go to makerdao.com

- On the home page click on use DAI

- On the open page you can decide to learn more about what DAI is used for , since we are focused on how to borrow scroll down to the bottom and click borrow

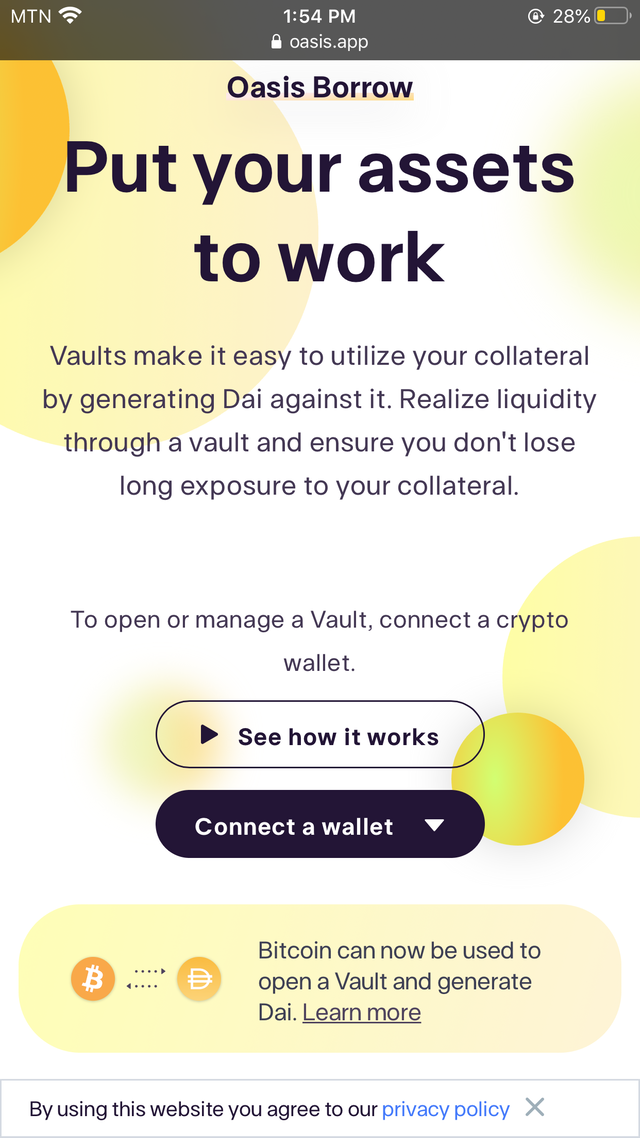

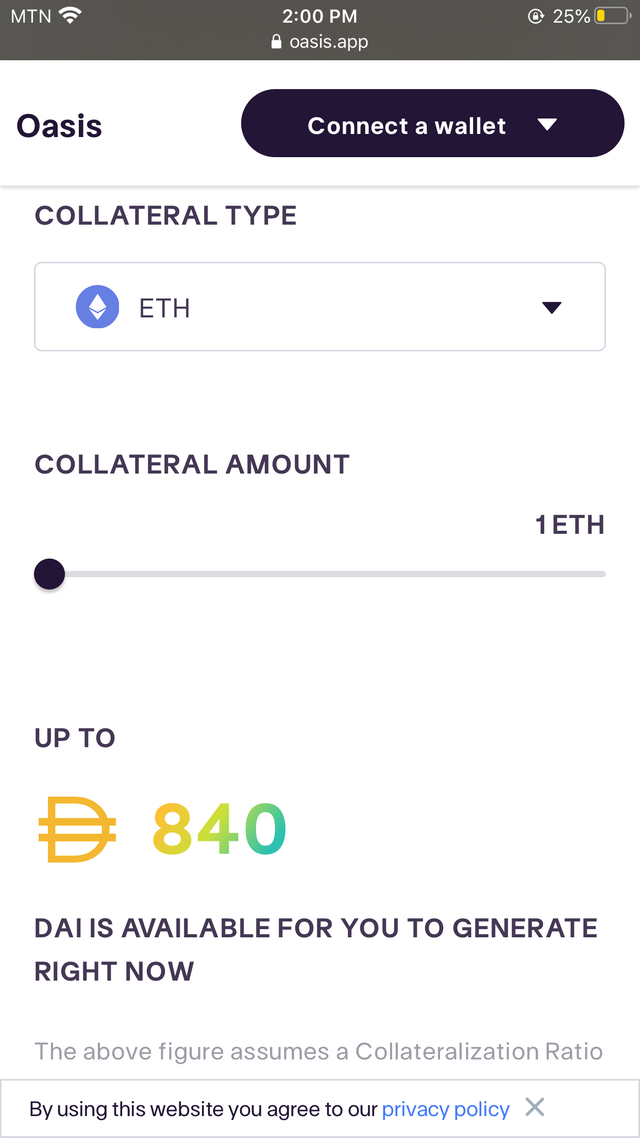

- A new page will open ,hear you will have to deposit your asset as a collateral to get 200% of DAI a loan

5 . You have to connect your wallet to the oasis platform and choose the collateral type and the payment method

Thanks for being a part of my class and for participating in this week's assignment. I hope you learned from the class as the aim of the school is to teach and allow people to learn alongside.

Remark

Your method of writing is similar to @alhajibabajnr. You should work on reducing the repetition of nouns in a paragraph.