AI and Machine Learning in Cryptocurrency Trading: A Steem/USDT Perspective

"AI and Machine Learning in Cryptocurrency Trading.

"AI and Machine Learning in Cryptocurrency Trading.Hello.

Welcome to S22W2 of the SLC. Equally excited to be discussing on this amazing theme brought by the community. Automating trading with robots. What an interesting way to go about your trading activities carefree and less stressful.

But before we begin, I want to wish each and every one of you and Merry Christmas and I believe we all enjoyed ourselves on this particular day, mentioning the entire Christmas season. I equally want to wish everyone a Happy New Year in advance.

AI is fast and rapidly evolving since its innovation, it is being applied in different means of our day today activities. One of the key aspects which we are going to be discussing on this day is the use of AI and machine learning in cryptocurrency trading. Key focus being how it can be applied to trade our steem token. There is some guided questions which we are going to use to tackle this topic.

Question 1: Exploring AI and ML in Cryptocurrency Trading

Explain how Artificial Intelligence and Machine Learning are applied in cryptocurrency trading.

Due to the rapid change and volatile nature of the crypto market, AI and machine learning are fast becoming resourceful tools for trading cryptocurrencies. These technologies have empowered traders, institutional traders and firms so carry on data driven decisions to predict Market trend and manage risk effectively.

| Application |

|---|

1 Market Analysis and prediction.

- Market sentiment.

Cryptocurrencies are highly favored by market sentiment, such as happenings, news, public in influence and social media trend. Instituted AI tools program with Natural language processing (NLP)can be used to scan the social media platform, news and events and provide information in a real time.

By analyzing the public influence, news and the rest this AI tools can use this information to predict the market sentiment. There is to say if the market is going to be bullish or bearish after a particular happening.

An AI tool which have greatly make use of this Market sentiment is Trade The Newspopularly used to analyze Market sentiment data.

- Market prediction.

Machine learning tools have been trained on massive dataset , using technical analysis. Interacting with historical data in real life charts, trading volumes and conditions of Market volatility

These tools I capable to pay from complex analysis which are beyond human scope. That is what a normal trader would normally analyze.

Example could be the application of this machine learning doors to predict Bitcoin price using historical data set and global economic indicators.

2 Trading Algorithm

- Automated trading at High speed.

Automated AI powered bots Can execute, buy and sell orders in a matter of milliseconds based on predefined strategies.

These systems work around the clock, there by optimizing Market opportunities without the need of human intervention.

- Adaptive learning algorithms.

Unlike traditional trading algorithms, ML-powered algorithms are able to adapt and learn from every trade there by redefining their strategies and producing better results every time.

Let's take for instance, if a bot sees a continuous repetition of pattern in a particular trade, It is capable to adjust its future trade accordingly.

3 Emotions Free Trading

human emotions such as greed, fear, fomo, And impatience of ten lead to unmatched Trading decisions. It's not

With AI, these problems are resolved as traits are executed based solely on data and predefined conditions.

For instance, take profit, and stop lost are executed automatically when the price reaches a certain Point.

4 High Frequency Trading.

Htf rely on advance trading algorithms , to execute thousands of trade in Milliseconds..

These AI capitalize on small price changes across several currencies, I need to lies them accordingly which are so impossible to be spotted by humans.

Examples are in cases of arbitrage trading where commodities are bought at lower end and sold at High price in another currency.

5 Fraud Detection And Security

- Identifying suspicious pattern

AI systems are capable to scan trading platforms and blockchain Network to identifying suspicious buttons or unusual patterns in a particular market.

Circumstances are cases of identifying pump and dumps , unauthorized transactions.

- Improve Security Exchange.

ML algorithms are capable to scan and analyze historical security Breached . And use this data to predict and prevent for the security problems.

6 Portfolio Management

- smart portfolio allocation

AI analysis historical at the performance, current price and asset allocation to recommend an optional asset allocation strategy for improved Trading.

For instance, readjusting portfolio in real time to protect Market against unexpected downturns.

