Bitcoin's Trajectory - Crypto Academy S4W5 - Homework Post for @imagen

1.) How many times has Bitcoin been "halved"? When is the next expected? What is the current amount that Bitcoin miners receive? Mention at least 2 cryptocurrencies that are or have halved.

Bitcoin halving is a situation where the rewards given to miners for mining a block are halved. Mining is done to get the blocks where transactions are recorded on the blockchain and miners are rewarded in a certain amount of Bitcoins for their services of providing blocks to the blockchain.

Through this process of mining, Bitcoins are released to the market. The founders of Bitcoins made the supply of the coins to be limited so they made an avenue whereby the number of Bitcoins given to miners as rewards is halved. So far 3 Halvings have occurred on the Bitcoin blockchain. The first to occur was on the 28th of November 2012, then the most recent occurred on the 11th of May 2020.

As you know that Bitcoin's network experiences Halvings every 210,000 blocks which are translated to every 4 years. This helps make the supply of Bitcoins to be constant and also makes the value of Bitcoins increase due to the demands for it. And the next expected Halvings to occur is in 2024. This would make it the fourth Halvings.

When block productions started on Bitcoin's blockchain, miners were rewarded with 50 BTC, then after the first halving, it dropped to 25 BTC. The second halving took place and the amount was reduced to 12.5 BTC. The third halving which took place reduced the amount to 6.25 BTC. This is the amount of BTC given to miners as rewards for mining a block currently.

Mention at least 2 cryptocurrencies that are or have halved.

Verge (XVG)

Verge is a crypto coin that is open-sourced and privacy-focused that runs on blockchain technology. It provides services of decentralized payments that are secure, fast, and efficient. Verge blockchain performs its halving every 500,000 blocks. Its recent halving took place in January 2021 and its next halving is scheduled to take place in September 2021.

Ravencoin (RVN)

Ravencoin is a coin created from the Fork of Bitcoin's blockchain in 2018. It was created to make the digital transfer of assets seamless and efficient. Its First halving has been scheduled to hold in January 2022. When the halving takes place, the block rewards will reduce from 5000 to 2500 RVN per block. It takes 60 seconds to produce a block.

2.) What are consensus mechanisms? How do Proof-of-Work and Proof-of-Staking differ?

A Consensus Mechanism is a means by which consensus decision-making and agreements on a blockchain network are achieved. It is important for a blockchain network to use a system of consensus mechanism because it is intrinsically decentralized with no central authorities making decisions. This system makes decentralized blockchain to be devoid of corruption which is prevalent in centralized systems where a single entity has the powers and makes the decisions.

However, there is the issue of how decisions are made and how things have to be done on a blockchain network. In a typical centralized system, decisions are made by a leader or the decision-maker of the system. But in a blockchain network, it is not possible because there is no central authority or 'leader'. Everyone on the blockchain network is a leader and hence needs to come to a consensus using a Consensus Mechanism.

With a Consensus Mechanism, a consensus can be reached by a group of people who are scattered around the world.

Purpose of a Consensus Mechanism

It seeks Agreements: With a consensus, mechanism agreements should be the top priority for a group of people.

It seeks to collaborate: Everyone In the group should work together to achieve a common goal that is in the best interest of the group.

It seeks to cooperate: Everyone in the group should put the interest of the group first and put their interest last, so as to work as y team and not as individuals.

Egalitarian: A group using a consensus mechanism should be as egalitarian as possible. That is, everyone's vote on the group should be equal. One person's vote cannot be more important than another person In the group.

How do Proof-of-Work and Proof-of-Staking differ?

Proof-of-Work PoW

In proof of work, the miners are tasked with trying to solve very complex mathematical equations to find blocks. The network gives each block a nonce that can only be solved in a particular way. They need hashing algorithms to find the nonce. This process involves a lot of computational power and energy resources. By design getting the nonce is hard and taxing on the system. When the nonce is found and hashed, it is sent to the other nodes on the network to verify it.

Like I stated earlier, this process consumes a lot of computational power, therefore it consumes a lot of energy (electricity). Because of the computational power required, only specialized computer systems are needed. An example is Application Specific Integration Computers (ASICs). It is only those who can afford to have the specialized computers that can join the Bitcoins network and perform mining activities.

There are lots of miners who are expanding computational to find the right nonce. Once it has been found verified and appended to a block, a reward is given to the miners for their efforts.

Proof-of-Stake PoS

In proof of stake, the miners become Validators. The validators would have to lock part of their coins of the network that they own as Stake. This makes them eligible to validate blocks in the blockchain. They achieve this by placing a bet on a block (validating) they discovered and feel should be added to the blockchain. If the block gets appended then the validators of that block would get rewarded in proportion to the bets they placed on the block.

