Crypto Academy /Season 4 / Week 1 - Homework Post for Professor [@awesononso] || Bid- Ask Spread

1. Bid - Ask Spread

Before being learnt about the Bid- Ask spread, it is necessary to be informed about Bid & Ask separately. This is related with the simple business.

There is two main parties called “Buyer” & “Seller” in every business or a trade. They are called price takers. But there is an intermediate party in some trading or business platforms called “Brokers or Market makers”. So the all the trades are handled by these market makers so called brokers. But for the time being we will consider only the simple transaction between buyer and seller.

As an example, let’s take Forex market. When we logged into its trading platform with currency pairs,( let’s say EUR/USD), there is a list of sellers with their expecting selling prices and list of buyers with their expecting buying prices. Always willingness of selling price is greater than the willingness of buying prices. So the traders wait in the platform until their demand is fulfilled.

In the crypto exchangers like Binance, traders have already decided their price limits for closing the trading. Buyers are waiting there until the price gets reduced up to their decided maximum price. Sellers are waiting there until the price is risen up to their desired minimum price.

This is the normal trading nature in the market. Bid and Ask prices are deduced from the above mentioned criteria.

What is a Bid/ Bid Price?

Bid Price is the highest price which buyers are willing to pay for a commodity or a service at a time. In a nutshell, Bid price is the buying price of a commodity.

What is an Ask/ Ask Price?

Ask price is the lowest price which sellers are willing to sell their commodity or a service at a given time. In a nutshell, Ask price is the selling price of a commodity.

What is Bid-Ask Spread

Bid-Ask spread or spread is the difference between the Bid and Ask prices. Every time Ask price is larger than the Bid Price. So the Spread is a positive value.

Spread = Ask Price – Bid Price

Normally Bid and Ask prices are not met with each other.

In a Forex market, spread is the brokerage fee to the market makers. Because they are the interface of trading. They buy a commodity for 100$ Bid price and sale the same for 105$ Ask price. The difference of 5$ (105$-100$) which meant so called Spread is their profit.

2. Why is the Bid-Ask Spread important in a market?

• Spread is a measurement of the market liquidity which means how much active the market is in trading. Lower spread means buyers are willing to buy the commodities or services at a price which sellers are willing to sell. So the lower spread leads for a high liquidity market, easy to trade, no much negotiation are taken place in there.

Higher spread means buyers are willing to buy commodities or services at a slightly lower value than the price which sellers are willing to sell. The market having higher spread tends to be lower liquidity or illiquidity.

• Spread is a good measurement for identify the trading risk. If the spread is low then it means that the commodity has a good liquidity and it can be sold at any time without any hesitation. So the risk of trading is low. If the spread is high then it means the commodity has low liquidity and it is difficult to sell (Trade back). So the risk of trading is high.

• Spread gives a good indication on the placed order. If the spread is low then it means the commodity has been traded to it’s best price in the market. So the trader has taken a wise decision.

• Spread narrowing and expanding gives a good indication of the market movement.

3. If Crypto X has a bid price of $5 and an ask price of $5.20

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

Soulution

a) Spread = Ask Price – Bid Price

Bid Price = $5

Ask Price = $5.20

Spread= $5.20 -$5.00

= $0.2

b) Bid-Ask Spread Percentage = Spread/Ask Price x 100%

= $0.2/$5.20 x 100%

= 3.84%

4. If Crypto Y has a bid price of $8.40 and an ask price of $8.80,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

Solution

a) Spread = Ask Price – Bid Price

Bid Price = $8.4

Ask Price = $8.8

Spread= $8.8 -$8.4

= $0.4

b) Bid-Ask Spread Percentage = Spread/Ask Price x 100%

= $0.4/$8.8 x 100%

= 4.54%

5. In one statement, which of the assets above has the higher liquidity and why?

Crypto X has the highest liquidity.

Because the spread of Y, $0.4 is greater than the spread of X, 0.2$. Since the lower spread tends to higher liquidity, the crypto X has the highest liquidity.

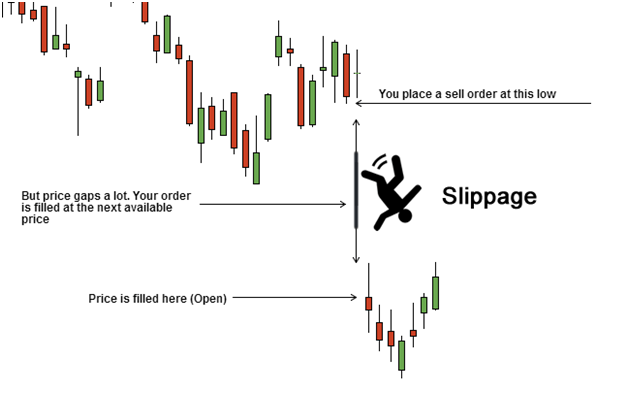

6. Explain Slippage

https://www.babypips.com

These crypto and currency markets are so volatile. Price is changing time to time. Therefore the trader opens an order at a particular value and it takes some seconds to execute the trade.

During this time period, market value can be changed and the execution will done as per the market price at the execution time only. That means the actual trade execution price is not exactly same as the trader’s intended execution market price. This phenomenon is called as a slippage.

Those sudden market movements can be happened due to breaking news and economic data releases.

7. Explain Positive Slippage and Negative slippage with price illustrations for each.

Positive Slippage

If the trade is executed as it makes a beneficial to trader, then it is called Positive Slippage.

Let’s see in buyer’s perspective. I place an order to buy STEEM at the current market price which is 0.6000 USDT.

But when it is executed ultimately, the execution rate is 0.5990 USDT. That is a unexpected benefit for me.

Let’s see in seller’s perspective. I place an order to sell STEEM at current market price at 0.6100USDT. But the trade is executed to the rate of 0.6105 USDT. Price gets increased but it is a benefit for me as a seller.

Negative Slippage

If the trade is executed as it makes a loss to trader, then it is called Negative Slippage

Let’s see in buyer’s perspective. I place an order to buy STEEM at the current market price which is 0.6000 USDT.

But when it is executed ultimately, the execution rate is 0.6005 USDT. That is a unexpected loss for me.

Let’s see in seller’s perspective. I place an order to sell STEEM at current market price at 0.6100USDT. But the trade is executed to the rate of 0.6095 USDT. Price gets decreased but it is a loss for me as a seller.

I would like to thank to professor @awesononso for your awesome guidelines and make us encourage to learn about the basis of crypto and marketing.

Hello @pushpika,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

Is not so clear and it affects the entire presentation.

Thanks again as we anticipate your participation in the next class.

Thank you very much for your feedback. Will come back in next class with the improvement ...

Great explanation brother. Good luck

Thank you bro!!!