- Adaptive portfolio arrangement

Asthmatic conditions changes, ml models continuously adjust the portfolio in real time to optimize return while maintaining risk management.

7 Risk Management.

- portfolio risk assessment.

AI systems access the risk level of different assets and recommend diversification strategies to minimize exposure.

For instance, if one currency shows a high volatility on a particular, the AI might I just or suggest relocating forms to more stable assets like stable coin . e.g USDT.

- Predicting Market Crashes

By analyzing indicators sudden market sell off, increase volatility, and abnormal trading behavior, AI can signal warnings about potential Market crashes

- and I can help sort out conditions of Market manipulation, abnormal trading patterns. There by minimizing risk.

Highlight their advantages over traditional methods and provide

| Aspect | AI & ML | Traditional methods | advantages |

|---|---|---|---|

| Data processing | real time analysis of large data set instantly | slower manual analysis of limited data set | faster decision decision making & responsable marketing |

| Emotions in trading | totally emotional free, controlled by data set and logic | Vulnerable emotional biased, such as greed and fear | provide rational and consistent decisions making |

| Trading hours | works 24/7 without getting tired | limite to human working hours | monitor and trade the market progressively |

| Pattern identification | identify patterns and trends limited beyond human scope | limited capabilities and pattern recognition | Predict the market more accurate |

| Sentiment analysis | scan social media, public new and magazine instantly | depends solely on selective news confirmation and interpretation | give accurate market sentiment predictions |

| Cost efficiency | automated trades require limited amount of individuals trading | numerous human efforts and hence high cost of maintenance | Provide low cost labor and high efficiency |

| Adaptability | Capable of adjusting to current market conditions | set strategies requires human efforts to update and upgrade | refine and optimize it strategy progressively |

| Risk Management | manage risk in real time and adjust portfolio accordingly | slower market risk adjustment | fit for risk management scheme as it's able to readjust in real time |

Examples of their effectiveness in analyzing and predicting market trends.

AI and ML has greatly enhanced the trading game refining it from the traditional trading methods in so many domains. Right now the are being employed in almost every domain in and out of trading. To discuss on how effective this tools are gradually winning the trading game, we will pick a few prototype and see how it works.

Predicting Bitcoin price using deep learning models

For this to make sense, researchers and trading platforms are currently making use of RNNs(recurring nueral network) and LSTM( long-short term memory) to predict future price of Bitcoin.

The models is set to analyze and review historical charts, volumes and volatile patterns to predict future price movement.

Studies have shown that these models are 80% accurate and reliable for predicting short term BTC price movement using LSTM. There after, traders can make buy/sell decisions accordingly.

Predicting Market Reaction Using Sentiment Analysis

AI tools Such as The Tie are popularly used to scan Twitter and other news platforms to track market sentiment.

These models scan millions of posts instantly and daily predicting patterns of market sentiment and prediction of price in the next hours or days.

During periods of market shift,such billionaires purchasing a particular token or Twit about them, the AI quickly picks this news and adjust accordingly to predict the market trend in the next hour or day.

Example could be Elon musk purchasing Bitcoin and driving the price to $78k all time high in 2022. When AI analysis such scenarios, traders can anticipate for market movement base on predictions.

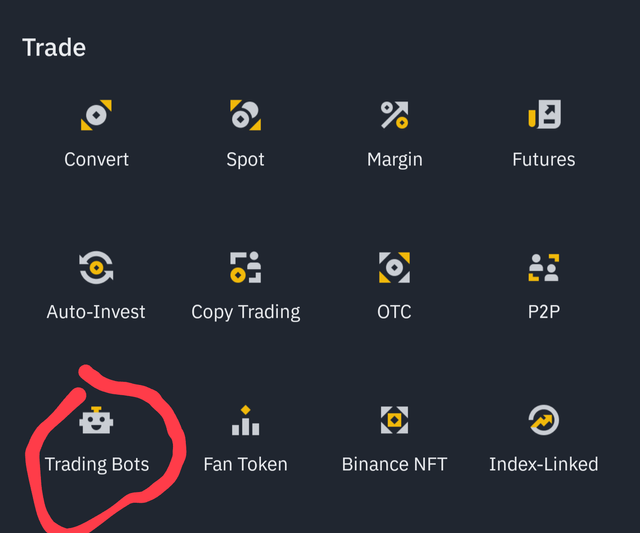

Adaptive trading Algorithms in Binance

Binance has made use of adaptive trading bots to execute trades accordingly. These bots analysis real time market data, make use of arbitrage opportunities and predict Market breakouts.