The rewards are usually from the transaction fees because there are no block rewards. Also, the proof of stake consensus mechanism is by far cost-effective and efficient due to the reduced amounts of computational power needed.

3.) Enter the Bitcoin explorer and indicate the hash corresponding to the last transaction. Show Screenshot.

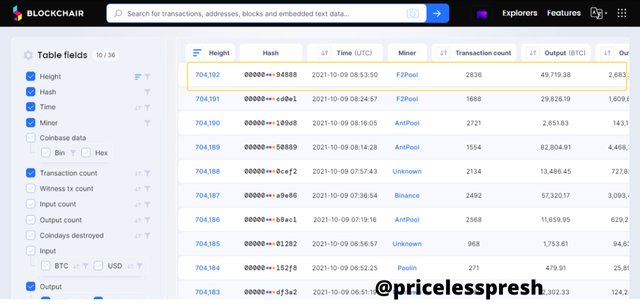

For this exercise, I would be using one of the existing blockchains explorers where transactions on the Bitcoin network can be viewed. The explorer is Blockchair

The image above shows the latest block as shown in the Height. The latest Block Number (Height) is 704,192. The hash of the block is also displayed but not in full.

So I clicked on the block number to get the full disclosure of the Hash. The Hash of the block is 000000000000000000096d4dc25aa22e6dca803194c97d6055a52c562ee94888. We can also get full disclosure of different information regarding the block.

4.) What is meant by Altcoin Season? Are we currently in Altcoin Season? When was the last Altcoin Season? Mention and show 2 charts of Altcoins followed by their growth in the most recent Season. Give reasons for your answer.

Altcoin Season is defined as a period between 60 days to 120 days but usually at 90 days where 75% of the top 50 altcoins outperform Bitcoin. During the Altcoin season, the cryptocurrency space is dominated by Altcoins. During this time Bitcoin's market cap experienced a decrease while the top 50 Altcoins experienced an increase in their market cap. This is likely due to the investors selling their Bitcoins after making some profit on Bitcoin and investing it in other coins i.e Altcoins.

This is usually due to new services being provided by Altcoins. An example is a crypto project providing services of Non-Fungible Tokens (NFT) and Decentralized Finance (Defi).

The coins created after Bitcoins are called Altcoins. This is because they are Alternative coins to Bitcoin.

Are we currently in Altcoin Season?

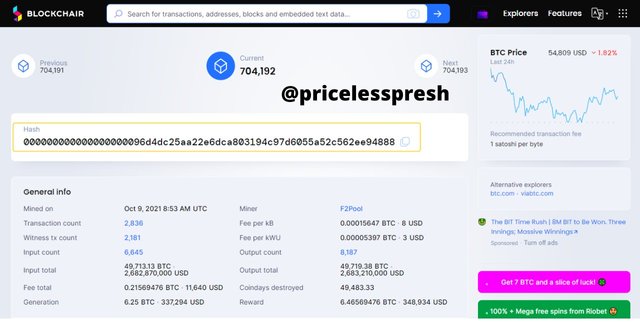

To determine if we are currently in an alt season, we shall be using the index provided by Blockchain center to get a better view of the season. On it, we have a view of Altcoins in comparison with Bitcoins for 30 days (1 month), 90 days, and 1 year.

From the image above we can see that there is kind of a balance between Bitcoin season and Altcoin season. Although the month is seen to be Bitcoin Month, the year is significantly a year for Altcoin Season.

However, from the definition of Alt Season where 75% of the top 50 Altcoins increase in value for 90 days, we can infer that we are currently NOT in an Altcoin Season.

When was the last Altcoin Season?

The chart clearly shows us the time period of the Alt Season through the scale of index numbers ranging from 0 to 100.

On it, we see that the Alt Season started in early March 2021 and ended in late June 2021. This is because during those periods the 50 of the top Altcoins passed the 75% mark index and came down. This is indicated with the yellow rectangle shape on the image and the yellow arrow pointing to the 75% mark.

Mention and show 2 charts of Altcoins followed by their growth in the most recent Season. Give reasons for your answer.