Analysis shows that these tools are effective than the traditional trading system and even more effective in high frequency trading scene. This make them more reliable for higher profit margins even in volatile markets.

Arbitrage trading bot

Arbitrage trading bot

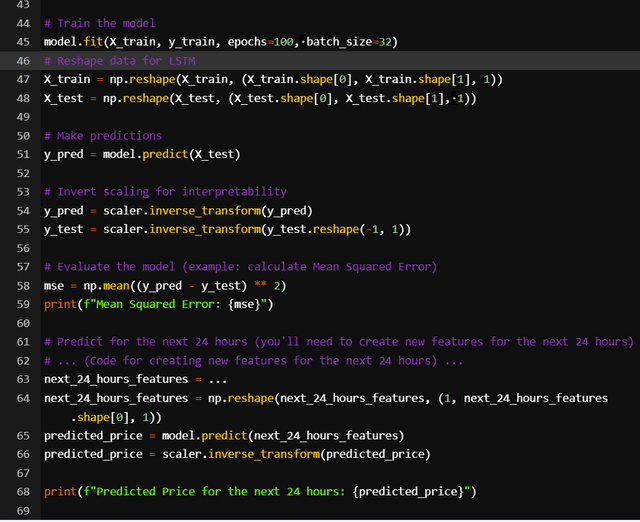

Question 2: Building a Predictive Trading Model

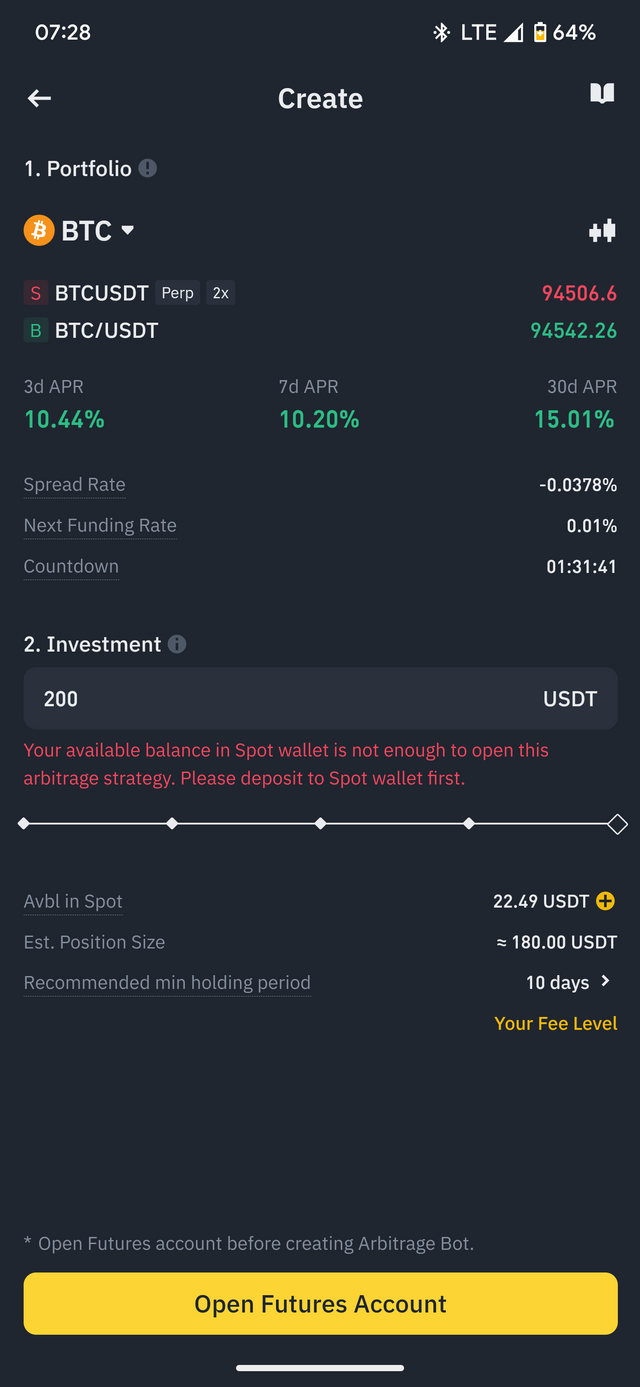

Create a simple predictive trading model using historical Steem/USDT price data

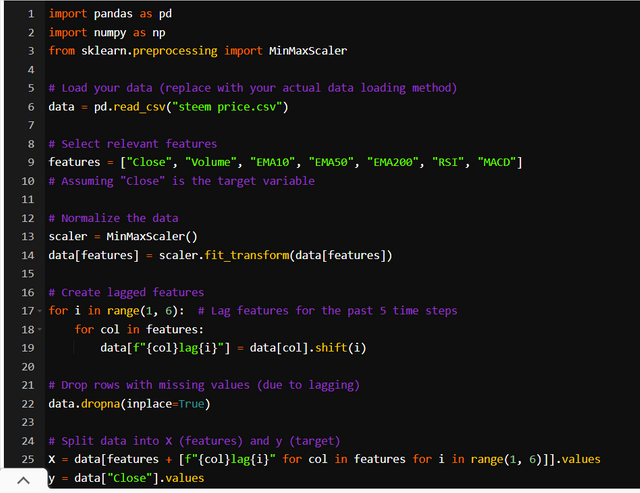

Building a simple model to predict the steem/USDT pair will require a key factors and step to work with. This will involve a few analysis and implementation. By making use of python scikit learn we could make data possible with a simple ML model.

1• Data collection and preparation

- Gather historical data.

First is is getting a visible steem/USDT chart from a reliable source. I choose Binance steem chart for the next 24 hours.

Data Extraction:

Time Series: I extract the time series of the STEEM/USDT price from the chart. This will be the target variable for my model.

Technical Indicators: proceeding , I Extract the values of the technical indicators displayed on the chart:

- EMA(10), EMA(50), EMA(200)

- Volume (Vol)

- MA(5), MA(10)

- STOCHRSI, MASTOCHRSI

Data Cleaning:

Missing Values: here I carefully scan for any missing values in the time series or technical indicators. If present, I apply appropriate imputation technique such forward/backward fill, mean/median imputation

Outliers: making sure any outliers in the data is treated as such. Outliers can significantly impact the model's performance. removing extreme values is necessary.

**Feature Engineering:

Lagged Features: I Create lagged features of the price and technical indicators. For instance, including the price and indicator values from the previous hour, day, or week as additional tips.

Rolling Window Statistics: here we Calculate rolling window statistics such as mean, standard deviation, maximum, minimum of the price and indicators over different time windows.

Volatility Measures: equally we Calculate volatility measures like the standard deviation of price changes over different time intervals.

Data Splitting:

- Train-Test Split: we are going to Divide the data into training and testing sets. The training set is to be implemented to train the model, and the testing set is allocated to evaluate the models active performance.

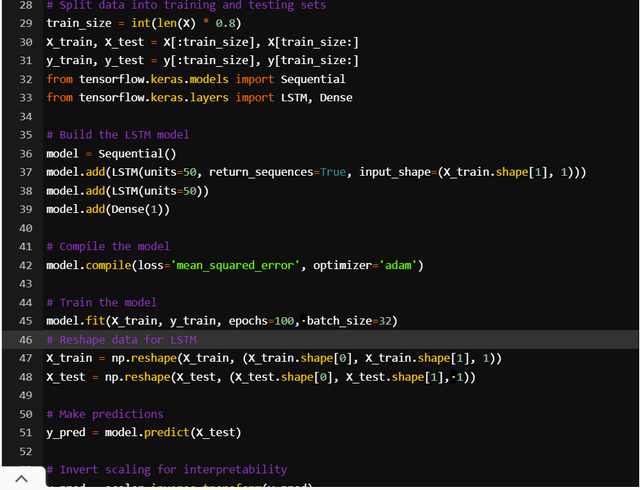

** Model Choice:

- RNN: these are best fit for time series data as they can capture temporal dependencies in data units.

Model Training:

Training our model using the training data and selected features.

Tune Hyperparameters: Experiment with different hyperparameters of the model , such as number of layers, number of units, learning rate to optimize its performance.

Validation Set: Use a validation set to monitor the model's performance during training and prevent overfitting.

Model Evaluation and Prediction

Evaluation Metrics:

Accuracy: cumulative percentage correct predictions for up or down.

Backtesting: Simulate trading strategies based on the model's predictions on historical data to evaluate potential profits and risks.

** Prediction:**

- Use the trained model to predict the price direction that is up or down for the next 24 hours based on the latest available data.

Interpretation and Considerations

Interpret Model Output:

Probabilities: If the model provides probabilities, use them to validate the capabilities in the prediction.

- Risk Management: make use of risk management rules such as stop-loss orders to limit potential losses.

Model Limitations:

Market Volatility: the crypto market is so volatile and unpredictable at times . So some predictions may not align with the real time market.

Data Limitations: Historical data may not always accurately represent the future market behavior in many aspects.

Overfitting: Models may fit too much on the training data, resulting to poor performance on new data.

No Guarantees: This is a simplified model, and there's no guarantee of profits.

Practical session.

Historical chart

Historical chart

Question 3: Implementing Sentiment Analysis for Trading Decisions

Perform sentiment analysis on recent Twitter posts or Steemit articles mentioning "Steem." Use an AI-based sentiment analysis tool (eg, NLTK, VADER, or Hugging Face) to classify posts as positive, neutral, or negative.

Performing Market analysis, on twitter post related to steemit, there are a few things we need to put in place to make sure this works perfect.

1. Data Collection

Use Twitter Api To scan and search recent Post related to Steemit or mentioning steemit. This is done with the help of Twitter API keys.

Use predefined methodology search queries such as: steemit or steem And filter options To refine your search

Make use of steeemit API or scrap techniques to search relevant content related to steem.

2. Data Preprocessing

Get rid of unwanted characters such as characters hashtags, mentions, URLs, and punctuation.

Convert All text to lowercase .

Take care of slang, emojis, and other informal language used.

Divide the text into single words.

3. Sentiment Analysis with VADER

Install in make use of vader Sentiment analyzer

analyzer = SentimentIntensityAnalyzer()

def analyze_sentiment(text):

score = analyzer.polarity_scores(text)

if score['compound'] >= 0.05:

return 'positive'

elif score['compound'] <= -0.05:

return 'negative'

else:

return 'neutral'

# Apply the function to each tweet or post

sentiments = [analyze_sentiment(text) for text in cleaned_texts]

4. Results and Interpretation

Proceed to calculate the sentiment. The percentage of positive, negative and neutral post.

Create a chat or graph to visualize the distribution of sentiment.

Analyze The pattern or trying of the sentiment over a certain period of time

Identify The key topics to identify positive and negative post with common themes or topics

##:Example

def analyze_sentiment(text):

analyzer = SentimentIntensityAnalyzer()

score = analyzer.polarity_scores(text)

if score['compound'] >= 0.05:

return 'positive'

elif score['compound'] <= -0.05:

return 'negative'

else:

return 'neutral'

# Sample text

text = "I'm really overwhelmed about the current price of Steem! It's a great performance."

sentiment = analyze_sentiment(text)

print(f"Sentiment: {sentiment}")

Important Considerations:

Data Quality: the validity of the sentiment analysis depends solely on the quality of the data collection.