During the Altcoin Season, 75% of the 50 top Altcoins experienced an increase in the value of their coins in the market. From the definition of an Altcoin season, the most recent Altcoin Season started on March 25, 2021, and ended on June 21, 2021. This is the time period I would use for my analysis on the chart. However, the price of some Altcoins had moved before the actual Altcoin Season. So the time period I am using for this exercise is 8th March - 21 June 2021. I shall be choosing two of them, they are:

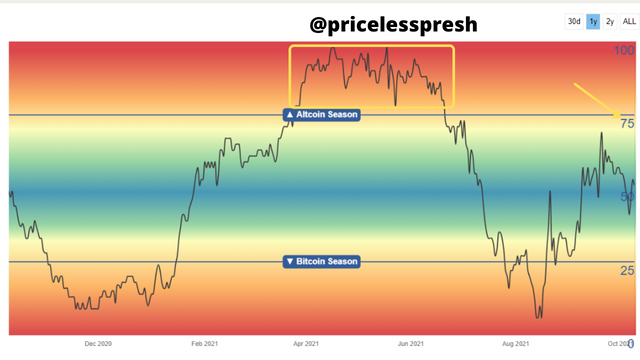

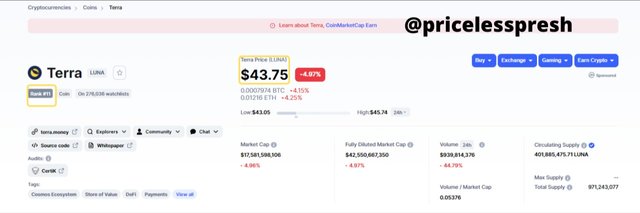

Terra (LUNA)

On the 8th of March 2021, the price of LUNA was 8.33 USDT which is depicted with the yellow arrow 1. The price moved and reached a peak of 22.42 USDT which is indicated with yellow arrow 2. This bull run gave a 269.15% increase in price.

I chose this Altcoin because it has a current price of $43.75 and is ranked at No. 11 on coinmarketcap. Terra (LUNA) is a payment system that runs on a blockchain network. It is interwoven with stablecoins. It is a programmable blockchain e-commerce platform that provides stablecoins that are pegged to a fiat currency so that there is more stability during a cross-border transaction. The native coin of Terra, LUNA is used as a utility and staking coin. It also makes use of several other stablecoins that are pegged to the top fiat currencies of the world. Because they use stablecoins, the fees on the Terra blockchain network are low, the transactions are instant, and the execution of cross-border exchange is handled without issues. All these combined together helps to power retail transactions.

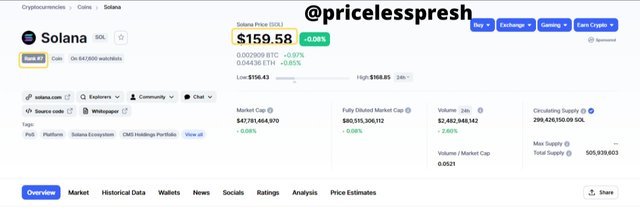

Solana (SOL)

During the period leading to the Altcoin Season, the price of SOL was at 13.27 USDT which is shown by yellow arrow 1. Then it increased to a peak of 58.30 USDT during the Altcoin Season. This bull run gave an impressive 439.33%.

I chose this Altcoin because it has a current price of $159.58 and is ranked at No. 7 on coinmarketcap. One of the reasons why there is a surge in the price of SOL is because of Solana's blockchain technology. It uses Proof-of-History along with Proof-of-Stake to process transactions on the blockchain. This makes it that Solana's network produces a block every 0.5 seconds with a peak of 60,000 transactions per second (tps). This makes Solana's blockchain the fastest in the industry and hence the most sought after.

5.) Make a purchase from your verified account of the exchange of your choice of at least 15 USD in a currency that is not in the top 25 of Coinmarket (SBD, tron or steem are not allowed). Why did you choose this coin? What is the goal or purpose behind this project? Who are its founders / developers? Indicate the currency's ATH and its current price. Reason for your answers. Show Screenshots.

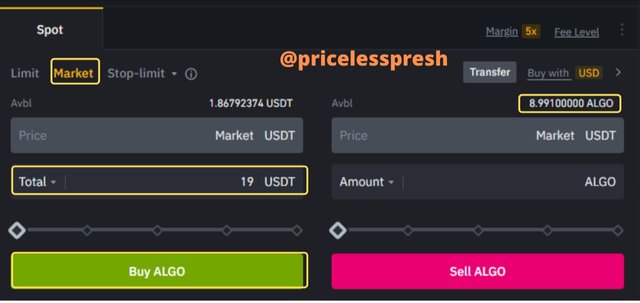

In this exercise, I would be doing the transaction using Algorand's native coin ALGO.