Sentiment analysis sometimes do not always align the true consent or explanation behind the news.

Explain how the sentiment trends can be used to adjust a Steem/USDT trading strategy, providing a clear example based on your findings.

Very important, let's see how sentiment can be used to adjusting straightening strategy based on happening.

1. Identifying Trading Signals

Positive Sentiment:

Buy Signal: A reliable positive sentiment can cause rapid excitement in the trading community and might potentially increase demand leading to increase in the price. this might buy steem order, increase in position sizing and long positions, and also reaffirming stop loss. Order to ensure profit is retained.

Negative Sentiment:

- Bearish Signal: bad sentiment or news Can raised concerns In the trading community + also could sign al potential down pressure on the price which might result so actions like, selling steem, reducing position sizes in long-term positions and widening stop losses to limit losses..

Neutral Sentiment:

This of course when there is a high period of volatility and stagnation in the market. Here traders are equally informed to observe the market and maintain their position as there is no significance increase in the price. Equally they should avoid putting on new trades as the direction of the market is not clear..

2. Important Considerations

Sentiment analysis should be used in conjunction with other technical and fundamental analysis indicators To minimize losses.

Most often, Sentiment shifts might not immediately let to a significant price movements Instantly . There can be a lag between sentiment changes and actual price action in real time.

Sentiment analysis does not always lead to Positive. Or negative returns. High positive sentiment might not always lead to price increases, and vice versa.

Always make use of risk management techniques irrespective of the sentiment, news or analysis at the moment.

Example.

# Assuming you have sentiment scores for each day (e.g., 'sentiment_score')

def adjust_position(sentiment_score, current_position):

if sentiment_score > 0.5: # Strong positive sentiment

if current_position == 0:

return "Buy STEEM"

elif current_position == "long":

return "Increase position size"

elif current_position == "short":

return "Close short position"

elif sentiment_score < -0.5: # Strong negative sentiment

if current_position == 0:

return "Avoid trading"

elif current_position == "long":

return "Close long position"

elif current_position == "short":

return "Increase short position"

else: # Neutral sentiment

return "Maintain current position"

# Example usage

sentiment_score_today = 0.7 # Example sentiment score

current_position = "long" # Example current position

trading_action = adjust_position(sentiment_score_today, current_position)

print(f"Trading Action: {trading_action}")

Question 4: Designing an Automated Trading Strategy

Describes how an automated trading system can be designed using AI tools. Includes the logic for triggering trades, setting stop-loss levels, and taking profits. Use examples to illustrate how the system can respond to live market data in a Steem/USDT trading scenario.

These are advanced automated trading model applicable to manage risks and optimize profit based on free time Market data. Let's experiment on steem/USDT token..

1. Data Collection & processing

1. Data Preprocessing

Source live Market data such as price, volume and other book from exchange API such as binance, coinbase etc. From here we clean unnecessary data and preprocess the data for analysis.

2. AI Model for Market Prediction:

Include machine learning model such LSTM, Random Forest, to state and predict short-term price movements.

Input: Historical prices, volume, RSI, MACD, Bollinger Bands.

Output: Buy, Sell, or Hold signals.

3. Trade Logic Engine:

Translate AI predictions into execution triggers. These responses include Define rules for entry, stop-loss, and take-profit levels.

4. Risk Management Module:

This makes sure no single trade risks more than a certain % of capital.Dynamize stop-loss adjustment depending on volatility.

5. Execution Engine:

This is a core Interface with the exchange API responsible for placing orders instantly.

6. Monitoring & Logging:

This section Continuously monitor active trades in the run and Log all actions for analysis and debugging where need be.

2. Trade Logic and Rules

Here it predefined how the AI execute order.

| Buy Signal: | AI predicts a bullish trend. | RSI < 30 (oversold condition). |

|---|

Price crosses above the 20-period moving average.

| Sell Signal: | AI predicts a bearish trend. | RSI > 70 (overbought condition). |

|---|

Price crosses below the 20-period moving average.

| Stop-Loss Logic: | Static Stop-Loss: Set at 2% below the entry price. |

|---|

Dynamic Stop-Loss: Adjust based on Average True Range (ATR) for volatility.

| Take-Profit Logic: | Set profit target at 1.5x the stop-loss distance. |

|---|

Use trailing stop-loss to lock in profits if the price moves favorably.

3. Steem/USDT Trade

| Market Data Input: | Current Price: $0.24 | RSI: 28 (Oversold) |

|---|---|---|

| MACD: Bullish crossover detected | Price above 20-period MA: Yes |

AI Model Prediction:

High probability of short-term price increase.

| Signal: BUY | Trade Execution: | Entry Price: $0.24 | Stop-Loss: $0.235 (-2%) | Take-Profit Target: $0.247 (+3%) |

|---|

Case 1: Price Hits Take-Profit Target

| Price rises to $0.247. | The system automatically sells and locks in profits. |

|---|

Case 2: Price Hits Stop-Loss

| Price drops to $0.235. | System closes the position to minimize losses. |

|---|

4. Real-Time Adjustments and Adaptation

In cases of increasing volatile markets , the stop-loss adjusts dynamically.

Equally if the market sentiment shifts rapidly, the AI can override a previous signal.

5. Tools and Technologies

The AI will incorporate Programming Languages like Python :Pandas, NumPy, TensorFlow

| APIs: Binance API or KuCoin API | Cloud Deployment: AWS or Google Cloud | Data Visualization: Plotly, Matplotlib |

|---|

By analyzing and putting our model into leverage on market sentiment and real time market data, the system can efficiently trade. Mitigate risk and maximize profit.

Question 5: Addressing Challenges and Improving Reliability

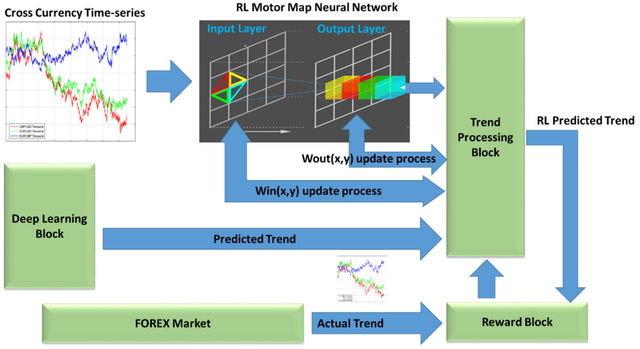

Ai and ML how good for trading with a 70 to 80% success rate but they are limitations and here we are going to propose solutions which can mitigate these limitations.

1. Overfitting

Overfitting it's a condition whereby an AI/ML model performs too dependent on historical data but neglects real time data and live charts.

As we all know, crypto Market is so volatile and influenced by happenings which are so unpredictable. It doesn't have a fixed routine and hands our AI variant is limited in this aspect.

- Proposed Solution:

Applications of regular factors like L1 (Lasso) and L2 (Ridge) regularization to refine overly complex models.

Introduction of k-fold cross-validation scheme to ensure the model respond well to invisible data schème.

The mode should be tested on sequential, non-overlapping data segments.

Avoid excessively deep or complex models unless absolutely necessary.

2. Data Limitations

Limited availability of quality historical data, especially for newer cryptocurrencies yes I made your problem of information to feed the AI with. There's is concerns of market noise, anomalies, and data manipulation. Equally we have corporation problems between data from different exchanges.

Solution:

We can simulate realistic cases to expand the training dataset.

For point of information, we can Rely on reputable data providers like CoinGecko, CoinMarketCap, or exchange APIs.

Feature Engineering implementation to Carefully select relevant features such as trading volume, order book depth, in the market.

Use outlier detection algorithms to identify and clean anomalous data of any sort

3. Execution Speed

High-frequency trading (HFT) works best with split-second decision-making and order execution.