I performed a buy market operation with ALGOUSDT pair. I used 19 USDT to purchase ALGO coins. It was a Market Order. The amount of ALGO coins purchased is 8.991 ALGO.

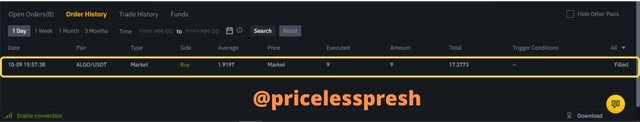

This is the Order History pane where the purchase transaction involving ALGOUSDT is displayed. As it is seen, the order was Filled, which means the order was completed and therefore recorded.

Why did you choose this coin?

I chose this coin because it is a public smart contract blockchain that aims to rival the Ethereum blockchain. It relies on staking. It has the capacity to host the development of decentralized applications (dapps) on its network and is able to provide significant scalability. The rising cost of gas fees on Ethereum's blockchain network has let prospective dapp developers seek an alternative blockchain for solutions. It was launched to the market in June 2019. It uses a Proof-of-Stake (PoS) consensus mechanism where validators' rewards are given to all holders of the ALGO coin.

Recently, the Government of El Salvador signs a cooperation agreement with Koibanx to help them develop the Government’s Blockchain Infrastructure on the Algorand blockchain.

What is the goal or purpose behind this project?

Algorand is a blockchain network that was created and designed to profer solutions to the trilemma of blockchain networks achieving speed, security, decentralization all at the same time. It is a permissionless and blockchain network that developers and businesses can build on top of. The network focuses on payments with the aim of achieving rapid transactions and a strong focus on processing more than 1,000 transactions per second (TPS) in less than 5 seconds.

Who are its founders / developers?

The founder of Algorand is Silvio Micali. He is a cryptography pioneer, Turing award winner, and MIT professor.

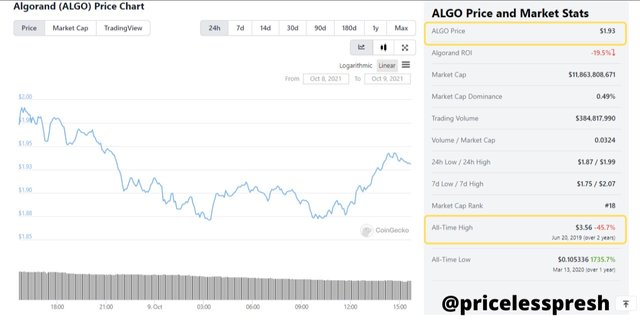

Indicate the currency's ATH and its current price.

From the image above we can see that the All-Time High ATH of Algorand coin ALGO is $3.56, and the current price is $1.93.

6.) Conclusions

Generally, halving is an event that takes place in some blockchain networks, especially those that have a limited supply of their coins to the market. This is done to limit the rate at which the coins are entered into the market. It also makes the demand for the coin increase thereby increasing the value of the coins. Bitcoin has experienced 3 halvings so far, and the next expected halving is by 2024. Coin halving is related to the reduction of coin rewards for miners. As Bitcoin coins halved, the rewards for the miners have reduced. So far the amount of Bitcoins that miners receive as rewards has reduced from 50 BTC to 6.25 BTC. It is expected to reduce a little further to 3.125 BTC by 2024.

Most blockchain networks undergo a consensus mechanism for the network to function efficiently. This is because it is not like a centralized system where decision-making is at the helm of the people at the top. In blockchain networks, decision-making is for everyone on the network and it is a global thing. So in other, for a blockchain to thrive, they need to have a means by which everyone involved in the network reaches an agreement together via a consensus mechanism. There are different types of consensus mechanisms, but the most common of them all is Proof-of-Work PoW and Proof-of-Stake. The way they differ is that PoW allows miners to solve mathematical puzzles that are complex, due to this it consumes a lot of computational resources and hence electricity. While PoS turns the miners to validators who then place a bet on a block they feel would be eligible for storage of transaction, once successful, they are given validator's rewards.

In the cryptocurrency world, there is usually a time period when Altcoins, that is coins created after Bitcoins experience an increase in their value. During this time the value of Bitcoin reduces. This time period is known as Alt Season. It is usually described as a period when 75% of the top 50 Altcoins experience high value within 90 days. The most recent Altcoin Season occurred between March 2021 and June 2021. It can be said that the acceptance of NFTs and Defis caused the Altcoins to experience an increase in their value and hence price.

CC:

@imagen

Gracias por participar en la Cuarta Temporada de la Steemit Crypto Academy.

Continua esforzandote, espero seguir corrigiendo tus asignaciones.

Thank you for your correction professor @imagen.