High execution in data processing and execution can lead to missed opportunities or financial losses in the market.

Solution:

By making use of co-location services near exchange servers to reduce latency rate.

Mm: Optimize trading algorithms for faster execution and decision-making.

We can Make use of GPU and multi-threading for real-time data processing.

4. Market Volatility

Challenge:

Cryptocurrencies are notoriously for their volatility, with sudden price swings caused by regulatory news, social media trends, or large whale trades such as buy and sell fill.

AI models trained on historical data may face some problems adapting to these sudden market shifts.

Solution:

We can generalize Using reinforcement learning (RL) models that adjust strategies based on real-time market feedback.

Simulate extreme market conditions to stress-test the AI strategies before implementation in real time.

Implement automated stop-loss and fail-safe mechanisms to limit risk of loosing funds.

6. Adaptation to Market Changes

Cryptocurrency markets evolve rapidly at all times, making static models useless.

A strategy that worked in the past might fail in future due to changing market microstructures.

Solution:

Incorporated online learning scheme so models evolve with new data.

Regularly retrain models on fresh data frequently.

Combine market predictions from multiple models to reduce reliance on a single approach.

Conclusion

AI and ML hold substantial potential in cryptocurrency trading but come with challenges related to data quality, overfitting, latency, and market volatility. By employing advanced techniques like walk-forward analysis, anomaly detection, reinforcement learning, and explainable AI, these challenges can be mitigated.

Firms that combine robust infrastructure, adaptive strategies, and transparent AI models are best positioned to succeed in the dynamic world of cryptocurrency trading...

And this wine I would like to invite the following persons share their opinion on this amazing topic.

Credit to: @rafk

Your code doesn't work. Why not?

Can you share your VS Code terminal of the code running without the error messages?

cc - @kouba01.

Thank you for your feedback. I appreciate the opportunity to clarify and improve.

Regarding the code not working, it is important to acknowledge that topics such as artificial intelligence (AI) and machine learning (ML) often involve complexities like interacting with APIs or managing datasets, while these tasks require certain technical skills the primary objective of this lesson is to demonstrate that these technoloagies can be made accessible, even to those with limited programming expertise.

This wasn't intended as a criticism of you or your teaching. I appreciate that you're trying to teach something more significant than the detail.

The reason that I highlighted this, is that the code has been generated by AI which the author obviously hasn't tested. If the code wasn't important, he could have simply shared pseudo code but he didn't, he shared the entire block which he didn't write. As a coder, if somebody goes to the effort of sharing the entire code, I'd be 100% sure that my code worked perfectly. (I'd also share the output.)

I've said more in my other comment.

Greetings sir.

That's right. It's but true that programming is a fun but complex task. Which without deep learning of concept and understanding, u can face challenges when working on complex task as beginner.

This post is basically related to trading and that can easily be answered. I'm used to already in the traditional way. But automation not much. So I will say my post of a trial rather than a complete version of what's expected. It typically for corrections to be made and I learn from it rather than a perfect post. I suppose that's the essence of a learning challenge.

Equally thank you for your review and if there a further worries. I be glad to answer 🙏

I’m just curious as to how much of your post was driven by AI. I can see that the code and overall structure is AI generated. Which AI did you use?

Presumably Python isn’t your language. Are you more of a PHP, JS or something else?

Edit: I see that Java or C# are the preference for Mechanical Engineering.

Alright sir. That said what's lacking is the references to some information which have be reviewed and pointed out in the evaluation post. I took note of that and in the next exercises. We we have that.

Talking of language. I am not a pro programer. Currently I practice on the languages taught in the previous lessons in the engagement challenge which I participated. C++, Js, html, CSS by the dev team.

I believe you have more Intel about programming. I'd be happy to learn a lot from you.

If you'd mind sharing your discord....

It’s simply #thegorilla

I don’t have an issue with AI but people need to be transparent in how they’re using it. Especially when you should be demonstrating learning.

Alright sir.

Thanks do appreciate. I will tap in where I need clarification.